Introduction

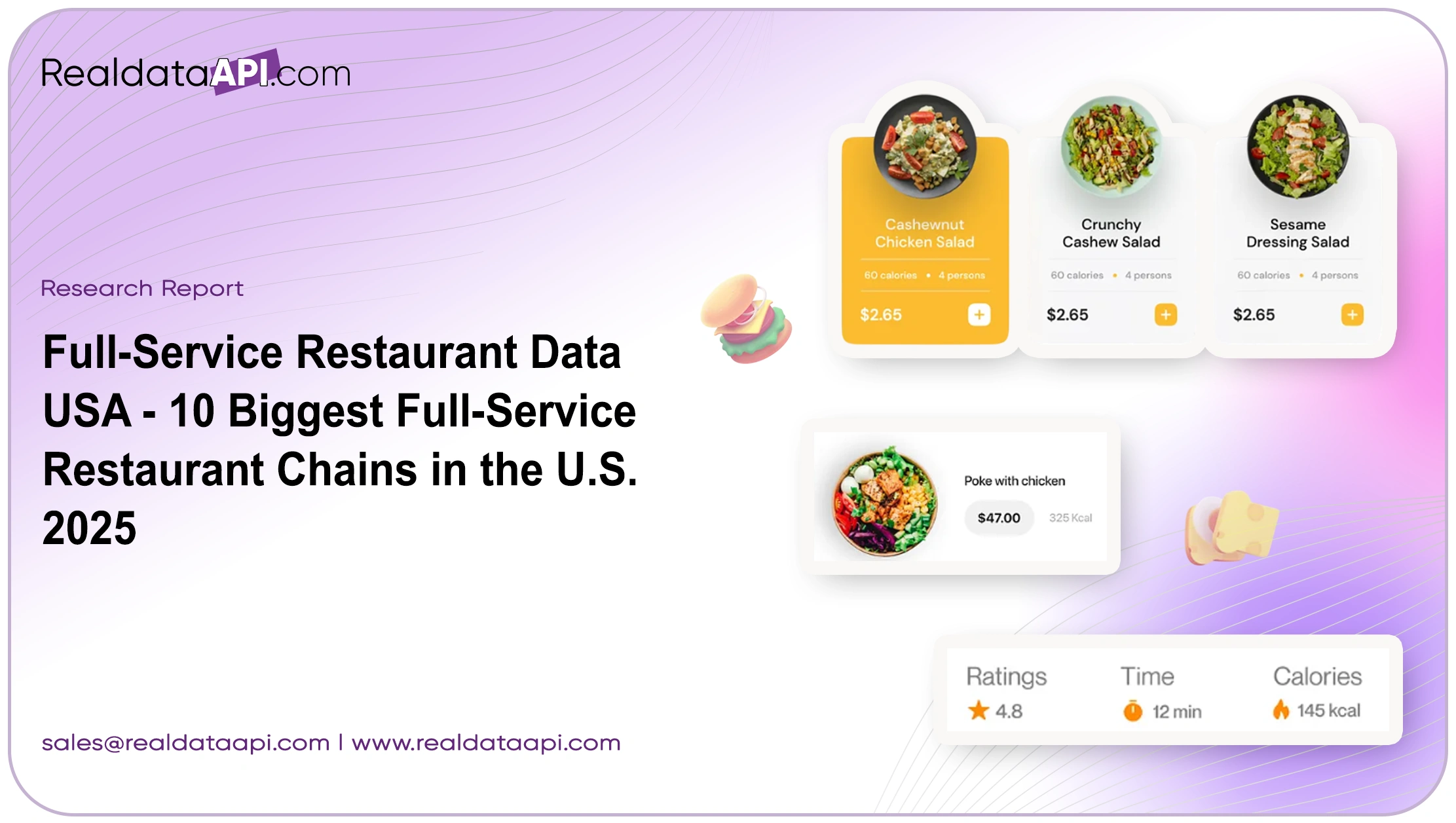

The full-service restaurant (FSR) sector remains a cornerstone of the U.S. food service industry. In an era where fast food dominates delivery and digital spaces, full-service chains continue to attract loyal customers with dine-in experiences, personalized service, and diverse cuisine offerings. This report by Real Data API analyzes the top 10 full-service restaurant chains in the U.S. in 2025 using Full-Service Restaurant location Data USA and location intelligence insights gathered through advanced scraping technologies.

From location counts and revenue trends to geographic spread and expansion strategies, we dive deep into the data to uncover what's driving the FSR market and where the biggest players are headed next.

Methodology

The report relies on a combination of:

- Real-time location scraping using Restaurant Data Collection Services

- Chain-level data from corporate disclosures and industry benchmarks

- Custom datasets including Full-Service Restaurant location Data USA

- Regional traffic patterns and proximity analytics using Location Intelligence

We used the scrape Full-Service Location USA approach, ensuring up-to-date and verified data across all 50 states.

