Introduction

Grocery pricing and availability are no longer uniform across regions. Consumers shopping through Instacart often see different prices, product assortments, and stock levels depending on where they live. For brands, retailers, and analysts, this creates a major challenge: how do you accurately understand local market conditions at scale? This is where Extract Instacart product data by ZIP code becomes critical. By Grocery Data Scraping API collecting structured data at a ZIP-code level, businesses can uncover regional pricing gaps, identify inventory inconsistencies, and adapt strategies based on real-world consumer experiences. Automation replaces guesswork, offering clarity into how local markets truly behave—without relying on averages or manual research.

Understanding Local Price Variations at Scale

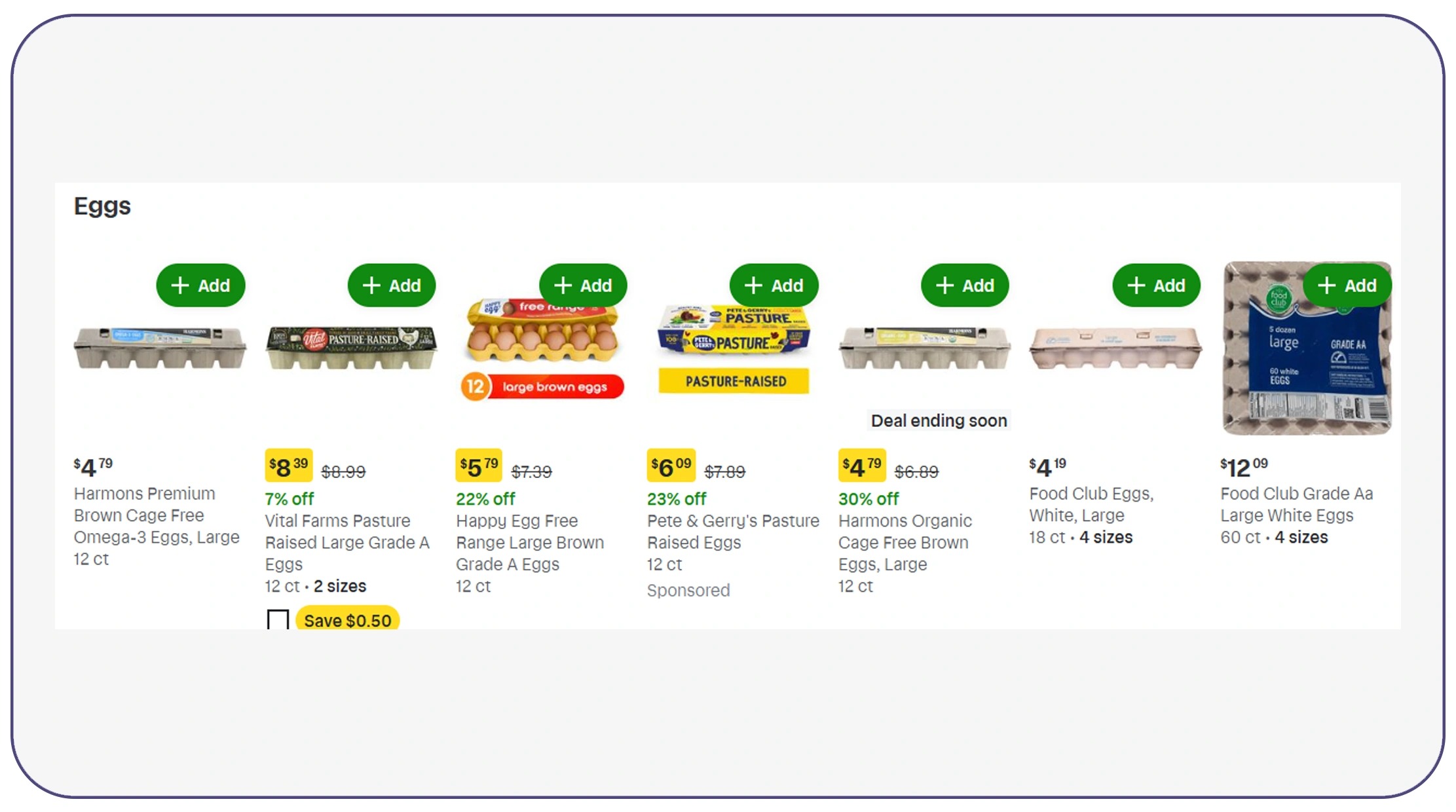

Regional pricing differences are one of the biggest blind spots in grocery analytics. Scrape Instacart pricing and availability data by location allows businesses to track how the same product is priced and stocked across ZIP codes.

