Introduction

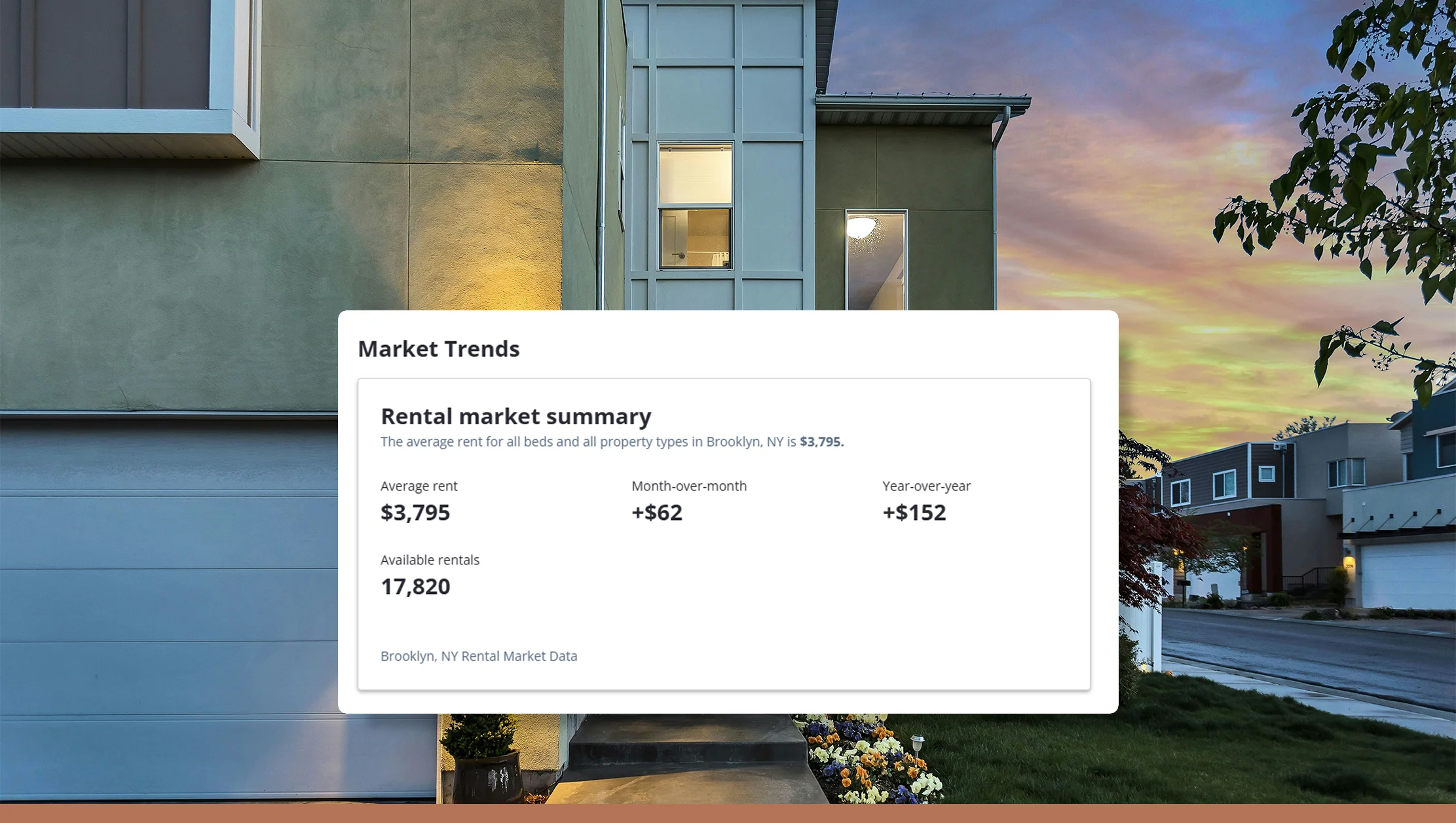

The rental housing market is evolving rapidly, especially in urban centers where affordability, migration patterns, and economic shifts influence pricing every month. For real estate professionals, investors, proptech startups, and municipal planners, staying ahead of these dynamic changes is a necessity. Manual data collection from hundreds of listings across different cities is no longer viable. Instead, City-Wise Rental Price API Scraping provides a powerful, automated way to extract localized, real-time rental information.

