Introduction

The online food delivery market has evolved from a convenience-driven service into a fiercely competitive digital ecosystem. Platforms such as DoorDash and GrubHub now compete not only on delivery speed and pricing, but also on restaurant availability, menu diversity, geographic reach, and real-time customer demand. For restaurants, brands, and aggregators, understanding these competitive dynamics is critical to improving visibility and revenue.

Data-driven insights are reshaping how businesses evaluate platform performance. Instead of relying on anecdotal trends or limited reports, companies are now leveraging large-scale delivery data to analyze coverage gaps, pricing differences, and platform dominance across regions. At the center of this transformation is DoorDash vs GrubHub restaurant availability analysis, which provides a granular view of how each platform positions itself in local and national markets.

This blog explores how scraped food delivery data from DoorDash and GrubHub reveals competitive strengths, pricing behavior, and long-term market shifts from 2020 to 2026, and how Real Data API helps Improve Your Food Delivery Business with Grubhub Scraping API to turn this intelligence into strategic advantage.

Mapping Platform Reach Across Cities

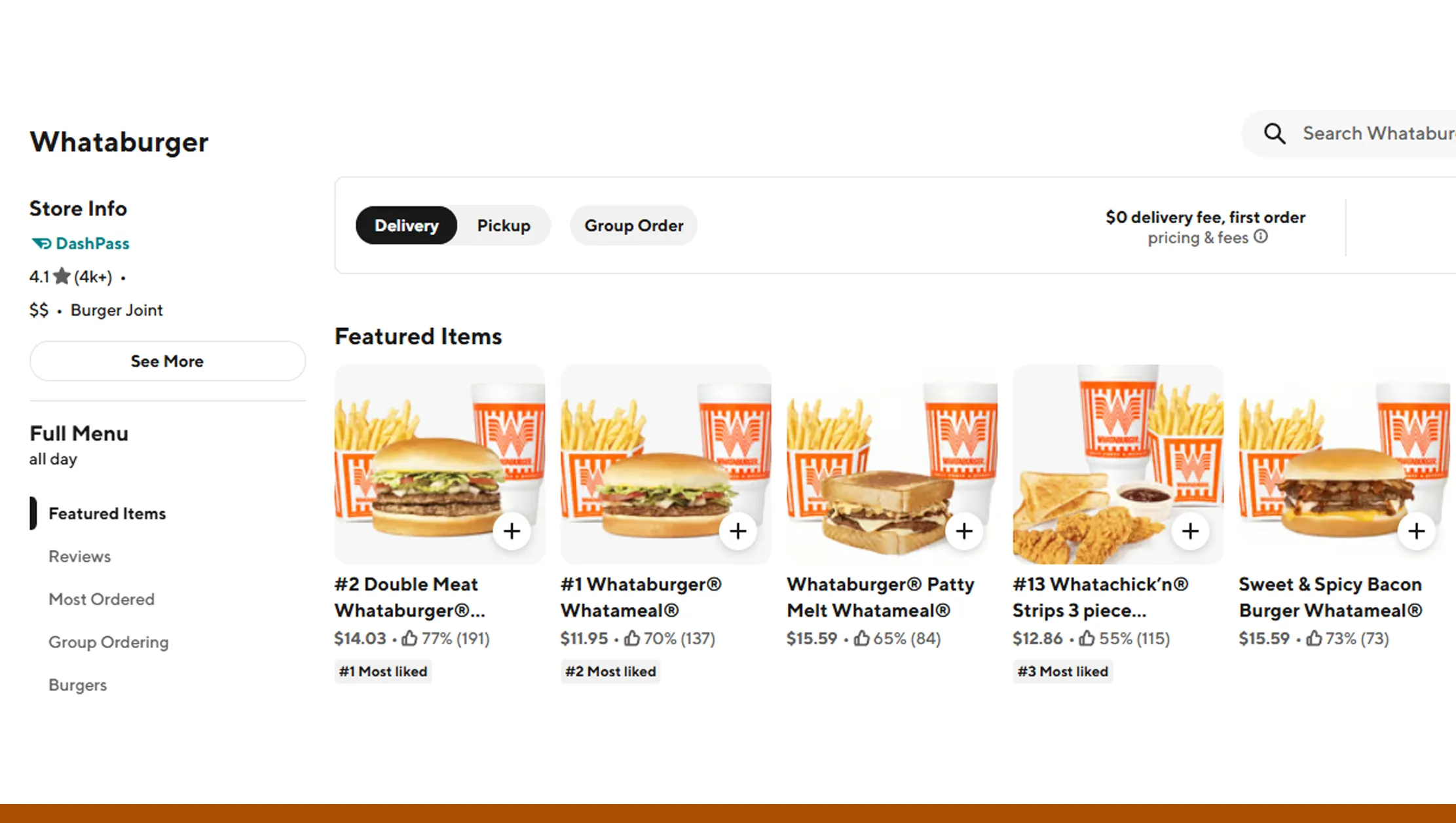

Restaurant availability is one of the strongest indicators of a food delivery platform's market power. A wider and more diverse restaurant network increases customer choice, improves retention, and strengthens platform loyalty. By using Scrape DoorDash and GrubHub food delivery data, businesses can compare how restaurant coverage has expanded across metro, suburban, and secondary markets.

Between 2020 and 2026, DoorDash consistently expanded faster in suburban and Tier-2 cities, while GrubHub maintained stronger penetration in dense urban centers. Scraped data shows that DoorDash added restaurants at nearly twice the annual rate of GrubHub during the post-pandemic expansion phase.

| Year | DoorDash Restaurants | GrubHub Restaurants |

|---|---|---|

| 2020 | 390,000 | 300,000 |

| 2022 | 520,000 | 360,000 |

| 2024 | 650,000 | 410,000 |

| 2026 | 780,000 | 460,000 |

This data helps brands and restaurant chains decide which platform offers better exposure in specific regions, enabling smarter onboarding and expansion strategies.

