Introduction

The real estate market has witnessed remarkable transformations over the past few years, driven by urban expansion, technological innovations, and evolving buyer preferences. Accurate property insights are crucial for investors, analysts, and developers to make data-driven decisions. Leveraging the LandWatch Property data extraction for price insights enables businesses to analyse pricing trends, inventory levels, and emerging hotspots. Through a Web Scraping Real Estate Data API, stakeholders can collect real-time and historical property data to identify market opportunities and mitigate risks. By automating data collection and processing, property professionals gain access to structured, reliable datasets that streamline strategy planning.

Tracking Market Trends Efficiently

Using advanced tools, analysts can scrape LandWatch property listings for analytics, uncovering pricing patterns and sales velocity across regions. Between 2020 and 2025, the US property market saw a 35% increase in suburban listings, while urban high-demand areas witnessed only 18% growth, reflecting a shift in buyer preference toward space and affordability.

| Year | Urban Listings | Suburban Listings | Price Index (USD) |

|---|---|---|---|

| 2020 | 4,500 | 3,200 | 320 |

| 2021 | 4,700 | 3,800 | 335 |

| 2022 | 4,850 | 4,100 | 360 |

| 2023 | 5,000 | 4,500 | 380 |

| 2024 | 5,100 | 4,750 | 400 |

| 2025 | 5,200 | 5,000 | 420 |

Scraping listings at scale allows investors to compare property types, average prices, and time-on-market metrics, revealing actionable insights for investment decisions. For example, single-family homes in emerging suburbs showed a 28% faster turnover than downtown condos, suggesting lucrative investment areas.

Unlocking Property Analytics

By using Extract Property insights via LandWatch API, analysts can delve into property attributes like square footage, lot size, amenities, and local school ratings. Data from 2020-2025 reveals that homes with modern amenities experienced a 22% higher average price appreciation.

| Year | Avg. Sq. Ft | Avg. Lot Size | Amenities Score | Price Appreciation (%) |

|---|---|---|---|---|

| 2020 | 1,800 | 0.25 acres | 7.5 | 5 |

| 2021 | 1,820 | 0.27 acres | 7.8 | 6 |

| 2022 | 1,850 | 0.30 acres | 8.0 | 7 |

| 2023 | 1,900 | 0.32 acres | 8.2 | 8 |

| 2024 | 1,950 | 0.35 acres | 8.5 | 10 |

| 2025 | 2,000 | 0.38 acres | 8.8 | 12 |

This extraction enables comprehensive evaluation of property value drivers and assists in predicting market movement, highlighting the importance of real-time property intelligence in strategic planning.

Optimizing Investment Decisions

The LandWatch property data extractor simplifies the process of compiling historical price trends, neighbourhood statistics, and investment hotspots. Between 2020 and 2025, the average ROI on suburban properties increased from 6% to 11%, while urban condos remained steady at around 7%.

| Year | Suburban ROI (%) | Urban ROI (%) | Avg. Days on Market |

|---|---|---|---|

| 2020 | 6 | 7 | 45 |

| 2021 | 7 | 7 | 42 |

| 2022 | 8 | 7 | 40 |

| 2023 | 9 | 7 | 38 |

| 2024 | 10 | 7 | 36 |

| 2025 | 11 | 7 | 34 |

Investors using this extractor can compare ROI across regions, evaluate property types, and anticipate high-demand areas, making data-driven investment choices more precise and profitable.

Real-Time Market Surveillance

The LandWatch API scraper allows continuous monitoring of property listings, ensuring updated information on price changes, new inventory, and local market conditions. Analysis shows that from 2020 to 2025, properties in tech-driven metro areas appreciated 15% faster than the national average, reflecting the influence of economic growth on pricing.

| Year | Listings Added | Avg. Price Increase (%) | Tech Hub Growth Rate (%) |

|---|---|---|---|

| 2020 | 7,500 | 5 | 8 |

| 2021 | 8,000 | 6 | 9 |

| 2022 | 8,200 | 7 | 10 |

| 2023 | 8,400 | 8 | 11 |

| 2024 | 8,600 | 9 | 12 |

| 2025 | 8,800 | 10 | 13 |

By leveraging the API scraper, property analysts can automate monitoring workflows, identify emerging investment opportunities, and react promptly to market fluctuations.

