Introduction

The retail landscape in the U.S. is undergoing rapid transformation, with location intelligence playing a crucial role in shaping brand strategies. One of the key players driving the discount retail segment is Ollie’s Bargain Outlet. For brands aiming to align operations with changing consumer behavior, Ollie’s Bargain Outlet store location data scraping USA is emerging as a powerful tool for strategic insights. From planning hyper-local ad campaigns to selecting optimal store sites, location data scraping helps retailers adapt faster and smarter.

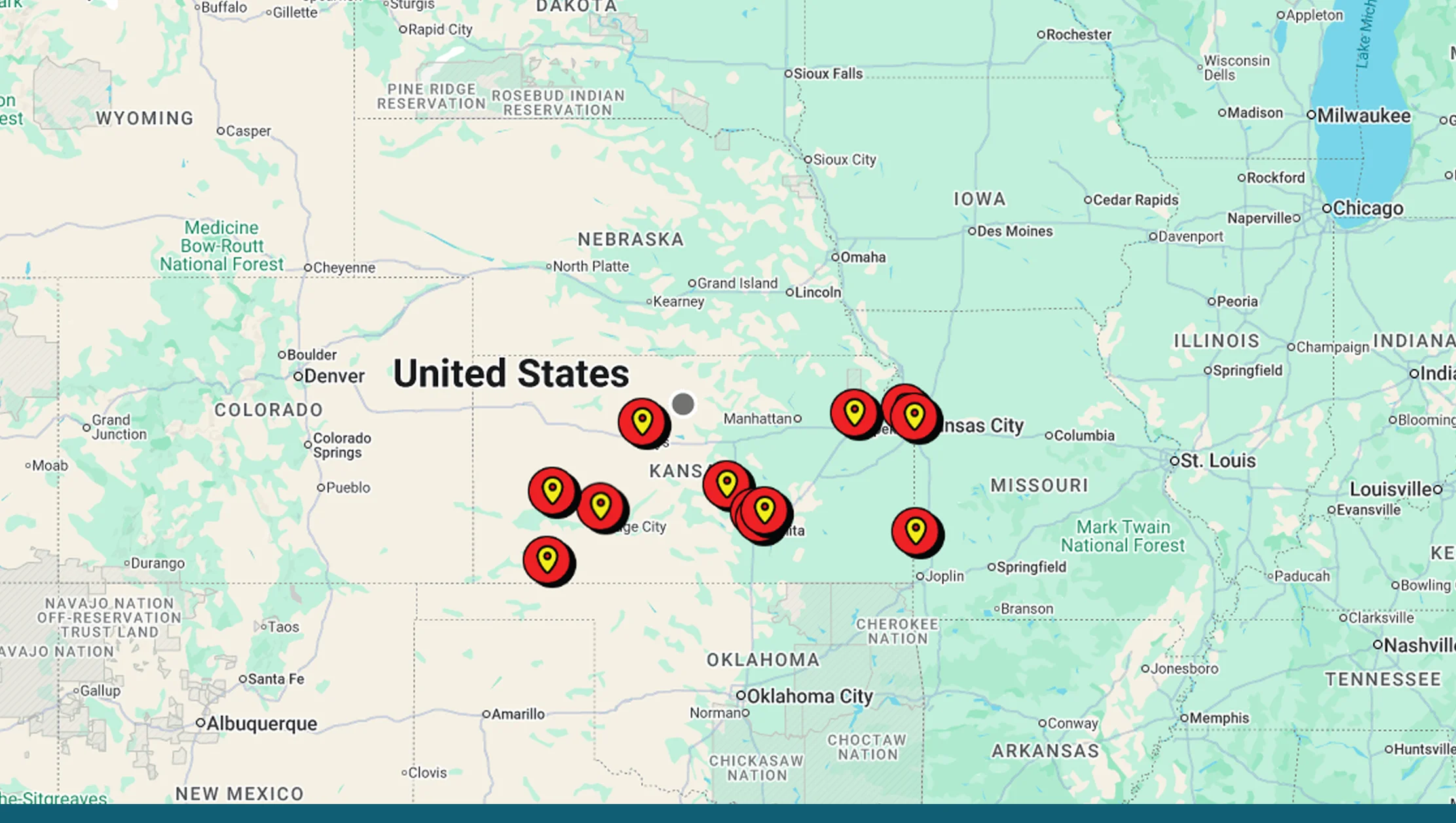

Between 2020 and 2025, value-focused retail chains saw a 33% increase in market penetration across non-metro areas, largely due to improved data-led decisions. By deploying tools to scrape Ollie’s store locations USA, retail brands can analyze spatial density, proximity to competitors, and growth potential. In this blog, we explore how location data scraping from Ollie’s enables smarter marketing, logistics, expansion, and benchmarking decisions. We also highlight the critical role of tools like Ollie’s Bargain Outlet locator data and Ollie’s store coordinates scraper in transforming raw data into retail intelligence.

