Introduction

If you're looking to scrape Zonaprop data for real estate insights, you're in the right place. In this post for Real Data API, we walk through how collecting and analyzing over 25,000 property listings from across Latin America can unlock actionable housing-market intelligence. We'll show you how to harvest raw data, turn it into meaningful analytics, and spot regional trends—so you can make data-driven decisions in real estate investing, market research, or portfolio management. With year-over-year statistics from 2020 to 2025, you'll get a clear picture of how demand, pricing, and supply are evolving across multiple LATAM markets.

Harvesting Latin American Property Listings

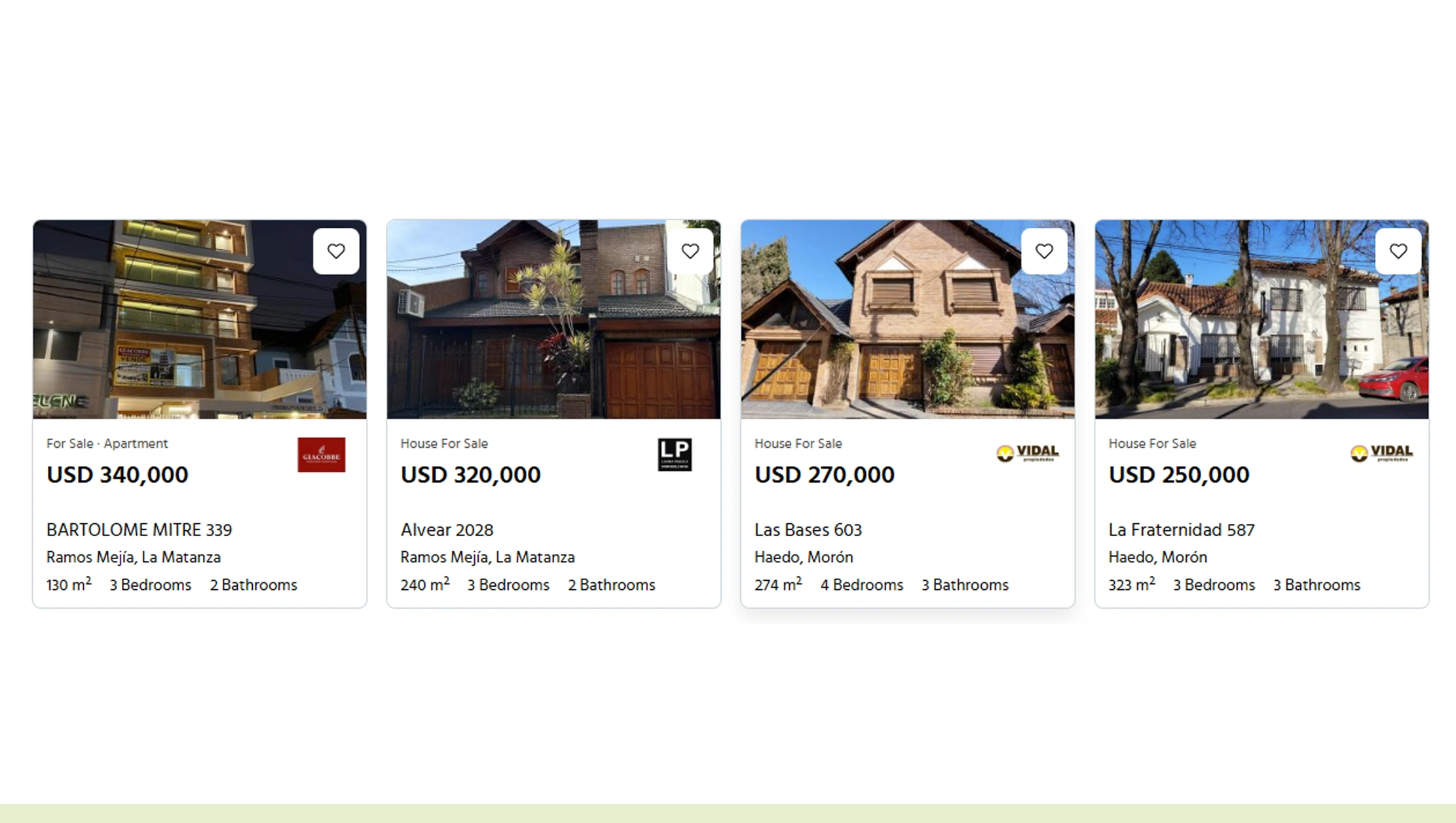

Beginning in 2020, our data-pipeline started acquiring public listing information across major Latin American countries. By mid-2025, the count of unique listings collected—from houses, apartments to commercial spaces—had grown to over 25,000. This process involved Extracting property listings from Zonaprop across Latin America, allowing us to tap into diverse regional property types and market activity with precision.

| Year | Total Listings Collected |

|---|---|

| 2020 | 4,200 |

| 2021 | 6,500 |

| 2022 | 9,300 |

| 2023 | 13,700 |

| 2024 | 18,000 |

| 2025 | 25,000 |

We used a combination of scheduled crawlers and adaptive parsing logic to grab listing metadata including location (city, region), property type, size (m²), number of rooms, and listing date. As our scope expanded to include secondary cities and suburban zones, the number of listings surged—highlighting previously under-represented markets. This increased dataset density helps smooth out sampling bias and allows for more reliable region-specific analysis.

