Introduction

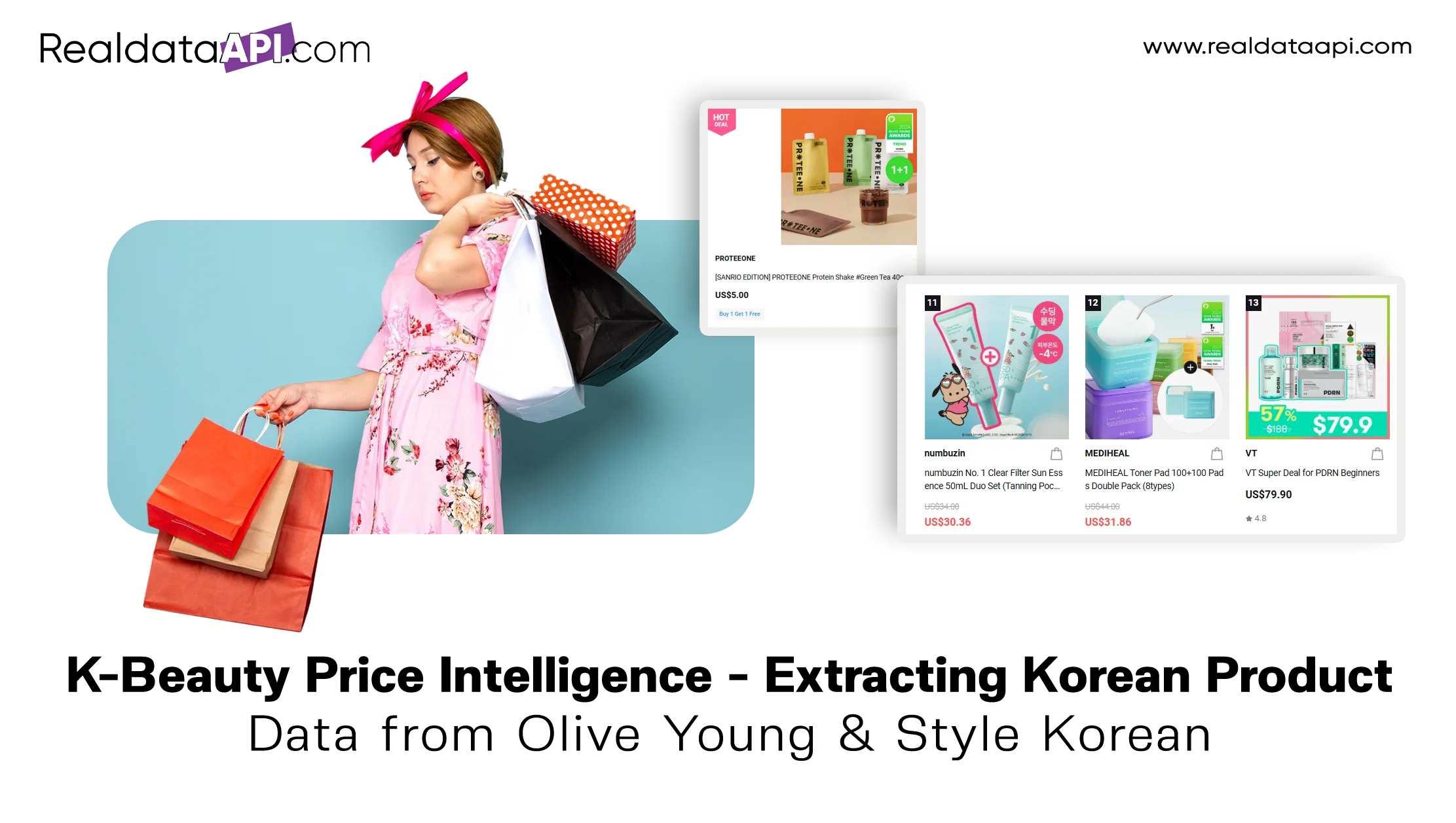

K-Beauty is more than a trend — it’s a global retail powerhouse worth billions, with fans worldwide chasing the next big product. But as demand grows, competition grows even faster. Smart brands and resellers now rely on Extracting Korean Product Data to stay one step ahead. By scraping top sites like Olive Young and Style Korean, they gain real-time pricing data, compare offers, and track shifting trends before anyone else. For both emerging D2C brands and global resellers, K-Beauty price intelligence means understanding not just what sells but where, when, and for how much. From bestseller masks to new SPF launches, the Korean beauty market’s data is scattered across hundreds of SKUs and dynamic listings. Without a structured approach, brands miss crucial shifts. That’s where Real Data API steps in: with advanced Web scraping Korean Style, brands get fresh, clean, structured data feeds that turn K-Beauty chaos into competitive clarity.

