Introduction

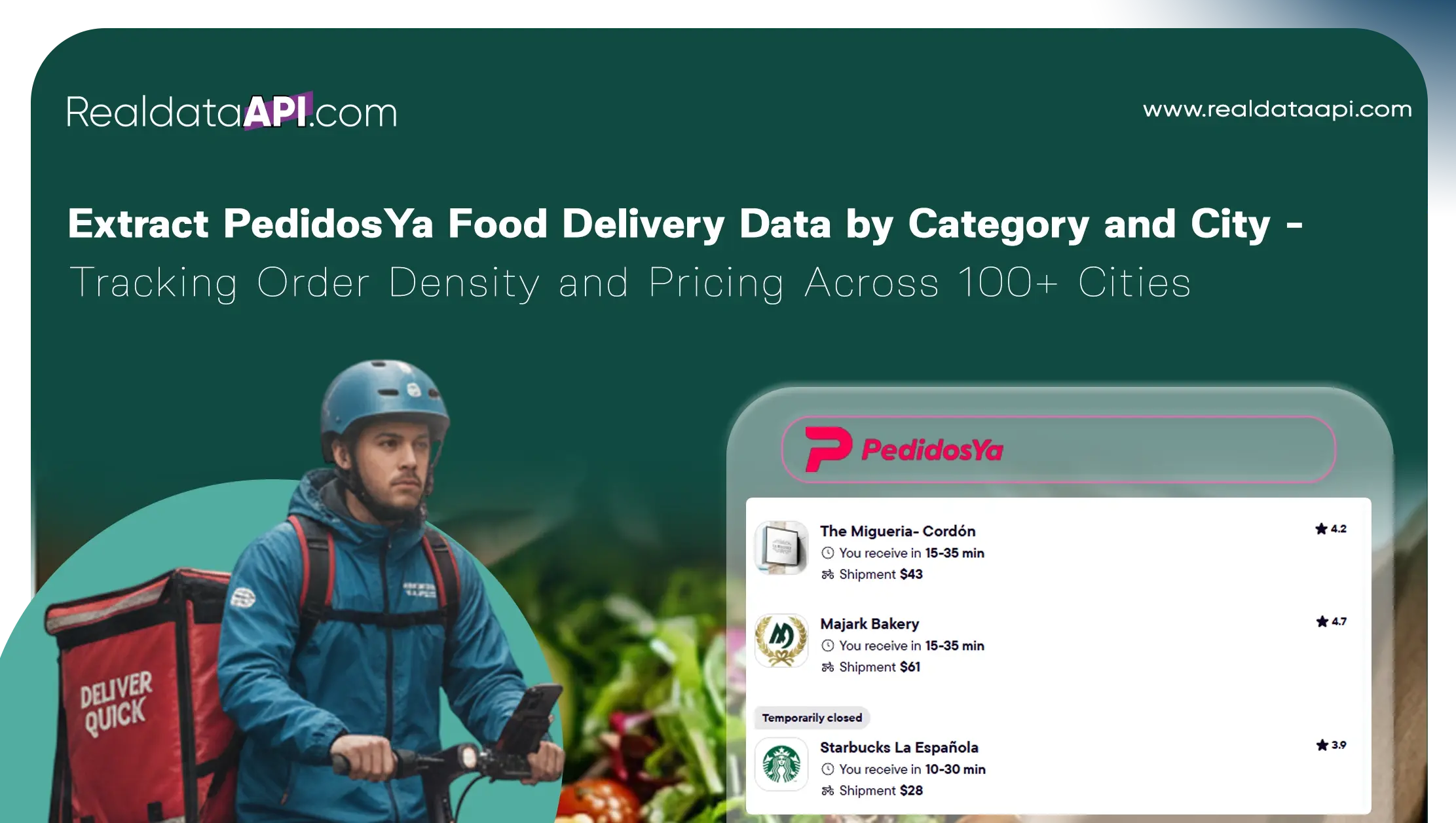

Food delivery platforms have become a critical source of urban consumption data, offering real-time visibility into customer demand, pricing behavior, and restaurant performance. Across Latin America, PedidosYa plays a dominant role in shaping how consumers interact with food delivery services at the city and neighborhood level. To understand these dynamics at scale, businesses increasingly rely on Extract PedidosYa food delivery data by category and city to analyze how cuisine preferences, pricing, and order density vary across locations.

