Introduction

In an increasingly competitive real-estate landscape, savvy investors know that data is power. With the right tools and approach, you can scrape Bezrealitky property data for real estate market insights that reveal where demand outpaces supply — and where hidden investment opportunities lie. Combining such data with deeper Market Research enables you to identify pricing trends, rental yields, and gaps that traditional agents might miss. In this post, we show how using an API-driven scraping approach unlocks patterns in the Czech housing market, helping investors and analysts stay ahead.

Rising Demand and Apartment Prices

Between 2020 and 2025, the Czech housing market has undergone impressive growth in prices and rental demand. Consider the following table summarizing average apartment prices and rental indices:

| Year | Avg. Asking Price (CZK/m²) | YoY Price Change* | Typical Rent (CZK/m²/month) |

|---|---|---|---|

| 2020 | ~ 69,125 | baseline | ~ 280 (approx.) |

| 2021 | ~ 82,475 | +19% | ~ 310 |

| 2022 | ~ 93,025 | +13% | ~ 330 |

| 2023 | ~ 92,200 (appr.) | –1.2% | ~ 373 |

| 2024 | ~ 99,300 (Q1) | +4% vs 2023 | ~ 422 |

| 2025 | avg old-apartment offering ~ 103,473 (nationwide) | +10–16% YoY | rents rising ~6–8% |

*Change relative to previous year or baseline.

These numbers show sustained upward pressure on both sale prices and rents — a clear sign that the market remains dynamic and competitive. The gap between sale price growth and rental growth suggests that long-term investment (buy & hold for rent) can yield attractive returns if one picks units wisely.

Real-time Property and Owner-Listed Data Is a Game-Changer

By harvesting live listings directly from platforms, you gain an edge. Real (up-to-the-minute) data helps you catch new listings before others, spot patterns in how soon properties are taken, and detect price drops or hikes. For instance: average asking price per square meter nationwide rose to ~ CZK 103,473 by early 2025.

