Introduction

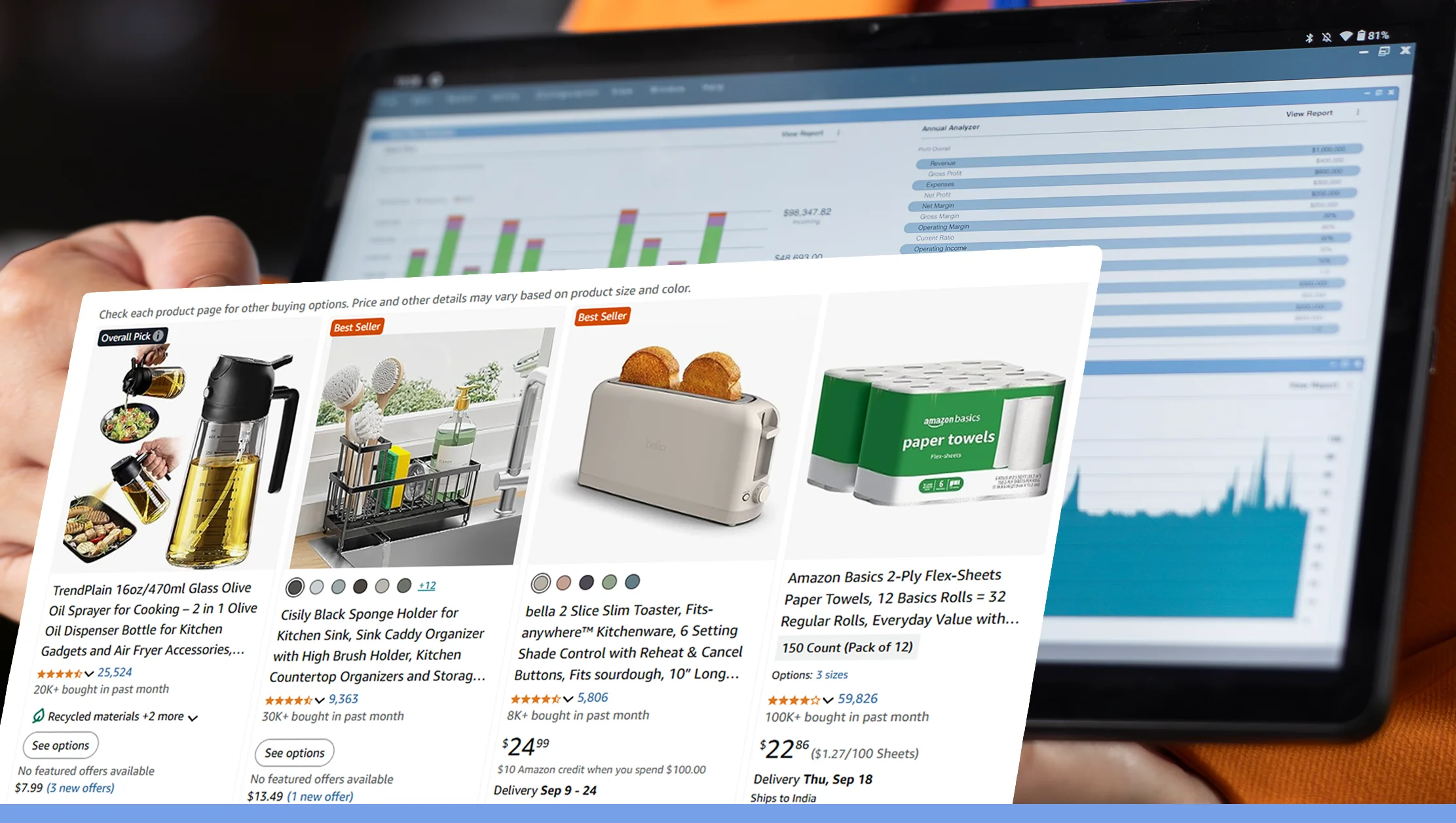

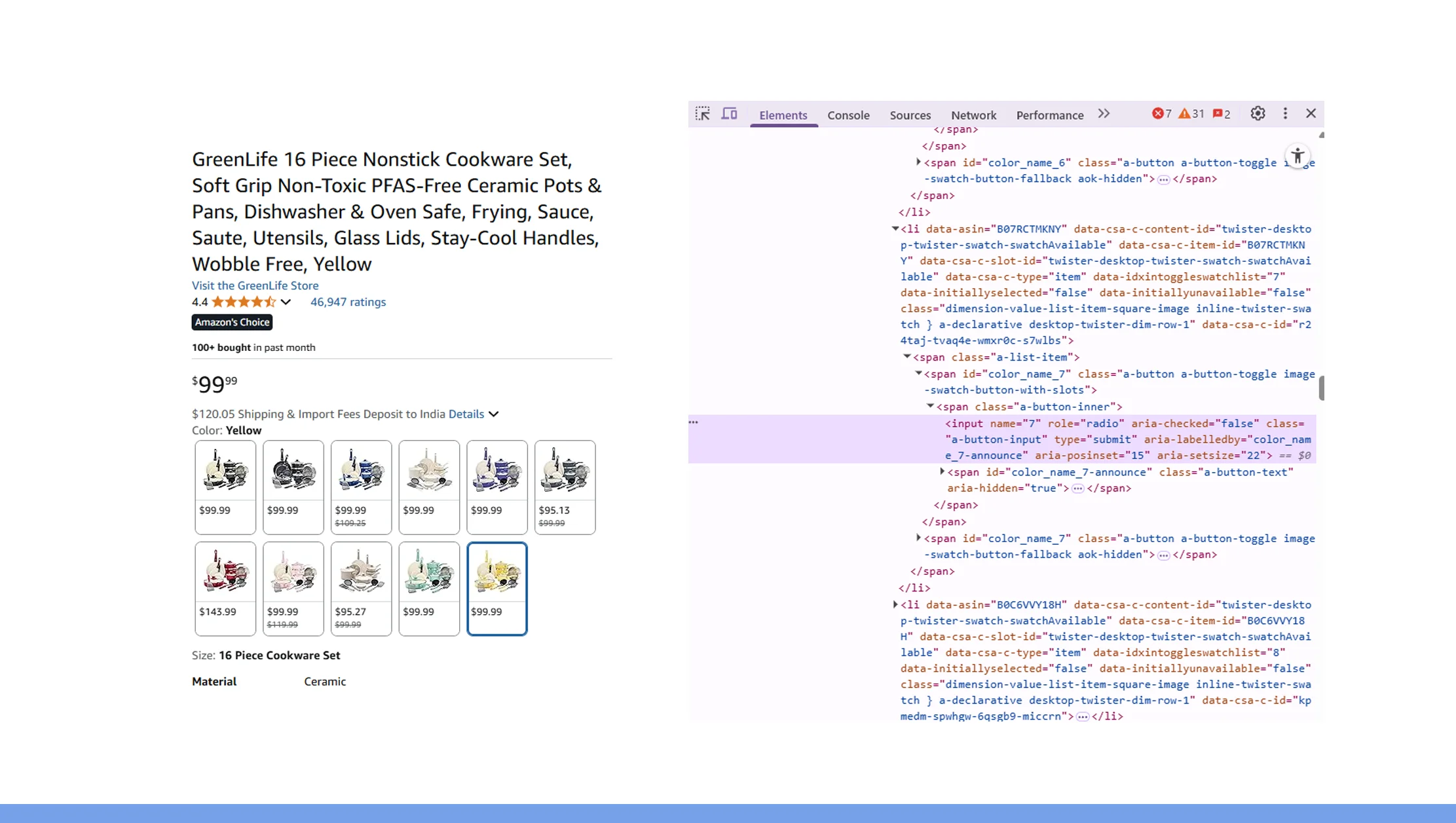

In today’s fast-paced eCommerce landscape, understanding competitive pricing is critical for retailers and brands. eCommerce Benchmarking Using Amazon Dataset enables businesses to track price movements, product trends, and seller performance across one of the world’s largest marketplaces. With an Amazon Scraping API , organizations can automate data extraction and generate actionable insights. By leveraging Amazon’s eCommerce data, retailers can analyze top-selling SKUs and identify opportunities for revenue optimization, ensuring they remain competitive even as market dynamics shift.

