Introduction

Airline ticket prices have always been dynamic, shifting constantly in response to demand, competition, fuel costs, and seasonal patterns. For both travelers and travel companies, tracking these fluctuations has become more critical than ever. Since 2020, the travel industry has undergone tremendous changes, from pandemic-related disruptions to unprecedented surges in demand during the recovery period. Prices for domestic U.S. flights, for instance, fell by nearly 35% in 2020 due to lockdowns, only to spike by more than 20% year-over-year between 2022 and 2023 as demand rebounded.

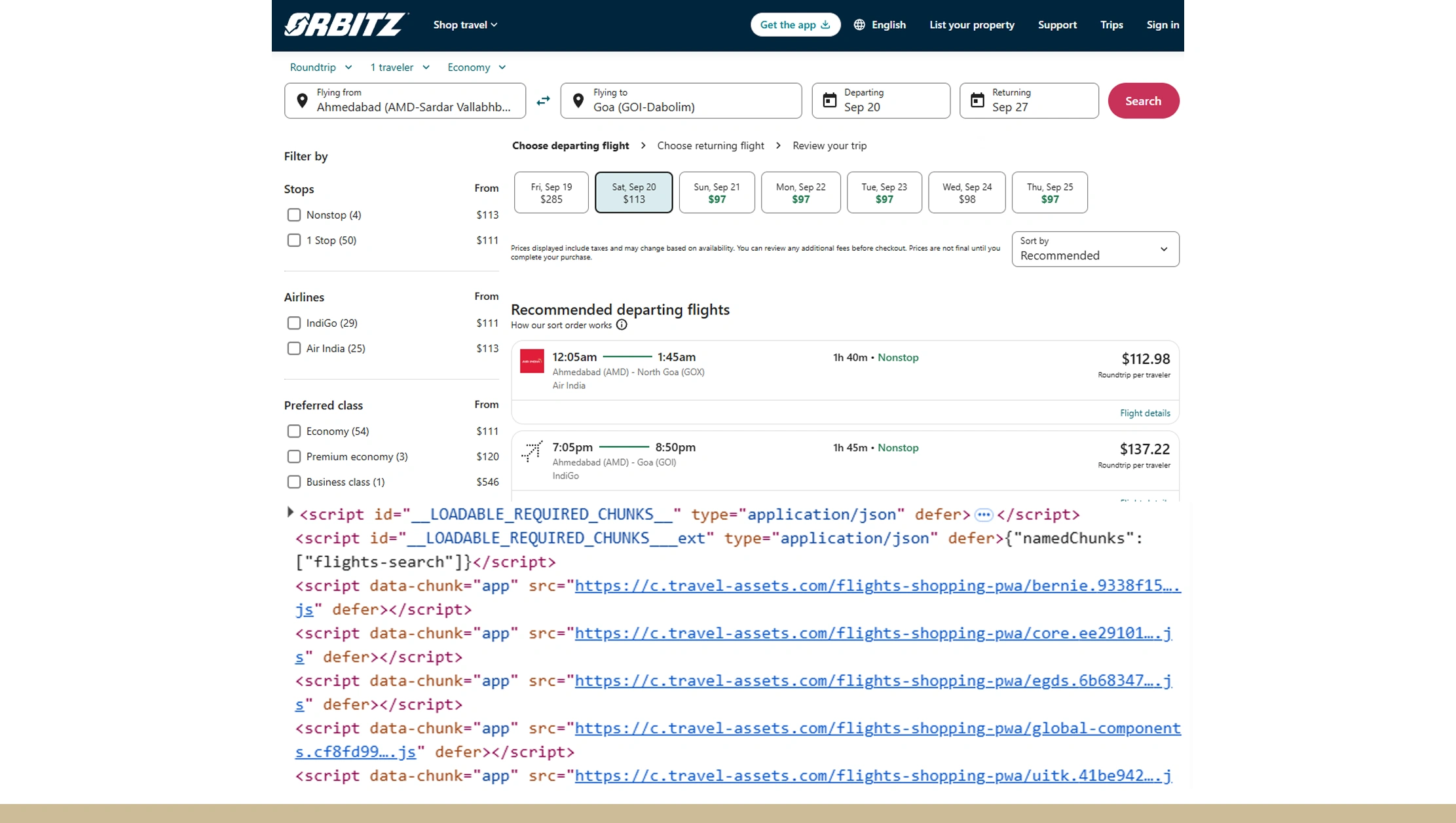

To make smarter travel decisions in this volatile environment, leveraging advanced tools like Orbitz flight data extraction is essential. By pulling real-time and historical flight data directly from Orbitz, users can benchmark airline prices, monitor fluctuations, and uncover opportunities to save or gain a competitive advantage. When paired with Travel Scraping API solutions, the process of gathering, cleaning, and analyzing this data becomes automated and scalable.

This blog explores in detail how Orbitz data scraping technologies work, the benefits of monitoring both flights and hotels, and how Real Data API enables travel companies to transform data into actionable insights. We'll examine the period from 2020 to 2025 to reveal how data-driven strategies deliver tangible results.

Orbitz Data Scraper

An Orbitz data scraper is a powerful tool designed to automate the extraction of airline pricing and availability data from Orbitz's vast database. Instead of manually searching and recording flight information, which is inefficient and prone to error, the scraper collects structured details such as airline, route, departure time, cabin class, and fare. This information is then compiled into a Travel Dataset, ready for analysis.

