Introduction

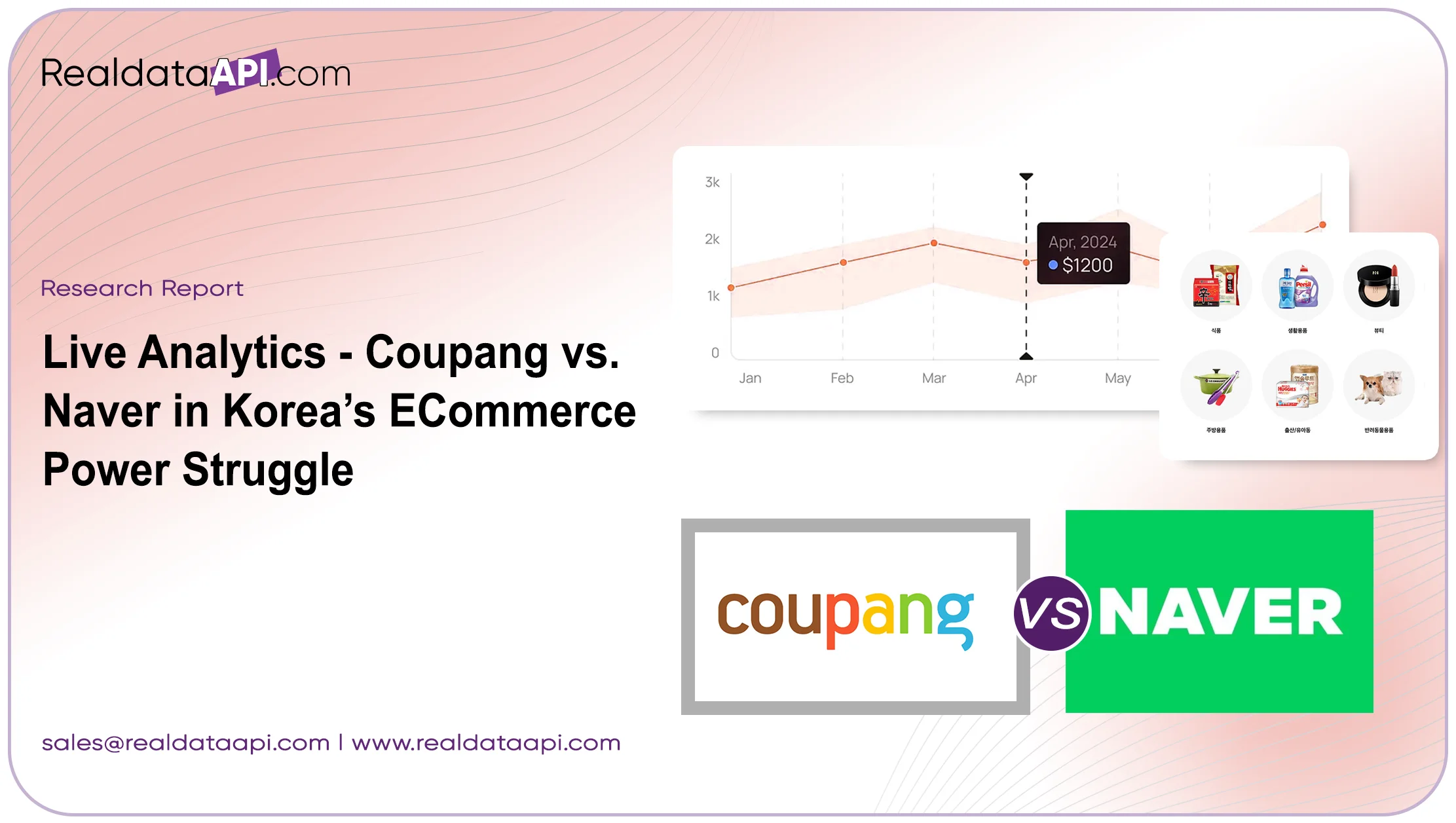

The Korean e-commerce market has become a fierce battleground, with Coupang vs Naver dominating the competition. As we move towards 2025, brands and investors need reliable, real-time eCommerce intelligence Korea to understand how these two giants are shaping consumer behavior, market share, and innovation. This Research Report uses Live eCommerce data Korea to break down the shifting trends, spending patterns, and customer insights defining the Coupang vs Naver rivalry. For brands looking to expand in Korea, staying updated on South Korea eCommerce trends 2025 and using tools to Scrape Naver Product Data is no longer optional — it’s essential. This study highlights key metrics for Coupang vs Naver online sales, Naver vs Coupang eCommerce performance, and Coupang vs Naver customer insights so you can strategize better with data-driven confidence.

