Introduction

Over the last five years, the UAE's food delivery ecosystem has experienced explosive digital growth. From the bustling streets of Dubai to the vibrant food scene in Abu Dhabi, online delivery platforms have become integral to everyday dining habits. In 2025, more than 85% of restaurant orders in the UAE are placed through delivery apps, underscoring how consumers have fully embraced digital-first dining.

This transformation is led by three major players — Zomato, Talabat, and Careem — which together control nearly 90% of the UAE's online food delivery market. Businesses are now leveraging these platforms not just for logistics, but also for market intelligence, competitive analysis, and data-driven decision-making. The ability to Extract restaurant data from Zomato, Talabat & Careem enables restaurants, aggregators, and investors to decode dynamic trends in pricing, consumer demand, and delivery patterns.

With Real Data API, companies gain seamless access to comprehensive datasets through a Multi-Platform Food Delivery Scraper, providing unparalleled visibility into menus, ratings, delivery times, and pricing shifts. This blog unpacks the evolution of the UAE's food delivery market from 2020–2025, the insights hidden within platform data, and how Real Data API empowers decision-makers with real-time food delivery insights for UAE restaurant market research.

UAE Food Delivery Growth (2020–2025) — Digital Dominance Redefined

The UAE's food delivery sector has become one of the fastest-growing digital industries in the MENA region. In 2020, the market was valued at USD 2.3 billion, primarily driven by urban consumers during the pandemic. By 2025, it is projected to reach USD 5.8 billion, reflecting a 19.2% CAGR over five years. This surge is powered by changing lifestyles, convenience-oriented consumption, and the expansion of digital infrastructure across the Emirates.

| Year | Market Size (USD Billion) | Growth Rate | Online Share of Total Orders |

|---|---|---|---|

| 2020 | 2.3 | — | 52% |

| 2021 | 3.0 | 30% | 63% |

| 2022 | 3.8 | 27% | 71% |

| 2023 | 4.6 | 21% | 78% |

| 2024 | 5.3 | 15% | 82% |

| 2025 | 5.8 | 9% | 85% |

This consistent upward trajectory is evidence of the UAE's evolving consumer base — a tech-savvy population that prioritizes convenience and time efficiency. Moreover, as smartphone penetration crossed 99% in 2024, digital platforms became the default mode for ordering meals.

To remain competitive, restaurants increasingly rely on Restaurant menu and pricing data scraping tools to analyze competitor trends, track pricing fluctuations, and benchmark delivery efficiency. With Real Data API, enterprises can go beyond generic data reports and access raw, structured data in real time — enabling custom dashboards for UAE food delivery market research and strategy building.

Furthermore, government initiatives under the UAE's Smart City Vision 2030 are driving digital adoption. The result is a marketplace where timely, accurate data can dictate business success. As the industry becomes more data-driven, the capacity to Extract restaurant data from Zomato, Talabat & Careem emerges as a defining capability for any business targeting growth in the UAE's food delivery landscape.

Platform Performance Analysis — Zomato, Talabat & Careem (2020–2025)

Zomato, Talabat, and Careem have shaped the digital dining experience across the Emirates. Collectively, they handle millions of daily transactions, yet their strategic focus areas differ significantly.

| Platform | 2020 Market Share | 2025 Market Share | Avg. Delivery Time (min) | Avg. Fee (AED) | Restaurant Partners |

|---|---|---|---|---|---|

| Talabat | 40% | 45% | 29 | 7.8 | 18,000+ |

| Zomato | 35% | 28% | 32 | 8.5 | 14,000+ |

| Careem | 25% | 27% | 31 | 9.2 | 9,500+ |

Talabat Data Scraping UAE shows that Talabat's market leadership is fueled by operational efficiency and a broader restaurant network. Zomato, in contrast, remains the go-to platform for premium and dine-in crossover customers, supported by its strong review ecosystem and loyalty programs. Meanwhile, Careem Data Extraction highlights the platform's pivot toward express deliveries and quick commerce, which accounts for nearly 35% of its total food transactions by 2025.