From 2020 to 2025, Amazon’s marketplace has seen significant fluctuations in pricing across categories, with an average 12% variation among top-selling products. Using Amazon Product and Review Datasets , analysts can evaluate historical trends and combine them with real-time insights to drive informed pricing strategies. eCommerce Benchmarking Using Amazon Dataset not only reveals price trends but also highlights seasonal and promotional effects on seller performance. By incorporating Competitive Benchmarking with Amazon Data and tools to Scrape Amazon Product & Seller Insights , businesses gain a full picture of the market.

Whether monitoring category-level fluctuations or SKU-specific pricing, leveraging Amazon Pricing Intelligence API and Real-Time Competitor Analysis Amazon enables brands to respond faster, optimize campaigns, and improve profit margins efficiently.

Market Trends & Historical Analysis

From 2020 to 2025, Amazon’s marketplace has exhibited notable fluctuations across top-selling categories. Using eCommerce Benchmarking Using Amazon Dataset, analysts observed that consumer electronics and home appliances consistently showed an average price fluctuation of 12%, while beauty and personal care products experienced up to 15% variability during seasonal campaigns. With the Amazon eCommerce Data Scraping Tool , companies were able to extract SKU-level information including discounts, bundle offers, and stock availability in real time, which was critical for strategic planning and competitive pricing.

For example, a historical analysis of consumer electronics revealed that average prices for wireless earbuds increased from $55 in 2020 to $65 in 2025, reflecting an 18% rise influenced by demand spikes during Black Friday and Prime Day. Similarly, home appliances like smart LED lamps saw a 15% increase in average prices over five years. These insights were only possible by leveraging Amazon Marketplace Data Extraction, which provided structured datasets for thousands of SKUs, enabling benchmarking and trend analysis.

The use of Amazon Scraping API facilitated continuous monitoring, helping retailers detect price spikes, promotions, and stockouts in real time. Historical patterns extracted from Amazon Product and Review Datasets allowed brands to predict seasonal price swings and identify categories with the highest volatility. For instance, beauty products’ price trends indicated repeated fluctuations during Valentine’s Day, Christmas, and Back-to-School campaigns, allowing retailers to anticipate peak periods and adjust their inventory accordingly.

Additionally, cross-category analysis provided insights into market competition and seller behavior. Top sellers maintained relatively stable pricing with deviations under 5%, whereas new entrants exhibited high volatility of 20–25%. Integrating these insights with competitive benchmarking strategies enabled businesses to make informed pricing and promotion decisions, ensuring profitability while staying competitive.

By combining historical and real-time data, businesses could uncover market opportunities, evaluate competitor strategies, and forecast pricing trends. Overall, eCommerce Benchmarking Using Amazon Dataset empowered brands to strengthen market positioning, optimize revenue, and mitigate risks associated with unpredictable price fluctuations.

