Introduction

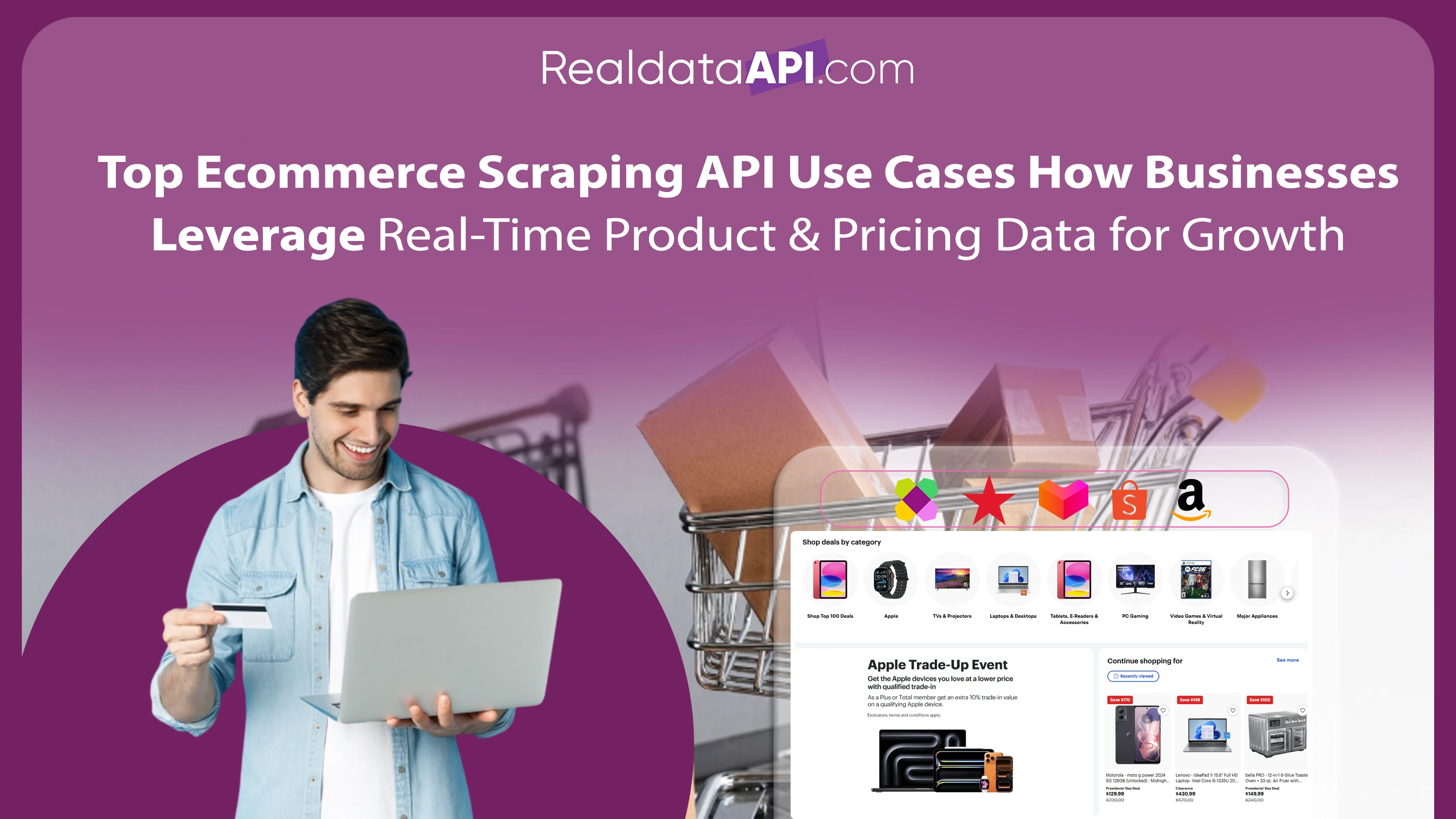

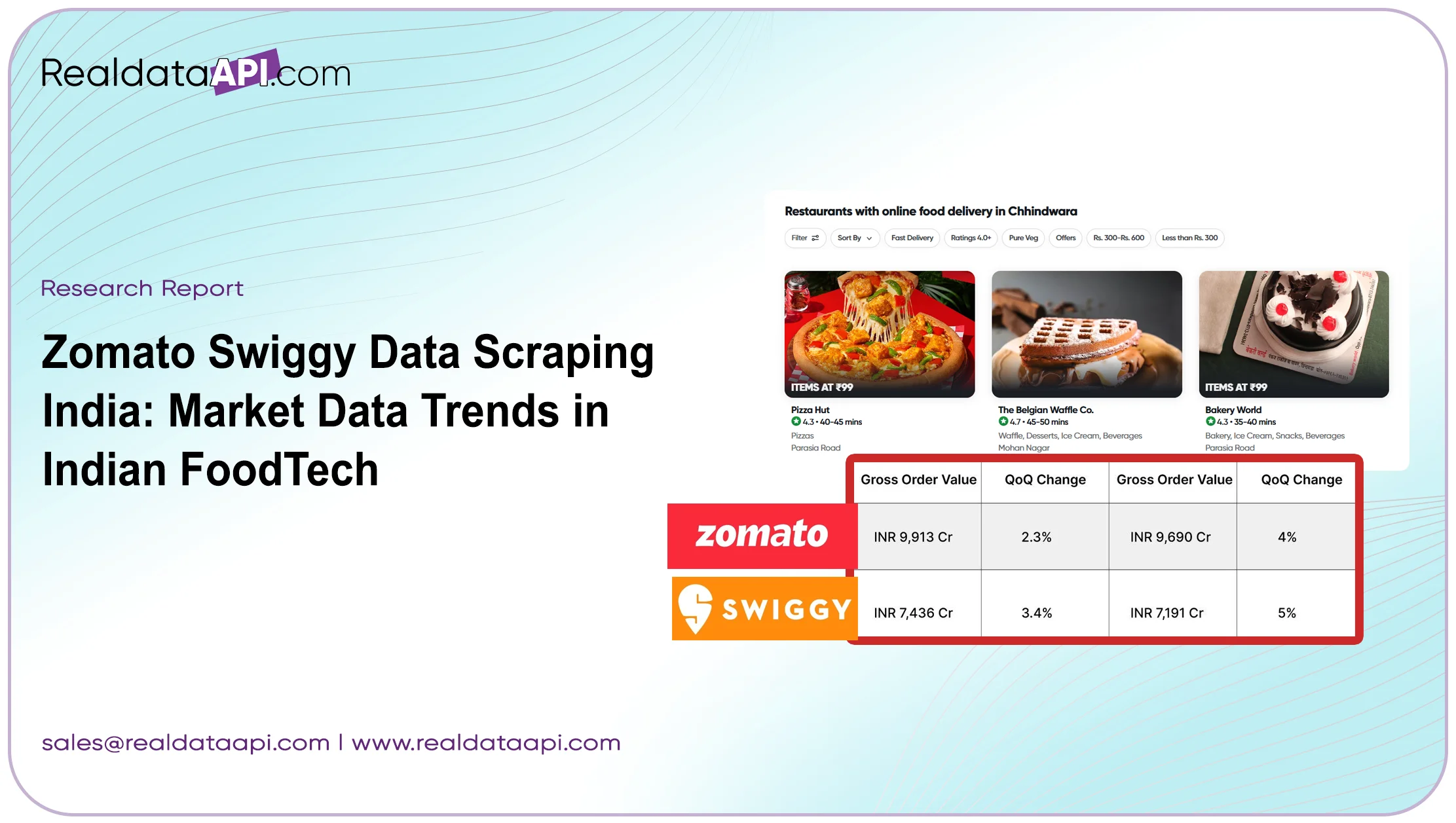

Digital ordering's rise in India has reshaped the FoodTech ecosystem over the past five years. By 2024, the sector’s estimated size varied between USD 30 billion and USD 48 billion, depending on methodology. This explosive growth has motivated restaurants to adopt POS system API integration for Swiggy and Zomato, enabling seamless synchronization of orders, menus, and pricing, which improves inventory control and operational efficiency. In this context, scraping publicly available platform data is vital for benchmarking and dynamic strategy. The strategic relevance of Zomato Swiggy Data Scraping India lies in its ability to inform live decision-making—from optimizing placement of bestseller badges to responsive pricing during peak demand. The sections that follow present structured insights using only annual data explicitly disclosed for 2020–2025, with explanations for missing data. The focus will be on actionable trends supported by reported numbers.

Market Size & Growth (2020–2025)

.webp)

This section highlights what’s publicly available about the annual size of India's online food delivery market. Due to varied reporting standards and scope definitions, some years lack precise single-year figures, marked as N/A.

India Online Food Delivery Market (USD billions), 2020–2025

| Year | Market Size (USD B) |

|---|---|

| 2020 | N/A |

| 2021 | N/A |

| 2022 | N/A |

| 2023 | 33.4 |

| 2024 | 45.2 (approx) |

