Introduction

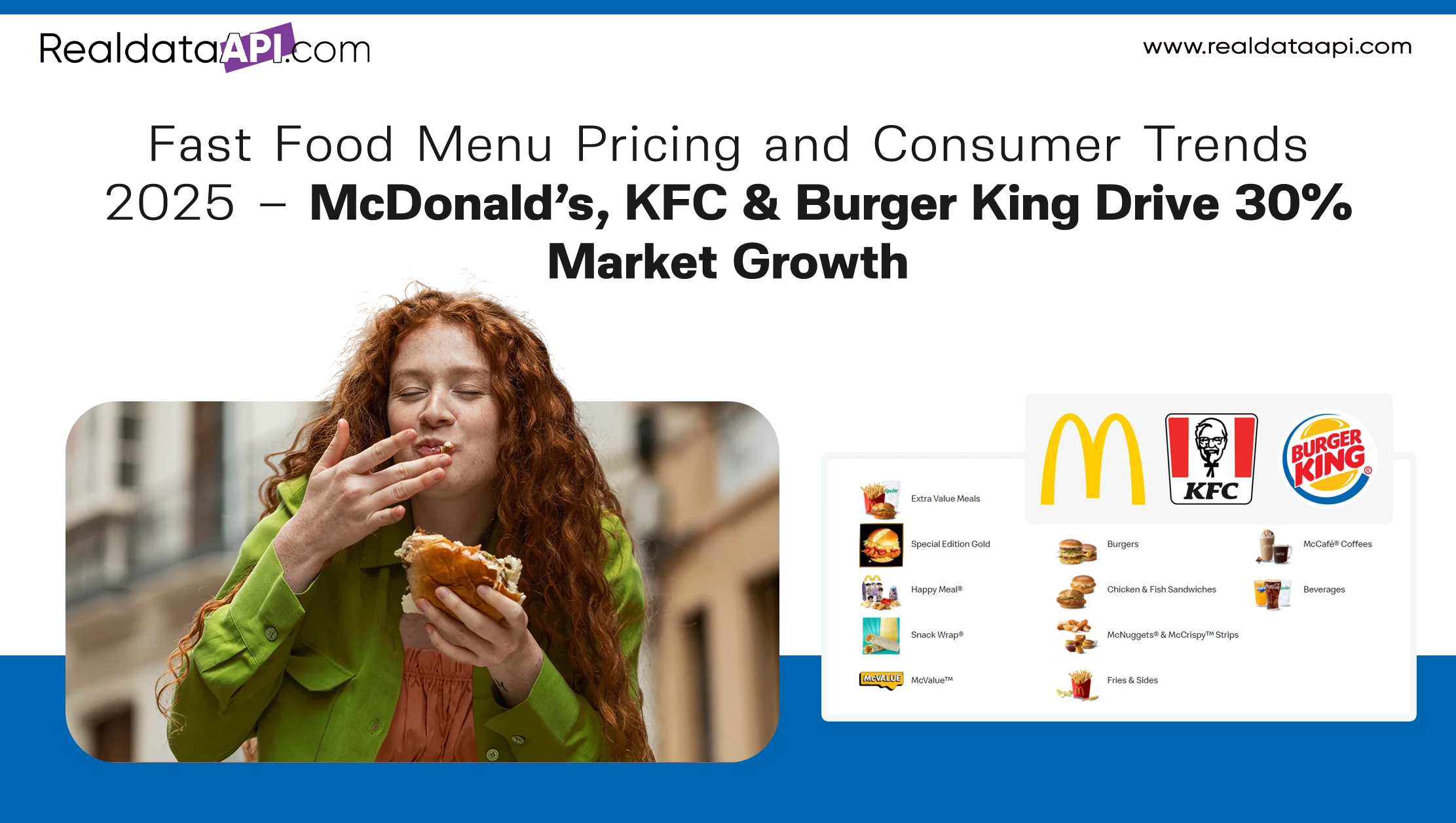

The fast-food industry is experiencing rapid evolution, driven by consumer demand for convenience, affordability, and digital accessibility. The Fast Food Menu Pricing and Consumer Trends 2025 report highlights how top quick-service restaurant (QSR) chains, including McDonald’s, KFC, and Burger King, have captured significant market share, driving a 30% growth in overall sector revenue. Businesses are increasingly leveraging fast food chain data scraping to track menus, pricing, promotions, and consumer behavior patterns.

