Introduction

The UK vehicle rental market has evolved rapidly over the last few years, driven by travel recovery, changing mobility preferences, and dynamic pricing strategies. Businesses operating in this space require accurate, large-scale intelligence to remain competitive. Extract UK vehicle rental pricing and availability data enables rental brands, travel platforms, and analysts to understand market fluctuations with precision and speed.

By leveraging automation, companies can Extract UK vehicle rental pricing and availability data at scale, transforming millions of price points into actionable insights. From airport rentals to city-based fleets, data-driven intelligence now plays a critical role in optimizing pricing, improving fleet utilization, and forecasting demand with confidence.

Market Expansion and Demand Shifts Across Regions

The UK vehicle rental industry has experienced measurable growth since 2020, with demand rebounding sharply post-pandemic. To support strategic decisions, businesses increasingly rely on Scrape car hire data across the UK to monitor how demand differs across airports, cities, and tourist hubs.

Between 2020 and 2026, regional demand has shifted significantly:

| Year | Avg Daily Rate (£) | Availability (%) | YoY Demand Change |

|---|---|---|---|

| 2020 | 42 | 78 | -35% |

| 2021 | 48 | 72 | +18% |

| 2022 | 61 | 65 | +42% |

| 2023 | 69 | 62 | +21% |

| 2024 | 73 | 60 | +9% |

| 2025* | 76 | 58 | +6% |

| 2026* | 79 | 56 | +5% |

Airport locations consistently show higher price volatility, while suburban areas maintain steadier availability. By capturing nationwide pricing and availability metrics, businesses gain visibility into underserved locations, emerging demand corridors, and optimal fleet distribution opportunities.

Seasonal Pricing Volatility and Consumer Behavior

Pricing in the UK vehicle rental market is highly seasonal, influenced by holidays, weather, and travel surges. Analysis of UK vehicle rental price trends reveals that summer months experience price increases of up to 35% compared to winter lows.

Key insights from 2020–2026 data include:

| Season | Avg Price Increase | Availability Drop |

|---|---|---|

| Summer | +32% | -18% |

| Easter | +21% | -12% |

| Christmas | +26% | -15% |

| Off-season | Baseline | Stable |

Consumers are booking earlier, while last-minute bookings command premium pricing. Continuous pricing intelligence allows rental providers to fine-tune dynamic pricing models, reduce idle fleet time, and respond proactively to market fluctuations rather than reacting after revenue opportunities are missed.

