Introduction

In Italy’s thriving tourism sector, global booking giants like Booking.com, Expedia, and Airbnb dominate the digital landscape. However, local travel businesses, hotels, and agencies are increasingly leveraging travel data scraping in Italy to level the playing field. By extracting real-time information from public travel websites, these businesses gain insights into competitive pricing, seasonal demand, and availability—allowing them to outsmart the OTAs (Online Travel Agencies) that once seemed unbeatable.

This blog explores how travel data scraping in Italy gives homegrown players the edge, with actionable insights, strategic advantages, and powerful analytics derived from real-time data. From pricing comparison to demand forecasting, we’ll highlight the core use cases, support it with stats, and show how Real Data API helps travel brands implement advanced scraping strategies.

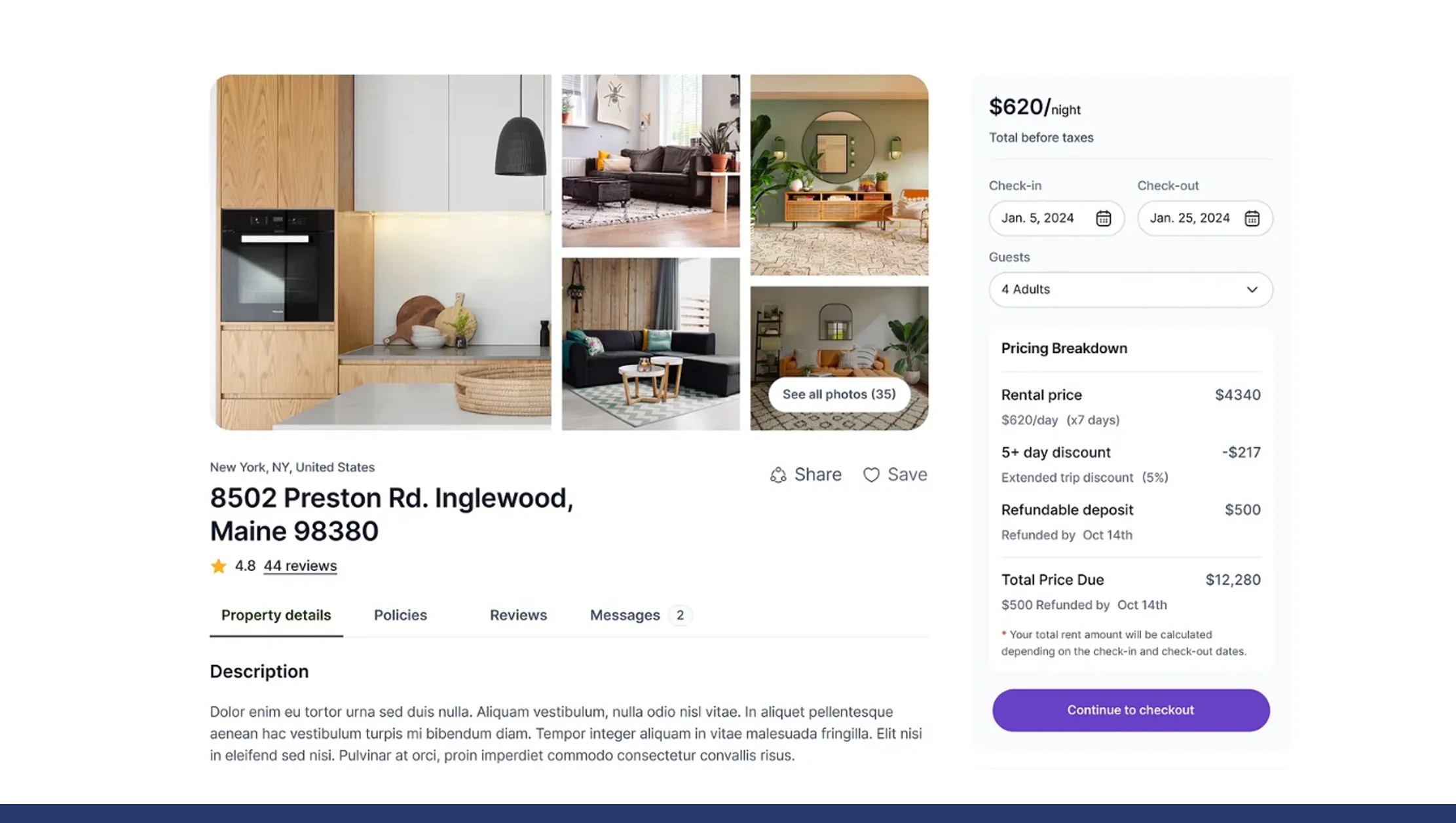

Competitive Pricing Comparison Across Booking Platforms

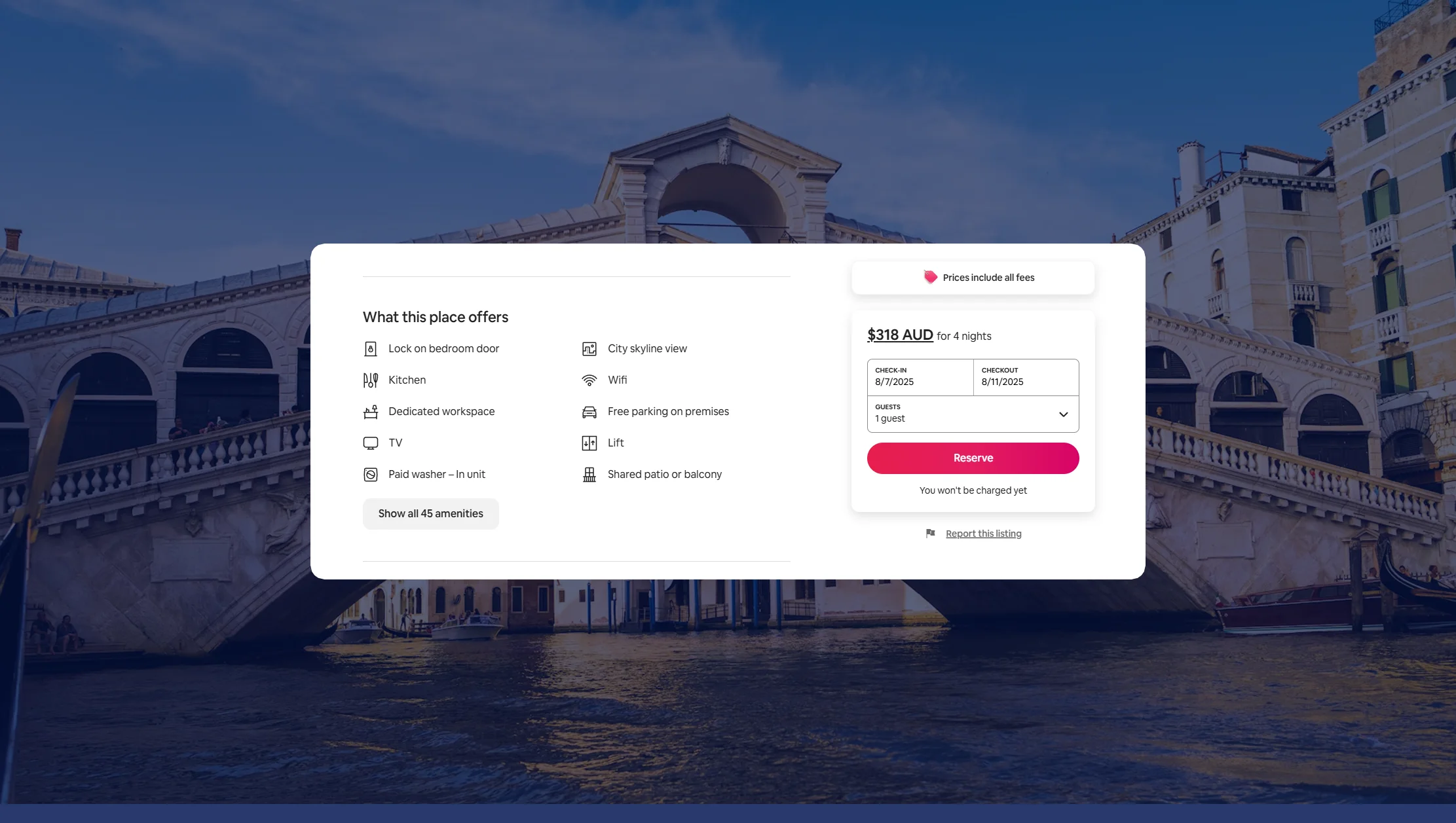

One of the primary uses of travel data scraping in Italy is pricing comparison. Local hotels and travel operators face the challenge of competing with large OTAs who constantly adjust prices based on market demand, reviews, and even user behavior. Scraping public data from these platforms enables businesses to compare prices across cities, seasons, and room categories to remain competitively priced without compromising profit margins.