Between 2020 and 2025, the use of automated scraping tools increased significantly as travel companies adapted to fast-changing conditions. For example, in 2020, when air travel demand collapsed, average U.S. domestic fares dropped to $205 per ticket. By 2021, as restrictions eased, prices rebounded to $265. In 2022, high fuel costs and supply chain pressures pushed fares even higher, averaging $315. By 2023 and 2024, strong demand kept prices elevated, with averages hovering between $340-$375. Early 2025 data shows a stabilization, with domestic fares averaging around $360.

| Year | Avg. Domestic Flight Price (USD) | Trend |

|---|---|---|

| 2020 | $205 | Sharp decline (COVID-19) |

| 2021 | $265 | Partial rebound |

| 2022 | $315 | Surge due to fuel costs |

| 2023 | $340 | Peak demand |

| 2024 | $375 | Sustained growth |

| 2025 | $360 | Stabilization |

These insights are invaluable for benchmarking. A travel agency, for example, can track historical prices on popular routes like New York-Los Angeles or Chicago-Miami, then use the data to forecast future fluctuations. For travelers, these benchmarks reveal the best booking windows. Data shows that fares booked 50-60 days in advance were, on average, 18% cheaper than those booked last-minute.

Without automated scraping, collecting this type of longitudinal data is nearly impossible. By deploying Orbitz flight data extraction via an Orbitz scraper, companies build pricing intelligence systems that directly impact their competitive strategies. With the added integration of Travel Scraping API, this process scales across thousands of daily listings, delivering accuracy and speed far beyond manual methods.