Between 2020 and 2026, grocery price dispersion increased due to inflation, supply chain disruptions, and localized demand. Data-driven companies began monitoring prices at a hyper-local level to remain competitive.

| Year | Avg. ZIP Price Variation | Availability Gaps | Data Adoption |

|---|---|---|---|

| 2020 | 6% | Low | 18% |

| 2021 | 8% | Moderate | 27% |

| 2022 | 12% | High | 39% |

| 2023 | 15% | High | 52% |

| 2024 | 18% | Very High | 64% |

| 2025 | 21% | Very High | 72% |

| 2026 | 24% | Extreme | 81% |

Access to localized pricing data helps businesses detect price inconsistencies, optimize regional promotions, and avoid losing customers due to misaligned pricing strategies.

Capturing Neighborhood-Level Grocery Insights

ZIP-code-level data reveals patterns that city- or state-level data cannot. ZIP-wise Instacart grocery data extraction enables granular analysis of consumer behavior, demand fluctuations, and regional preferences.

From 2020 onward, demand localization became more pronounced. Urban ZIP codes showed higher price tolerance, while suburban and rural areas prioritized availability and value. Brands that adjusted pricing and assortment by ZIP code saw improved conversion rates and reduced stockouts.

| Year | High-Demand ZIPs | Avg. Basket Value | Stock Sensitivity |

|---|---|---|---|

| 2020 | 34% | Medium | Low |

| 2021 | 39% | Medium | Moderate |

| 2022 | 45% | High | High |

| 2023 | 51% | High | High |

| 2024 | 58% | Very High | Very High |

| 2025 | 63% | Very High | Extreme |

| 2026 | 69% | Premium | Extreme |

These insights empower retailers to customize inventory planning, pricing tiers, and delivery strategies based on real neighborhood-level data.