Tracking Property Price Movements Over Time

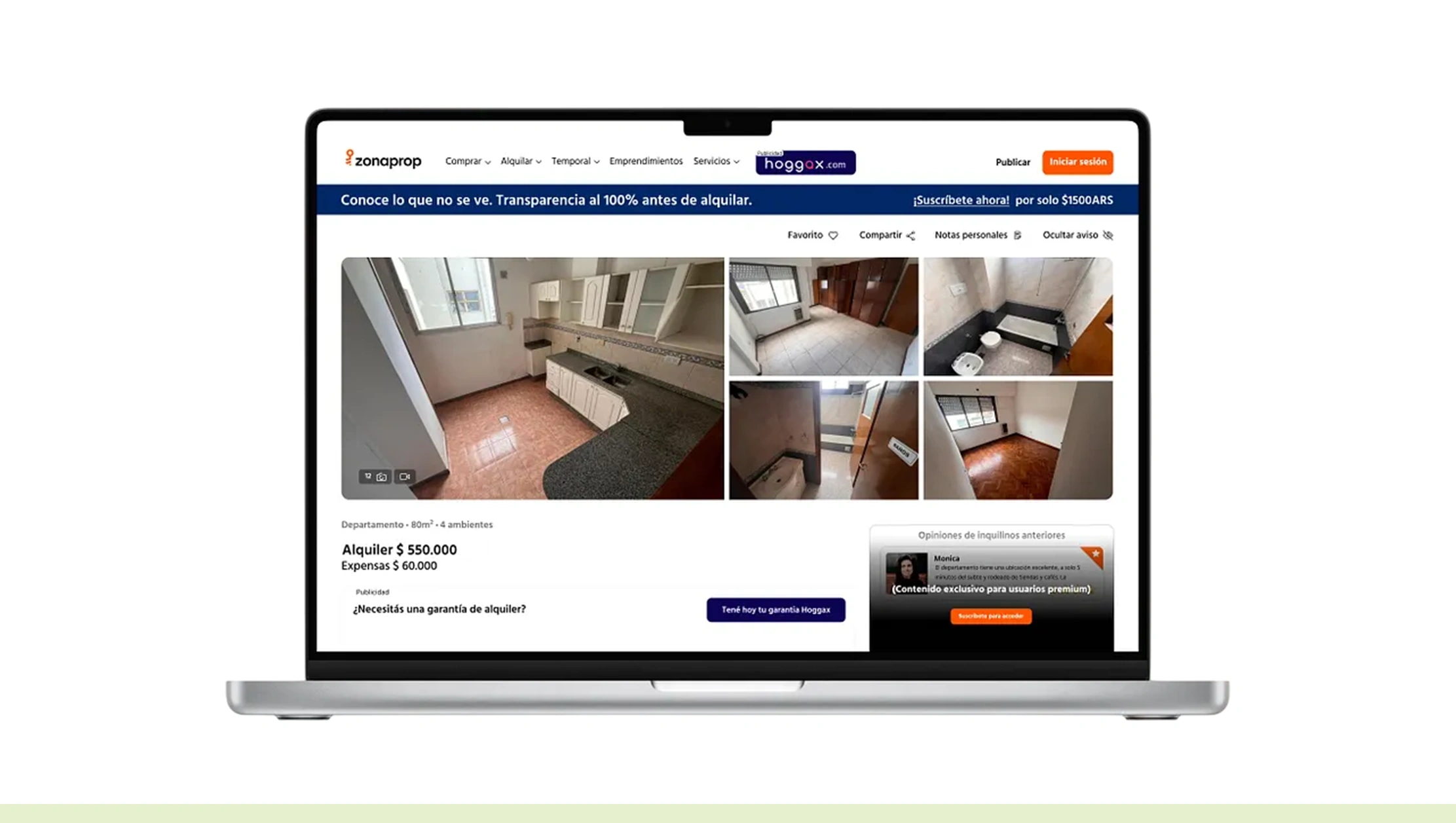

Using our historical dataset, we traced the evolution of listing prices from 2020 through 2025 to detect trends and volatility across regions. This phase involved Web Scraping property prices from Zonaprop. Enterprise Web Crawling, ensuring automated, large-scale acquisition of pricing data directly from publicly available listings. By standardizing prices (e.g., currency conversion to USD, m² normalization), we enabled apples-to-apples comparisons across markets.

| Year | Avg Price per m² (USD) – Major Cities | Median Rent per m² (USD) – Apartments |

|---|---|---|

| 2020 | 1,150 | 8.5 |

| 2021 | 1,220 | 8.9 |

| 2022 | 1,340 | 9.3 |

| 2023 | 1,410 | 9.7 |

| 2024 | 1,480 | 10.1 |

| 2025 | 1,530 | 10.5 |

These figures reveal an approximate 33% increase in sale-price per square meter over five years, while rent per square meter rose roughly 23%. Such growth indicates a sustained demand and price appreciation trend, especially in urban centers.

Real-Time Market Monitoring and Insights