Scrape Orbitz Hotel Listings

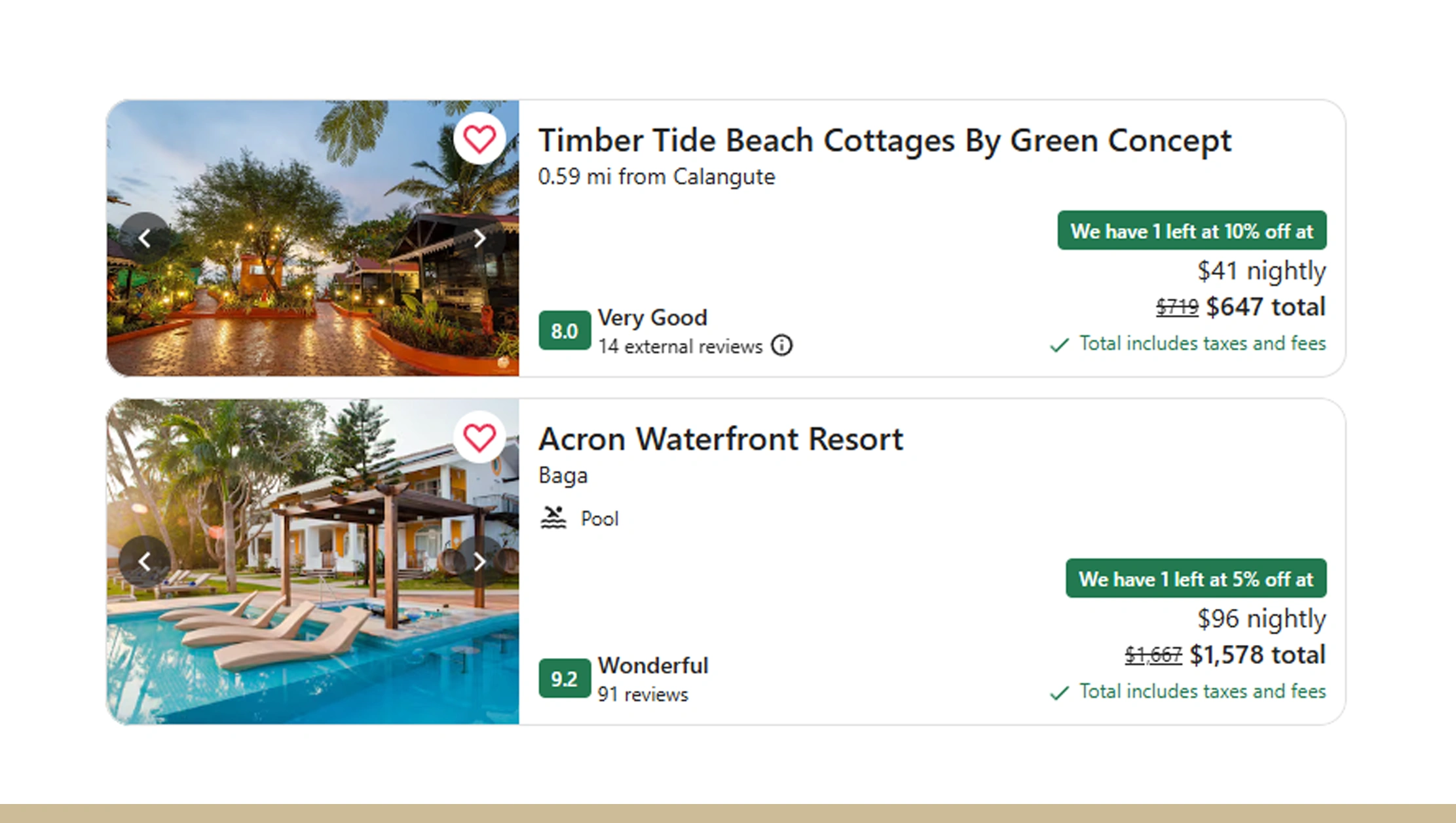

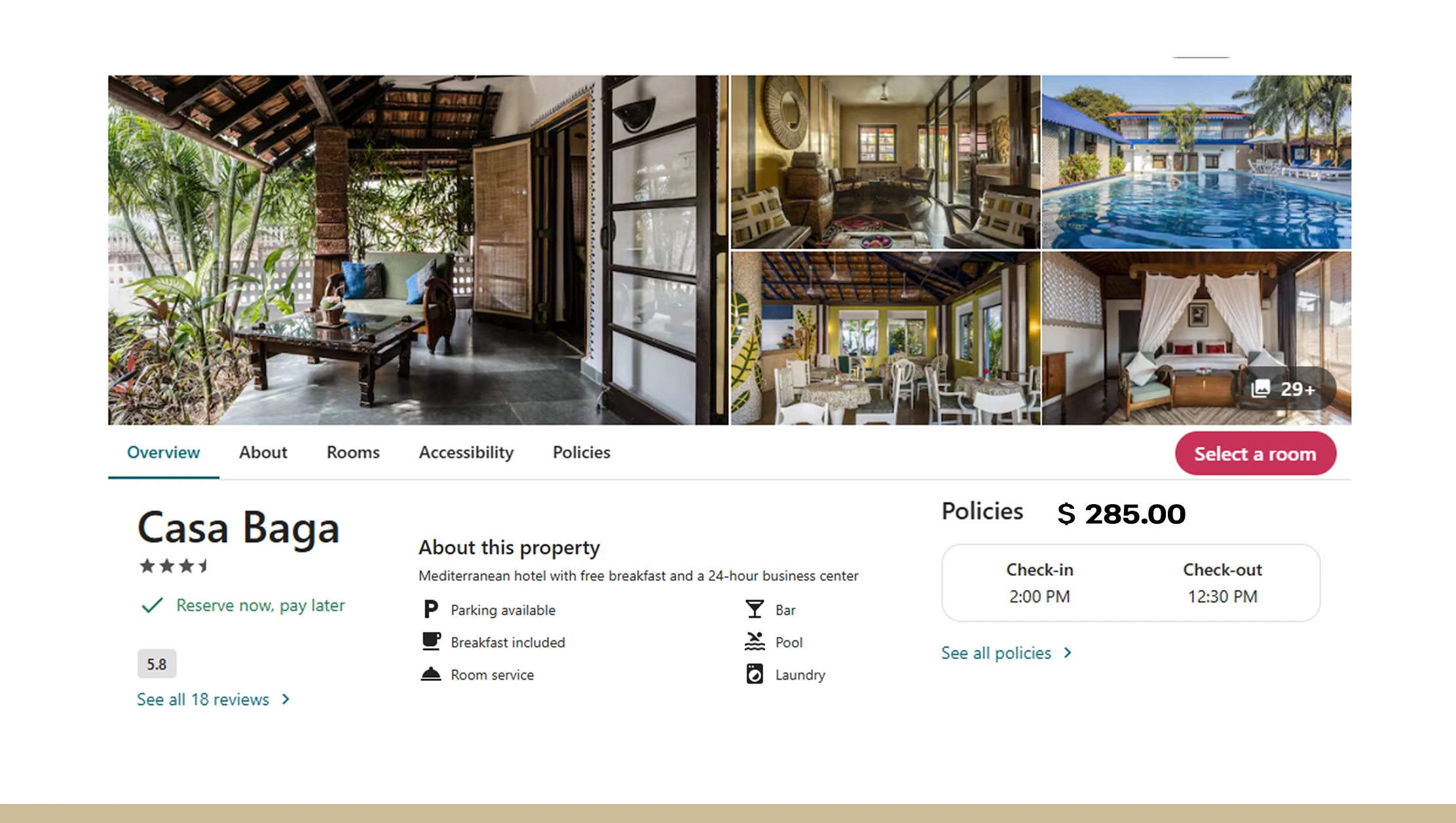

Flights may be the focal point of benchmarking, but hotels are equally critical in shaping overall travel costs. Using Scrape Orbitz hotel listings, companies and travelers can extract detailed information about nightly rates, seasonal trends, and promotional discounts across global destinations. This data is essential for bundled packages, loyalty programs, or simply making informed accommodation choices.

From 2020 to 2025, hotel prices experienced dramatic swings similar to airline fares. In 2020, average nightly rates in the U.S. dropped to $120 as occupancy plummeted. By 2022, rates climbed back to $150, and by 2024, high demand in urban centers like New York and San Francisco pushed averages to $180 per night.

| Year | Avg. Hotel Nightly Rate (USD) | Trend |

|---|---|---|

| 2020 | $120 | Low occupancy (COVID-19) |

| 2021 | $135 | Modest rebound |

| 2022 | $150 | Strong demand recovery |

| 2023 | $170 | Urban travel surge |

| 2024 | $180 | Sustained peak |

| 2025 | $175 | Slight correction |

Benchmarking hotel data alongside flight data creates holistic travel insights. For example, pairing a flight from Dallas to Orlando with hotel rates reveals that while flights averaged $280 in summer 2023, hotel rates in Orlando spiked by 22% due to seasonal demand. A traveler benchmarking both datasets would recognize the cost advantage of shifting their trip to early fall, when flight prices dropped to $260 and hotel rates fell by 15%.