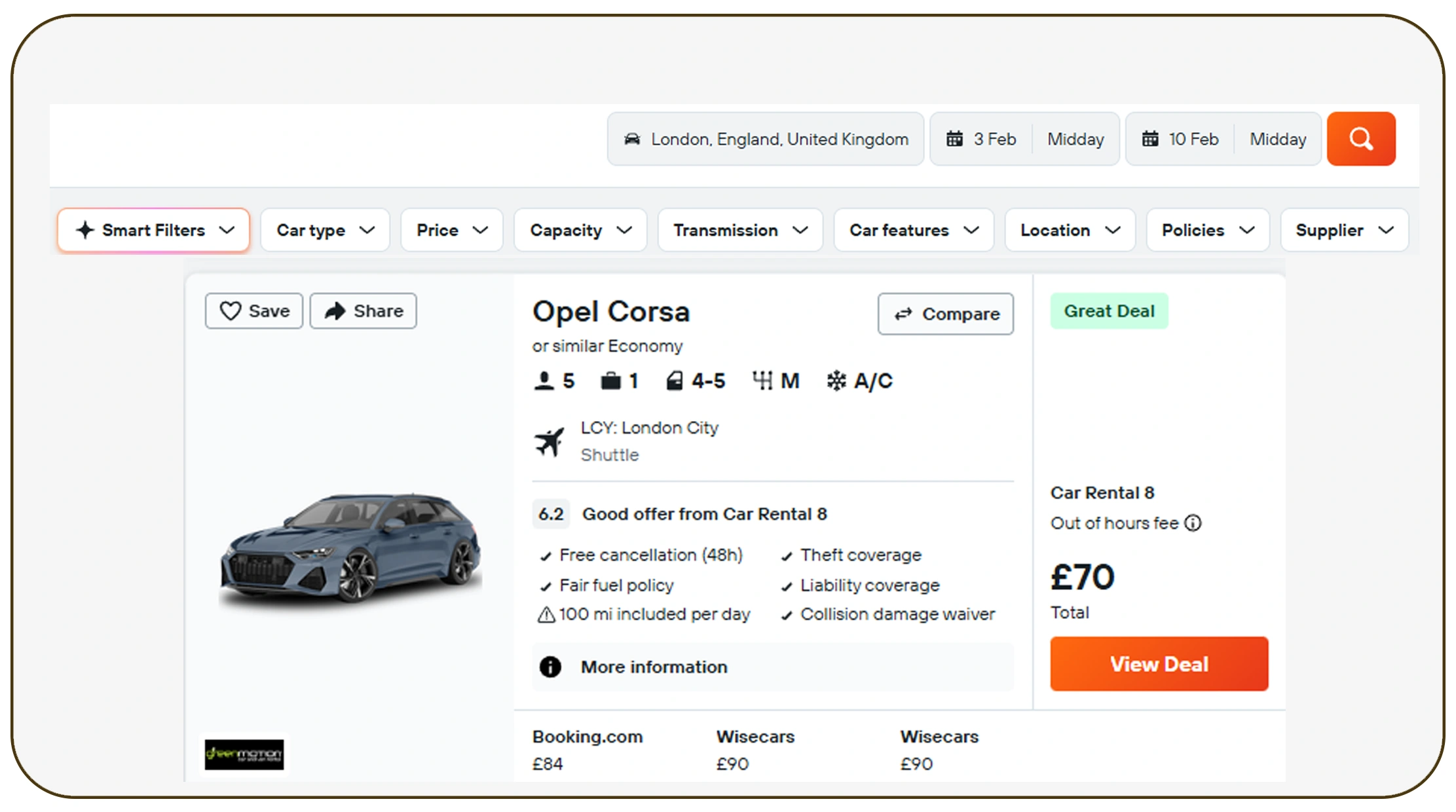

Real-Time Availability and Competitive Intelligence

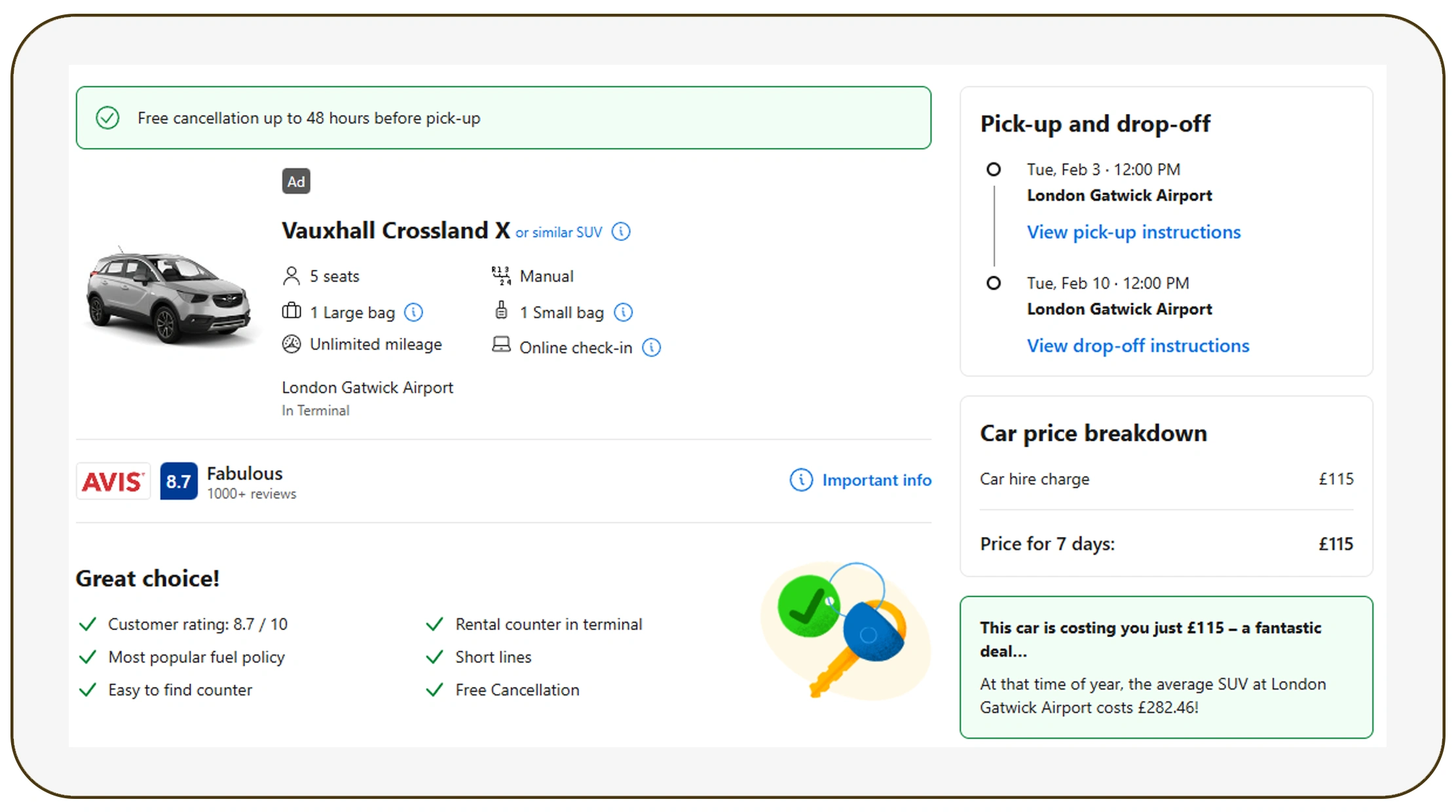

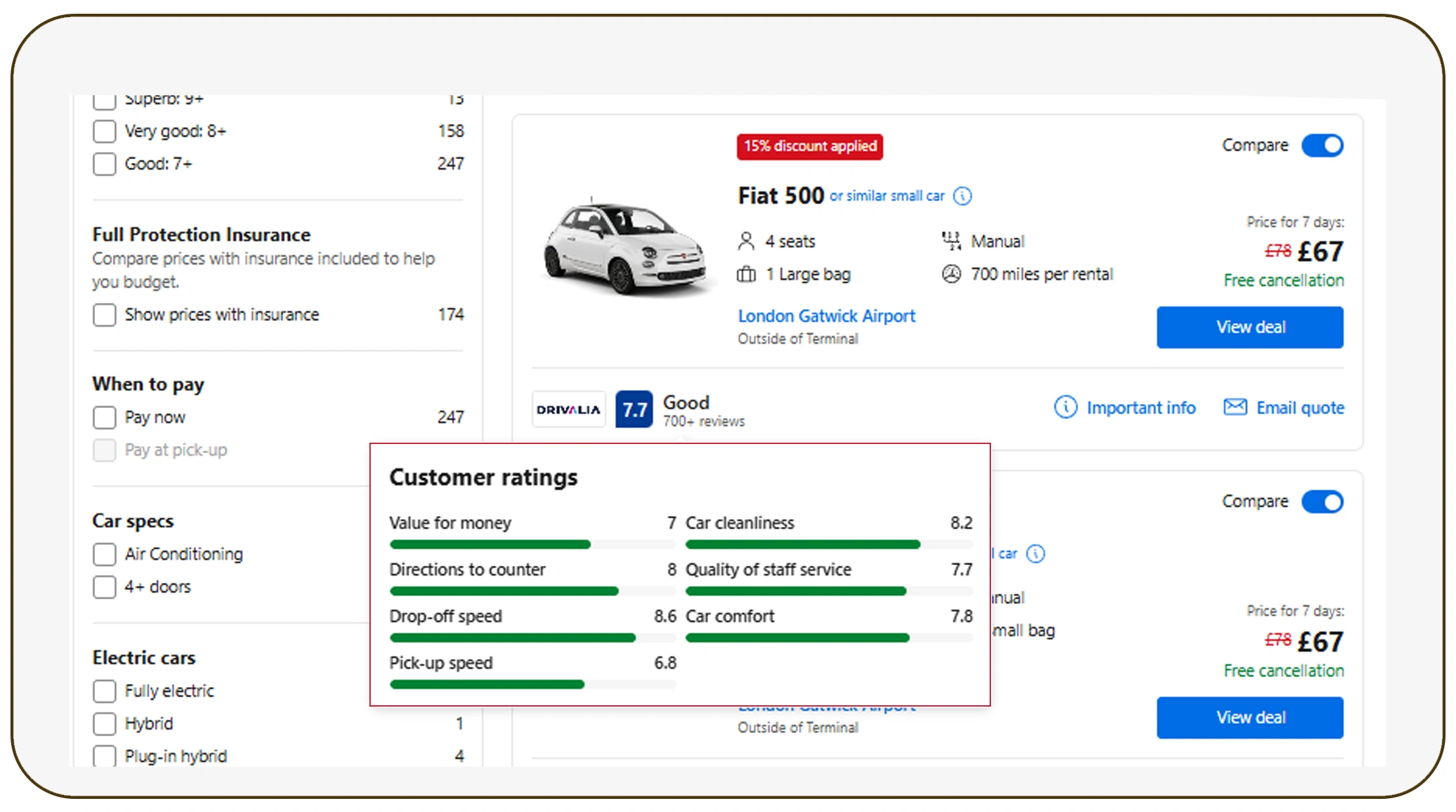

Access to live inventory is now essential for competitive differentiation. With Real-time UK vehicle rental data extraction, businesses can monitor availability changes as they happen, especially during peak demand windows.

From 2022 onwards, real-time tracking revealed:

| Metric | Avg Change |

|---|---|

| Hourly price fluctuation | 6–12% |

| Same-day availability drop | 22% |

| Weekend surge impact | +30% |

This level of granularity empowers pricing teams to adjust rates dynamically, improve customer conversion, and maintain competitiveness across booking platforms.

