Introduction

Expanding a QSR brand or evaluating market potential requires data-driven decision-making. One of the most effective ways to enhance strategic planning is to Scrape Tim Hortons Restaurant Locations Data in the USA. This data helps franchises assess market saturation, optimize placement of new outlets, and forecast regional demand more accurately.

In this blog, we’ll explore how location intelligence gathered from Tim Hortons restaurant locations data scraping USA can revolutionize business performance.

The Importance of Location Data in QSR Strategy

In the fast-evolving landscape of the quick service restaurant (QSR) industry, success depends heavily on strategic placement. As competition increases and consumer expectations shift, franchises must go beyond instinct and adopt a location intelligence-driven approach. Especially in a saturated market like the United States, the question is no longer just what to sell, but also where to sell it.

One of the most effective methods to drive smart location-based decisions is to Scrape Tim Hortons Restaurant Locations Data in the USA. This dataset offers granular visibility into existing store distribution, enabling franchise owners and corporate teams to make informed expansion or optimization decisions.

Analyzing Tim Hortons restaurant locations data supports multiple high-impact business outcomes, including:

- Benchmarking store density across urban, suburban, and rural landscapes

- Identifying underserved regions where demand may exceed supply

- Avoiding internal competition by preventing outlet cannibalization

- Improving delivery radius efficiency, thereby enhancing customer experience

Understanding these dimensions through data allows franchisors to unlock localized insights that influence revenue, logistics, and brand presence.

