Introduction

Understanding grocery accessibility is crucial for businesses, researchers, and urban planners. Randalls, a prominent supermarket chain in the U.S., operates hundreds of stores across Texas and surrounding areas, making it a key player in analyzing consumer reach and competitive positioning. Leveraging data to identify store locations, accessibility patterns, and competitive density can inform strategic decisions like site selection, delivery optimization, and pricing strategies.

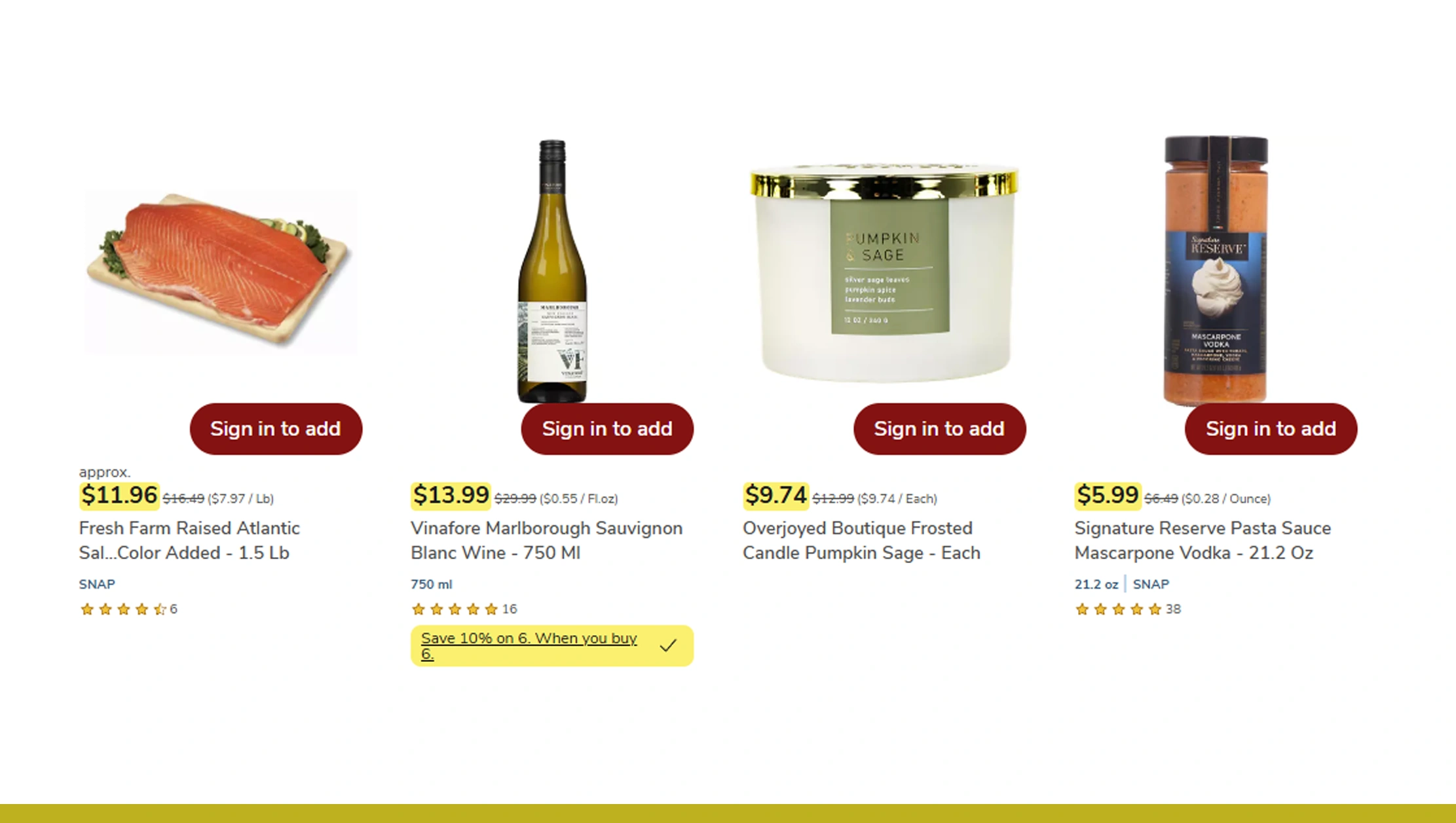

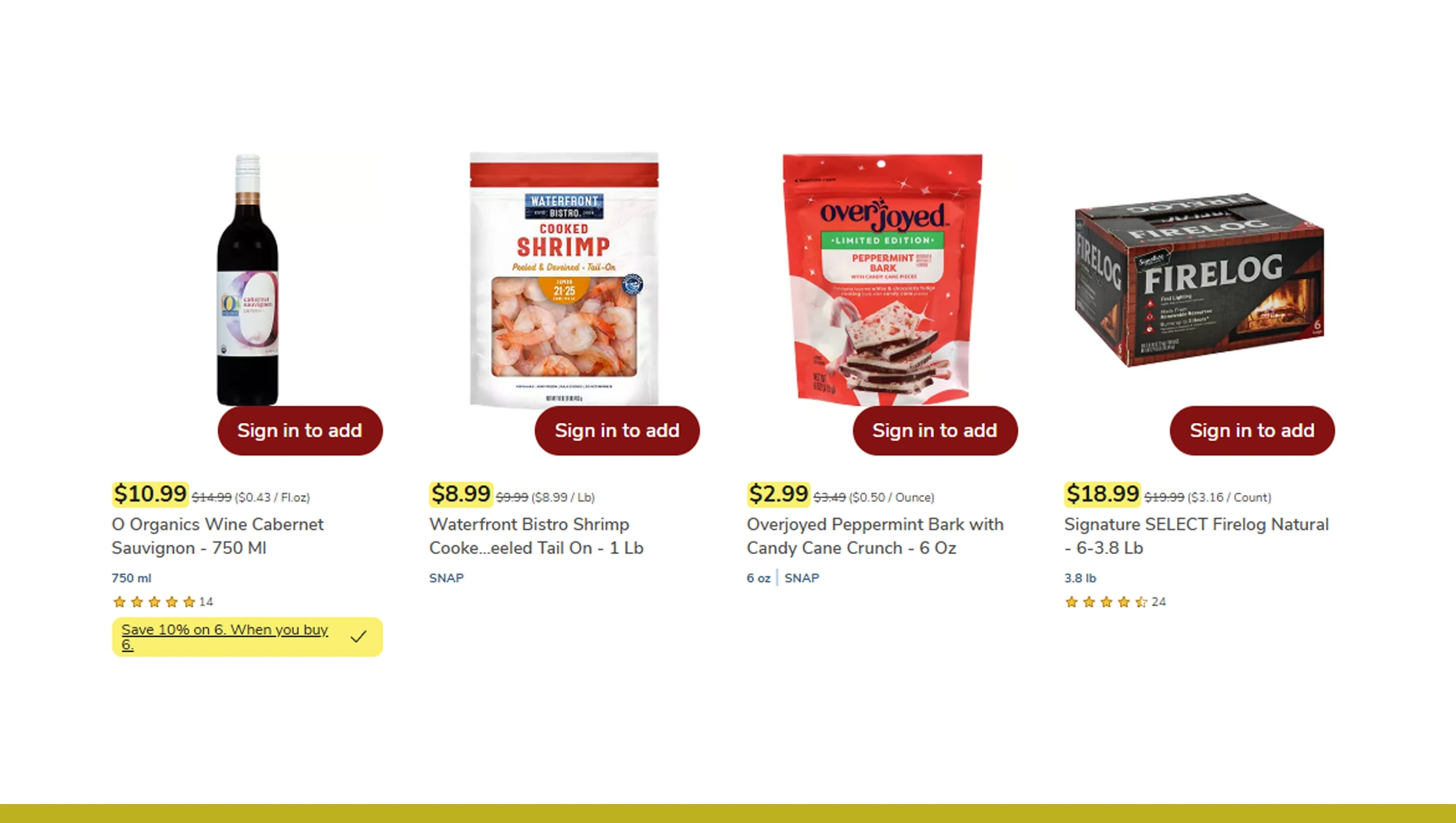

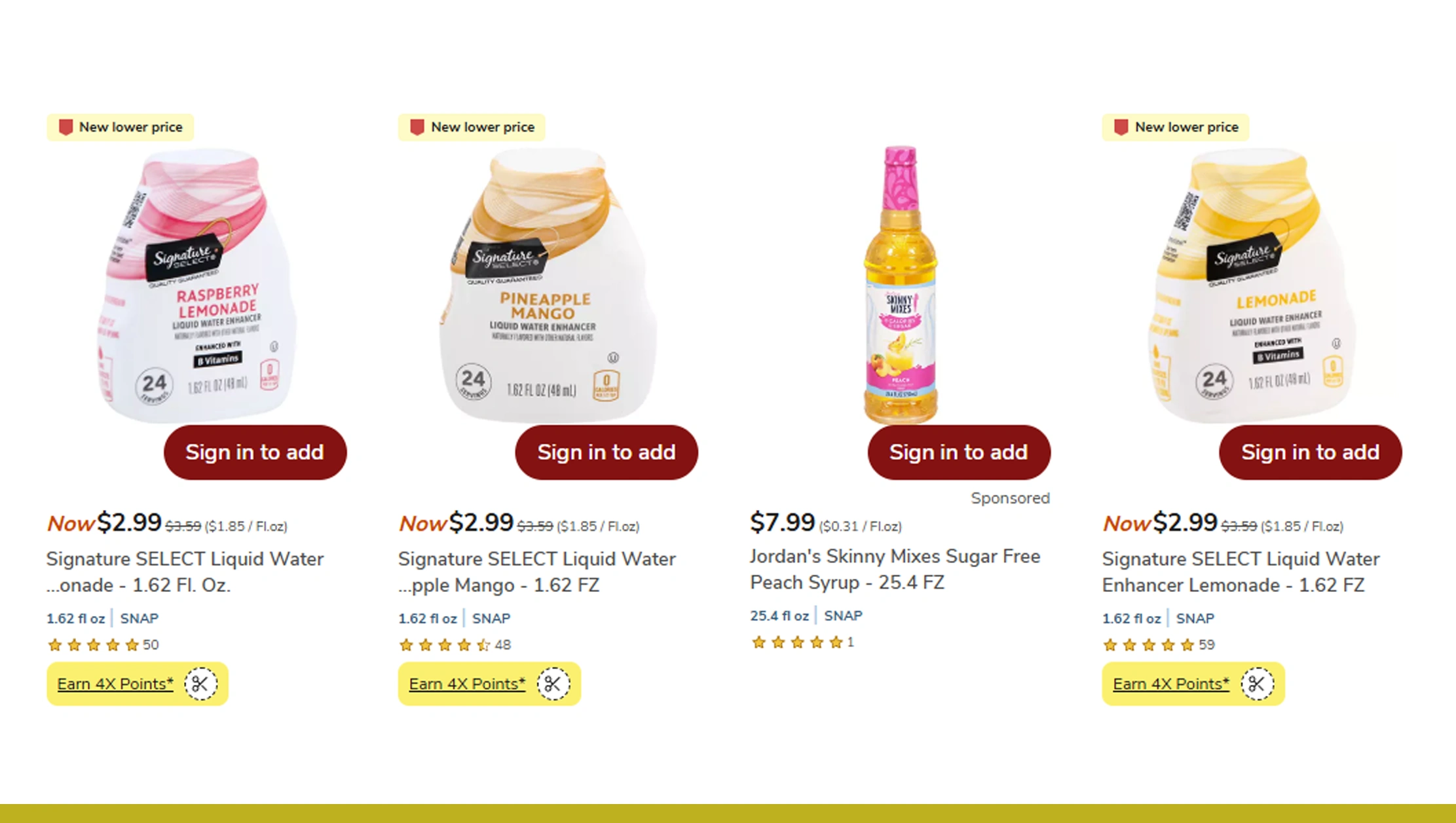

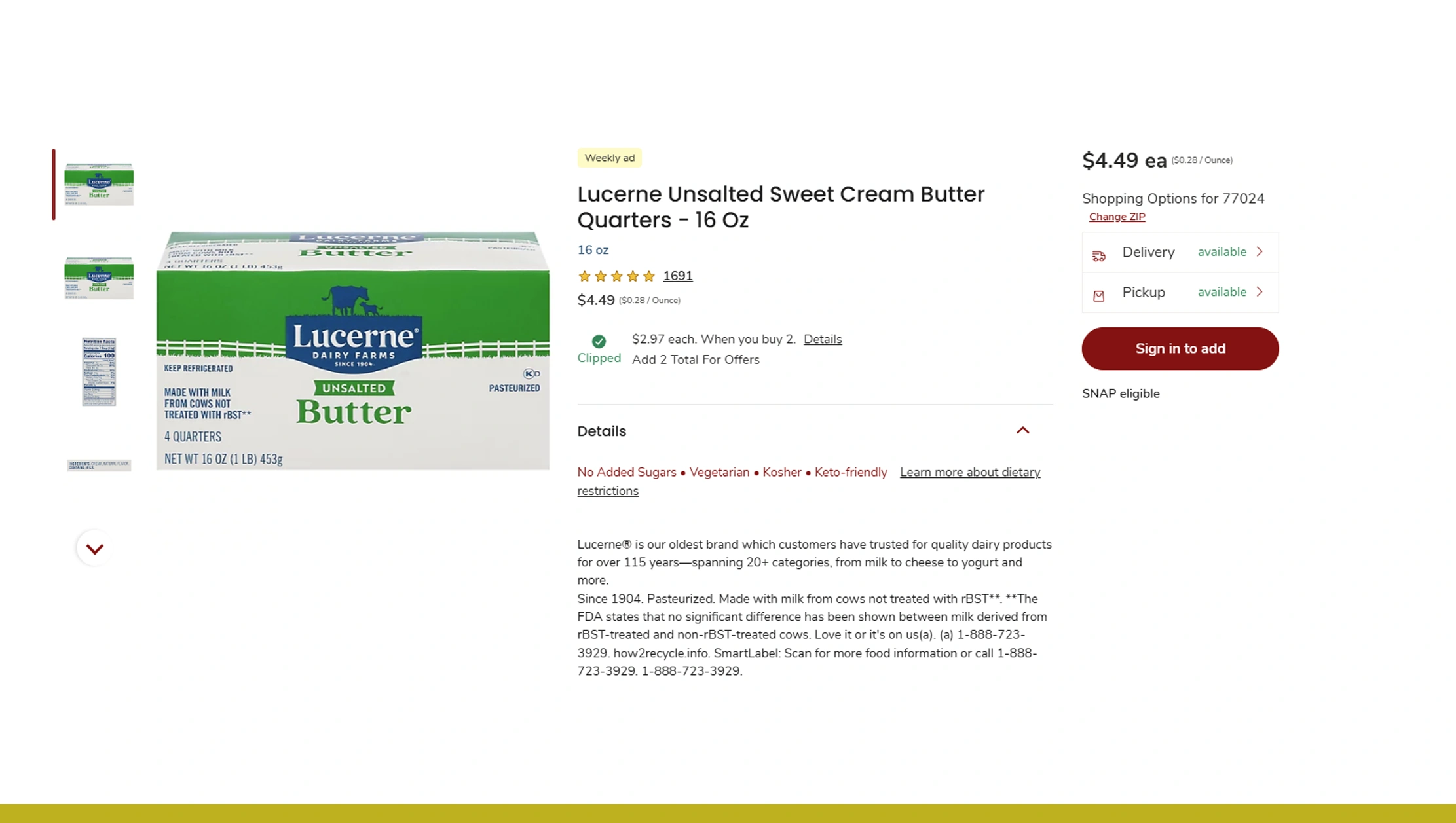