Data-Driven Insights for Fleet Optimization

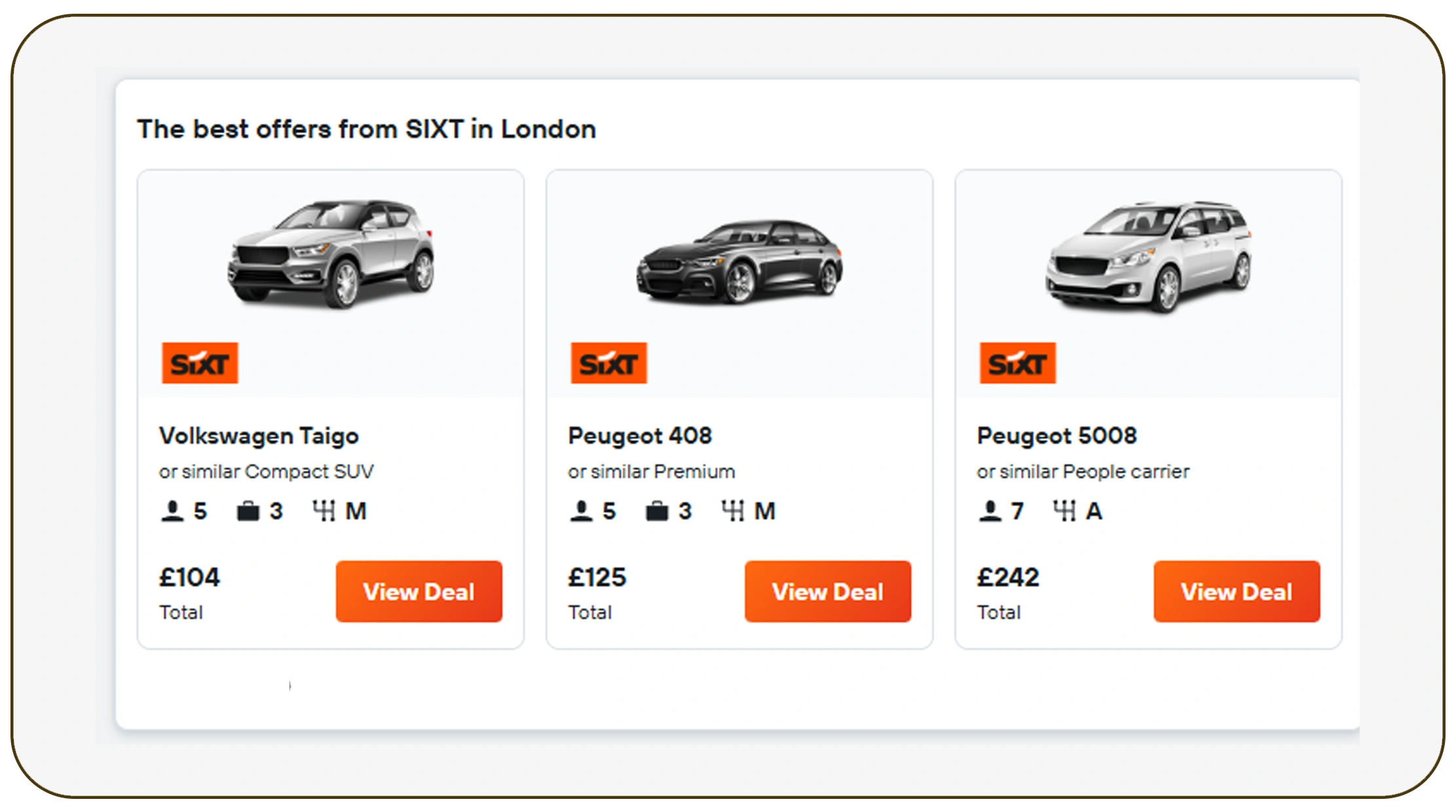

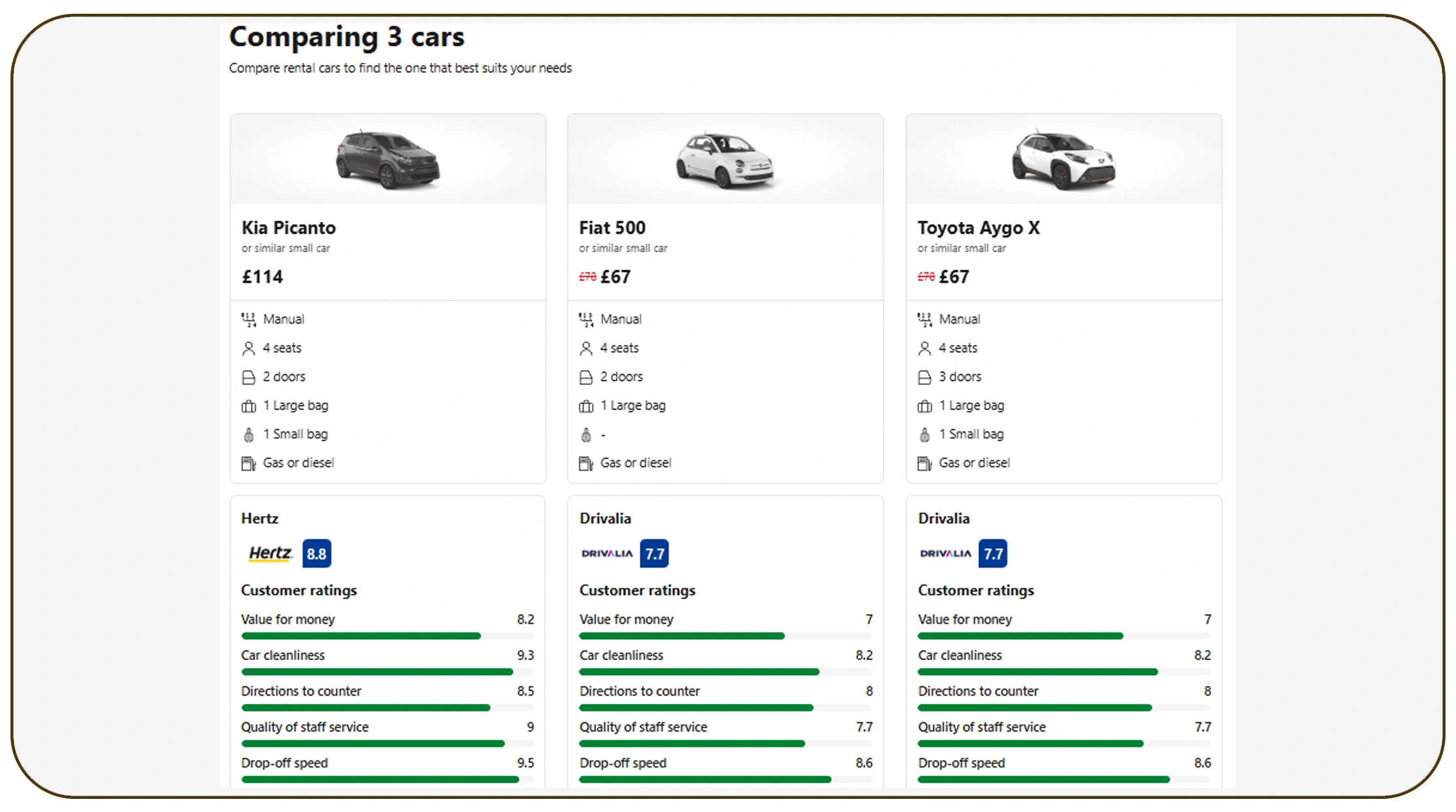

Fleet optimization depends on knowing exactly which vehicles are in demand and where. Using UK vehicle hire data scraping, businesses can analyze vehicle categories, fuel types, and rental duration trends over time.

Key findings from multi-year data analysis:

| Vehicle Type | Demand Share | Growth Rate |

|---|---|---|

| Economy | 46% | +8% |

| Compact | 22% | +6% |

| SUV | 18% | +18% |

| EV | 9% | +31% |

| Luxury | 5% | +4% |

These insights allow operators to realign fleets, reduce maintenance costs, and prioritize high-performing vehicle categories.

Advanced Pricing Models and Forecasting Accuracy

Modern rental pricing strategies depend heavily on predictive analytics. By choosing to Scrape Car Rental Data for Pricing Models, businesses gain historical depth and forecasting accuracy.

Between 2020 and 2026, predictive models built on large-scale pricing datasets improved forecast accuracy by:

| Forecast Area | Accuracy Improvement |

|---|---|

| Seasonal pricing | +24% |

| Fleet utilization | +21% |

| Demand prediction | +27% |

These improvements translate directly into higher margins and reduced operational inefficiencies.

Continuous Monitoring for Competitive Advantage

Ongoing intelligence is critical in a market where prices can change multiple times per day. With automated Price Monitoring, businesses can track competitors, detect anomalies, and maintain rate parity across platforms.

Continuous tracking revealed:

| Monitoring Metric | Avg Value |

|---|---|

| Monthly price changes | 18 |

| Competitive undercut | 7% |

| Conversion uplift | +12% |

Always-on monitoring ensures pricing teams stay ahead rather than reacting late to market changes.