From 2020 to 2026, PedidosYa experienced rapid expansion in restaurant listings, delivery zones, and menu diversity. These changes created a rich data environment for analysts, brands, and market researchers seeking hyperlocal insights. City-level food delivery data helps identify underserved markets, optimize pricing strategies, and evaluate category-level demand trends over time.

This blog explores how Real Data API enables structured, scalable access to PedidosYa food delivery intelligence, transforming raw listings into actionable insights for decision-makers across food tech, retail, and analytics sectors.

Understanding Localized Restaurant Supply Patterns

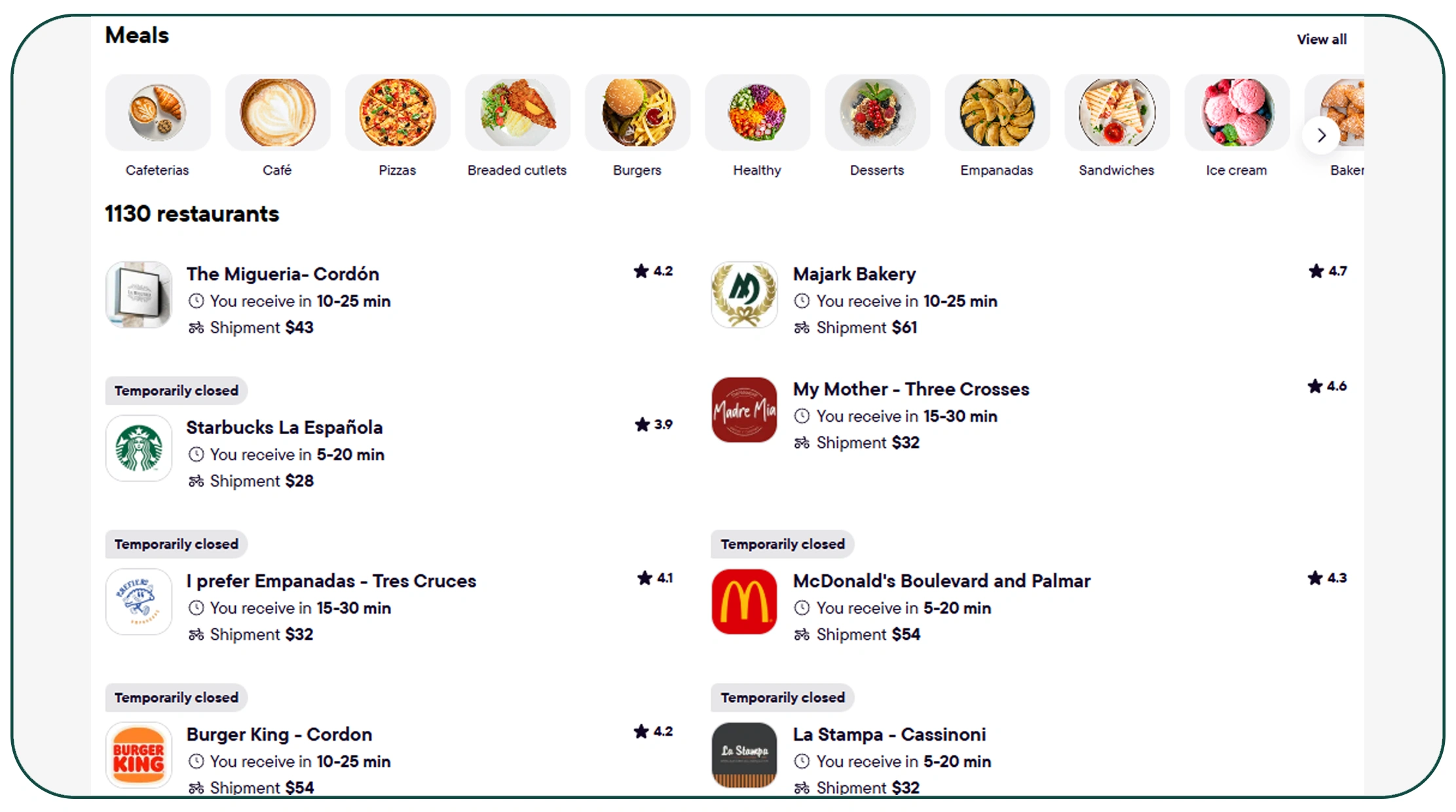

Using PedidosYa city-wise restaurant data scraping, analysts can measure how restaurant density and cuisine availability vary by location. City-level extraction reveals major disparities between metro hubs and tier-two cities, especially in category diversity and average delivery pricing.

Between 2020 and 2026, the number of active restaurants on PedidosYa grew sharply, with the fastest growth observed in mid-sized cities. Scraped data shows that while capital cities still dominate total listings, regional cities saw higher year-over-year onboarding rates.

City-Level Restaurant Growth (2020–2026):

| Year | Cities Covered | Avg. Restaurants per City |

|---|---|---|

| 2020 | 48 | 620 |

| 2022 | 67 | 810 |

| 2024 | 89 | 1,020 |

| 2026 | 112 | 1,340 |

This data enables brands to benchmark market saturation, identify expansion opportunities, and assess competitive density at the city level.

Measuring Platform-Wide Restaurant Expansion

With PedidosYa restaurant data extraction, businesses can track platform-wide growth trends beyond city boundaries. This includes onboarding velocity, restaurant churn, and shifts in category composition.

Historical analysis from 2020–2026 shows a steady rise in independent restaurants joining the platform, particularly post-2021. At the same time, chain restaurants maintained higher order volumes but lower menu diversity.

Restaurant Composition Trends:

| Year | Independent Restaurants | Chain Restaurants |

|---|---|---|

| 2020 | 62% | 38% |

| 2023 | 69% | 31% |

| 2026 | 74% | 26% |

This extraction supports strategic decisions in partnerships, commission modeling, and supplier segmentation across markets.

