Introduction

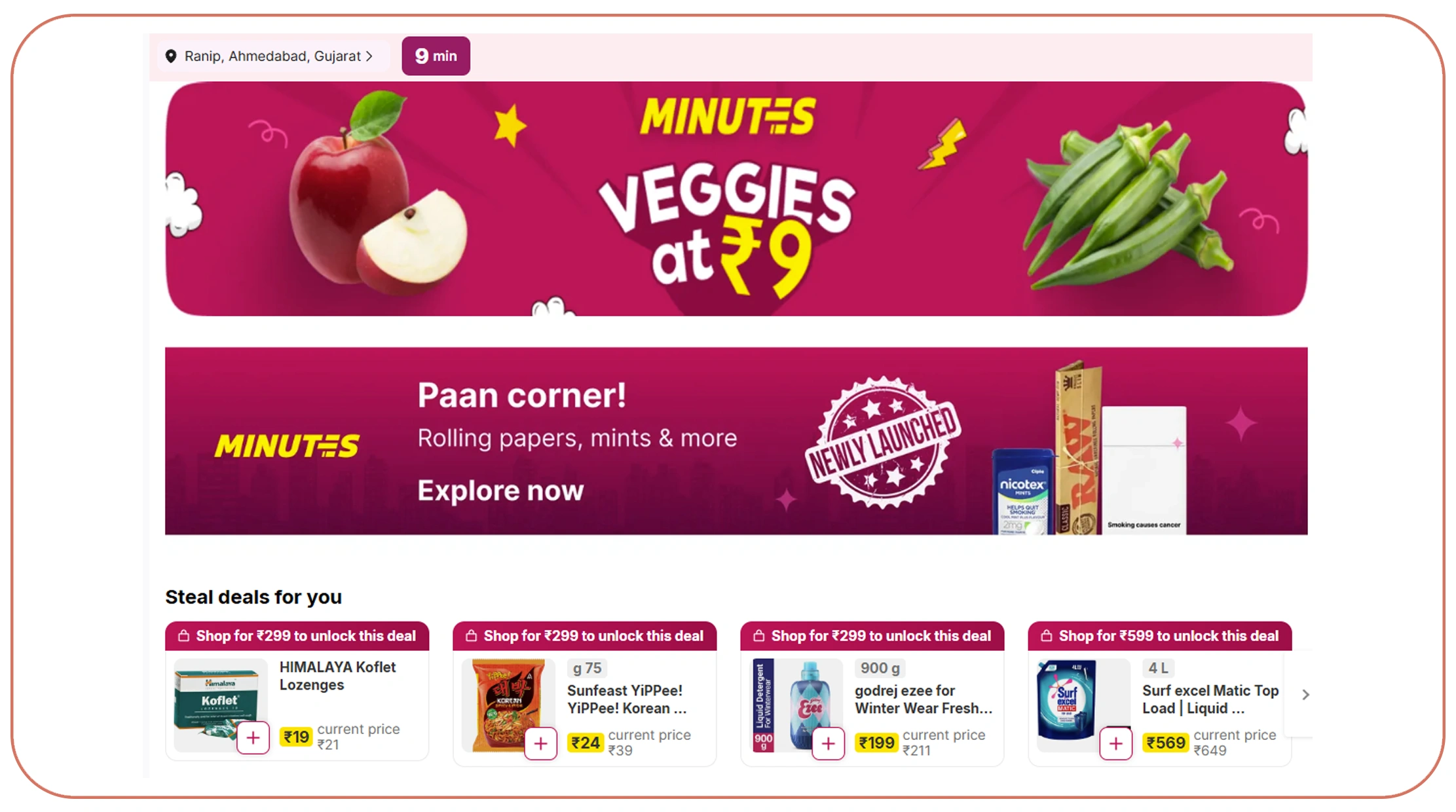

India's quick commerce sector has transformed urban retail, promising groceries and essentials within 10–20 minutes. Between 2020 and 2026, the segment grew at a CAGR of over 25%, driven by urbanization, smartphone penetration, and changing consumer expectations. Understanding how scraping Flipkart Minutes data reveals Indian delivery trends is crucial for brands, retailers, and logistics planners aiming to stay competitive in this rapidly evolving space.

With the support of a robust Quick Commerce Data Scraping API, businesses can monitor delivery timelines, pricing shifts, hyperlocal availability, and promotional campaigns across cities. This data-driven visibility empowers companies to optimize inventory planning, track demand surges, and refine last-mile strategies. In this blog, we explore how structured intelligence from Flipkart Minutes helps decode India's quick commerce ecosystem and shape smarter retail decisions.