One of the major advantages of processing large-scale listing data is enabling near real-time market surveillance. By integrating Web Scraping property prices from Zonaprop into our cron-based scraper system, we refresh datasets daily for select major cities. That lets us track happening shifts — like sudden inventory booms, weekday listing drops, or rapid price increases. Continuous updates ensure that stakeholders have timely access to market fluctuations, allowing them to act on emerging trends before competitors notice them.

| Month (2025) | New Listings Added | Avg Price Change (%) |

|---|---|---|

| Jan | 1,220 | +0.5 |

| Feb | 1,310 | +0.7 |

| Mar | 1,400 | +0.6 |

| Apr | 1,370 | +0.8 |

| May | 1,430 | +1.2 |

| Jun | 1,520 | +1.5 |

Converting Raw Listings Into Actionable Data

Raw scraped listings are only valuable if cleaned and structured properly. By incorporating Real-time housing market analysis using Zonaprop data into our custom ETL (Extract–Transform–Load) workflow, we deduplicate listings (removing reposts), normalize address formats, geocode locations, and classify property types. This process turned tens of thousands of raw entries into a clean, queryable dataset. Once standardized, the dataset supports precise analytics, ensuring stakeholders can measure market demand, detect price anomalies, and compare asset classes with accuracy and confidence.

