Introduction

The travel industry is evolving rapidly, with digital platforms playing a critical role in shaping consumer decisions. Leveraging a Travel Data Scraping API enables travel companies, analysts, and OTAs to extract actionable insights from large datasets efficiently. One of the most important sources for Asian travel trends is Trip.com, a leading online travel agency (OTA) providing comprehensive data on flights, hotels, and customer preferences. Using advanced tools, businesses can scrape Trip.com hotel data to monitor pricing, availability, seasonal trends, and market demand.

Between 2020 and 2025, the Asian travel market has seen tremendous growth. The number of online hotel bookings on Trip.com rose from 12 million in 2020 to 18 million in 2025, while flight searches increased by 25%, reflecting post-pandemic recovery and pent-up demand. A Travel Data Scraping API provides an automated solution for tracking these trends, enabling businesses to make informed decisions. By analyzing historical trends and current availability, travel companies can optimize pricing, forecast demand, and improve overall operational efficiency.

Using structured and automated data extraction, companies gain access to comprehensive datasets covering room types, pricing tiers, seasonal discounts, and airline routes. This empowers travel planners, OTAs, and market analysts to stay ahead of competition by using insights derived from real-time Trip.com data. Scrape Trip.com hotel data becomes a strategic advantage for identifying emerging trends in Asia’s dynamic travel market.