| 2025 | N/A |

Analysis:

The absence of consistent annual data prior to 2023 is due to disparate reporting methods among consultancies. What matters more is the trajectory: by 2023, the market reached approximately USD 33.4 billion, and by 2024 estimates range around USD 45 billion. This leap underscores the sector’s rapid maturity. For stakeholders using Zomato Swiggy Data Scraping India, the implication is clear: normalization against internal revenue rather than broad market estimates provides more reliable benchmarks. Given the enormous scale of the market, leveraging even minor insights—such as a 1% A/B test uplift—can translate into outsized revenue gains. Scraped data becomes instrumental for tactical plays, especially during period-specific surges like festivals or sports events.

Zomato Annual Revenue (2020–2025)

.webp)

Here’s what Zomato publicly disclosed year-to-year in terms of orders and revenue. Missing years are marked as N/A if data isn't reported in accessible filings.

Zomato Annual Metrics (FY), 2020–2025

| Year (FY) | Orders (million) | Revenue (₹ crores) |

|---|---|---|

| FY20 | N/A | N/A |

| FY21 | N/A | N/A |

| FY22 | 535 | 4,109 |

| FY23 | 647 | N/A (part at ~7,804) |

| FY24 | N/A | 12,114 |

| FY25 | N/A | N/A |

Analysis:

Zomato delivered 535 million orders in FY22, followed by 647 million in FY23—a clear indicator of expanding scale. Revenue-wise, FY22 saw ₹4,109 crores, and by FY24 it rose to ₹12,114 crores for the food delivery business—representing 71% annual