The Evolution of 10-Minute Retail

The rise of instant delivery platforms accelerated during the pandemic, permanently shifting consumer buying behavior. Flipkart Minutes data scraping provides insights into how delivery models have matured over time.

From 2020 to 2026, average promised delivery times improved while SKU expansion increased significantly.

| Year | Avg Delivery Time (Minutes) | Avg SKUs Listed | Active Cities |

|---|---|---|---|

| 2020 | 25 | 2,500 | 6 |

| 2022 | 18 | 5,800 | 12 |

| 2024 | 15 | 9,500 | 20 |

| 2026 | 12 | 15,000+ | 35 |

The expansion into Tier-2 cities after 2023 marked a significant milestone. Data indicates that grocery staples, dairy products, and personal care items accounted for 60% of total orders. Monitoring these trends enables brands to anticipate category growth and adjust distribution strategies accordingly.

Consumer Behavior and Hyperlocal Demand

Instant delivery thrives on micro-level demand patterns. Businesses analyzing quick commerce platforms gain granular insights for quick commerce market insights that traditional retail data cannot provide.

Key consumer shifts between 2020–2026 include:

| Trend | 2020 | 2023 | 2026 |

|---|---|---|---|

| Evening Order Share | 42% | 48% | 52% |

| Weekend Demand Spike | 15% | 22% | 28% |

| Fresh Produce Orders | 18% | 26% | 34% |

Urban professionals increasingly rely on quick commerce for top-up purchases rather than bulk monthly shopping.

Hyperlocal warehouses (dark stores) expanded by nearly 3x between 2022 and 2025, reducing delivery time and improving fulfillment rates. By analyzing order windows and stock rotations, brands can better allocate inventory to high-performing local clusters.