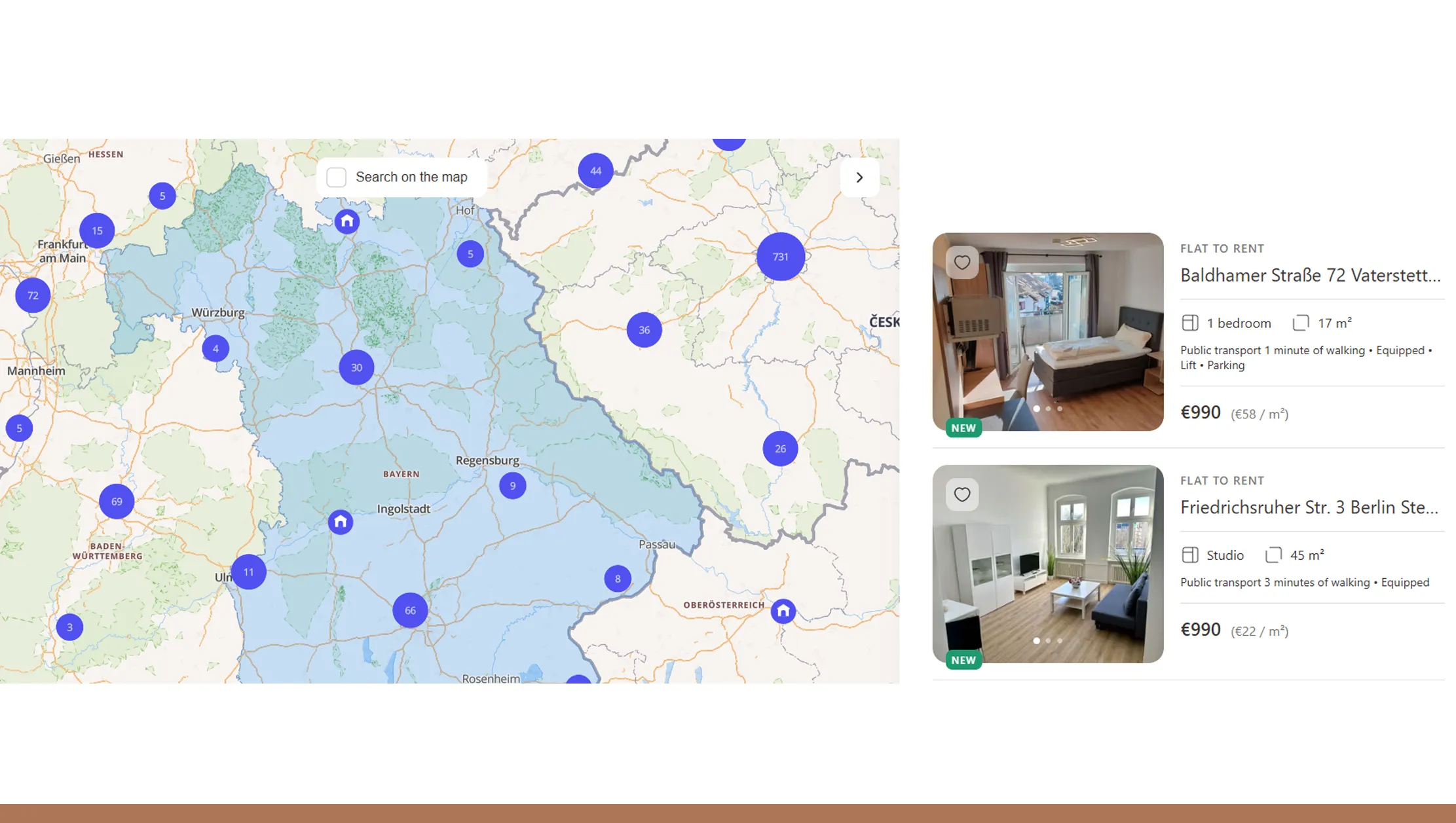

Using Real Data API to Real-time Bezrealitky property and owner-listed data scraping allows you to build a database of active listings — including location, size, asking price, rent offers, and listing date. Once you accumulate enough data, you can:

- Estimate how long apartments stay on the market;

- Identify neighborhoods with fastest turnover;

- Detect underpriced units (relative to local averages);

- Track supply trends (number of listings over time).

This data-driven approach can unearth “hidden” investment opportunities long before they attract mainstream attention.

Czech Housing Market: What the Trends Show

The broader Czech housing environment has experienced volatility — but overall growth — over the past five years.

Sale prices surged from ~ CZK 69,125/m² in 2020 to ~ CZK 99,300/m² by early 2024.

After a slight dip in 2023 (–1.2% on average), 2024 and 2025 saw renewed growth: by Q2 2025, house-price index recorded ~ 10.5% year-on-year increase.

In 2025 alone, asking prices on some older apartments rose ~16% YoY; in some regions, even higher.

Rent prices, while rising steadily, lagged sale-price growth — creating widening spread between buy and rent, which may bode well for rental investors.

In an environment like this, timing matters. The ability to analyze listings historically (2020–2025) via scraped data can reveal cycles, windows of opportunity, and undervalued localities before price surges.