Enhancing Geo-Targeted Marketing Through Location Intelligence

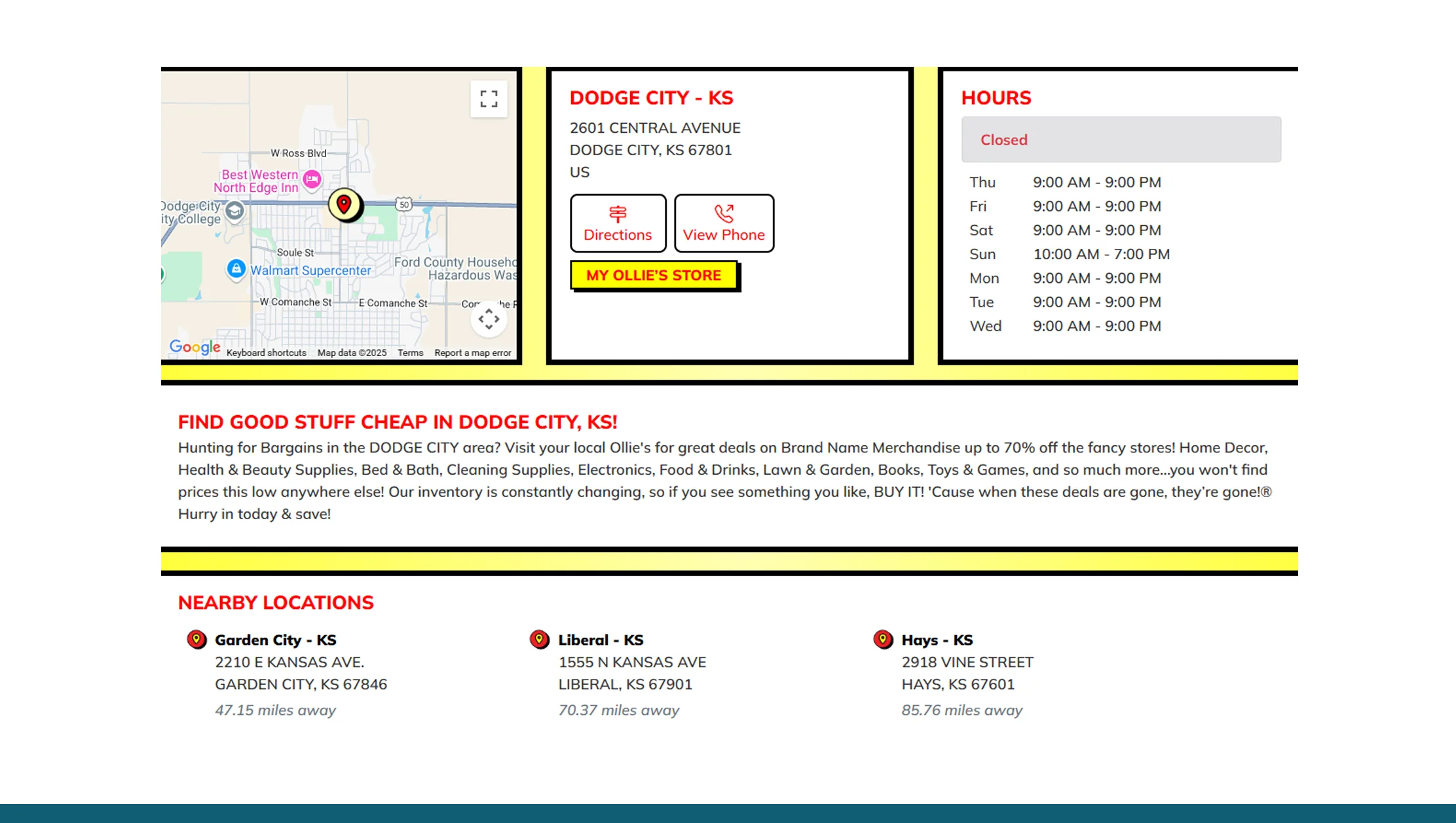

Retailers targeting value-conscious shoppers must align digital marketing campaigns with physical store footprints. Using Ollie’s Bargain Outlet locator data, brands can create proximity-based audience segments, enabling hyper-local ad delivery. For example, by incorporating retail chain location scraping USA, advertisers can geo-fence ZIP codes around Ollie’s locations and tailor content to nearby consumers.

From 2020 to 2025, businesses leveraging ZIP-level targeting reported a 29% increase in foot traffic and a 22% rise in regional conversion rates. Tools that extract Ollie’s addresses and ZIP codes are essential for feeding CRM systems and ad servers with precise location inputs. This ensures that campaigns are not only localized but also accurately timed with store launches or promotions.

Moreover, integrating scraped location data into programmatic platforms reduces media waste. In 2024, advertisers using location-anchored targeting saw a 16% drop in cost-per-click and a 21% boost in campaign ROI. With increased personalization and efficiency, location-based targeting has become indispensable for national brands targeting regional markets.

Powering Real Estate and Site Expansion Decisions

Site selection remains one of the most critical investments for retail chains. With tools that offer web scraping for retail store chains, brands can analyze Ollie’s store lifecycle events—such as openings, closures, and relocations—to assess expansion opportunities.

Using Ollie’s POI data scraper, teams identify high-performing trade areas and detect market saturation. From 2020 to 2025, retail chains that implemented POI-based expansion strategies saw an 18% reduction in failed launches and a 25% improvement in average store profitability. Overlaying competitor presence and demographic trends on these maps adds an extra layer of insight.

