Introduction

Wholesale retail has always been driven by volume, value, and long-term purchasing behavior. However, in recent years, bulk buying patterns have become more dynamic, influenced by inflation, supply chain disruptions, changing household sizes, and the rise of small business buyers. Costco, as one of the world's largest membership-based wholesale retailers, sits at the center of this transformation. Its product assortment, pricing strategy, and inventory behavior offer valuable signals about how consumers and businesses are buying in bulk.

For retailers, distributors, and private-label brands, understanding these signals requires access to structured, historical data rather than surface-level observations. This is where bulk buying trends analysis via Costco data scraping becomes essential. By collecting product-level pricing, pack sizes, availability, and reviews, businesses can identify demand shifts, optimize pricing models, and align inventory strategies with real-world purchasing behavior.

In this blog, we explore how Costco data from 2020 to 2026 reveals evolving bulk buying trends and how Real Data API enables smarter, data-driven retail decisions.

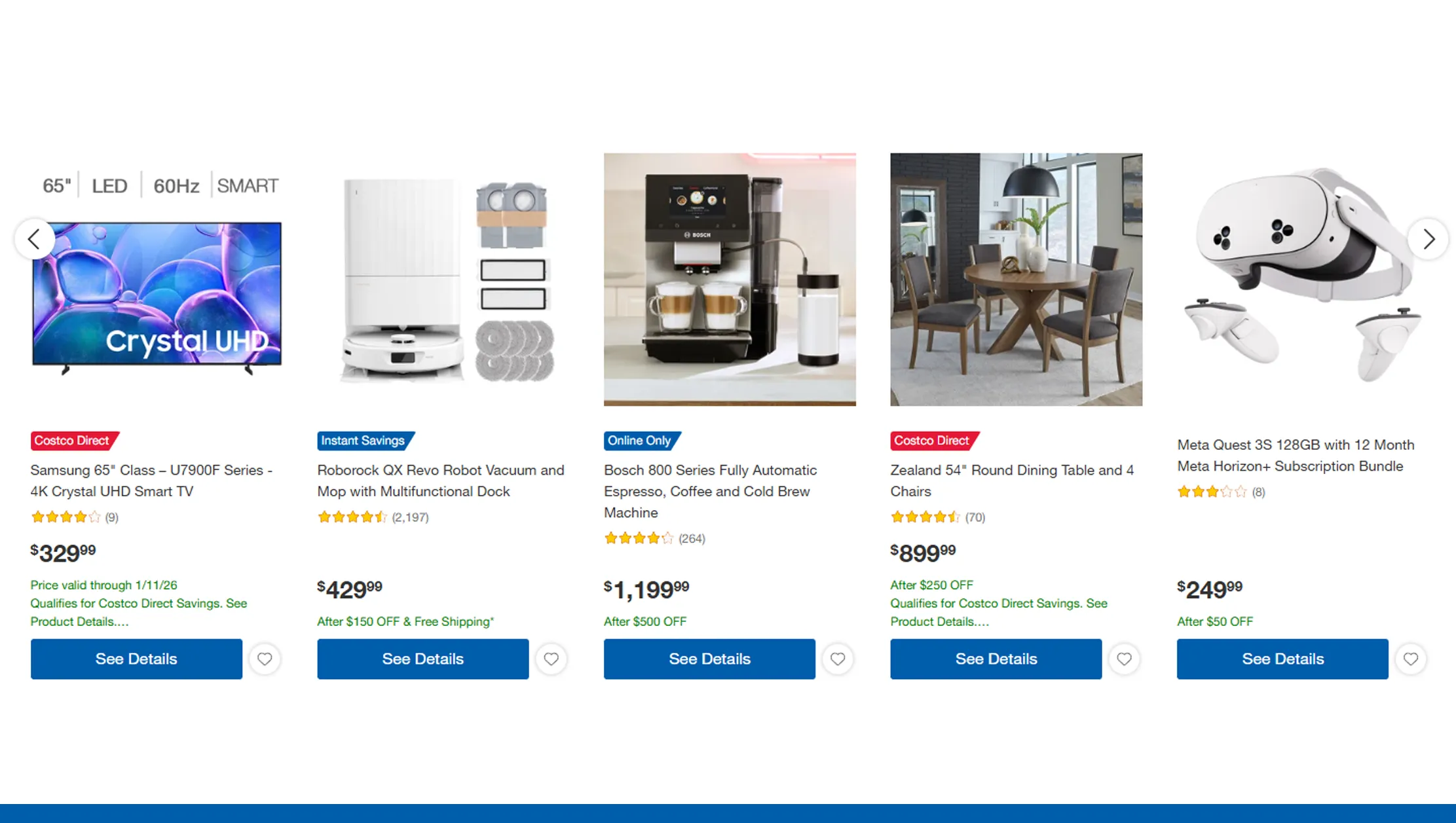

Pricing Signals That Shape Volume Purchases

Bulk purchasing decisions are highly sensitive to price-per-unit value rather than sticker price alone. Costco's pricing model emphasizes perceived savings at scale, making it an ideal source for analyzing wholesale price behavior. Through Costco bulk pricing trend analysis, retailers can observe how price points, pack sizes, and discount structures have evolved over time.

Between 2020 and 2026, Costco adjusted bulk pricing in response to inflation, logistics costs, and supplier consolidation. Data shows that while absolute prices increased, per-unit costs remained comparatively stable, reinforcing Costco's value proposition.

Average Price Per Unit Trend (2020–2026)

| Year | Avg Bulk Pack Price | Avg Unit Cost |

|---|---|---|

| 2020 | $14.20 | $0.82 |

| 2022 | $16.90 | $0.85 |

| 2024 | $18.40 | $0.88 |

| 2026 | $20.10 | $0.90 |

These trends help retailers benchmark their own bulk pricing strategies, ensuring competitiveness without sacrificing margins.

