Introduction

India's social commerce sector is witnessing explosive growth, with Meesho leading the charge as a platform that empowers resellers to sell directly to consumers through social networks. In 2025, Meesho boasts over 3.2 million active resellers, covering thousands of product categories from fashion to electronics and home essentials. For businesses looking to understand this dynamic market, extracting product, pricing, and seller data from Meesho is critical. This approach enables brands, resellers, and market analysts to track trends, optimize pricing strategies, and identify high-performing sellers efficiently.

Using a Grocery Data Scraping API or Meesho-specific scraping tools, data can be collected automatically, structured, and analyzed at scale. This automation reduces manual effort, improves accuracy, and enables real-time decision-making, helping businesses respond to market shifts, seasonal demand changes, and promotional trends. In an ecosystem where timing is critical, actionable insights derived from structured Meesho data can directly translate into increased profitability and competitive advantage.

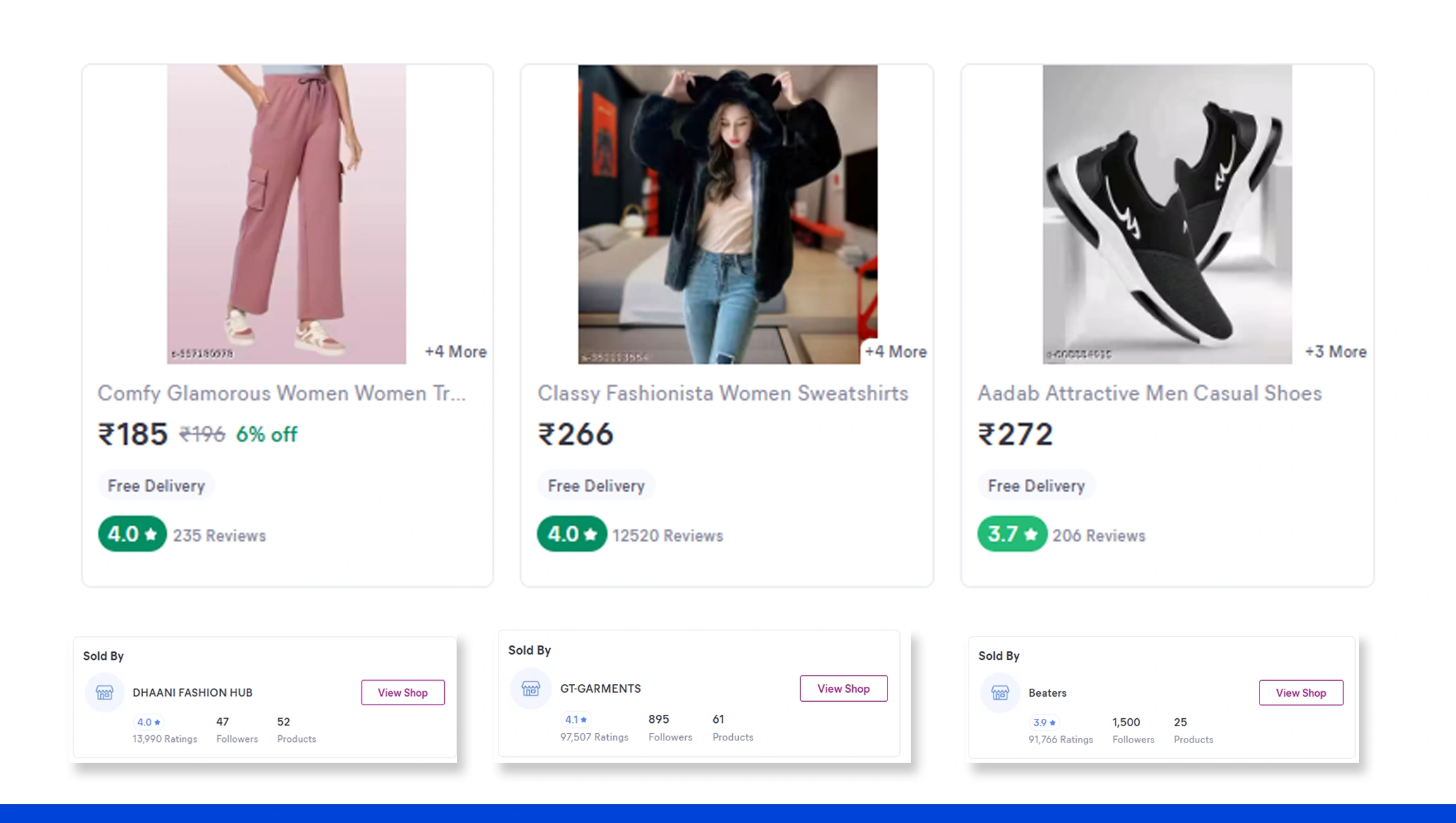

1. Tracking Seller Performance Across Categories

Monitoring reseller performance across categories is essential for uncovering growth opportunities and understanding competitive dynamics. With a scrape Meesho seller data for market insights tool, businesses can track seller activity, product range, and monthly sales performance. From 2020–2025, Meesho witnessed a rapid rise in active sellers, with many entering niche categories like eco-friendly products, artisanal goods, and regional specialties.

