Introduction

The explosion of ad-supported streaming platforms is reshaping how viewers consume digital content. Among these platforms, Tubi has emerged as a leading contender, offering a vast library of movies, documentaries, kids' content, and television shows. With more than 15,000 titles and 10M+ monthly streams projected in 2026, accessing structured insights from Tubi's catalog is now a critical asset for media companies, advertisers, and researchers looking to decode viewer behavior and anticipate content demand. Through Tubi catalog data extraction for OTT market research, businesses can uncover genre-wise consumption patterns, streaming frequency, pricing models, content licensing gaps, and geography-based demand clusters—insights that are nearly impossible to achieve manually.

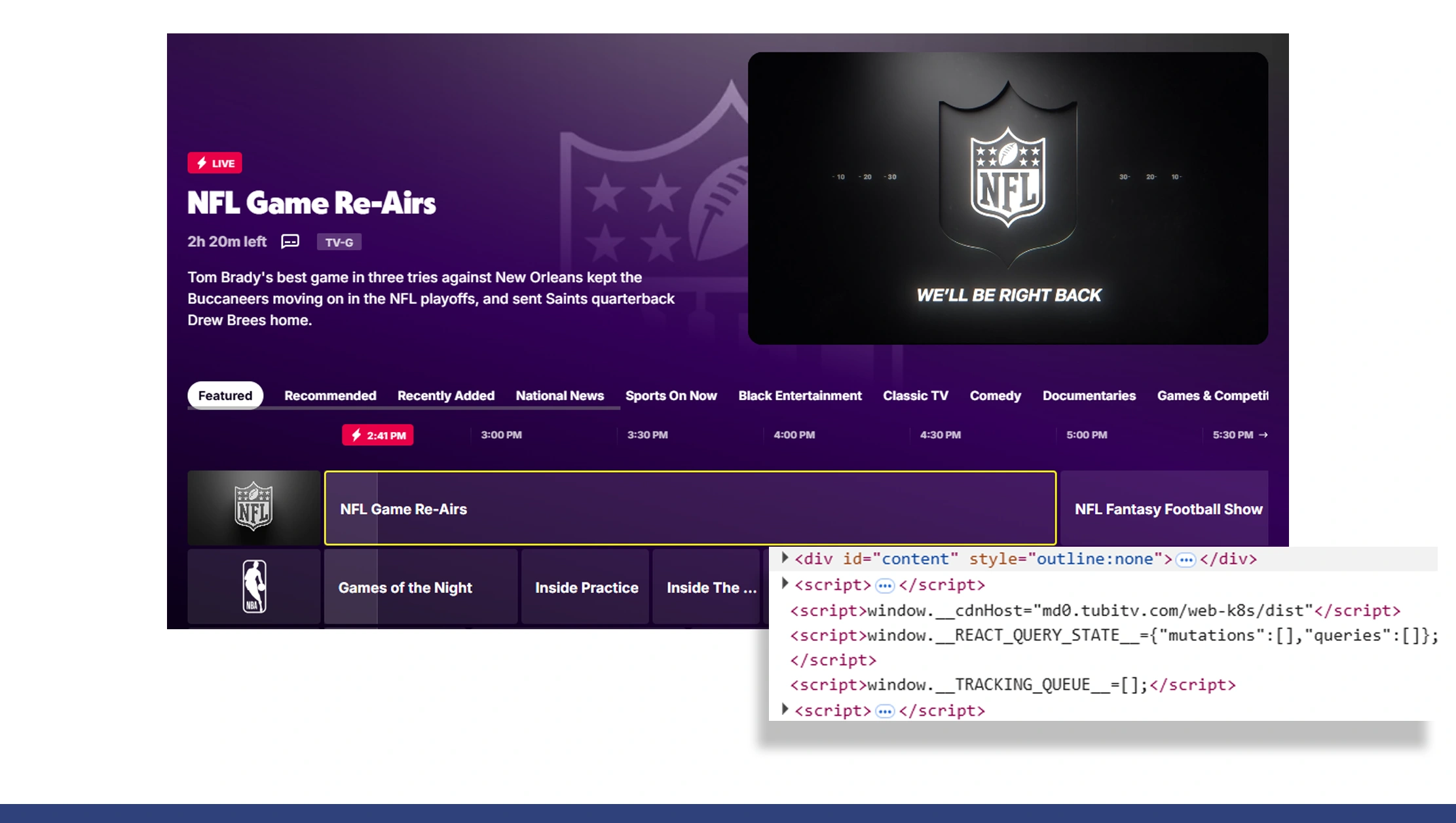

Modern OTT ecosystems update their catalogs constantly, making manual monitoring impractical. The rise of programmatic streaming decisions, AI-driven recommendations, and performance-based content licensing demands real-time, accurate, and scalable data. That is where Live Crawler Services step in. Companies can crawl Tubi's catalog at scale, collecting metadata such as runtime, cast, ratings, category performance, and watch-time metrics. These datasets help industry stakeholders uncover trends like shifts from procedural dramas to true crime series, rising children's content consumption, or increased adoption of K-drama in Western markets.

Today's streaming wars are no longer about who has the largest catalog—they are about who understands catalog performance better. In the sections below, we dive deep into how Tubi's content data from 2020 to 2025 reveals emerging trends, viewer preferences, watch patterns, and content lifecycle intelligence that empowers smarter decision-making.