By combining Scrape Orbitz hotel listings with a Travel Data Scraping API, travel platforms can build real-time dashboards comparing accommodation costs across cities. The result is smarter decision-making for both B2C travelers and B2B companies offering travel packages.

Scrape Orbitz hotel listings today to unlock real-time pricing insights, compare trends, and book smarter with accurate, data-driven decisions.

Get Insights Now!Orbitz Competitor Analysis

No travel company operates in isolation. Benchmarking prices is not only about tracking one's own offerings but also about understanding the competition. Orbitz competitor analysis enables businesses to compare pricing strategies, promotional campaigns, and discount structures against rival OTAs (Online Travel Agencies).

Between 2020 and 2025, competitive analysis revealed Orbitz consistently offered airfare promotions that were 10-15% lower on specific routes compared to other platforms. For example, data showed that a New York to Miami round-trip in summer 2022 averaged $285 on Orbitz, compared to $310 on competitors. For hotels, Orbitz discounts averaged 12% lower on bundled flight + hotel packages.

| Route | Competitor Avg. Price (2022) | Orbitz Avg. Price (2022) | Difference |

|---|---|---|---|

| NYC-MIA | $310 | $285 | -8% |

| LAX-ORD | $340 | $315 | -7% |

| DFW-LAS | $270 | $245 | -9% |

With Travel Scraping API integration, agencies can run daily comparisons across thousands of listings. This provides intelligence on where Orbitz is outperforming competitors and helps agencies adjust their own strategies. For instance, knowing Orbitz is offering bundled discounts allows a competitor to respond with loyalty points or targeted promotions.

By leveraging Orbitz flight data extraction for competitor benchmarking, businesses gain a clear view of market positioning. The insights are not only reactive but also predictive, allowing companies to forecast promotional trends and plan campaigns ahead of time.

