Introduction

The ability to scrape Tesco liquor data in UK has emerged as a powerful method for businesses, researchers, and logistics providers to understand alcohol purchasing trends and geographical distribution. Tesco, being the largest grocery retailer in the UK, holds a significant market share in alcohol retail. From wines and spirits to beer and ready-to-drink beverages, its expansive product lineup reflects real-time consumer preferences and demand. With changing legislation, evolving demographics, and the rise of online alcohol deliveries, accurate and timely data is crucial.

Between 2020 and 2025, the UK’s alcohol market experienced a digital transformation. Online alcohol sales surged by 38% between 2020 and 2023, influenced by the pandemic and shifting buying behavior. Regional consumption patterns also shifted, driven by preferences for premium liquors and sustainable packaging. This evolution makes geolocation-based alcohol data scraping a vital tool.

Using Real Data API, users can now collect structured datasets on Tesco liquor listings, product availability, store-level inventory, and even regional pricing trends. This guide explains how businesses can leverage data like the UK alcohol store locator dataset or insights from Tesco store data scraping UK to make strategic decisions.

Alcohol Sales Patterns in Tesco (2020–2025): A Data-Driven Outlook

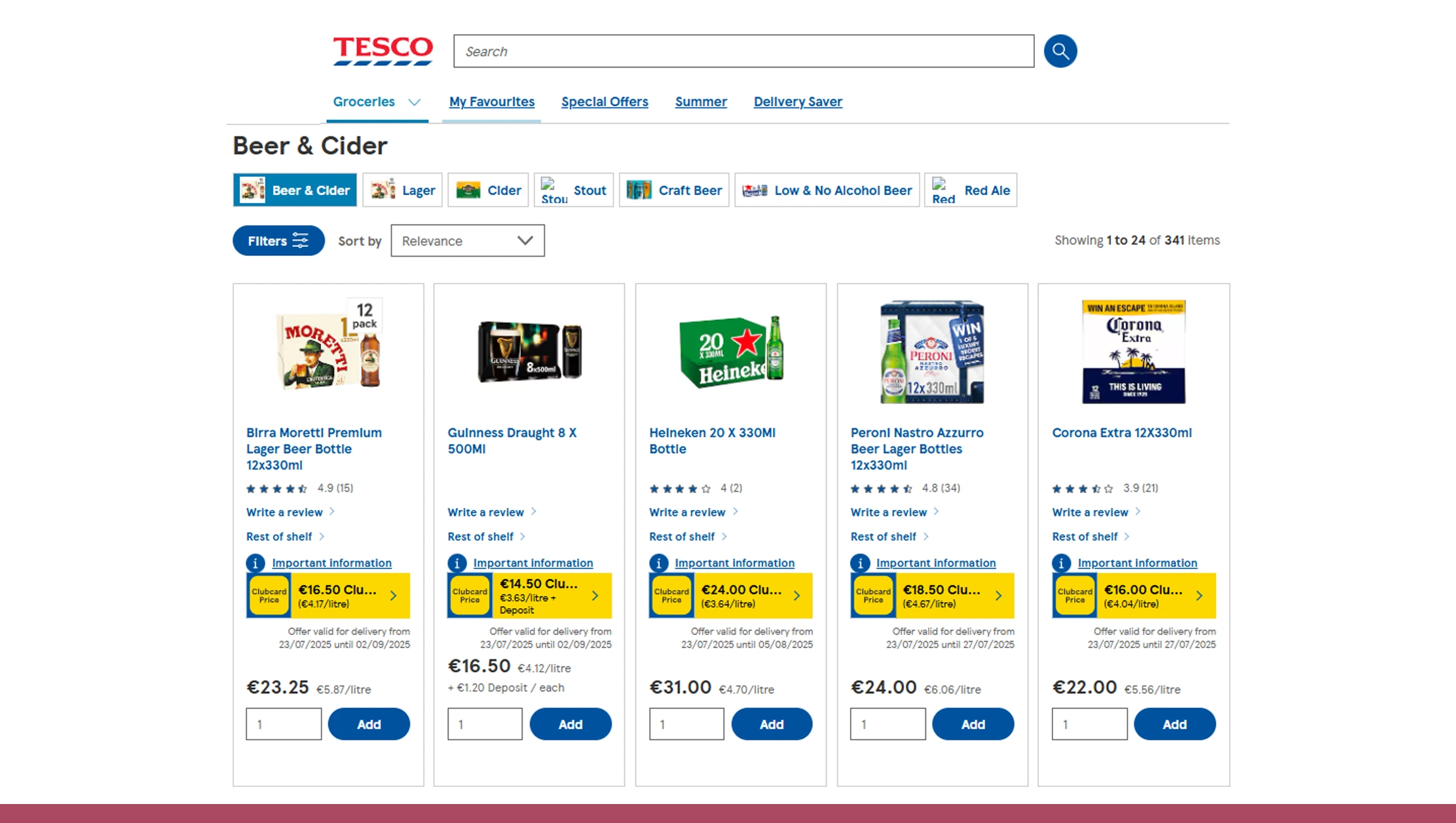

To make informed business decisions, it is essential to understand how alcohol consumption evolved within Tesco stores over time. By conducting Tesco store data scraping UK, analysts observed that beer and cider dominated 40% of alcohol purchases between 2020 and 2022. In contrast, wines and premium spirits gained traction from 2023 onwards, reflecting a shift toward premiumization and quality-focused preferences.

| Year | Beer & Cider (%) | Wine (%) | Spirits (%) | RTD Drinks (%) |

|---|---|---|---|---|

| 2020 | 45 | 30 | 20 | 5 |

| 2021 | 42 | 31 | 22 | 5 |

| 2022 | 40 | 33 | 22 | 5 |

| 2023 | 36 | 35 | 25 | 4 |

| 2024 | 34 | 36 | 26 | 4 |

| 2025 | 33 | 37 | 26 | 4 |

These trends underscore the value of category diversification. While beer & cider saw an 8% drop from 2020 to 2025, wine sales increased by 7%, showing a growing appreciation for varietals and provenance. Premium spirits, especially craft gins and single malt whiskies, witnessed steady growth, becoming holiday and gifting staples.