The Rising Value of K-Beauty Price Intelligence

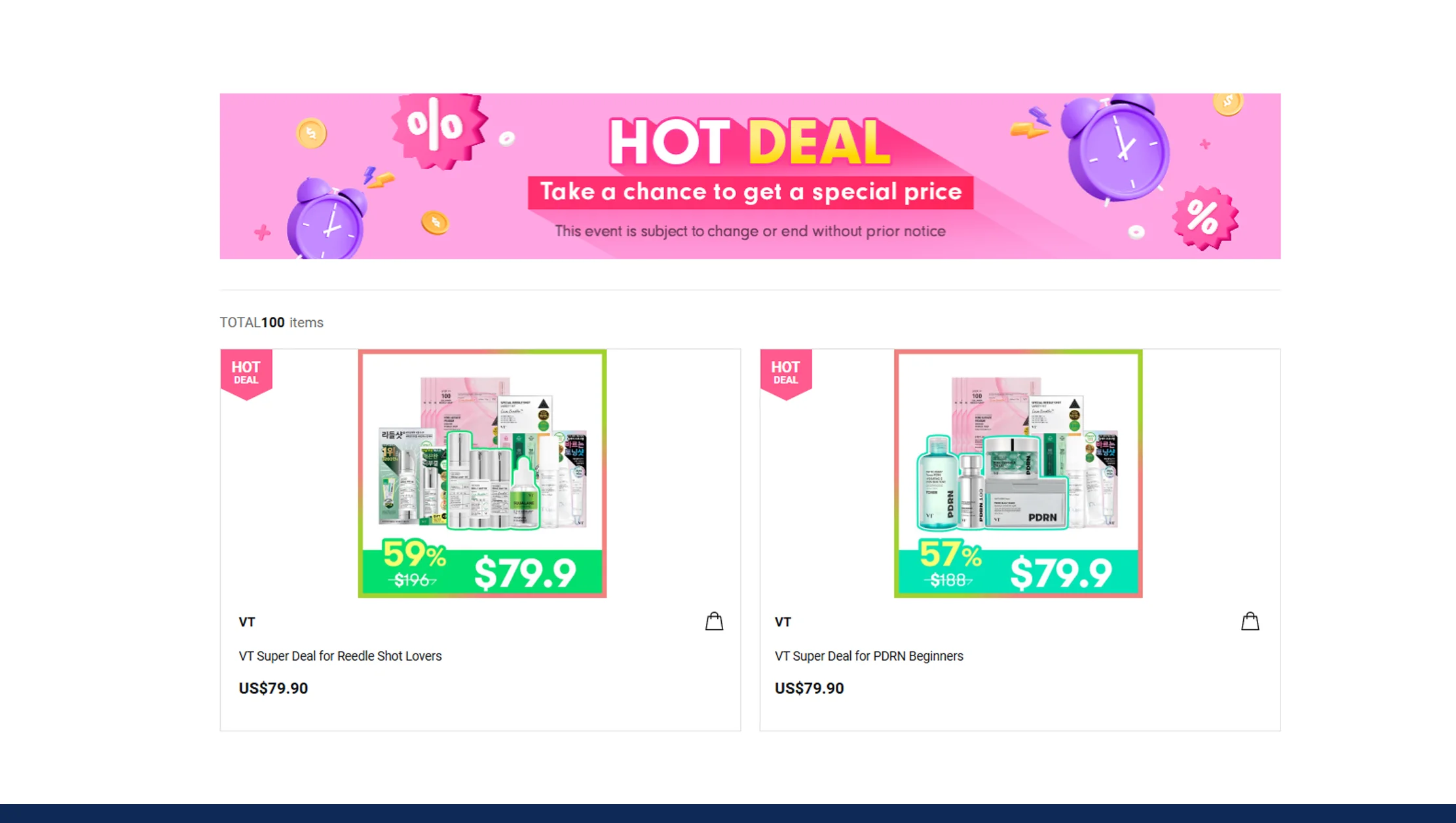

The Korean beauty market has exploded, growing from $10 billion in 2020 to an estimated $14 billion by 2025. This boom comes with new pressures — copycat products, rapid launches, and daily price wars. Brands use Extracting Korean Product Data to monitor Olive Young’s weekly sales, Style Korean’s limited drops, and seasonal campaigns that affect prices overnight. For example, during Korea’s massive November shopping festival, sheet mask prices drop by an average of 25%, while skincare sets see up to 40% discounts.

| Year | Market Size ($B) | Avg. Price Drop on Sale | Bestselling Category |

|---|---|---|---|

| 2020 | 10.0 | 20% | Sheet Masks |

| 2021 | 11.0 | 22% | Serums |

| 2022 | 12.0 | 24% | SPFs |

| 2023 | 13.0 | 26% | Toners |

| 2024 | 13.8 | 27% | Cleansers |

| 2025* | 14.0 est. | 28% | Sets & Bundles |

This is why real K-beauty product price tracking isn’t optional — it’s survival.

Stay ahead of K-Beauty trends — track prices daily, spot hidden discounts, and grow your market share with real-time price intelligence today!

Get Insights Now!What Data Do Smart Brands Extract?