| Year | Avg. OTA Price/Night (€) | Avg. Direct Booking Price (€) | Price Gap (%) |

|---|---|---|---|

| 2020 | 112 | 104 | 7.1% |

| 2021 | 118 | 109 | 7.6% |

| 2022 | 124 | 113 | 8.8% |

| 2023 | 130 | 117 | 10% |

| 2024 | 137 | 123 | 10.2% |

| 2025 | 142 (est.) | 127 (est.) | 10.6% |

Analysis: The price gap between OTA listings and direct hotel prices is growing. With pricing comparison tools powered by web scraping,

small players can match or beat OTA prices where needed, or highlight unique value propositions (e.g., free breakfast, upgrades) on their own booking channels.

Unlock smarter pricing decisions—use travel data scraping to compare OTA rates and stay competitive across booking platforms in real time!

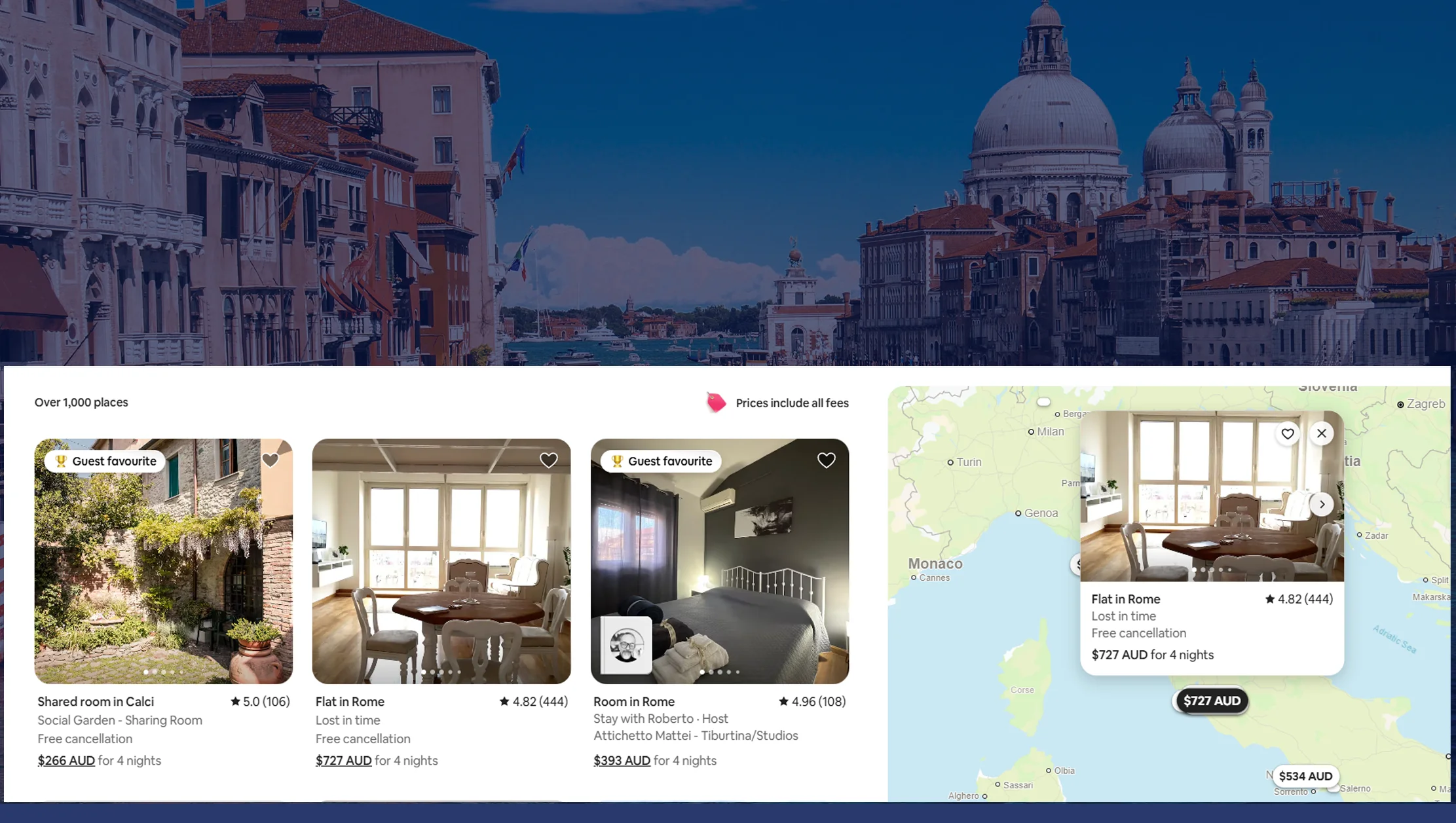

Get Insights Now!Web Scraping Italian Travel Sites for Availability Trends

Besides pricing, Web Scraping Italian Travel Sites offers crucial insights into availability. By tracking how frequently rooms or experiences are marked “sold out” or “only 1 left,” local operators can gauge demand patterns, plan promotions, and better manage inventory.

