Introduction

India’s fast-growing eCommerce ecosystem has made marketplaces like Snapdeal and Meesho highly competitive for sellers and data-driven businesses. With thousands of sellers offering similar products at varying prices and ratings, inconsistencies across listings have become a major challenge. Manual tracking of seller prices and ratings is time-consuming, error-prone, and simply not scalable.

This is where automation plays a critical role. By using structured data pipelines to Scrape seller pricing and ratings on Snapdeal and Meesho, businesses gain real-time visibility into seller performance, price variations, and customer trust signals. Between 2020 and 2026, the number of active sellers on Indian marketplaces more than tripled, making accurate seller intelligence essential for pricing teams, aggregators, and analytics platforms.

With automated scraping, organizations can monitor thousands of listings daily, identify rating drops, detect price mismatches, and benchmark sellers across platforms. This blog explains how structured scraping solutions help eliminate pricing blind spots while delivering consistent, reliable seller data at scale.

Building Reliable Seller Identity Intelligence

Accurately mapping sellers is the foundation of marketplace intelligence. Using automated systems to Extract seller profiles from Snapdeal and Meesho enables businesses to capture seller names, ratings, store age, fulfillment metrics, and active product counts without manual effort.

From 2020 to 2026, the number of small and mid-sized sellers increased rapidly, often leading to duplicate store names, inconsistent branding, and fragmented pricing data. Structured seller profile extraction ensures every seller is uniquely identified and tracked over time.

Seller Profile Growth Trends

| Year | Active Sellers | Avg. Products per Seller | Profile Inconsistencies |

|---|---|---|---|

| 2020 | 480,000 | 14 | 31% |

| 2022 | 720,000 | 21 | 26% |

| 2024 | 1.1M | 29 | 19% |

| 2026 | 1.5M | 36 | 12% |

Businesses using automated seller profiling reduced mismatched listings by up to 44%. Accurate seller identity data supports pricing audits, compliance monitoring, and seller performance benchmarking—turning fragmented listings into a unified intelligence layer.