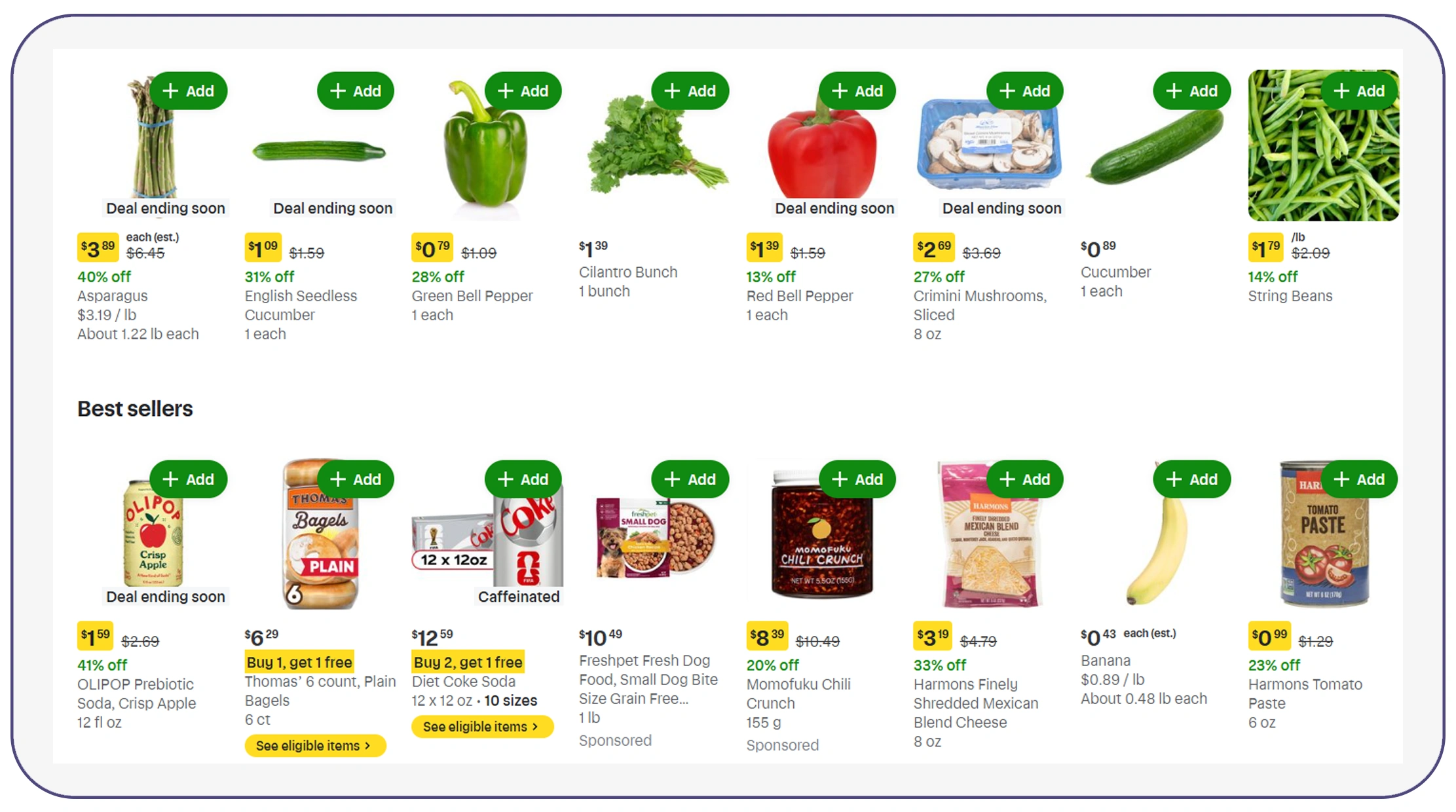

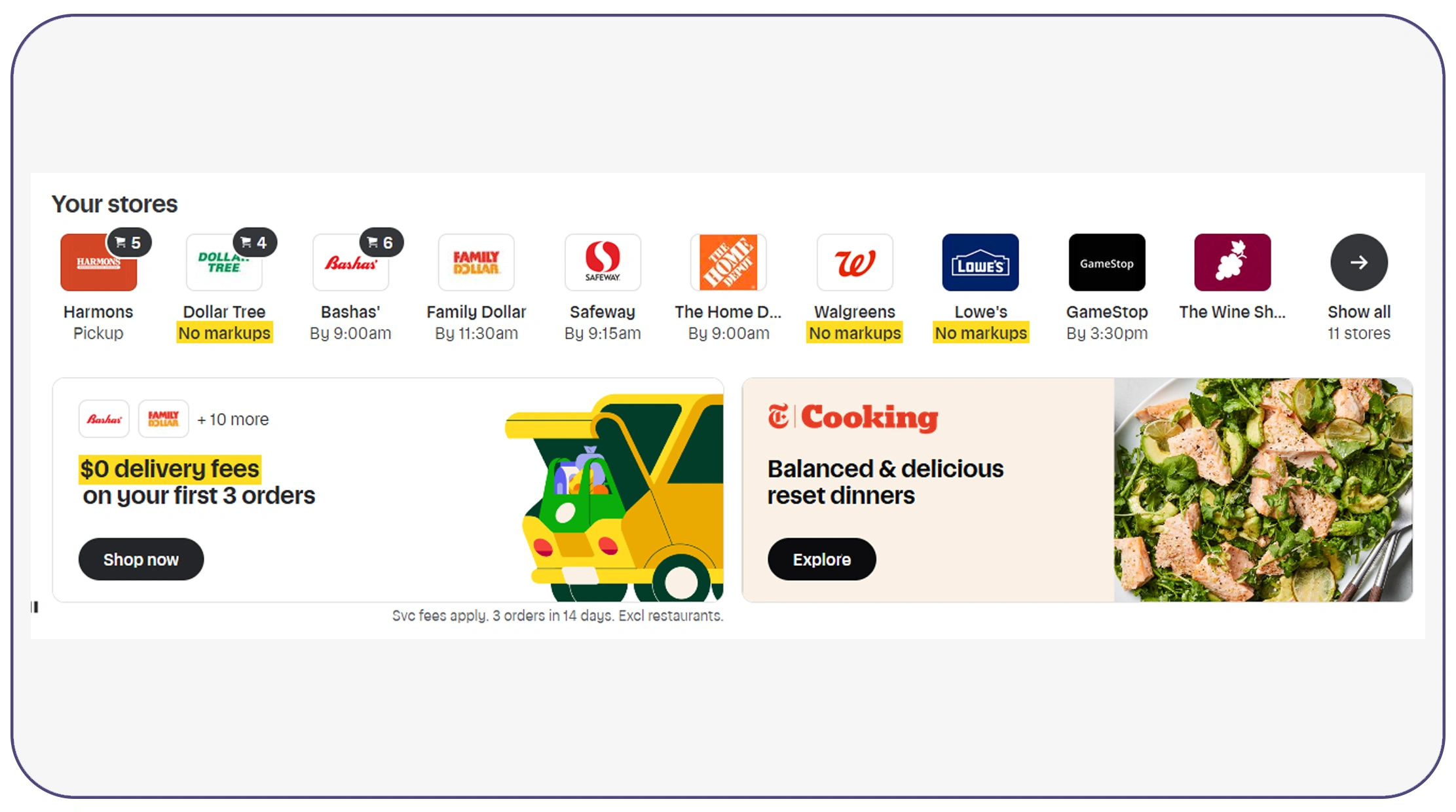

Connecting Products Across Multiple Retailers

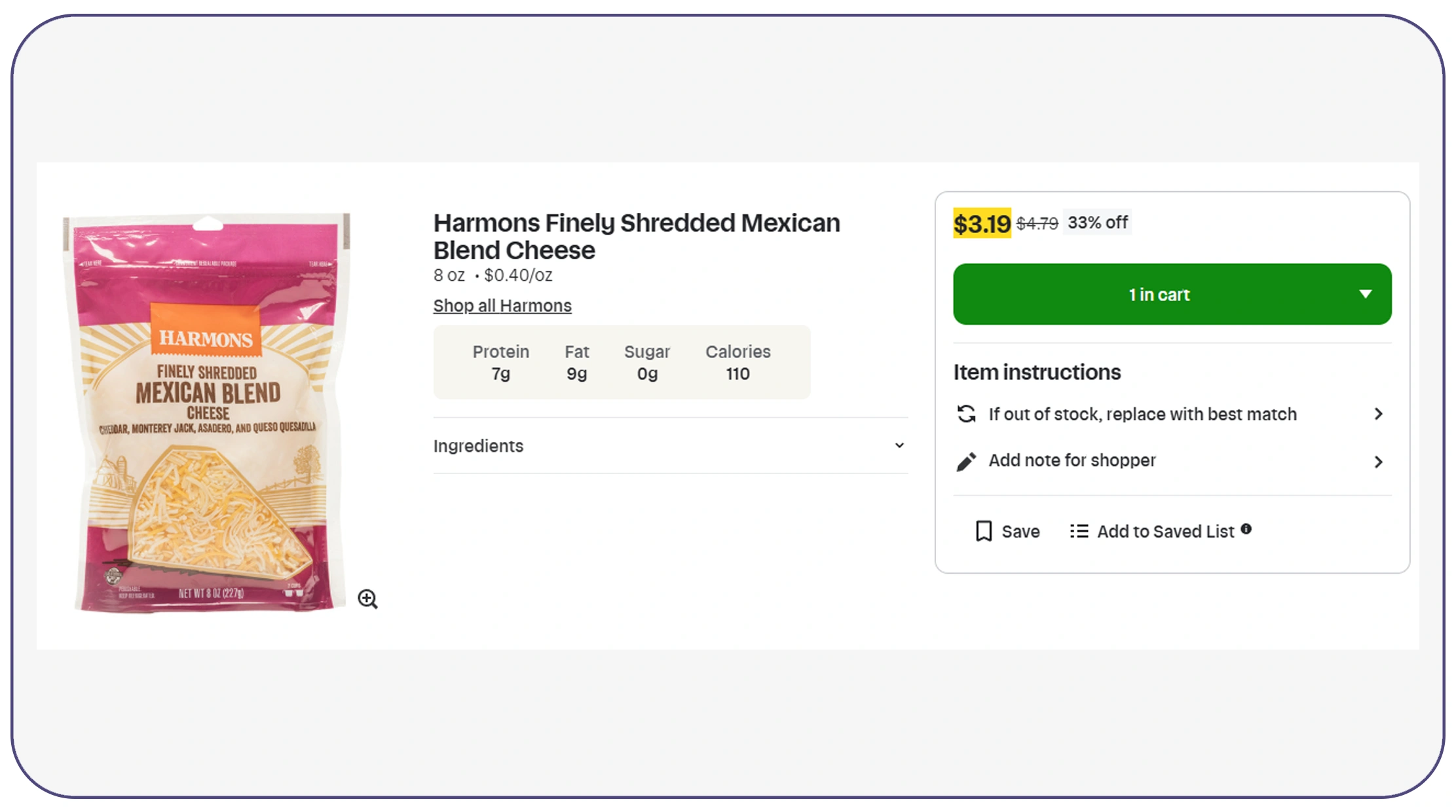