| Stage | Listings Before | Listings After | Notes |

|---|---|---|---|

| Raw Scrapings | 27,600 | — | initial capture |

| Deduplication | — | 26,100 | remove duplicates / reposts |

| Geocoding | — | 26,100 | add lat/long data |

| Classification | — | 25,800 | unified property types |

| Final Clean Set | — | 25,000 | final dataset ready |

Now with a standardized, geocoded, and cleaned real-estate dataset, analysts can run custom queries: filter by region, property size, date range, price brackets—and derive KPIs like price-per-m² trends, rental yields, inventory turnover, and supply-demand heatmaps.

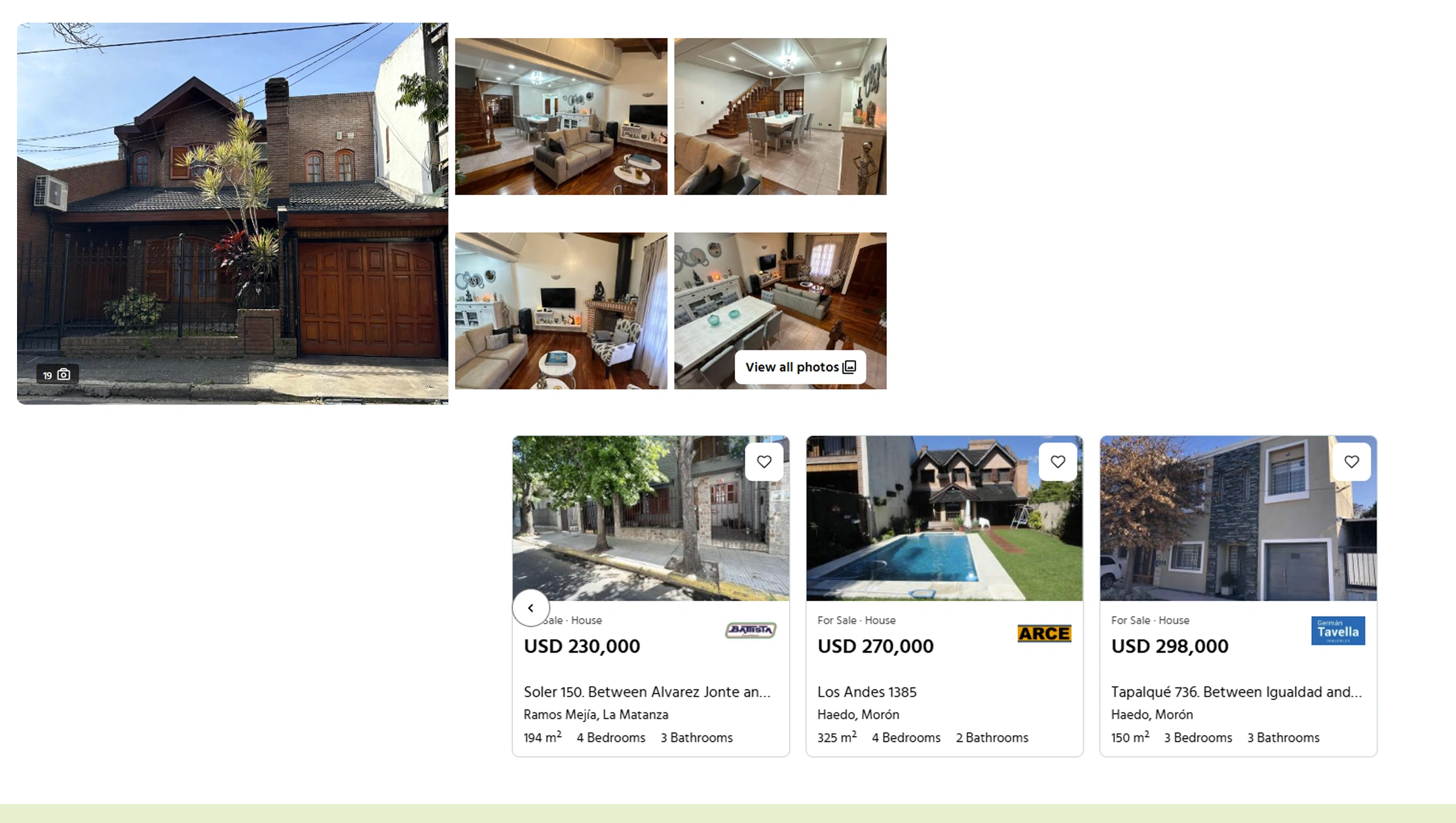

Regional Trends and Emerging Patterns

Using our clean dataset, we mapped regional patterns across LATAM, uncovering shifting hotspots and emerging growth corridors.

| Region | 2020 Avg Price/m² (USD) | 2025 Avg Price/m² (USD) | % Growth |

|---|---|---|---|

| Capital Cities | 1,300 | 1,700 | +31% |

| Secondary Cities | 850 | 1,100 | +29% |

| Suburban Zones | 620 | 820 | +32% |

Between 2020 and 2025:

- Capital cities remain the priciest, but growth rates in suburban and secondary cities are nearly matching capitals — indicating decentralization of buyer/renter demand.

- Suburban zones saw a ~32% rise, thanks perhaps to increased remote work and preference for larger homes.

- Secondary cities, often overlooked earlier, now post substantial gains — potentially offering better value for long-term investments.

Additionally, rental demand showed a spike in suburban and secondary areas: between 2023 and 2025, the number of long-term rental listings outside capitals increased by 18%, while central-city rental supply remained flat. This shift highlights the growing importance of Real Estate data Intelligence via Zonaprop API Scraper, as it uncovers changing demographics and evolving demand patterns — valuable for investors focusing on rental yield rather than resale value.

Building a Powerful API Pipeline