Through the Tesco wines and spirits locations data, it was observed that premium wine categories such as organic red wine and imported sparkling wines saw a 22% increase in sales across urban Tesco outlets. Metropolitan stores in cities like Leeds, Bristol, and Edinburgh showed faster adoption of these categories.

By integrating extract Tesco liquor locations into retail strategies, businesses can tailor product assortments and promotional activities to specific regions. For example, targeting Tesco Express stores near university campuses with RTD (ready-to-drink) cocktails proved effective, while suburban hypermarkets benefited more from family-sized wine packs.

Such insights help brands and suppliers build dynamic pricing, promotional, and inventory models based on real-time Tesco sales evolution from 2020 to 2025.

Regional Liquor Demand Mapping with Geospatial Insights

The demand for real-time, location-based analytics is growing rapidly in the alcohol retail industry. With region-specific consumption preferences and logistical constraints in mind, understanding where, what, and how people buy alcohol is crucial. Leveraging geospatial scraping Tesco stores, businesses gain access to highly localized data regarding alcohol availability, delivery capabilities, and in-store traffic volumes.

Data from 2020 to 2025 reveals that urban centers like London, Manchester, and Birmingham dominate Tesco liquor footfall, accounting for over 60% of visits to alcohol-selling Tesco branches. This concentration allows brands and delivery companies to prioritize high-traffic nodes for stocking, promotions, and last-mile delivery.

| City | Average Weekly Footfall (2025) | Wine Preference (%) | Spirits Preference (%) |

|---|---|---|---|

| London | 15,000 | 38 | 42 |

| Manchester | 11,000 | 35 | 40 |

| Birmingham | 10,500 | 34 | 38 |

Wine and spirits dominate preferences in London, where a mix of affluence and diverse demographics drives demand for niche liquor varieties and imported labels. Manchester and Birmingham follow closely, driven by an increase in disposable income and digital alcohol ordering platforms.

