Introduction

Traditional wine and spirits market research relies heavily on distributor surveys, delayed sales reports, and limited consumer panels. These methods are costly, slow, and often outdated by the time insights reach decision-makers. In contrast, modern alcohol brands, importers, and analysts require near real-time visibility into pricing, availability, and demand shifts—especially in tightly regulated markets like Finland.

This is where Alko webshop data Scraping for wine and spirits market analysis becomes a game changer. By capturing structured retail data directly from Alko's official online storefront, businesses gain immediate access to product-level intelligence across wines, spirits, and specialty alcohol categories. Instead of waiting months for reports, teams can analyze pricing changes, assortment evolution, and demand signals as they happen.

Between 2020 and 2026, Finland's alcohol market has undergone significant shifts due to inflation, regulatory updates, premiumization trends, and changing consumer preferences. Static research methods struggle to keep up with this pace of change. Data-driven approaches powered by automated scraping and APIs now deliver insights up to 90% faster, enabling smarter pricing, forecasting, and product strategies.

Market Blind Spots Created by Legacy Research Models

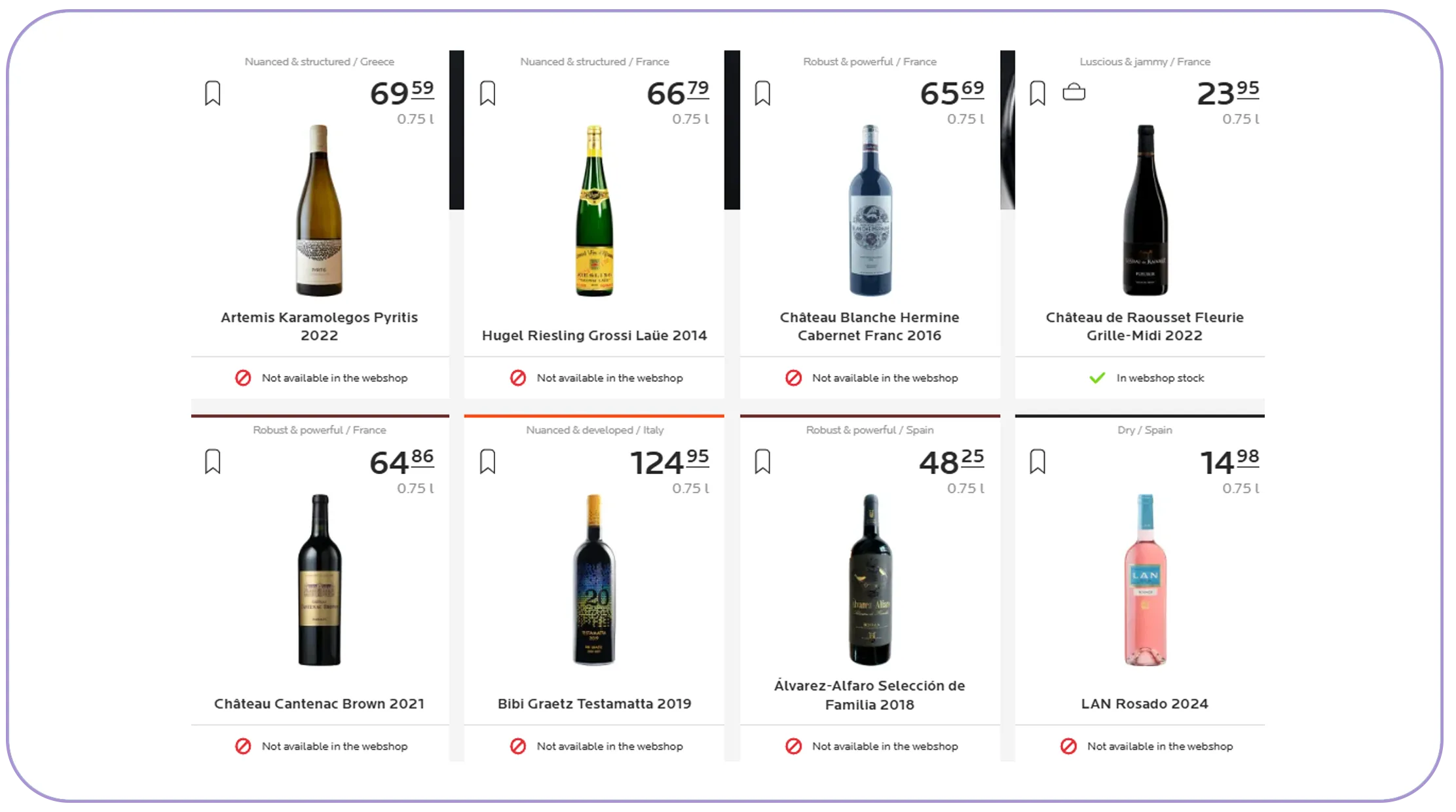

Legacy research models depend on historical averages and fragmented datasets. In alcohol retail, this creates blind spots where brands fail to detect early pricing signals, SKU rationalization, or category expansion. Between 2020 and 2022, Finnish alcohol prices fluctuated significantly due to logistics disruptions and tax adjustments, yet many suppliers only recognized these trends months later.