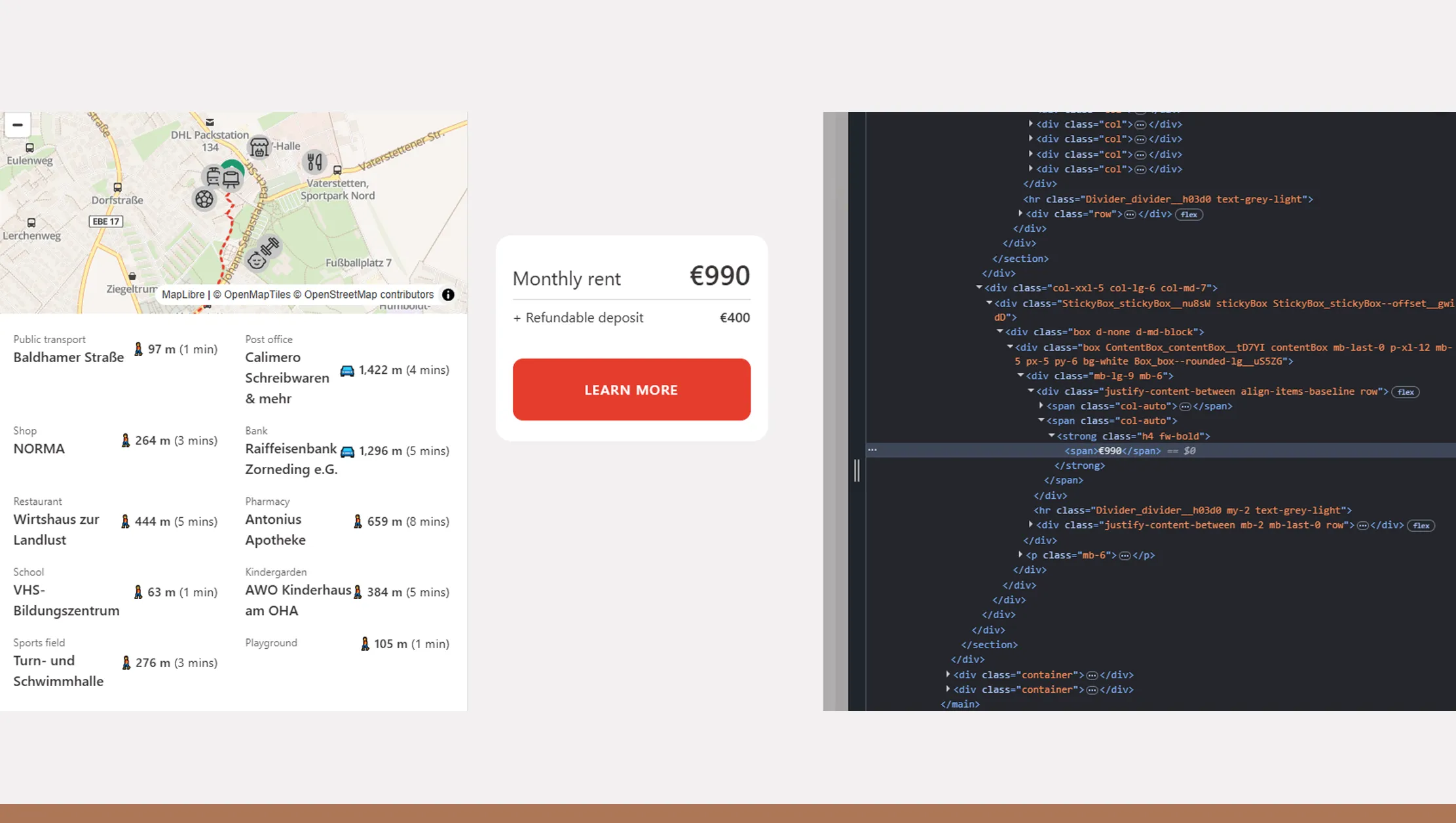

The Power of API: Automated Scraping of Listings

Manually browsing listings is time-consuming and often too slow — many good deals vanish within hours. That’s why leveraging an automated Bezrealitky property listings scraper API can transform your workflow:

- Schedule periodic crawls (e.g., every hour) to capture new listings.

- Store structured data: location (city, district), property type, size (m²), asking price, rent, listing age, landlord type (owner vs agent).

- Build trend dashboards: average price/m² by area, median listing age, rent yields over time.

- Alert on outliers — e.g., listings priced significantly below median, or high rent yield prospects.

With this level of automation and data, investors or analysts can respond quickly — cherry-picking opportunities before they’re gone — and base decisions on quantitative evidence rather than intuition.