Using a Multi-Platform Food Delivery Scraper like Real Data API, analysts can gather cross-platform performance indicators in real time — comparing delivery times, pricing disparities, menu duplication rates, and rating volatility. For example, 2025 data indicates that average delivery times dropped by 12% compared to 2020, while restaurant onboarding grew by 60%.

Such granular intelligence enables businesses to fine-tune pricing strategies and identify underperforming cuisines or localities. For policymakers and consultants conducting Market Research, platform data reveals consumption clusters — such as higher average order values in Dubai Marina versus value-seeking behavior in Sharjah.

Ultimately, the ability to Extract restaurant data from Zomato, Talabat & Careem provides an unparalleled competitive advantage, allowing organizations to benchmark performance, understand consumer demand, and forecast delivery trends across the UAE's major cities.

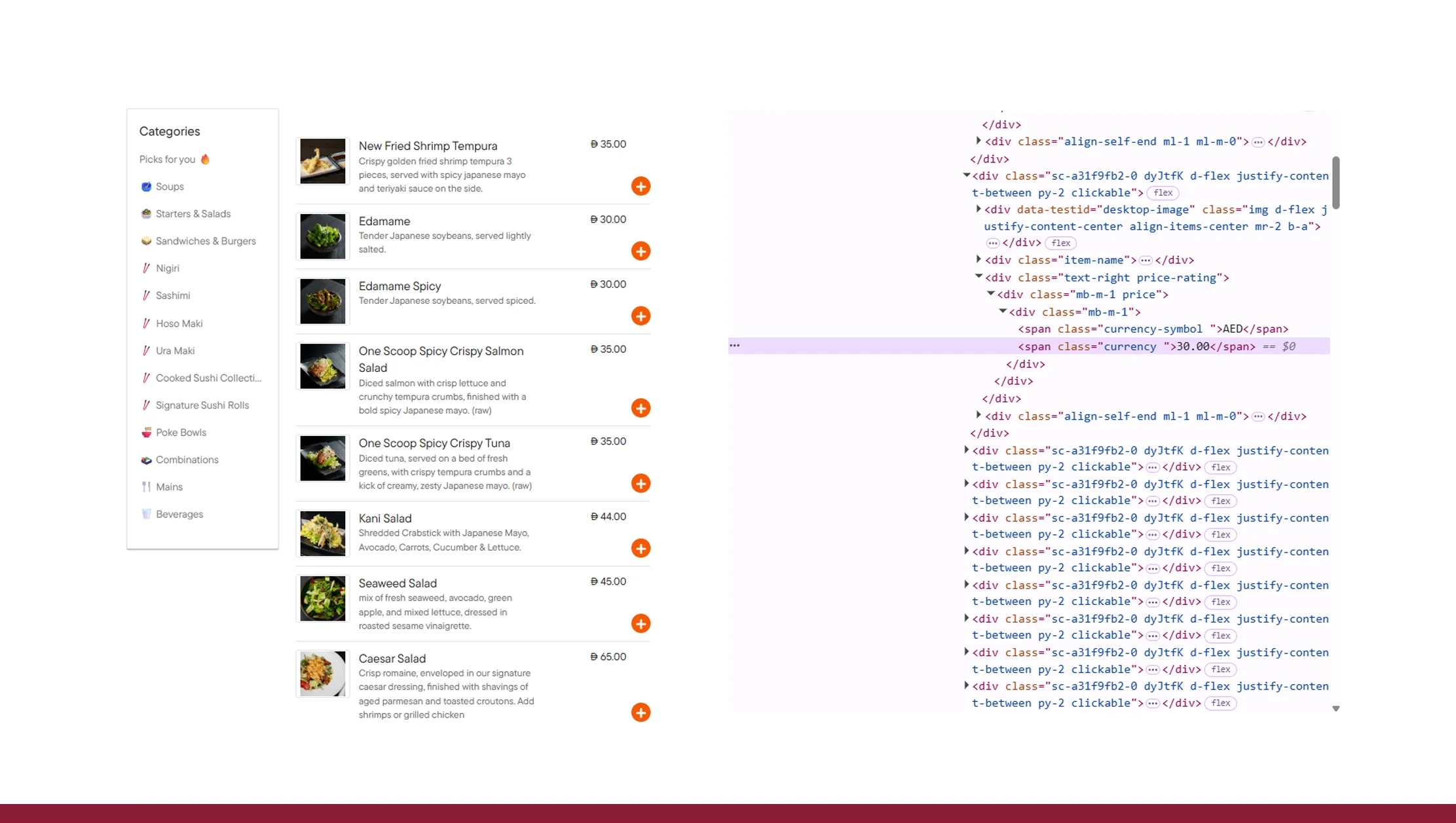

Menu & Pricing Trends — The Data Behind 30,000+ Restaurants

Between 2020 and 2025, over 30,000 restaurants have actively participated on food delivery platforms in the UAE, reflecting a diverse mix of cuisines and price points. Using Restaurant menu and pricing data scraping, analysts can trace how inflation, brand competition, and delivery promotions have reshaped menu pricing.

| Category | Avg. Price 2020 (AED) | Avg. Price 2025 (AED) | Change (%) |

|---|---|---|---|

| Burgers | 24.5 | 29.3 | +19.6% |

| Shawarma | 18.2 | 21.7 | +19.2% |

| Pizza | 32.8 | 36.5 | +11.3% |

| Salads | 21.4 | 25.8 | +20.5% |

| Sushi | 42.7 | 46.2 | +8.2% |