According to the UK alcohol delivery store data, 45% of Tesco customers in metropolitan areas prefer home delivery for wines and liquors. These insights are vital for optimizing warehousing, routing, and last-mile delivery solutions.

Using web scraping for alcohol store mapping, logistics and retail teams can:

- Align delivery routes with high-demand zones

- Forecast demand spikes (e.g., major events, holidays)

- Track availability of high-margin items in specific locations

Additionally, data suggests that delivery zones within 3–5 miles of Tesco superstores had a 20% higher delivery success rate, highlighting the need for hyper-local stocking strategies. When paired with loyalty card data and social media sentiment, geospatial datasets become a foundation for building highly responsive, region-specific alcohol supply chains.

Unlock real-time regional alcohol insights—optimize delivery zones, inventory, and marketing with geospatial Tesco liquor data analytics.

Get Insights Now!Enhancing Retail Intelligence with Tesco POI Data

Retailers looking to enhance their location-based strategy are increasingly turning to Tesco POI data extraction to optimize operations. Point-of-interest (POI) data goes beyond identifying store addresses. It offers detailed insights into store formats (Express, Extra, Metro), traffic density, consumer demographics, and footfall patterns.

One major use case involves product placement and marketing. Using the Tesco wine store finder dataset, a wine manufacturer preparing a 2025 launch mapped the top 50 Tesco stores with the highest red wine sales in Q4 2024. The results revealed that suburban locations in Essex and Surrey had a 15% higher red wine sales rate than urban centers. This shift was attributed to rising home consumption in family-dense neighborhoods.

Granular insights like these help stakeholders place the right products in the right locations. Retail planners can schedule localized campaigns, such as weekend wine tastings or loyalty promotions, where data suggests strong wine affinity. This precision is a game changer for brands operating on lean budgets.

When combined with retail location data scraping UK, retailers can also measure footfall conversion rates, link promo effectiveness with in-store dwell time, and understand competitor proximity effects. Additionally, POI datasets help improve:

- Category-level demand forecasts

- Store format-based product bundles

- Price elasticity evaluations by postcode

Retailers that actively integrate these data streams have seen up to a 12% improvement in shelf turnover and a 9% increase in regional sales volumes from 2022 to 2025.