Trip.com Hotel Data Trends

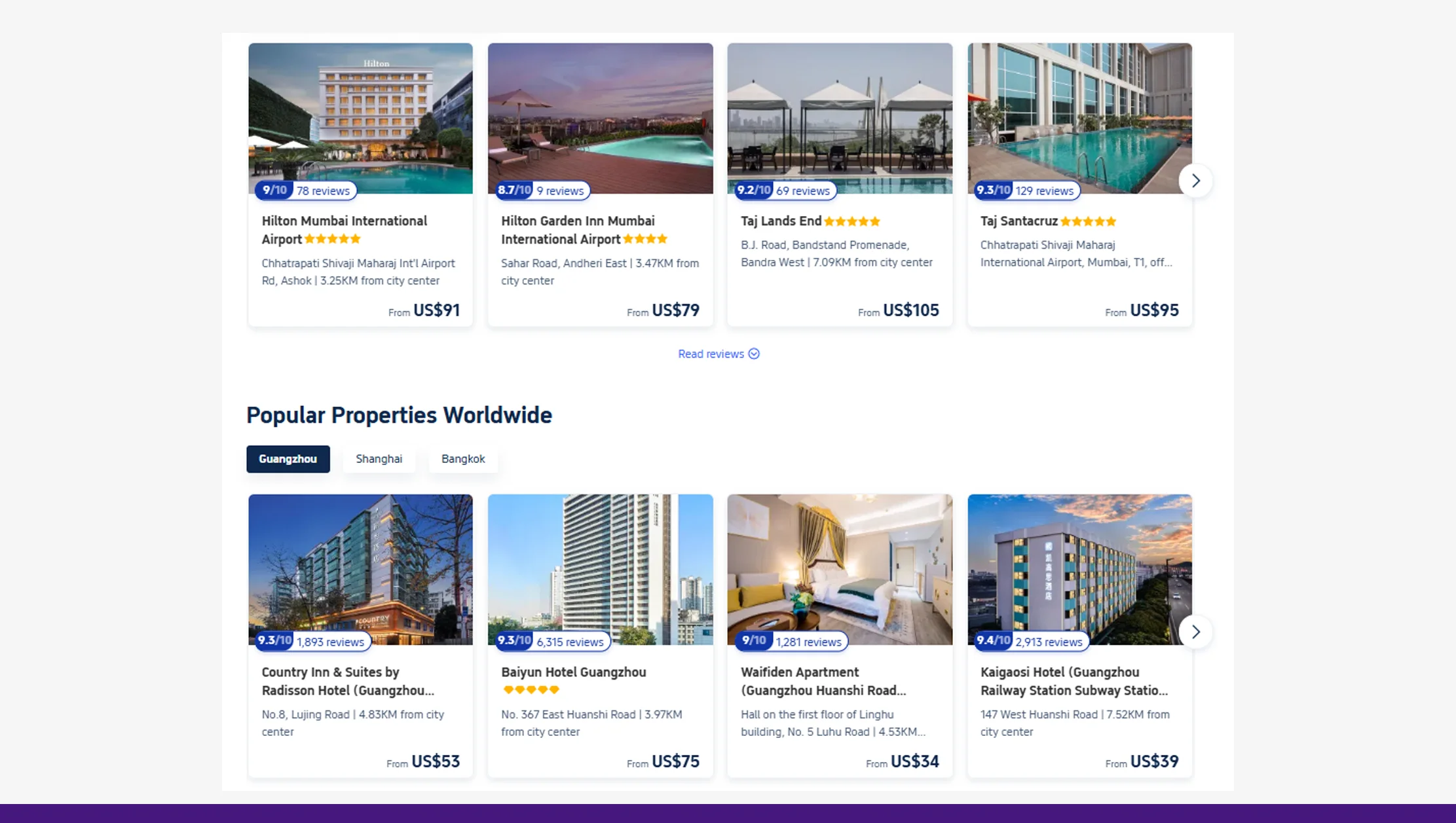

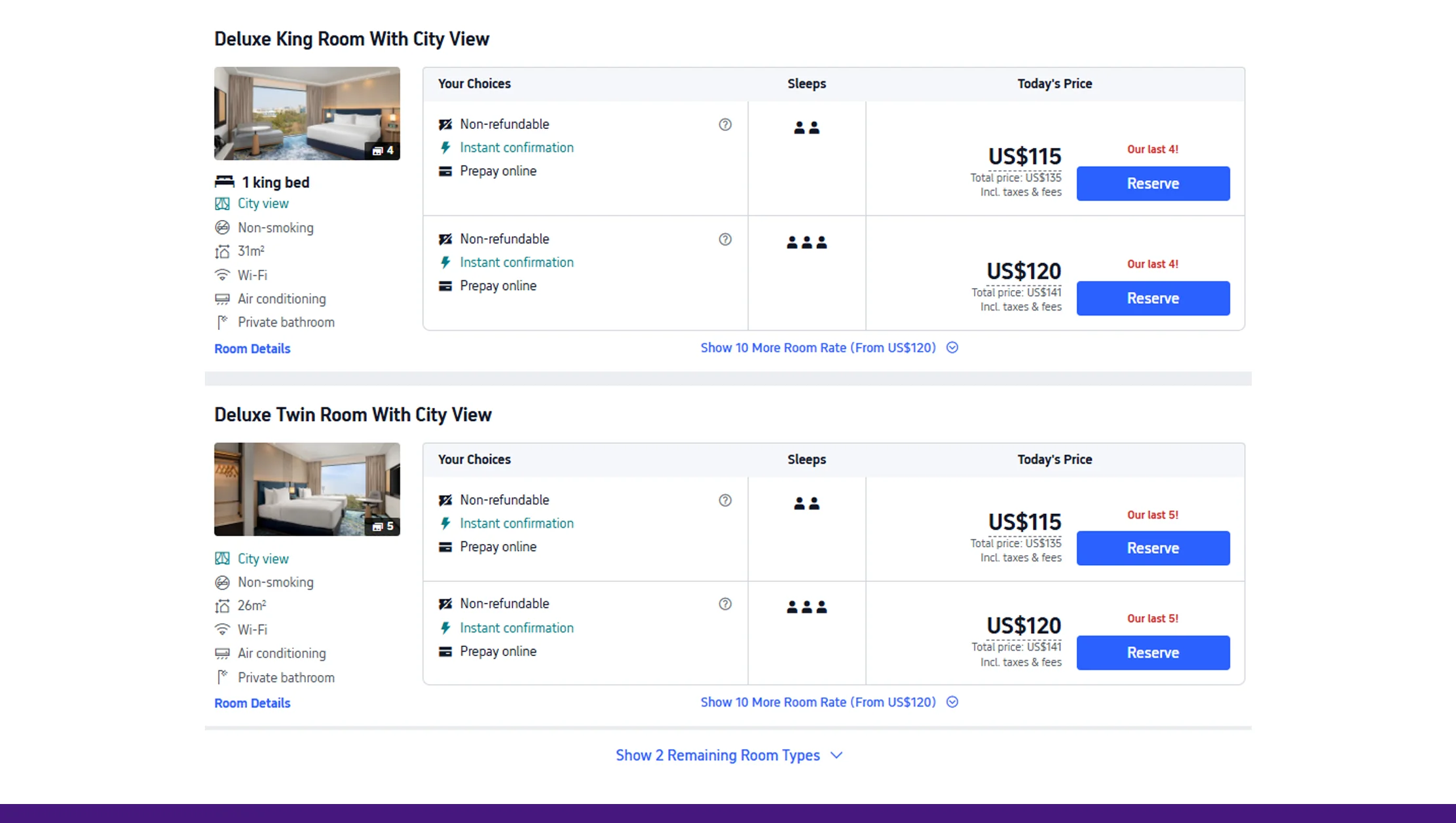

Tracking hotel trends on Trip.com provides a comprehensive view of consumer demand, pricing dynamics, and market segmentation across Asia. Using Trip.com scraping services, analysts can scrape Trip.com hotel data to track room availability, seasonal pricing, promotions, customer reviews, and property types in real time. The ability to automate this process using a Travel Data Scraping API allows businesses to collect structured datasets efficiently, saving hours of manual data collection while enabling advanced analytics.

Between 2020 and 2025, the average hotel price on Trip.com in major Asian cities increased from $85 to $105, reflecting post-pandemic recovery, rising travel demand, and inflationary effects on operational costs. Similarly, the number of new hotel listings rose steadily from 1,200 in 2020 to 1,700 in 2025, indicating market expansion and growing investor interest in hospitality.

| Year | Avg. Hotel Price (USD) | New Hotel Listings |

|---|---|---|

| 2020 | 85 | 1,200 |

| 2022 | 95 | 1,450 |

| 2025 | 105 | 1,700 |

Major urban centers such as Bangkok, Singapore, and Tokyo collectively account for approximately 45% of total hotel bookings, whereas emerging destinations like Da Nang, Hanoi, and Cebu are experiencing 12–15% annual growth in bookings. By leveraging a Trip Data Scraping API, businesses can extract detailed information on room categories, nightly rates, seasonal discounts, and occupancy levels, allowing for optimized inventory allocation, dynamic pricing, and targeted marketing campaigns.

