Introduction

Accurate grocery price tracking has become one of the most critical yet challenging tasks for modern businesses. Supermarket prices in North America change frequently due to inflation, supplier costs, logistics disruptions, currency fluctuations, and aggressive promotional strategies. Many companies still depend on outdated reports, limited store audits, or manual data collection methods that fail to reflect real market conditions. This gap leads to pricing errors, reduced margins, and missed competitive opportunities. By leveraging Scrape supermarket price fluctuations in Canada and USA, businesses can replace fragmented insights with reliable, real-time intelligence. Automated data extraction enables consistent monitoring of prices, discounts, and promotions across regions, helping organizations respond faster, price smarter, and compete more effectively in an increasingly volatile grocery landscape.

Pricing Gaps That Distort Competitive Decisions

Understanding US vs Canada grocery prices is more complex than simply comparing averages. From 2020 to 2026, both markets experienced inflationary pressure, but at different speeds and intensities due to regulatory structures, import dependencies, and currency variations.

Average Weekly Grocery Basket Cost (USD Equivalent)

| Year | USA | Canada | Difference |

|---|---|---|---|

| 2020 | 56.8 | 60.9 | +7.2% |

| 2022 | 63.4 | 68.7 | +8.4% |

| 2024 | 70.6 | 76.8 | +8.8% |

| 2026* | 75.2 | 82.1 | +9.2% |

Businesses that rely on national averages often miss category-specific divergences. For example, dairy and meat prices in Canada have consistently outpaced those in the US due to supply management systems, while packaged foods show narrower gaps. Without scraped supermarket data, pricing teams underestimate these differences, leading to poor cross-border benchmarking and misaligned pricing strategies. Continuous monitoring enables businesses to identify inflation drivers, evaluate supplier impact, and align pricing models with real consumer conditions rather than static reports.