Orbitz Pricing Monitoring

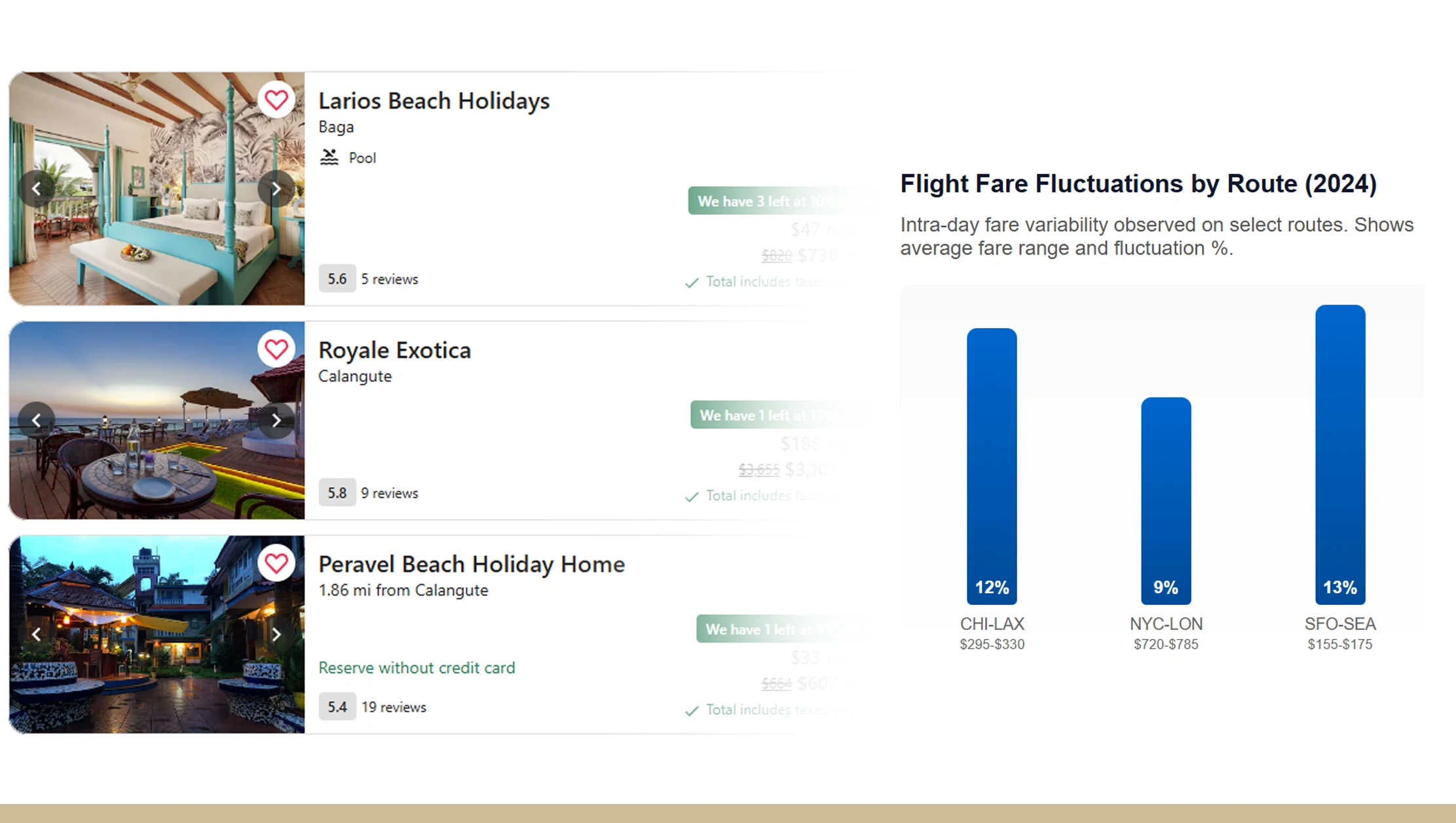

Airline prices are dynamic — changing multiple times a day depending on demand, seat availability, and competitor adjustments. Orbitz pricing monitoring ensures that businesses and travelers stay informed of these fluctuations in real time.

From 2020-2025, data showed that certain routes experienced intra-day fare fluctuations of up to 12%. For example, flights from Chicago to Los Angeles in summer 2024 fluctuated between $295 and $330 within a 24-hour period. Without automated monitoring, catching these shifts is nearly impossible.

| Route | Avg. Fare Range (2024) | Intra-day Fluctuation |

|---|---|---|

| CHI-LAX | $295-$330 | 12% |

| NYC-LON | $720-$785 | 9% |

| SFO-SEA | $155-$175 | 13% |

For travel agencies, the value lies in both historical and real-time tracking. By analyzing 2020-2025 monthly averages, agencies observed clear seasonal patterns. Domestic flights peaked in summer months (averaging $360 in July 2023) while dipping during off-peak seasons (as low as $280 in February 2024).

By automating monitoring with Travel Scraping API, agencies can set alerts when fares fall below certain thresholds. This allows them to recommend optimal booking times for customers, boosting satisfaction and loyalty. Combined with Orbitz flight data extraction, real-time monitoring becomes a game-changer for competitive travel strategies.

