Introduction

In today’s rapidly shifting mobility landscape, rental car companies face intense pressure to offer competitive pricing and maintain a well-balanced fleet. Whether you're running a regional car rental service or a multinational platform, staying ahead requires constant access to real-time, accurate data. That’s where Rental Car Market Data Extraction becomes a game-changer.

By leveraging structured data from top rental platforms, businesses can optimize pricing, predict demand, and fine-tune fleet allocation—leading to increased margins, fewer idle vehicles, and happier customers.

Real-Time Pricing Accuracy with Rental Car Market Data Extraction

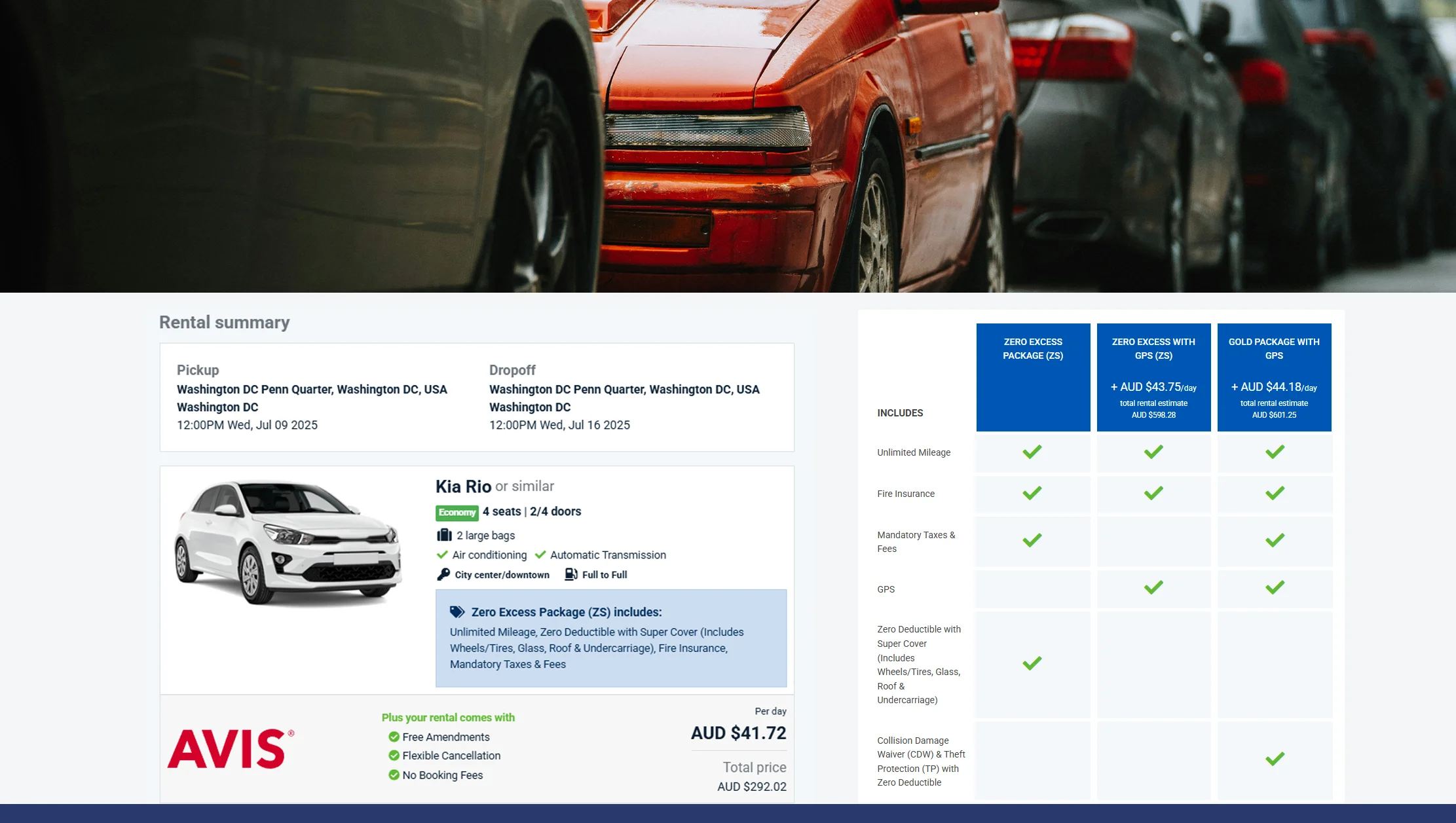

Modern rental platforms update pricing based on supply, demand, season, location, and competitor rates. Manual tracking of these variables is nearly impossible. With Rental Car Market Data Extraction, businesses can automate the collection of price, vehicle type, availability, and rental terms across various providers in real-time.