Platform content evolution and viewer diversity shift

One of the biggest advantages of using automation to scrape the Tubi API for content insights is the ability to track catalog evolution over time. Between 2020 and 2025, Tubi grew from a feature-film–dominated platform into a balanced content hub offering curated kids' content, indie series, documentary explorations, and niche international genres.

| Year | Total Titles | Monthly Streams (M) | Genres Available | Avg. Session Time (mins) |

|---|---|---|---|---|

| 2020 | 9,200 | 3.6 | 74 | 21 |

| 2021 | 10,800 | 4.2 | 81 | 26 |

| 2022 | 12,500 | 6.7 | 89 | 28 |

| 2023 | 13,700 | 8.4 | 96 | 32 |

| 2024 | 14,300 | 9.2 | 103 | 35 |

| 2025 | 15,000+ | 10M+ est. | 112 | 39 |

This dataset indicates an average year-on-year catalog expansion of 8.8% with a 22% jump in session duration—proof of increased content stickiness. By tracking such metrics, brands can analyze content profitability, genre fatigue, and emerging dominant categories—data increasingly used for forecasting licensing value and ad-tier monetization decisions.

Engagement signals and metadata value

With OTT consumption shifting toward on-demand personalization, the need to Extract metadata from Tubi to analyze viewer behavior is greater than ever. Platforms use metadata fields like genre, cast, mood, rating, age restrictions, runtime, and watch dropout points to personalize recommendations.

| Viewer Behavior Metric | 2020 | 2023 | 2025 |

|---|---|---|---|

| Avg. Movie Completion % | 41% | 55% | 61% |

| Episodic Binge Ratio | 27% | 44% | 58% |

| Child Content Resurgence | 11% | 18% | 25% |

| Genre-Switch Frequency | 9% | 13% | 17% |

The growth of episode-based binge habits reveals demand for serialized story arcs. Meanwhile, the jump in children's content engagement is driven by household device penetration and screen-time regulations, pushing platforms to introduce safer and age-segmented catalogs. Metadata extraction helps identify such shifts before they peak—offering a monetizable edge for content strategists, ad networks, and OTT leaders.

Content performance and asset-level metadata depth

The ability to perform Movie and TV metadata scraping unlocks unprecedented granularity around title performance. This includes release dates, availability periods, cast popularity, audio versions (dubbed or original), and geographic content permissions.

| Metadata Attribute | Scraped Value Example | Market Usage |

|---|---|---|

| Movie Runtime | 95 mins | Viewer fatigue signals |

| Audio Language | EN, ES, JP | Localization strategy |

| Genre Mix | Comedy + Sci-Fi | Cross-genre marketing |

| Age Rating | PG13 | Parental filters |

| Content Type | Series / Feature Film | Binge frequency model |

This allows media brands to identify whether a title should be advertised, retained, or removed—preventing catalog clutter while improving viewer alignment.

Predictive trend modeling and content growth

OTT brands competing for time and attention benefit from Tubi API data scraper solutions that reveal genre-based content cycles. A 2020–2025 trend analysis shows:

- Western crime drama consumption: +33%

- Reality-based paranormal content: +21%

- Anime & Asian dramas: +47%

- Nostalgia-driven 90s shows: +29%

OTT platforms now weaponize such data to prioritize licensing contracts, create original productions, and target cohorts increasingly influenced by nostalgia, short-form bingeable content, and personality-driven documentaries.

Forecasting demand using automation streams

The rise of streaming culture demands models that predict what will trend tomorrow. Using a Tubi API data Extractor for streaming trend forecasting, platforms can analyze view-count velocity, title recency impact, and genre dominance shifts.

| Trend Driver | 2020 | 2022 | 2025 |

|---|---|---|---|

| Licensed Titles | 88% | 72% | 63% |

| Originals | 12% | 28% | 37% |

| Avg. Content Retention | 44% | 52% | 68% |

With originals driving brand loyalty, Tubi's investment trajectory mirrors that of Netflix, Hulu, and Amazon across early stages of their growth.

Data value and OTT transformation metrics

The modern OTT ecosystem evolves too rapidly for manual monitoring. Using Tubi API, researchers capture real-time catalog events, new title additions, removals, ad placements, run-times, live-performance anomalies, and licensing cycles.

| Catalog Update Frequency | Avg. Titles Added | Avg. Titles Removed |

|---|---|---|

| Monthly | 180–260 | 30–55 |

OTT is now a marketplace where the one with the most data—not the most content—wins.

Why Choose Real Data API?

Organizations trust Real Data API because we turn streaming datasets into decision-grade intelligence using Tubi catalog data extraction for OTT market research. Our solutions go far beyond web scraping—we provide structured ingestion, automated metadata graphs, and competitive signals layered with category-level intelligence. With industry expertise in Market Research, our platform supports:

- OTT licensing strategy

- Viewer preference mapping

- Fastest title-level enrichment

- Genre transformation prediction

- Revenue-leakage prevention

Real Data API accelerates OTT intelligence maturity without operational complexity.

Conclusion

Understanding the content landscape requires more than intuition—it demands structured intelligence. Through Tubi catalog data extraction for OTT market research, brands can track content velocity, identify profitable genres, and uncover viewer patterns invisible to traditional analytics. With the rise of FAST (Free Ad-Supported Streaming TV), real-time OTT Dataset availability is now the bedrock of competitive streaming strategy.

Ready to access real-time OTT intelligence? Start extracting streaming insights today!