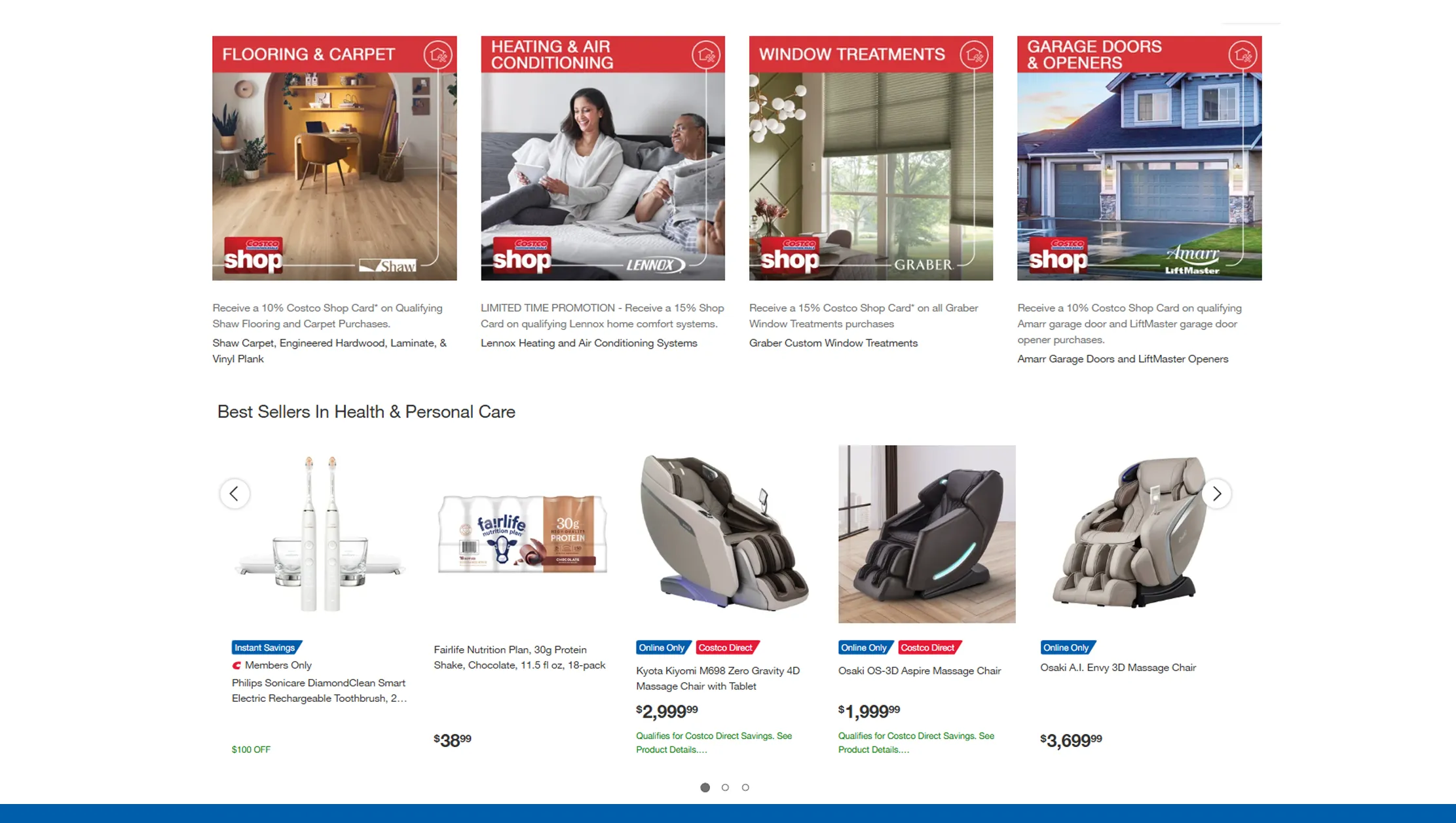

Building Visibility into Wholesale Assortments

Product assortment depth is a key driver of bulk purchasing behavior. Costco's curated catalog reflects a balance between national brands, private labels, and limited-SKU efficiency. With Costco product data collection, businesses gain visibility into how assortments shift based on category demand and buyer profiles.

From 2020 to 2026, data reveals significant growth in categories such as household essentials, packaged foods, wellness products, and office supplies. Seasonal SKU rotation also became more pronounced, aligning inventory with bulk demand cycles.

Category Distribution Growth

| Category | 2020 Share | 2026 Share |

|---|---|---|

| Grocery & Packaged | 38% | 44% |

| Household Essentials | 21% | 26% |

| Health & Wellness | 14% | 18% |

| Office & Business | 9% | 12% |

| Others | 18% | 10% |

These insights allow retailers and brands to refine assortment planning and align product offerings with proven bulk-buy demand.

Tracking Availability at Scale

Inventory availability is a critical factor in bulk purchasing, especially for small businesses and institutional buyers. Missing stock can push buyers to competitors or alternate channels. By using Scrape Costco inventory data, retailers can monitor availability patterns and understand how inventory levels respond to demand spikes.