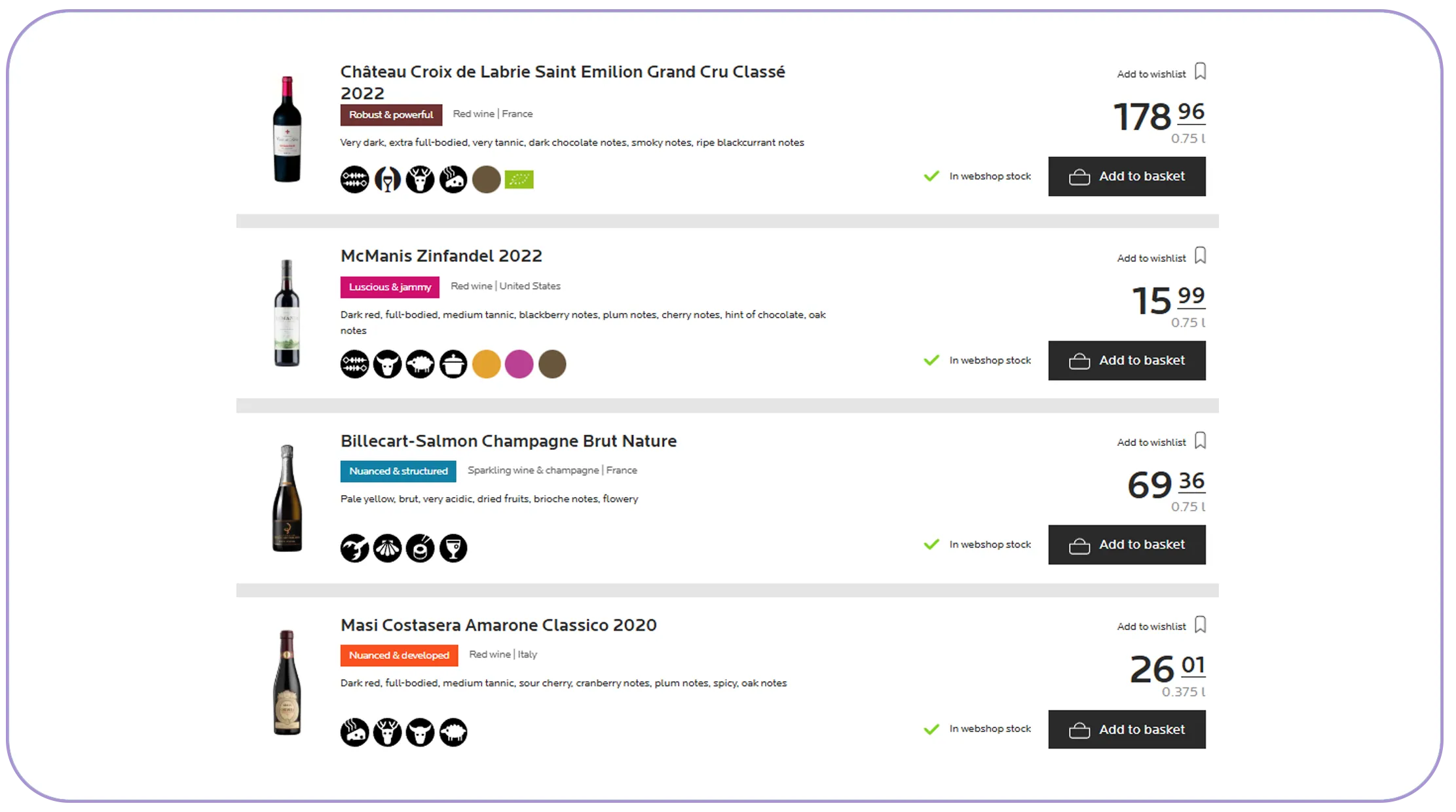

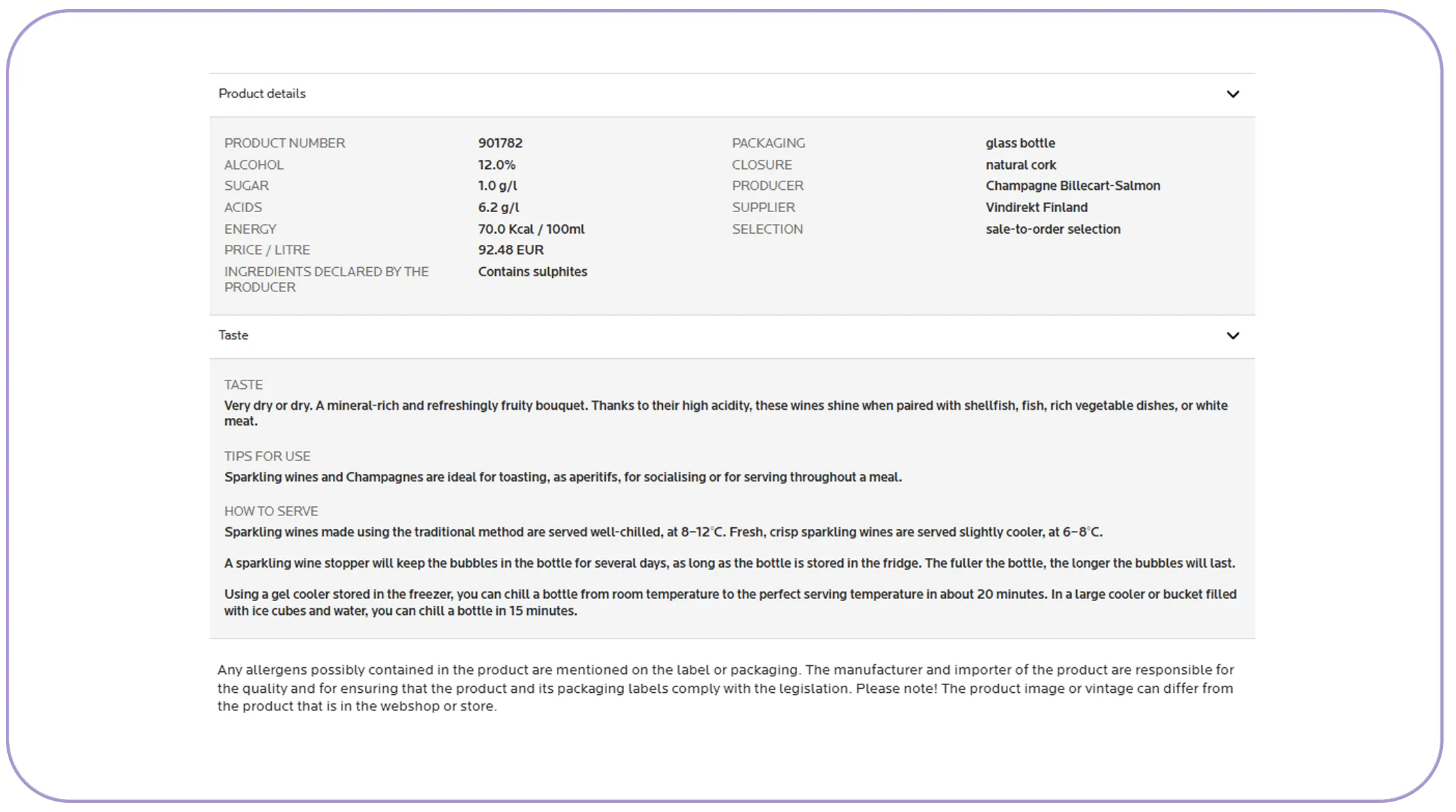

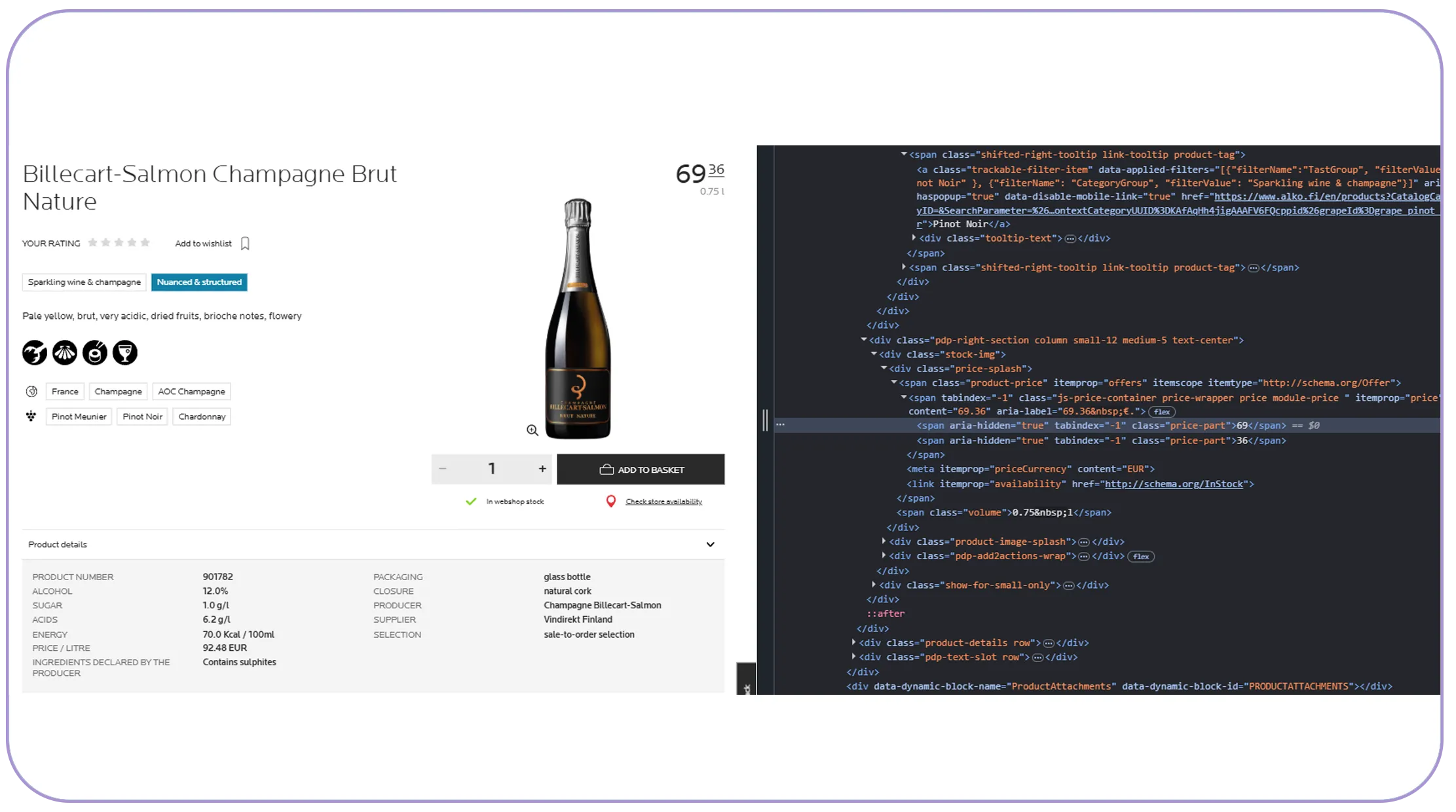

By choosing to scrape Alko pricing data for alcohol retail insights, companies gain SKU-level visibility into price tiers, promotions, bottle sizes, and alcohol percentages. This data reveals how products move across price bands and how competitors respond to market pressure in real time.

Key Market Indicators (2020–2026)

| Metric | 2020 | 2022 | 2024 | 2026 (Est.) |

|---|---|---|---|---|

| Avg. Wine Price (€) | 13.2 | 14.8 | 16.1 | 17.5 |

| Avg. Spirits Price (€) | 24.6 | 27.9 | 30.4 | 33.0 |

| SKUs Listed Online | 9,200 | 10,100 | 11,300 | 12,500 |

These patterns are invisible through surveys alone. Scraped data eliminates guesswork and replaces it with factual, structured pricing intelligence.

