Introduction

Food transparency has become a global priority as consumers demand clarity about what they eat. From calorie counts to ingredient origins, modern users expect real-time, accurate, and comparable nutrition information across food products. This shift has fueled the rise of AI-powered platforms that aggregate, analyze, and interpret food data at scale. At the heart of these platforms lies nutrition data scraping for AI food analytics, enabling automated collection of nutrition facts from food labels, brand websites, grocery platforms, and regulatory databases.

Between 2020 and 2026, food transparency apps have seen exponential adoption as health awareness, dietary restrictions, and regulatory scrutiny increased worldwide. AI systems rely on continuously updated nutrition datasets to deliver personalized insights, allergen alerts, and health scoring models. Manual data collection is no longer viable given the scale and frequency of product updates. Automated scraping APIs ensure consistency, speed, and reliability—making them essential infrastructure for next-generation food intelligence platforms.

The Role of Data Accuracy in Consumer Trust

Accurate nutrition information is foundational to consumer trust. Platforms leveraging scraped nutrition data for food transparency enable users to compare products instantly, identify unhealthy ingredients, and make informed dietary choices. From 2020 onward, inaccuracies in food labeling became a major concern, prompting demand for third-party verification through data-driven platforms.

Food Transparency Adoption Trends (2020–2026)

| Year | Transparency App Users (M) | Label Accuracy Issues (%) | Verified Products (%) |

|---|---|---|---|

| 2020 | 45 | 21% | 38% |

| 2021 | 58 | 19% | 44% |

| 2022 | 73 | 17% | 51% |

| 2023 | 92 | 14% | 59% |

| 2024 | 116 | 12% | 66% |

| 2025 | 138 | 10% | 72% |

| 2026 | 165 | 8% | 79% |

As shown above, verified nutrition data has become a competitive differentiator. Platforms using automated extraction reduce human error while increasing update frequency. This builds long-term credibility with health-conscious consumers and regulatory bodies alike.