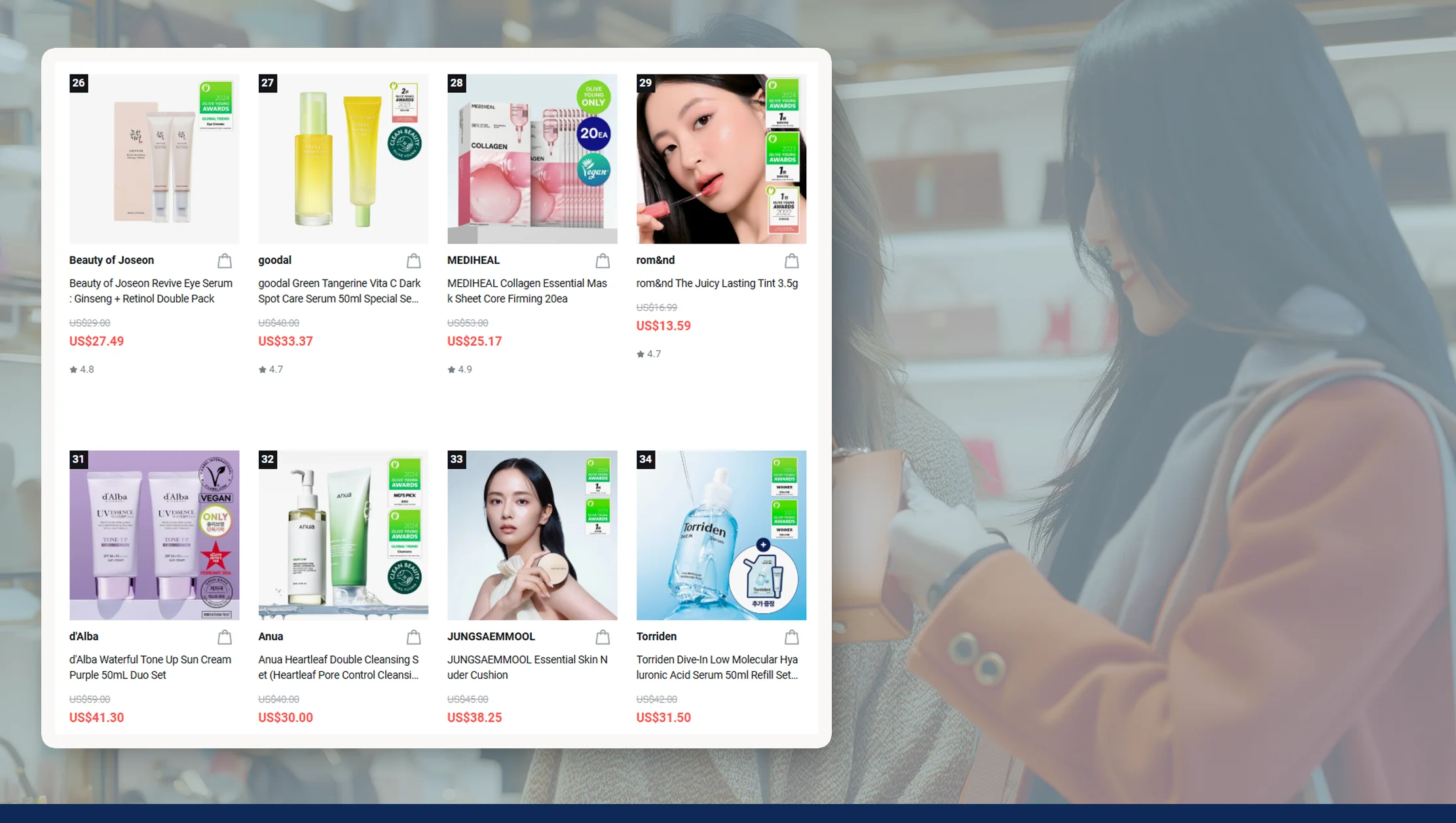

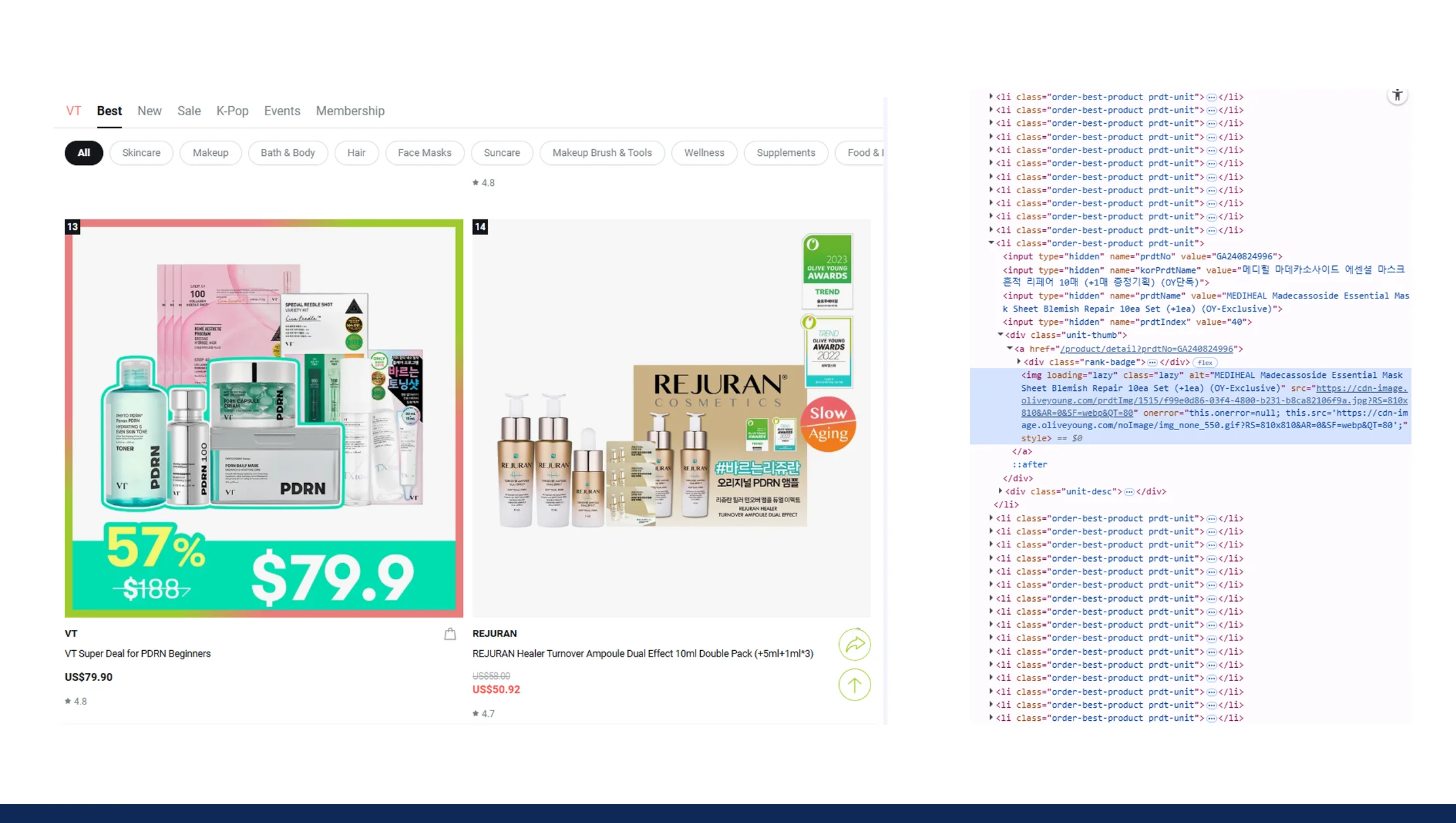

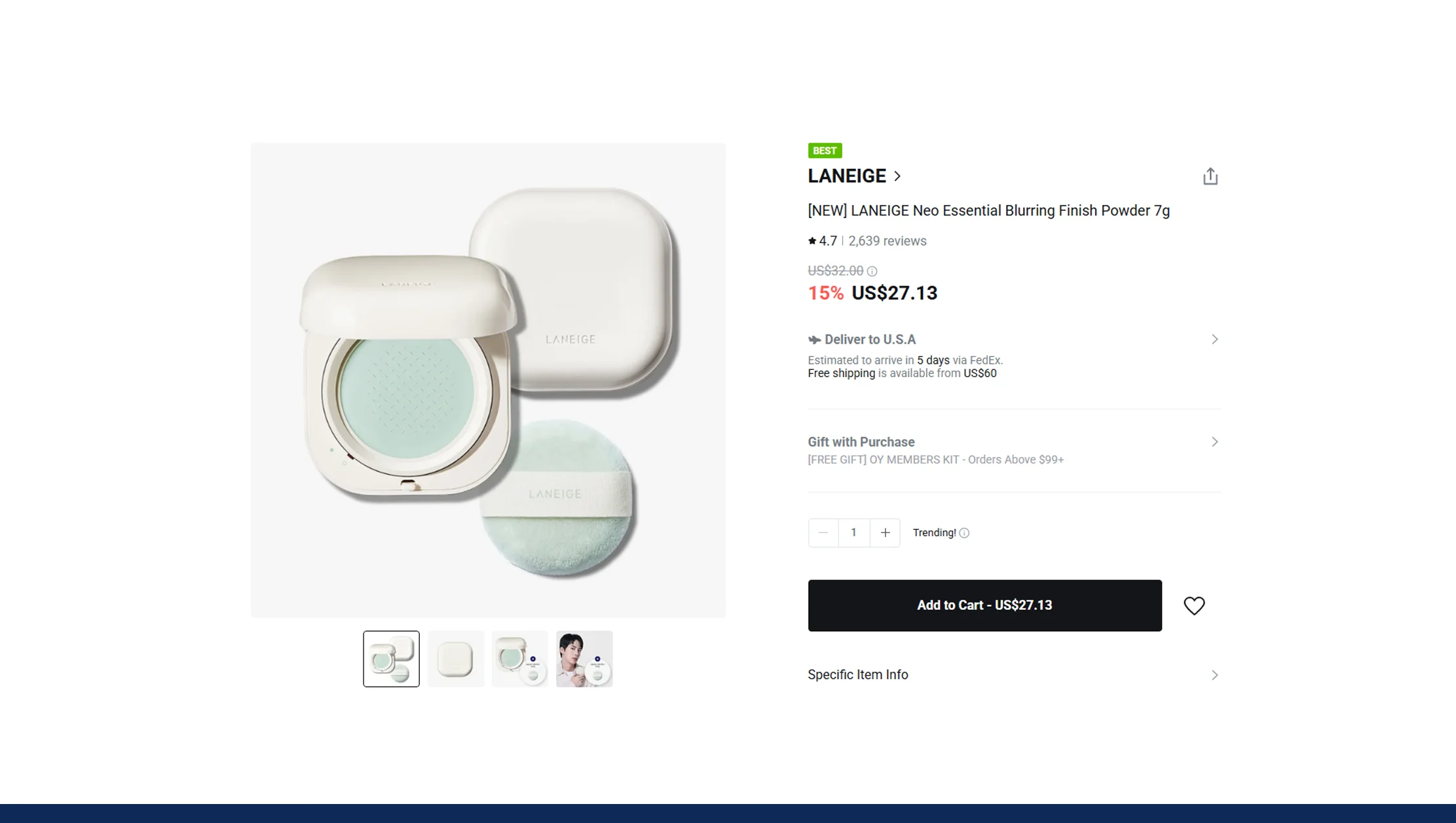

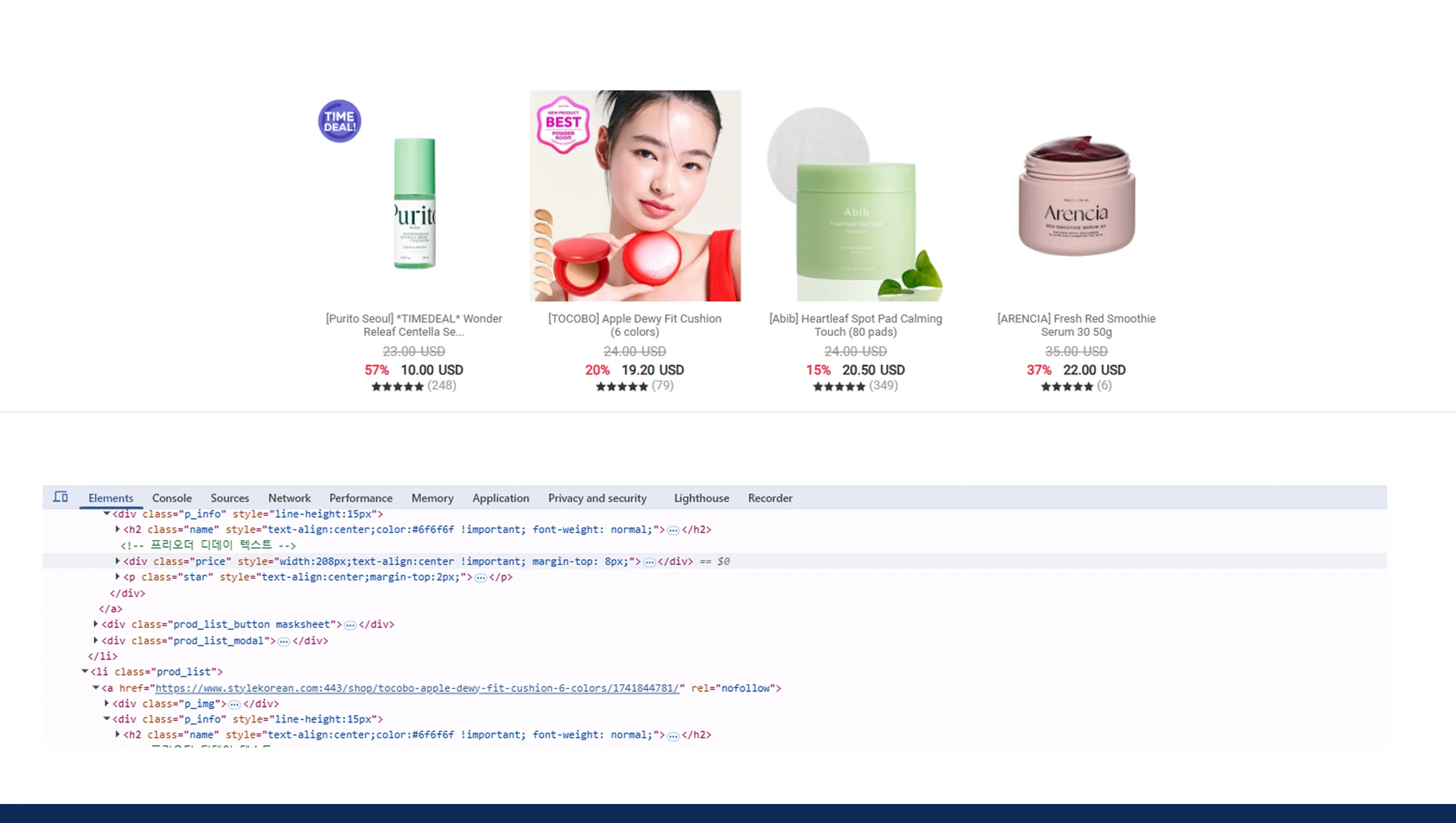

Successful brands don’t stop at price tags. Extracting Korean Product Data includes SKUs, variants, sizes, stock levels, discount codes, and customer ratings. This is the backbone of reliable Korean beauty eCommerce scraping — combining Olive Young’s local market data with Style Korean’s global reach. Brands also monitor keywords