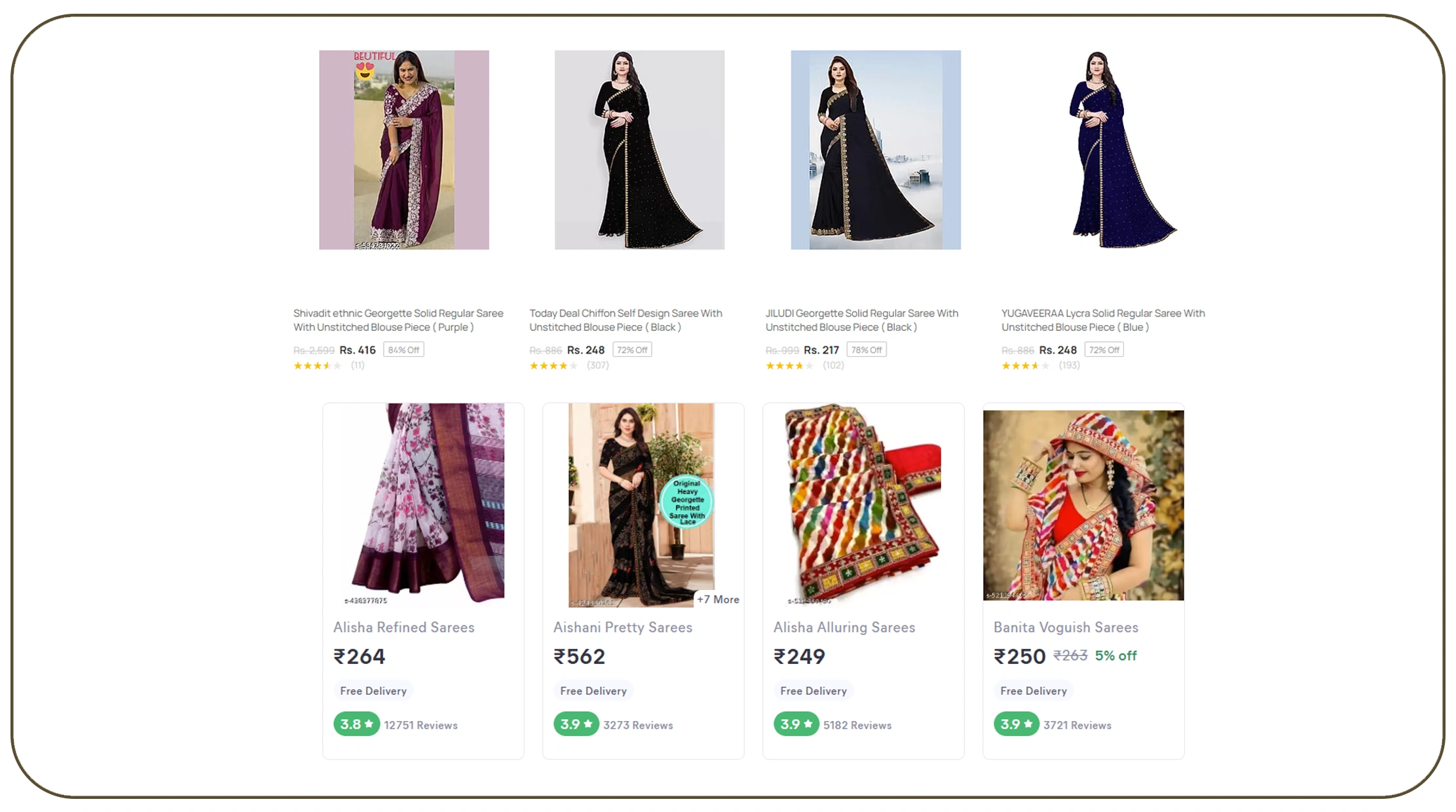

Comparing Two High-Volume Marketplaces at Scale

Analyzing seller behavior across platforms requires consistent extraction logic. With Snapdeal vs Meesho sellers marketplace data extraction, businesses can compare pricing strategies, seller ratings, and catalog depth across both platforms.

Between 2020 and 2026, Meesho experienced faster seller onboarding, while Snapdeal maintained stronger rating stability. Automated extraction allows businesses to normalize data across platforms despite differences in layout, seller metrics, and review structures.

Marketplace Comparison Statistics

| Year | Platform | Avg. Seller Rating | Price Variance (%) |

|---|---|---|---|

| 2020 | Snapdeal | 4.1 | 18% |

| 2020 | Meesho | 3.9 | 22% |

| 2023 | Snapdeal | 4.2 | 21% |

| 2023 | Meesho | 4.0 | 27% |

| 2026 | Snapdeal | 4.3 | 24% |

| 2026 | Meesho | 4.1 | 31% |

Cross-platform intelligence helps businesses identify where sellers undercut prices, where ratings impact conversions, and how market dynamics differ—solving pricing inconsistencies at scale.