Unlocking Ingredient-Level Insights at Scale

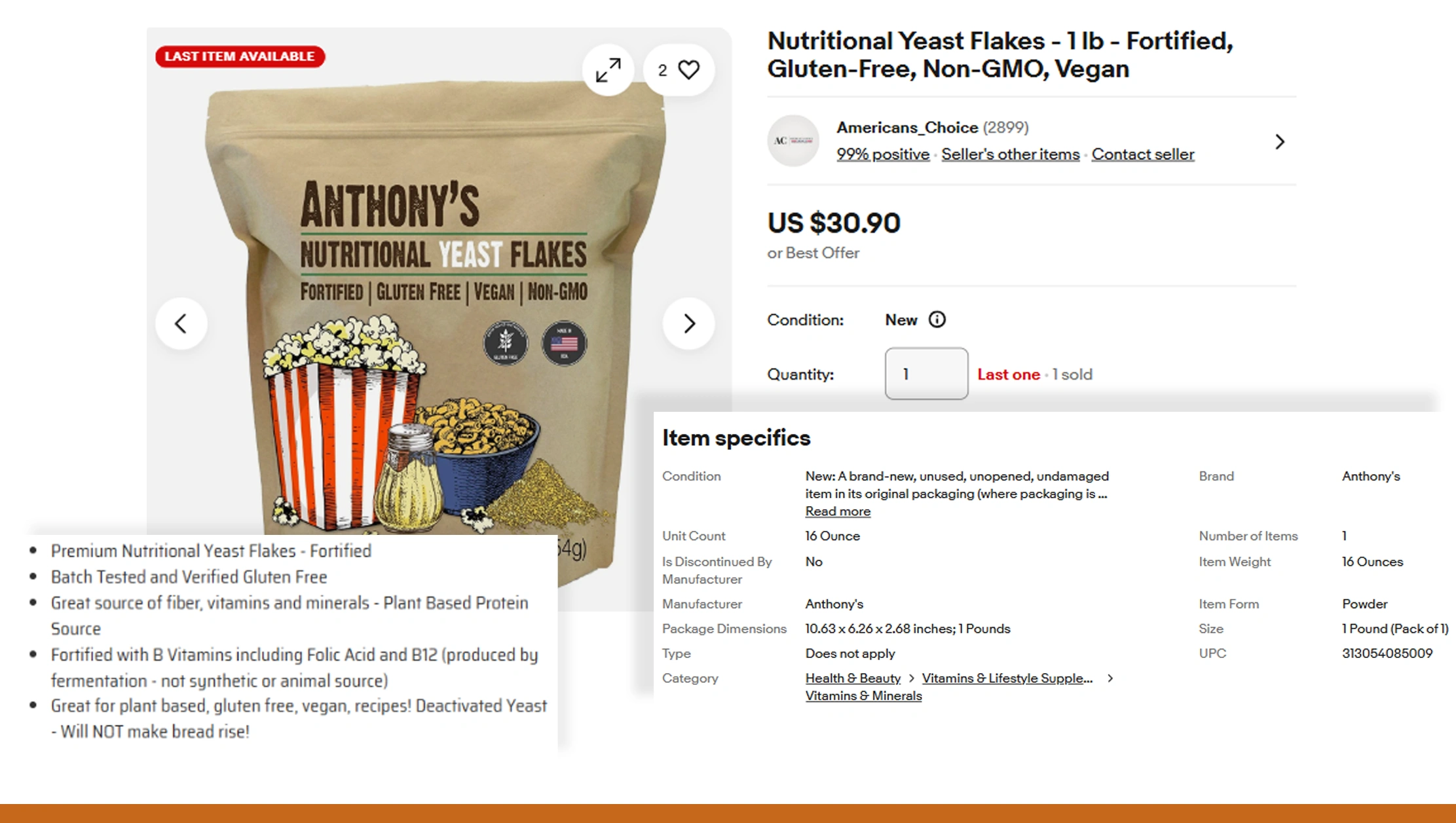

Ingredient-level data plays a critical role in identifying allergens, additives, and nutritional quality. Food ingredient data extraction allows AI models to break down complex ingredient lists and classify them based on health impact, origin, and processing level.

Between 2020 and 2026, ingredient-focused analytics gained traction due to rising food allergies and clean-label movements.

Ingredient Intelligence Growth (2020–2026)

| Year | Products Analyzed (M) | Allergen Detection Accuracy | Clean-Label Demand |

|---|---|---|---|

| 2020 | 12 | 82% | Moderate |

| 2021 | 18 | 85% | Moderate |

| 2022 | 27 | 88% | High |

| 2023 | 39 | 91% | High |

| 2024 | 54 | 93% | Very High |

| 2025 | 71 | 95% | Very High |

| 2026 | 90 | 97% | Critical |

Extracted ingredient data allows platforms to flag ultra-processed foods, identify hidden sugars, and support dietary preferences such as vegan, gluten-free, or keto. This granular intelligence enhances user engagement and platform value.