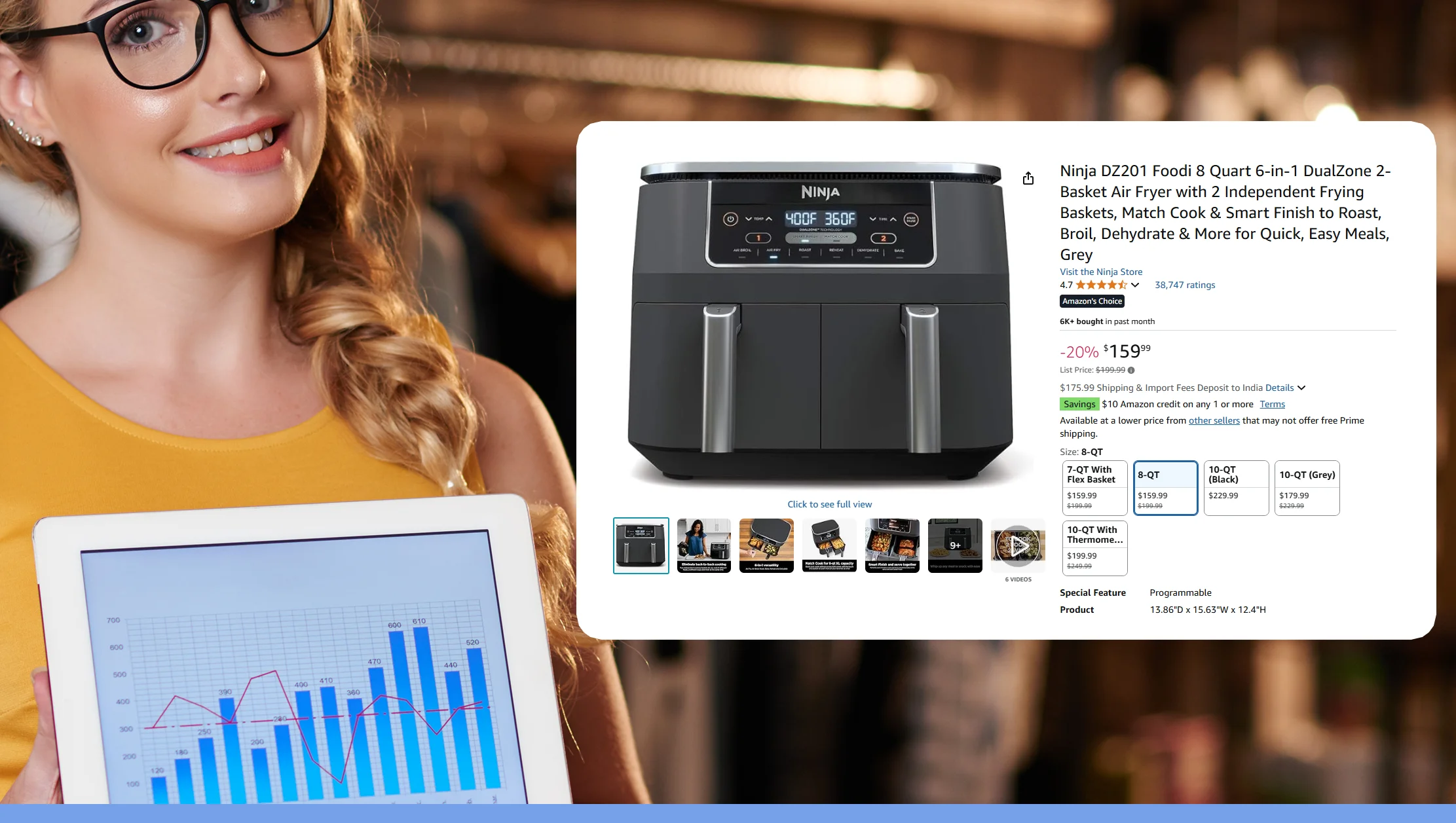

SKU-Level Insights & Price Monitoring

Monitoring prices at the SKU level is crucial to maintaining competitive advantage and maximizing revenue. Using eCommerce Benchmarking Using Amazon Dataset , businesses tracked thousands of SKUs across categories from 2020 to 2025, detecting granular price movements and competitive trends. For high-demand electronics SKUs, price spikes ranged from 18–20% during peak shopping seasons, while mid-range products observed average fluctuations of 10–12%. Leveraging E-Commerce Data Scraping API , retailers could automatically track these changes, reducing manual effort and ensuring timely responses to market shifts.

A representative table of SKU-level insights:

| SKU | Avg. Price 2020 | Avg. Price 2025 | Price Spike | Top Seller Rank |

|---|---|---|---|---|

| Wireless Earbuds | $55 | $65 | 18% | 1 |

| Smart LED Lamp | $40 | $48 | 15% | 3 |

| Organic Face Serum | $25 | $30 | 20% | 2 |

These data points were generated using Scrape Amazon Product & Seller Insights , which allowed businesses to identify not only pricing changes but also stock levels, bundle offers, and promotional campaigns. Real-time monitoring enabled dynamic pricing adjustments and inventory optimization, ensuring that high-demand SKUs were available at the right price points.