Zomato Data Scraping UAE insights reveal that premium items like sushi and gourmet burgers have seen moderate price hikes, while mass-market items such as shawarma and pizza faced tighter margins due to heavy discounting. Across platforms, dynamic pricing is now commonplace — 2025 data shows that nearly 45% of restaurants modify prices monthly based on demand, promotions, or inflation trends.

By integrating these patterns into predictive dashboards via Real Data API, companies can perform elasticity analysis — identifying how price changes impact order frequency. Careem Data Extraction confirms that smaller restaurants are increasingly using dynamic menus to compete with chains, often updating offers daily.

These granular datasets, when processed through Multi-Platform Food Delivery Scraper tools, provide deep visibility into UAE's pricing logic, helping investors and operators make data-backed expansion and positioning decisions. For anyone conducting UAE food delivery market research, such insights are indispensable for identifying emerging menu categories and aligning with shifting consumer preferences.

Unlock real-time UAE menu and pricing insights — start using Real Data API today to power smarter restaurant and delivery decisions.

Get Insights Now!Customer Behavior Shifts — Data-Driven Dining in the UAE

Consumer behavior has evolved rapidly in the UAE's food delivery ecosystem. Based on Careem Now Food Delivery Dataset and similar multi-platform datasets, several notable patterns define the 2020–2025 period:

- 70% of users now prefer ordering via mobile apps over desktop websites.

- 54% of users reorder from the same restaurant at least once a month.

- 42% increase in weekday lunch orders compared to 2020 levels.

- 25% growth in plant-based and "healthy" menu categories.