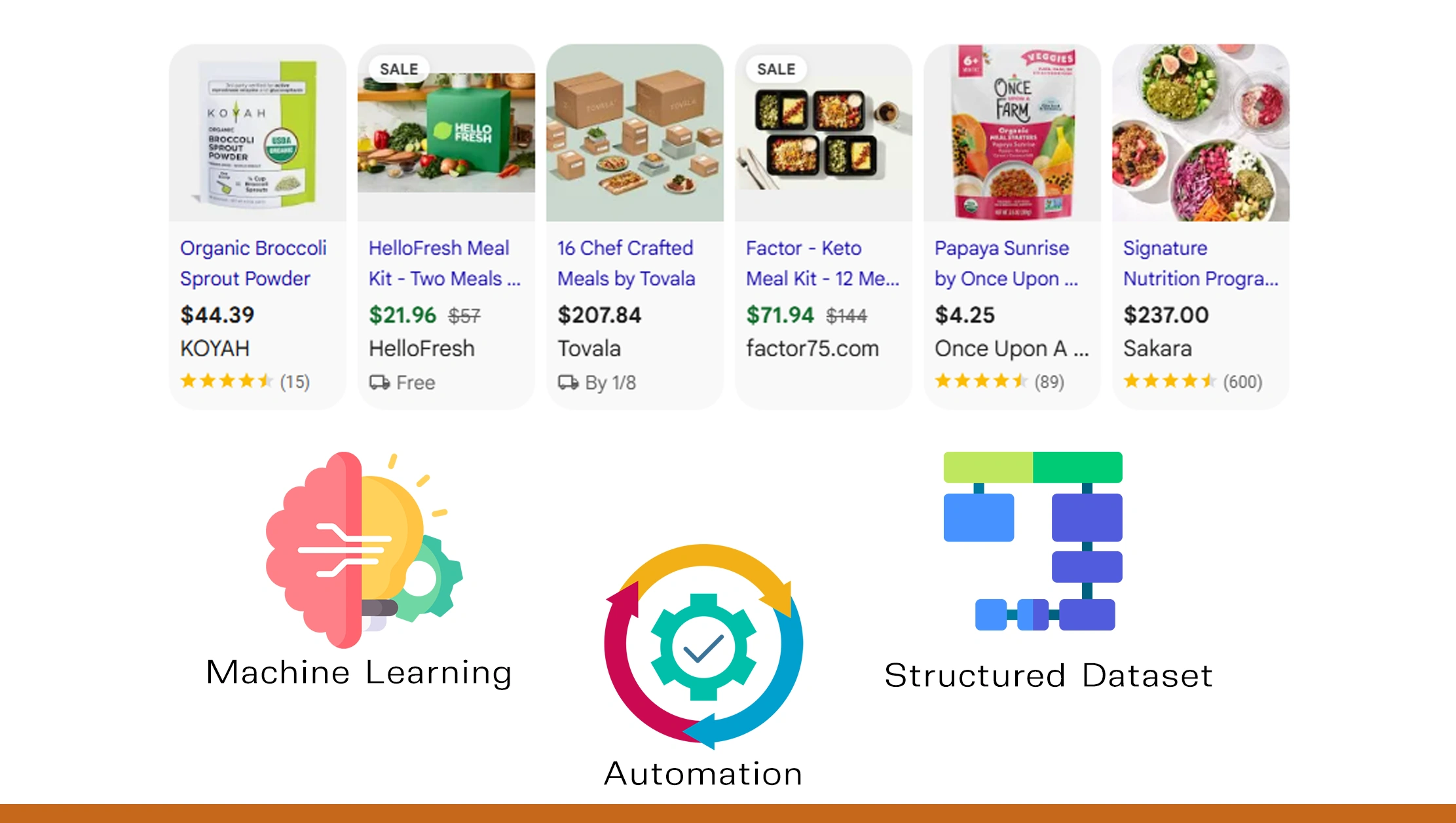

Powering Intelligent Transparency Systems

Modern transparency tools are no longer static databases—they are intelligent ecosystems. A Web Scraping AI-Powered Food Transparency Platform combines automation, machine learning, and structured datasets to deliver dynamic food insights in real time.

From 2020 to 2026, AI-driven transparency platforms outperformed traditional food databases in both accuracy and user retention.

AI Transparency Platform Performance (2020–2026)

| Year | AI Adoption Rate | Data Refresh Speed | User Retention |

|---|---|---|---|

| 2020 | 22% | Weekly | 41% |

| 2021 | 29% | Daily | 46% |

| 2022 | 38% | Daily | 52% |

| 2023 | 47% | Hourly | 59% |

| 2024 | 56% | Near Real-Time | 65% |

| 2025 | 64% | Near Real-Time | 71% |

| 2026 | 72% | Real-Time | 78% |

By integrating scraped nutrition data into AI pipelines, platforms can generate food scores, health warnings, and predictive dietary insights. This transforms raw data into actionable intelligence for consumers and enterprises.