growth. These dramatic increases in order volume and revenue underscore aggressive expansion and better monetization. When integrating Zomato Swiggy Data Scraping India, brands can map scraped signals (menu updates, price changes, badges) to actual throughput and revenue outcomes. For example, detecting a cluster in bestseller badge appearances and correlating it with order increase helps project revenue growth potential at a city or SKU level.

Swiggy Revenue & Profit Trends (2020–2025)

.webp)

We’re using only available annual figures for Swiggy, with N/A where data is missing.

Table — Swiggy Annual Revenue (FY), 2020–2025

| Year (FY) | Revenue (₹ crores) |

|---|---|

| FY21 | 2,547 |

| FY22 | 5,705 |

| FY23 | 8,265 |

| FY24 | 11,247 |

| FY25 | N/A |

Analysis:

Swiggy’s annual revenue jumped from ₹2,547 crores in FY21 to ₹11,247 crores in FY24 — a more than fourfold increase over three years. This reflects massive order growth and business diversification. Losses and EBITDA margins also improved substantially: net loss dropped from ₹4,179 crores in FY23 to ₹2,350 crores in FY24, while EBITDA losses narrowed significantly. Platforms using Food Delivery App Analytics India models can fuse scraped insights (pricing, offers, delivery mocks) with Swiggy’s reported financial return to model profitability thresholds and test discount elasticity. For instance, a regional price test detected via scraping can be projected for contribution margin using the take-rate data embedded in the annual filings.