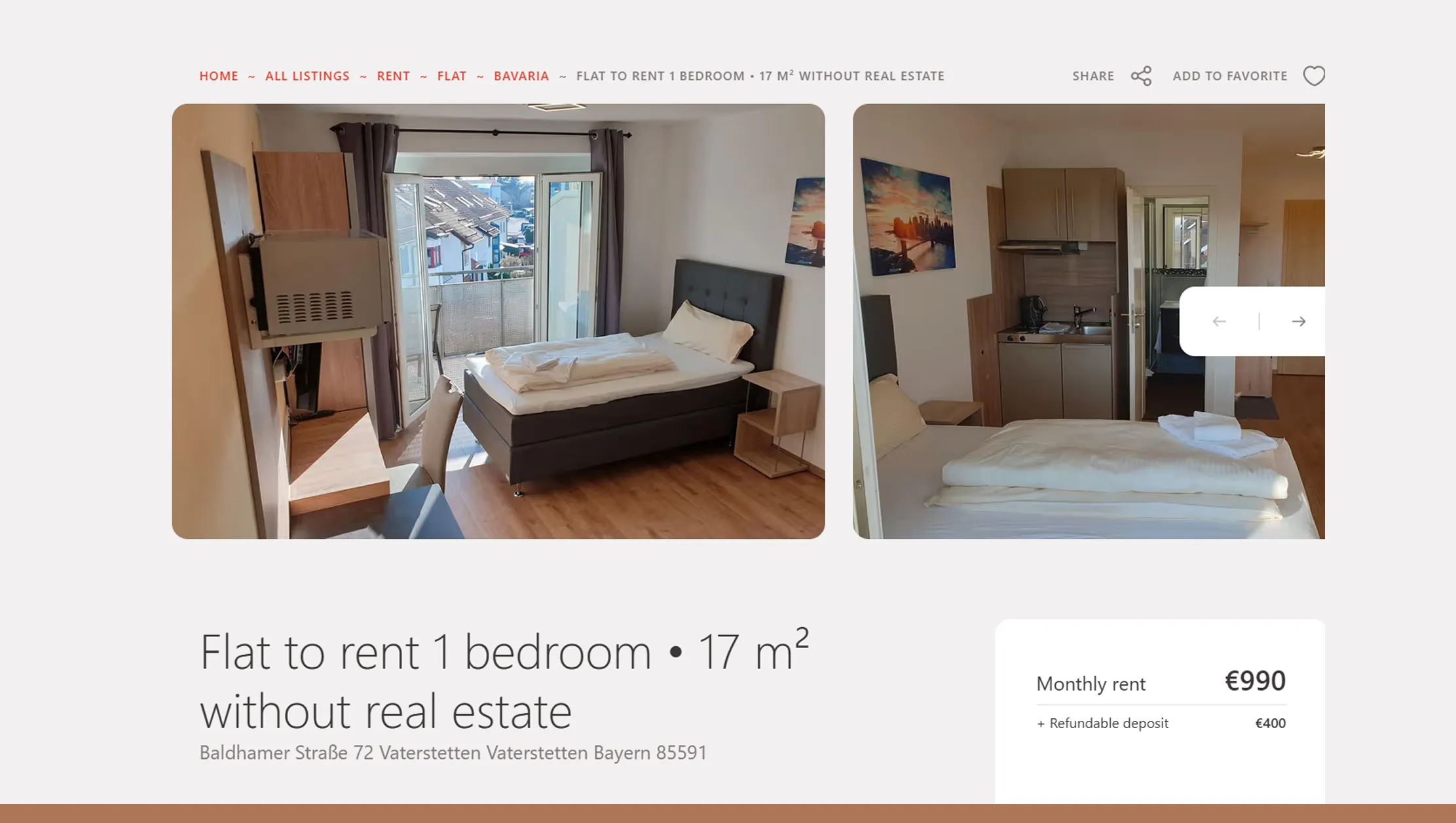

Extracting More Value: Beyond Basic Listings

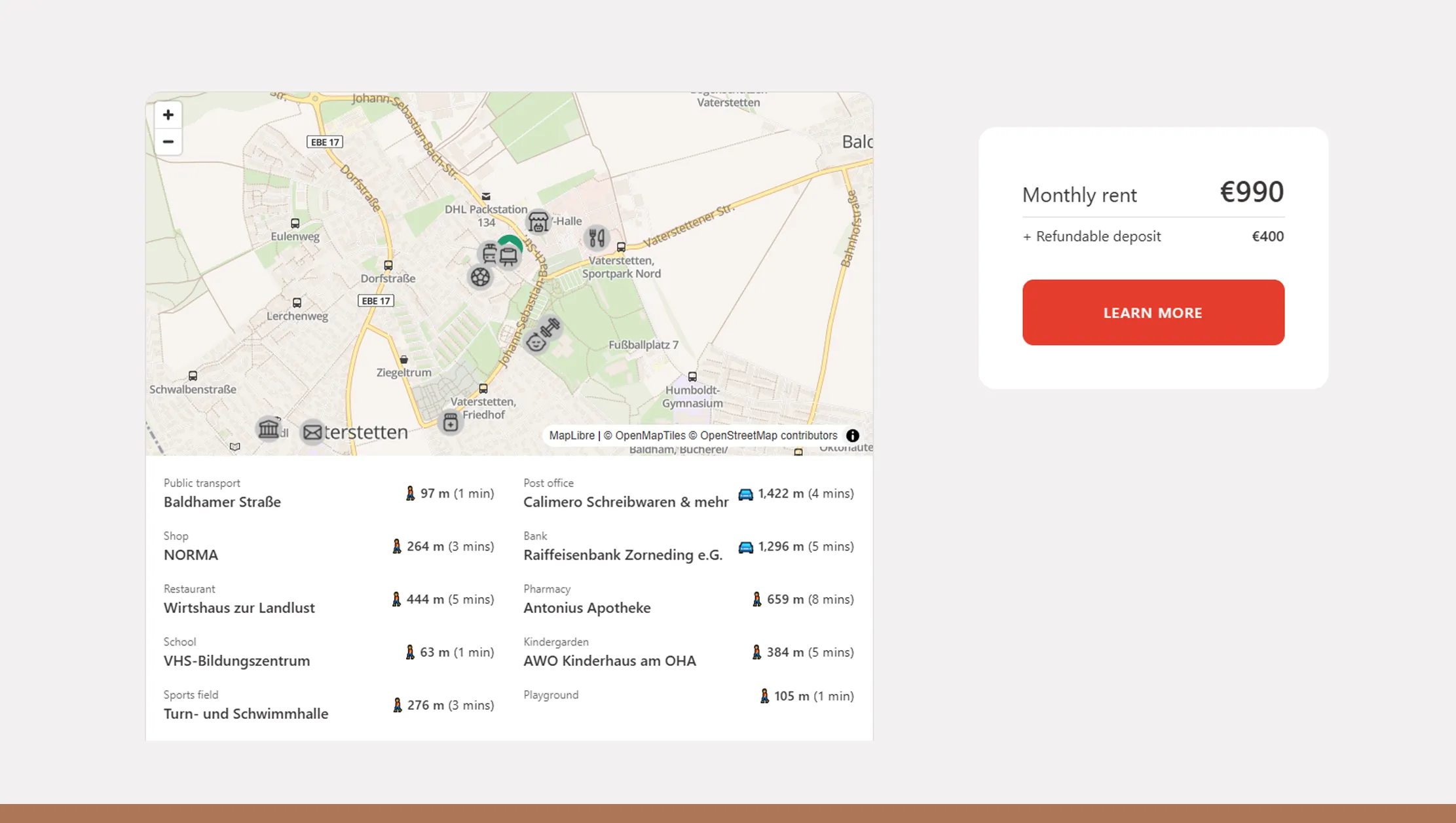

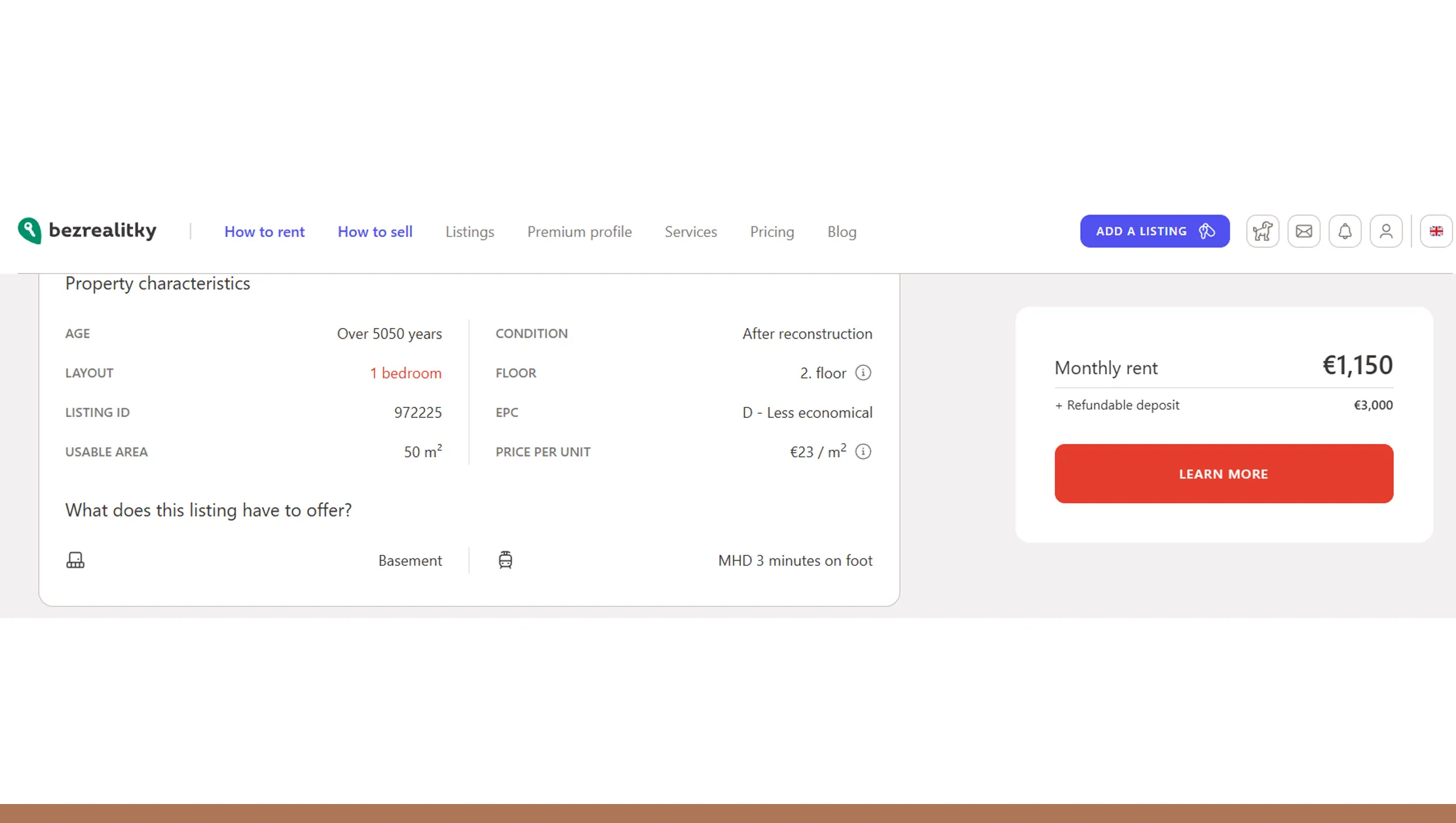

Web Scraping Real Estate Data API does more than capture just price and address. With a full-featured Bezrealitky Property data extractor, you can pull:

- Listing history (when first posted, price changes, if relisted) — helpful to spot motivated sellers or price drops.

- Owner vs agency tags — direct owner listings often mean fewer fees or cheaper deals.

- Metadata: amenities, floor, building type, photos count, description — helpful to rank properties by “value per CZK”.