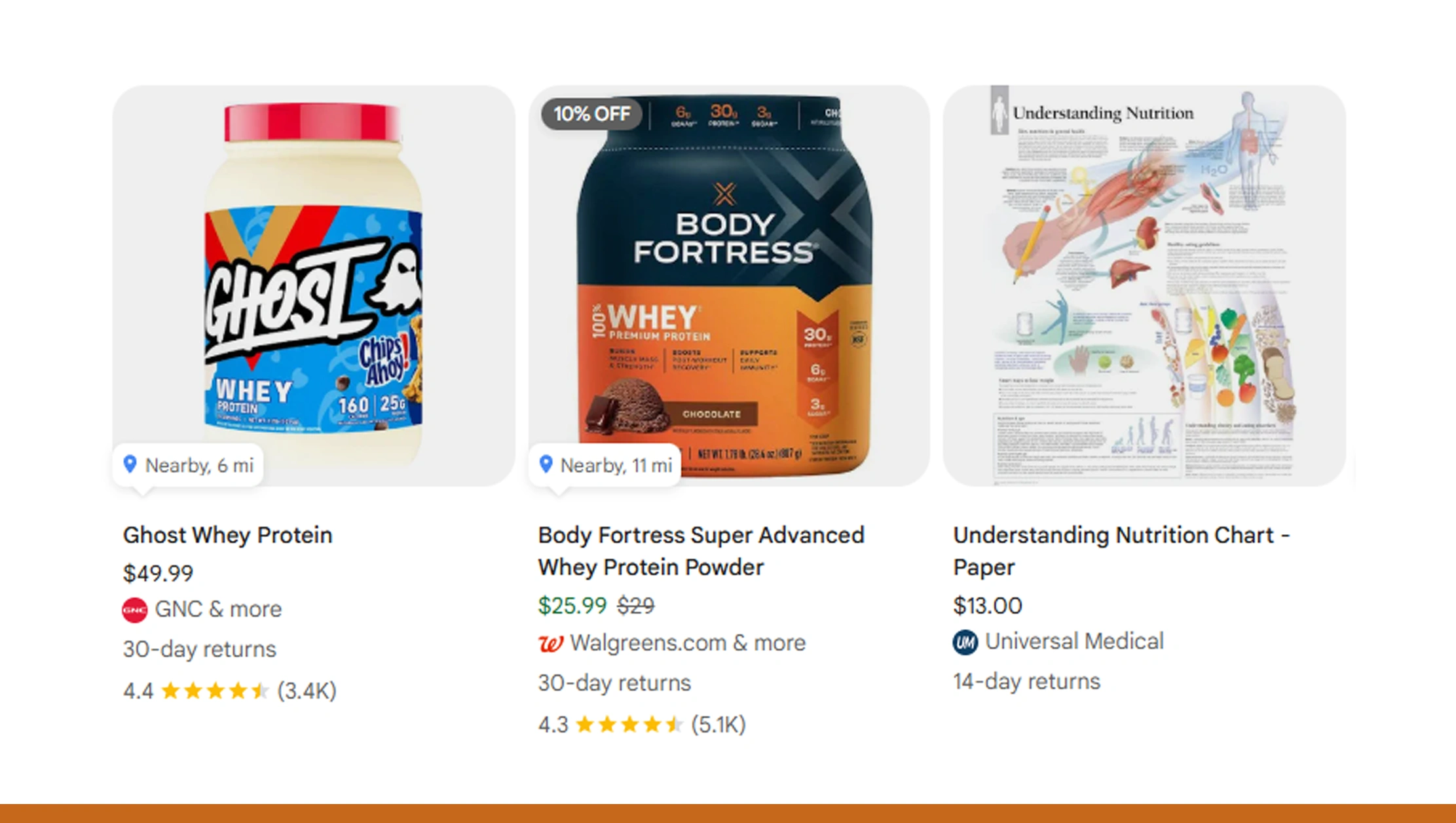

Turning Raw Product Data into Strategic Intelligence

Beyond nutrition facts, broader product attributes are essential for comprehensive food analysis. Extract food product data intelligence enables platforms to unify nutritional values with brand, pricing, packaging, and sustainability information.