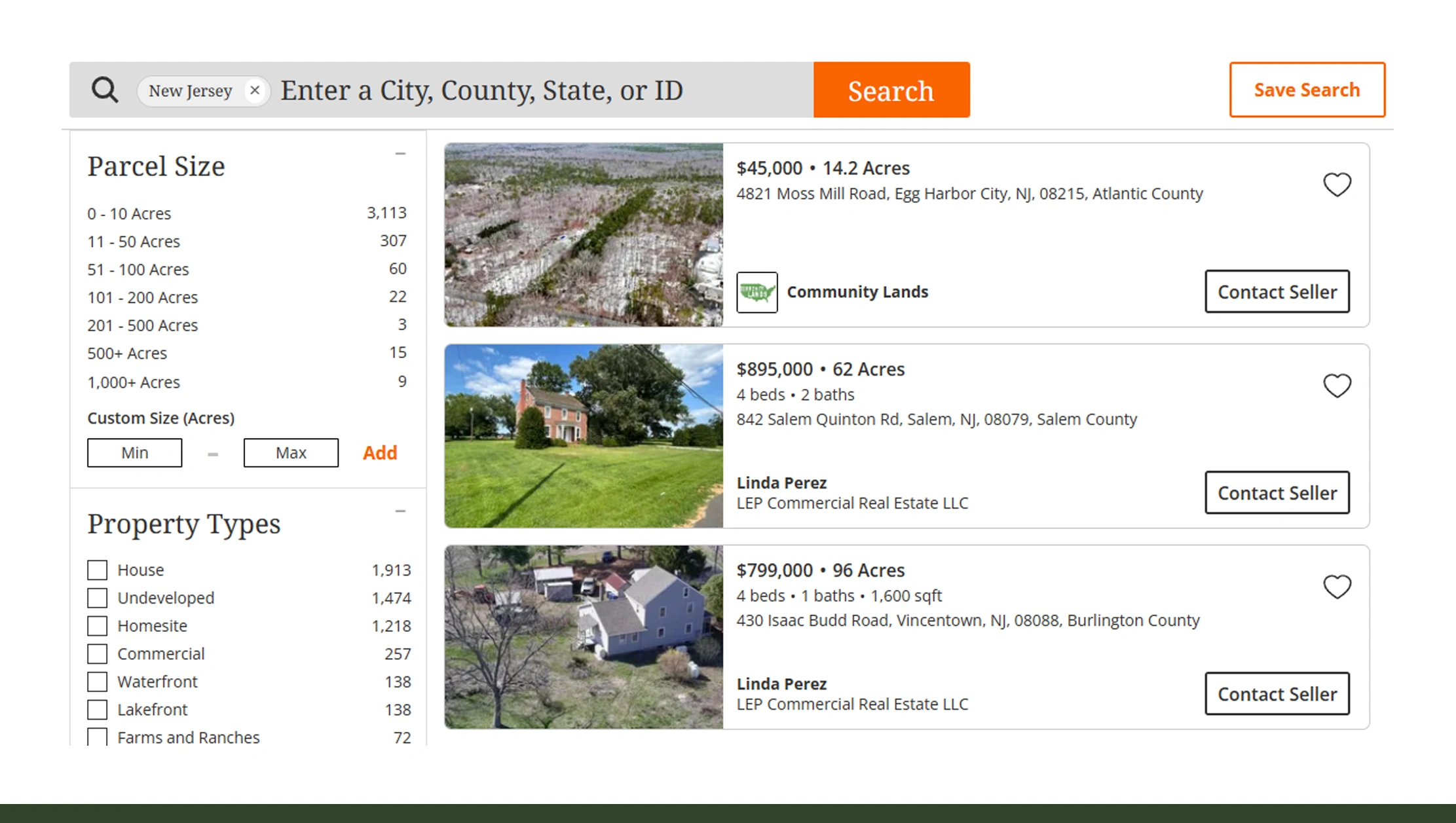

Comprehensive Listings Analysis

With the LandWatch listings dataset, businesses can explore detailed property records, including historical pricing, sale timelines, property type distributions, and local amenities. Data between 2020-2025 shows that single-family homes accounted for 60% of suburban listings, while urban condos represented 45% of city inventories.

| Property Type | 2020 (%) | 2021 (%) | 2022 (%) | 2023 (%) | 2024 (%) | 2025 (%) |

|---|---|---|---|---|---|---|

| Single-Family | 55 | 56 | 57 | 58 | 59 | 60 |

| Condo | 40 | 41 | 42 | 43 | 44 | 45 |

| Townhouse | 5 | 3 | 1 | 1 | 2 | 3 |

The dataset allows detailed segmentation of properties by type, location, and price band, enabling deeper analytics for pricing strategies, investment planning, and competitive benchmarking.