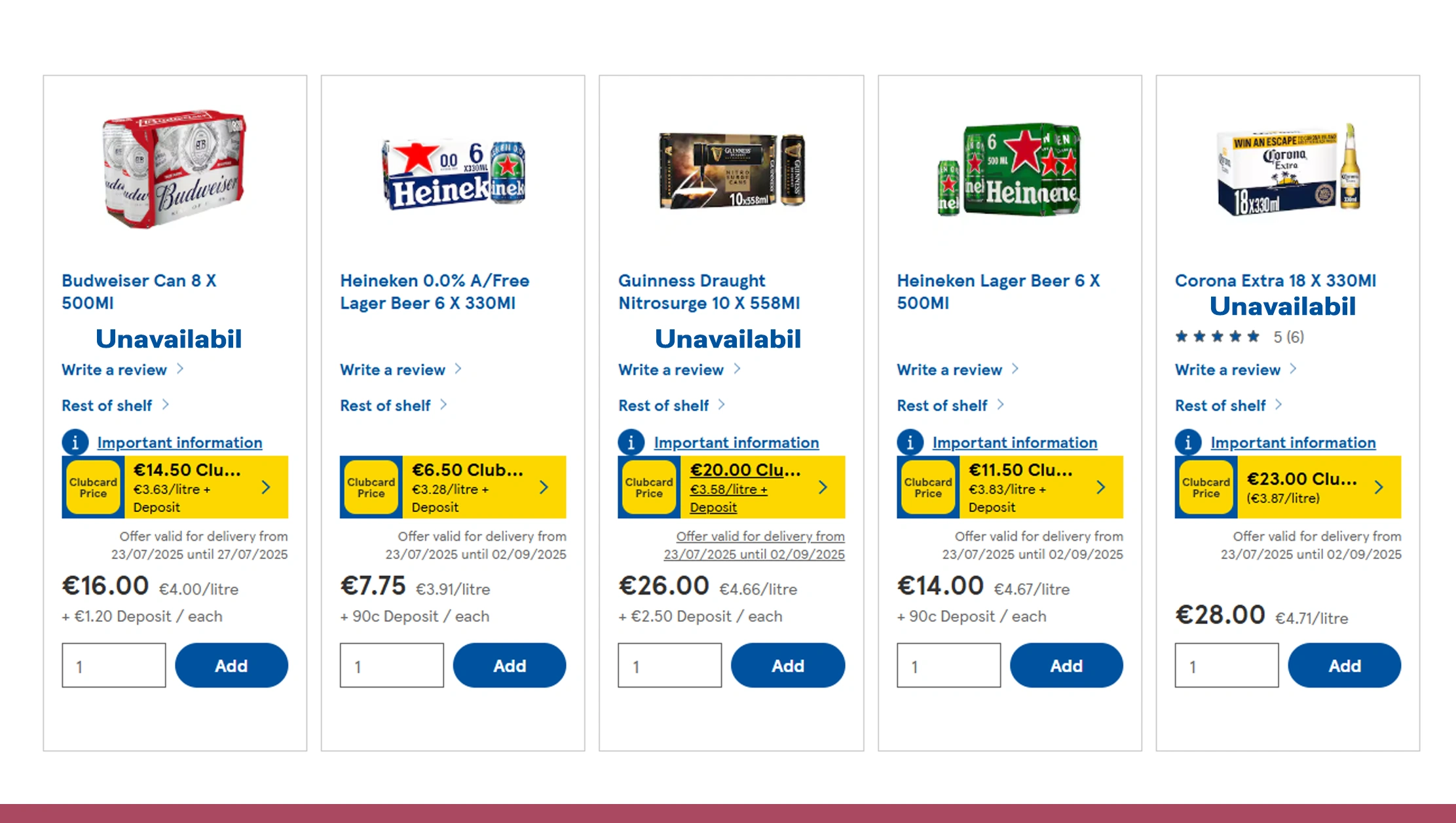

Understanding Tesco’s Product Availability Fluctuations

Alcohol product availability across Tesco outlets is dynamic and seasonally volatile. From supply chain challenges to limited-edition promotions, the ability to predict and respond to inventory changes is vital for sales continuity. Monitoring Tesco supermarket liquor availability is a proven strategy to manage this challenge effectively.

A Real Data API study showed that in 2024, out-of-stock (OOS) events in the liquor segment increased by 28% during holidays like Christmas and the Queen’s Birthday. The most affected categories were champagne, Irish whiskey, and local ales.

To mitigate such disruptions, brands and distributors are deploying real-time scraping tools to scrape Tesco liquor data in UK. These tools track stock availability, alert suppliers to dips, and flag pricing or assortment updates in real time. In 2025 alone, the Real Data API recorded over 3,200 inventory fluctuations per month across Tesco stores.

Notable findings included:

- The delisting of over 120 low-performing SKUs

- A 12% price reduction in domestic beer due to competitive pressure

- Weekly arrival of new SKUs in the premium gin segment

For logistics firms, this intelligence feeds into automated replenishment systems, while marketers use it to time their campaigns alongside new arrivals. Regional managers can adjust their planograms dynamically based on location-specific stock insights, reducing overstocking and missed sales opportunities.

Ultimately, this level of operational responsiveness leads to better forecasting accuracy, improved customer satisfaction, and stronger profit margins across Tesco’s nationwide retail network.