By employing a Food Data Scraping API, analysts can gather real-time insights from multiple restaurant websites and mobile platforms, ensuring accurate tracking of price changes, new menu introductions, and regional variations. This capability enables retailers, marketers, and investors to understand which products resonate with customers and how competitors respond to market dynamics.

Moreover, QSR chains are optimizing their digital menus and loyalty programs based on scraped data, enabling personalized promotions and efficient inventory management. Understanding Fast Food Menu Pricing and Consumer Trends 2025 allows stakeholders to make informed business decisions and stay competitive in a rapidly changing industry landscape.

Menu Trends Across Leading Chains

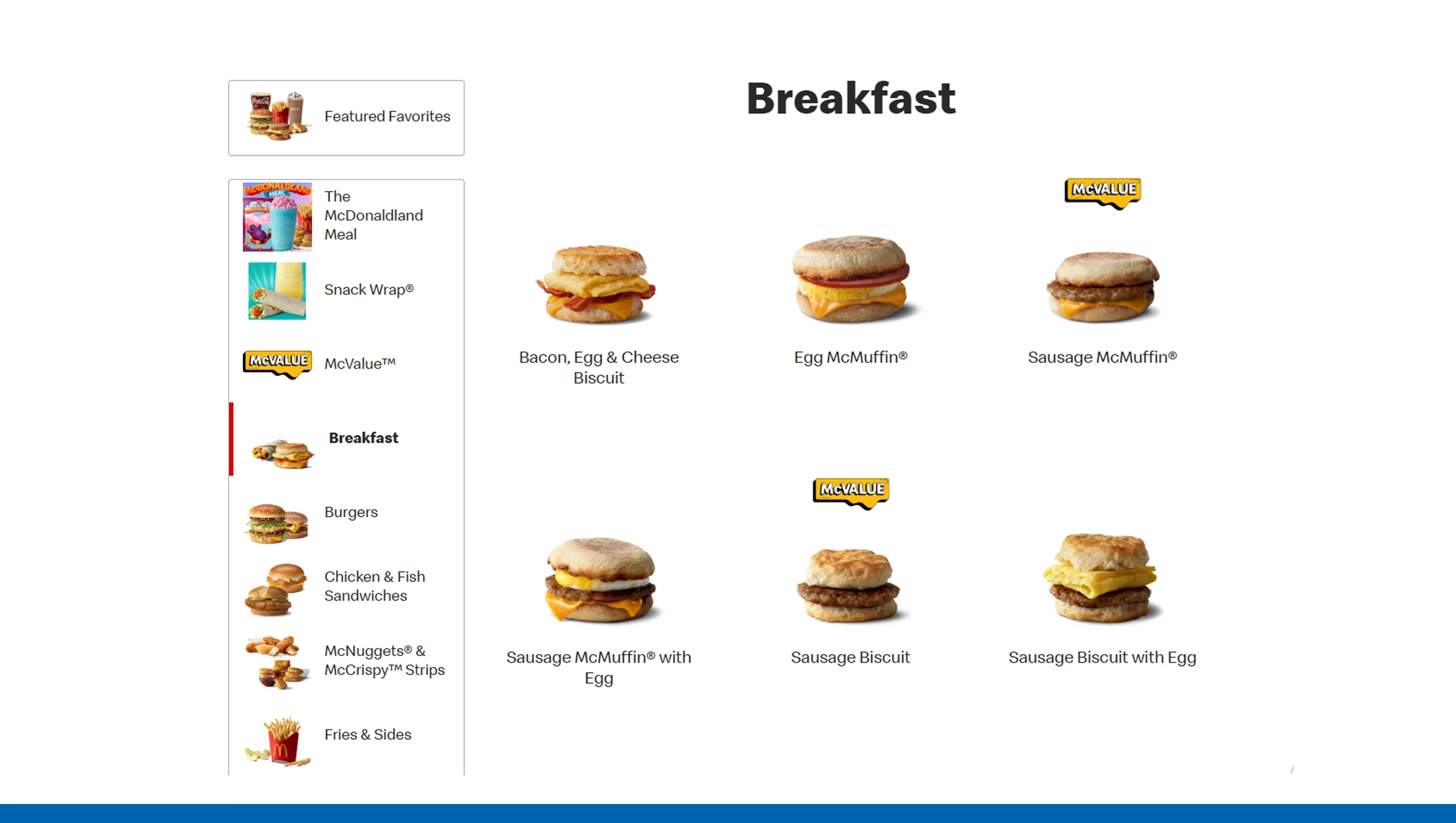