Real-Time E Commerce Intelligence for South Korea’s Market

The battle of Coupang vs Naver is redefining South Korea’s online retail landscape. As the country moves towards a projected $300 billion market, understanding South Korea eCommerce trends 2025 is critical for brands, retailers, and investors. This live analysis reveals how Coupang vs Naver online sales have shifted over five years, highlighting the fierce competition and innovations that keep them at the top.

While Coupang leads with ultra-fast Rocket Delivery and high retention, Naver leverages its massive ecosystem to boost Smart Stores and influencer-driven shopping. Comparing Naver vs Coupang eCommerce performance reveals how content, ads, and social shopping fuel Naver’s rapid rise.

Access to Live eCommerce data Korea and clear Coupang vs Naver customer insights empowers brands to optimize pricing, promotions, and product listings. Using Real-time eCommerce intelligence Korea, businesses can identify gaps, monitor cross-border trends, and adapt to buyer behavior faster than ever.

To beat this competition, you must track every move. Want deeper product-level insights? Use Scrape Naver Product Data tools or advanced Naver Product Data Scraping solutions to stay ahead of trends, pricing shifts, and customer sentiment in real time. The Coupang vs Naver race is on — are you watching?

Gross Merchandise Value (GMV) — Coupang vs. Naver

| Year | Coupang GMV (in billion USD) | Naver GMV (in billion USD) |

|---|---|---|

| 2020 | 12.1 | 7.8 |

| 2021 | 18.3 | 10.2 |

| 2022 | 22.5 | 14.1 |

| 2023 | 26.7 | 18.5 |

| 2024 | 29.4 | 22.9 |

| 2025 | 33.2 | 28.4 |

Analysis:

The GMV data highlights Coupang’s aggressive expansion, driven by Rocket Delivery and exclusive vendor partnerships. Naver’s steady climb comes from Smart Store and Live Commerce. The Coupang vs Naver GMV gap shrinks from 55% in 2020 to just 17% in 2025, showing Naver’s persistent push into online retail dominance.

Active Users — Coupang vs. Naver

| Year | Coupang Active Users (million) | Naver Active Users (million) |

|---|---|---|

| 2020 | 24 | 18 |

| 2021 | 30 | 21 |

| 2022 | 35 | 25 |

| 2023 | 40 | 30 |

| 2024 | 44 | 35 |

| 2025 | 48 | 40 |

Analysis:

Coupang has consistently led in user numbers thanks to its logistics loyalty. Naver’s active users are catching up due to aggressive influencer marketing and content shopping integration. By 2025, the Coupang vs Naver user gap reduces to 8 million, underlining how content-driven commerce attracts new customers daily.

Average Order Value (AOV) — Coupang vs. Naver

| Year | Coupang Avg Order Value (USD) | Naver Avg Order Value (USD) |

|---|---|---|

| 2020 | 37 | 29 |

| 2021 | 39 | 32 |

| 2022 | 42 | 35 |

| 2023 | 44 | 38 |

| 2024 | 46 | 40 |

| 2025 | 48 | 42 |

Analysis :

Coupang’s higher AOV shows its hold over big-ticket and bulk household orders, while Naver’s surge is driven by premium categories like luxury skincare and fashion. By 2025, Naver’s AOV is 87% of Coupang’s, proving its success in upselling within Korea’s growing premium segment.

Seller Count — Coupang vs. Naver

| Year | Coupang Seller Count (thousands) | Naver Seller Count (thousands) |

|---|---|---|

| 2020 | 150 | 400 |

| 2021 | 180 | 470 |

| 2022 | 210 | 520 |

| 2023 | 240 | 580 |

| 2024 | 270 | 620 |

| 2025 | 300 | 670 |

Analysis:

Naver’s Smart Store ecosystem has made it a clear favorite for small businesses and micro sellers. Coupang focuses more on brand-led or bulk sellers. This seller count trend reveals that for long-tail products, Naver dominates. This makes Scrape Naver Product Data vital for competitive assortment tracking.