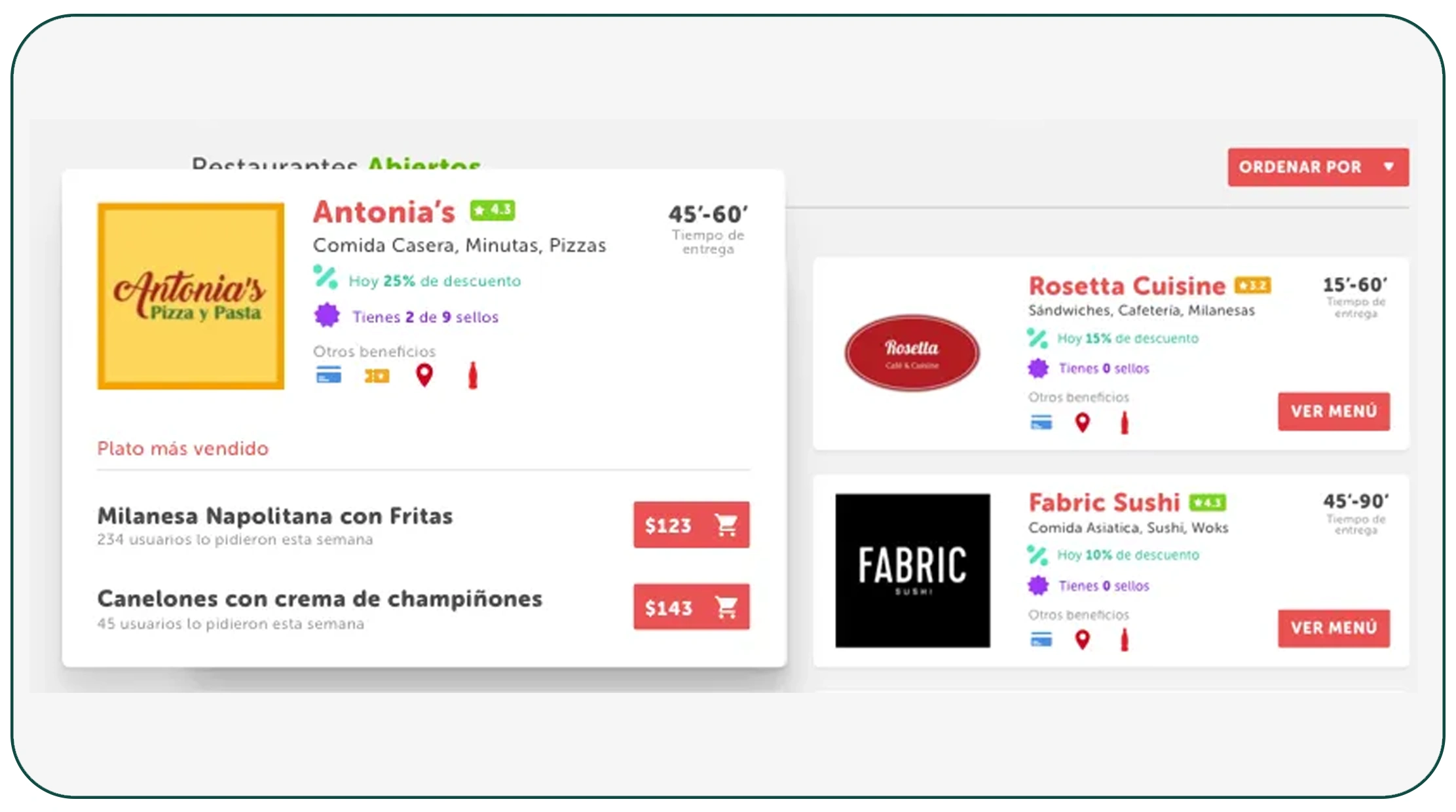

Evaluating Category-Level Availability and Competition

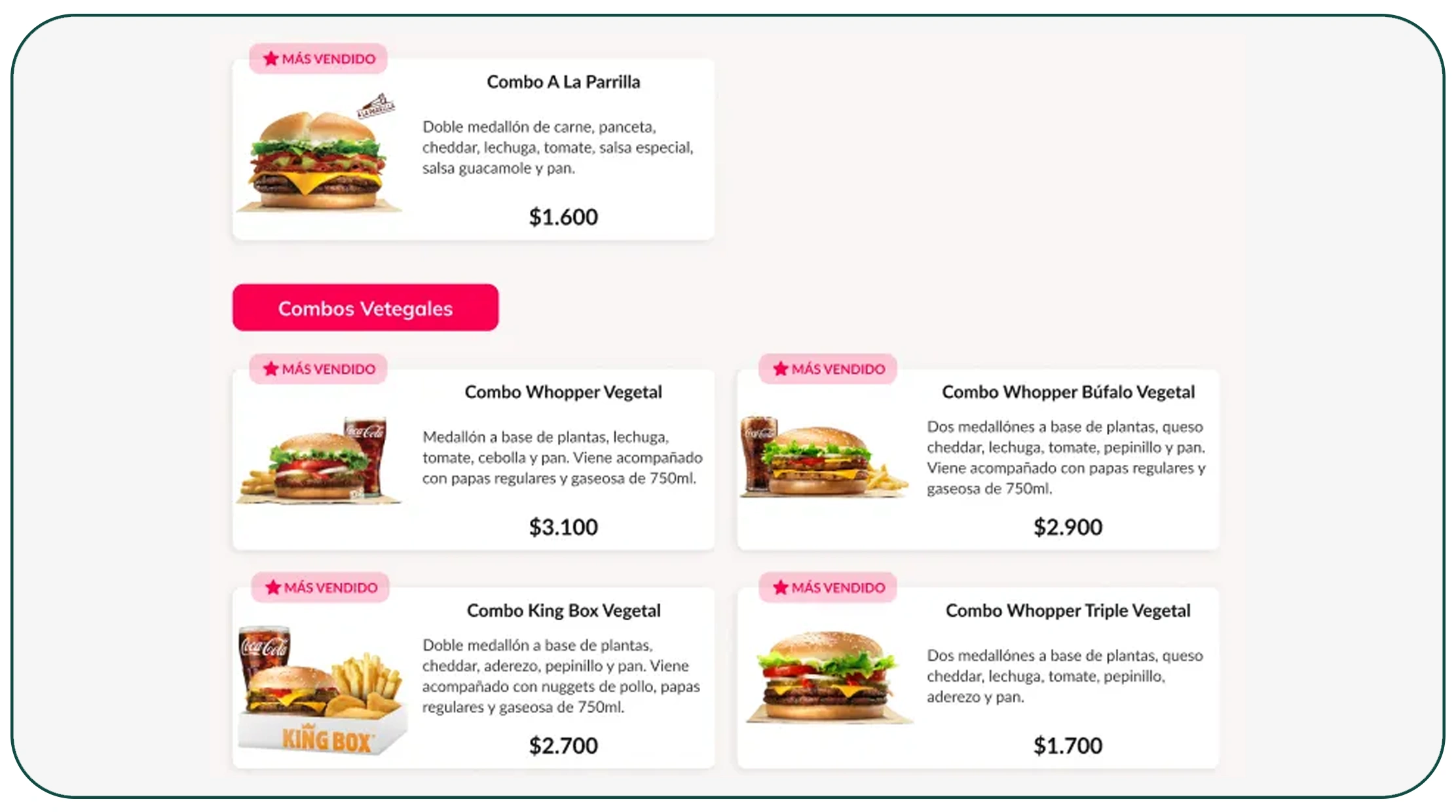

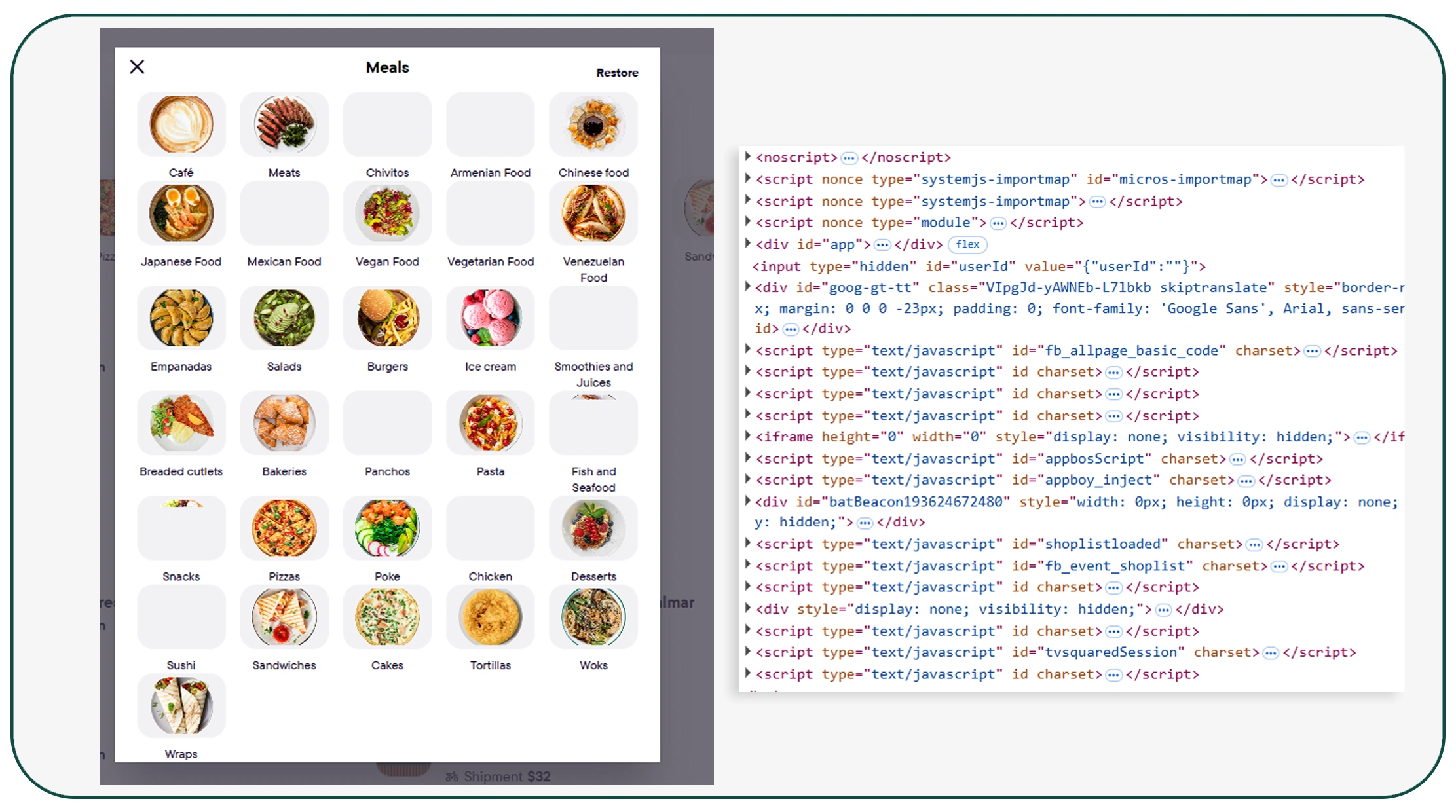

When analysts scrape PedidosYa restaurant listings data, they gain visibility into how food categories compete across cities. Categories such as burgers, pizza, and fast food dominate listings, but newer segments like healthy bowls and vegan cuisine have grown rapidly since 2022.

Category-level scraping highlights how demand density differs by geography. For example, Asian cuisine showed strong growth in metro regions, while local comfort foods remained dominant in smaller cities.

Top Categories by Listing Share (2026):

| Category | Share of Listings |

|---|---|

| Fast Food | 31% |

| Pizza | 22% |

| Local Cuisine | 18% |

| Healthy / Vegan | 11% |

| Desserts & Cafés | 9% |

These insights help brands tailor menus, promotions, and expansion strategies to local preferences.