With APIs designed to pull property listing data by city, region, and property type, stakeholders can visualize rent growth, spot pricing anomalies, and forecast future trends based on verified market activity. These tools go far beyond generic analytics—offering granular, block-by-block intelligence.

Using Real Estate Datasets enriched with filters like square footage, property age, and amenities, users can dissect rental trends down to specific zip codes. This blog explores how City-Wise Rental Price API Scraping enables smarter, real-time housing analysis, with six practical use cases, performance tables (2020–2025), and an overview of how Real Data API supports seamless, scalable deployment for all players in the real estate ecosystem.

Optimizing Rental Pricing Strategy for Landlords and Agents

Landlords and property agents constantly face the challenge of pricing units competitively while maximizing profits. Setting rents too high leads to longer vacancy periods, while underpricing results in lost revenue. Traditional methods like using outdated comps or neighborhood averages fail to reflect real-time market behavior.

With City-Wise Rental Price API Scraping, landlords gain precise, current data on similar properties in their target neighborhoods. The API pulls real-time rental listings filtered by property type, size, location, and listing status—allowing property owners to benchmark their rents with high confidence.

By incorporating data from the Rental Price Monitoring by City module, agents can adjust listings dynamically based on what competitors are charging, localized demand surges, or even seasonal fluctuations.

Table: Average Monthly Rent for 2BHK Apartments (2020–2025)

| City | 2020 ($) | 2021 ($) | 2022 ($) | 2023 ($) | 2024 ($) | 2025 ($ est.) |

|---|---|---|---|---|---|---|

| New York | 2,970 | 3,050 | 3,210 | 3,380 | 3,520 | 3,640 |

| San Francisco | 3,200 | 3,150 | 3,300 | 3,460 | 3,610 | 3,750 |

| Chicago | 1,870 | 1,930 | 2,010 | 2,080 | 2,140 | 2,210 |

| Austin | 1,600 | 1,690 | 1,780 | 1,860 | 1,910 | 1,970 |

With this kind of real-time benchmarking, landlords and agents ensure their units remain attractive and competitively priced—backed by the power of automated rental data insights.

