Introduction

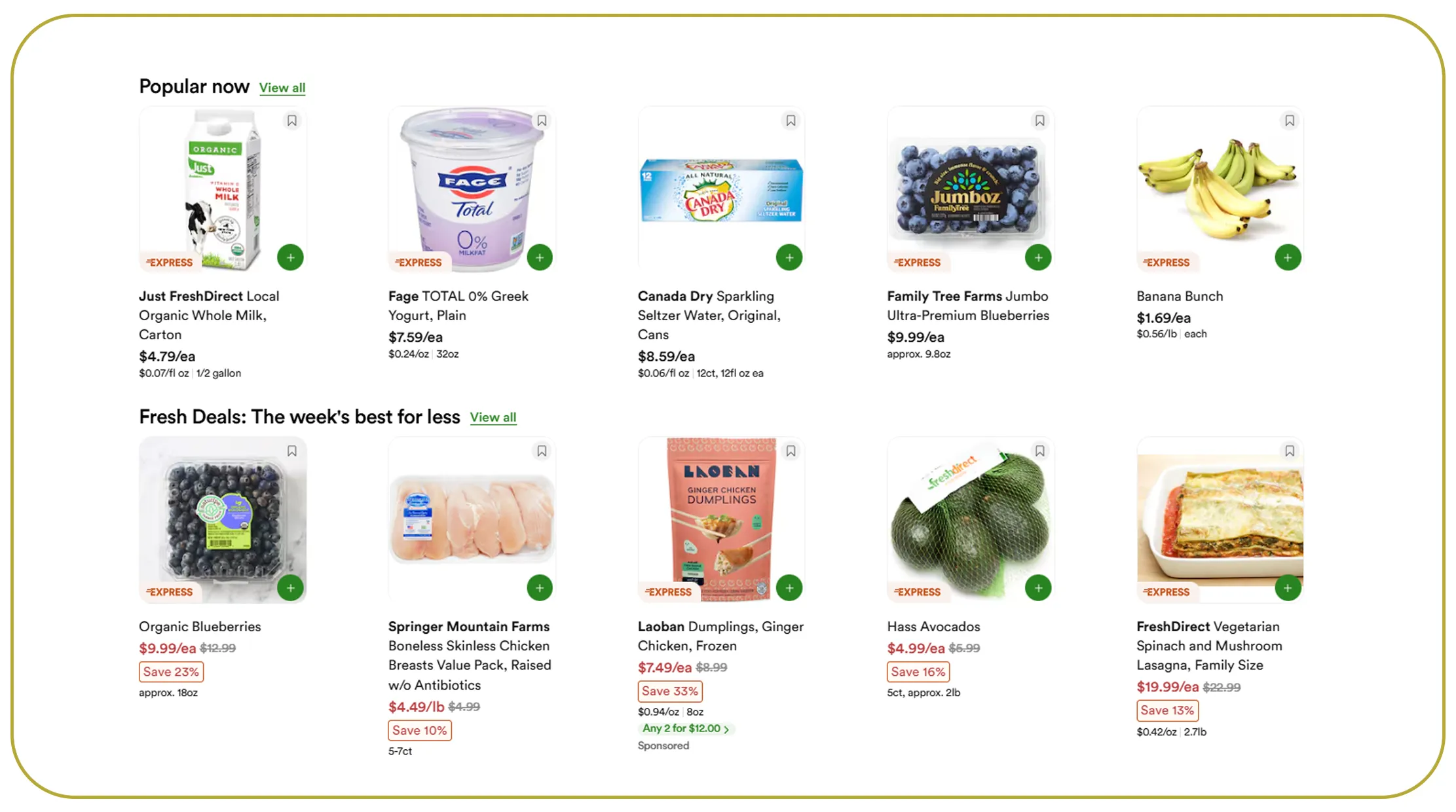

In the hyper-competitive grocery retail landscape, pricing accuracy and speed have become decisive factors for brand success. With consumers comparing prices across multiple platforms in seconds, even a minor pricing gap can mean lost sales and weakened brand trust. This is why more companies now Leverage Top Retail Pricing Platforms for Grocery Price monitoring—to gain a real-time view of market movements, promotions, and competitor strategies. By combining advanced analytics with automated data collection, brands no longer rely on outdated reports or manual tracking. Instead, they operate with continuous intelligence that helps them react instantly to price fluctuations, demand spikes, and regional trends. This shift from reactive to proactive pricing is transforming how grocery brands compete, scale, and protect margins in a data-driven economy.