Shifting Price Dynamics in a Regulated Market

Finland's alcohol pricing is shaped by strict regulation, excise duties, and centralized retail control. From 2020 to 2026, inflation and policy changes steadily pushed prices upward, while premium segments grew faster than entry-level products. Understanding Finland alcohol pricing trends requires continuous monitoring, not annual reports.

Retail data shows that between 2021 and 2024, premium wine SKUs priced above €20 grew nearly twice as fast as budget wines under €10. Spirits followed a similar pattern, with craft and imported labels gaining shelf space despite higher price points.

Price Evolution by Category

| Category | 2020 Avg (€) | 2023 Avg (€) | 2026 Avg (€) |

|---|---|---|---|

| Red Wine | 12.9 | 15.4 | 17.1 |

| White Wine | 11.8 | 14.2 | 16.0 |

| Vodka | 22.5 | 26.7 | 31.2 |

| Whisky | 29.1 | 34.8 | 39.5 |

These insights help producers adjust packaging, ABV, and positioning to align with evolving consumer willingness to pay.

Turning Price Signals into Demand Intelligence

Pricing data is more than a number—it's a demand signal. When prices rise without losing shelf presence or assortment depth, it often reflects resilient demand. Businesses that Extract alcohol demand patterns from Alko pricing data can detect which categories absorb price increases and which are more elastic.

Between 2020 and 2025, sparkling wines and low-ABV spirits showed strong demand stability despite repeated price hikes. Conversely, flavored spirits exhibited higher churn and SKU turnover, signaling more volatile demand.

Demand Stability Index (2020–2026)

| Category | Price Increase % | SKU Retention % |

|---|---|---|

| Sparkling Wine | +28% | 91% |

| Whisky | +35% | 88% |

| Flavored Spirits | +22% | 63% |

| Ready-to-Drink | +18% | 69% |

Such insights help brands prioritize investment, forecast sales, and refine distribution strategies based on real market behavior.

Long-Term Patterns Hidden in Plain Sight

Looking across multiple years reveals structural patterns that short-term analysis misses. A deeper look at Finland alcohol pricing trends from 2020 to 2026 highlights steady premiumization and declining mid-tier dominance.

Wine priced between €12–€16 lost relative share, while ultra-premium and entry-level segments both expanded. This polarization suggests changing consumption habits, with consumers either trading up for quality or down for affordability.

Segment Share Evolution (%)

| Price Segment | 2020 | 2023 | 2026 |

|---|---|---|---|

| Entry-Level | 34% | 36% | 38% |

| Mid-Tier | 41% | 37% | 32% |

| Premium | 25% | 27% | 30% |

Such data empowers long-term planning, portfolio restructuring, and investment prioritization.

Automation as the Foundation of Speed

Manual tracking of thousands of SKUs is neither scalable nor accurate. This is why modern analytics teams rely on automation through solutions like the Alko API. APIs transform scraped webshop data into structured, ready-to-use datasets delivered in real time.

From 2020 onward, businesses using API-driven data reduced research cycles from weeks to hours. Automated pipelines ensure consistency, reduce human error, and support advanced analytics such as forecasting and elasticity modeling.

Research Efficiency Comparison

| Method | Data Refresh Time | Error Rate |

|---|---|---|

| Manual Research | 30–60 days | High |

| Surveys | 60–90 days | Medium |

| API-Based Data | Daily / Real-Time | Low |

Speed is no longer optional—it is a competitive requirement.