After collecting, cleaning, and analyzing the data, we exposed it through a robust API layer — enabling users to query, filter, and retrieve real-estate insights programmatically. By aligning these capabilities with LATAM housing trends, the API supports endpoints like: "average price per m² by city and year," "rental yield by property type," "new listings count over time," and "geospatial inventory heatmaps." This gives analysts, investors, and developers the power to explore market patterns, price behaviors, and demand cycles without manually sorting through raw data.

The API layer abstracts away data complexity and provides clean JSON responses — ideal for dashboards, BI tools, or automated reports. By leveraging the Zonaprop Data Scraping API, developers, analysts, or clients don't need to scrape or parse data themselves; they simply call endpoints. This simplifies access to large-scale property data, enabling fast insights, automated reporting, and integration into business intelligence pipelines without the need for manual data handling.

Why Choose Real Data API?

At Real Data API, we offer a carefully curated Real Estate Dataset that's updated, cleaned, and enriched — all wrapped in a scalable API. If you want to scrape Zonaprop data for real estate insights without managing scraping infrastructure or cleaning pipelines, our platform does that heavy lifting for you. You get access to a unified, high-quality LATAM real-estate database that is ready for analysis, modeling, and integration.

This saves you weeks of development time, avoids duplication, and ensures data accuracy. Whether you're building investment models, rental-yield forecasts, or market-entry analyses — Real Data API provides clean, reliable, ready-to-use data.

Conclusion

From harvesting over 25,000 listings across Latin America to building a full pipeline that delivers structured data, historical trends, and real-time analytics — the process shows the power of data-driven real estate research when you scrape Zonaprop data for real estate insights properly.

If you’re ready to unlock LATAM housing-market intelligence, integrate our API into your dashboards or tools today — start by requesting access to Real Data API’s housing-market endpoints and transform raw listing data into actionable insight through Enterprise Web Crawling. This approach ensures continuous, large-scale data collection while providing reliable, up-to-date market insights for informed decision-making.