| Month | Florence Room Sell-out Rate (%) | Venice Room Sell-out Rate (%) | Rome Room Sell-out Rate (%) |

|---|---|---|---|

| Jan | 41.2 | 43.1 | 39.7 |

| Apr | 76.5 | 79.3 | 74.1 |

| Jul | 88.7 | 92.1 | 86.3 |

| Oct | 64.3 | 68.2 | 61.8 |

Analysis: Data from web scraping shows that summer (July) sees the highest room scarcity, and cities like Venice are especially sensitive to seasonal surges. Armed with this data, businesses can optimize pricing and set booking thresholds well in advance.

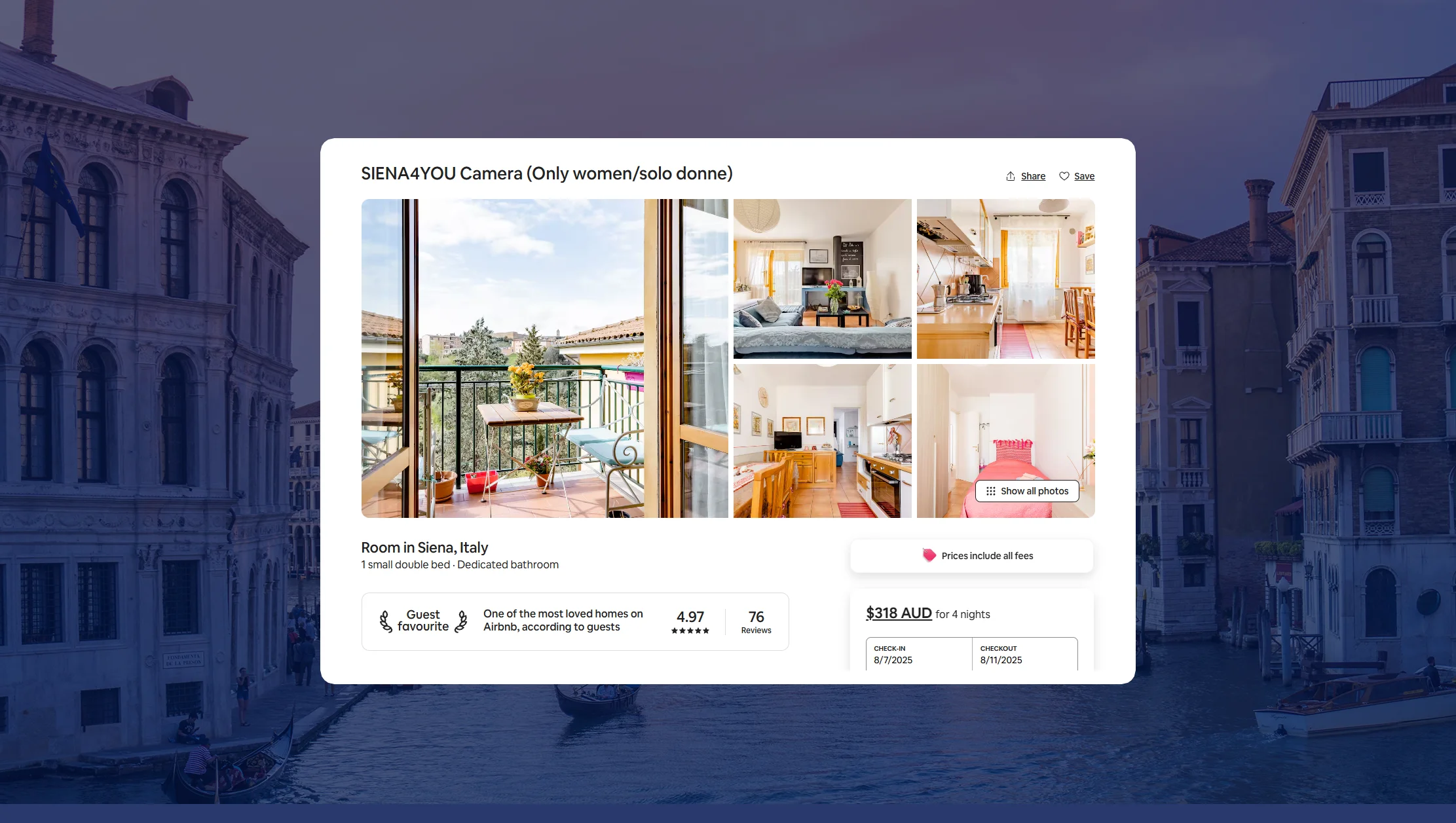

Leveraging Italian Travel Scraping for Seasonal Promotions

Italian travel scraping helps identify seasonal trends, peak periods, and travel motivations (e.g., cultural events, festivals, etc.). By analyzing historical and current data, operators can launch targeted promotions just before peak demand hits.

| Year | Avg. Seasonal Promo Bookings | Promo Period | Booking Growth (%) |

|---|---|---|---|

| 2020 | 1,240 | June–August | 12.4% |

| 2021 | 1,580 | June–August | 14.1% |

| 2022 | 1,840 | May–July | 15.9% |

| 2023 | 2,110 | May–July | 18.2% |

| 2024 | 2,420 | April–July | 20.1% |

Analysis: Seasonal promotions backed by real-time scraping significantly improve conversions. Italian operators using this data can pre-load discounts or packages and time campaigns around actual demand, instead of relying solely on historical assumptions.