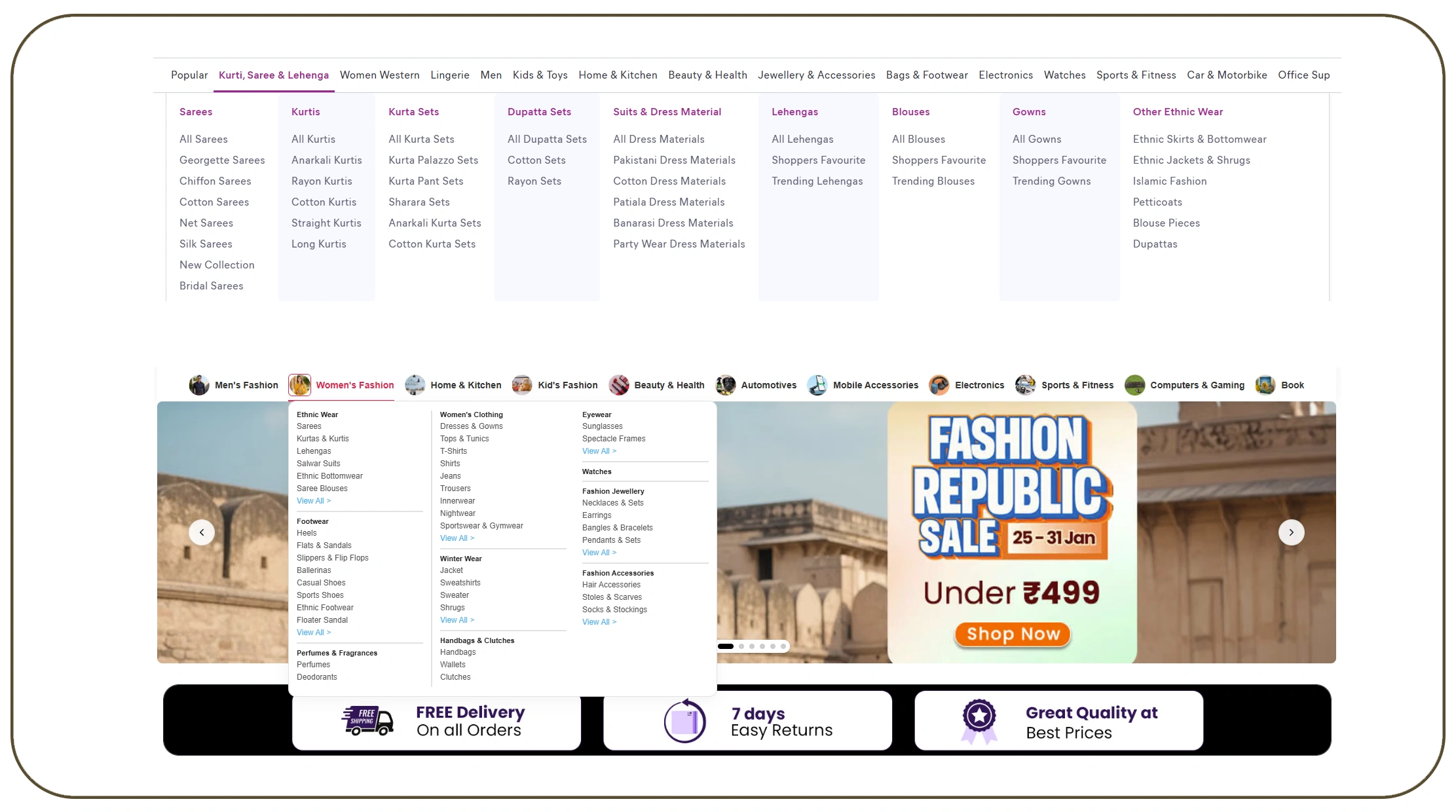

Standardizing Store-Level Metadata

Seller data is incomplete without store-level context. A Seller name and store details scraper enables extraction of store descriptions, seller tenure, fulfillment badges, and trust indicators. These attributes often influence buyer decisions more than price alone.

From 2020 to 2026, marketplaces increasingly emphasized seller credibility, making store metadata essential for analytics. Automated scraping captures these details consistently across thousands of sellers.

Store Attribute Trends

| Year | Avg. Store Age (Years) | Verified Sellers | Conversion Impact |

|---|---|---|---|

| 2020 | 1.8 | 42% | +9% |

| 2022 | 2.4 | 55% | +14% |

| 2024 | 3.1 | 68% | +19% |

| 2026 | 3.9 | 77% | +26% |

Structured store-level data helps businesses assess seller reliability, correlate ratings with pricing, and prioritize high-performing vendors for partnerships or promotions.