used, bundling strategies, and seasonal discounts. For instance, many top sellers launch mini versions of bestsellers for under $10 to attract repeat buyers — insights you’ll only catch if you’re scraping the listings daily. Bulk eCommerce Product Data scraping lets you merge this with ad spend, influencer deals, and reviews, building a full 360-degree pricing map.

Cross-Platform Benchmarking

K-Beauty brands rarely list on just one site. Olive Young might price a serum at $35, while Style Korean drops it to $30 during a promo. With Real-time Korean beauty pricing data, brands can react instantly. A competitor dropping prices for a bestseller? Adjust yours or launch a bundle to stay ahead. This agile benchmarking stops profit leaks and sharpens your margins. Data shows brands who compare at least three marketplaces boost average promo ROI by 15% year-over-year.

Real-World Use Case: Seasonal Promotions

Let’s say you’re a D2C brand launching a new SPF line before summer. By Extracting Korean Product Data from Style Korean’s April listings, you’ll see competitor launch dates, intro discounts, and trending keywords. Combine this with K-Beauty price intelligence to plan when to drop flash deals, match local buying habits, and win traffic during peak search weeks. Historical scraping shows that summer SPF launches in Korea jump sales by 60% compared to winter.

Maximize seasonal sales — use fresh K-Beauty data to time your promotions perfectly and boost profits when demand spikes every year!

Get Insights Now!Why Real-Time Data Wins?

Static price checks won’t cut it — Olive Young updates listings multiple times daily during sales. Smart brands invest in Web scraping Korean Style that updates hourly or daily, so there’s no lag when reacting to price drops or bundle promos. Real Data API’s Real-time Korean beauty pricing data feed helps global resellers align bulk shipments with the best margin windows. Resellers who adjust buying based on daily scrapes report up to 20% better profit per unit.

