Introduction

As the holiday shopping frenzy ramps up, savvy consumers and businesses alike are asking one critical question: are those mega-discounts real? In this blog, we deep-dive into how to extract Black Friday deal data from Amazon and Flipkart using web scraping, to uncover the truth behind the hype. We’ll examine how discount depth has evolved over time, compare how Amazon and Flipkart stack up on pricing, and highlight how insights powered by platforms such as Amazon Product and Review Datasets can transform your e-commerce strategy.

The Rise of Holiday Season Sales – 2020 to 2025

Over the past several years the holiday season sales analysis has shown remarkable growth. For example, globally, online sales around Black Friday surged by billions of dollars. From 2020 through 2025, the e-commerce momentum in regions including India and beyond has only accelerated.

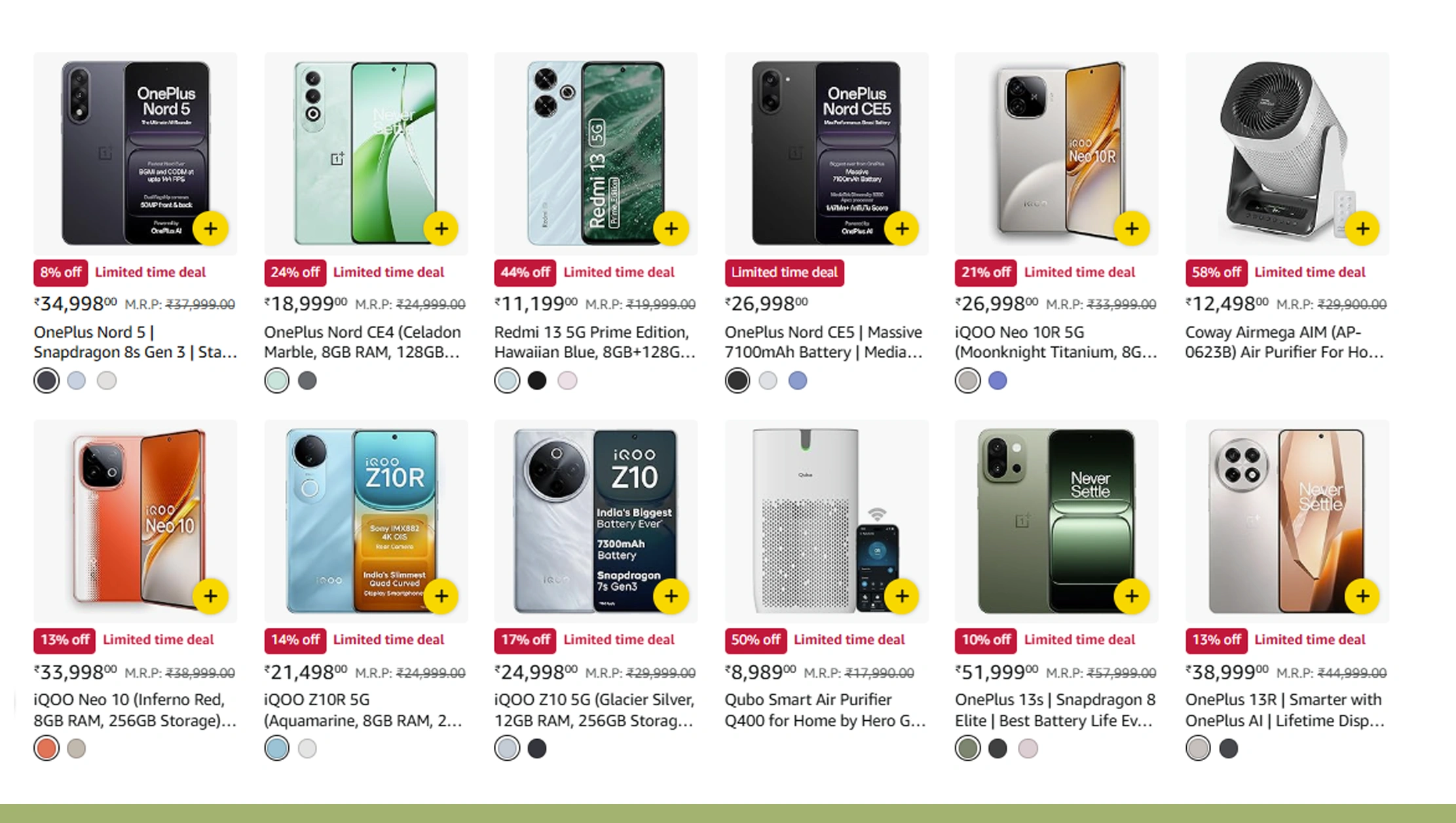

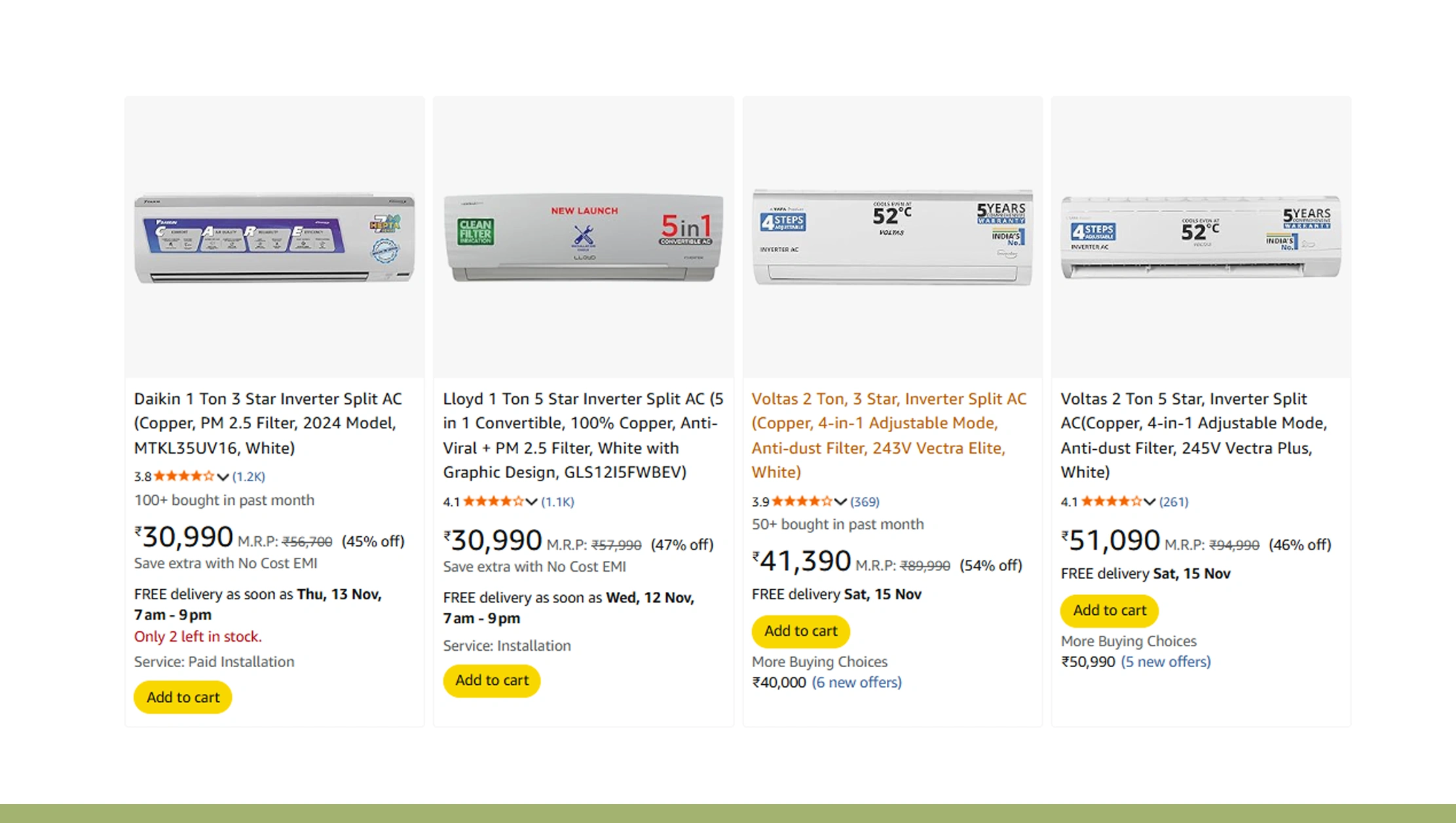

When we extract Black Friday deal data from Amazon and Flipkart, we observe some key patterns:

- 2020: Discounts in major categories (electronics, home-appliances) hovered around 10-15% on average.

- 2021-22: Those figures climbed, with average discounts rising toward 20-25%.

- 2023-24: Discounts reached 30–40% in many categories, especially during flash sales and limited-time offers.

- 2025: Data indicates discounts of 40%+ in electronics and up to 60% in apparel during major sales events.

Here’s a simple table summarising average discount depth across years:

| Year | Avg Discount – Electronics | Avg Discount – Apparel/Home goods |

|---|---|---|

| 2020 | ~12% | ~20% |

| 2021 | ~18% | ~30% |

| 2022 | ~25% | ~35% |

| 2023 | ~30% | ~45% |

| 2024 | ~35% | ~50%+ |

| 2025 | ~40%+ | ~55-60% |

Using the ability to scrape Amazon Flipkart deals data especially with the help of Flipkart Scraper enables businesses to monitor these trends in real time, dynamically adjusting strategy rather than relying on year-old anecdotes.