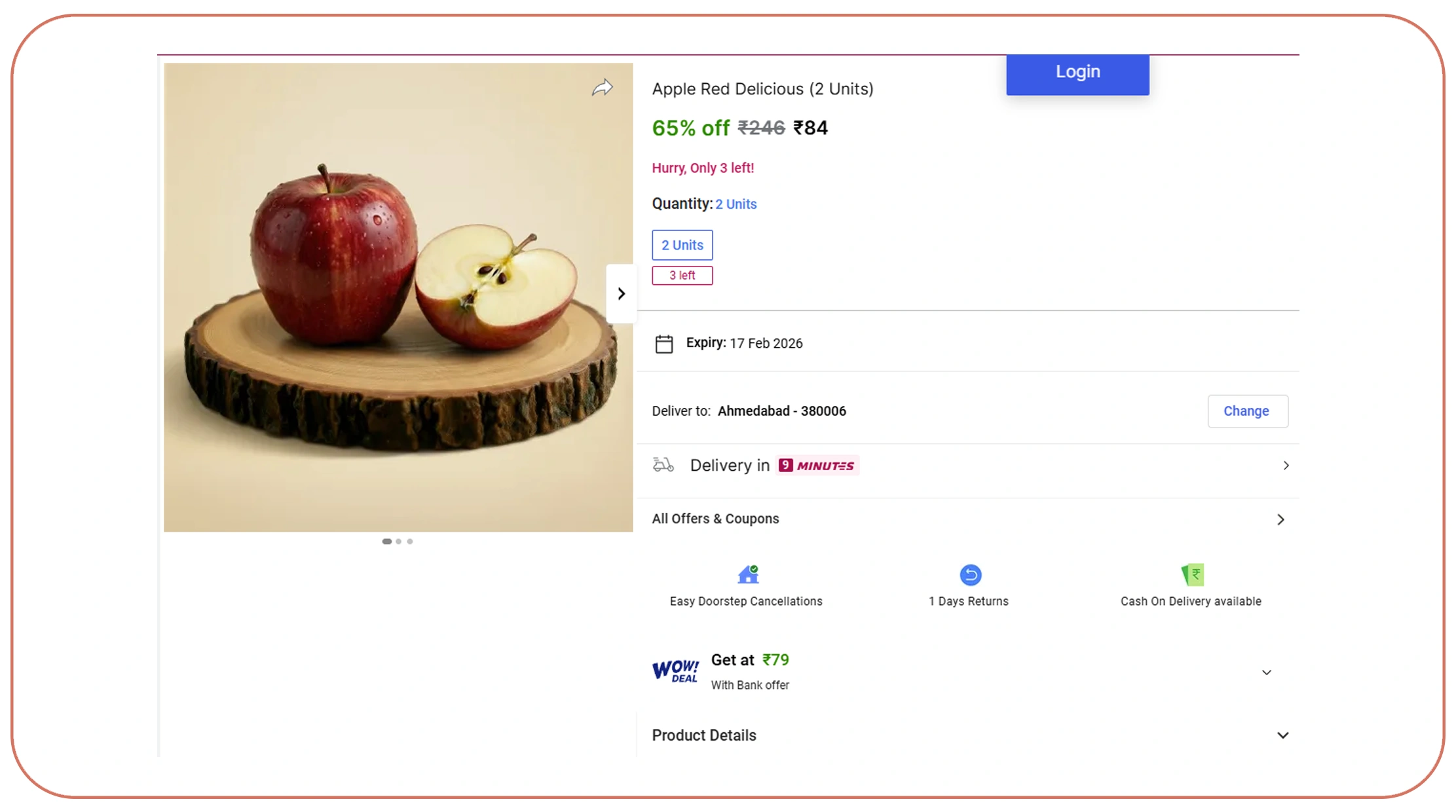

Real-Time Pricing and Stock Visibility

Dynamic pricing is central to quick commerce profitability. Retailers can extract real-time Flipkart Minutes pricing and availability data to monitor price fluctuations and inventory changes hourly.

From 2020–2026, pricing volatility increased during high-demand hours:

| Year | Avg Daily Price Changes per SKU | Stockout Rate % |

|---|---|---|

| 2020 | 1.2 | 8% |

| 2022 | 2.8 | 12% |

| 2024 | 3.5 | 9% |

| 2026 | 4.1 | 6% |

Peak-hour markups ranged between 3–7% in metro cities. Conversely, promotional pricing during late-night slots increased conversion rates by 9–14%.

Real-time data monitoring ensures that retailers avoid revenue leakage due to uncompetitive pricing or missed restocking opportunities.

Competitive Pricing and Instant Fulfillment Strategies

The competitive landscape intensified as more players entered the quick commerce segment. Using a Flipkart instant delivery pricing data Scraper, businesses track price positioning against rivals like Blinkit, Zepto, and Swiggy Instamart.

Between 2020–2026, promotional intensity rose steadily:

| Year | Avg Discount % | Flash Sale Frequency (Monthly) |

|---|---|---|

| 2020 | 10% | 4 |

| 2022 | 15% | 8 |

| 2024 | 18% | 12 |

| 2026 | 22% | 16 |

Flash deals and bundle offers significantly impacted basket size growth.

Data analysis reveals that price parity within ±2% of competitors maximizes conversions. Monitoring competitor pricing daily helps platforms retain consumer trust and prevent migration to alternative apps.