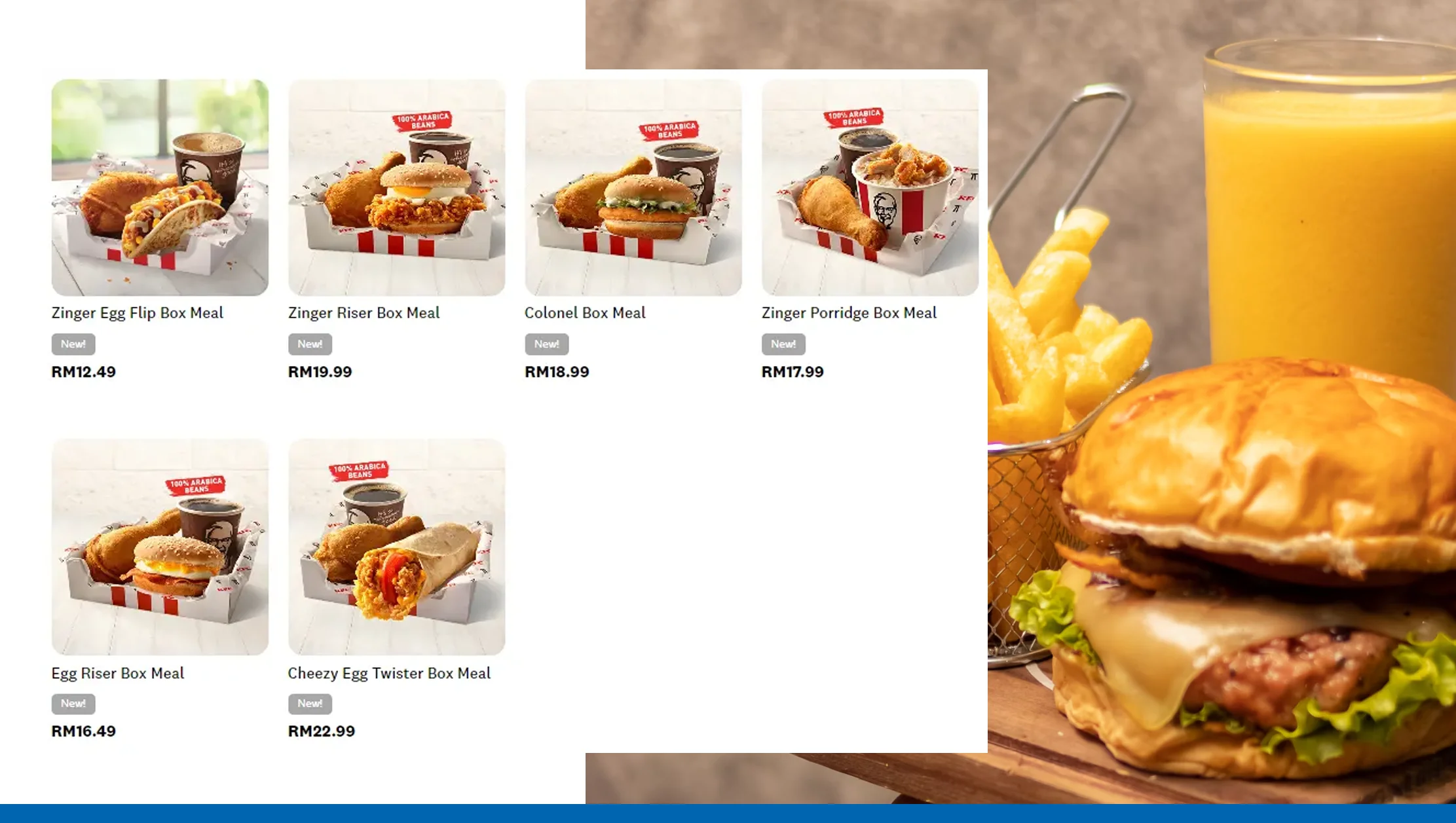

Analyzing fast food chain data scraping provides critical insight into the categories driving customer engagement and revenue growth. Leading chains like McDonald’s, KFC, and Burger King have strategically adjusted their menus in response to changing consumer preferences and competitive pressures. McDonald’s has expanded its breakfast offerings and introduced plant-based items, targeting both early-morning consumers and health-conscious customers. Items like plant-based sausage sandwiches and alternative protein burgers not only diversify the menu but also appeal to environmentally and diet-conscious consumers. Utilizing a Food Data Scraping API allows analysts to monitor these menu updates, track new item launches, and measure their contribution to incremental sales.