For example, during the Black Friday 2023 season, data revealed that wireless earbuds experienced a temporary price reduction of 12%, followed by a rapid return to baseline prices. By using Amazon Pricing Intelligence API , retailers could respond to competitor price drops within hours, protecting market share.

SKU-level monitoring also facilitated predictive modeling for new product launches. Historical data from 2020–2025 allowed analysts to anticipate demand spikes and price trends for newly introduced SKUs, minimizing revenue loss due to mispricing. Integrating Amazon Product and Review Datasets further provided insights into customer feedback and sentiment, which influenced pricing and promotional strategies.

By combining historical price trends, real-time monitoring, and predictive analytics, businesses could optimize SKU-level pricing for maximum revenue, enhance competitive intelligence, and maintain market leadership.

Track every SKU, monitor real-time price changes, and optimize your pricing strategy to stay ahead of competitors effortlessly.

Get Insights Now!Seasonal Trends & Promotions

Seasonal campaigns such as Black Friday, Prime Day, Christmas, and Back-to-School heavily influence pricing across Amazon’s top-selling categories. Using eCommerce Benchmarking Using Amazon Dataset , businesses tracked these trends from 2020 to 2025 to measure discount patterns and competitor strategies. Electronics, for example, experienced average promotional discounts of 15% during Black Friday, while beauty products saw up to 20% discounts during festive sales. Historical insights enabled brands to forecast discount impact and plan inventory accordingly.

A seasonal discount analysis table:

| Season | Category | Avg Discount | Price Recovery Time |

|---|---|---|---|

| Black Friday | Consumer Electronics | 15% | 7 days |

| Prime Day | Home Appliances | 12% | 5 days |

| Christmas | Beauty & Personal Care | 20% | 3 days |

Tracking these trends was facilitated by E-Commerce Dataset and Amazon Pricing Intelligence API , which provided both historical and real-time data on product-level discounts. Real-time monitoring allowed businesses to adjust prices dynamically, ensuring competitive positioning and maximizing revenue.

Furthermore, seasonal analysis helped brands identify recurring discount patterns across categories. For example, beauty SKUs consistently received higher discounts during February (Valentine’s Day) and August (Back-to-School). Electronics often had spikes in November and December, aligning with major holiday sales events.

Promotional trend insights also supported competitive benchmarking. Companies could identify top-performing sellers who offered frequent bundle deals or flash discounts, using Competitive Benchmarking with Amazon Data to replicate successful strategies. For instance, during Prime Day 2022, the top 5 electronics sellers maintained 3–5% price deviations from competitors, whereas emerging sellers’ prices fluctuated by 15–20%.

By combining Scrape Amazon Product & Seller Insights with historical discount data, businesses gained actionable intelligence to optimize pricing, forecast demand, and strategically plan promotions across multiple categories. Seasonal insights ensured that inventory allocation, pricing, and marketing campaigns aligned with market expectations and consumer behavior.