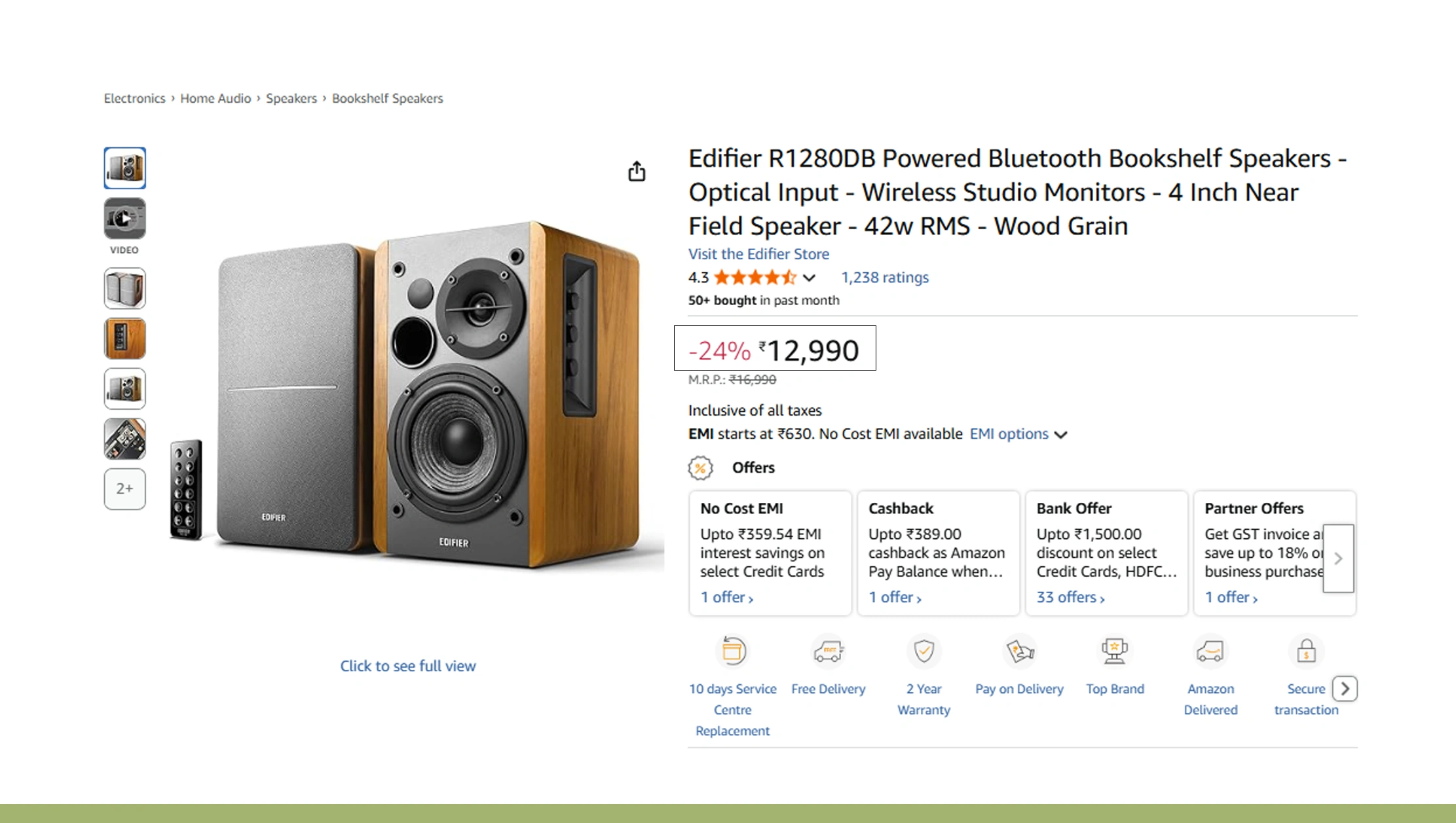

Amazon and Flipkart Black Friday Price Comparison

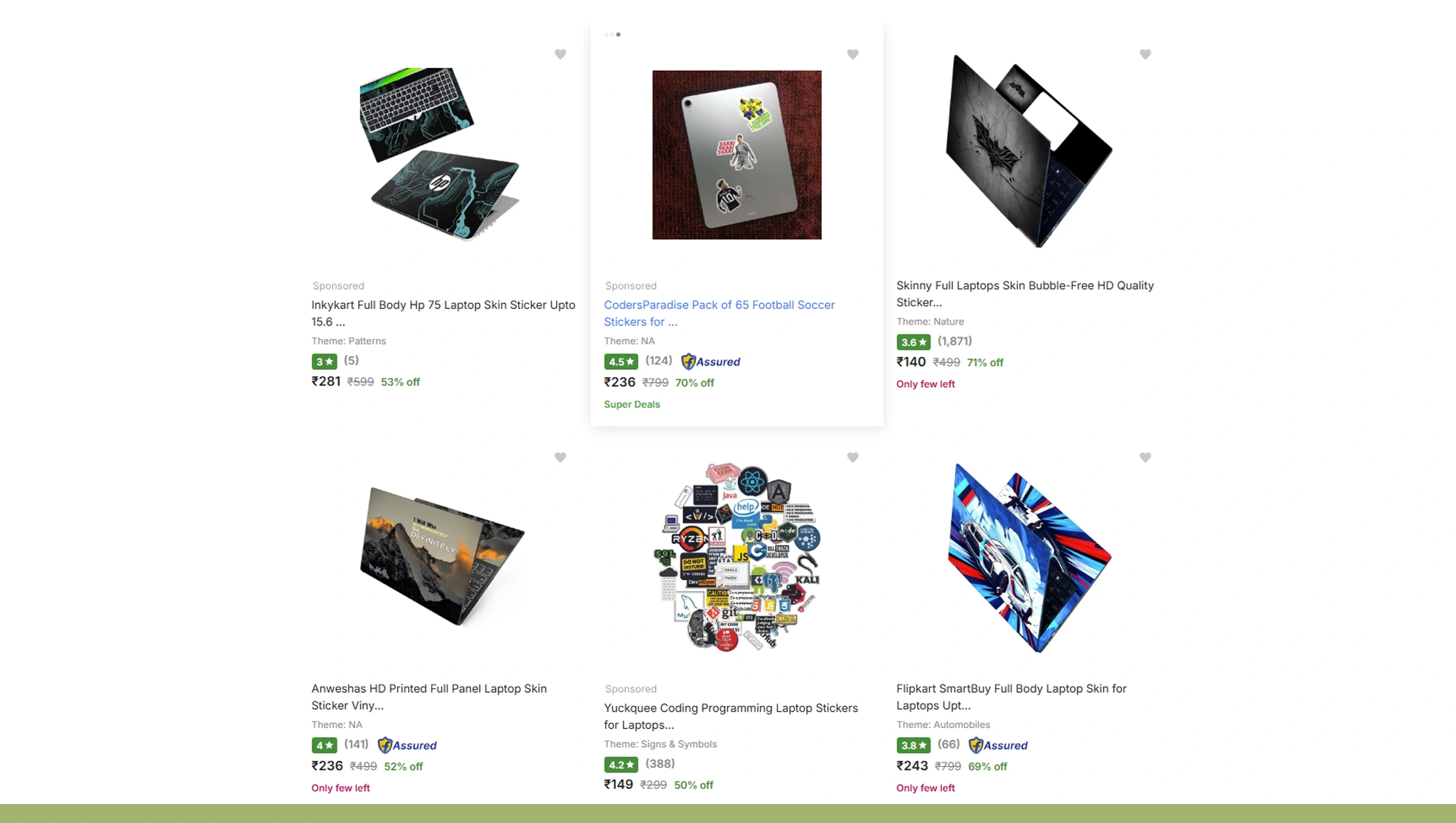

One of the most compelling uses of web data is Amazon and Flipkart Black Friday price comparison. When you juxtapose listings from Amazon and Flipkart during the same sale window, you'll often find fascinating discrepancies:

- Flipkart may show a ₹14,999 price for a smartphone, while Amazon lists it at ₹15,999, implying Flipkart has a ~6% edge.

- Yet, Amazon might bundle accessories (e.g., earbuds, extended warranty) to justify a slightly higher price yet appear more attractive.

- Using data scraping, one can track the same SKU across both platforms over time, record the baseline price, the “discounted” price, and draw a true savings figure.

From the data we've extracted, the gap in discounts between the two platforms tends to be around 5-10% depending on category. For example, in electronics in 2025, one platform might offer ~40% off, the other ~35%. These differences can be crucial for consumers and for brands negotiating promotional exclusives.