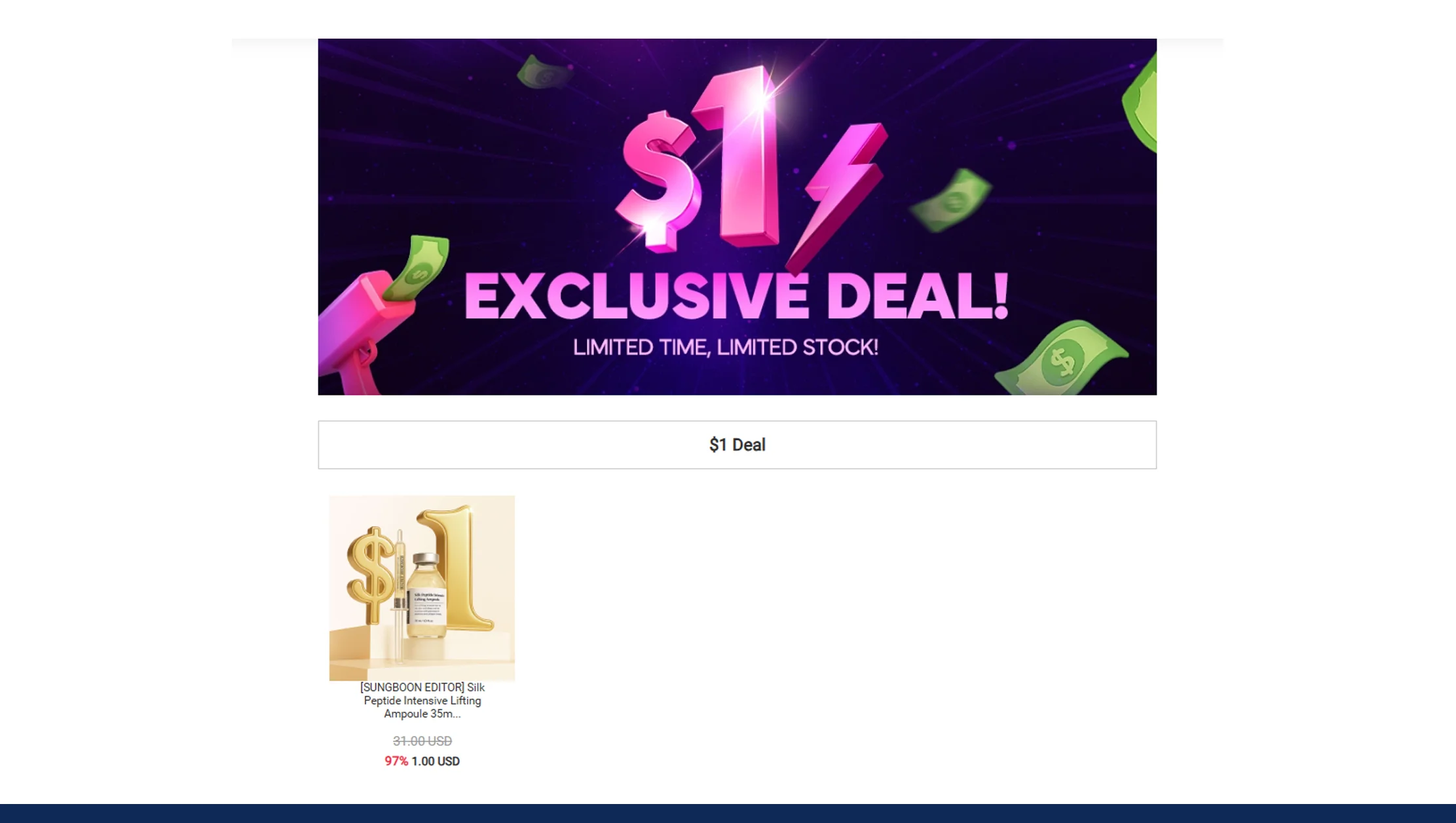

The Extra Edge: Coupons & Hidden Discounts

One trick brands miss? Scraping promo codes. Many K-Beauty shoppers wait for site-wide or influencer coupon drops. Advanced setups add Scrape Naver Discount Coupons to standard product data feeds, capturing bonus savings that affect your profit math. Savvy resellers watch for these hidden deals and adjust stock buys instantly. For example, a 10% site-wide coupon during Olive Young’s anniversary sale can swing profit margins by thousands for bulk buyers.

Why Choose Real Data API?

Real Data API makes Extracting Korean Product Data simple, scalable, and fully compliant. Our robust crawlers run daily across Olive Young, Style Korean, and other niche K-Beauty sites. We handle dynamic pages, hidden variants, and promo codes — then deliver clean data straight to your dashboard or feed. With a dedicated team, local language capabilities, and fast support, Real Data API removes the guesswork and lets your team focus on winning the K-Beauty market with confidence. If you want bulletproof K-Beauty price intelligence, we’re your trusted partner.

Conclusion

Whether you’re a brand owner, bulk reseller, or retail analyst, smart moves start with accurate data. With Real Data API’s Extracting Korean Product Data solutions, you get real-time clarity on pricing, trends, and hidden deals from Olive Young and Style Korean. Ready to track trends, benchmark prices, and boost your margins? Let Real Data API help you own the K-Beauty game — one SKU at a time.