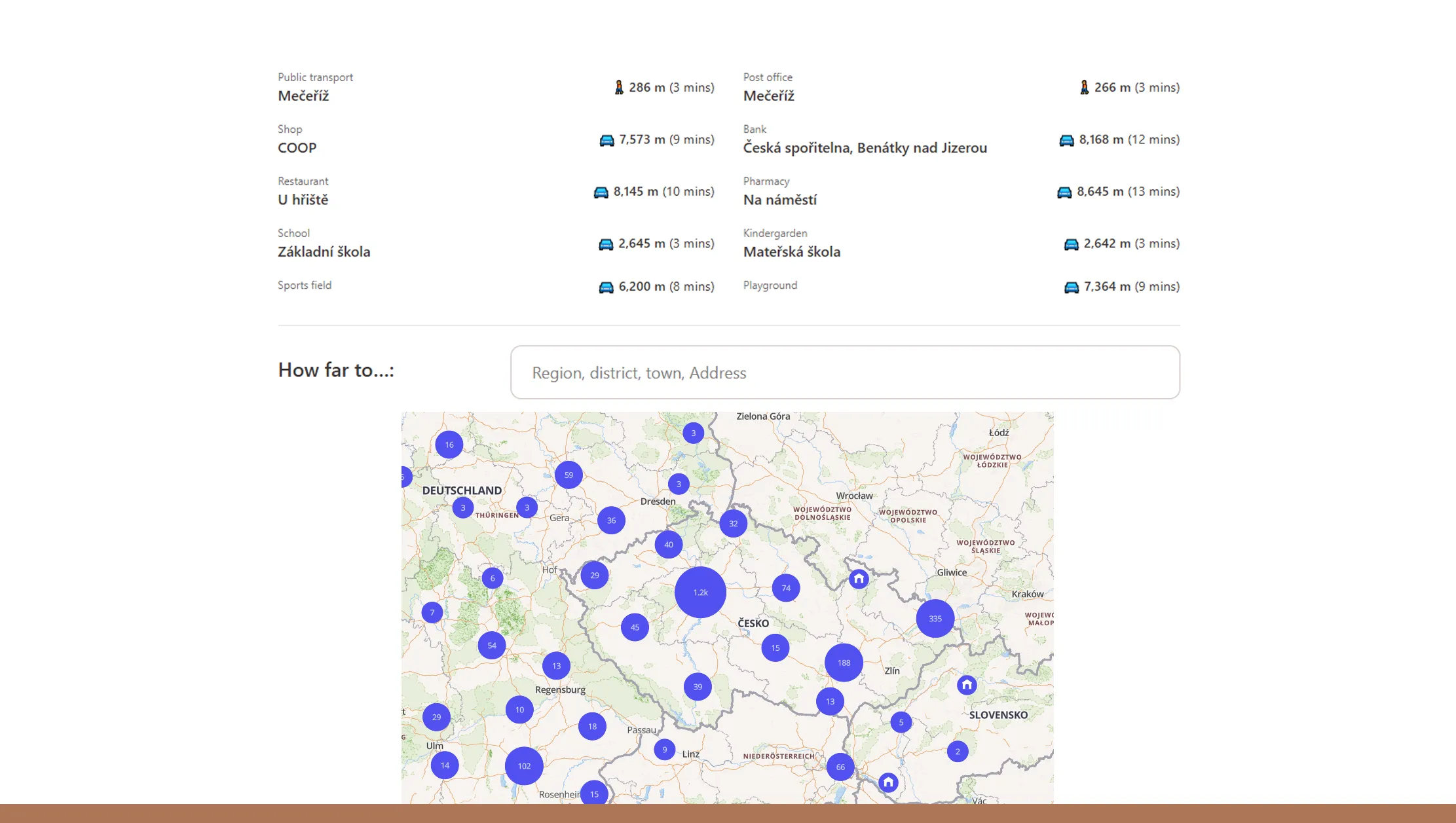

- Geolocation (district, neighborhood, proximity to transport/university/work) — indispensable for assessing long-term demand and yield potential.

Over a 2020–2025 dataset, such extracted data can reveal which neighborhoods consistently offer the best rent-to-price ratio, which types of properties (studio, 1-bed, small 2-bed) tend to rent faster, and where supply cycles align with demand surges.

Tracking Rental Potential: Rent Data Insights

As sales prices climb, the rental segment remains heated too. A comprehensive Bezrealitky rental data extraction effort allows you to capture asking rents across regions — enabling yield calculations and trend spotting. For example:

- Average asking rent in major cities rose significantly: by 2023–2024, rents in major cities reached ~ CZK 422/m²/month.

- Nationwide rent growth has hovered around 6–8% in 2025.

By comparing rent data against historical purchase prices, investors can estimate gross rental yield, identify which cities or districts offer the most favorable cash-flow ratios, and even forecast when rental demand might outstrip supply (for example, with growing urban population, influx of students or workforce). Ultimately — good rent data helps decide whether to buy for rental or resale.

API-Driven Data Collection: A Strategic Advantage

Using a dedicated Bezrealitky Data Scraping API — such as offered by Real Data API — gives you several strategic benefits over manual methods:

- Scalability: You can track thousands of listings across regions in real time, far beyond what manual browsing allows.

- Historical data accumulation: As the database grows, you can analyse 2020–2025 trends — price evolution, rental changes, supply dynamics.

- Speed: Automated alerts let you act fast when a promising property appears (e.g., underpriced, high yield, direct-owner).

- Data-driven decision making: Instead of relying on anecdotal evidence or gut feeling, you make investment choices based on robust, up-to-date datasets.

In a fast-moving market like Czech real estate — where price per square meter has nearly doubled in some segments over five years — this kind of agility matters.

Why Choose Real Data API?

With Real Data API you can scrape Bezrealitky property data for real estate market insights quickly and reliably — no manual scraping, no missed listings.

The platform delivers a rich Real Estate Dataset structured, clean, ready for analytics.

You get both sale-listing data and historical rent data — enabling full-cycle investment analysis (buy → rent → hold → sell).

Real Data API’s infrastructure handles rate-limits, site changes, and legal compliance — giving you peace of mind and time to focus on investing.

Conclusion

If you’re serious about uncovering undervalued properties or tracking rental yields in the Czech Republic, using a robust API-driven scraper is no longer optional — it’s essential. By tapping into the power to scrape Bezrealitky property data for real estate market insights, you gain a competitive edge that manual browsing can’t match. As you build and analyze your dataset, you’ll surface hidden investment opportunities long before they hit the mainstream.

Ready to see what hidden gems the Czech real estate market holds? Sign up for Real Data API today — and start turning data into smart investment decisions.

Explore Real Data API now to unlock full-scale Czech property insights with the power of Web Scraping Real Estate Data API.