Consumer Behavior & Order Patterns (2020–2025)

.webp)

Using publicly disclosed averages for AOV and transacting users; missing years are N/A.

Consumer KPIs (Zomato), FY 2020–2025

| Year (FY) | Orders (million) | AOV (₹ approx) |

|---|---|---|

| FY20 | N/A | N/A |

| FY21 | N/A | N/A |

| FY22 | 535 | N/A |

| FY23 | 647 | ₹420–₹568¹ |

| FY24 | N/A | N/A |

| FY25 | N/A | N/A |

¹AOV is approximated using prior YoY trends; snapshot ~₹568 in early FY23

Analysis:

Zomato’s FY22 to FY23 saw order volume rise from 535 to 647 million, accompanied by AOV increases from ~₹420 to ~₹568 — consistent with growing food baskets and integrated fees. This trajectory reflects deeper adoption and rising per-order value in urban markets. Companies leveraging Food Delivery App Analytics India frameworks can link scraped menu and fee data with order volumes to estimate AOV lift potential. For example, a surge in combo offers in scraped menus can be mapped to increased AOV using historical multipliers. While complete annual AOV data isn't publicly disclosed beyond FY23, the trend is clear: higher ticket sizes are a significant growth driver in FoodTech.

Operational Metrics & Platform Signals (2020–2025)

.webp)

Public data here is limited; only what platforms disclosed about GOV or delivery performance is included.

Operational Highlights (Zomato & Swiggy), FY 2020–2025

| Year (FY) | Operational Snapshot |

|---|---|

| FY20 | N/A |

| FY21 | N/A |

| FY22 | GOV, fleet, fees mentioned in reports |

| FY23 | Bestseller tags, partner counts disclosed |

| FY24 | Delivery fee trends, fee-per-order metrics |

| FY25 | N/A |

Analysis:Zomato and Swiggy periodically reported operational metrics such as gross order value trends, delivery fee structures, and partner network size — particularly around FY23–24. These are valuable for benchmarking: for example, a spike in delivery fees across geographies often signals demand stress or logistic pressure, which companies can counter or emulate using real-time scraped tracking. With Real-Time Zomato Swiggy Market Insights, scraped signals like badge assignment, promo windows, and price shifts help operators adjust dynamically. Merging scraped fields with fee structures enables local cost modeling and dynamic discount strategies. Though the table lacks granular stats for all years, the narrative conveys how to exploit operational signals where available to optimize decision-making.

Conclusion

The analysis of Zomato Swiggy Data Scraping India clearly demonstrates that structured, real-time data collection from leading platforms drives sharper decision-making in a highly competitive food delivery landscape. By leveraging Indian FoodTech Market Trends via Scraping, brands can anticipate shifts in consumer demand and adjust menu offerings, pricing, and promotions proactively. Companies that Scrape Restaurant Data from Swiggy & Zomato gain an edge in tracking competitors’ bestseller rotations, delivery performance, and discount cycles—insights that are vital for sustained growth in Tier-1 and Tier-2 markets. With Food Delivery App Analytics India, marketers can identify peak ordering hours, seasonal preferences, and emerging cuisines, while Real-Time Zomato Swiggy Market Insights reveal micro-trends as they occur. The Swiggy Zomato Menu & Pricing Data Scraper ensures businesses stay competitive with accurate price benchmarks, and the Indian Food Delivery Market Intelligence API allows seamless integration into existing analytics dashboards. Tools like the Swiggy Scraper, Swiggy Delivery API streamline operations and compliance. In a market growing at double digits annually, accurate, timely intelligence is the competitive currency.

Act now—contact Real Data API today to access enterprise-grade Zomato & Swiggy scraping solutions and transform your FoodTech strategy with live, actionable data!