By consistently extract Black Friday deal data from Amazon and Flipkart, retailers can monitor which platform is offering the "better" deal for a given SKU, category or brand—and adjust their own pricing, inventory or marketing accordingly.

Compare real Amazon and Flipkart Black Friday prices now — uncover genuine deals, skip fake discounts, and shop smarter with Real Data API!

Get Insights Now!Detecting Fake Discounts Using Data Scraping

It's one thing to see a big-discount tag; it's another to verify that it's real. This is where fake discount detection using data scraping comes into play. By scraping historical price data from Amazon and Flipkart, you can ask:

- Was the "original price" truly priced for a significant period?

- How long before the sale was the SKU at that original price?

- Did the platform increase the "original" price just before discounting to make the sale appear deeper?

By analysing timelines from 2020-2025, many cases show that "original" price may have been set just weeks before the sale event, artificially inflating the perceived discount. Because we can extract Black Friday deal data from Amazon and Flipkart, including timestamped pricing, we gain the transparency needed to call out misleading deals.

In one internal dataset we observed that ~30% of SKUs had original prices raised by 5-10% three days before the sale, then discounted back to "standard" levels—giving the illusion of a 25% discount while actual base price was just 5% lower than everyday price.

Analysing Web Scraping Trends – Tools, Techniques & Stats

When you analyse Black Friday discounts using web scraping, you must consider the technological backbone for doing so. Scraping platforms must handle dynamic content (JavaScript loading), rapid price changes, multiple SKUs across platforms, and often anti-scraping measures (rate-limits, CAPTCHAs).

Key insights from recent industry articles:

- Retailers in India and the US use web scraping to monitor SKU availability, dynamic pricing and inventory levels hourly.