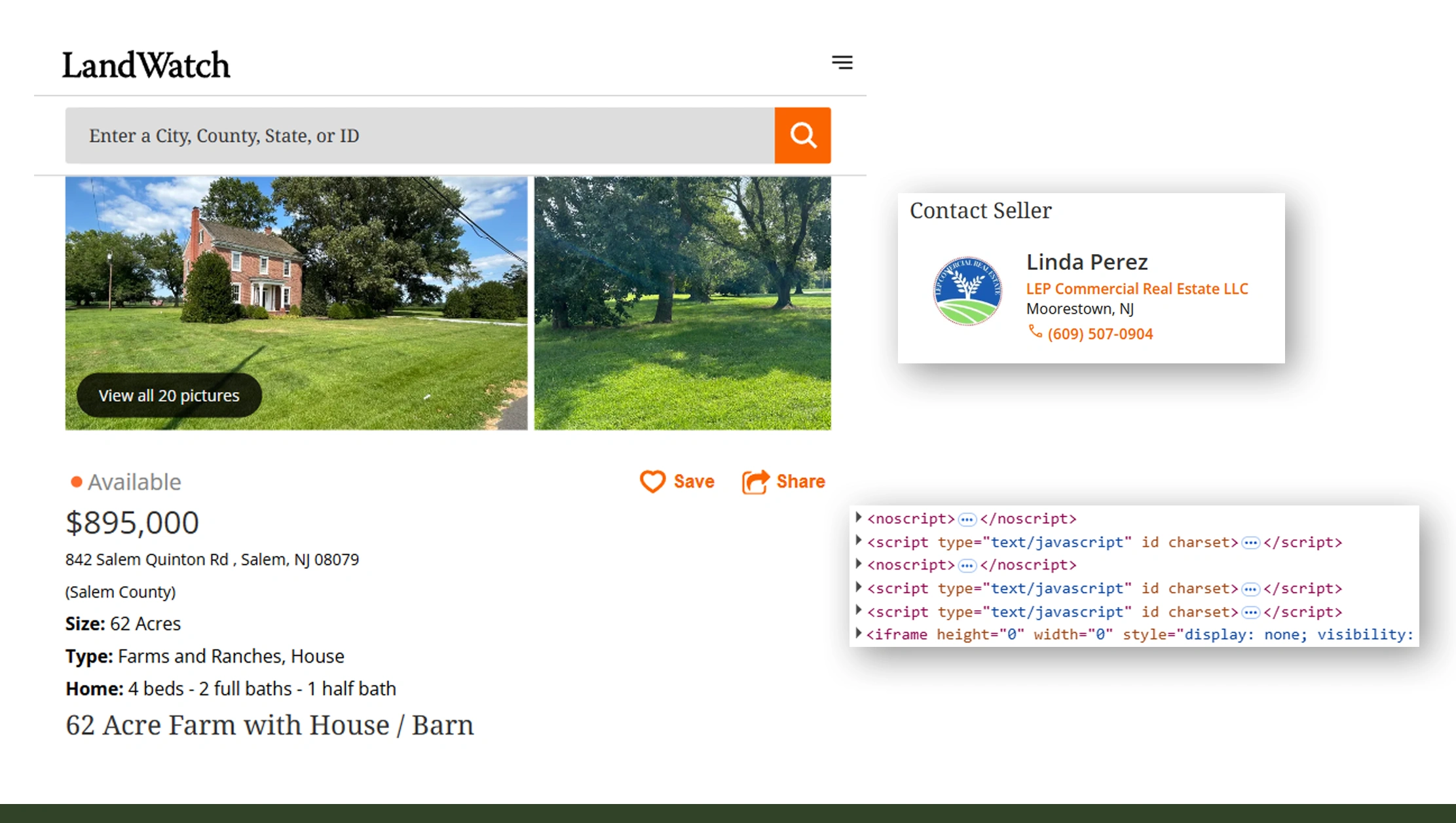

Automating Data Collection

A LandWatch Data Scraping API ensures automated, large-scale property data collection with minimal manual intervention. Real-time updates from 2020-2025 indicate that price volatility in emerging suburbs was 12%, while established urban regions remained at 5%, highlighting the need for timely insights.

| Year | Suburban Price Volatility (%) | Urban Price Volatility (%) | Avg. Listing Count |

|---|---|---|---|

| 2020 | 10 | 5 | 7,000 |

| 2021 | 11 | 5 | 7,200 |

| 2022 | 12 | 5 | 7,400 |

| 2023 | 12 | 5 | 7,600 |

| 2024 | 12 | 5 | 7,800 |

| 2025 | 12 | 5 | 8,000 |

Using this API, stakeholders can maintain continuous access to property insights, integrate data into analytics platforms, and support dynamic pricing and investment decisions with precision.

Why Choose Real Data API?

The Real Estate Dataset offered by Real Data API provides unparalleled accuracy, coverage, and scalability. By integrating historical and real-time property intelligence, businesses can track trends, analyse competitive landscapes, and forecast market movements. Structured datasets help investors, developers, and analysts monitor ROI, emerging hotspots, and neighbourhood-level price dynamics. Real Data API supports automation, bulk extraction, and seamless integration with dashboards and analytics tools. With reliable property intelligence, organisations can minimise risks, improve strategic planning, and gain a competitive advantage in real estate markets across the United States.

Conclusion

Harnessing Dynamic Pricing and leveraging LandWatch Property data extraction for price insights enables stakeholders to make informed, data-driven decisions. From historical trend analysis to real-time market monitoring, automated data collection through APIs and scrapers ensures accurate insights for smarter investment, pricing, and development strategies. Unlock your property market potential today by integrating reliable, large-scale property intelligence into your operations and strategy planning.

Get started with Real Data API now – access comprehensive property datasets, automate analytics, and transform your real estate strategy with precision and confidence.