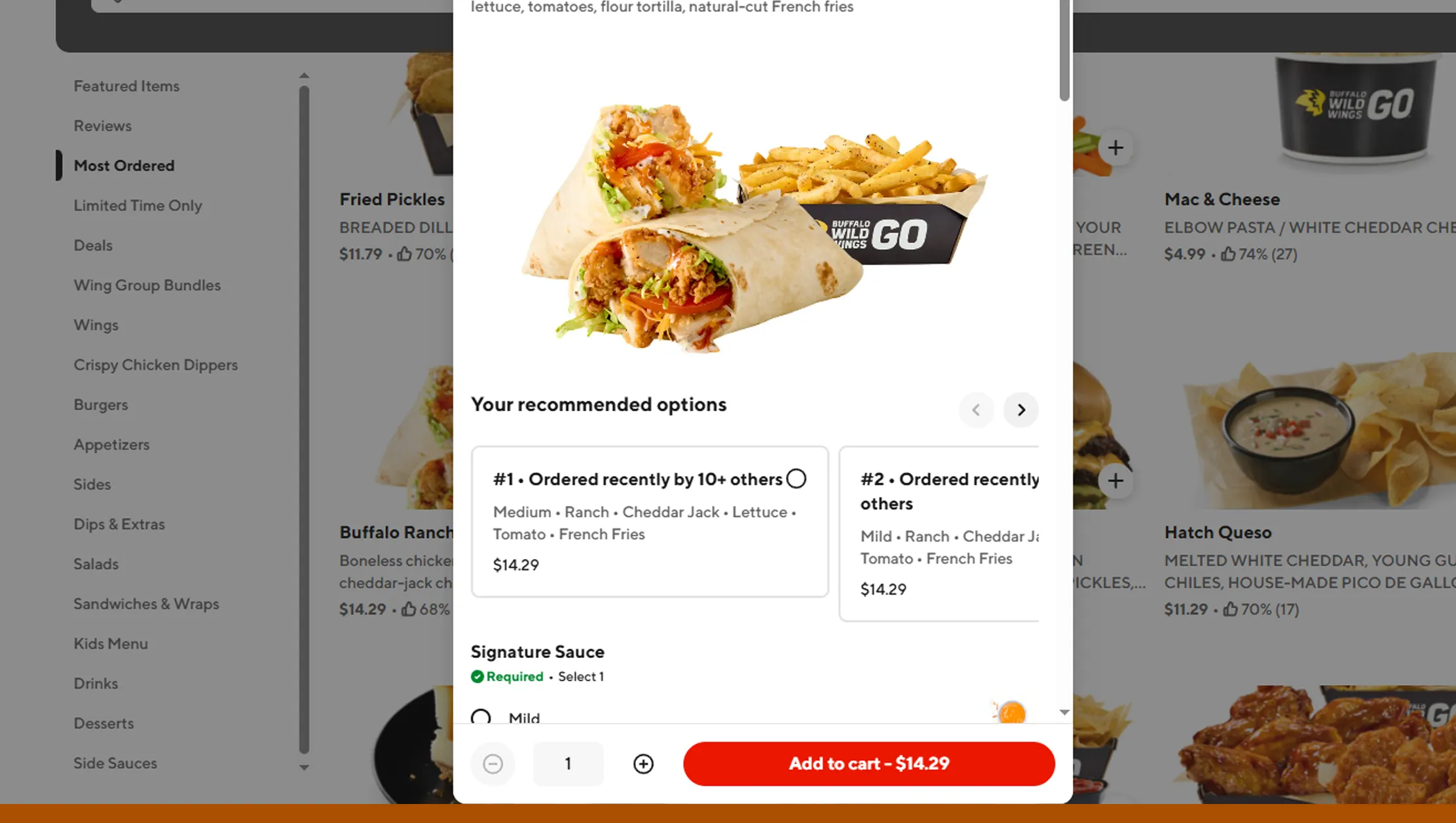

Comparing Menu Pricing and Fees

Pricing transparency plays a major role in customer decision-making. Menu prices, delivery fees, service charges, and surge pricing vary significantly between platforms. By applying Web Scraping DoorDash and GrubHub pricing data, businesses can monitor these fluctuations at scale.

From 2020 onward, DoorDash displayed more dynamic pricing behavior, with frequent fee adjustments during peak hours. GrubHub, on the other hand, maintained more stable pricing but introduced higher service fees in select markets after 2023. Scraped datasets reveal that average menu prices on DoorDash tend to be slightly higher due to restaurant-side markups.

| Year | DoorDash Avg Order | GrubHub Avg Order |

|---|---|---|

| 2020 | $27.40 | $25.80 |

| 2022 | $30.10 | $28.90 |

| 2024 | $33.60 | $31.20 |

| 2026 | $36.80 | $34.10 |

These insights allow restaurants and brands to adjust pricing strategies, promotions, and commission negotiations based on real competitive benchmarks.

Understanding Long-Term Price Behavior

Beyond individual fees, long-term pricing behavior reflects platform strategy and customer positioning. Analyzing food delivery pricing trends over multiple years helps businesses understand inflation impact, promotional cycles, and platform-driven margin shifts.

From 2020 to 2026, both platforms saw steady price increases driven by rising labor costs, fuel prices, and technology investments. However, DoorDash relied more heavily on targeted promotions and subscription-based discounts, while GrubHub focused on loyalty-based incentives.

| Metric (2026) | DoorDash | GrubHub |

|---|---|---|

| Avg Annual Price Growth | 5.8% | 4.9% |

| Promo Frequency | High | Medium |

| Subscription Impact | Strong | Moderate |

These patterns help investors, analysts, and brands forecast future pricing behavior and evaluate customer affordability across platforms.