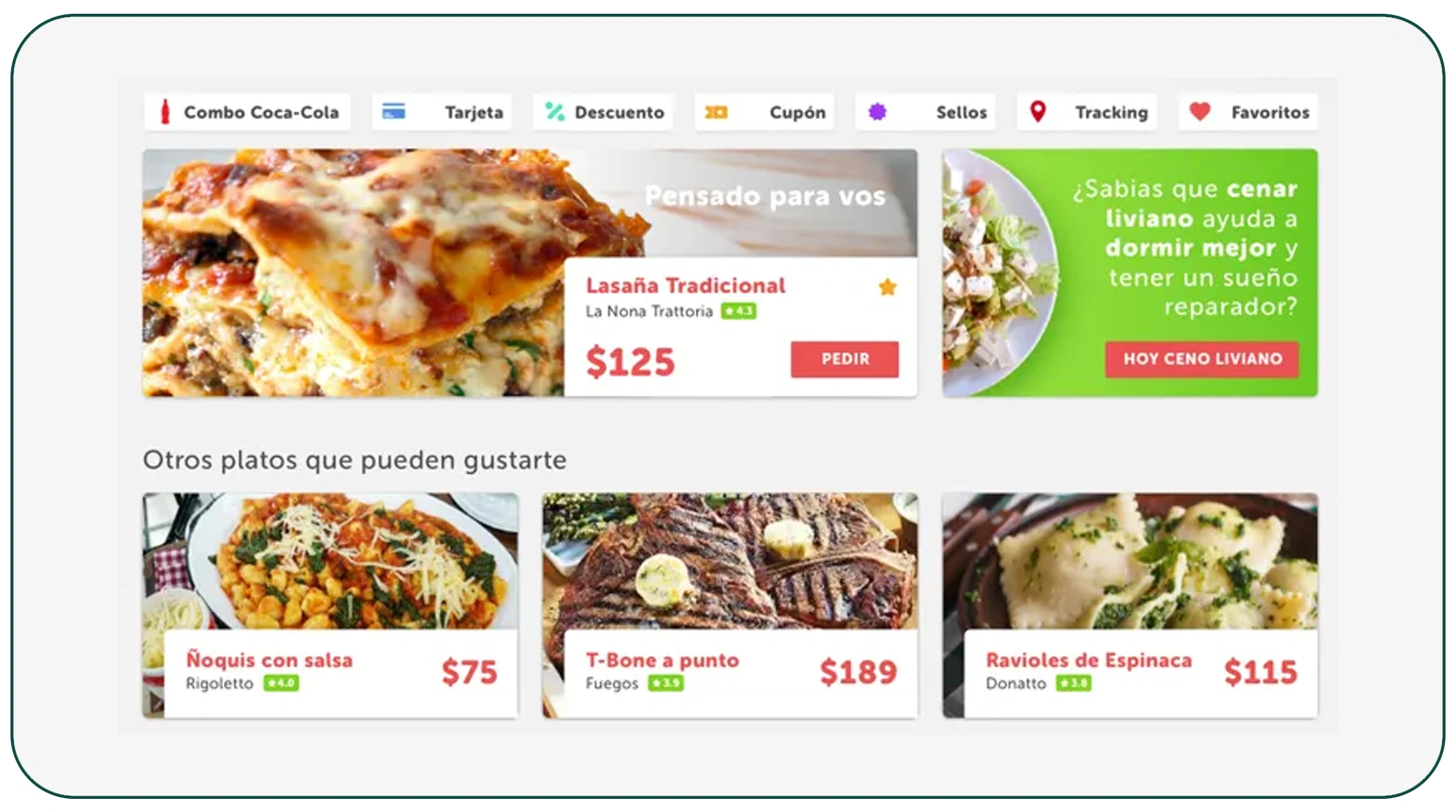

Analyzing Menu Pricing and Inflation Trends

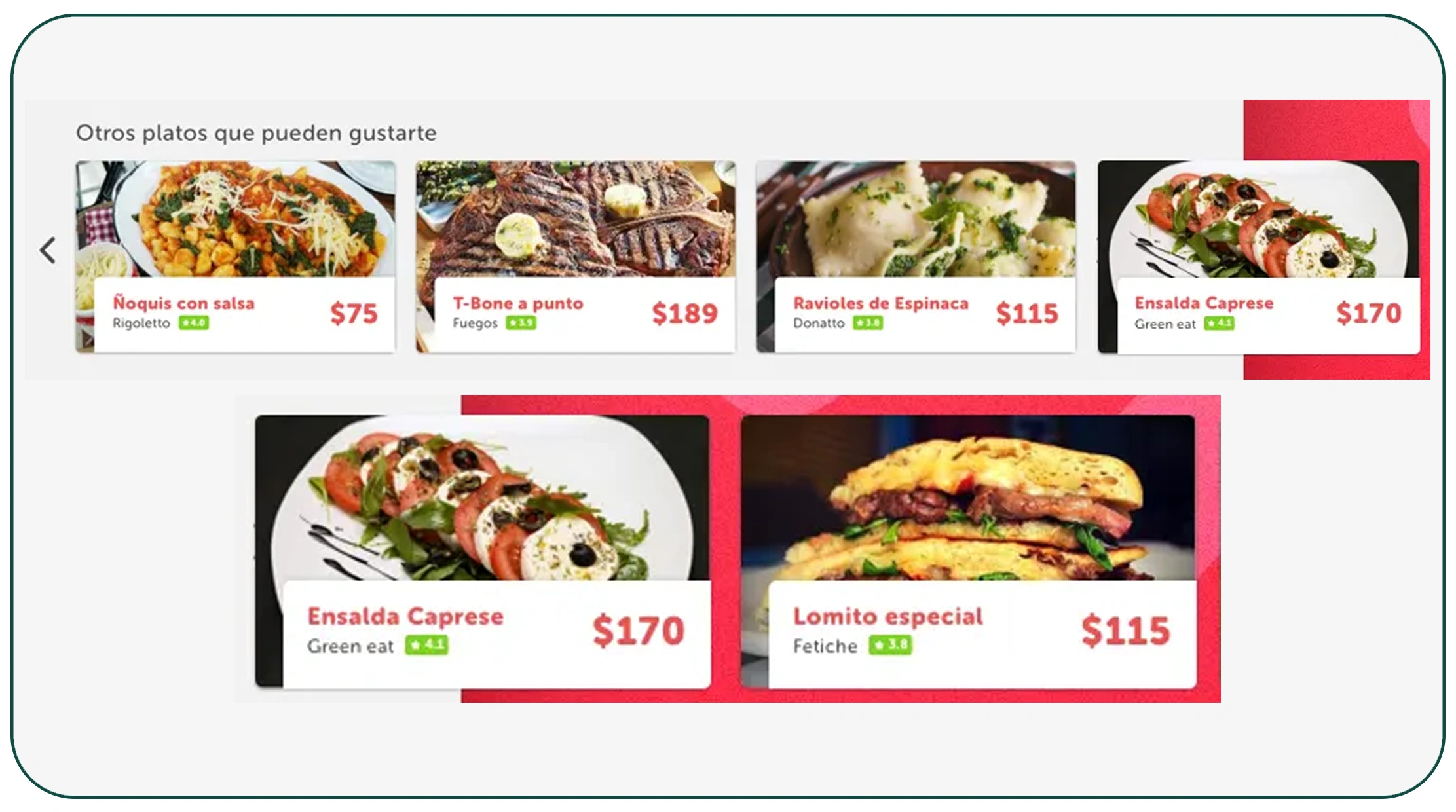

Using PedidosYa restaurant menus and price scraper, businesses can monitor how menu pricing evolves over time. From 2020 to 2026, average menu prices increased significantly, driven by inflation, delivery costs, and ingredient pricing.

Scraped menu data shows that price increases were not uniform. Metro cities experienced faster price growth, while smaller cities showed higher price sensitivity and slower adjustments.

Average Menu Price Growth (Index 2020 = 100):

| Year | Metro Cities | Regional Cities |

|---|---|---|

| 2020 | 100 | 100 |

| 2022 | 118 | 111 |

| 2024 | 136 | 124 |

| 2026 | 154 | 138 |

This pricing intelligence supports dynamic pricing analysis, margin optimization, and promotional planning.

Powering Real-Time Delivery Intelligence

At scale, structured access via PedidosYa Delivery API enables continuous monitoring of listings, prices, and availability. APIs reduce data latency and support real-time analytics across multiple cities simultaneously.