From 2020 onward, unified product intelligence became essential for food-tech and retail analytics.

Product Intelligence Expansion (2020–2026)

| Year | Attributes per Product | Platform Coverage | Insight Depth |

|---|---|---|---|

| 2020 | 14 | Limited | Basic |

| 2021 | 18 | Moderate | Basic |

| 2022 | 23 | Moderate | Advanced |

| 2023 | 28 | High | Advanced |

| 2024 | 33 | High | Predictive |

| 2025 | 38 | Very High | Predictive |

| 2026 | 44 | Global | Prescriptive |

This intelligence allows businesses to optimize product positioning, comply with regulations, and meet evolving consumer expectations. It also supports advanced AI use cases such as health scoring algorithms and recommendation engines.

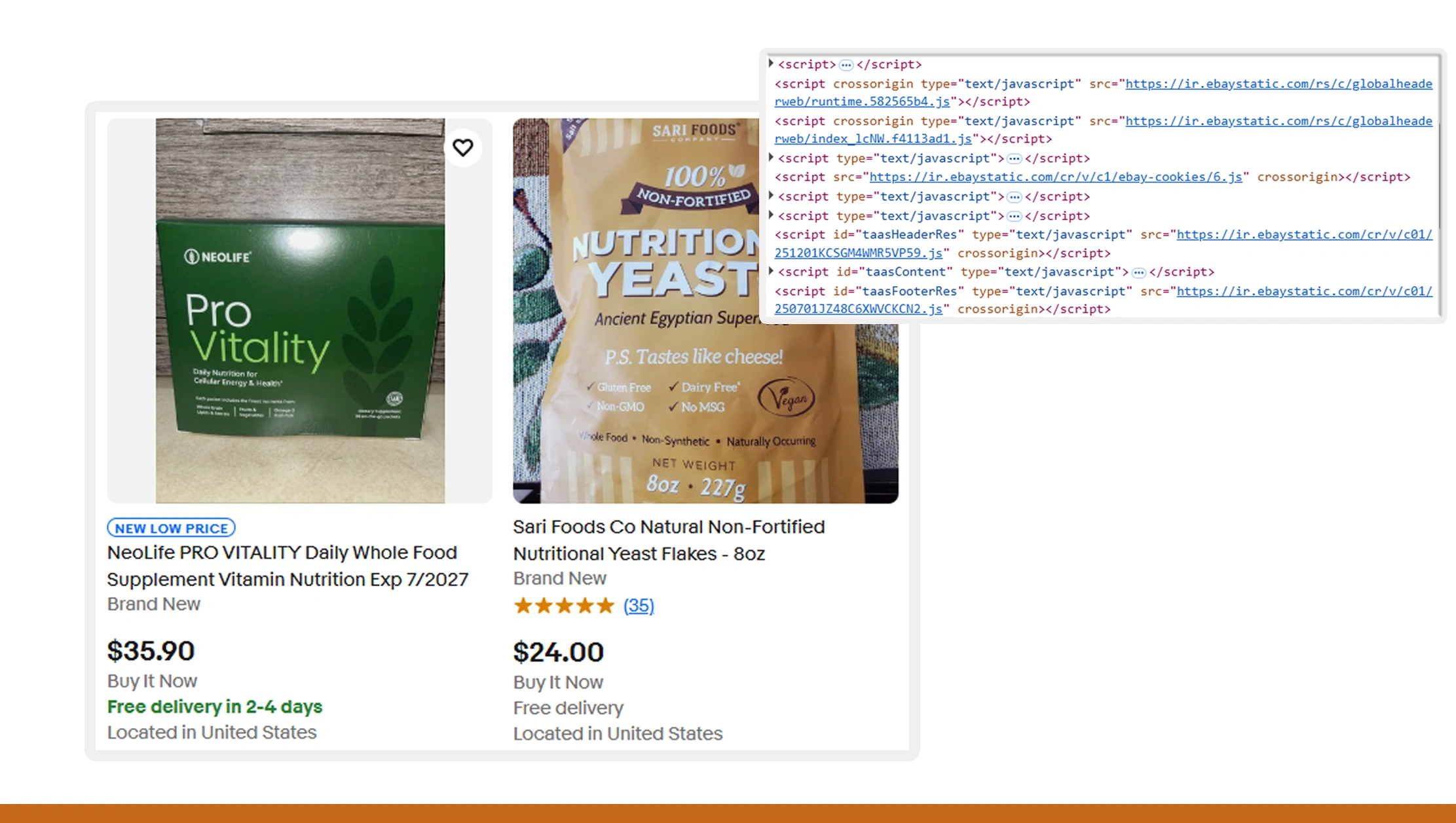

Automating Nutrition Label Collection

Nutrition labels are one of the most standardized yet frequently updated data sources. A Nutritional Label Scraper API automates the extraction of calories, macros, vitamins, and serving sizes directly from digital labels and online listings.

From 2020 to 2026, automation significantly improved label coverage and accuracy.

Nutrition Label Automation Trends (2020–2026)

| Year | Labels Scraped (M) | Manual Errors (%) | Update Frequency |

|---|---|---|---|

| 2020 | 9 | 16% | Monthly |

| 2021 | 14 | 14% | Bi-Weekly |

| 2022 | 21 | 12% | Weekly |

| 2023 | 31 | 9% | Daily |

| 2024 | 44 | 7% | Daily |

| 2025 | 60 | 5% | Near Real-Time |

| 2026 | 78 | 3% | Real-Time |

Automated label scraping ensures consistency across regions and brands, making it ideal for nutrition apps, regulatory monitoring, and health analytics platforms.

Scaling Nutrition Intelligence Across Markets

As food markets globalize, platforms must scale rapidly across regions and languages. Nutritional Data Scraping enables continuous ingestion of nutrition information from diverse sources while maintaining data uniformity.