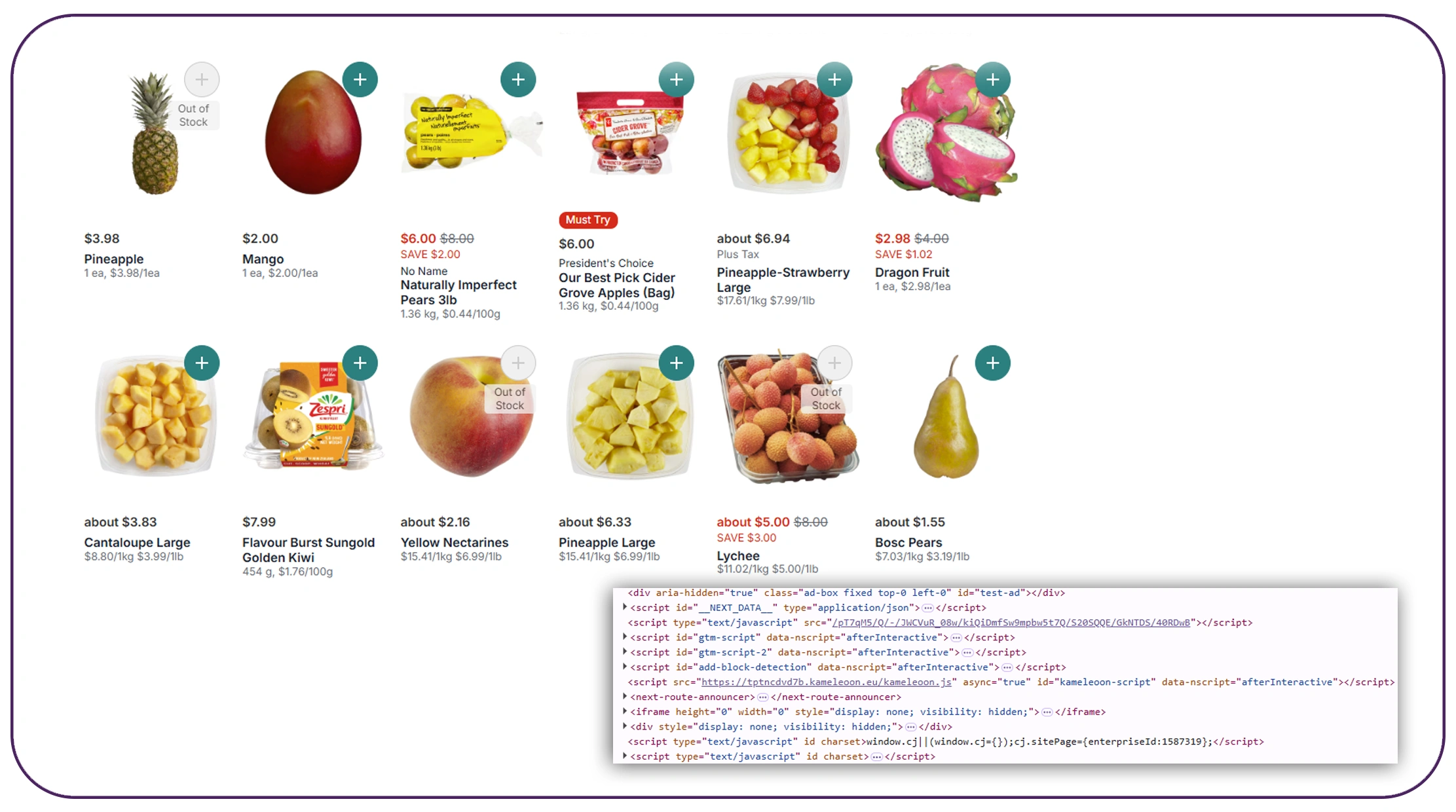

Breaking Free from Manual Price Tracking Failures

Manual tracking remains one of the biggest reasons businesses fail to keep up with market changes. Automated grocery data extraction for US and Canada replaces spreadsheets, store visits, and infrequent audits with real-time data pipelines. Between 2020 and 2026, automation adoption in grocery analytics rose sharply as pricing volatility increased.

Performance Comparison

| Metric | Manual Tracking | Automated Extraction |

|---|---|---|

| Update Frequency | Weekly / Monthly | Real-time |

| Price Accuracy | 88–91% | 99%+ |

| Store Coverage | Limited | Nationwide |

| Labor Hours/Month | 120+ | 35 |

Automation ensures that every SKU price, discount, and promotional change is captured consistently. Businesses can track thousands of products across multiple chains without increasing operational costs. This shift allows pricing analysts to focus on insights, forecasting, and strategy instead of data collection, significantly improving decision speed and confidence.