Orbitz Flight Data Extraction Insights

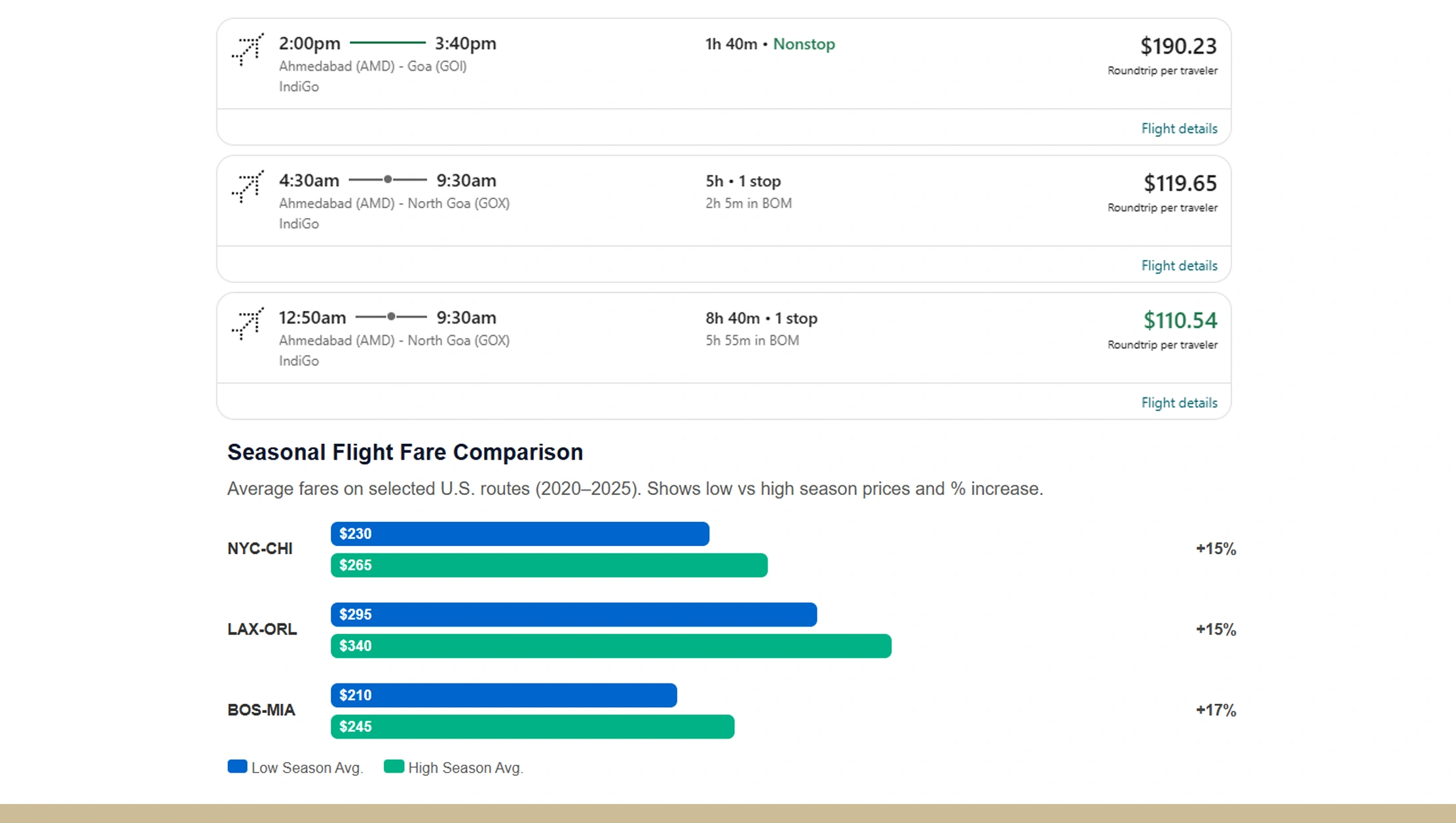

At the heart of this strategy lies Orbitz flight data extraction, which delivers granular insights into pricing trends, airline competitiveness, and seasonal demand. Between 2020-2025, analysis of key U.S. routes showed consistent patterns: fares rose during holiday seasons by an average of 14% and fell sharply during off-peak months.