Between 2020 and 2026, global nutrition data coverage expanded dramatically.

Global Nutrition Data Coverage (2020–2026)

| Year | Countries Covered | Data Sources | AI Readiness |

|---|---|---|---|

| 2020 | 18 | Low | Moderate |

| 2021 | 26 | Moderate | Moderate |

| 2022 | 35 | Moderate | High |

| 2023 | 46 | High | High |

| 2024 | 58 | High | Very High |

| 2025 | 71 | Very High | Very High |

| 2026 | 85 | Global | Enterprise |

This scalability ensures platforms remain competitive while meeting regional nutrition standards and consumer expectations.

Why Choose Real Data API?

Real Data API delivers enterprise-grade nutrition intelligence through scalable, reliable solutions designed for modern food-tech platforms. With a robust Food Data API for Nutrition Apps, businesses can unify ingredient data, nutrition labels, and product intelligence into clean, AI-ready datasets. Combined with nutrition data scraping for AI food analytics, Real Data API empowers faster innovation, higher accuracy, and global scalability without infrastructure complexity.

Key advantages include:

- Real-time data delivery

- High accuracy and compliance-ready formats

- Global coverage

- AI-optimized structured datasets

Conclusion

Smart food transparency platforms rely on continuous, accurate, and scalable data pipelines to deliver real value. With AI Web Data Monitoring and nutrition data scraping for AI food analytics, businesses can move beyond static labels and build intelligent systems that empower healthier choices and regulatory confidence.

Start building your AI-powered food transparency platform today with Real Data API and transform nutrition data into actionable intelligence at scale.