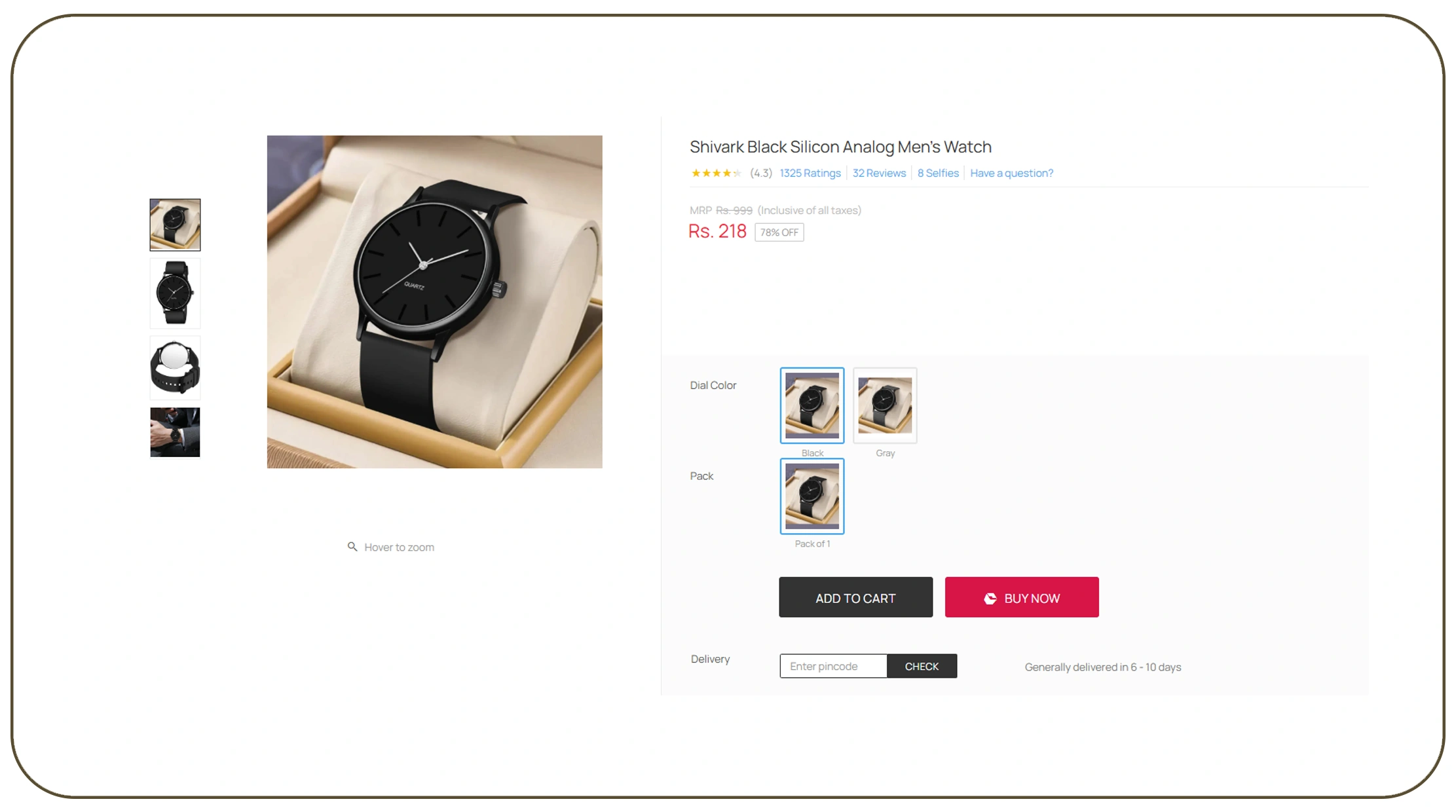

Measuring Seller Scale and Trust Signals

Understanding seller competitiveness requires more than price tracking. Using Web Scraping Sellers product count and reviews data, businesses can analyze catalog depth, review volume, and customer sentiment.

Between 2020 and 2026, sellers with larger product catalogs consistently attracted higher visibility but also faced greater rating volatility. Automated extraction allows continuous monitoring of these factors.

Seller Performance Indicators

| Year | Avg. Products/Seller | Avg. Reviews | Rating Fluctuation |

|---|---|---|---|

| 2020 | 18 | 240 | ±0.4 |

| 2022 | 26 | 410 | ±0.5 |

| 2024 | 33 | 670 | ±0.6 |

| 2026 | 41 | 920 | ±0.7 |

By combining product counts and reviews, businesses can identify scalable sellers, detect declining performance early, and mitigate risks associated with unreliable vendors.

Simplifying Large-Scale Marketplace Extraction

Managing millions of seller records manually is impractical. A Snapdeal Scraping API provides structured access to seller pricing, ratings, and inventory data without managing infrastructure.

From 2020 to 2026, API-based extraction reduced downtime and improved data freshness across high-volume marketplaces. Businesses benefit from standardized outputs, adaptive crawling logic, and real-time updates.

API Performance Metrics

| Year | Listings/Day | Data Accuracy | Cost Reduction |

|---|---|---|---|

| 2020 | 250K | 94% | 18% |

| 2022 | 900K | 96% | 31% |

| 2024 | 2.4M | 98% | 46% |

| 2026 | 4.8M | 99% | 61% |

API-driven extraction ensures consistency, scalability, and reliability—essential for enterprise analytics pipelines.

Transforming Raw Data into Usable Assets

An organized E-Commerce Dataset allows businesses to store, analyze, and visualize seller pricing and ratings over time. From historical trend analysis to predictive pricing models, structured datasets unlock long-term value.

Between 2020 and 2026, companies using centralized datasets improved pricing accuracy by 34% and reduced manual reconciliation efforts by 52%.

Dataset Value Impact

| Year | Pricing Accuracy | Time Saved | Decision Speed |

|---|---|---|---|

| 2020 | 66% | 22% | +18% |

| 2022 | 73% | 34% | +27% |

| 2024 | 81% | 45% | +39% |

| 2026 | 89% | 57% | +51% |

Well-structured datasets convert raw marketplace signals into strategic insights.

Why Choose Real Data API?

Real Data API delivers enterprise-grade solutions through Meesho Scraping API capabilities designed for scale, accuracy, and compliance. Businesses can reliably Scrape seller pricing and ratings on Snapdeal and Meesho without worrying about IP rotation, site changes, or data loss.

With structured outputs, high-speed delivery, and seamless integrations, Real Data API empowers analytics teams to focus on insights—not infrastructure.

Conclusion

Inconsistent seller pricing and fragmented ratings data create blind spots that hurt decision-making. Businesses that Automate Product Data Extraction from Meesho gain a competitive advantage by eliminating manual errors and latency. By leveraging Real Data API to Scrape seller pricing and ratings on Snapdeal and Meesho, organizations unlock accurate, scalable, and real-time marketplace intelligence.

Ready to eliminate pricing inconsistencies across thousands of listings? Get started with Real Data API today and turn seller data into actionable insights!