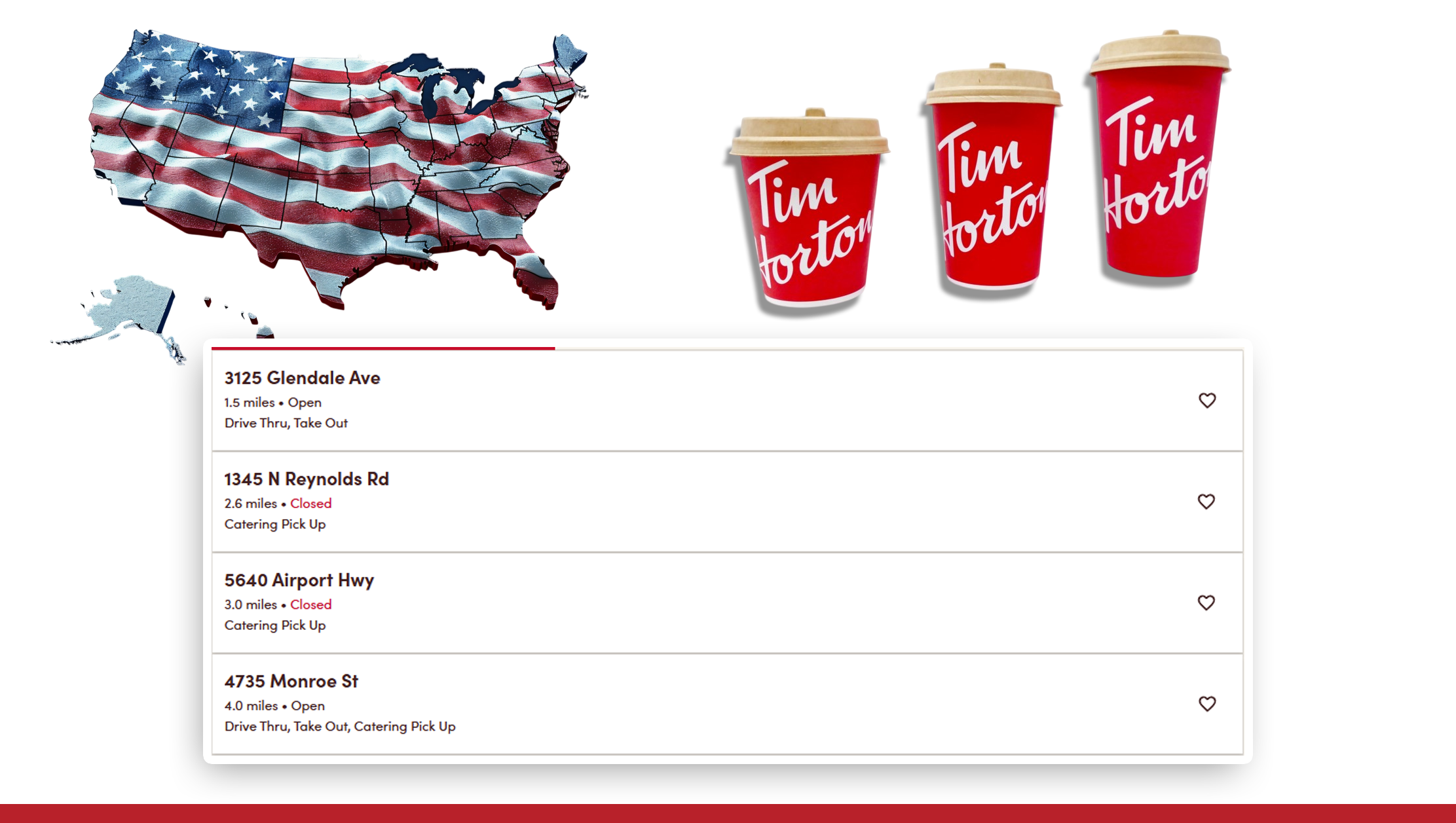

Tim Hortons USA Store Distribution by Region (2025)

| Region | Number of Locations | Population per Store |

|---|---|---|

| Northeast | 420 | 32,000 |

| Midwest | 385 | 29,500 |

| South | 210 | 56,700 |

| West | 135 | 74,200 |

Analysis

The Midwest and Northeast show higher store saturation, indicating mature markets with limited expansion room. In contrast, the South and West offer low store density yet high population per outlet. This suggests untapped market potential. Businesses that Scrape Tim Hortons Restaurant Locations Data in the USA can discover these gaps early and capitalize on them.

By combining store location data with other metrics like traffic patterns, competitive presence, and regional spending capacity, businesses can make strategic moves confidently. Whether you're a franchise operator or a corporate strategist, knowing where not to expand can be just as valuable as knowing where to grow next.

Unlock smarter expansion decisions—leverage QSR location data to optimize store placement, reduce risk, and drive franchise profitability today.

Get Insights Now!How Store Location Data Supports Market Research?

In today’s data-first world, market research is no longer just about surveys and trend reports—it’s about extracting real-time, location-based insights that directly impact business performance. For QSR brands like Tim Hortons, understanding the local landscape is essential to outmaneuver competitors and meet consumer demand where it’s strongest.

By using Scraping Tim Hortons restaurant Locations Data USA, businesses gain access to powerful, location-centric intelligence that transcends a simple list of store addresses. This data empowers analysts and decision-makers with rich context about the environment surrounding each restaurant location.

Here’s how Scraping Tim Hortons restaurant Locations Data USA enhances market research capabilities:

- Proximity to high-traffic areas: Restaurants near schools, universities, shopping malls, and public transport hubs generally attract more footfall. Mapping Tim Hortons locations relative to these hotspots can predict potential sales volume and customer segments.

- Presence of competitors: Knowing where other popular chains like Starbucks or Dunkin’ operate in relation to Tim Hortons helps brands plan defensive or aggressive expansion strategies. Competitive clustering or spacing can be used to either create synergy or avoid overlap.

- Local demographics and spending behavior: Layering location data with demographic profiles—such as age, income level, or lifestyle choices—enables tailored offerings. For instance, outlets in college towns may promote value meals, while those in affluent areas might benefit from premium product launches.

- Foot traffic and accessibility: Accessibility factors such as drive-through availability, nearby parking, or pedestrian-friendly access play a crucial role in determining restaurant success. High visibility and easy entry often translate to higher conversion rates.

These data points, when unified under a smart location analytics framework, enable predictive modeling—a major leap from traditional reactive market analysis. You can forecast store performance before even opening the doors, minimizing risk and maximizing ROI.

Furthermore, with the aid of automated tools for Scraping Tim Hortons restaurant Locations Data USA, this intelligence can be updated continuously to reflect evolving trends, competitor moves, and urban development patterns.

