Introduction

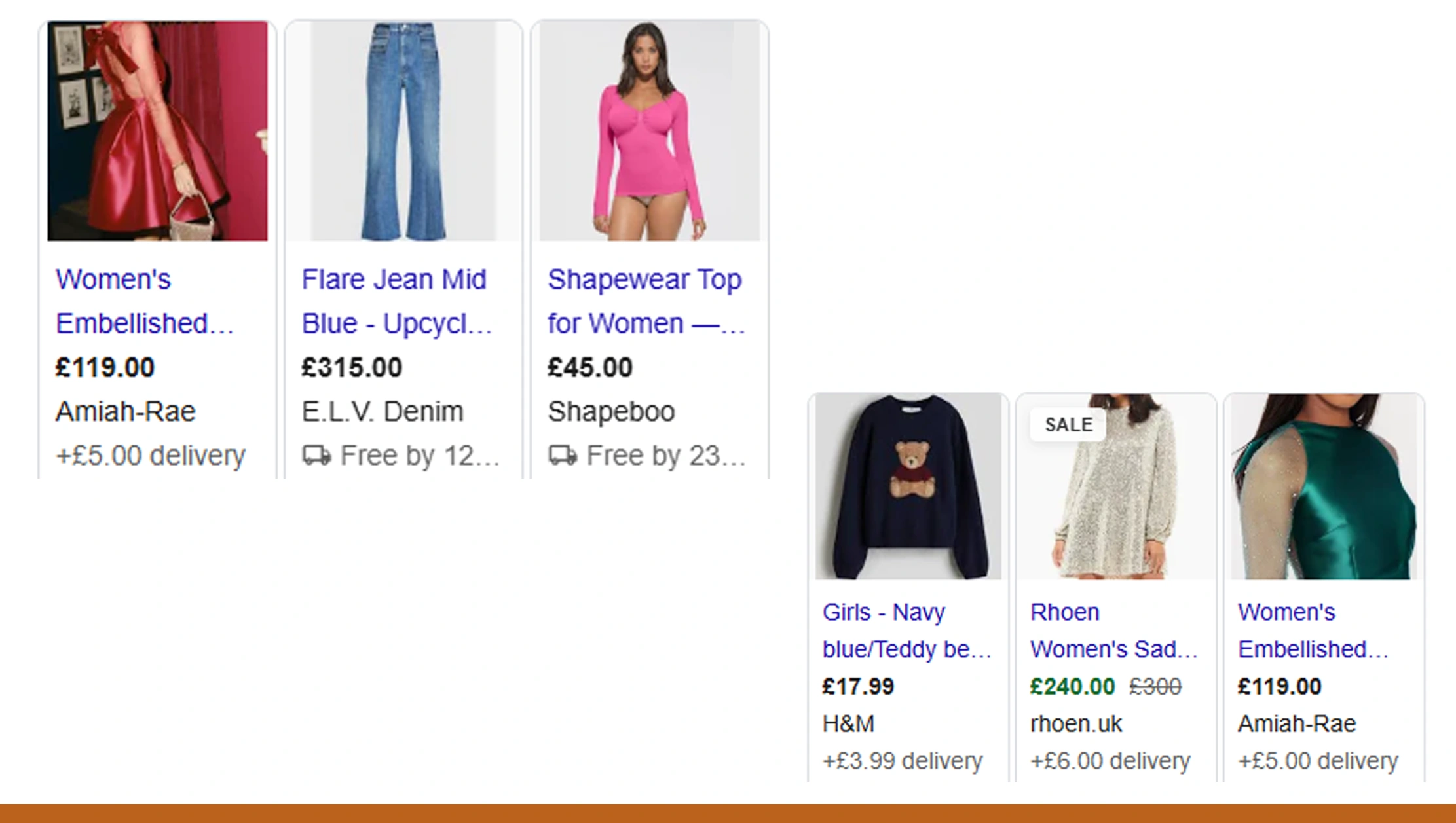

In today's fast-evolving fashion industry, data is the new currency. The rise of e-commerce, social commerce, and mobile shopping has transformed how brands connect with consumers and track their competition. By leveraging discover top apparel performers via data scraping, retailers and analysts can monitor real-time sales across 1,000+ brands and gain insights into a $12B market. Global e-commerce penetration in fashion reached 32% in 2025, up from 18% in 2020, highlighting the rapid shift from offline to online retail. This approach allows businesses to track top-performing categories, seasonal demand patterns, pricing strategies, and promotional effectiveness, providing a comprehensive competitive edge in an increasingly dynamic marketplace.