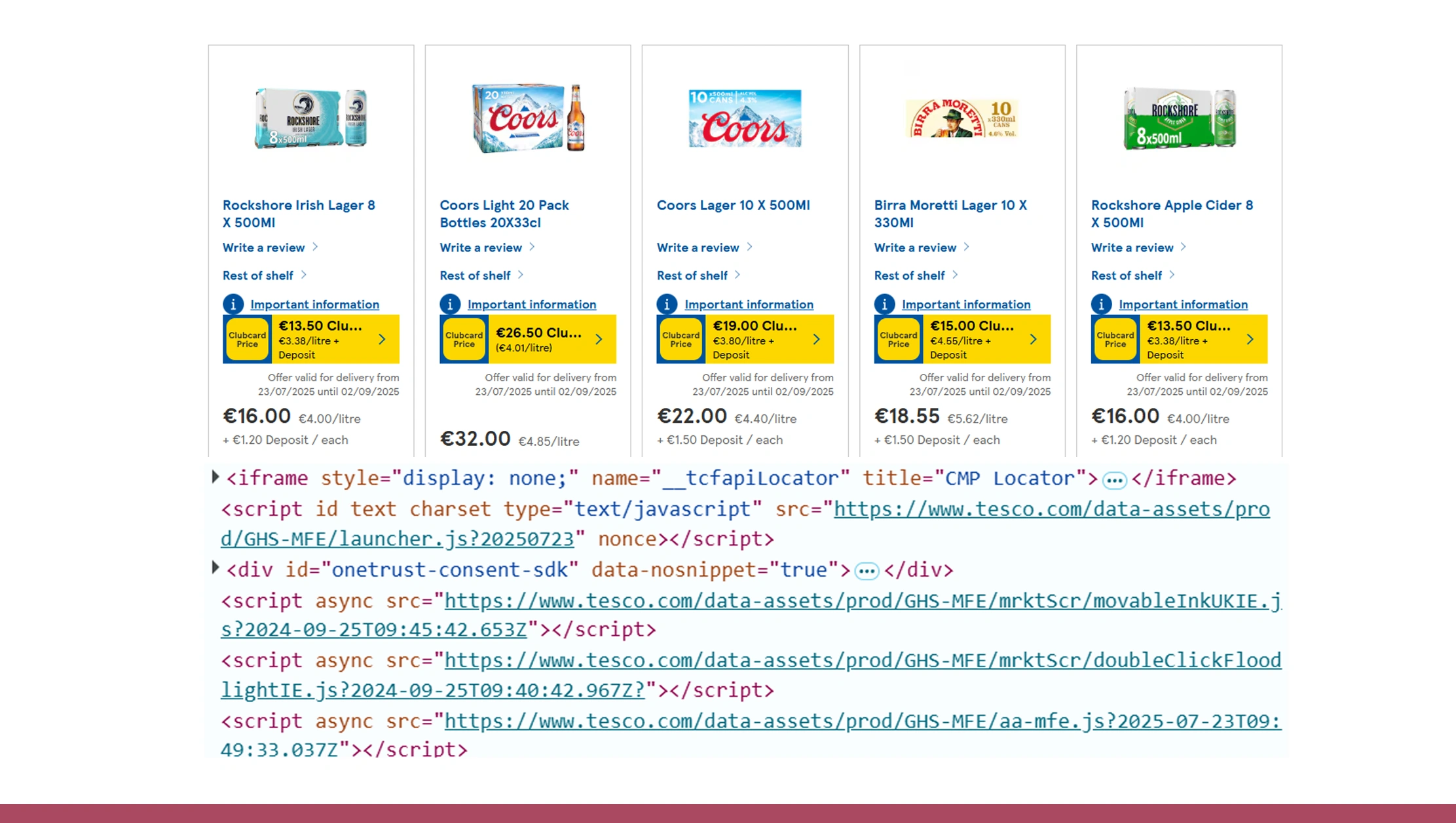

Leveraging Tesco API Scraping for Delivery Optimization

The demand for rapid, accurate delivery in the alcohol sector has intensified in recent years. In the UK, same-day alcohol delivery services experienced a 31% increase between 2022 and 2025, driven by changing consumer habits and the rise of app-based ordering platforms. By leveraging techniques to scrape Tesco API for store info, businesses gain access to real-time data on store locations, inventory levels, and operational hours—enabling superior last-mile logistics.

