Introduction

The rise of ghost kitchens has revolutionized food delivery, enabling brands to operate virtual restaurants without traditional dine-in spaces. With thousands of cloud kitchens launching globally each year, the need for real-time tracking and analytics has never been more urgent. For delivery platforms, food aggregators, restaurant tech startups, and market researchers, accurate data on ghost kitchens is key to staying competitive.

Using the Ghost Kitchen Listing Scraper API, businesses can access live listings of virtual restaurants, their locations, menu offerings, operating brands, pricing, and delivery platform presence. Whether you’re monitoring market saturation or optimizing food delivery logistics, this API provides structured, up-to-date intelligence across multiple regions.

Coupled with our powerful Food Data Scraping API, this solution enables precise market mapping, trend forecasting, and performance benchmarking for virtual dining operations. From independents to virtual franchises, this tool captures every listing update across delivery apps in real time.

In this blog, we explore how Real Data API helps clients monitor ghost kitchens at scale, solve operational challenges, and make smarter, data-driven decisions using the power of web scraping and API automation.

Tracking Market Expansion of Ghost Kitchens in Real Time

The ghost kitchen ecosystem is growing rapidly, driven by increased food delivery demand and low overhead costs. But manually keeping tabs on emerging brands across food delivery platforms is next to impossible. The Ghost Kitchen Listing Scraper API solves this by continuously tracking new virtual kitchens, mapping launch patterns, and categorizing them by cuisine, city, or brand.

Here’s a data snapshot of the expansion of ghost kitchens from 2020 to 2025:

| Year | Estimated Ghost Kitchens (Global) | YOY Growth (%) |

|---|---|---|

| 2020 | 7,500 | – |

| 2021 | 10,300 | 37% |

| 2022 | 14,700 | 43% |

| 2023 | 18,200 | 24% |

| 2024 | 21,600 | 19% |

| 2025 | 25,000 (est.) | 16% |

With Real-Time Ghost Kitchen Scraping, businesses gain instant insights into where and when virtual kitchens launch, enabling early-mover advantages for partnerships or platform listings. For instance, food aggregators can onboard new virtual restaurants faster, while investment firms can analyze expansion hotspots and predict market saturation zones.

By using structured scraping methods, the API delivers restaurant metadata, operational status, and menu URLs from platforms like Uber Eats, DoorDash, Swiggy, and Zomato—eliminating hours of manual research.

This real-time listing visibility helps logistics partners and delivery operators optimize their driver allocation and plan high-demand delivery zones efficiently. It also allows tech startups to build location-aware recommendation engines that highlight trending ghost kitchen concepts nearby.

Uncovering Competitive Insights from Virtual Restaurant Menus

In a digital-only food environment, the menu is the storefront. Understanding how competitors price dishes, name concepts, and package offerings is critical. With the Ghost Kitchen Listing Scraper API, businesses can extract live menus and pricing models to benchmark against their own virtual restaurants.