This allows for smarter, data-driven pricing strategies. For example, if competitors drop rates in a specific city due to low demand, you can match or beat that pricing instantly.

Table: Average Daily Rental Price Trends (2020–2025)

| Year | Economy (USD) | SUV (USD) | Luxury (USD) | Avg. Industry Price |

|---|---|---|---|---|

| 2020 | $42 | $68 | $120 | $76 |

| 2021 | $46 | $71 | $127 | $81 |

| 2022 | $49 | $74 | $133 | $85 |

| 2023 | $52 | $78 | $139 | $89 |

| 2024 | $55 | $81 | $145 | $93 |

| 2025 | $58 | $84 | $150 | $97 |

Analysis: From 2020 to 2025, average rental prices increased by over 27%, highlighting the need for precise, dynamic pricing backed by real-time data extraction.

With tools like the Rental Car Data Scraping API, you can track these changes across platforms such as Hertz, Enterprise, Europcar, and local aggregators—ensuring your pricing always stays relevant and competitive.

Boost your rental profits today—use Rental Car Market Data Extraction for real-time pricing accuracy and stay ahead of competitors with smarter, data-driven strategies!

Get Insights Now!Optimize Fleet Allocation with Real-Time Market Signals

Over or under-utilizing vehicles can drastically affect profitability. With real-time car rental data monitoring, you gain visibility into which vehicle types are in demand, seasonal booking trends, and geographic usage patterns.

By integrating a Monitor Car Pricing API with internal fleet data, companies can:

- Reduce downtime by relocating underutilized cars.

- Predict high-demand zones and allocate inventory proactively.

- Track vehicle shortages across competitors for smarter procurement.

Table: Fleet Utilization Rates by Category (2020–2025)

| Year | Economy Cars | SUVs | Luxury Cars | Vans |

|---|---|---|---|---|

| 2020 | 62% | 55% | 45% | 50% |

| 2021 | 67% | 58% | 48% | 53% |

| 2022 | 70% | 60% | 51% | 56% |

| 2023 | 74% | 64% | 55% | 58% |

| 2024 | 77% | 67% | 58% | 61% |

| 2025 | 80% | 70% | 60% | 64% |

Analysis: With accurate market signals, rental companies have significantly improved fleet utilization rates—especially in the economy and SUV categories.

Using Rental Car Market Data Extraction, you not only know what’s trending but can also forecast shifts before they happen.