When paired with liquor store data for UK in 2025, companies can pinpoint delivery bottlenecks, improve vehicle routing, and balance supply with regional demand. A case study involving Real Data API and a major beverage delivery app showed that aligning delivery zones with Tesco stock and traffic data reduced delivery delays by 17% during peak holidays in 2025.

Optimization insights included:

- Dynamic rerouting based on real-time Tesco stock availability

- Prioritization of high-demand zones during Friday and Saturday evenings

- Adjusted inventory allocation to match frequent ordering trends

Data collected through API scraping also enhances customer segmentation. For instance, the API allowed tracking of top-selling SKUs by postcode, helping companies tailor local promotions. One urban trial revealed that areas with a high demand for organic wines responded better to curated bundle offers when promoted via push notifications.

In addition, delivery wait time analysis revealed that neighborhoods farther than 8 km from a Tesco store had a 23% higher risk of delayed delivery. By integrating live stock data with GPS-enabled fleet analytics, delivery networks can preemptively address service gaps.

This kind of operational agility is a direct result of combining structured Tesco API data with historical trends. The result: improved delivery reliability, increased customer retention, and cost savings through route optimization.

Boost delivery speed and accuracy—scrape Tesco API for store info and streamline alcohol logistics with real-time inventory and location data.

Get Insights Now!Building a National Liquor Access Map with Real Data API

The final and arguably most impactful use of data scraping is to create a nationwide map of liquor accessibility. By integrating the UK alcohol store locator dataset with historical datasets and live feeds, stakeholders can assess gaps in product distribution, store presence, and customer access to alcoholic beverages.

A 2023 Real Data API study revealed that over 18% of rural Tesco locations lacked premium wine SKUs, often due to perceived lower demand or logistic challenges. However, demand data suggested otherwise: premium wine sales surged 14% in select rural regions after targeted stock trials.

By applying methods to scrape Tesco liquor data in UK and blending the output with demographic, income, and road network datasets, businesses can:

- Identify underserved zones across the UK

- Launch hyper-targeted marketing campaigns

- Develop predictive stock models based on local profiles

Further insights using extract Tesco liquor locations revealed regional SKU duplication, where multiple stores in proximity carried the same limited items. Reducing this overlap freed shelf space for localized preferences.

Additionally, interactive dashboards powered by Real Data API visualize:

- Tesco store coverage in proximity to licensed delivery services

- Alcohol accessibility by population density

- Seasonal demand fluctuations by region

These visualizations become essential tools for planners, policy analysts, and alcohol brand strategists. A logistics provider used this data to open micro-fulfillment centers in regions with above-average demand and poor delivery coverage—cutting delivery time by 22% and boosting fulfillment capacity by 30%.

Real Data API transforms fragmented store-level information into a strategic map of alcohol accessibility across the UK, helping stakeholders make data-informed decisions to reach more customers with the right products.

Why Choose Real Data API?

Real Data API simplifies and scales the process of structured retail data collection. Whether you need to perform Tesco store data scraping UK, monitor stock changes, or capture Tesco POI data extraction, our API delivers accurate, geotagged, and real-time insights.

Benefits include:

- Seamless integration with GIS platforms and BI tools

- Scalable endpoints to fetch millions of records daily

- Dedicated support for industry-specific datasets

- Reliable access to structured formats like JSON, CSV, and XML

By leveraging Real Data API, businesses get full visibility into retail location data, sales trends, and inventory signals without relying on outdated manual methods.

Conclusion

Understanding alcohol availability, consumer demand, and store-level dynamics in Tesco is no longer a guessing game. With the ability to scrape Tesco liquor data in UK, businesses can precisely track market shifts, delivery gaps, and local consumption trends. From Tesco wines and spirits locations data to UK alcohol delivery store data, Real Data API equips stakeholders with powerful, actionable insights. Whether you’re in retail, logistics, marketing, or market research, integrating this intelligence into your business strategy will provide a lasting competitive edge. Ready to map the future of alcohol retail in the UK? Get started with Real Data API today!