In essence, this form of data-driven market research offers more than just insight—it provides strategic foresight. It gives brands the power to not only understand the market as it is today but to anticipate where demand will grow tomorrow. That’s how brands stay ahead in an ultra-competitive QSR landscape.

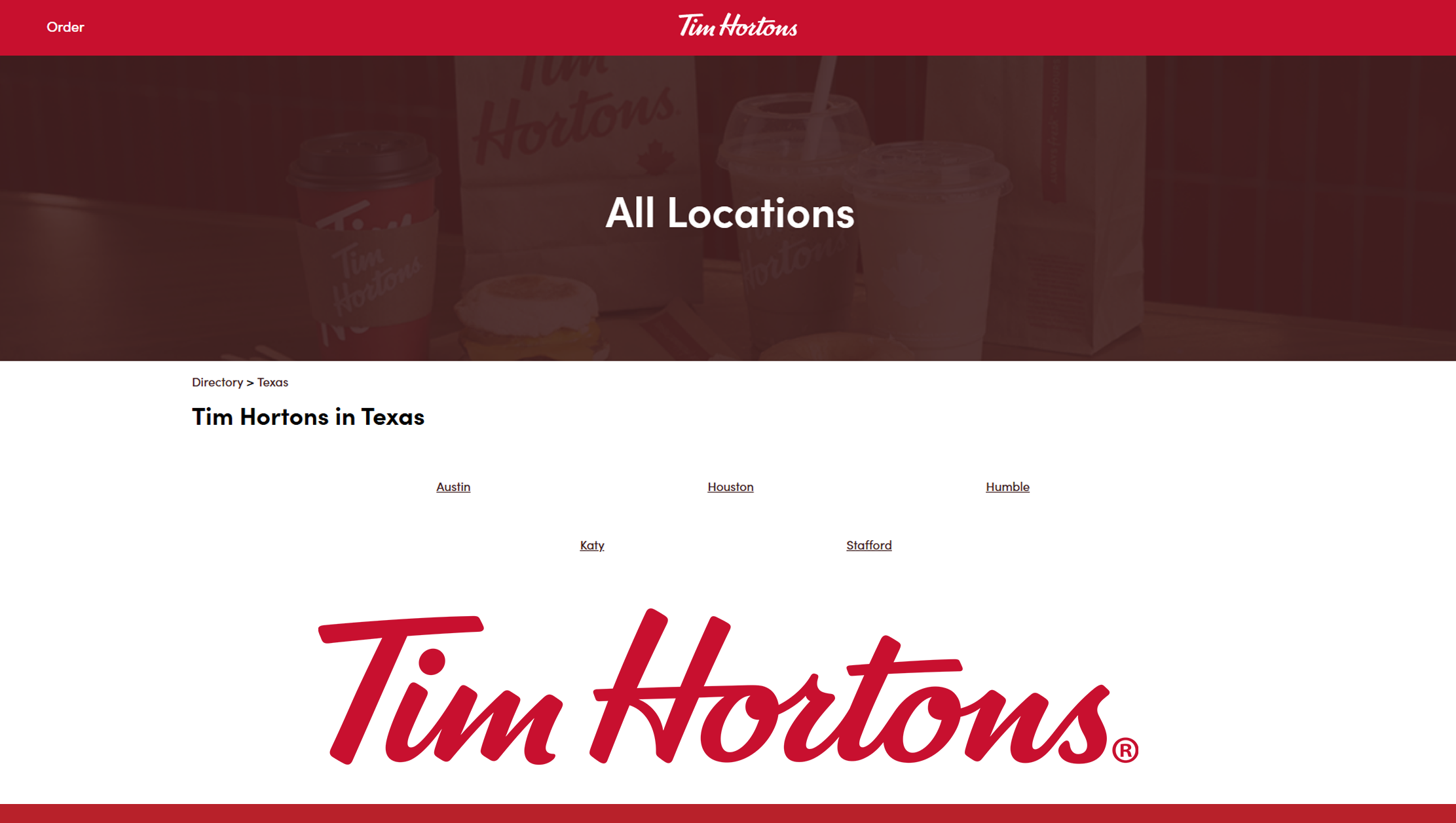

Use Case: Territory Gap Analysis

In a competitive franchise landscape, expansion without strategic planning can lead to wasted investments or underperformance. That’s where location intelligence becomes a powerful tool. Let’s take a real-world scenario.