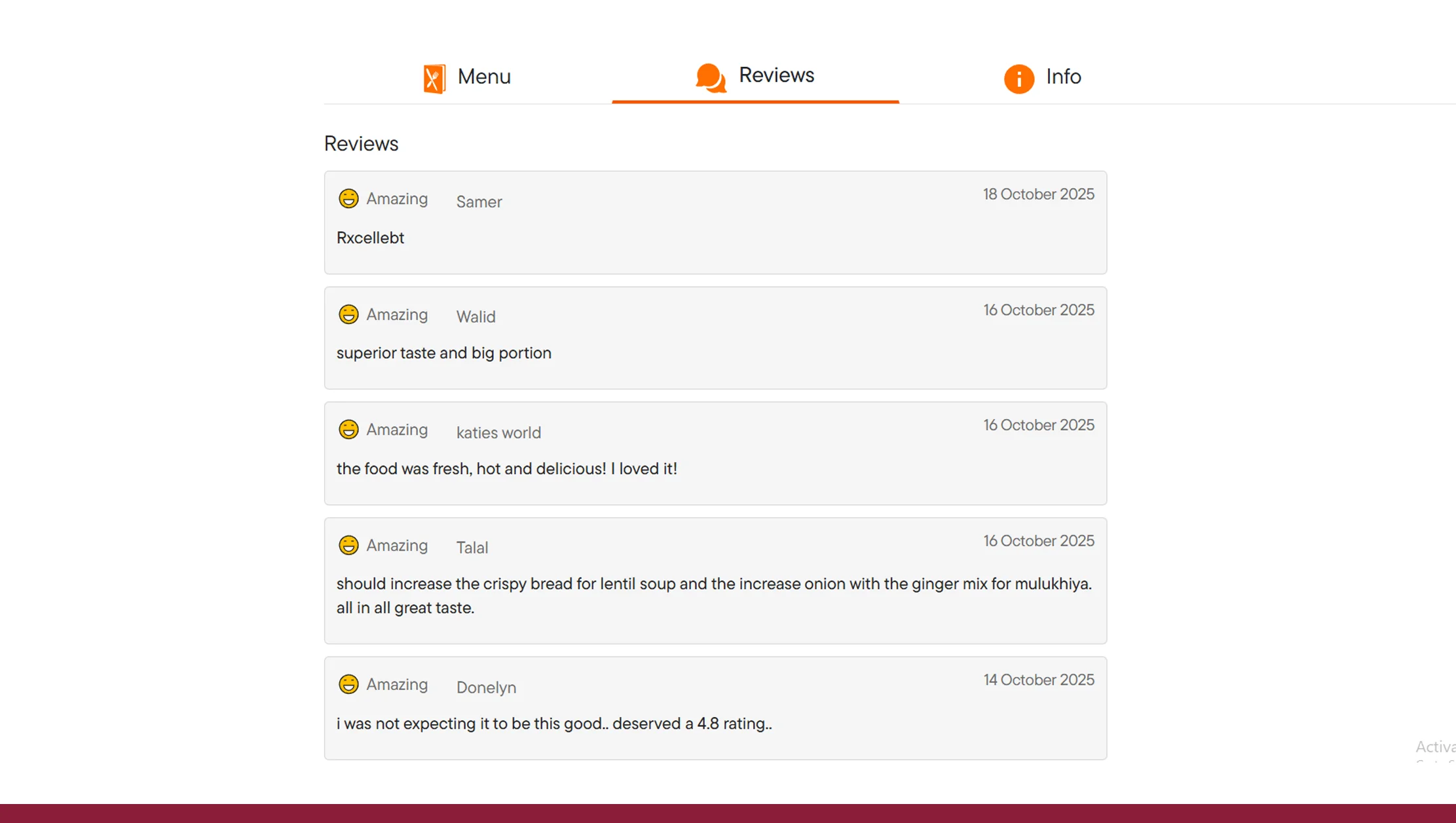

The convergence of technology, lifestyle, and convenience is shaping consumption. Talabat Data Scraping UAE indicates a growing appetite for subscription-based meal plans, which have seen 18% annual growth since 2023. Similarly, Zomato Data Scraping UAE shows that users are increasingly drawn to personalized recommendations and "repeat order" features.

This behavioral data helps businesses predict demand peaks, identify loyalty drivers, and optimize marketing spend. Through Multi-Platform Food Delivery Scraper solutions, Real Data API enables segmentation of users by cuisine preference, price sensitivity, and order timing. Restaurants can then deploy targeted campaigns — such as lunchtime discounts or healthy meal bundles — based on factual behavioral data.

With Restaurant menu and pricing data scraping, marketers can align promotions with menu categories seeing the fastest growth. These real-time behavioral insights are the cornerstone of Market Research, allowing brands to stay ahead of shifting trends and deliver what UAE consumers truly want.