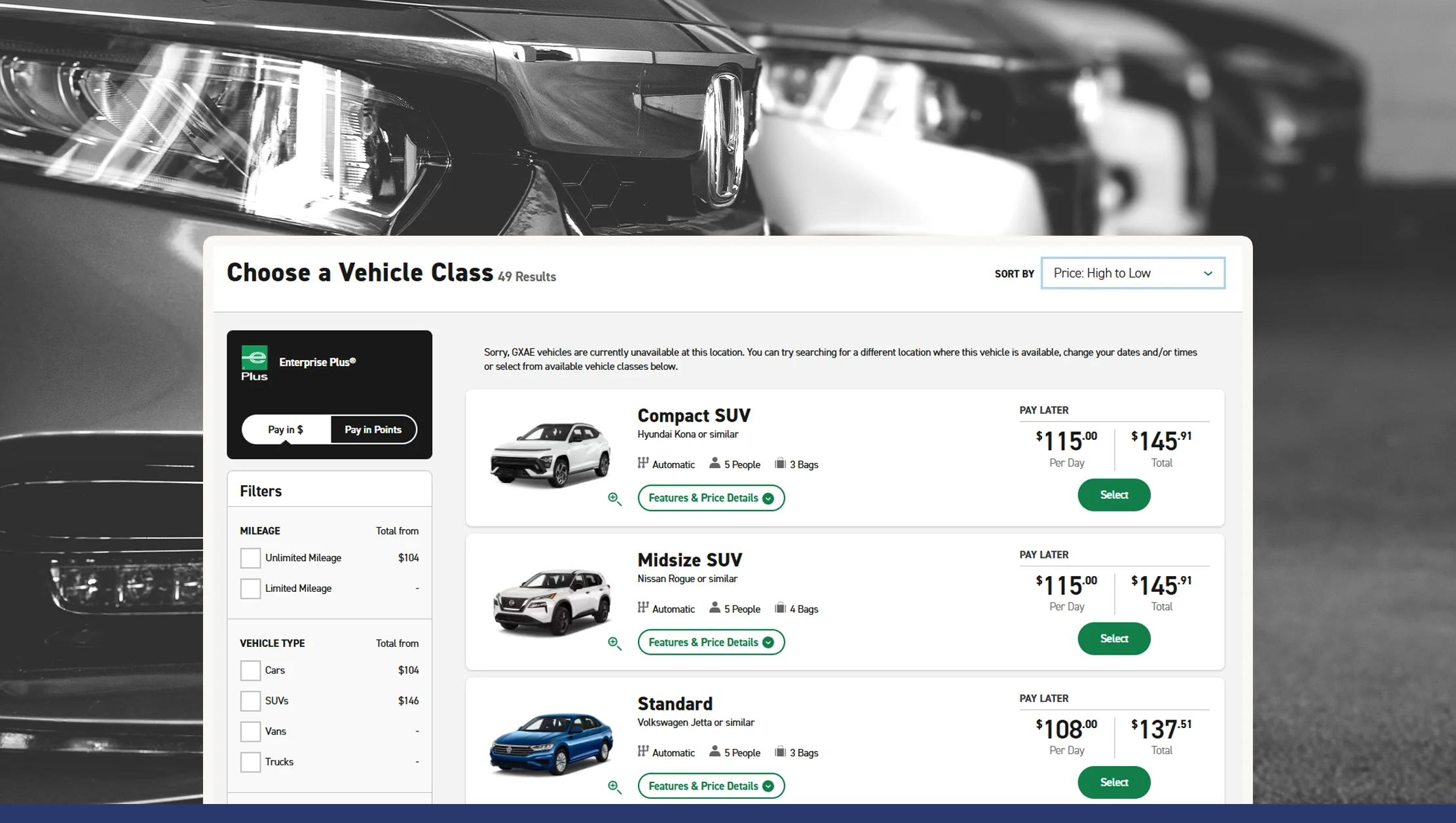

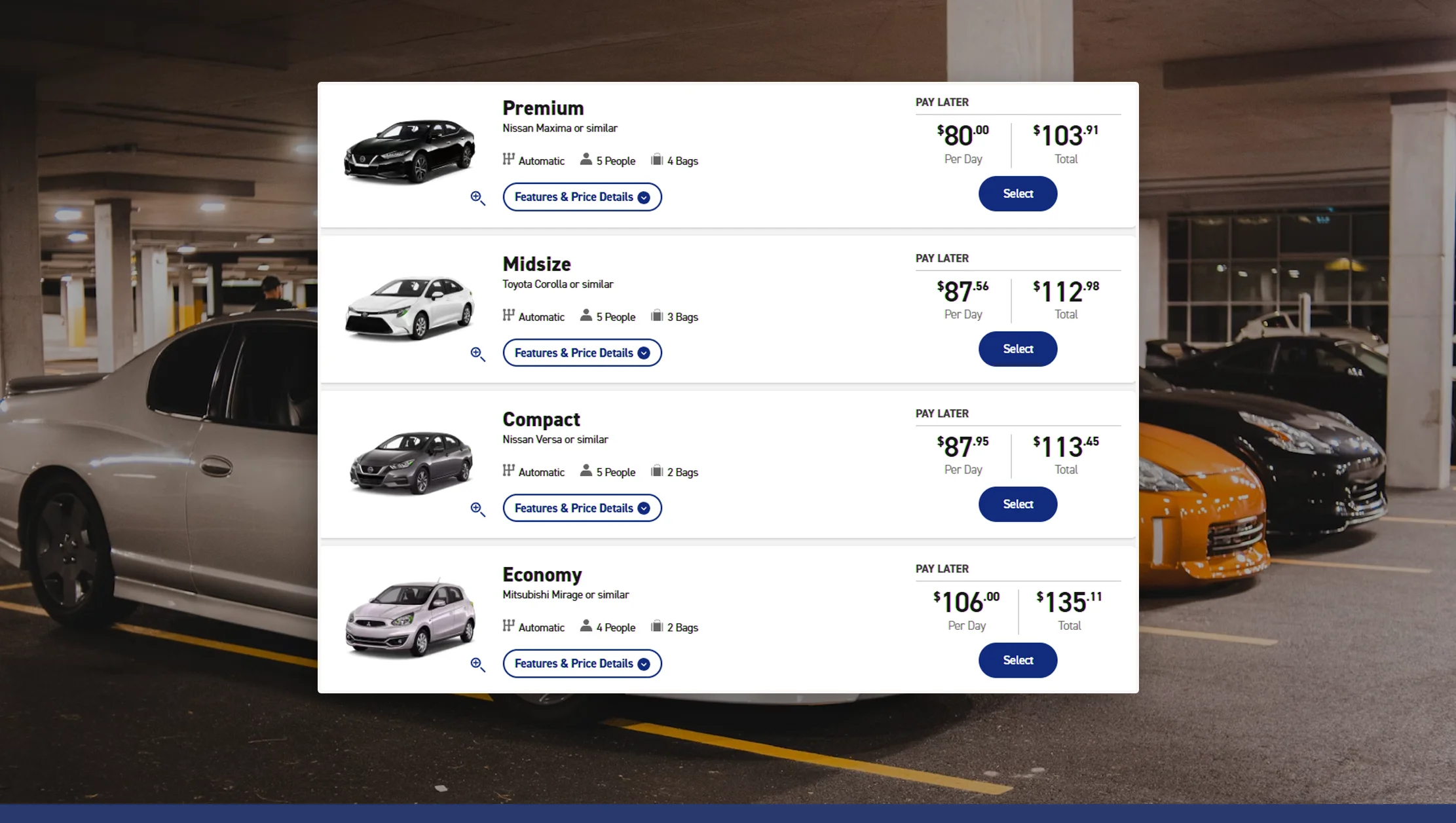

Competitive Edge Through Rental Car Price Comparison

In a hyper-competitive rental market, customer loyalty often comes down to price. Offering the right price at the right time is crucial. Rental car price comparison tools built on scraped market data allow you to benchmark against top players in any region.

By conducting frequent Price Comparison analyses, companies can adjust offerings based on competitor actions, customer preferences, and real-time supply-demand balances.

Table: Price Difference Between Top Rental Providers (Q1 2025 – New York)

| Provider | Economy Price (USD) | SUV Price (USD) | Luxury Price (USD) |

|---|---|---|---|

| Company A | $60 | $85 | $145 |

| Company B | $58 | $89 | $155 |

| Company C | $62 | $80 | $140 |

| Your Brand | $57 | $83 | $150 |

Analysis: With market-wide price visibility, your brand can remain the most competitive in all three categories, optimizing both revenue and booking volume.

These insights, powered by Rental Car Data Scraping API, deliver actionable intelligence that sales and marketing teams can use to run effective promotions and pricing strategies.