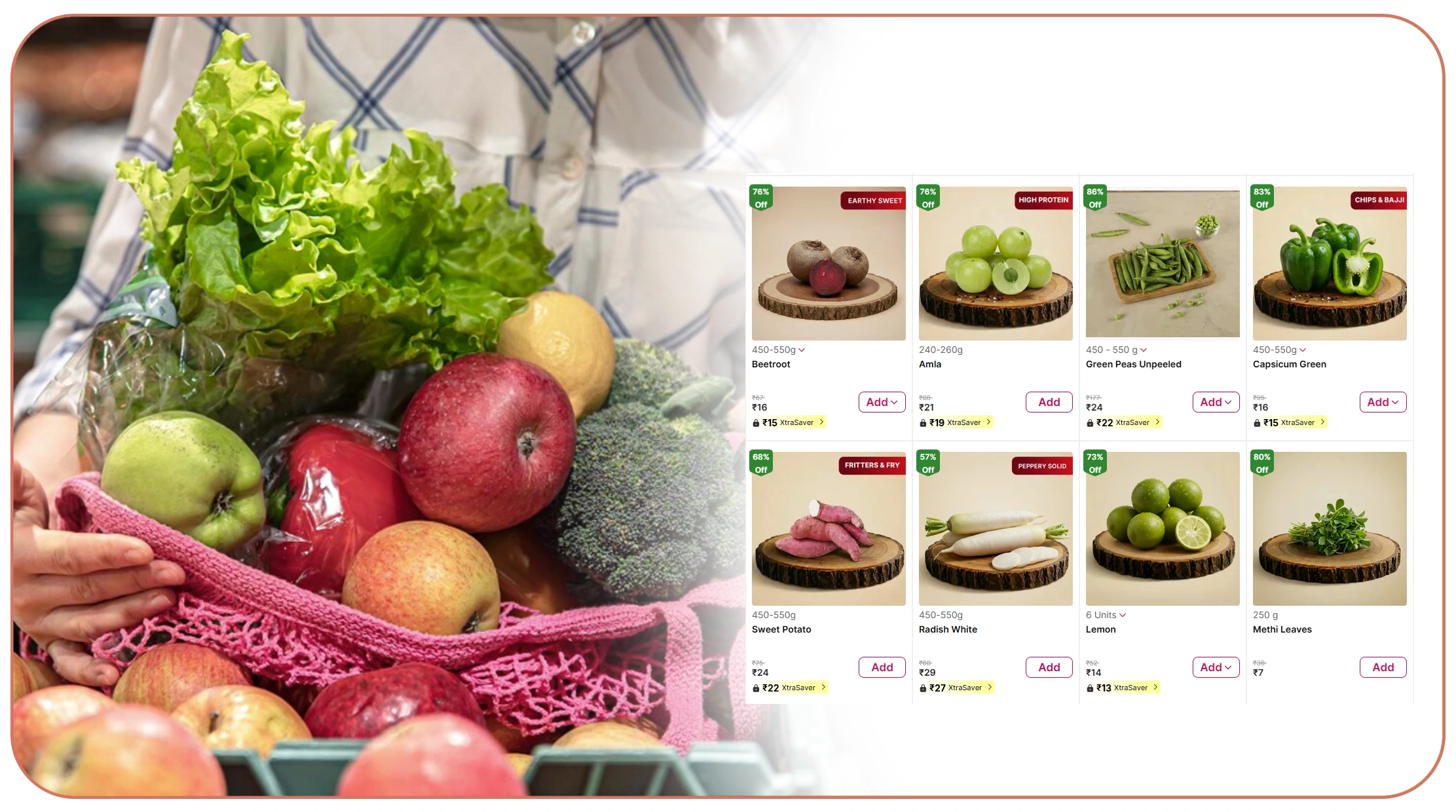

Category Expansion and Product Intelligence

Quick commerce initially focused on groceries but has diversified into electronics, beauty, and home essentials. Companies that scrape Flipkart Minutes product data can analyze SKU expansion patterns and emerging demand clusters.

Category share evolution (2020–2026):

| Category | 2020 Share | 2023 Share | 2026 Share |

|---|---|---|---|

| Grocery | 70% | 58% | 50% |

| Personal Care | 12% | 18% | 22% |

| Electronics | 5% | 10% | 14% |

| Household | 13% | 14% | 14% |

Personal care and electronics showed rapid growth, reflecting impulse-driven urban buying behavior.

Tracking product assortment changes ensures brands can identify whitespace opportunities and expand SKUs aligned with consumer demand.

Dataset Intelligence and Predictive Planning

Structured data aggregation through Web Scraping Flipkart Minutes Dataset pipelines allows businesses to forecast demand and optimize logistics planning.

Predictive insights derived from 2020–2026 trends show:

- 30% faster restocking cycles in metros

- 18% increase in dark store density

- 25% growth in repeat order frequency

- 12% improvement in fulfillment efficiency

Inventory forecasting models trained on historical price and demand data improved accuracy by nearly 20%.

By analyzing delivery speed trends, pricing shifts, and city-level demand spikes, brands can allocate inventory more effectively and minimize wastage in perishable categories.

Why Choose Real Data API?

Real Data API delivers enterprise-grade solutions powered by advanced scraping infrastructure and scalable analytics frameworks. Our Grocery Data Scraping API enables businesses to capture SKU-level pricing, delivery time estimates, and availability insights across hyperlocal regions.

We help organizations understand how scraping Flipkart Minutes data reveals Indian delivery trends by transforming raw datasets into structured dashboards and actionable intelligence. From monitoring promotional cycles to identifying fulfillment gaps, our data pipelines ensure accuracy, compliance, and scalability.

With real-time automation, secure APIs, and customizable reporting modules, Real Data API empowers retailers, logistics firms, and research agencies to gain a measurable competitive advantage in India's booming quick commerce ecosystem.

Conclusion

The transformation of India's instant retail ecosystem highlights the strategic importance of understanding how scraping Flipkart Minutes data reveals Indian delivery trends. Delivery speed optimization, dynamic pricing adjustments, SKU expansion, and hyperlocal inventory management all rely on accurate, real-time data intelligence.

Businesses leveraging structured datasets gain a clearer view of consumer behavior, demand spikes, and competitive pricing movements—essential for informed Market Research and strategic planning.

As quick commerce continues expanding into Tier-2 and Tier-3 cities, data-driven agility will determine market leadership.

Partner with Real Data API today to unlock real-time quick commerce intelligence and turn actionable insights into sustainable growth.