Scrape Travel Pricing to Identify Underserved Regions

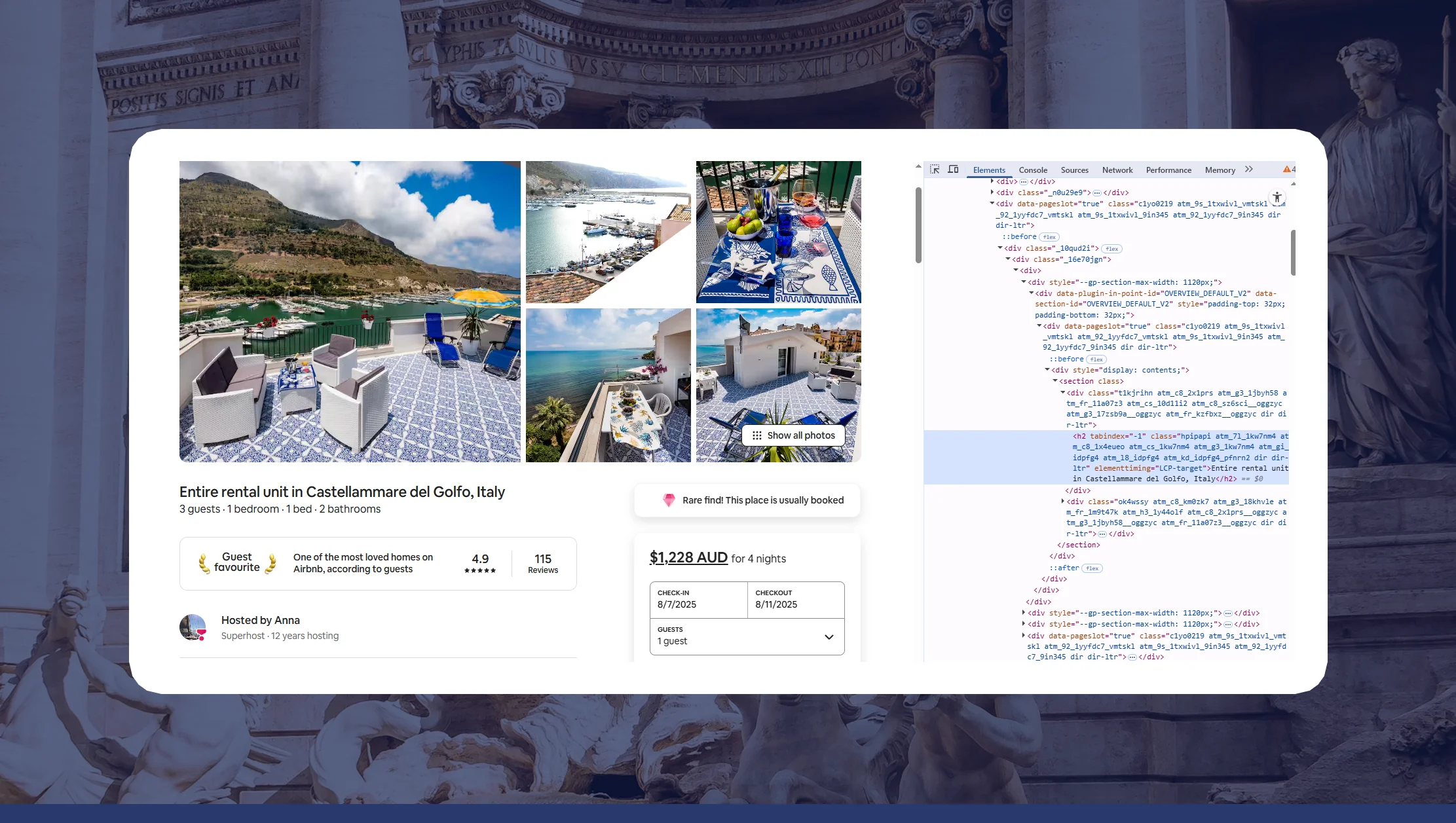

Scraping regional and city-level pricing helps identify gaps in inventory and rising micro-markets. For example, Tuscany and Puglia are rapidly growing destinations not yet saturated by OTAs. Through Scrape Travel Pricing, businesses can track occupancy rates, accommodation counts, and price bands to identify where opportunity lies.

| Region | Avg. Listings/OTA | Avg. Occupancy Rate (%) | Price/Night Avg (€) |

|---|---|---|---|

| Amalfi | 1,200 | 89.3 | 155 |

| Puglia | 830 | 77.2 | 112 |

| Tuscany | 1,050 | 80.1 | 138 |

| Dolomites | 510 | 72.6 | 122 |

Analysis: With fewer listings but increasing demand, regions like Puglia and Dolomites represent untapped potential. Scraping allows boutique hotels, B&Bs, and local hosts to discover where global platforms haven't saturated the market yet.

Discover untapped markets—scrape travel pricing data to identify underserved regions and expand your reach with data-driven confidence!

Get Insights Now!Using Travel Data Scraping API for Real-Time Adjustments

Modern travel businesses need fast data, and that’s where a robust Travel Data Scraping API comes in. Instead of pulling static reports, APIs allow businesses to access dynamic pricing, availability, and review sentiment data for continuous optimization.

| Year | Businesses Using Travel APIs | Real-Time Price Updates (%) | Campaign ROIs (%) |

|---|---|---|---|

| 2020 | 18 | 37.1 | 112% |

| 2021 | 31 | 46.2 | 128% |

| 2022 | 47 | 58.7 | 139% |

| 2023 | 62 | 69.4 | 152% |

| 2024 | 78 | 74.3 | 164% |

Analysis: APIs enable travel agencies and hotels to make real-time changes to pricing and inventory, outperforming static models. As the table shows, this adaptability directly impacts ROI. Real Data API offers scalable API access with minimal integration hassle, giving clients live feeds from the most relevant Italian travel sources.