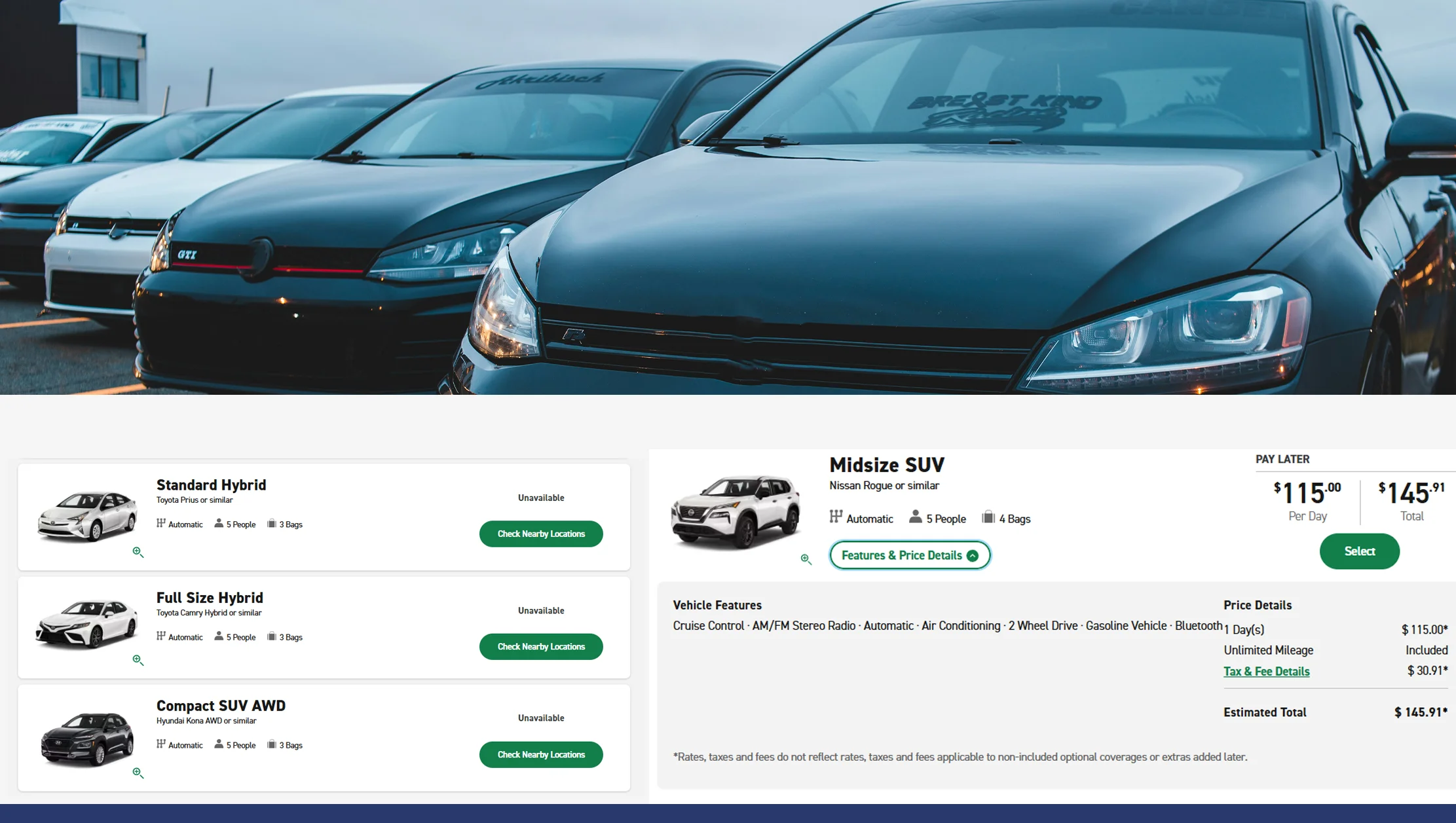

Fuel Better Decisions with Accurate Market Research

Understanding regional trends, consumer behavior, and seasonal demand cycles requires deep market research. With data extraction tools, you can capture large-scale information such as:

- Popular pick-up/drop-off locations

- Booking duration trends

- Add-on services (insurance, GPS, etc.)

- Fuel pricing impacts

Table: Average Booking Duration by City (2020–2025)

| Year | Tokyo | Dubai | Los Angeles | Paris |

|---|---|---|---|---|

| 2020 | 3.2 | 4.1 | 3.5 | 3.8 |

| 2021 | 3.4 | 4.3 | 3.8 | 4.0 |

| 2022 | 3.6 | 4.5 | 4.0 | 4.2 |

| 2023 | 3.8 | 4.7 | 4.3 | 4.4 |

| 2024 | 4.0 | 4.9 | 4.5 | 4.6 |

| 2025 | 4.2 | 5.1 | 4.7 | 4.8 |

Analysis: A growing trend in longer rentals highlights the need for flexible pricing packages and extended-period discounts—insights that can only be surfaced through robust market research and real-time data extraction.

Make smarter business moves—leverage accurate market research from Rental Car Market Data Extraction to optimize pricing, fleet planning, and stay ahead in the rental game!

Get Insights Now!Why Choose Real Data API?

Real Data API is the leading provider of specialized web scraping solutions for the mobility and car rental industries. Here’s why top rental businesses trust us:

- Reliable & Scalable Infrastructure: Handle millions of data points across global platforms.

- Highly Accurate Data: Precise extraction of pricing, availability, reviews, vehicle types, and more.

- Real-Time Integration: Plug directly into your systems for real-time car rental data monitoring.

- Custom Dashboards & Alerts: Monitor trends, pricing shifts, and competitor behavior automatically.

- Global Coverage: From Tokyo to Toronto, we support data scraping across continents.

Whether you need competitive benchmarking, fleet intelligence, or dynamic pricing models, we deliver the structured data you need—when and where you need it.

Conclusion

Rental Car Market Data Extraction is more than just a tool—it’s a strategic asset. From pricing optimization and competitive benchmarking to smarter fleet management, extracting structured, real-time rental data is key to staying ahead in a fast-paced industry.

Ready to drive smarter decisions with data? Contact Real Data API today and unlock the full potential of your rental car business!