From Raw Data to Strategic Assets

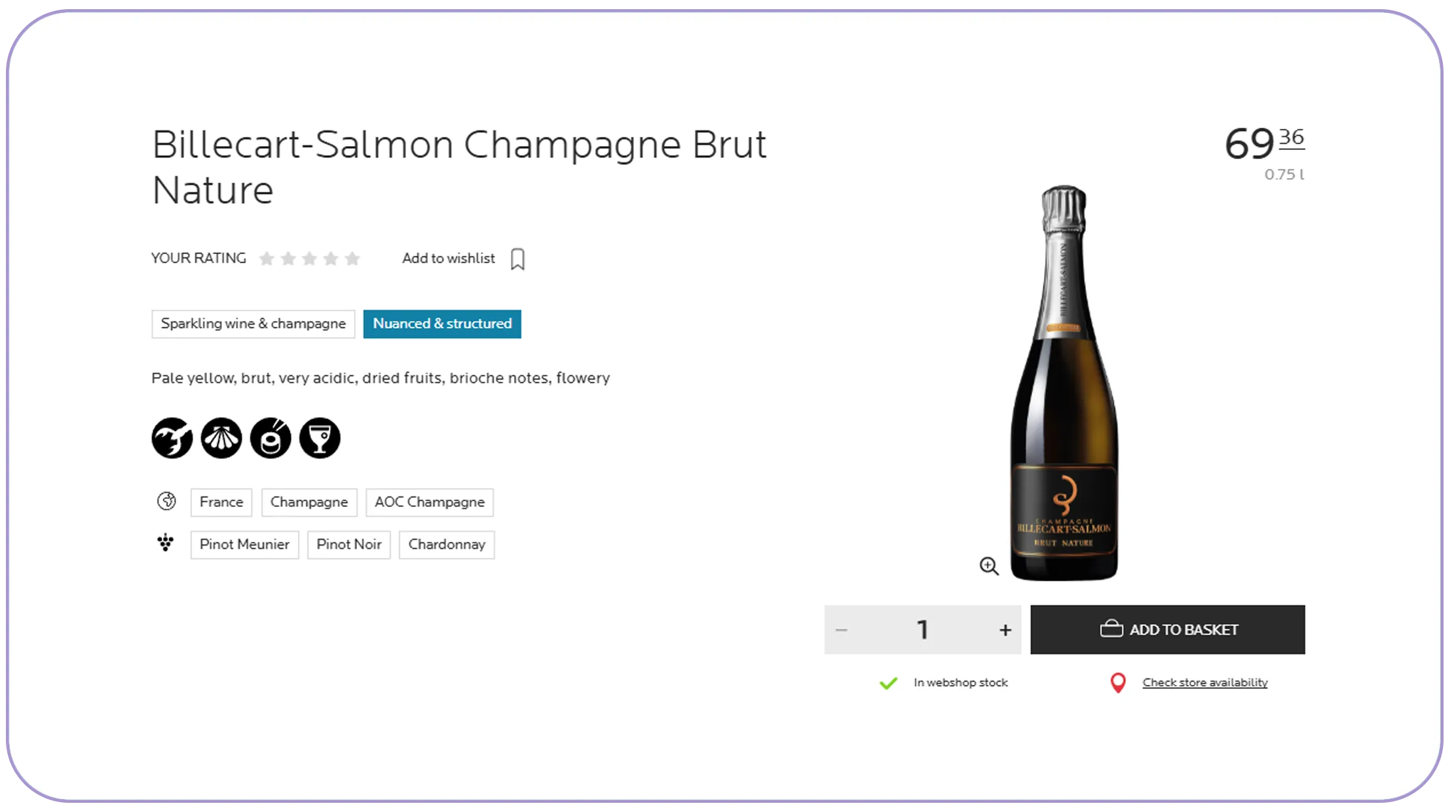

A well-structured Liquor Dataset converts raw pricing and product information into strategic intelligence. These datasets typically include brand, origin, ABV, bottle size, price history, and availability—enabling advanced analysis across time.

Between 2022 and 2026, companies leveraging historical liquor datasets improved forecast accuracy by over 25% compared to those using static reports. Structured data also supports AI-driven demand modeling and scenario planning.

Dataset Value Indicators

| Capability | Impact |

|---|---|

| Historical Pricing | Better Forecasting |

| SKU Tracking | Portfolio Optimization |

| Category Analysis | Smarter Expansion |

| Competitive Benchmarking | Faster Decisions |

Data becomes a long-term asset rather than a one-time report.

Why Choose Real Data API?

Real Data API specializes in compliant, scalable alcohol retail intelligence. With advanced Liquor Data Scraping API solutions, businesses gain reliable access to structured retail data without operational complexity. Combined with expertise in Alko webshop data Scraping for wine and spirits market analysis, Real Data API delivers accuracy, speed, and market relevance.

Clients benefit from:

- Clean, normalized datasets

- Historical and real-time access

- Enterprise-grade delivery formats

- Faster insight generation across teams

Real Data API turns raw webshop information into actionable business intelligence.

Conclusion

Traditional research can no longer keep pace with the modern alcohol market. Real-time retail intelligence now drives smarter pricing, forecasting, and Product Development decisions. By leveraging Alko webshop data Scraping for wine and spirits market analysis, businesses unlock faster, deeper, and more reliable insights.

Ready to transform your wine and spirits strategy? Contact Real Data API today and turn real-time data into real competitive advantage.