Real-Time City Comparisons for Investors

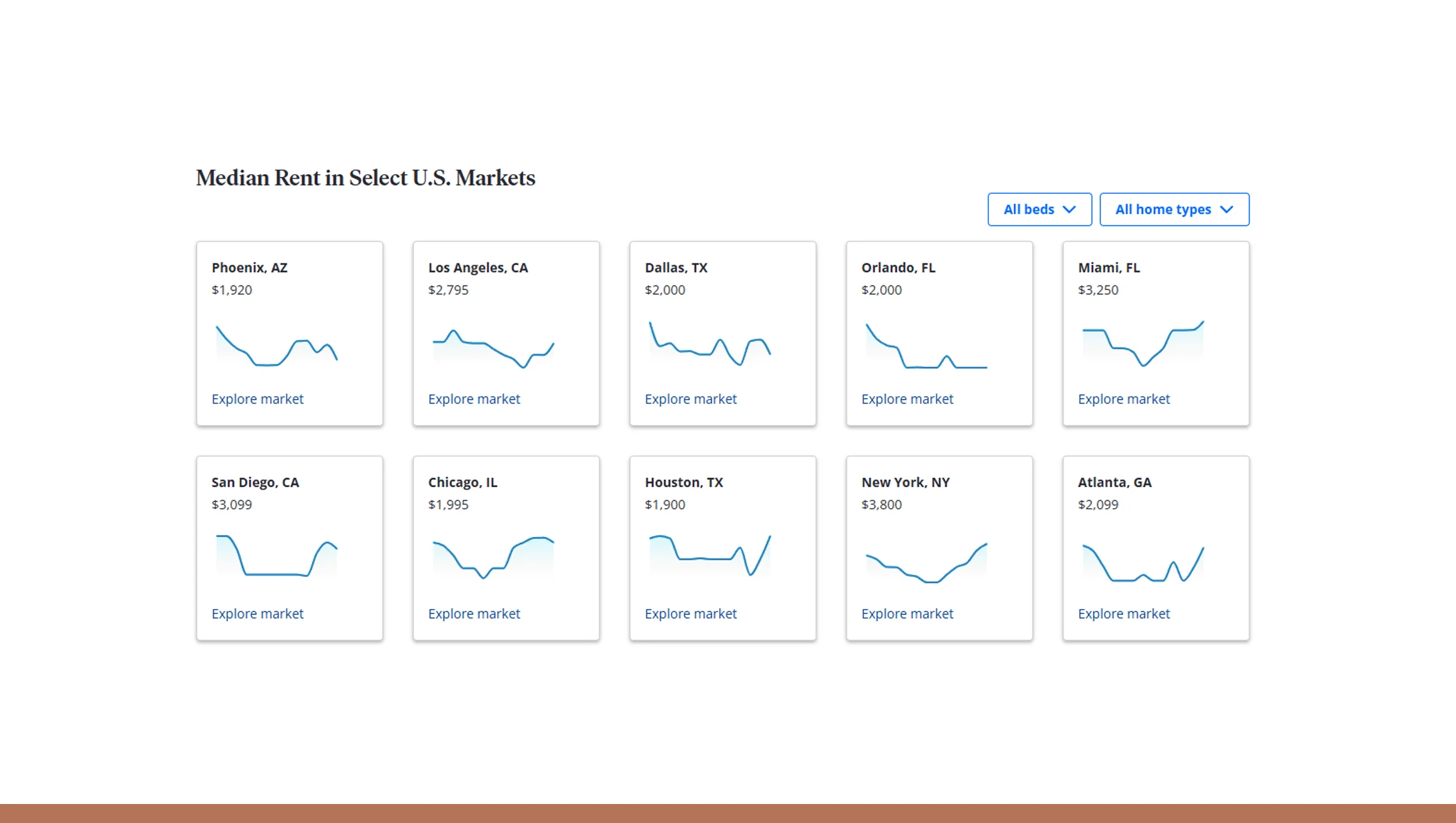

Property investors increasingly diversify across multiple cities to spread risk and capture high-growth rental markets. However, making city-to-city comparisons without uniform, current data leads to guesswork.

With Scrape Real-Time Rental Data API, investors can extract comparable rental figures across cities based on property type, neighborhood ratings, and tenant demand. The result is a data-rich map of urban rental health in real time.

Consider an investor comparing rental yields between Denver and Miami. The API can surface average rent, occupancy trends, and listing saturation in each city. Combined with purchase price trends, this offers a clear ROI calculation.

Table: Rental Yield Comparison by City (2020–2025)

| City | Avg Rent (2025 est.) | Avg Property Price (2025) | Gross Yield (%) |

|---|---|---|---|

| Denver | $2,300 | $445,000 | 6.20% |

| Miami | $2,850 | $610,000 | 5.60% |

| Phoenix | $1,920 | $370,000 | 6.23% |

| Boston | $3,100 | $715,000 | 5.20% |

The API helps investors allocate capital to markets with higher yield potential and stronger rental demand trends—based on verified rental data, not speculation.

Compare rental markets across cities instantly—use real-time APIs to guide smarter investment decisions with accurate, city-wise rental price data.

Get Insights Now!Government & Urban Planning Analysis

City planners and housing departments rely on timely data to address affordability, gentrification, and housing availability. Yet, they often operate with outdated census or survey data.

Using the Urban Rental Price Trend Scraper, municipalities can monitor rent increases at the neighborhood level, identify hotspots of rental inflation, and target policy interventions where needed. When integrated with demographic and income data, city-wide rental scraping provides a complete socio-economic picture.

Let’s say a city wants to measure the impact of a new transit line on rental prices. The scraper provides before-and-after rent data, enabling evidence-based policymaking.

Table: Rental Price Increase Near Transit Projects (2020–2025)

| Project Area | Pre-Transit Rent (2020) | Post-Transit Rent (2025) | Increase (%) |

|---|---|---|---|

| LA Metro Purple | $2,150 | $2,490 | 15.8% |

| DC Silver Line | $1,980 | $2,320 | 17.2% |

| Seattle Light Rail | $1,720 | $2,080 | 20.9% |

City APIs like these ensure better housing equity strategies—built on fresh, location-specific data.