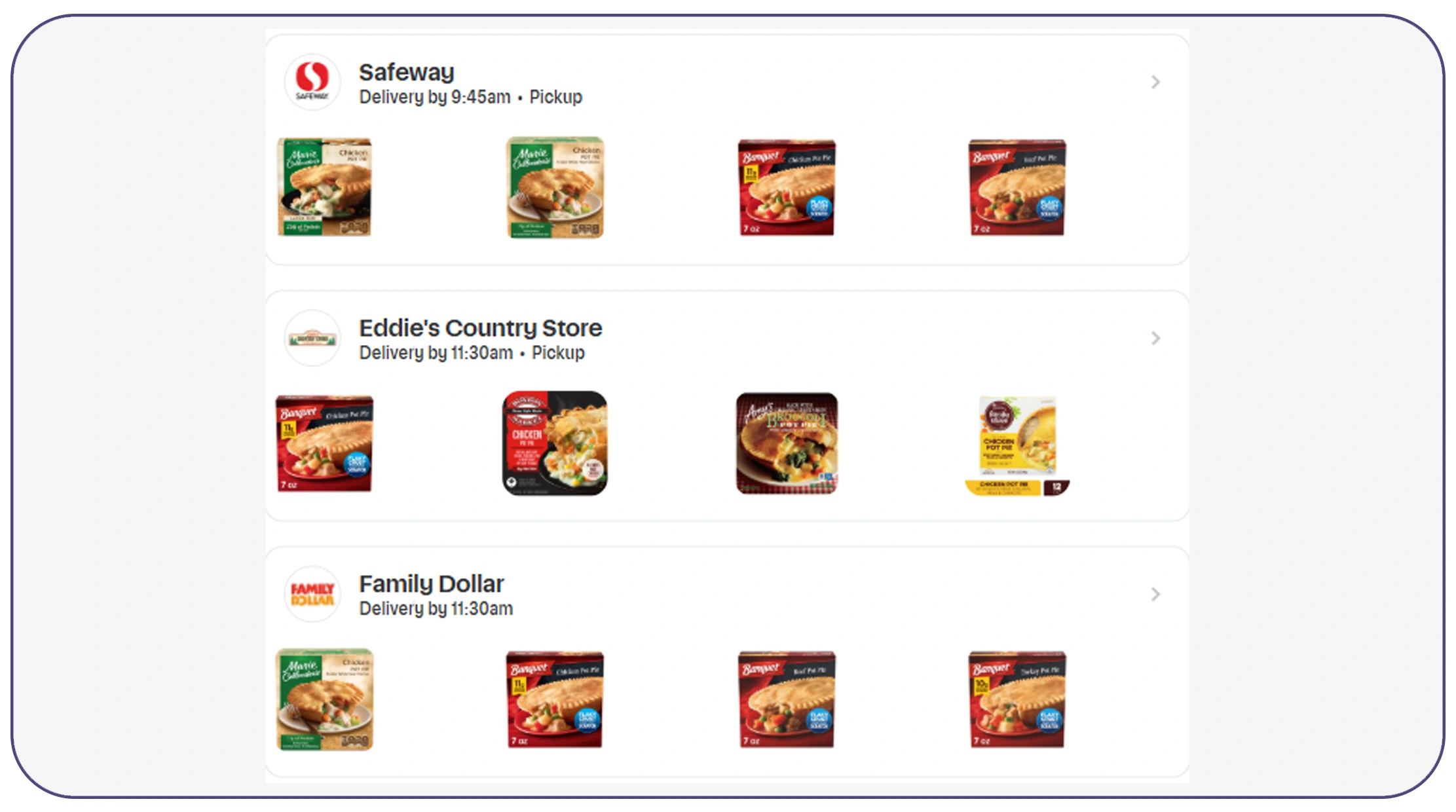

Instacart aggregates products from multiple grocery chains, making cross-store analysis essential. Instacart store-wise product mapping helps businesses understand how pricing, availability, and assortment vary between stores within the same ZIP code.