Structured data collection through scraping ensures that brands, e-commerce platforms, and market analysts can make informed decisions on inventory, marketing campaigns, and product launches. These insights also support predictive analytics, helping retailers forecast trends and optimize resource allocation to maximize revenue and customer satisfaction.

Global Apparel Sales Growth (2020-2025)

.webp)

The global apparel market has witnessed exponential growth from 2020 to 2025. Online apparel sales rose from $3.2B in 2020 to $12B in 2025, a staggering 275% increase. This growth is fueled by mobile commerce, social media influence, and increasing consumer preference for convenience. By leveraging Online apparel sales dataset insights, businesses can pinpoint high-performing categories like athleisure, outerwear, and sustainable fashion.

Regional sales trends provide deeper understanding:

| Year | Online Apparel Sales (Billion $) | Growth (%) | Top Categories | Region Highlights |

|---|---|---|---|---|

| 2020 | 3.2 | - | Athleisure, Tops | US 35%, Europe 25%, Asia 30% |

| 2021 | 4.5 | 40 | Outerwear, Jeans | Mobile shopping 55% |

| 2022 | 6.0 | 33 | Athleisure, Dresses | Asia 40% surge, EU 28% |

| 2023 | 8.2 | 37 | Tops, Jackets | US 38%, India 18% |

| 2024 | 10.1 | 23 | Athleisure, Outerwear | Social commerce drives 20% sales |

| 2025 | 12.0 | 19 | Sustainable Fashion, Dresses | Mobile checkout 70% of sales |

These datasets enable brands to track market trends, identify high-demand products, and align inventory planning with consumer preferences.