Extracting Competitive Market Signals

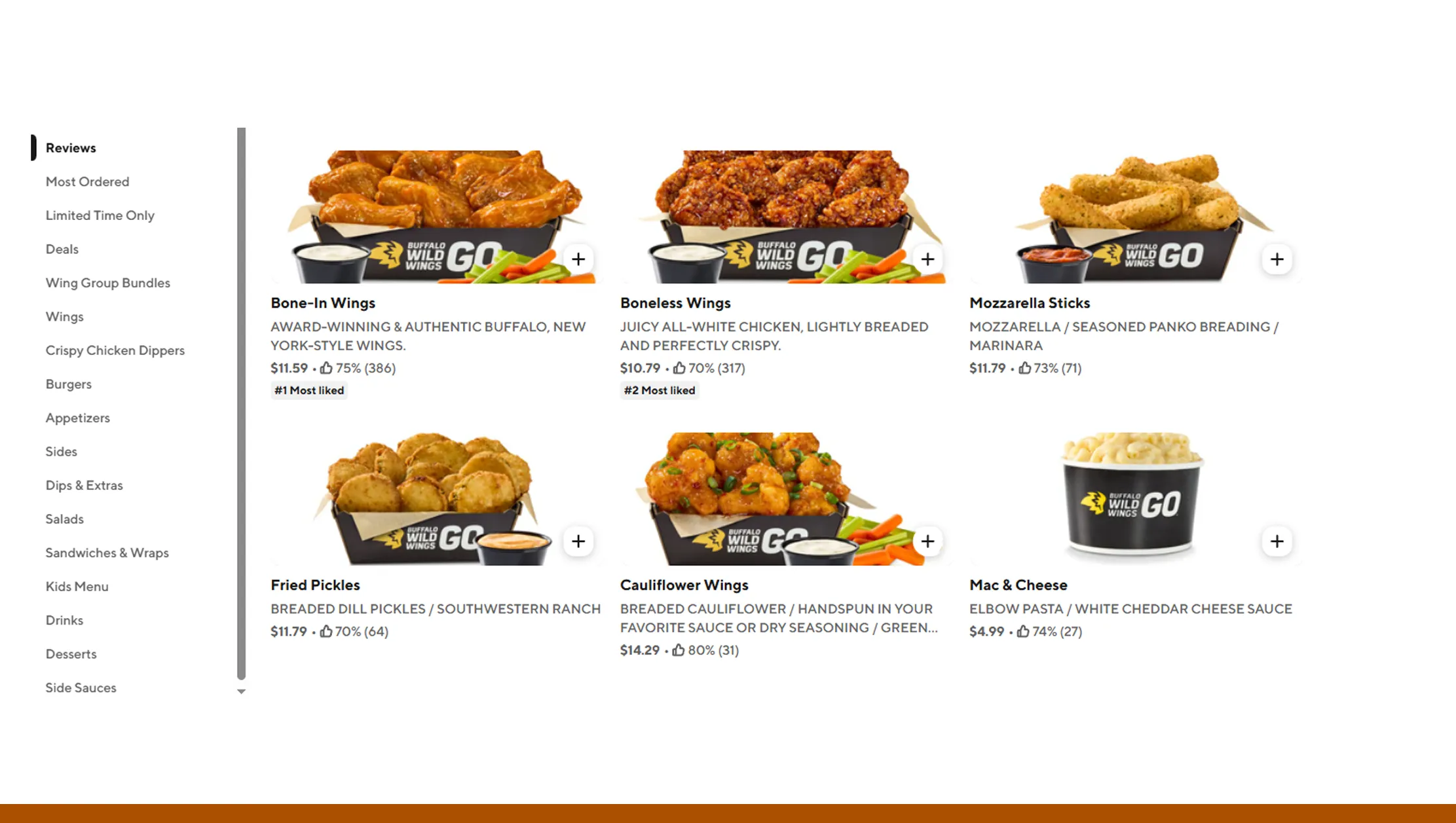

Availability and pricing are only part of the competitive story. Menu variety, cuisine diversity, and restaurant onboarding speed also shape platform performance. Using Extract food delivery market data via DoorDash and GrubHub, businesses can analyze these deeper competitive signals.

Scraped data from 2020–2026 shows DoorDash leading in chain restaurant onboarding, while GrubHub retained stronger relationships with independent and legacy urban restaurants. Cuisine diversity also expanded faster on DoorDash, especially in fast-casual and virtual brand categories.

| Cuisine Type | DoorDash Share | GrubHub Share |

|---|---|---|

| Fast Food | 32% | 26% |

| Casual Dining | 28% | 31% |

| Cloud Kitchens | 18% | 11% |

| Ethnic Cuisine | 22% | 32% |

These insights support smarter market entry decisions for restaurant groups and food brands targeting specific consumer segments.