Suppose you’re a franchise operator planning to open five new Tim Hortons outlets in Texas. This state, with its rapidly growing population and urban sprawl, holds massive potential. But which neighborhoods or zip codes should you target?

By leveraging Web Scraping Tim Hortons restaurant locations USA, you can analyze the entire geographic spread of existing Tim Hortons outlets. This enables you to identify white spaces—zip codes that lack Tim Hortons presence but are rich in potential demand. These may be areas near:

- Large universities and colleges

- Transit hubs and metro stations

- Residential clusters with young professionals

- Commercial districts with limited QSR options

Using historical footfall data and GIS overlays, such territory gap analysis empowers decision-makers to deploy new stores where they’re most likely to succeed. It’s smarter than relying on intuition alone—and more cost-effective.

Identify high-potential locations and reduce expansion risk—use location data to uncover untapped territories with proven demand insights.

Get Insights Now!Combining Location Data with Sales Trends

Location data becomes exponentially more powerful when paired with performance metrics. When businesses integrate their internal POS data with geographic information from Tim Hortons locations data scraping USA, they uncover patterns that drive smarter operations.

Here’s what this integrated analysis can deliver:

- High-performing clusters: Understand which city zones or neighborhoods consistently yield above-average revenues. These clusters can become models for future site selection or marketing tactics.

- Seasonal spikes by region: Maybe outlets near universities spike in the fall, or stores in business parks thrive during the workweek. Tracking these patterns supports inventory planning and seasonal campaigns.

- Delivery vs. dine-in performance: With remote working on the rise, dine-in traffic may drop while delivery orders surge. This helps adjust staffing and service models in real-time.

All of this becomes seamless through a Tim Hortons restaurant locations Extractor USA—a powerful tool that connects real-time location data with sales and demographic insights. Businesses no longer need to rely on lagging reports or gut feel. Instead, they can build predictive models to optimize where, when, and how they operate.

Whether you’re a corporate franchise team or an individual operator, these insights can be game-changing—helping you reduce risk, increase efficiency, and unlock long-term growth.

Example – Store Density vs. Estimated Annual Revenue

| City | Tim Hortons Locations | Estimated Annual Revenue (Per Store) |

|---|---|---|

| Buffalo, NY | 52 | $480,000 |

| Detroit, MI | 37 | $510,000 |

| Houston, TX | 6 | $670,000 |

| Phoenix, AZ | 4 | $690,000 |

Analysis

Cities with fewer stores like Houston and Phoenix are generating more per-location revenue, suggesting underserved high-demand markets. Brands using Store location USA insights can prioritize these metros for new franchises, boosting ROI while avoiding the saturation seen in legacy regions like Buffalo or Detroit.

Why Choose Real Data API?

Real Data API offers precise, scalable, and reliable solutions for Tim Hortons restaurant locations data scraping USA needs. Here’s what sets us apart:

- Real-Time Updates: Always access fresh location insights.

- Geo-Tagged Data: Includes coordinates, zip codes, store type (drive-thru, café).

- Custom Filters: Slice data by region, revenue estimate, or urban/rural setting.

- Automation Ready: Plug data into CRMs, analytics dashboards, and GIS tools.

- Compliance Focused: Adheres to data usage regulations and privacy standards.

Whether you're planning new outlets or optimizing delivery zones, Real Data API empowers your strategy with actionable location intelligence.

Conclusion

To unlock true business potential, franchisors must move beyond gut instinct. Scrape Tim Hortons Restaurant Locations Data in the USA to make smarter, location-driven decisions. From benchmarking store saturation to identifying emerging opportunities, data is the game-changer you can’t ignore.

Ready to elevate your QSR expansion strategy? Contact Real Data API today for enterprise-grade location scraping solutions.