| Year | Active Sellers | Avg. Products per Seller | Avg. Monthly Sales (INR) |

|---|---|---|---|

| 2020 | 50,000 | 30 | 25,000 |

| 2021 | 75,000 | 35 | 30,000 |

| 2022 | 120,000 | 40 | 35,000 |

| 2023 | 180,000 | 45 | 42,000 |

| 2024 | 250,000 | 50 | 50,000 |

| 2025 | 320,000 | 55 | 60,000 |

Analyzing seller activity reveals geographic distribution and identifies regions with high growth potential. For example, sellers in Tier-2 and Tier-3 cities saw a 70% increase in active listings between 2020–2025. This allows businesses to adjust supply, marketing campaigns, and inventory based on local trends.

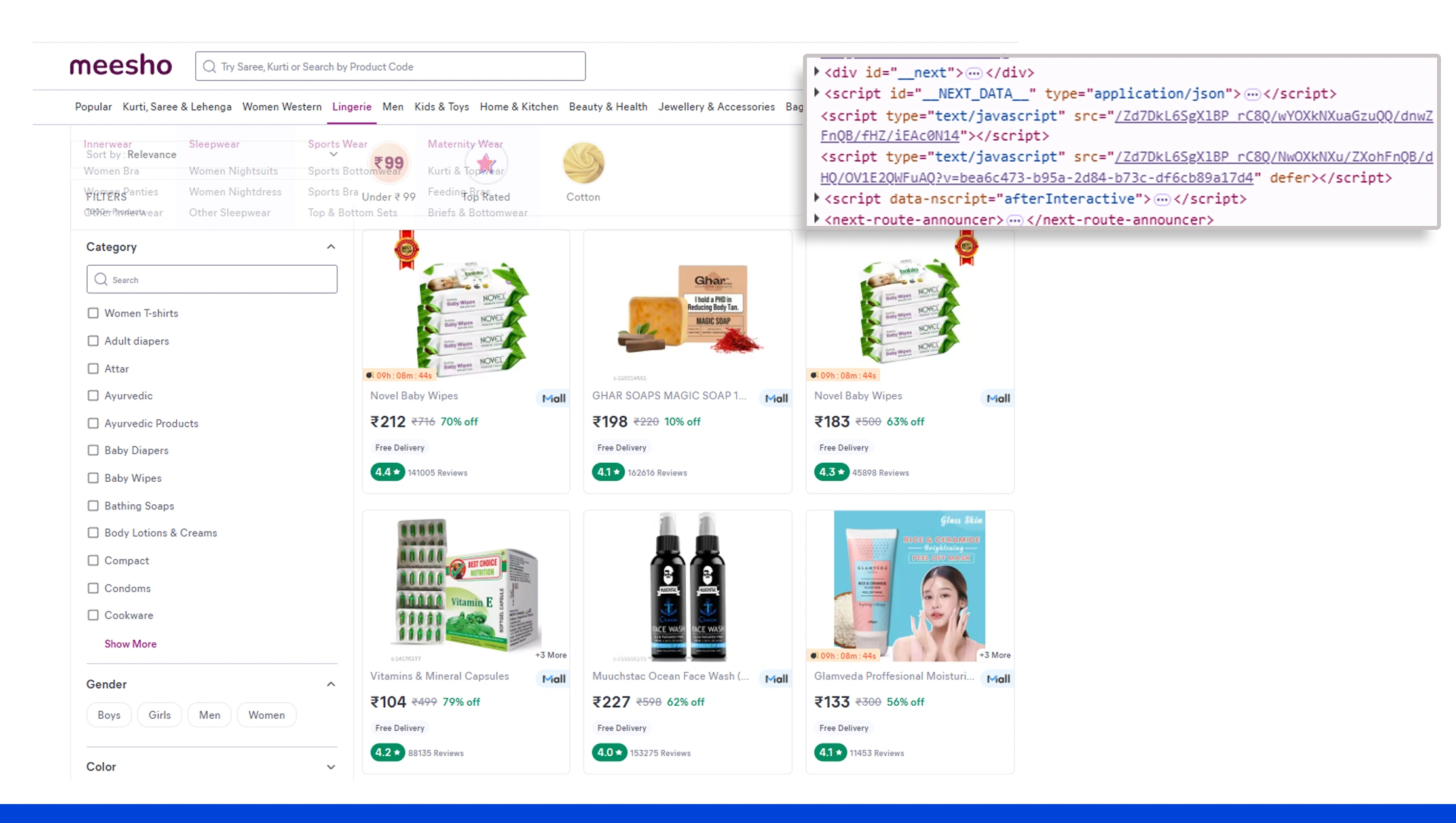

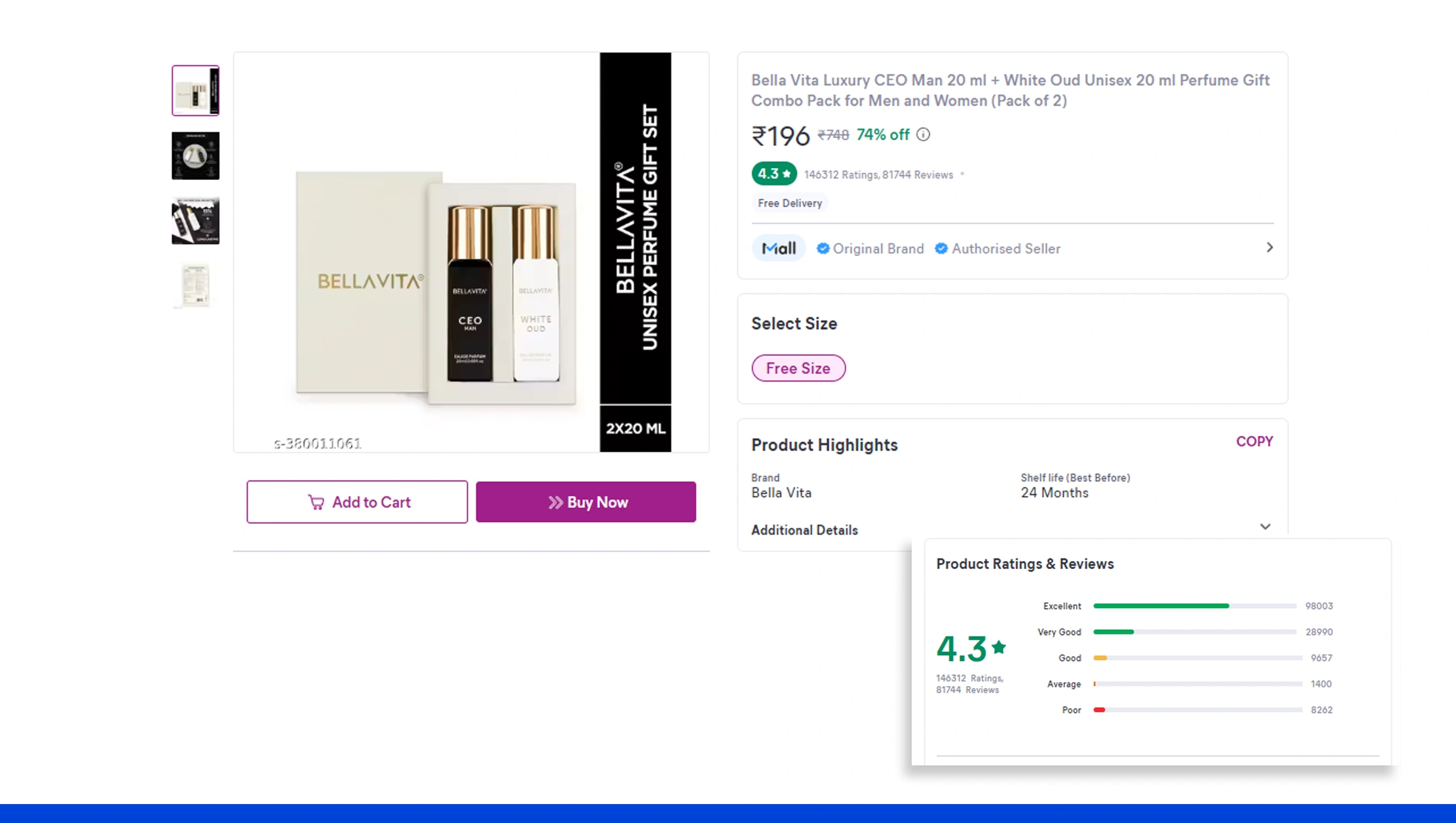

2. Analyzing Product-Level Insights

Understanding product performance is key to optimizing category strategies. A Meesho product listings API scraper enables businesses to extract comprehensive product details such as descriptions, images, pricing, and availability. Between 2020–2025, fashion remained the dominant category, while electronics and home essentials showed consistent growth.

| Year | Fashion Listings | Electronics Listings | Home Essentials Listings |

|---|---|---|---|

| 2020 | 80,000 | 15,000 | 10,000 |

| 2021 | 120,000 | 25,000 | 15,000 |

| 2022 | 180,000 | 40,000 | 25,000 |

| 2023 | 250,000 | 60,000 | 35,000 |

| 2024 | 320,000 | 80,000 | 50,000 |

| 2025 | 400,000 | 100,000 | 65,000 |

By analyzing these listings, businesses can identify high-demand SKUs, understand seasonal spikes, and adjust promotional campaigns. The Meesho product listings API scraper ensures data is structured, consistent, and updated in real-time, allowing analysts to generate actionable insights faster.