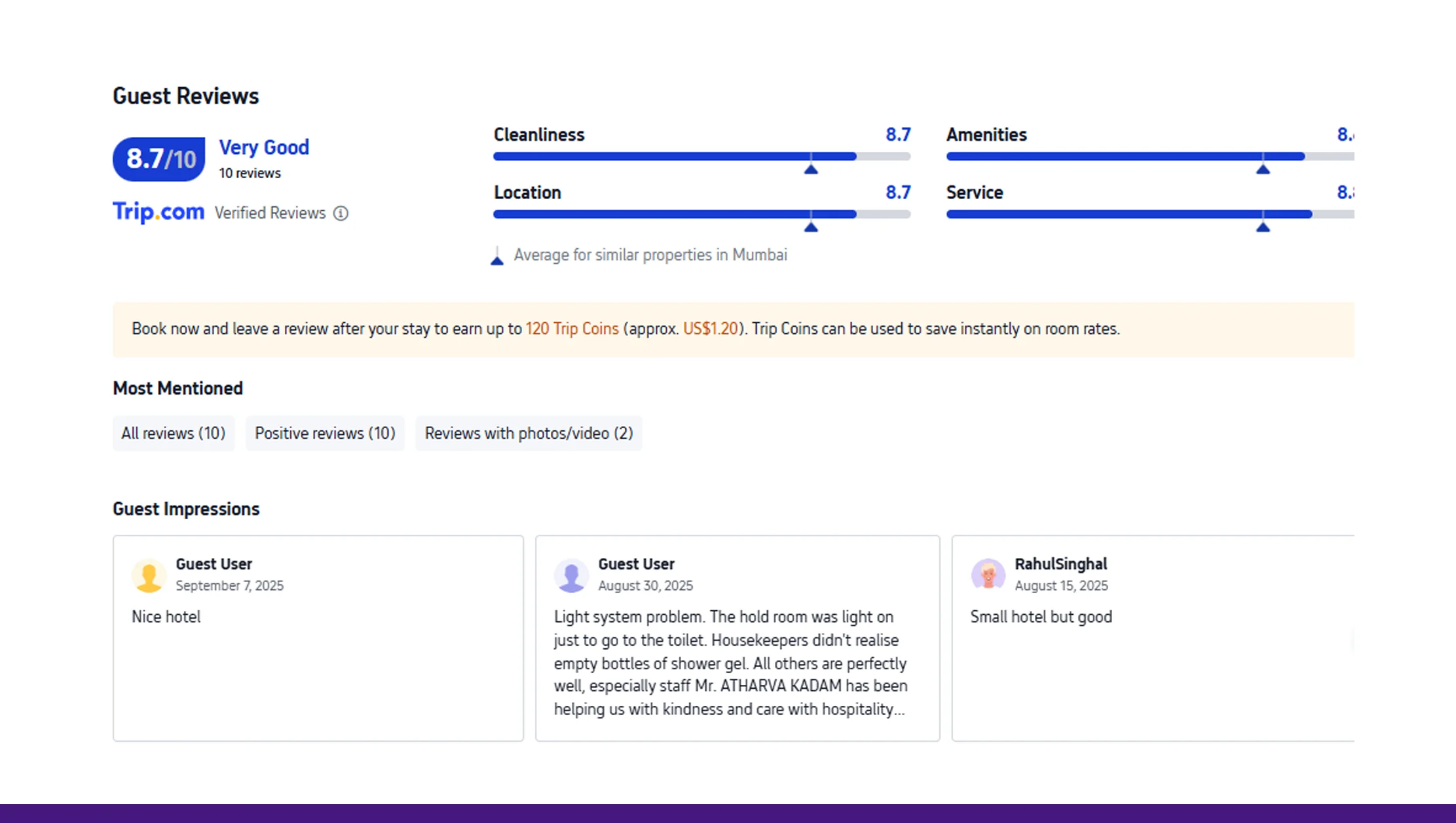

Analyzing guest reviews and ratings provides critical insights into customer behavior. Hotels maintaining high ratings (4.5 stars or above) experienced a 20% increase in repeat bookings over the five-year period. Scrape Trip.com hotel data enables OTAs and travel agencies to identify top-performing properties, monitor competitors, and uncover trends in amenities or promotional packages that drive customer engagement.

Seasonality significantly impacts booking patterns. Summer months in Southeast Asia see a 30% surge in searches for coastal resorts, while winter months attract travelers to ski destinations in Japan, South Korea, and Northern China. Through Trip.com travel market insights, companies can adjust pricing strategies, forecast demand, and tailor promotions to peak seasons. Bundled offers including hotels and experiences further increase average ticket size and customer retention.

Overall, leveraging Trip.com scraping services to monitor hotel trends helps travel businesses remain competitive by identifying new opportunities, optimizing pricing, improving occupancy rates, and offering personalized packages based on evolving consumer behavior.

Flight Data Insights

The airline sector is a core component of the Asian travel market, driving connectivity and supporting tourism growth. Utilizing a Trip.com flight data extractor, analysts can access comprehensive data on fares, routes, flight schedules, airline performance, and seat availability. Combining this with a Trip Data Scraping API provides a structured approach to monitor market trends, identify pricing fluctuations, and respond to competitive pressures.