One effective method to gather such insights is to Scrape Randalls supermarket data for U.S. grocery chains, enabling analysts to access structured information about store addresses, operational hours, and regional presence. Combined with Price Comparison and market analysis, this approach allows businesses to benchmark offerings, monitor competitor pricing, and identify underserved neighborhoods. Using real-time, automated tools ensures that the data is accurate, up-to-date, and ready for analytics, helping grocery chains and research teams make informed, data-driven decisions for expansion and customer engagement.

Understanding Market Reach Through Store Data

Analyzing store presence over time can reveal trends in growth, consolidation, and regional dominance. Businesses looking to extract Randalls store data for market research can gain valuable insights into store distribution, cluster density, and regional penetration. For instance, between 2020 and 2025, the total number of Randalls stores has remained relatively stable, with minor expansion in suburban regions and occasional closures in urban centers to optimize operational efficiency.

| Year | Total Stores | New Openings | Closures |

|---|---|---|---|

| 2020 | 130 | 4 | 2 |

| 2021 | 132 | 3 | 1 |

| 2022 | 135 | 5 | 2 |

| 2023 | 137 | 4 | 2 |

| 2024 | 139 | 3 | 1 |

| 2025 | 140 | 4 | 3 |

By analyzing this dataset, businesses can evaluate which regions are oversaturated and which markets offer expansion potential. Market researchers also use these insights to correlate store presence with demographic data, competitive offerings, and population density. Accurate extraction and visualization of store data allow grocery chains and analysts to make informed strategic choices in expansion planning and operational efficiency.

Automating Location Intelligence

Manual collection of store addresses, coordinates, and contact details can be time-consuming and error-prone. Implementing a Randalls store location data scraper automates the process, enabling businesses to gather consistent and structured datasets in a fraction of the time. Automated scraping can capture key parameters including street address, city, zip code, phone numbers, and GPS coordinates, which are critical for logistics planning and competitive benchmarking.

Between 2020 and 2025, the adoption of automated location intelligence tools in the grocery sector has increased by over 65%. These tools allow businesses to track competitor stores, monitor openings and closures, and integrate location datasets into mapping software for better visual analysis. A structured approach to collecting store data also facilitates price comparison, targeted marketing campaigns, and delivery route optimization.

By using a dedicated scraper, analysts can ensure high accuracy and up-to-date information. The resulting dataset can then feed into analytics platforms, enabling regional performance comparisons, population coverage studies, and strategic decision-making for retail expansion and operational efficiency.