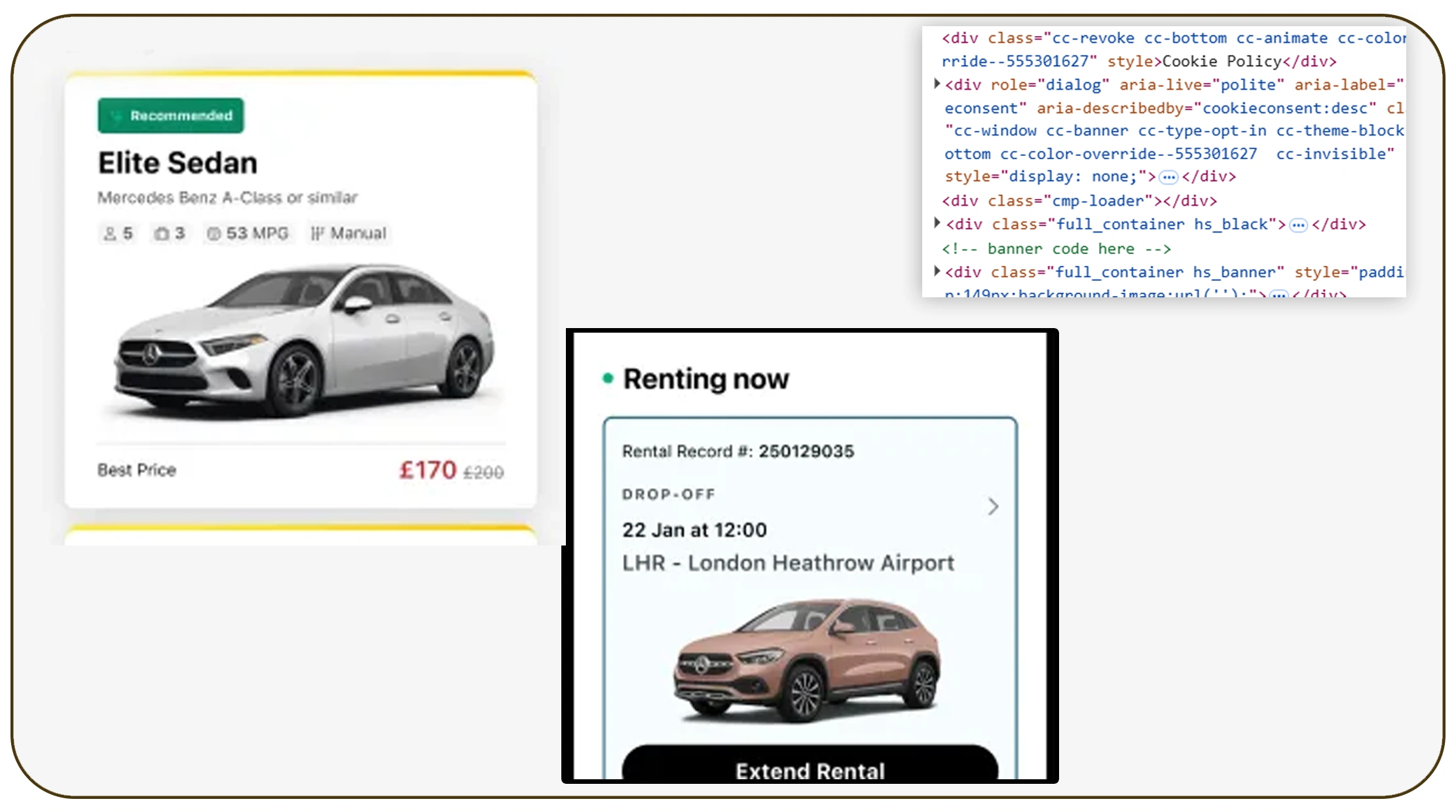

Why Choose Real Data API?

Real Data API delivers scalable, accurate, and compliant data solutions tailored for high-frequency markets like vehicle rentals. With a powerful Web Scraping API, businesses can Extract UK vehicle rental pricing and availability data reliably across platforms, locations, and timeframes.

Key advantages include:

- High-volume data extraction at scale

- Structured, analytics-ready datasets

- Real-time and historical coverage

- Secure delivery via APIs and feeds

- Custom scheduling and monitoring

Real Data API enables businesses to move from raw data collection to actionable intelligence without operational complexity.

Conclusion

The UK vehicle rental market demands precision, speed, and scale. By leveraging Live Crawler Services, businesses can continuously Extract UK vehicle rental pricing and availability data, unlocking real-time insights that drive smarter pricing, better fleet utilization, and sustained competitive advantage.

Power your pricing strategy with Real Data API — start extracting real-time UK vehicle rental intelligence today!