Between 2020 and 2026, API-driven pipelines reduced refresh cycles from daily to near real-time, allowing businesses to react quickly to demand surges, price changes, and category shifts.

Operational Performance Improvements:

| Metric | 2020 | 2026 |

|---|---|---|

| Data Refresh Time | 24 hrs | <2 hrs |

| Coverage Accuracy | 92% | 99% |

| City-Level Granularity | Medium | High |

This real-time capability is essential for competitive monitoring and operational intelligence.

Building Scalable Food Intelligence Assets

By consolidating scraped insights into a structured Food Dataset, organizations can unlock long-term value from historical and real-time data. These datasets support trend analysis, forecasting models, and city-level demand simulations.

From 2020–2026, long-term datasets revealed recurring demand spikes around weekends, holidays, and major events. They also exposed underserved zones where order density consistently exceeded restaurant supply.

Order Density Trends (Avg. Orders per km²):

| Year | High-Density Zones | Emerging Zones |

|---|---|---|

| 2020 | 180 | 65 |

| 2023 | 240 | 110 |

| 2026 | 310 | 165 |

Structured datasets allow businesses to move beyond snapshots and build predictive food delivery intelligence.

Why Choose Real Data API?

Real Data API empowers data-driven teams with scalable, compliant extraction built for Market Research and competitive intelligence. Our infrastructure supports city-level, category-level, and historical analysis across food delivery platforms.

With proven expertise in Extract PedidosYa food delivery data by category and city, Real Data API delivers clean, structured outputs ready for analytics, dashboards, and machine learning pipelines—without the complexity of maintaining scraping infrastructure.

Conclusion

PedidosYa data offers a powerful lens into how urban food consumption evolves across cities and categories. When transformed into structured insights, this data supports smarter pricing, expansion, and operational decisions.

By leveraging Real Data API’s Food Data Scraping API, businesses can build real-time intelligence systems powered by Extract PedidosYa food delivery data by category and city.

Ready to uncover city-level food delivery insights at scale? Contact Real Data API today and turn food platform data into competitive advantage!