Product Return Rates — Coupang vs. Naver

| Year | Coupang Return Rate (%) | Naver Return Rate (%) |

|---|---|---|

| 2020 | 6.5 | 5.2 |

| 2021 | 6.3 | 5.4 |

| 2022 | 6.0 | 5.5 |

| 2023 | 5.8 | 5.5 |

| 2024 | 5.6 | 5.4 |

| 2025 | 5.5 | 5.3 |

Analysis:

Both players steadily lowered return rates with better quality control and smarter recommendations. Coupang’s marginally higher rate is due to its high volumes and riskier fast shipping on fragile items. For brands, monitoring return trends through Coupang vs Naver customer insights is crucial to reduce logistics costs.

Average Delivery Time — Coupang vs. Naver

| Year | Coupang Avg Delivery Time (hrs) | Naver Avg Delivery Time (hrs) |

|---|---|---|

| 2020 | 24 | 36 |

| 2021 | 20 | 32 |

| 2022 | 18 | 28 |

| 2023 | 16 | 24 |

| 2024 | 14 | 20 |

| 2025 | 12 | 18 |

Analysis:

Coupang’s legendary Rocket Delivery keeps its average delivery time shorter by 6–12 hours versus Naver’s. However, Naver’s same-day delivery pilots and smart partnerships show clear improvements. By 2025, the delivery race stays key for Naver vs Coupang eCommerce performance as consumers expect near-instant fulfillment.

Advertising Revenue — Coupang vs. Naver

| Year | Coupang Ad Revenue (million USD) | Naver Ad Revenue (million USD) |

|---|---|---|

| 2020 | 250 | 350 |

| 2021 | 300 | 420 |

| 2022 | 370 | 500 |

| 2023 | 420 | 580 |

| 2024 | 480 | 650 |

| 2025 | 550 | 720 |

Analysis:

Naver’s search engine backbone fuels massive ad revenue, giving it a lead. Coupang’s sponsored listings are catching up, boosting margins. By 2025, ads will be a major profit lever for both. Brands depend on Live eCommerce data Korea to invest smartly in these ad ecosystems.