Mapping Accessibility for Better Insights

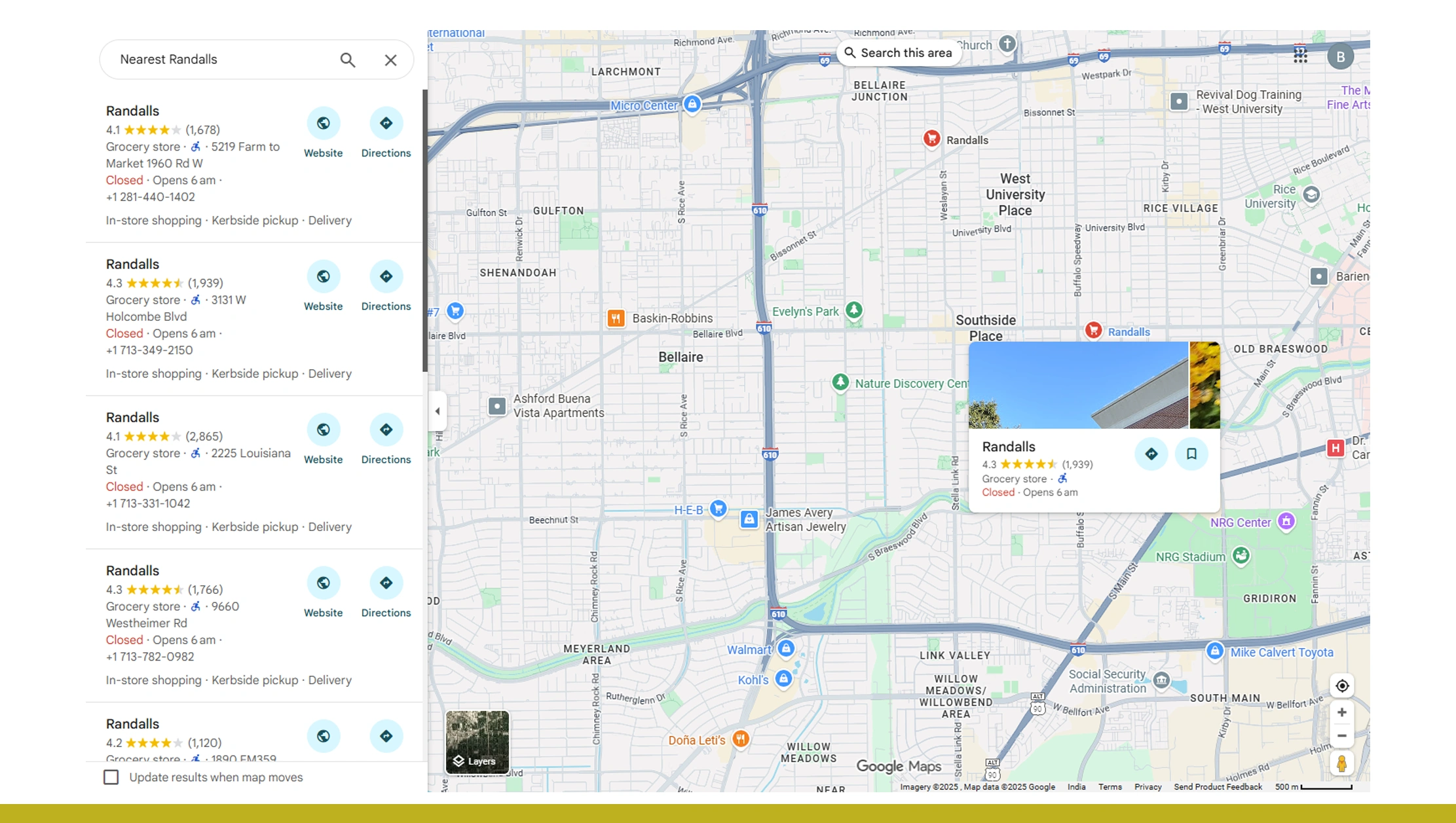

Accessibility analysis helps grocery chains understand customer reach, identify underserved areas, and plan targeted marketing initiatives. Randalls location data scraping for grocery accessibility enables businesses to overlay store locations with demographic and geographic datasets, providing insights into service gaps, customer density, and regional purchasing patterns.

| Year | Average Distance Between Stores (Miles) | Accessibility Score | Customer Coverage (%) |

|---|---|---|---|

| 2020 | 5.2 | 82% | 75% |

| 2021 | 5.1 | 83% | 76% |

| 2022 | 5.0 | 85% | 78% |

| 2023 | 4.9 | 86% | 79% |

| 2024 | 4.8 | 88% | 81% |

| 2025 | 4.7 | 89% | 83% |

By analyzing accessibility, businesses can prioritize regions for new store openings or marketing initiatives. Additionally, accessibility maps aid urban planners in understanding grocery deserts and informing public policy. Combining location scraping with demographic insights enables highly accurate predictive models for customer reach and regional performance, helping grocery chains optimize store placement and improve community access to essential goods.