Navigating Regional Complexity Across Borders

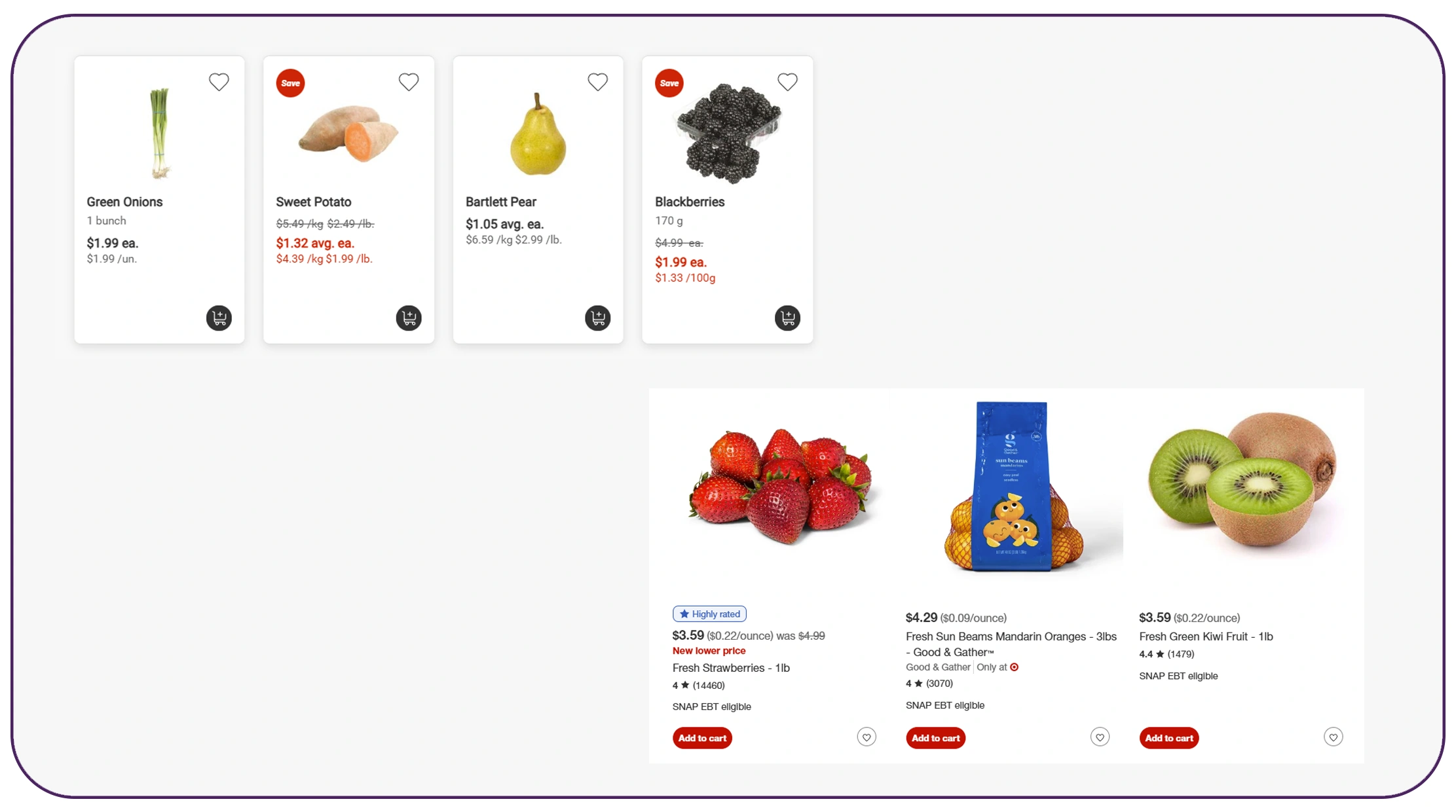

Effective pricing today demands Cross-border grocery price comparison, especially as retailers expand operations and sourcing across North America. From 2020 onward, shared suppliers and private-label expansion blurred traditional pricing boundaries between the US and Canada.

Category Price Index (2020 = 100)

| Category | USA 2026* | Canada 2026* |

|---|---|---|

| Dairy | 127 | 134 |

| Meat | 121 | 130 |

| Produce | 116 | 123 |

| Packaged Foods | 125 | 132 |

Without consistent cross-border data, businesses risk overpricing in competitive regions or underpricing in higher-cost markets. Scraped data enables SKU-level comparisons, helping brands understand how taxes, logistics, and local regulations impact shelf prices. These insights support smarter expansion strategies, supplier negotiations, and region-specific promotions that align with local purchasing power.