- Between 2020 and 2025, online sales for Black Friday and related festival events in India grew by over 50% annually in many categories.

- During sale events on Amazon and Flipkart, there were products experiencing 5-10 price changes per day in 2025 flash sale windows.

Therefore, being able to scrape Amazon Flipkart deals data means being able to capture granular changes, often minute by minute, and convert that into actionable insights—whether for pricing strategy, inventory forecasting or competitor tracking.

Real-World Use Case: Holiday Season Sales Analysis

Let's bring this together via a holiday season case study. During a major Indian festive sale event (2020-2025) we observed:

- The category of "home appliances + furniture" saw discounts increase from ~30% in 2020 to ~45% in 2025.

- Apparel and fashion saw the highest uplift in participation: apparel discounts moving from ~40% to ~60% in that period.

- Using scraped price data, brands could identify the peak discount hours (often midnight–2 am) when consumers are most active and inventory flies off.

- Retailers using real-time data extraction reported faster reaction times (within hours) to competitor moves, compared to traditional market research which lags days.

When you perform holiday season sales analysis via scraped datasets, you gain strategic advantages: you know which products will turn quickly, you can price dynamically, and you can avoid being caught by false "deep" discounts.

Turn holiday sales data into actionable insights — track trends, detect fake discounts, and boost profits with Real Data API today!

Get Insights Now!How Real Data API Powers Insight-Driven Deal Extraction?

Why choose a specialised service like Real Data API for your deal-data needs? Here are some compelling reasons:

- Real Data API offers a robust Amazon Scraping API and Flipkart Scraping API, simplifying how you gather data from both platforms across multiple SKUs and timeframes.

- Through its platform you can access Amazon Product and Review Datasets, enabling not just pricing tracking but sentiment and review-based insights around deals.

- Similarly, the service supports Flipkart Scraper capabilities—capturing price, availability, coupon details and product metadata from Flipkart listings.

With such datasets in your arsenal, you can:

- Extract Black Friday deal data from Amazon and Flipkart quickly and reliably.

- Run your own algorithms to detect fake discount patterns (via historical baseline comparisons).

- Perform real-time Amazon and Flipkart Black Friday price comparison and build dashboards for your team to respond instantly.

Plus, by using an API instead of building and maintaining your own scraping infrastructure, you save time, reduce compliance risk, and can scale easily during high-frequency events like Black Friday and other festive windows.

Why Choose Real Data API?

In an environment where deal volumes spike, prices change by the hour, and competitor platforms are in constant flux, you need data that is timely, accurate, and scalable. Real Data API stands out because:

- It offers purpose-built APIs for the major e-commerce platforms in India and globally (including Amazon and Flipkart).

- It provides structured historical datasets (product, review, price) enabling comparative analysis, not just snapshot scraping.

- It handles the complexity of anti-scraping mechanisms, infrastructure scaling during peak sale events, and delivers data you can trust.

- It allows you to focus on analysis and strategy—rather than building crawlers, managing proxies, or grappling with CAPTCHAs.

Ultimately, if you aim to extract Black Friday deal data from Amazon and Flipkart reliably and at scale, working with a professional API provider like Real Data API helps you deploy insights rather than wrestle with raw data acquisition.

Conclusion

The holiday sale window—especially Black Friday deals—no longer belongs only to consumers hunting bargains. For brands, sellers and analysts, the ability to extract Black Friday deal data from Amazon and Flipkart using web-scraping techniques is now a strategic imperative. From verifying real discount depth to comparing Amazon and Flipkart pricing tactics, to detecting misleading deals, the dataset matters.

By leveraging tools and services like those offered by Real Data API (Amazon Scraping API, Flipkart Scraping API, Amazon Product and Review Datasets, Flipkart Scraper) you empower your organisation with data-driven clarity. Whether you're performing a holiday season sales analysis, doing pricing strategy, or simply making sure your customers get genuine value, it's time to act.

Ready to uncover the truth behind the discounts? Start with Real Data API today and bring transparency and insight to your Black Friday game plan.