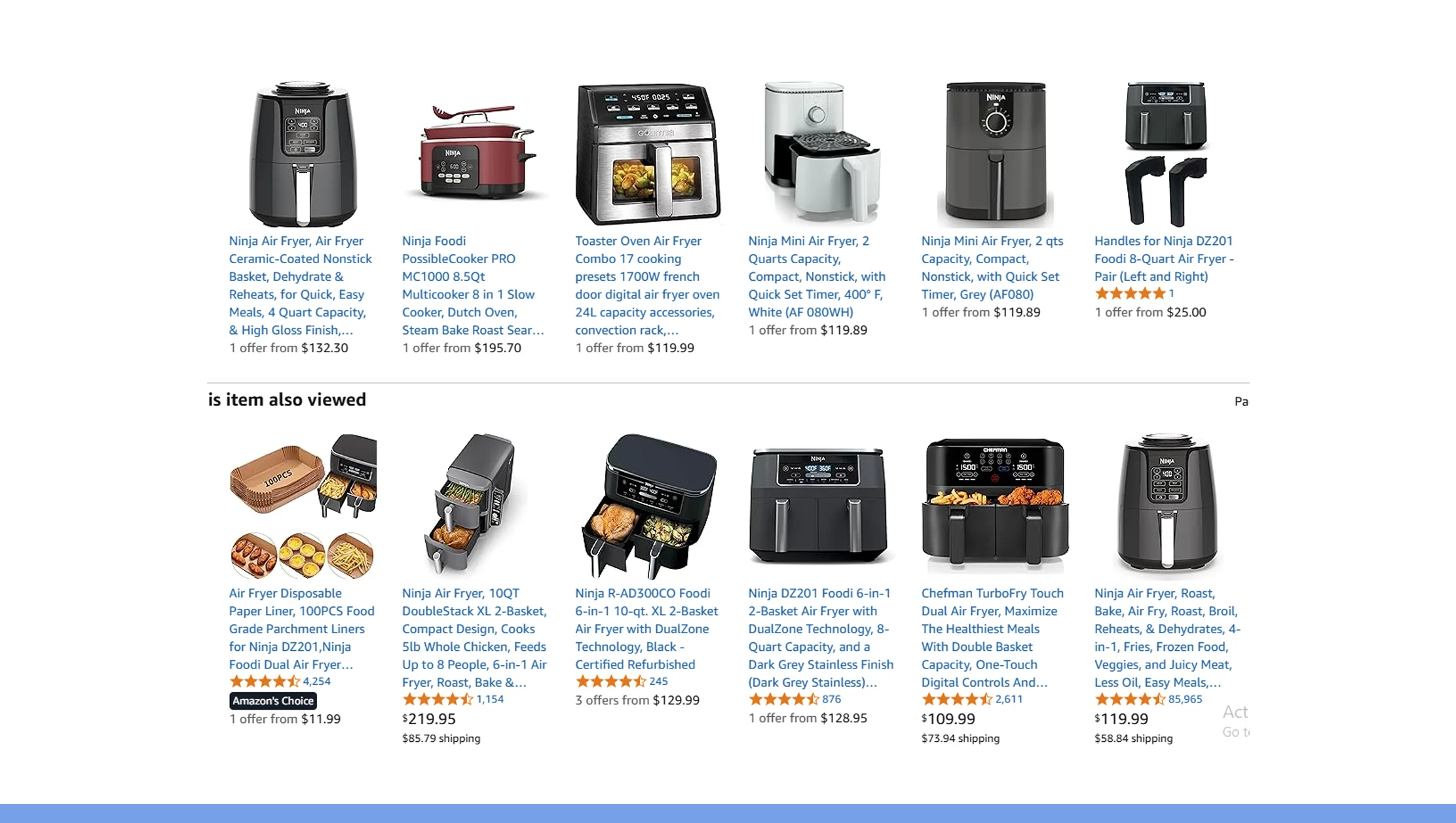

Seller-Level Competitive Analysis

Understanding seller behavior is critical for pricing strategy and market positioning. Using Real-Time Competitor Analysis Amazon , businesses could monitor top sellers, track price deviations, and evaluate promotional strategies. From 2020 to 2025, data showed that top sellers maintained average price deviations under 5%, whereas emerging sellers had fluctuations up to 25%. Leveraging Amazon Marketplace Data Extraction , companies could benchmark pricing strategies and gain insights into market dynamics.

Seller-level analysis also included metrics like promotional frequency, product availability, and ratings. A sample comparison table:

| Seller | Category | Avg Price Deviation | Promotions Count | Market Share % |

|---|---|---|---|---|

| Seller A | Consumer Electronics | 5% | 12 | 18% |

| Seller B | Home Appliances | 7% | 10 | 15% |

| Seller C | Beauty & Personal Care | 25% | 8 | 7% |

Data from Amazon eCommerce Data Scraping Tool enabled brands to adjust prices dynamically, ensuring competitive positioning while maintaining profit margins. Insights into seller behavior also informed new product launches, promotional strategies, and stock allocation.