Top Performing Brands

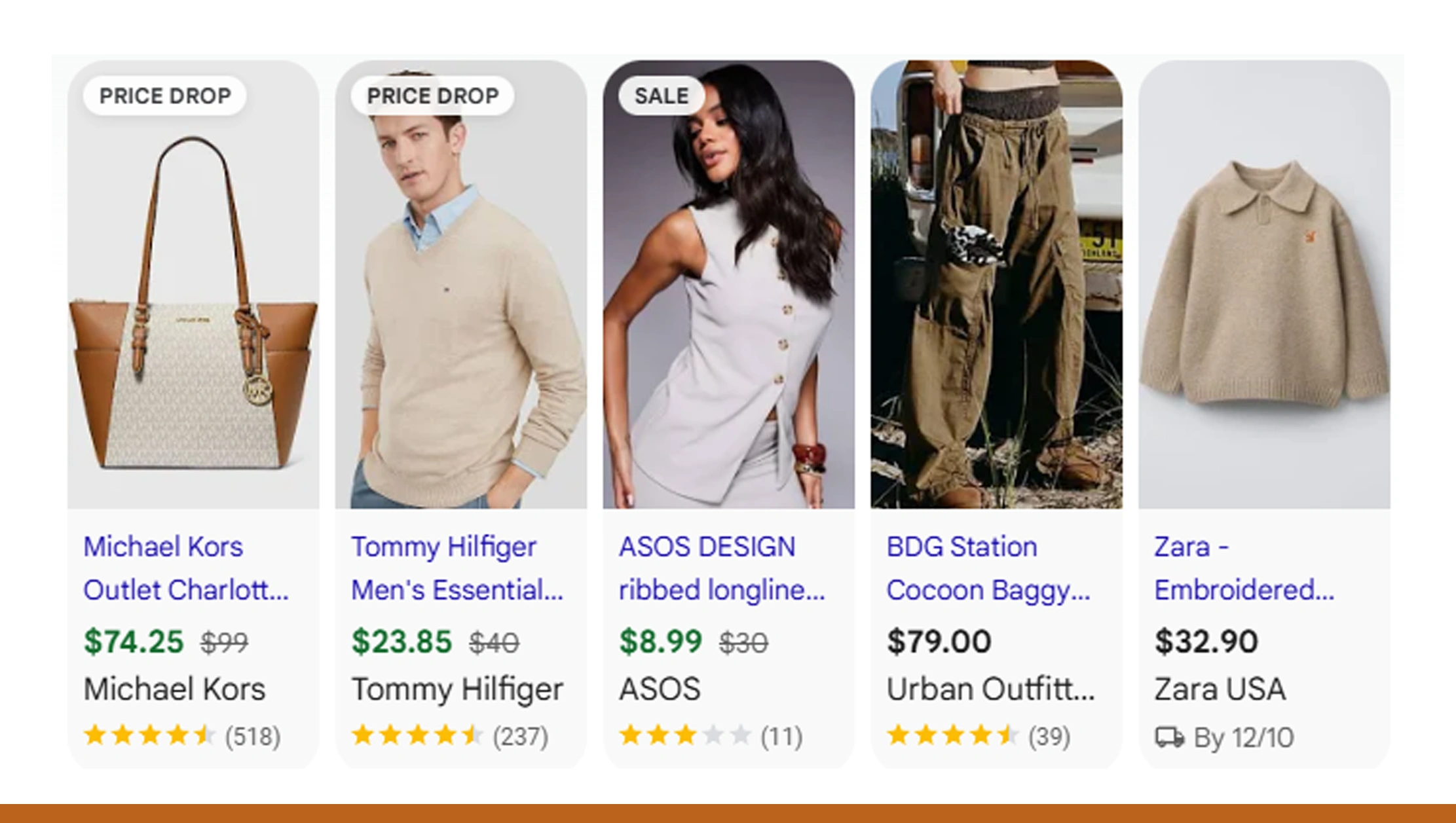

Between 2020-2025, certain brands consistently captured online market share. Fast-fashion retailers and eco-conscious brands saw the largest growth. Data-driven insights into best-selling apparel brands show seasonal peaks, flash sale performance, and category dominance. For instance, Brand A's summer athleisure line grew 55% in revenue year-over-year, while Brand B's winter outerwear dominated Tier-1 cities, increasing online engagement by 40%.

Brands using real-time performance data can benchmark against competitors, adjust pricing strategies, and plan promotions more efficiently. Insights into influencer campaigns, product reviews, and bundle deals reveal why certain brands outperform the rest, helping retailers replicate successful strategies in their own marketing efforts.

Consumer Behavior Shifts

Understanding the consumer is critical for online success. Apparel consumer behavior analysis indicates that Millennials and Gen Z now account for 62% of online fashion purchases. Sustainability, fast delivery, and personalized recommendations are key decision drivers. For example, 45% of consumers prioritize eco-friendly collections, while 30% respond positively to limited-time promotions. Mobile shopping continues to dominate, representing 70% of online apparel transactions in 2025.

Payment preferences have evolved as well, with digital wallets and buy-now-pay-later options increasing conversion rates. Brands integrating personalized recommendation engines, loyalty programs, and flexible delivery options experience higher customer retention and repeat purchases. Understanding these behaviors allows brands to optimize marketing campaigns, product positioning, and inventory allocation.

Market Segmentation Insights

Segmenting the market allows precise targeting. Clothing sales market research shows that urban areas prefer premium outerwear, whereas suburban and rural areas favor casual athleisure and accessories. Gender-based preferences also impact sales: women's apparel accounts for 52% of total online sales, while men's categories contribute 38%, and unisex products 10%.

Seasonal trends further influence buying behavior. Winter collections see 40% of their sales concentrated in Tier-1 cities, while summer athleisure peaks in Tier-2 and Tier-3 regions. Cross-platform analysis highlights that marketplaces capture 60% of transactions, while brand-owned websites account for 40%. These insights enable targeted marketing campaigns, stock optimization, and better logistical planning to maximize ROI.