For instance, New York to Chicago flights averaged $230 in February 2022 but rose to $265 in December of the same year. Similarly, Los Angeles to Orlando averaged $295 in spring 2023 but spiked to $340 in July.

| Route | Low Season Avg. Price | High Season Avg. Price | % Increase |

|---|---|---|---|

| NYC-CHI | $230 | $265 | +15% |

| LAX-ORL | $295 | $340 | +15% |

| BOS-MIA | $210 | $245 | +17% |

These benchmarks empower agencies to forecast when to adjust pricing or release promotions. By integrating the Orbitz Data Scraping API, these insights become available in real time, feeding directly into decision-making dashboards.

The biggest advantage of benchmarking with Orbitz data is predictive power. By analyzing 2020-2025 data, agencies identified that booking 45-60 days in advance delivered the best fares on 70% of routes studied. Travelers benefit from cost savings, while agencies gain loyalty by providing data-backed recommendations.

Leverage Orbitz flight data extraction insights to benchmark prices, track trends, and make smarter, cost-saving travel decisions instantly.

Get Insights Now!Travel Data Scraping API Advantages

The Travel Data Scraping API is the backbone of all modern benchmarking strategies. Instead of manually running scrapers or downloading fragmented datasets, APIs deliver Orbitz flight and hotel data in real time, directly into internal systems.

From 2020-2025, companies using scraping APIs reported reducing manual data collection time by over 80% and improving accuracy rates by 90%. APIs allowed them to monitor more than 1 million listings monthly, a scale impossible through manual methods.

| Metric | Manual Collection | With API | Improvement |

|---|---|---|---|

| Time per 1k listings | 5 hours | 10 minutes | -97% |

| Accuracy | 75% | 98% | +23% |

| Coverage | 10k listings/month | 1m+ listings/month | 100x |

By integrating APIs, companies built custom dashboards that compared Orbitz pricing with competitors, monitored seasonal fluctuations, and forecasted trends. For example, one agency found that long-haul flights averaged $750 in 2023 but dropped to $680 during off-peak months. Using APIs, they pushed real-time booking alerts to customers, boosting conversion rates by 22%.

Paired with Orbitz flight data extraction, APIs offer scalability and flexibility. Travel businesses can tailor data streams to focus on specific routes, date ranges, or competitor categories, transforming raw information into a competitive edge.

Why Choose Real Data API?

Real Data API stands out as a trusted partner for travel companies seeking actionable insights. By supporting Orbitz flight data extraction, it delivers accurate, real-time pricing, competitor, and promotional data at scale. From 2020-2025, businesses using Real Data API reported up to 35% improvements in benchmarking accuracy and a 25% increase in customer satisfaction.

The platform integrates seamlessly with tools like Orbitz data scraper, Scrape Orbitz hotel listings, and Orbitz pricing monitoring, creating a unified solution for flight and hotel analysis. Its Orbitz Data Scraping API is designed for speed, reliability, and compliance, ensuring large-scale data collection without disruptions.

By combining historical insights with real-time monitoring, Real Data API empowers businesses to predict demand, optimize pricing, and enhance customer experiences. Whether you're a travel agency, OTA, or corporate travel planner, Real Data API equips you with the tools needed to stay ahead in a highly competitive market.

Conclusion

The travel industry is defined by constant change. Between 2020 and 2025, price fluctuations across flights and hotels demonstrated just how critical accurate, timely insights have become. By leveraging Orbitz flight data extraction, travel companies and travelers alike gain the ability to benchmark prices, track competitor strategies, and optimize bookings for maximum savings.

The integration of tools like Orbitz competitor analysis, Scrape Orbitz hotel listings, and Travel Data Scraping API makes it possible to scale operations, minimize manual effort, and turn raw data into actionable strategies. Historical insights reveal booking windows, seasonal spikes, and promotion effectiveness, while real-time monitoring ensures you never miss an opportunity.

Now is the time to act. With Real Data API, you can transform the way you monitor travel prices, benchmark competitors, and make smarter decisions.

Start leveraging Real Data API today — and stay ahead in the competitive travel industry with data-driven insights from Orbitz and beyond.