By scraping US retail outlet locations, teams simulate drive-time zones, compare sales density, and evaluate accessibility. These insights are particularly valuable when entering new states or micro-markets. As a result, brands make data-backed decisions about store sizes, staffing levels, and merchandising layouts.

Real estate analysts also benefit from heatmaps showing Ollie’s growth by state. In 2025, states like Texas and Florida saw a 40% increase in Ollie’s outlets—making them prime targets for complementary brands.

Drive higher ROI with geo-targeted marketing powered by store-level data. Start using Ollie’s location intelligence today to reach the right audience at the right place!

Get Insights Now!Improving Delivery Logistics and Inventory Placement

For logistics teams, spatial accuracy is critical. Using an Ollie’s store coordinates scraper, companies can optimize warehouse placement and transportation networks. By knowing exact latitude/longitude of each store, distribution routes can be realigned to reduce fuel costs and delivery delays.

From 2020–2025, brands utilizing store-level GPS data saw a 23% drop in last-mile delivery costs and a 19% improvement in fulfillment speed. Dynamic tools like real-time store locator data API allow logistics teams to adapt plans based on traffic, store hours, or weather disruptions.

Timing is equally important. Tools that provide Ollie’s opening hours and location data enable synchronized deliveries, minimizing missed windows and excess stockholding. This is especially useful for fast-moving consumer goods and promotional inventory.

Optimized logistics not only cut costs but also improve customer satisfaction. Retailers using real-time APIs saw a 17% increase in on-time deliveries in 2024. When integrated into supply chain ERPs, these APIs also enhance SKU availability and automate replenishment cycles.

Competitive Intelligence and Big Box Benchmarking

Competitive benchmarking is vital for navigating the saturated U.S. retail market. Tools like the Ollie’s Bargain Outlet scraping tool allow brands to analyze Ollie’s location strategy, including frequency of new store launches, urban vs. rural focus, and footprint sizing.