Data Quality and Reliability

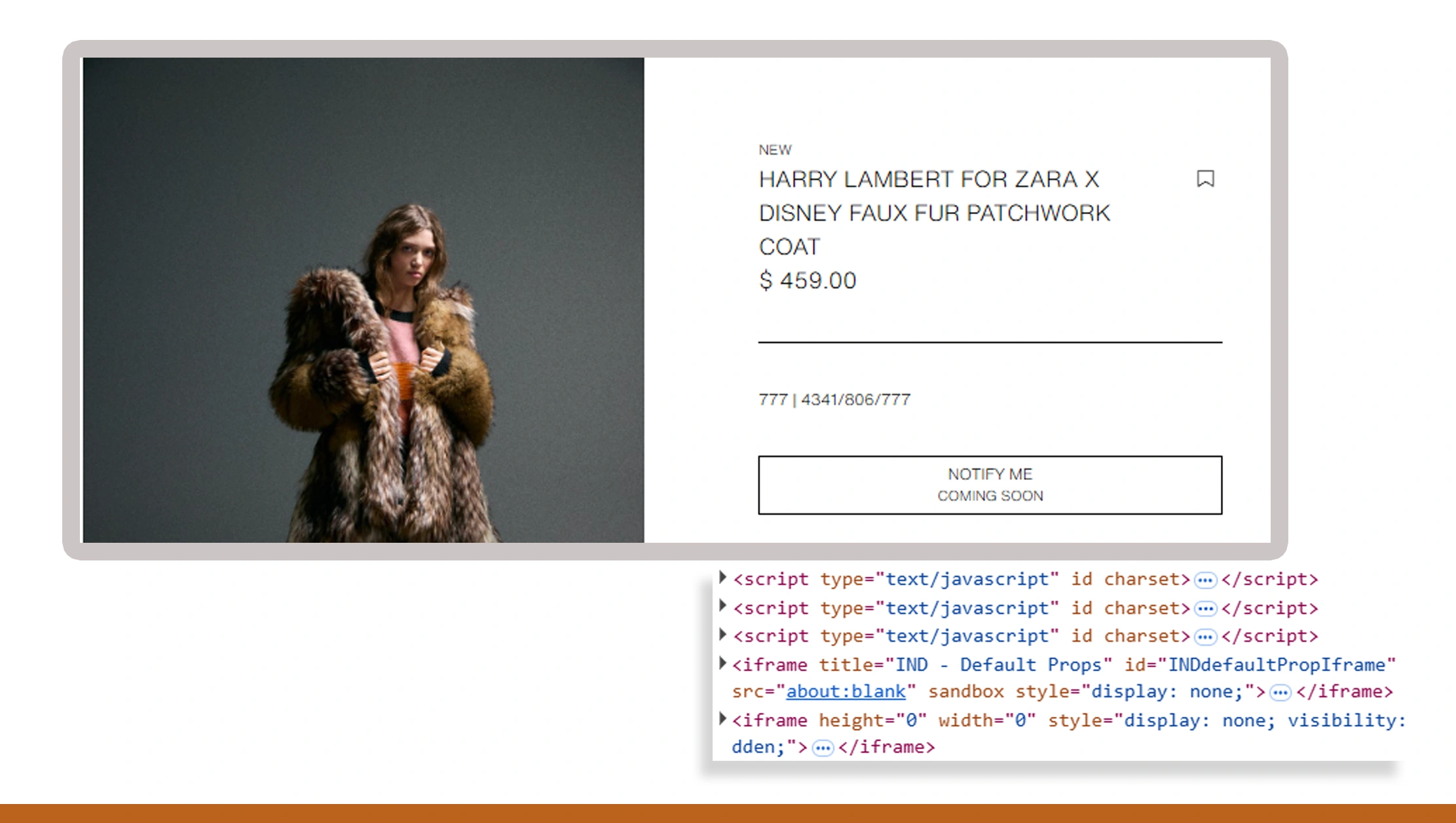

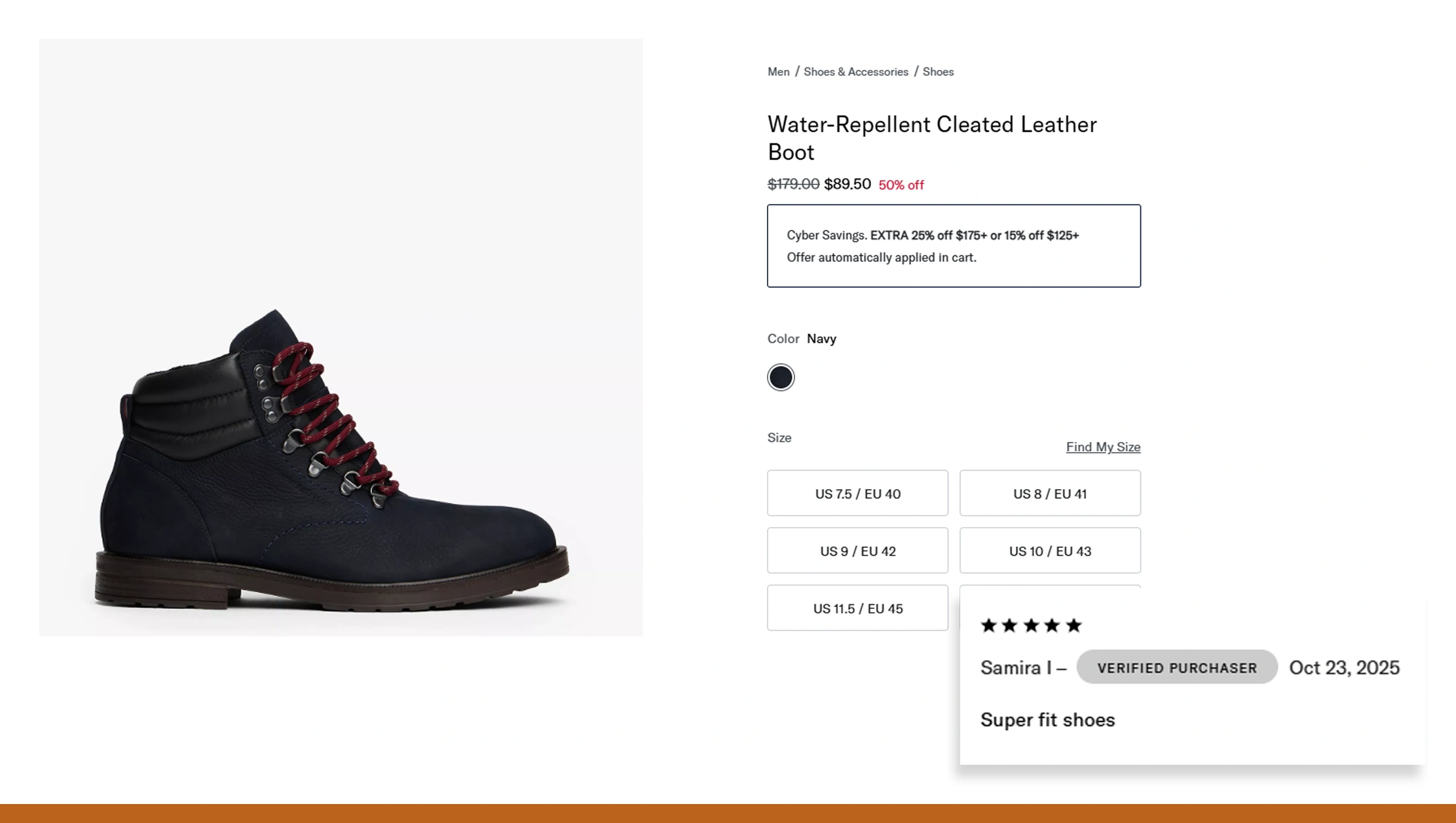

Accurate and comprehensive datasets are crucial for actionable insights. Fashion & Apparel Datasets include SKU-level pricing, inventory status, promotion details, and customer reviews. Between 2020-2025, SKU-level coverage improved by 35%, providing more reliable insights into category performance and pricing elasticity.

Structured datasets allow brands to analyze historical performance, forecast demand, and evaluate promotions. Clean, real-time datasets are essential for AI-powered predictive analytics, enabling fashion retailers to plan launches, adjust marketing strategies, and optimize inventory. High-quality datasets reduce errors and support informed decision-making across departments, from product development to supply chain management.

Benchmarking and Trend Forecasting

Competitive benchmarking and forecasting are essential for staying ahead. Market Research combining historical sales, consumer behavior, and competitor data identifies top categories and emerging trends. For example, predictive models forecast 2025's top-performing categories, such as sustainable fashion and personalized apparel bundles.

Comparing over 1,000 brands allows retailers to benchmark KPIs, evaluate promotional effectiveness, and plan for seasonal peaks. Trend forecasting also reduces inventory risks, maximizes sales, and supports strategic decision-making, ensuring that retailers can capture consumer demand before competitors.

Why Choose Real Data API?

Real Data API provides advanced Sentiment Analysis and trend monitoring, helping brands discover top apparel performers via data scraping efficiently. The API delivers real-time datasets covering pricing, promotions, inventory, and reviews. Businesses can integrate these datasets into dashboards, CRMs, or analytics platforms to monitor competitor activity, track top-selling SKUs, and optimize campaigns.

By using Real Data API, fashion brands gain actionable insights, respond faster to market changes, and make informed decisions. The API supports predictive analytics, dynamic pricing strategies, and inventory optimization, giving retailers a competitive edge in the fast-paced fashion e-commerce landscape.

Conclusion

Leveraging Enterprise Web Crawling and discover top apparel performers via data scraping enables brands to analyze 1,000+ fashion brands and $12B market trends accurately. Real-time insights into sales, consumer behavior, and competitor strategies allow retailers to optimize inventory, marketing, and pricing. Real Data API provides clean, structured datasets for forecasting, benchmarking, and trend analysis, empowering brands to maintain a competitive edge.

Partner with Real Data API to transform raw sales data into actionable insights and identify the leading apparel performers of 2025!