Between 2020 and 2025, the average domestic flight fare in Asia rose from $120 to $145, while international routes increased from $420 to $500, reflecting the recovery of air travel post-pandemic and rising demand for both business and leisure travel.

| Year | Avg. Domestic Fare (USD) | Avg. International Fare (USD) |

|---|---|---|

| 2020 | 120 | 420 |

| 2022 | 135 | 460 |

| 2025 | 145 | 500 |

Key high-traffic routes include Bangkok–Singapore, Tokyo–Seoul, and Kuala Lumpur–Hong Kong, collectively accounting for over 35% of total bookings. Airlines offering flexible fare options, early-bird discounts, and seasonal promotions gained measurable increases in load factors, demonstrating the importance of strategic pricing. Using Asian OTA data scraping, businesses can monitor competitors’ fares, promotional campaigns, and emerging low-cost carriers.

Flight data insights also enable OTAs to create bundled offerings that combine hotel stays with flights, providing consumers with value-driven packages. Analyzing Trip.com search patterns helps identify peak booking periods, with 30–45 days in advance representing 40% of bookings during peak travel months. Predictive analytics powered by Trip.com flight data extractor allows airlines and travel agencies to optimize pricing, adjust capacity, and forecast demand accurately.

Seasonal variations also impact international travel. For example, Lunar New Year, Golden Week, and summer vacations significantly increase demand for flights within Asia. Travel companies leveraging Trip.com scraping services can respond in real time, offering dynamic pricing and targeted promotions.

Moreover, consumer behavior trends, such as the rising preference for mobile booking and flexible cancellation options, require airlines and OTAs to adapt. Between 2020 and 2025, mobile flight bookings increased from 55% to 75%, indicating that digital-first strategies are crucial. Using Trip.com flight data extractor ensures that businesses have access to accurate and timely flight data, supporting revenue management, route planning, and marketing strategies.

Unlock real-time flight trends with our Trip.com flight data extractor—optimize routes, fares, and bookings for maximum revenue today!

Get Insights Now!Consumer Behavior & Travel Patterns

Understanding traveler behavior is essential for developing effective strategies. Using Travel Dataset from Trip.com, travel companies can analyze preferred destinations, booking channels, trip duration, seasonal demand, and demographic trends. Between 2020 and 2025, mobile bookings across Trip.com rose from 55% to 75%, reflecting the increasing shift toward digital platforms.

| Year | Mobile Booking % | Avg. Trip Duration (Days) |

|---|---|---|

| 2020 | 55% | 4.2 |

| 2022 | 65% | 4.5 |

| 2025 | 75% | 4.7 |

Urban hotels accounted for 60% of bookings, while leisure and adventure destinations grew by 15% annually. Using scrape Trip.com hotel data, travel companies can analyze patterns in room type selection, pricing preferences, and repeat bookings to tailor offers and loyalty programs effectively.

Bundled travel packages, combining flights and hotel stays, are increasingly preferred by consumers seeking convenience and value. Regional differences are prominent: Southeast Asian travelers tend to book shorter trips of 3–4 days, while East Asian travelers favor extended stays of 5–7 days. These insights allow OTAs to optimize offers and increase conversion rates.

Consumer reviews and ratings also influence future bookings. High-rated properties see repeat bookings increase by 18–20%, highlighting the importance of monitoring online sentiment. By leveraging Trip.com travel market insights, travel businesses can personalize marketing campaigns, offer relevant promotions, and improve overall customer retention.

Mobile and app-based engagement has also transformed behavior. Travelers increasingly check hotel amenities, compare fares, and book via apps, emphasizing the need for digital optimization. Using a Travel Scraping API, travel businesses can automate data collection from Trip.com, ensuring they remain agile in responding to shifting consumer preferences.

Overall, understanding consumer behavior and travel patterns enables businesses to predict demand, design effective pricing strategies, and optimize inventory allocation. Combining insights from scrape Trip.com hotel data and flight data ensures that OTAs, airlines, and travel agencies can enhance profitability while delivering superior customer experiences.