Why Choose Real Data API?

Real Data API provides industry-grade scraping infrastructure purpose-built for travel, hospitality, and OTA benchmarking. Our solutions for travel data scraping in Italy are trusted by DMCs, B&Bs, boutique hotels, and regional tourism boards looking for granular, real-time visibility into a crowded marketplace.

Whether you're looking to monitor pricing comparison across multiple OTAs or wish to tap into Web Scraping Italian Travel Sites for event-based pricing or availability changes, we’ve got you covered. We support high-volume extractions, geo-specific filters, historical data archiving, and fast deployment—all under a secure, compliant framework.

By combining smart scraping tools with human-verified data cleansing, we ensure your insights are not just fast but also accurate. Our team also specializes in building custom pipelines for clients who need regular feeds from niche or regional travel websites.

So, whether your goal is pricing parity, regional dominance, or launching new offerings during seasonal peaks, Real Data API enables data-backed travel growth strategies that challenge even the biggest OTA giants.

Conclusion

With giants dominating the booking landscape, smaller players in Italy must use every tool at their disposal. Travel data scraping in Italy provides a clear path to competitiveness by enabling real-time insights, smarter pricing, and improved market targeting. When paired with API access and strategic analysis, it allows local businesses to do what OTAs can’t—offer tailored, authentic, and agile service.

Start extracting Italian travel intelligence today—partner with Real Data API and take control of your market.