Visualizing Grocery Data for Operational Excellence

Effective visualization of store data allows organizations to monitor network coverage and identify trends in performance and competition. Using Randalls grocery store mapping, analysts can plot store locations on geographic information systems (GIS) to track density, proximity to competitors, and neighborhood-level coverage.

| Year | Stores with GIS Mapping | Competitor Overlap (%) | Expansion Zones Identified |

|---|---|---|---|

| 2020 | 120 | 18% | 5 |

| 2021 | 125 | 19% | 6 |

| 2022 | 130 | 20% | 7 |

| 2023 | 135 | 21% | 8 |

| 2024 | 138 | 22% | 9 |

| 2025 | 140 | 23% | 10 |

Mapping provides clear, actionable insights for store placement, marketing campaigns, and operational planning. Visual analysis helps businesses anticipate market saturation, plan deliveries efficiently, and improve customer service. It also allows executives to combine location intelligence with Price Comparison datasets to identify profitable regions and align store presence with consumer demand patterns, increasing both operational efficiency and market competitiveness.

Leveraging Intelligence for Strategic Growth

Businesses benefit significantly from Randalls grocery store location intelligence by combining store datasets with population, demographic, and competitor data. Between 2020 and 2025, grocers increasingly relied on location intelligence to plan expansion, optimize delivery routes, and enhance targeted marketing campaigns.

| Year | Stores Analyzed | Intelligence Insights Applied | Expansion Decisions Influenced |

|---|---|---|---|

| 2020 | 130 | 10 | 2 |

| 2021 | 132 | 12 | 3 |

| 2022 | 135 | 14 | 4 |

| 2023 | 137 | 15 | 4 |

| 2024 | 139 | 16 | 5 |

| 2025 | 140 | 18 | 6 |

Location intelligence helps grocery chains evaluate market saturation, optimize staffing, and understand competitor dynamics. Structured datasets enable predictive analytics, revealing potential gaps in service areas and forecasting customer behavior. Integrating scraped data with advanced analytics platforms empowers executives to make informed strategic decisions, optimize operational efficiency, and enhance overall market competitiveness.

Ensuring Comprehensive Coverage Across the U.S.

For nationwide strategic analysis, it is essential to Scrape Randalls store locations data in the USA to capture all operational stores and regional details. Between 2020 and 2025, businesses using structured scraping solutions achieved near-complete coverage of store locations, enabling comprehensive market analysis, operational benchmarking, and competitive evaluation.

| Year | Total Stores Collected | States Covered | Missing Data Instances |

|---|---|---|---|

| 2020 | 130 | 1 | 3 |

| 2021 | 132 | 1 | 2 |

| 2022 | 135 | 1 | 2 |

| 2023 | 137 | 1 | 1 |

| 2024 | 139 | 1 | 1 |

| 2025 | 140 | 1 | 0 |

Complete datasets support advanced analytics such as competitor benchmarking, delivery network optimization, and pricing strategies. The combination of automated scraping, location intelligence, and demographic overlays ensures that businesses can make informed, data-driven decisions about expansion, pricing, and service coverage in all operational areas.

Why Choose Real Data API?

Real Data API offers a reliable and scalable Grocery Data Scraping API designed for businesses, researchers, and analysts looking to gather accurate and up-to-date store information. With automated scraping, structured outputs, and easy integration into analytics platforms, it eliminates manual data collection errors and accelerates decision-making. The API supports multiple grocery chains, enabling competitive benchmarking, market analysis, and operational planning. Its real-time updates ensure datasets remain current, while advanced features like location intelligence, price comparison, and accessibility mapping provide actionable insights. Choosing Real Data API means faster workflows, higher data accuracy, and smarter strategic decisions for grocery businesses.

Conclusion

Understanding store locations and accessibility is essential for grocery chains seeking growth and market insights. Using Real Data API, businesses can Scrape Randalls supermarket data for U.S. grocery chains and build a comprehensive Grocery Dataset for strategic decision-making. Structured data empowers retailers, analysts, and researchers to optimize store placement, pricing, and operations while improving market competitiveness. Real-time, accurate, and automated solutions transform traditional workflows, enabling data-driven insights that drive growth and operational efficiency. Get accurate, real-time grocery insights with Real Data API—Scrape Randalls supermarket data today!