Pricing & Seasonal Trends

Optimizing pricing is a critical strategy for travel businesses looking to maximize profitability in the Asian travel market. Using a Travel Scraping API, OTAs and travel agencies can monitor competitor pricing, detect seasonal peaks, and implement dynamic pricing strategies across hotels and flights. Between 2020 and 2025, the average hotel price on Trip.com increased from $85 to $105, while flight fares rose from $120 to $145. These increases reflect rising demand, inflation, and the gradual post-pandemic recovery of travel markets.

| Year | Avg. Hotel Price (USD) | Avg. Flight Price (USD) |

|---|---|---|

| 2020 | 85 | 120 |

| 2022 | 95 | 135 |

| 2025 | 105 | 145 |

Seasonality strongly influences travel behavior in Asia. Summer months, particularly June to August, see a 30% increase in hotel searches in Southeast Asia, while winter draws travelers to ski resorts in Japan and South Korea. Similarly, international flight bookings peak during Lunar New Year, Golden Week, and Christmas, with a 25–35% increase in average search volume. Leveraging Trip.com scraping services, businesses can track these seasonal trends in real time and adjust pricing or promotions accordingly.

Promotional campaigns, loyalty programs, and app-exclusive deals have proven highly effective. Data shows that hotels offering seasonal discounts or bundled offers during peak periods experience a 12–15% increase in bookings, while airlines that provide dynamic fare adjustments see a 10% rise in occupancy. Using Trip.com travel market insights, businesses can analyze the timing, frequency, and impact of competitor promotions to inform their own pricing strategies.

Dynamic pricing is further enhanced by data extracted from scrape Trip.com hotel data, which provides detailed information about room categories, special offers, and occupancy rates. By aligning pricing with market demand, travel businesses can maximize revenue without sacrificing customer satisfaction. Furthermore, predictive analytics allows OTAs to forecast peak periods and adjust inventory proactively, ensuring optimal availability while maintaining competitive rates.

Overall, leveraging pricing and seasonal trends through advanced scraping and analytics ensures that travel businesses remain competitive, responsive, and profitable in a rapidly evolving market.

Competitive Benchmarking

Competitive benchmarking is essential for travel companies aiming to secure market share and maximize profitability. Using Trip.com scraping services and Asian OTA data scraping, businesses can monitor competitor pricing, promotional campaigns, hotel offerings, and flight routes in real time. This data-driven approach enables OTAs and airlines to make informed decisions regarding pricing, inventory management, and marketing strategies.

Between 2020 and 2025, leading hotel markets like Bangkok, Singapore, and Tokyo maintained dominance, capturing approximately 45% of bookings, while emerging destinations such as Ho Chi Minh City, Da Nang, and Bali saw annual growth of 12–15%.

| City | Market Share 2020 | Market Share 2025 | Growth % |

|---|---|---|---|

| Bangkok | 12% | 15% | +3% |

| Singapore | 10% | 12% | +2% |

| Tokyo | 8% | 10% | +2% |

Airlines also benefit from competitive benchmarking. Using Trip.com flight data extractor, carriers can track competitor fares, route performance, and seasonal capacity trends. For example, budget carriers on Bangkok–Singapore routes saw a 20% increase in seat utilization when adjusting fares in response to competitor pricing. Similarly, full-service airlines that monitored rival promotions achieved higher load factors during holiday peaks.

Competitive intelligence extends beyond pricing. By analyzing Trip.com hotel ratings, amenities, and guest reviews, OTAs can identify high-performing properties and adjust their portfolios. Hotels with consistently high ratings (4.5+) saw a 20% increase in repeat bookings, demonstrating the importance of benchmarking guest satisfaction. Scrape Trip.com hotel data provides real-time insight into these performance indicators, enabling timely interventions and optimized marketing strategies.

Seasonal promotions, bundled offers, and app-exclusive deals are particularly effective in gaining market share. Competitor monitoring reveals that hotels and airlines using digital promotions experienced 10–15% higher incremental sales. Integrating Trip.com travel market insights into decision-making allows travel companies to maintain a competitive edge by anticipating market moves and adjusting campaigns proactively.