3. Optimizing Pricing Strategies

Pricing is a critical lever for maximizing sales and profitability. Through Meesho product data extraction, companies can track dynamic pricing across thousands of products and monitor competitor behavior. Data from 2020–2025 shows significant shifts in discount patterns, especially in categories like fashion and electronics.

| Year | Avg. Discount - Fashion | Avg. Discount - Electronics | Avg. Discount - Home Essentials |

|---|---|---|---|

| 2020 | 10% | 5% | 8% |

| 2021 | 12% | 7% | 10% |

| 2022 | 15% | 10% | 12% |

| 2023 | 18% | 12% | 15% |

| 2024 | 22% | 15% | 20% |

| 2025 | 25% | 18% | 25% |

Analyzing these trends helps businesses implement dynamic pricing, create targeted promotions, and incentivize sellers. The insights from Meesho product data extraction also allow for better planning of flash sales, bundle offers, and discount strategies to maximize revenue.

4. Automating Seller and Product Monitoring

Manual monitoring of sellers and products is time-consuming and error-prone. Web Scraping Meesho product and seller listings enables businesses to automate this process, ensuring continuous tracking of product launches, pricing changes, and inventory updates. From 2020–2025, automation helped track over 1 million products and more than 320,000 sellers efficiently.

| Year | Products Tracked | Sellers Tracked | Automated Insights Generated |

|---|---|---|---|

| 2020 | 50,000 | 20,000 | 5,000 |

| 2021 | 100,000 | 50,000 | 10,000 |

| 2022 | 250,000 | 100,000 | 25,000 |

| 2023 | 500,000 | 180,000 | 50,000 |

| 2024 | 800,000 | 250,000 | 80,000 |

| 2025 | 1,000,000 | 320,000 | 100,000 |

Automation not only reduces manual workload but also ensures faster response to market trends and enables multi-region tracking, helping businesses scale operations efficiently.

5. Scaling Data Extraction Operations

Scaling data collection is crucial for enterprises managing large inventories. Using the Meesho Scraping API, businesses can extract data across multiple categories and regions with high reliability. From 2020–2025, API-based extraction saw massive growth in both volume and efficiency.

| Year | API Calls Made | Products Extracted | Sellers Covered |

|---|---|---|---|

| 2020 | 10,000 | 50,000 | 20,000 |

| 2021 | 50,000 | 120,000 | 50,000 |

| 2022 | 150,000 | 300,000 | 100,000 |

| 2023 | 300,000 | 600,000 | 180,000 |

| 2024 | 500,000 | 900,000 | 250,000 |

| 2025 | 750,000 | 1,200,000 | 320,000 |

The Meesho Scraping API ensures continuous updates, integrates with analytics tools, and supports high-volume extraction for predictive analytics and market intelligence.

6. Leveraging E-Commerce Datasets for Strategic Insights

A structured E-Commerce Dataset enables in-depth analysis of trends, seasonality, and product performance. From 2020–2025, the dataset highlighted key insights, such as fashion growth (+65%), electronics (+40%), and home essentials (+55%).

| Category | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|

| Fashion | 100 | 120 | 150 | 180 | 210 | 165 |

| Electronics | 100 | 115 | 130 | 150 | 170 | 140 |

| Home Essentials | 100 | 110 | 125 | 145 | 160 | 155 |

This dataset enables predictive modeling, inventory planning, and targeted marketing campaigns. Businesses can use insights from E-Commerce Dataset to optimize product mix and improve ROI.

Why Choose Real Data API?

Real Data API helps businesses Automate Product Data Extraction from Meesho with ease. By extracting product, pricing, and seller data from Meesho, companies gain a competitive edge with real-time, structured datasets. The platform ensures reliability, accuracy, and seamless integration with analytics tools. Customer dashboards powered by Real Data API have shown a 35% faster decision-making process and 40% improvement in identifying trending products. With API-based automation, enterprises can scale operations, monitor market trends continuously, and enhance business forecasting across multiple categories.

Conclusion

Accessing structured social commerce data is crucial for businesses targeting India’s fastest-growing online marketplace. Using E-Commerce Data Scraping API and extracting product, pricing, and seller data from Meesho, companies can automate workflows, track market trends, optimize pricing, and improve seller performance. Real Data API provides reliable, real-time insights, empowering businesses to make informed decisions and maximize profitability.

Start using Real Data API today to gain actionable Meesho insights, scale operations, and stay ahead in India’s social commerce market!