KFC emphasizes value meals and limited-time offerings. Combo deals and meal bundles attract price-sensitive consumers while driving incremental foot traffic. Burger King focuses on premium sandwiches and combo deals, highlighting signature sauces and gourmet toppings to appeal to customers seeking indulgent, higher-value options. By combining menu expansion with marketing initiatives, these chains optimize customer satisfaction and profitability.

Through scrape fast food restaurant data, analysts can track trends such as frequency of menu updates, category diversification, and introduction of seasonal items. From 2020 to 2025, the average menu size across leading chains increased by 12%, reflecting ongoing innovation and consumer demand for variety. Desserts and beverages grew the fastest, with limited-time offers and seasonal items driving incremental sales.

| Year | Avg. Menu Items (Top 3 Chains) | New Additions per Year |

|---|---|---|

| 2020 | 85 | 12 |

| 2022 | 92 | 15 |

| 2025 | 95 | 18 |

Data shows McDonald’s breakfast lineup contributes 22% of incremental sales, KFC’s value meals 19%, and Burger King’s premium sandwiches 15%. Seasonal variations heavily influence product launches, with summer introducing iced beverages and limited-time desserts. Digital menus also impact customer choices; items featured on apps or online portals frequently see a 10–15% uplift in sales.

By leveraging menu and pricing scraping for QSR chains and insights from web scraping for fast food industry trends, companies can forecast potential menu developments and track competitor innovations effectively. Leading chains also benefit from fast food competitor analysis API, enabling data-driven decisions for menu optimization. Insights from Fast Food Menu Pricing and Consumer Trends 2025 highlight that combining digital visibility, menu innovation, and consumer-focused strategies is key to maintaining market leadership.

Pricing Strategies & Promotions

Pricing has become a crucial lever for growth in the fast food industry. Analysis from Fast Food Menu Pricing and Consumer Trends 2025 reveals that McDonald’s pricing adjustments increased basket size by 8% between 2020 and 2025. KFC optimized combo meal pricing for higher profitability, while Burger King leveraged digital coupons to enhance customer retention. Utilizing a Food Dataset, analysts can benchmark pricing across locations, evaluate the effectiveness of promotions, and measure customer sensitivity to discounts, ensuring data-driven decisions for margin optimization.

| Year | Avg. Combo Price ($) | Promotional Frequency |

|---|---|---|

| 2020 | 7.5 | 20% |

| 2022 | 7.8 | 25% |

| 2025 | 8.2 | 30% |

Web scraping for fast food industry trends provides insights into competitor pricing, promotional campaigns, and limited-time offers. Chains can leverage this intelligence to implement dynamic pricing, menu bundling, and loyalty programs targeting high-value customers. For instance, limited-time offers and app-exclusive deals drive incremental sales ranging from 5–12% annually.

Promotional campaigns not only affect revenue but also influence customer behavior. Seasonal discounts and targeted digital promotions improve engagement while increasing repeat visits. Digital coupons and app-based deals allow chains to capture customer preferences and spending patterns, enabling precise targeting.

Through Fast Food Menu Pricing and Consumer Trends 2025, it is evident that pricing strategies intertwined with technology and analytics are reshaping fast food growth strategies. Chains implementing data-backed pricing can simultaneously improve profitability and customer satisfaction.

By leveraging fast food competitor analysis API, brands gain visibility into competitor promotional strategies, enabling agile responses to market shifts. The integration of analytics, pricing intelligence, and digital promotion ensures chains maximize both short-term revenue and long-term loyalty. Fast Food Menu Pricing and Consumer Trends 2025 underscores that pricing optimization, when combined with digital and data insights, drives measurable gains in basket size and retention.

Maximize profits and customer engagement—implement data-driven pricing strategies, seasonal promotions, and digital deals to grow your fast food business!

Get Insights Now!Consumer Behavior & Preferences

Understanding shifting consumer behavior is central to fast food strategy. Fast Food Menu Pricing and Consumer Trends 2025 emphasizes that health-conscious options, plant-based items, and regional specialties are increasingly popular. Chains track these preferences using Web Scraping Services, which monitor customer reviews, ratings, and feedback across platforms, enabling real-time insights into consumer sentiment.