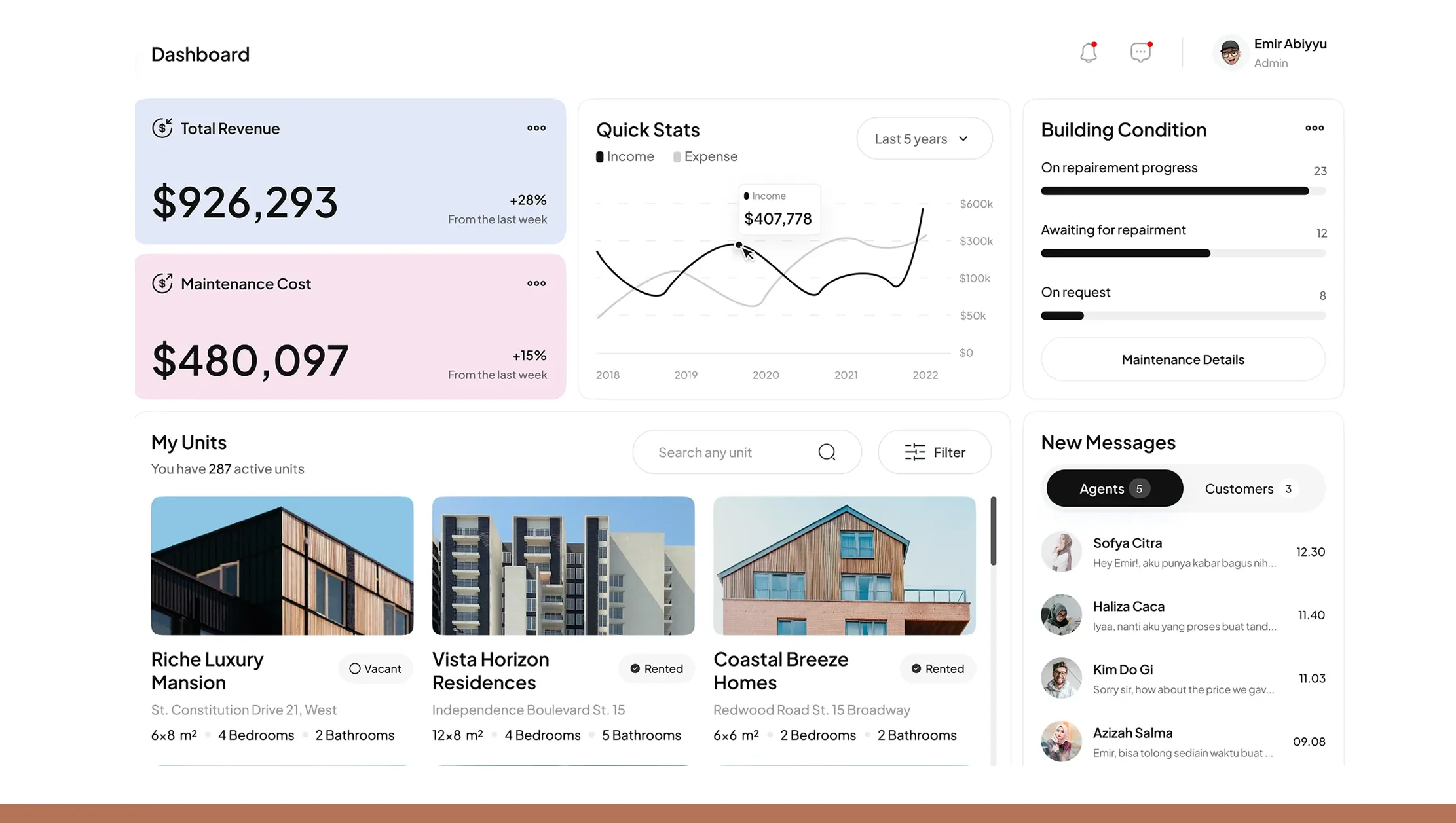

Enhancing PropTech Platforms & Rental Apps

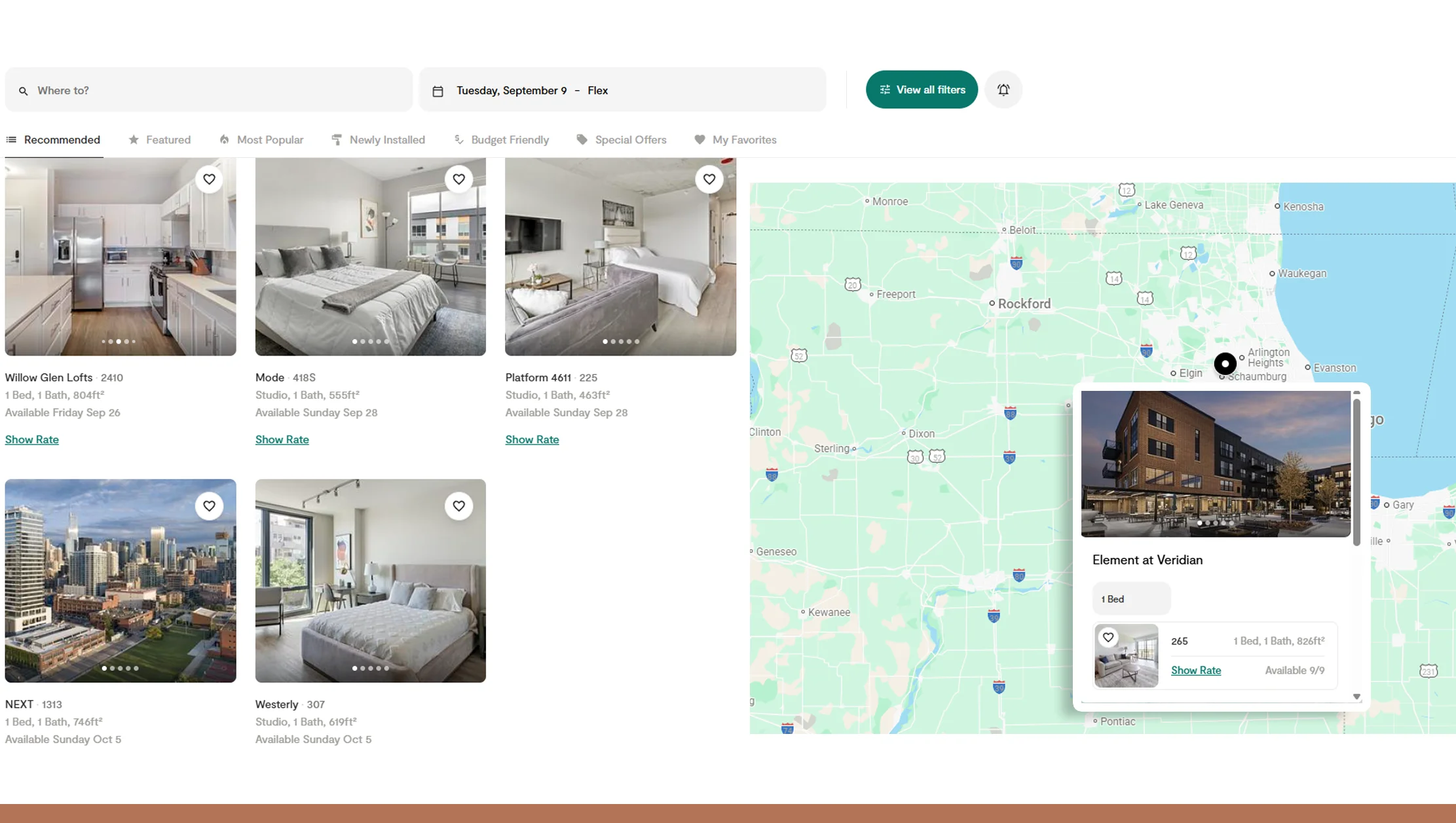

Modern PropTech startups rely heavily on automated data flows to deliver location intelligence, property recommendations, and rent estimators. Yet, building these tools internally is time-consuming and prone to data inconsistencies.

With City-Wise Rental Price API Scraping, developers can plug into verified property feeds filtered by city, district, and listing criteria. These feeds power rent calculators, forecast engines, and map overlays inside mobile and web apps.

By using an API for City-Based Real Estate Pricing, companies reduce their time-to-market and ensure accuracy for end-users—whether tenants searching for homes or landlords setting rates.