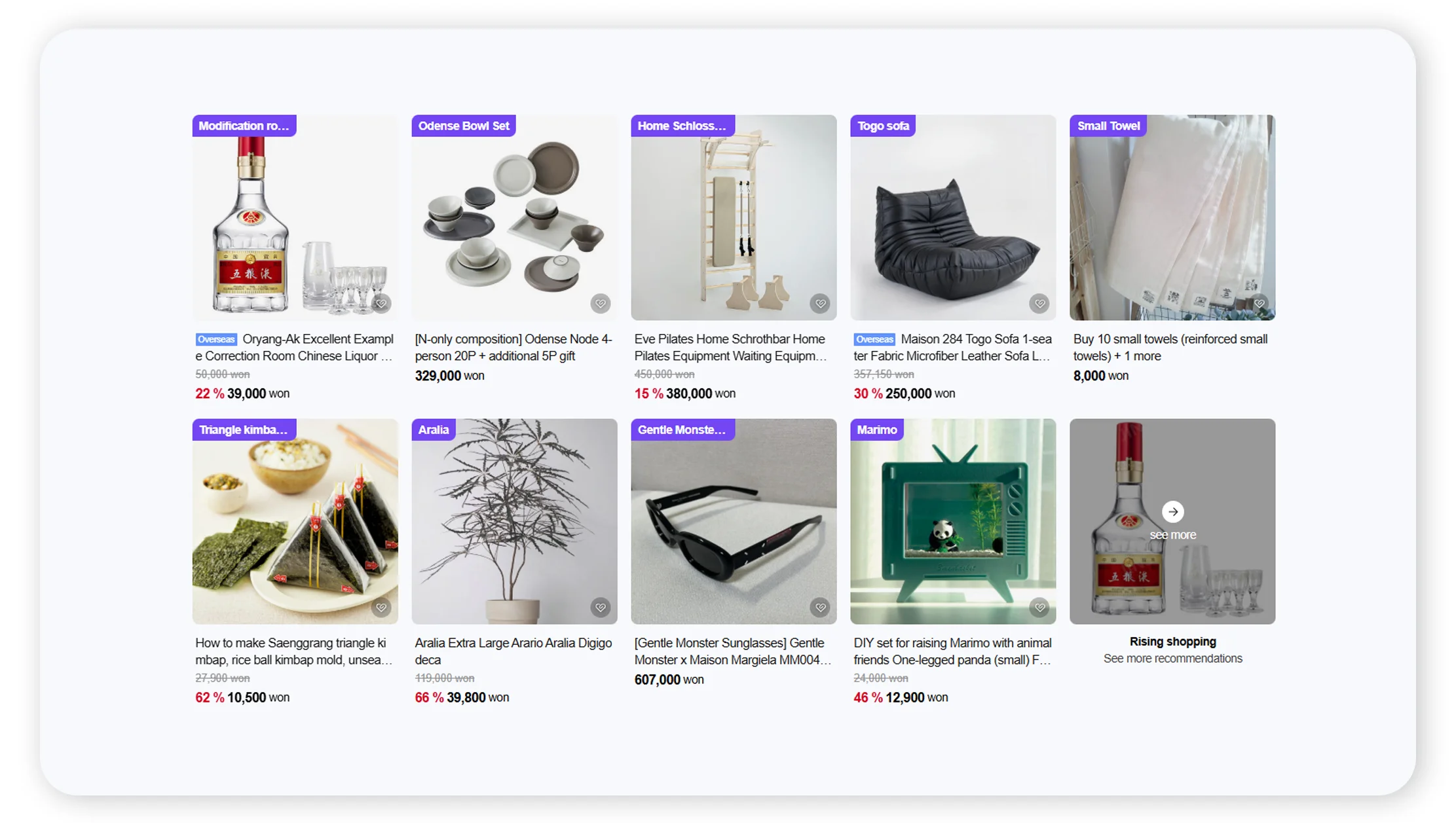

Mobile App Ranking — Coupang vs. Naver

| Year | Coupang App Rank | Naver App Rank |

|---|---|---|

| 2020 | 1 | 3 |

| 2021 | 1 | 2 |

| 2022 | 1 | 2 |

| 2023 | 1 | 2 |

| 2024 | 1 | 2 |

| 2025 | 1 | 2 |

Analysis:

Coupang holds Korea’s #1 shopping app spot thanks to convenience and daily orders. Naver jumped to second place by blending shopping with content and social. For user engagement, both ecosystems are sticky, which means brands must use Real-time eCommerce intelligence Korea to adapt fast.

Customer Retention — Coupang vs. Naver

| Year | Coupang Retention Rate (%) | Naver Retention Rate (%) |

|---|---|---|

| 2020 | 65 | 52 |

| 2021 | 68 | 55 |

| 2022 | 71 | 58 |

| 2023 | 73 | 61 |

| 2024 | 75 | 64 |

| 2025 | 77 | 67 |

Analysis:

Coupang’s Rocket Wow loyalty program keeps retention high. Naver is closing the gap by merging content, social, and shopping to keep users in its ecosystem. These rising rates show that loyalty and personalized offers will be key for both in the Coupang vs Naver fight for market share.

Cross-Border GMV % — Coupang vs. Naver

| Year | Coupang Cross-Border GMV (%) | Naver Cross-Border GMV (%) |

|---|---|---|

| 2020 | 8 | 5 |

| 2021 | 10 | 6 |

| 2022 | 12 | 8 |

| 2023 | 14 | 10 |

| 2024 | 16 | 12 |

| 2025 | 18 | 14 |

Analysis:

Cross-border is a growth frontier for both. Coupang invests in Japan and Southeast Asia fulfillment, while Naver expands Smart Store sellers overseas. Brands should track this using Naver Product Data Scraping to discover cross-border opportunities and price competitiveness in real time.

Conclusion

The Coupang vs Naver rivalry defines South Korea’s digital retail landscape. With South Korea eCommerce trends 2025 accelerating, smart brands rely on Live eCommerce data Korea and advanced tools to Scrape Naver Product Data and keep up with Coupang vs Naver customer insights.

Stay ahead — unlock real-time eCommerce performance data with Real Data API today!