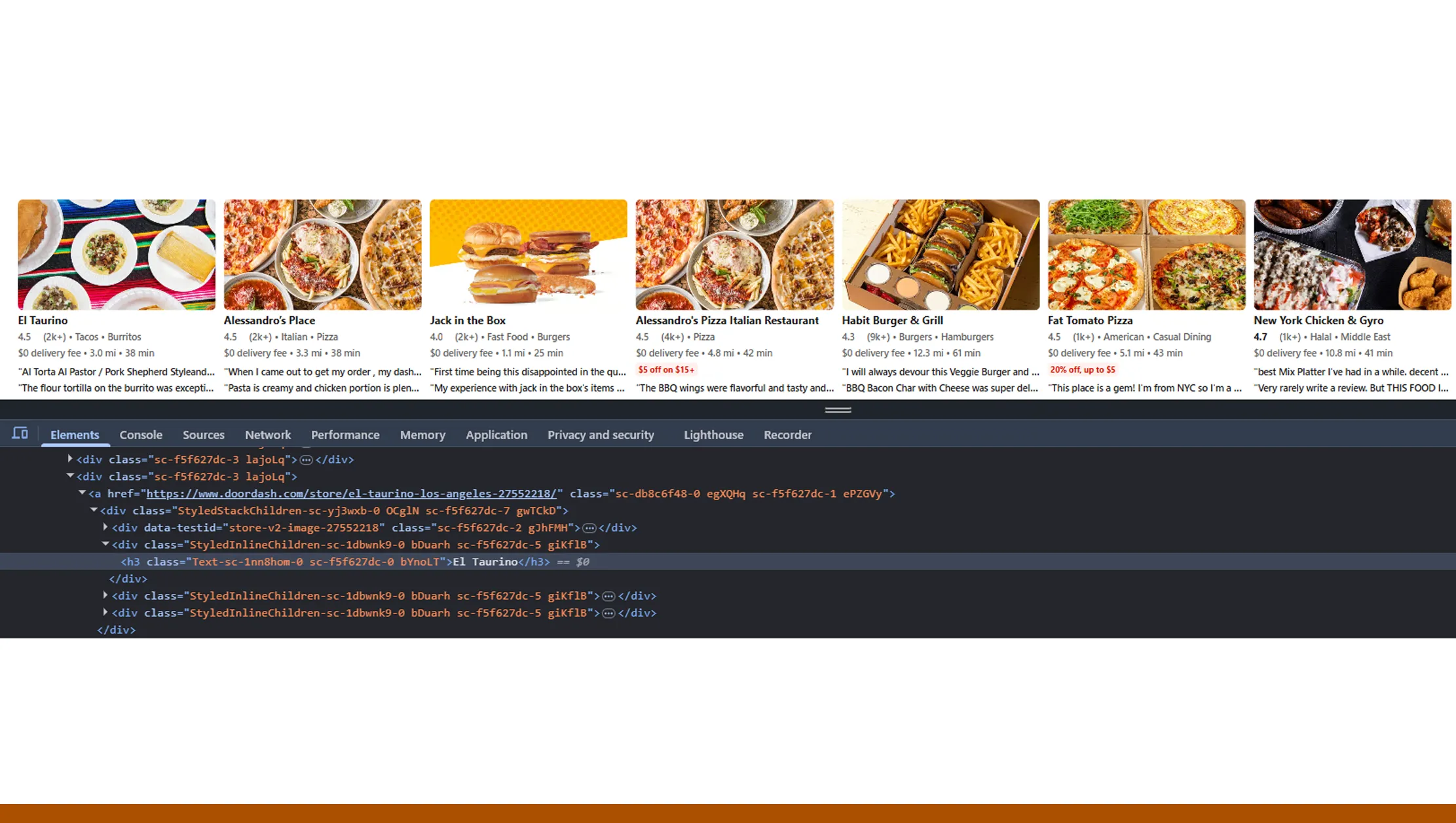

Leveraging Programmatic Data Access

To analyze food delivery data at scale, businesses require reliable and structured access methods. Platforms expose limited public information, making automated extraction essential. The DoorDash Delivery API enables structured access to restaurant listings, menus, pricing, and availability signals without the instability of manual scraping.

From 2020 to 2026, API-driven extraction reduced data latency significantly, enabling near real-time competitive monitoring. Businesses using APIs were able to refresh datasets multiple times per day, supporting dynamic dashboards and alerts.

| Method | Avg Refresh Rate |

|---|---|

| Manual Tracking | Weekly |

| Basic Scraping | Daily |

| API-Based Access | Real-Time |

This capability empowers analytics teams to shift from retrospective reporting to proactive decision-making.

Building Historical Intelligence Assets

Long-term competitive advantage comes from historical context. With Web Scraping Grubhub Dataset, businesses can build multi-year datasets that reveal patterns invisible in short-term snapshots.

From 2020–2026, historical GrubHub data highlights platform stabilization after aggressive expansion, with a focus on profitability and operational efficiency. Restaurant churn rates declined, while average order values steadily increased.

| Year | Active Restaurants | Avg Menu Items |

|---|---|---|

| 2020 | 300,000 | 42 |

| 2023 | 380,000 | 48 |

| 2026 | 460,000 | 55 |

These datasets enable forecasting, churn modeling, and competitive benchmarking at enterprise scale.

Why Choose Real Data API?

Real Data API delivers reliable, scalable, and compliance-ready food delivery intelligence for brands, restaurants, and analytics teams. By enabling Scrape DoorDash Restaurant List and Menu Data for Market Intelligence, businesses gain clean, structured datasets without the complexity of managing infrastructure.

Our solutions support deep DoorDash vs GrubHub restaurant availability analysis, helping clients uncover regional dominance, pricing gaps, and growth opportunities. With flexible delivery formats, historical coverage, and enterprise-grade uptime, Real Data API turns raw delivery data into actionable market intelligence.

Conclusion

As competition intensifies, success in food delivery depends on visibility, speed, and informed decision-making. Platforms evolve quickly, and only data-driven organizations can keep pace with shifting consumer behavior and platform strategies.

By leveraging Improve Your Food Delivery Business with Grubhub Scraping API alongside DoorDash vs GrubHub restaurant availability analysis, businesses can optimize platform selection, pricing strategy, and expansion planning.

Partner with Real Data API today to access reliable DoorDash and GrubHub insights and transform competitive food delivery data into measurable business growth.