Table: PropTech App Usage & Retention Metrics (API-Enabled vs Manual Feed)

| Metric | API-Enabled App | Manual Feed App |

|---|---|---|

| Avg Session Time (min) | 5.8 | 3.2 |

| User Retention (30 days) | 48% | 28% |

| Rent Estimate Accuracy (%) | 93% | 76% |

| Avg Development Time (weeks) | 2 | 6 |

By integrating rental APIs, PropTech platforms boost performance, cut dev time, and deliver real estate insights at scale.

Academic & Research-Based Housing Studies

Academia increasingly focuses on urban economics, rent inflation, and housing inequality. However, accessing standardized rental data across multiple cities poses major barriers.

With the Rental Market Data Extraction API, researchers can extract historical and real-time data across housing units, cities, and demographics. This supports deep learning models, affordability trend analysis, and predictive rent growth models.

Let’s consider a study analyzing gentrification trends in 10 U.S. cities from 2020 to 2025. Using scraped data, researchers correlate rent growth with income levels, migration trends, and eviction records.

Table: Annual Rent Growth in Gentrifying Neighborhoods (2020–2025)

| City | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 est. |

|---|---|---|---|---|---|---|

| Atlanta | 4.5% | 6.1% | 6.9% | 7.5% | 8.0% | 8.3% |

| Detroit | 3.2% | 4.0% | 4.6% | 5.3% | 5.9% | 6.2% |

| Portland | 5.0% | 6.5% | 7.2% | 7.9% | 8.4% | 8.7% |

Access to rental scraping APIs makes such impactful studies feasible and scalable.

Empower your housing research with real-time rental data—access accurate, city-wise insights for academic studies using advanced scraping APIs.

Get Insights Now!Developer Tools: Python Automation for Analysts

Analysts, data scientists, and automation engineers often require custom workflows to pull and visualize rental pricing data. Manual scraping is slow and violates many site policies. Enter Scraping Real Estate Data with Python combined with Real Data API’s endpoints.

With Python, analysts can schedule scripts to pull city-wise data, store it in SQL/NoSQL databases, and build Tableau or Power BI dashboards automatically. Using the Web Scraping Real Estate Data API, teams reduce manual work and eliminate human error.

A sample Python flow may involve calling the API daily for 10 cities, updating a dashboard, and alerting users when rent volatility exceeds a set threshold.

Table: API Workflow Time Saved vs Manual Collection (Per 10 Cities)

| Task | Manual Time | API Time |

|---|---|---|

| Data Collection | 3 hours | 15 mins |

| Cleaning & Structuring | 2 hours | 5 mins |

| Dashboard Update | 1 hour | Auto |

| Total Daily Time | 6 hours | 20 mins |

This automation frees analysts to focus on insights rather than data wrangling.

Why Choose Real Data API?

Real Data API offers the most accurate and developer-friendly solution for rental market intelligence. Our City-Wise Rental Price API Scraping tools are built for scale, supporting city-level customization, data enrichment, and high-frequency updates. We provide clean, structured data from real-time listings on leading property platforms, with coverage across North America, Europe, and Asia-Pacific regions.

Whether you’re an investor tracking price movements or a city official studying housing stress, our solutions offer flexibility, precision, and API-first design. From Real Estate Rental Trend Analysis API to location filters, historical snapshots, and JSON-ready formatting, every feature is engineered to make your data journey smooth and insightful.

We also provide comprehensive documentation, developer support, and enterprise deployment options. With a track record of serving PropTechs, research firms, and government agencies, Real Data API is your partner for high-performance rental data extraction—built to evolve with your needs.

Conclusion

The future of real estate lies in actionable data—and with rising urban complexity, accessing localized rental intelligence is more critical than ever. City-Wise Rental Price API Scraping bridges the gap between static data and real-time decision-making. Whether you're a landlord refining pricing, a startup scaling rental insights, or a researcher analyzing affordability, this API gives you an edge powered by automation and accuracy.

Real Data API delivers more than just listings. From predictive analytics to spatial analysis, our tools help you understand the why behind rental trends—not just the what. With seamless integration options and highly customizable parameters, it's never been easier to track, analyze, and act on housing market changes in real time.

Ready to transform how you access city-wise rental data? Start using Real Data API today for smarter real estate insights, powered by precision and speed.