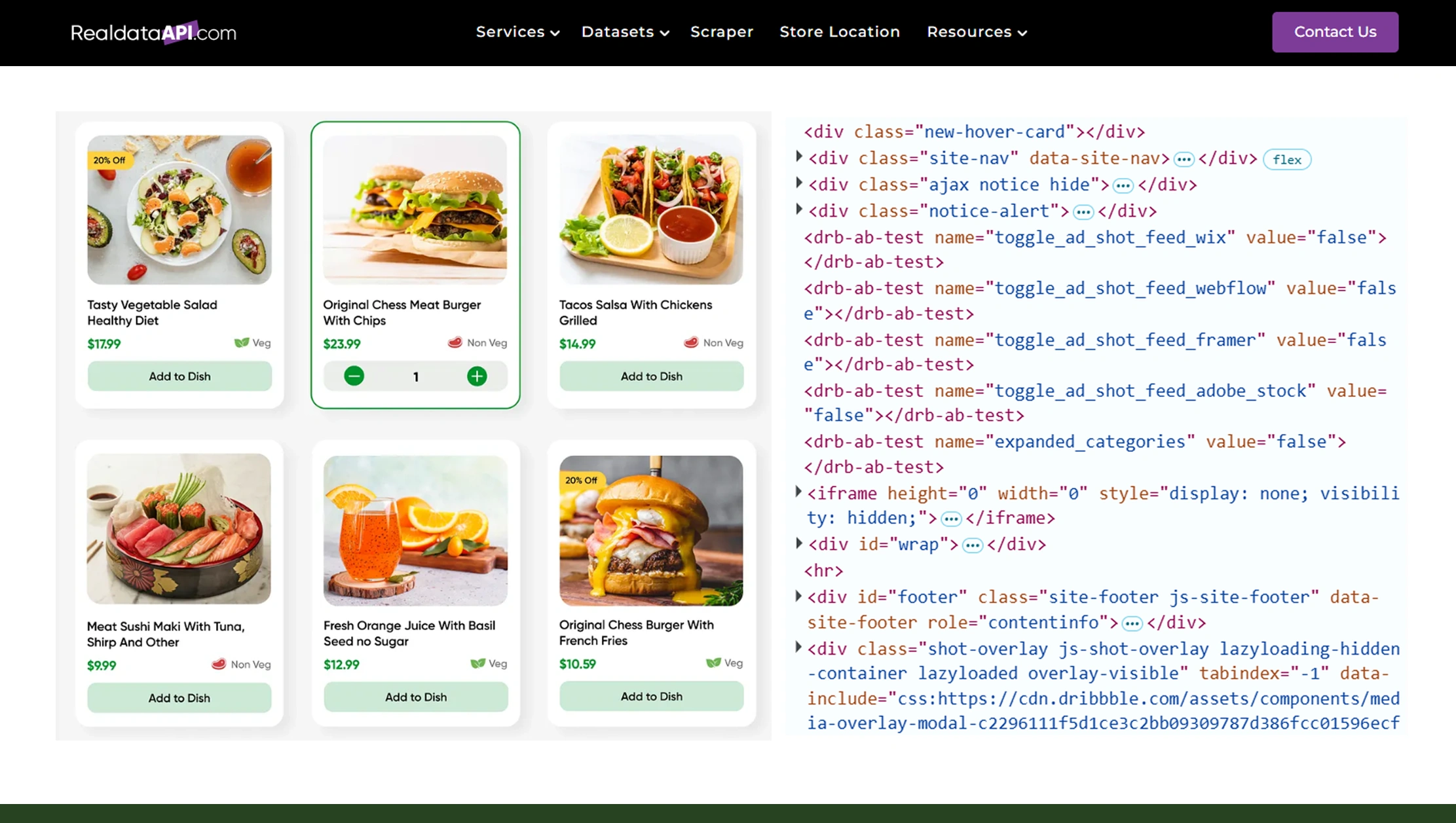

Using our Scrape Virtual Restaurants via API capability, clients can gather information like item names, price points, combo offers, and even images from competitors’ ghost kitchens.

Let’s look at pricing trends for three common cuisine types across ghost kitchens (2020–2025):

| Year | Avg. Price - Burgers | Avg. Price - Biryanis | Avg. Price - Pizzas |

|---|---|---|---|

| 2020 | ₹189 | ₹220 | ₹249 |

| 2021 | ₹199 | ₹235 | ₹265 |

| 2022 | ₹215 | ₹248 | ₹275 |

| 2023 | ₹225 | ₹260 | ₹285 |

| 2024 | ₹235 | ₹270 | ₹295 |

| 2025 | ₹245 (est.) | ₹280 (est.) | ₹310 (est.) |

These insights allow cloud kitchen operators to stay competitive, craft better bundle pricing, and improve dish naming strategies for higher conversions on delivery platforms. It also helps restaurant consultants advise brands on gaps in the virtual F&B market.

For example, if data shows a rise in vegan burger offerings with high review scores, emerging ghost kitchens can test new menu items in that category. This targeted data capture fuels smarter experimentation and menu optimization.

Uncover powerful competitive insights by analyzing virtual restaurant menus with real-time data from our Ghost Kitchen Listing Scraper API—

start now!Regional Trend Analysis for Cloud Kitchen Saturation

Understanding geographic saturation is key to ghost kitchen success. The Ghost Kitchen Listing Scraper API maps out where cloud kitchens are most concentrated and what cuisines dominate in those areas. This helps prevent launching in oversaturated zones and identifies underserved regions ripe for new concepts.

With our Platform API for Ghost Kitchen Data, users can filter listings by pin code, city, state, cuisine type, or even delivery radius. Here’s a comparative saturation index for metro cities in India (2020–2025):

| City | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 (est.) |

|---|---|---|---|---|---|---|

| Delhi NCR | 1.0 | 1.3 | 1.6 | 1.8 | 2.0 | 2.2 |

| Mumbai | 1.0 | 1.4 | 1.7 | 2.0 | 2.3 | 2.5 |

| Bengaluru | 1.0 | 1.2 | 1.5 | 1.7 | 1.9 | 2.1 |

| Hyderabad | 1.0 | 1.1 | 1.3 | 1.5 | 1.7 | 1.9 |

| Kolkata | 1.0 | 1.1 | 1.2 | 1.3 | 1.4 | 1.5 |

A saturation index above 2.0 indicates a highly competitive virtual market. Using this data, operators can evaluate ROI potential for each region before launching.

This regional intelligence also helps logistics platforms plan last-mile coverage zones. Franchise owners can determine expansion strategies, and food-tech investors can identify emerging Tier-2 hotspots for high-growth potential.