API-Driven Access — Automating Food Delivery Intelligence

Data automation is transforming how analysts and companies access competitive intelligence. Through integrations like the Talabat Delivery API, Zomato Scraper, and Real Data API, data collection is no longer a manual or static process.

| API Capability | Description | Business Impact |

|---|---|---|

| Real-time updates | Continuous syncing with live menu and pricing changes | Enables up-to-the-minute decision-making |

| Multi-platform aggregation | Data from Zomato, Talabat & Careem combined | Unified analytics across all delivery apps |

| Scalable queries | Handles millions of records per request | Ideal for enterprise-level analytics |

| Custom filters | Search by cuisine, area, or price | Precision targeting for campaigns |

Using Careem Data Extraction, teams can monitor delivery efficiency and customer satisfaction scores simultaneously. Zomato Data Scraping UAE and Talabat Data Scraping UAE integrations help cross-verify menu discrepancies or detect new restaurant openings automatically.

This automation significantly reduces operational overhead. A single query through Real Data API can fetch thousands of structured records, enabling analysts to conduct UAE food delivery market research with live, accurate data streams.

As the UAE moves toward predictive intelligence, businesses using automated systems can track trends faster, forecast demand spikes, and optimize supply chains. In a market where food delivery volumes grew 150% between 2020 and 2025, API-based data collection has become a necessity, not an option.

Predictive Analytics — The 2025 Data Advantage

Predictive analytics is redefining competition in the UAE's food delivery landscape. By integrating Multi-Platform Food Delivery Scraper outputs into machine learning systems, Real Data API helps companies uncover emerging trends before they become mainstream.

From 2020 to 2025, predictive models built using Real Data API datasets revealed:

- 15% YoY growth in healthy and organic food orders.

- 12% decline in loyalty for fast-food chains.

- 18% increase in demand for ready-to-eat meal kits.

These findings empower restaurants to realign menus, optimize pricing, and expand into fast-growing cuisine segments. Restaurant menu and pricing data scraping offers the foundation for these insights — capturing how price shifts impact consumer sentiment.

Moreover, by continuing to Extract restaurant data from Zomato, Talabat & Careem, Real Data API users gain real-time visibility into competitor promotions and delivery surges. For example, AI-driven dashboards can predict when shawarma orders spike by 25% during Ramadan, or when dessert orders rise by 30% in Dubai Marina during winter tourism peaks.

Such predictive intelligence forms the backbone of modern Market Research, helping investors and policymakers forecast growth areas and market saturation points. As predictive analytics evolves, data accuracy and granularity become the deciding factors — and this is precisely where Real Data API delivers its competitive advantage.

Harness predictive power with Real Data API — forecast UAE food trends, pricing shifts, and customer demand with real-time delivery insights.

Get Insights Now!Why Choose Real Data API?

Real Data API stands out as the most comprehensive and scalable solution for extracting structured, verified datasets from leading UAE delivery platforms. It's designed to power Zomato Data Scraping UAE, Talabat Data Scraping UAE, and Careem Data Extraction in one seamless interface — eliminating manual scraping and ensuring compliance with platform standards.

Key benefits include:

- Real-time data delivery from multiple food delivery apps.

- Custom filtering and segmentation by cuisine, location, or price band.

- Scalable architecture capable of processing millions of listings daily.

- Enterprise-grade integration via RESTful APIs and webhook support.

For organizations focused on UAE food delivery market research, Real Data API offers reliability, speed, and accuracy unmatched in the region. Whether you're a restaurant brand, investor, or analyst, Real Data API provides the actionable intelligence needed to stay ahead in the fast-evolving UAE F&B sector.

Conclusion

The UAE's food delivery sector continues to thrive on the foundation of data, convenience, and digital innovation. From menu pricing shifts to evolving customer habits, every insight counts in a market projected to surpass USD 6 billion by 2026.

By leveraging Real Data API, businesses can Extract restaurant data from Zomato, Talabat & Careem efficiently, enabling data-driven decision-making, predictive forecasting, and real-time trend analysis. With integrated tools for Zomato Data Scraping UAE, Talabat Delivery API, and Careem Data Extraction, Real Data API transforms raw data into business-ready intelligence.

Ready to decode the UAE's 2025 food delivery landscape? Start your Market Research journey with Real Data API today — and turn data into your competitive advantage.