Between 2020 and 2026, Costco improved inventory resilience by reducing stock-out duration and optimizing warehouse replenishment. Data shows a steady decline in out-of-stock frequency across high-demand categories.

Inventory Availability Metrics

| Year | Avg In-Stock Rate | Avg Restock Time |

|---|---|---|

| 2020 | 84% | 5.6 days |

| 2022 | 88% | 4.2 days |

| 2024 | 92% | 3.1 days |

| 2026 | 95% | 2.4 days |

These patterns help retailers anticipate demand surges and strengthen supply chain coordination.

Turning Wholesale Data into Retail Strategy

Raw data becomes valuable only when it supports decision-making. With Costco product data extraction for retailers, businesses can convert wholesale signals into actionable strategies for pricing, promotions, and inventory planning.

From 2020 onward, extracted data shows that retailers aligning their pack sizes and pricing tiers with Costco benchmarks experienced stronger volume growth. Multi-pack formats and value bundles consistently outperformed smaller SKUs in comparable channels.

Retail Impact Indicators

| Strategy Lever | Avg Sales Lift |

|---|---|

| Bulk Pack Matching | +18% |

| Price-Per-Unit Ads | +22% |

| Inventory Alignment | +15% |

These insights empower retailers to compete effectively with wholesale giants while maintaining differentiation.