From 2020 to 2026, store-level competition intensified as retailers used Instacart to reach digital-first shoppers. Data analysis showed that identical products could have price differences of up to 22% across stores located just miles apart.

| Year | Avg. Stores per ZIP | Price Spread | Availability Overlap |

|---|---|---|---|

| 2020 | 3.2 | Low | High |

| 2021 | 3.6 | Moderate | High |

| 2022 | 4.1 | High | Moderate |

| 2023 | 4.5 | High | Moderate |

| 2024 | 4.9 | Very High | Low |

| 2025 | 5.3 | Very High | Low |

| 2026 | 5.8 | Extreme | Very Low |

Mapping products across stores enables competitive benchmarking and helps brands negotiate better placement and pricing strategies with retail partners.

Monitoring Geographic Supply Patterns

Supply and availability vary sharply by location. Web Scraping Instacart location-based data provides visibility into stock levels, substitutions, and delivery constraints tied to specific ZIP codes.

Supply chain instability between 2020 and 2023 made localized monitoring essential. Products frequently appeared as "out of stock" in one ZIP code while remaining available in neighboring areas, impacting customer satisfaction and brand loyalty.

| Year | Avg. Stock-Out Rate | Substitution Frequency | Delivery Delays |

|---|---|---|---|

| 2020 | 11% | Low | Moderate |

| 2021 | 14% | Moderate | High |

| 2022 | 19% | High | High |

| 2023 | 22% | Very High | Very High |

| 2024 | 24% | High | Moderate |

| 2025 | 26% | Moderate | Low |

| 2026 | 28% | Low | Low |

Location-based data ensures businesses respond proactively to supply issues instead of reacting after sales decline.