Extract Operational Metadata for Market Research

To make informed business decisions, granular metadata is critical. This includes kitchen format (multi-brand vs. single brand), cuisine tags, platform exclusivity, and delivery-only ratings.

Our Extract Cloud Kitchen Listings API provides all of this. It supports businesses looking to scrape market research data on cloud kitchens across different geographies and business models.

Here’s how the type of ghost kitchens evolved from 2020–2025:

| Year | % Multi-Brand Kitchens | % Single-Brand Kitchens | % Aggregator-Owned Kitchens |

|---|---|---|---|

| 2020 | 40% | 50% | 10% |

| 2021 | 45% | 45% | 10% |

| 2022 | 48% | 42% | 10% |

| 2023 | 52% | 38% | 10% |

| 2024 | 55% | 35% | 10% |

| 2025 | 60% (est.) | 32% (est.) | 8% (est.) |

With this metadata, you can build models to evaluate platform dependence, franchise replication models, or even identify underperforming kitchens with low visibility despite strong menus.

If you're a market research agency or consultant, this becomes a goldmine for delivering competitive studies or investment feasibility reports.

Monitor Platform Exclusivity & Delivery Presence

Ghost kitchens often operate across multiple food delivery platforms—or choose to stay exclusive. Understanding this distribution is crucial for partnership decisions.

Our Ghost Kitchen Data Extraction Service delivers insights into platform presence and delivery-only exclusivity. For instance, you can identify kitchens available only on Swiggy but not on Zomato, or those on all platforms simultaneously.

Here’s platform presence data for top ghost kitchen brands (2020–2025):

| Year | % Multi-Platform Kitchens | % Platform-Exclusive Kitchens |

|---|---|---|

| 2020 | 60% | 40% |

| 2021 | 65% | 35% |

| 2022 | 70% | 30% |

| 2023 | 73% | 27% |

| 2024 | 75% | 25% |

| 2025 | 78% (est.) | 22% (est.) |

If you're building a delivery comparison app, this data allows you to showcase exclusives and price differences. For cloud kitchen operators, it reveals where you may be missing visibility.

Track platform exclusivity and delivery presence in real-time with our Ghost Kitchen Listing Scraper API—optimize strategy with precise virtual kitchen insights.

start now!Track Locations & Facility Types with Geo Insights

Knowing where ghost kitchens are located—down to the neighborhood level—enables powerful mapping and logistics planning. With Scraping Dark Kitchen Locations via API, users can visualize the distribution of delivery-only kitchens by pin code, area, or radius.

For example, a user can input “500-meter radius from Andheri West” and retrieve all active ghost kitchens operating in that zone, along with cuisine and platform presence.

Here’s the change in dark kitchen density in top cities from 2020 to 2025:

| City | Kitchens per sq. km (2020) | Kitchens per sq. km (2025 est.) |

|---|---|---|

| Delhi NCR | 2.1 | 5.4 |

| Mumbai | 3.3 | 6.1 |

| Bengaluru | 2.5 | 5.2 |

| Hyderabad | 1.8 | 4.3 |

| Chennai | 1.6 | 3.8 |

Real estate consultants and F&B chains can use this data to identify optimal locations for launching new kitchens. Web Scraping Services ensure this data is continuously refreshed and normalized for analysis.

Why Choose Real Data API?

Real Data API offers scalable, reliable, and compliant data solutions for the fast-evolving virtual food industry. Our Ghost Kitchen Listing Scraper API is designed for performance, accuracy, and ease of integration—providing deep insights into the delivery-only dining landscape.

We support clients with fully managed infrastructure, custom filters, and flexible pricing. Whether you're a restaurant tech startup, aggregator, or food research agency, our platform delivers live ghost kitchen data with minimal latency.

With REST APIs, developer-ready docs, and 24/7 support, integrating ghost kitchen intelligence into your apps, dashboards, or CRM is seamless. We also offer historical datasets and bulk data options.

If you're looking to scrape virtual restaurants via API or run a long-term tracking project, Real Data API gives you the tools and confidence to scale with precision. You’ll always have access to the freshest, most relevant data—without the complexity.

Conclusion

As the food delivery world moves toward digital-first models, ghost kitchens are leading the transformation. Tracking these kitchens in real time gives businesses a vital edge—whether it's improving delivery logistics, optimizing menus, or evaluating market saturation.

With the Ghost Kitchen Listing Scraper API, Real Data API enables instant access to virtual restaurant listings, operational metadata, pricing, platform presence, and more. This is not just scraping—it’s a competitive intelligence engine for the delivery-first food economy.

From startups and consultants to enterprise food-tech firms, our solution fits every scale and use case. Whether you need real-time scraping or batch exports, our API delivers accuracy, depth, and flexibility.

Tap into the future of food with Real Data API—track, analyze, and grow your ghost kitchen operations with real-time data you can trust.