Enabling Scalable and Reliable Access

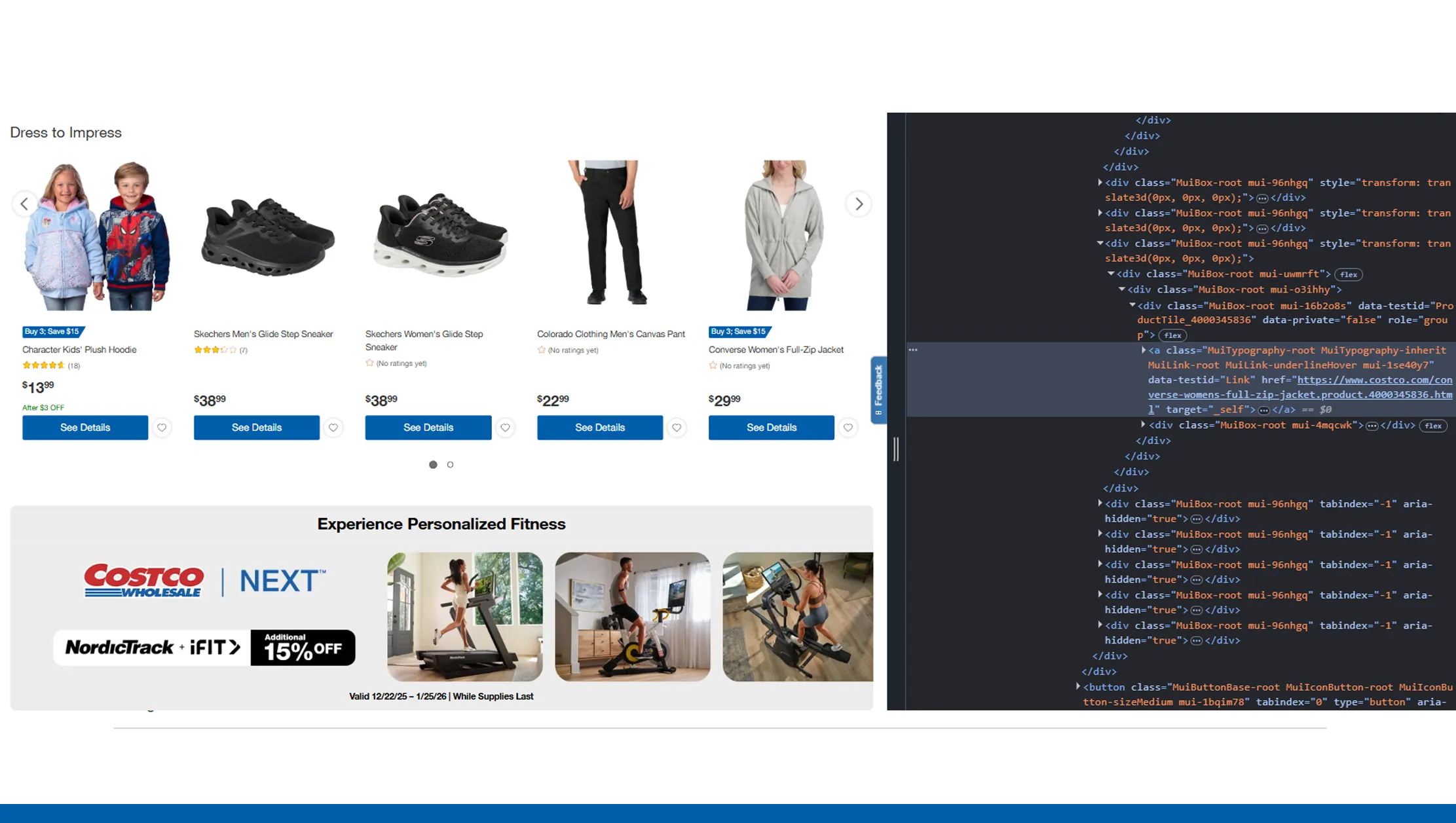

Collecting large-scale retail data manually is inefficient and unreliable. Modern analytics requires automation, consistency, and scalability. The Costco Scraping API provides structured access to pricing, availability, and product metadata across categories and locations.

From 2020 to 2026, API-based data collection enabled faster refresh cycles and reduced data gaps, supporting near real-time monitoring and historical analysis.

Data Collection Efficiency Comparison

| Method | Refresh Frequency |

|---|---|

| Manual Tracking | Monthly |

| Basic Scraping | Weekly |

| API-Based Access | Daily / Real-Time |

This level of automation allows analytics teams to focus on insights rather than infrastructure.