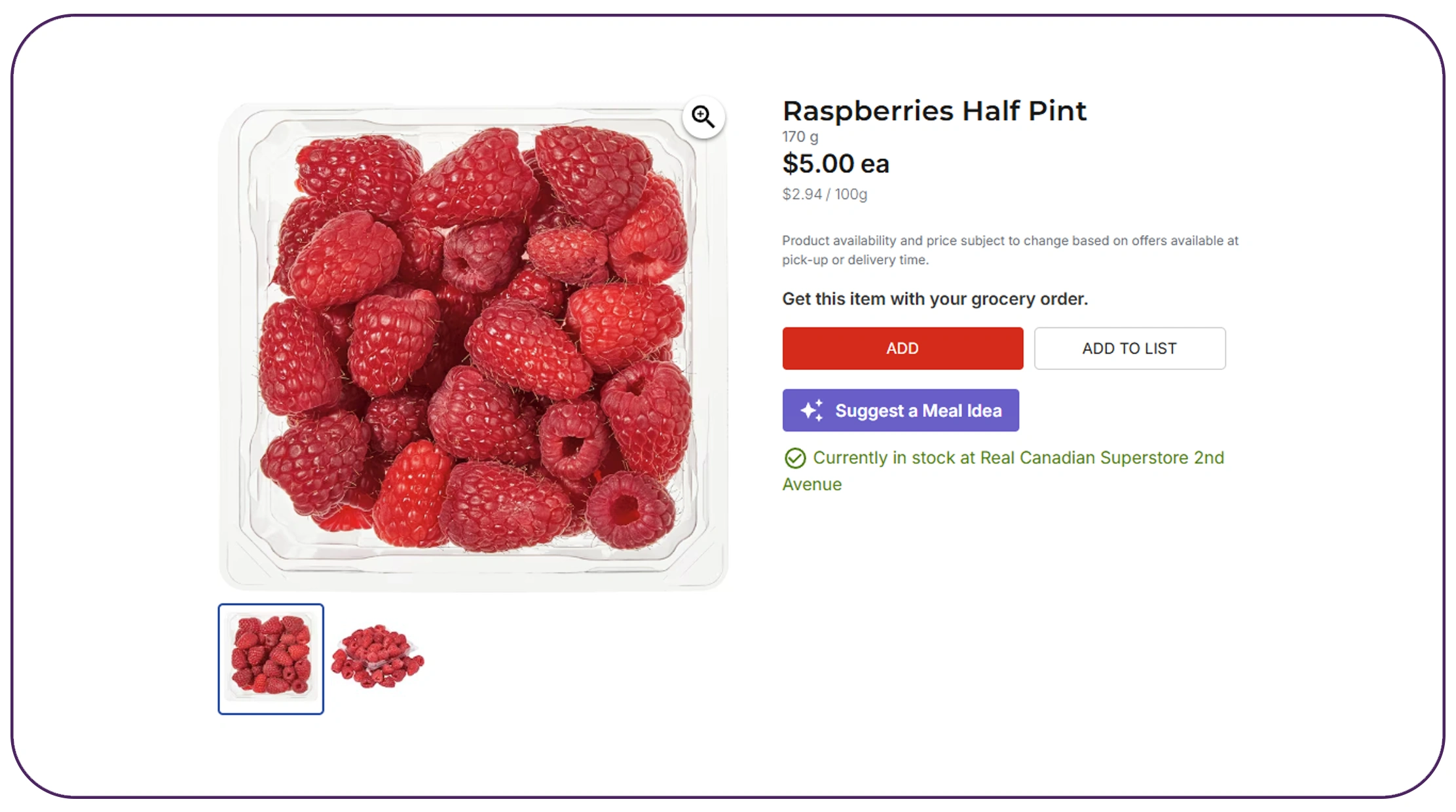

Managing Volatility with Live Market Intelligence

The pace of change accelerated dramatically after 2020, making North America grocery price comparison via real-time data scraping essential. Promotions are shorter, supply disruptions are frequent, and pricing adjustments happen weekly or even daily.

Average Monthly Price Change (%)

| Year | USA | Canada |

|---|---|---|

| 2020 | 1.1 | 1.3 |

| 2022 | 2.4 | 2.7 |

| 2024 | 3.0 | 3.3 |

| 2026* | 3.4 | 3.7 |

Real-time scraping enables alerts for sudden price spikes, discount launches, and competitive shifts. Businesses can respond immediately instead of reacting weeks later. This agility is critical for protecting margins, adjusting promotions, and maintaining competitiveness in volatile grocery markets.

Scaling Pricing Intelligence with API Infrastructure

A robust Grocery Data Scraping API underpins scalable pricing intelligence systems. From 2020 to 2026, API-driven data collection became the standard for enterprises seeking accuracy and speed.

Operational Impact of API Adoption

| Metric | Before API | After API |

|---|---|---|

| Data Latency | 24–72 hours | Minutes |

| SKU Coverage | 8,000 | 60,000+ |

| Integration Effort | High | Seamless |

| Decision Cycle | Slow | Near real-time |

APIs provide structured, normalized data streams that integrate easily with BI tools, dashboards, and AI models. This enables continuous monitoring, advanced analytics, and automated pricing adjustments without operational bottlenecks.

Transforming Raw Data into Long-Term Assets

A comprehensive Grocery Dataset turns scraped prices into strategic intelligence. Historical data from 2020 to 2026 enables trend analysis, promotion effectiveness studies, and elasticity modeling.

Dataset Growth Overview

| Year | Records Collected | Historical Depth |

|---|---|---|

| 2020 | 12M | 1 Year |

| 2023 | 48M | 3 Years |

| 2026* | 110M+ | 6 Years |

With structured datasets, businesses improve forecasting accuracy, optimize promotions, and support AI-driven pricing strategies. This long-term view transforms price tracking from a reactive task into a competitive advantage.

Why Choose Real Data API?

Real Data API delivers Real-Time Price Data Monitoring for Grocery Prices while enabling businesses to Scrape supermarket price fluctuations in Canada and USA at scale. With enterprise-grade infrastructure, high data accuracy, and customizable delivery formats, Real Data API removes tracking blind spots and supports advanced analytics. Businesses gain reliable, compliant, and scalable grocery intelligence without the complexity of building internal scraping systems.

Conclusion

Businesses fail at price tracking because they rely on delayed data, limited coverage, and manual processes that cannot keep pace with market volatility. By embracing Grocery Data Extraction and leveraging Scrape supermarket price fluctuations in Canada and USA, organizations can shift from reactive pricing to proactive market leadership.

Partner with Real Data API today to access real-time supermarket intelligence and build faster, smarter, and more profitable pricing strategies across North America!