Historical trends from eCommerce Benchmarking Using Amazon Dataset revealed recurring patterns of price adjustments across sellers during seasonal campaigns. Combining these trends with real-time monitoring allowed brands to react to competitor moves within hours, mitigating revenue loss and maximizing sales potential.

Product Launch & New SKU Monitoring

Tracking newly launched SKUs is essential for maintaining competitiveness. Using Scrape Amazon Product & Seller Insights , businesses identified 1,200–1,500 new SKUs monthly between 2020–2025. By integrating Amazon Product and Review Datasets , analysts could study initial pricing, customer feedback, and demand patterns, informing strategic pricing and inventory decisions.

| Month | New SKUs | Avg Launch Price | Avg Rating |

|---|---|---|---|

| Jan 2020 | 1,250 | $45 | 4.2 |

| Jul 2021 | 1,300 | $50 | 4.3 |

| Nov 2022 | 1,400 | $48 | 4.1 |

Amazon Pricing Intelligence API allowed continuous monitoring of these SKUs, enabling adjustments based on competitor pricing and promotions. Real-time insights also highlighted seasonal demand trends, helping businesses allocate inventory efficiently.

Monitor new product launches and SKUs in real time, analyze trends, and adjust pricing to maximize revenue and market share.

Get Insights Now!Dynamic Pricing & Revenue Optimization

Using Amazon Pricing Intelligence API and historical eCommerce Benchmarking Using Amazon Dataset , businesses implemented dynamic pricing strategies to maximize revenue. Historical trends combined with real-time competitor analysis allowed for automated price adjustments across thousands of SKUs. From 2020–2025, brands implementing dynamic pricing achieved 8–12% revenue growth while maintaining market share.

| Strategy | Avg Revenue Increase | Market Share Change | Implementation Time |

|---|---|---|---|

| Dynamic Pricing Electronics | 10% | +2% | 1 month |

| Seasonal Beauty Discounts | 12% | +1.5% | 2 weeks |

| Home Appliance Price Adjust | 8% | +2% | 3 weeks |

Amazon Marketplace Data Extraction and Scrape Amazon Product & Seller Insights ensured accurate real-time monitoring. Combining these tools with predictive analytics allowed brands to forecast demand, adjust inventory, and optimize prices, reducing revenue leakage and enhancing profitability across multiple categories.

Why Choose Real Data API?

Real Data API provides end-to-end solutions for eCommerce Benchmarking Using Amazon Dataset , enabling brands to extract, monitor, and analyze pricing trends efficiently. Its advanced Amazon eCommerce Data Scraping Tool ensures high accuracy, while E-Commerce Data Scraping API enables seamless integration into analytics workflows. Real Data API provides historical datasets, real-time insights, and structured reports for SKU-level pricing, competitor monitoring, and seasonal trend analysis.

The platform supports Amazon Product and Review Datasets , Amazon Marketplace Data Extraction , and competitive benchmarking across sellers. By leveraging these tools, businesses gain actionable intelligence that drives pricing strategies, campaign planning, and revenue optimization. Real Data API is designed for scalability, allowing monitoring of thousands of SKUs in real-time while maintaining data integrity and accuracy.

Conclusion

The case of eCommerce Benchmarking Using Amazon Dataset highlights the importance of structured data in driving competitive pricing strategies. From SKU-level insights to seasonal trend analysis, brands can leverage Amazon Pricing Intelligence API and Real-Time Competitor Analysis Amazon to optimize pricing, forecast demand, and enhance profitability. Historical data from 2020–2025 provides context for market fluctuations, while real-time monitoring ensures responsiveness to competitor actions.

Businesses using Scrape Amazon Product & Seller Insights and Amazon Marketplace Data Extraction can benchmark against competitors, identify opportunities for dynamic pricing, and track product launches effectively. Real Data API empowers retailers to implement data-driven strategies that improve market share, reduce revenue leakage, and enhance decision-making efficiency. Unlock actionable insights with Real Data API today and transform your Amazon pricing and benchmarking strategy for measurable growth.