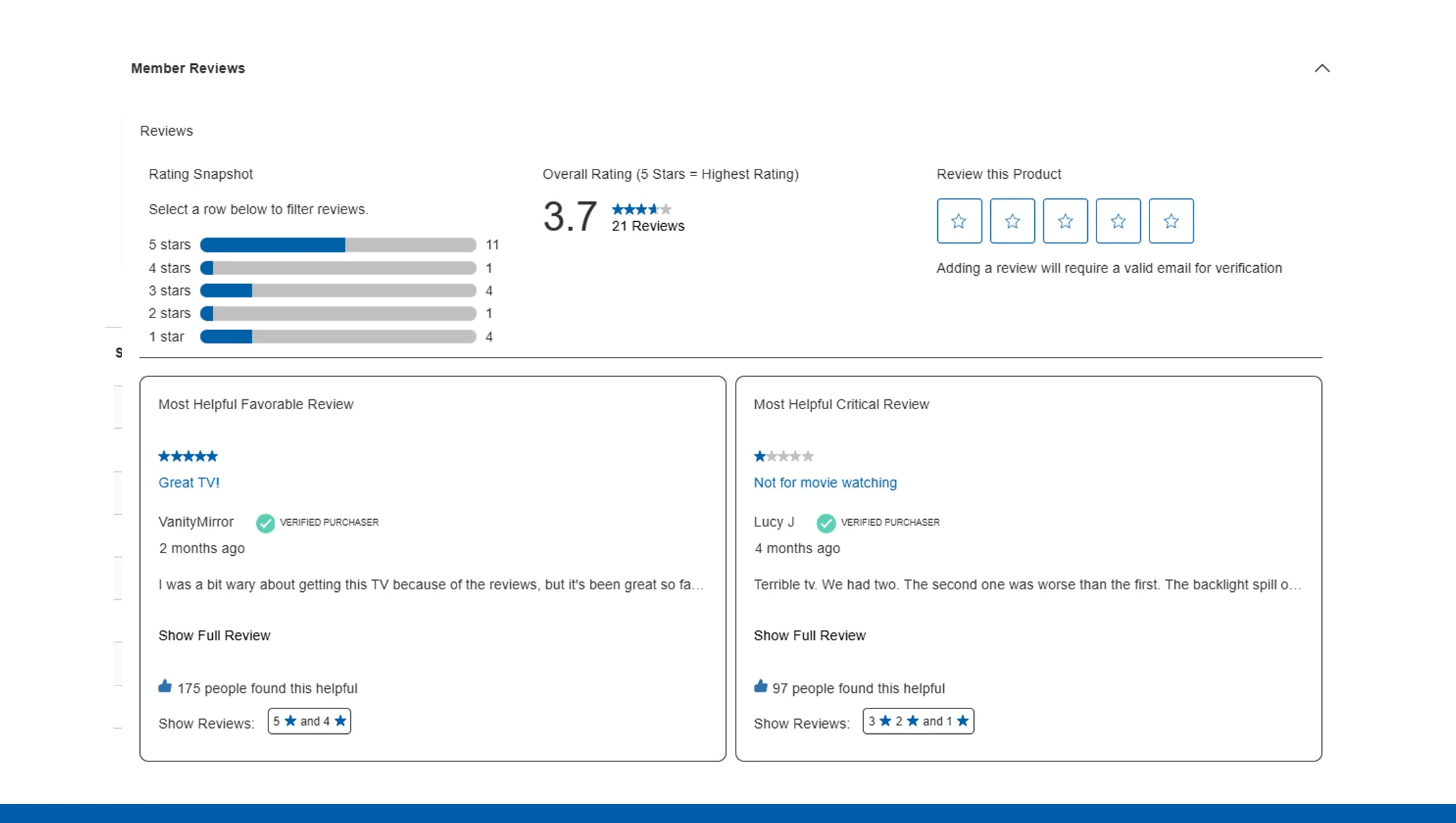

Leveraging Reviews for Demand Intelligence

Customer reviews and ratings provide qualitative context to quantitative sales signals. By analyzing Costco Product and Review Datasets, businesses can identify product satisfaction drivers, quality concerns, and evolving buyer expectations.

From 2020 to 2026, review data highlights increased emphasis on value, durability, and packaging efficiency. Products with consistently high ratings in bulk formats showed stronger long-term retention.

Review Trend Indicators

| Metric (2026) | Value |

|---|---|

| Avg Product Rating | 4.4★ |

| Reviews per SKU | 1,200 |

| Repeat Purchase % | 68% |

Combining review sentiment with pricing and inventory data creates a holistic view of bulk buying behavior.

Why Choose Real Data API?

Real Data API delivers enterprise-grade retail intelligence designed for wholesale and e-commerce analytics. With our Costco Scraper, businesses gain access to clean, structured, and scalable datasets without managing technical complexity.

By supporting bulk buying trends analysis via Costco data scraping, Real Data API enables retailers, brands, and analysts to uncover pricing benchmarks, demand patterns, and inventory signals with confidence. Our solutions are built for accuracy, compliance, and long-term strategic use.

Conclusion

Bulk buying behavior continues to evolve, driven by economic shifts and changing consumer priorities. Retailers that rely on intuition alone risk misalignment with real demand signals. Data-driven decision-making is now essential.

By leveraging E-Commerce Data Scraping API solutions alongside bulk buying trends analysis via Costco data scraping, businesses can unlock deeper wholesale insights, optimize retail strategies, and stay competitive in a rapidly changing market.

Partner with Real Data API today to access reliable Costco intelligence and turn bulk buying data into smarter, more profitable retail decisions.