Turning Raw Data into Actionable Intelligence

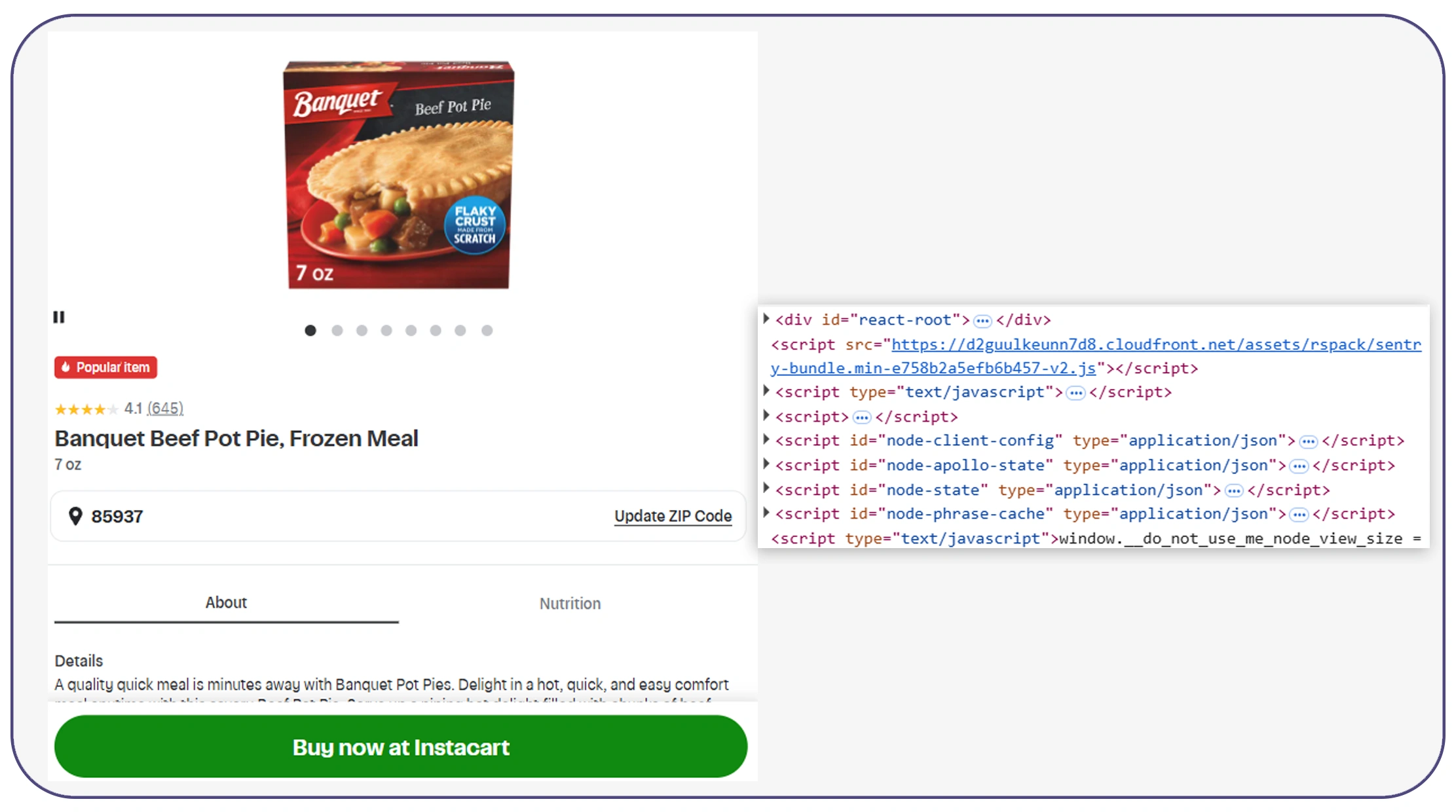

Collecting data is only useful if it leads to decisions. Instacart Grocery Scraping API enables businesses to automate data ingestion, normalize datasets, and integrate insights into dashboards and pricing engines.

Between 2020 and 2026, companies using API-driven analytics reduced manual reporting time by over 60%. Automated pipelines allowed teams to detect anomalies, forecast demand shifts, and respond to pricing gaps in near real time.

| Year | Data Processing Speed | Forecast Accuracy | Decision Efficiency |

|---|---|---|---|

| 2020 | Slow | 61% | Low |

| 2021 | Moderate | 67% | Moderate |

| 2022 | Fast | 73% | High |

| 2023 | Very Fast | 79% | High |

| 2024 | Real-Time | 85% | Very High |

| 2025 | Real-Time+ | 89% | Very High |

| 2026 | Predictive | 93% | Automated |

APIs allow teams to scale analysis without increasing operational complexity.

Scaling Data Collection for Enterprise Needs

As data volumes grow, scalability becomes essential. Web Scraping Instacart Dataset supports high-frequency updates, large geographic coverage, and consistent data quality.

From 2020 to 2026, enterprise adoption of automated scraping rose sharply as manual collection became impractical. Businesses monitoring thousands of ZIP codes relied on scalable datasets to maintain accuracy.

| Year | ZIP Codes Covered | Update Frequency | Manual Effort Reduced |

|---|---|---|---|

| 2020 | 200+ | Weekly | 18% |

| 2021 | 450+ | Weekly | 27% |

| 2022 | 900+ | Daily | 41% |

| 2023 | 1,500+ | Daily | 55% |

| 2024 | 2,300+ | Hourly | 66% |

| 2025 | 3,200+ | Hourly | 73% |

| 2026 | 4,000+ | Real-Time | 81% |

Scalable datasets ensure consistent insights across markets without sacrificing performance or accuracy.

Why Choose Real Data API?

Real Data API delivers enterprise-ready scraping solutions designed for reliability and scale. With Instacart Scraper, businesses gain structured access to localized grocery data without managing infrastructure. Combined with Extract Instacart product data by ZIP code, Real Data API enables accurate pricing analysis, availability tracking, and competitive benchmarking—all through automated, compliant data delivery.

Conclusion

Local pricing and availability gaps can no longer be ignored in modern grocery analytics. With access to tools like Grocery Data Scraping API and Extract Instacart product data by ZIP code, businesses gain hyper-local visibility, reduce operational blind spots, and make smarter data-driven decisions.

Ready to uncover real ZIP-code-level grocery insights? Start using Real Data API today and transform Instacart data into actionable intelligence!