In summary, competitive benchmarking using advanced scraping technologies empowers travel businesses to optimize pricing, improve product offerings, forecast demand, and maintain strong positioning in the Asian travel market.

Gain a competitive edge using Trip.com scraping services—track rivals, optimize pricing, and boost bookings across hotels and flights efficiently!

Get Insights Now!Emerging Trends in Asian Travel

The Asian travel market is evolving rapidly, driven by factors such as rising disposable incomes, mobile adoption, and domestic tourism recovery. Between 2020 and 2025, domestic travel in Asia increased by 28%, while international trips rebounded to 85% of pre-pandemic levels. Travel preferences are shifting toward eco-tourism, boutique hotels, adventure trips, and experiential travel.

By leveraging scrape Trip.com hotel data, OTAs and travel agencies can track new hotel launches, monitor pricing strategies, and analyze customer reviews. This allows them to identify emerging destinations and capitalize on trends such as wellness retreats, eco-lodges, and local cultural experiences. Similarly, airlines can use Trip.com flight data extractor to adjust routes, optimize schedules, and respond to rising demand for secondary city connections.

Data extracted from Trip.com also reveals behavioral shifts among travelers. Mobile bookings now represent 75% of total bookings, up from 55% in 2020, demonstrating the growing importance of app-based engagement. Travelers increasingly prefer bundled packages that include flights, hotels, and experiences, with 20% higher average spend compared to single-component bookings. Using a Travel Scraping API, travel businesses can automate collection and analysis of these insights, enabling proactive decision-making and targeted promotions.

Regional variations are notable. Southeast Asian travelers favor shorter, budget-friendly trips with high-value packages, while East Asian travelers opt for extended luxury or adventure-focused vacations. OTAs leveraging Trip.com travel market insights can personalize offers for each demographic, optimizing conversion rates and increasing customer loyalty.

Seasonal travel patterns remain critical. Summer and festive periods, such as Lunar New Year, Golden Week, and Eid, drive the highest demand. Travel companies utilizing Trip Data Scraping API can forecast peak travel windows, monitor competitor campaigns, and adjust inventory and pricing dynamically.

Overall, emerging trends highlight the importance of continuous monitoring and strategic analysis. Businesses using Trip.com scraping services and advanced analytics can capture opportunities early, respond to market shifts, and deliver personalized experiences that increase revenue and market share.

Why Choose Real Data API?

Real Data API provides robust solutions for travel businesses seeking actionable insights. With Travel Scraping API, you can extract structured data from Trip.com efficiently, including hotels, flights, pricing, and seasonal trends. The platform supports Trip Data Scraping API, enabling automated monitoring of competitor pricing, occupancy, and promotions.

Businesses can leverage Trip.com scraping services, Asian OTA data scraping, and Trip.com flight data extractor to gain a competitive edge. Real Data API integrates analytics-ready outputs that streamline decision-making, optimize marketing campaigns, and enhance operational efficiency.

Additionally, Real Data API ensures compliance with data protection regulations, scalable access to high-volume datasets, and seamless integration with BI and analytics tools. Using Real Data API, travel companies can stay ahead of market trends, maximize revenue, and provide personalized experiences to travelers across Asia.

Conclusion

The Asian travel market is growing rapidly, and data-driven insights from Trip.com are essential for competitive advantage. By using a Travel Scraping API, businesses can scrape Trip.com hotel data, track flights, and analyze trends from 2020 to 2025, providing actionable insights for pricing, promotions, and operational efficiency.

Companies leveraging Travel Dataset, Trip.com travel market insights, and Trip.com flight data extractor can forecast demand, optimize revenue, and improve customer satisfaction. Real-time data monitoring ensures that seasonal peaks, emerging destinations, and competitive benchmarks are always visible, enabling agile decision-making.

Scrape Trip.com hotel data today with Real Data API and unlock insights that drive profitability and growth in Asia’s dynamic travel market. Don’t wait—start turning Trip.com data into actionable intelligence now!

Unlock real-time Trip.com insights today—optimize hotels, flights, and packages to grow your travel business with Real Data API!