Data shows McDonald’s plant-based options received an average 4.2-star rating across 50,000 reviews, while KFC’s value meals earned a 4.0-star rating. Digital engagement also rose, with app orders increasing 25% between 2020 and 2025, illustrating the shift toward mobile and online ordering.

Basket analysis reveals that side items, beverages, and desserts significantly impact average ticket size. Chains optimizing their menus based on scraped consumer behavior experience a 10–15% improvement in repeat purchases and loyalty program sign-ups.

| Menu Item Type | Avg. Rating | Repeat Order % |

|---|---|---|

| Plant-Based | 4.2 | 18% |

| Value Meals | 4.0 | 15% |

| Premium Sandwiches | 4.1 | 12% |

By leveraging menu and pricing scraping for QSR chains, brands can identify emerging preferences and adjust offerings accordingly. Personalization through app-based recommendations and targeted promotions further reinforces loyalty. Fast food chains that respond effectively to consumer insights, as highlighted by Fast Food Menu Pricing and Consumer Trends 2025, are better positioned to retain customers and increase average order value.

Digital Ordering & Online Trends

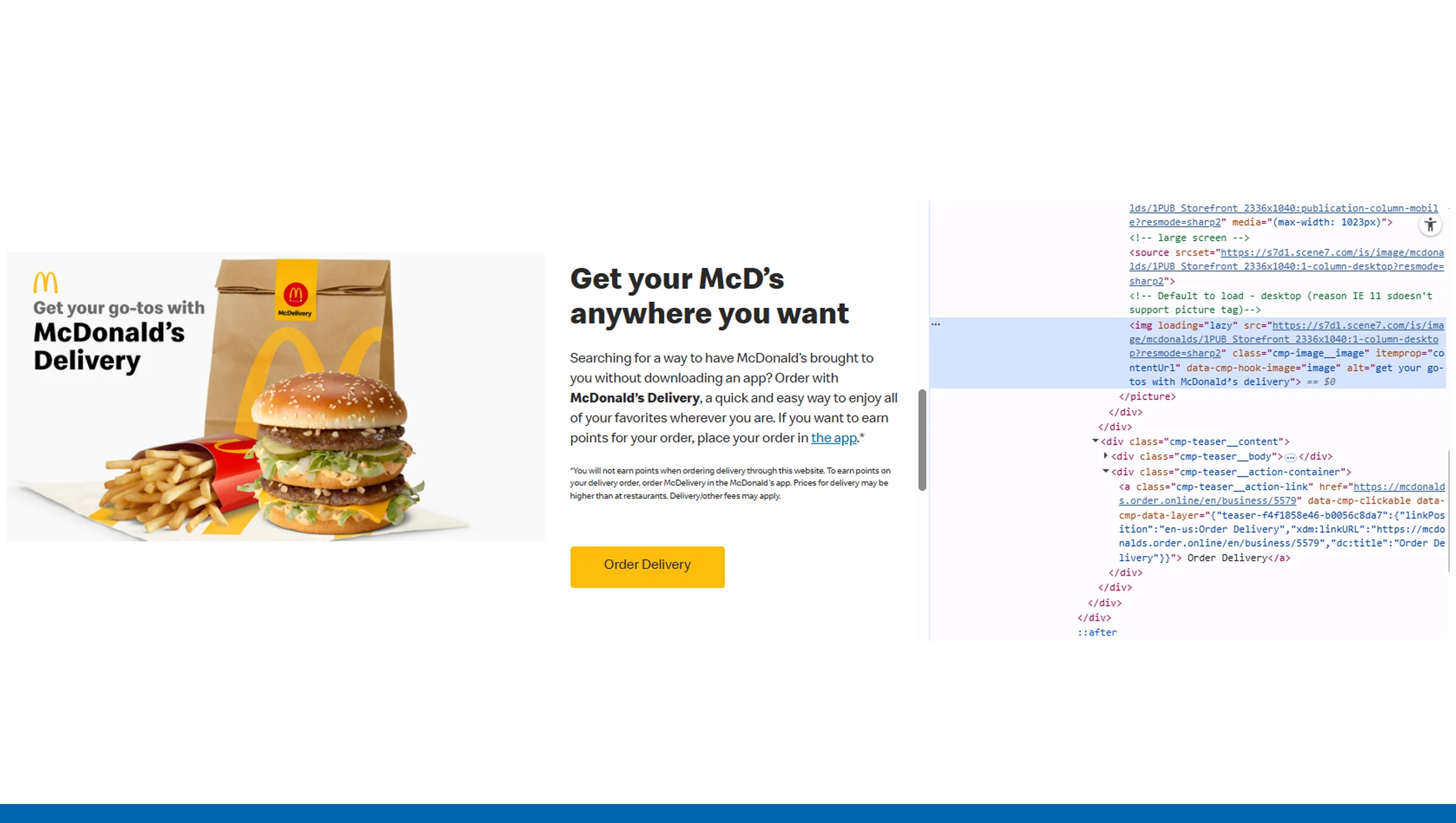

Online ordering has surged across all QSR chains, reflecting changing consumer habits. Fast Food Menu Pricing and Consumer Trends 2025 indicates a 35% growth in digital orders between 2020 and 2025. Using fast food competitor analysis API, companies can monitor app-based menu performance, track promotions, and optimize delivery times.

Chains offering real-time discounts via apps experienced a 12% increase in order volume. Web scraping for fast food industry trends also provides insights into which menu items are digitally highlighted, enabling predictive stocking and demand forecasting.

Regional and temporal ordering patterns emerge from digital trends. Breakfast items dominate in the Northeast, whereas beverages see higher demand in Southern states. This data-driven approach allows precise inventory planning and promotional targeting, improving profitability and customer satisfaction.

Digital ordering analytics also inform app design and user experience. Highlighting bestsellers, seasonal items, and personalized suggestions improves click-through and conversion rates. Leveraging menu and pricing scraping for QSR chains ensures these insights are aligned with broader competitive benchmarks, maximizing digital strategy effectiveness.

Operational Efficiency & Inventory Insights

Operational efficiency is crucial for profitability in the fast food industry. Using scrape fast food restaurant data, analysts can track inventory gaps, stockouts, and distribution efficiency, enabling proactive management of supply chains.