Top 10 Full-Service Restaurant Chains by Store Count (2025)

| Rank | Chain Name | Total Locations (2025) | 2020 Locations | CAGR (2020–2025) |

|---|---|---|---|---|

| 1 | Olive Garden | 910 | 875 | 0.78% |

| 2 | Applebee’s | 1,585 | 1,650 | -0.79% |

| 3 | IHOP | 1,685 | 1,710 | -0.29% |

| 4 | Chili’s | 1,200 | 1,260 | -0.95% |

| 5 | Texas Roadhouse | 750 | 610 | 4.21% |

| 6 | Red Lobster | 650 | 710 | -1.76% |

| 7 | Cracker Barrel | 670 | 660 | 0.30% |

| 8 | Outback Steakhouse | 690 | 725 | -0.98% |

| 9 | Buffalo Wild Wings | 630 | 640 | -0.31% |

| 10 | Perkins Restaurant & Bakery | 280 | 300 | -1.36% |

Analysis

Despite market challenges, full-service chains like Texas Roadhouse and Cracker Barrel demonstrate resilience through modest but steady growth. Others like Red Lobster and Outback Steakhouse show negative CAGR due to operational consolidation. Full-Service Restaurant location Data USA is crucial to pinpoint which regions sustain or lose outlet concentration over time.

Revenue Estimates by Chain (2025)

| Chain Name | Estimated 2025 Revenue (in $B) | Revenue Per Store ($M) |

|---|---|---|

| Olive Garden | $5.5 | $6.04 |

| Applebee’s | $4.3 | $2.71 |

| IHOP | $3.2 | $1.90 |

| Chili’s | $3.9 | $3.25 |

| Texas Roadhouse | $4.8 | $6.40 |

| Red Lobster | $2.7 | $4.15 |

| Cracker Barrel | $3.1 | $4.63 |

| Outback Steakhouse | $3.5 | $5.07 |

| Buffalo Wild Wings | $2.9 | $4.60 |

| Perkins Restaurant | $0.9 | $3.21 |

Analysis

Chains with higher per-location revenue, such as Texas Roadhouse and Outback Steakhouse, are optimizing fewer locations for better returns. This shift emphasizes the importance of Restaurant Chain Location decisions over sheer volume. Combining Full-Service Restaurant location Data USA with sales metrics allows brands to optimize market presence and profitability.

Regional Distribution of Locations (2025)

| Region | Leading Chain | % Regional Share | Total Chain Locations in Region |

|---|---|---|---|

| Midwest | Applebee’s | 28% | 450 |

| South | Texas Roadhouse | 25% | 310 |

| West | Olive Garden | 22% | 300 |

| Northeast | IHOP | 24% | 410 |

| Southeast | Cracker Barrel | 29% | 290 |

Analysis

Each chain tends to dominate specific regions due to localized tastes, competition levels, and franchise models. With tools to scrape full service restaurants location USA, stakeholders can evaluate white spaces for growth. Targeting underserved regions is now a data-driven strategy backed by Location Intelligence.

Market Exit & Entry Activity (2020–2025)

| Chain Name | New Locations Opened | Locations Closed | Net Change (2020–2025) |

|---|---|---|---|

| Olive Garden | 80 | 45 | +35 |

| Applebee’s | 60 | 125 | -65 |

| IHOP | 95 | 120 | -25 |

| Chili’s | 90 | 150 | -60 |

| Texas Roadhouse | 180 | 40 | +140 |

| Red Lobster | 55 | 115 | -60 |

| Cracker Barrel | 50 | 40 | +10 |

| Outback Steakhouse | 60 | 95 | -35 |

| Buffalo Wild Wings | 75 | 85 | -10 |

| Perkins Restaurant | 25 | 45 | -20 |

Analysis

Chains experiencing net losses are re-evaluating their real estate portfolios, influenced by rising operational costs and shifting customer patterns. Using Full-Service Restaurant location Data USA, Real Data API helps identify strategic exit locations and optimize entry strategies in emerging metro and suburban zones.

Technology-Driven Expansion Strategies

Modern full-service brands are now using a blend of data analytics, franchise modeling, and digital customer profiling to fuel growth. Real Data API’s clients can:

- Scrape Full-Service Location USA in real time for hyper-local intelligence

- Identify saturation levels using Restaurant Chain Location datasets

- Monitor proximity to competitors and delivery density

- Leverage Restaurant Data Collection Services to plan future-ready formats (e.g., hybrid dine-in + delivery hubs)

These capabilities are vital to maintaining an edge in a saturated and margin-sensitive market.

Future Outlook for Full-Service Chains

| Metric | 2025 Forecast | Change vs. 2020 |

|---|---|---|

| Total FSR Chains | 24,000 | -6% |

| Avg. Seats per Location | 120 | -12% |

| Avg. Check Size ($) | $27.40 | +15% |

| % Offering Digital Ordering | 91% | +43% |

| Delivery-Enabled Locations | 78% | +55% |

Analysis

While total unit counts decline, the focus shifts to efficiency, digital integration, and consumer-centric experiences. Full-service chains are optimizing their operations based on insights derived from Full-Service Restaurant location Data USA, ensuring each outlet is positioned for maximum performance.

Conclusion

The Full-Service Restaurant location Data USA uncovers a fascinating shift in how America dines out. Top chains are no longer chasing volume but value—maximizing fewer, well-located restaurants supported by strong customer engagement strategies and digital tools. Real Data API offers unparalleled access to FSR market data, location trends, and scraping solutions to help restaurant brands make confident, evidence-based decisions.

Whether you’re expanding, consolidating, or benchmarking, Real Data API enables you to:

- Track national and regional growth trends

- Scrape full service restaurants location USA for white-space mapping

- Access the most accurate, verified Full-Service Restaurant location Data USA

- Act faster with real-time Location Intelligence

Ready to take the next step?

Real Data API is your partner in unlocking the full potential of Full-Service Restaurant Data USA with precision, scale, and strategic clarity.

Contact us today to schedule a demo or get your customized dataset.