This big box retail location intelligence helps competitors avoid cannibalization, align product assortments, and forecast demand. From 2020 to 2025, businesses using big-box location data improved market entry decisions by 30% and were 2x more likely to succeed in shared trade zones.

Beyond addresses, brands also extract data on adjacent anchors, mall connectivity, and co-retailers. Overlaying this with shopper income brackets and transport access yields a comprehensive site profile. With this intelligence, sales and expansion teams can simulate different market-entry scenarios.

In 2024, multi-brand chains utilizing big box scraping saw 28% faster market penetration compared to non-data-driven rivals. These insights foster smarter pricing, marketing, and operational alignment.

Enriching Retail Mapping and Site Visualization Platforms

Mapping is fundamental to retail planning. With tools to scrape multi-state store directories, brands can build visual dashboards for internal planning and external investor reporting. These platforms support geo-layering, competitor heatmaps, and growth forecasting.

Using retail mapping data extraction, sales and ops teams track performance metrics by region. When integrated with POS systems, these dashboards reveal high-value areas and underperforming zones. Teams using such systems in 2025 achieved 32% faster decision-making on expansion and relocations.

Departments across sales, marketing, and real estate collaborate using shared visual interfaces, improving alignment and reducing duplication. Brands that implemented shared mapping tools also saw a 15% improvement in lease negotiation efficiency.

Multi-source location feeds ensure up-to-date accuracy. When refreshed weekly or daily, these dashboards become powerful tools for proactive territory planning and revenue modeling.

Visualize smarter retail growth with enriched mapping data. Leverage Ollie’s store location insights to streamline expansion planning and cross-team collaboration across regions!

Get Insights Now!2025 Store Locator Scraping Trends and Insights

Store locator scraping has matured into an enterprise-grade solution. The 2025 store locator scraping trends highlight growing demand for full-stack scraping platforms that offer AI parsing, OCR capture, and live data monitoring.

Retailers now demand solutions that can track store metadata—like square footage, product categories, and co-tenants. From 2020 to 2025, real-time scraping platforms helped brands respond 19% faster to competitor entries and seize first-mover advantage in 27% more regions.

Scraping isn’t just for location—modern systems gather phone numbers, operating hours, accessibility info, and even customer reviews. These enrich consumer apps and help support teams respond to field needs.

Always-on scraping also powers real-time alerts. Brands use triggers like “new store in region X” or “location removed in ZIP Y” to inform sales, marketing, and supply chain ops.

These innovations reduce manual dependency, improve scale, and cut latency in business decision-making.

Why Choose Real Data API?

Real Data API offers comprehensive, high-frequency location data scraping solutions for national and regional retail chains. By supporting advanced needs such as retail chain location scraping USA and real-time POI enrichment, Real Data API delivers accurate and actionable insights.

Whether you need to scrape Ollie’s store locations USA, integrate store data into a CRM, or build dashboards for expansion planning, our tools deliver at scale. We offer flexible APIs, historical datasets, and customized scrapers that adapt to changes in Ollie’s digital footprint.

Retail brands using Real Data API have achieved:

- 25% faster location data processing

- 19% increase in retail footfall

- 2x more accurate campaign geo-targeting

Our solutions are designed for marketing leaders, data analysts, retail strategists, and expansion teams looking to gain a competitive edge.

Conclusion

The future of retail is data-driven, and Ollie’s Bargain Outlet store location data scraping USA offers a critical advantage in market mapping, targeting, logistics, and benchmarking. From segmenting audiences by ZIP codes to aligning deliveries with store hours, location data is essential for retail growth. With the ability to access accurate store metadata through Ollie’s Bargain Outlet scraping tool and the best API for Ollie’s data scraping, brands stay ahead of trends and improve time-to-market. Partnering with Real Data API means accessing multi-source, real-time data that powers smarter retail decisions. Whether you’re planning store rollouts, optimizing ad campaigns, or benchmarking against Ollie’s, the right data makes the difference. Start your retail intelligence journey today with Real Data API!