| Year | Avg. Stockouts per Month | Waste Reduction % |

|---|---|---|

| 2020 | 12 | 10% |

| 2022 | 9 | 15% |

| 2025 | 6 | 20% |

Chains employing automated replenishment and real-time inventory monitoring reduce waste by 15–20% and improve fulfillment rates. Optimized inventory ensures menu availability, directly impacting both digital and in-store sales.

Operational insights from Fast Food Menu Pricing and Consumer Trends 2025 reinforce the importance of integrating analytics, automation, and demand forecasting to maintain consistent service and maximize profitability.

Optimize your fast food operations—reduce waste, prevent stockouts, and streamline inventory management for higher efficiency and profitability today!

Get Insights Now!Market Share & Competitive Benchmarking

Leveraging menu and pricing scraping for QSR chains enables detailed Market Research on market share, revenue trends, and competitor positioning. McDonald’s continues to lead with 35% share, KFC with 22%, and Burger King at 18% by 2025.

| Chain | Market Share 2020 | Market Share 2025 | Growth % |

|---|---|---|---|

| McDonald’s | 30% | 35% | +5% |

| KFC | 20% | 22% | +2% |

| Burger King | 17% | 18% | +1% |

By integrating insights from fast food competitor analysis API, chains gain a clear understanding of pricing strategies, menu innovation, and promotional effectiveness. Data-driven benchmarking, coupled with competitive intelligence, supports both strategic expansion and operational improvements. Insights from Fast Food Menu Pricing and Consumer Trends 2025 highlight that leading chains use analytics to maintain market dominance, optimize profitability, and drive consumer loyalty.

Why Choose Real Data API?

Real Data API provides cutting-edge tools to fast food chain data scraping, offering reliable access to menus, pricing, promotions, and consumer sentiment. With Food Data Scraping API, businesses can extract high-quality Food Dataset across multiple chains and regions.

Our Web Scraping Services ensure accurate, real-time data, supporting Market Research initiatives that drive growth, optimize pricing, and enhance customer satisfaction.

Conclusion

The Fast Food Menu Pricing and Consumer Trends 2025 report underscores the importance of actionable insights in a competitive market. By leveraging Real Data API for fast food chain data scraping, businesses can track pricing, menu innovation, digital trends, and market share to make data-driven decisions. Unlock the power of real-time fast food data. Contact Real Data API to extract, analyze, and act on insights for competitive advantage!