From Guesswork to Precision in Modern Pricing

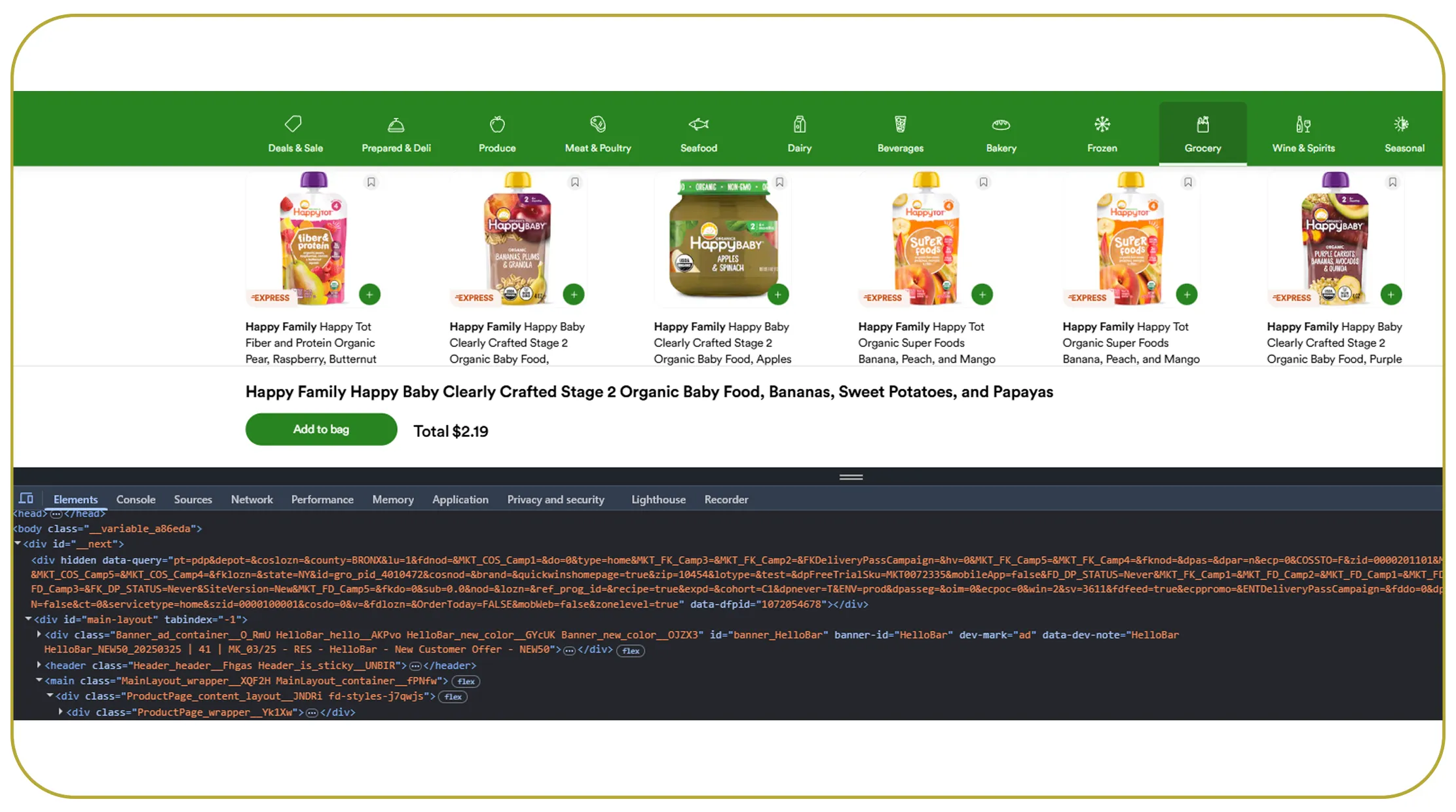

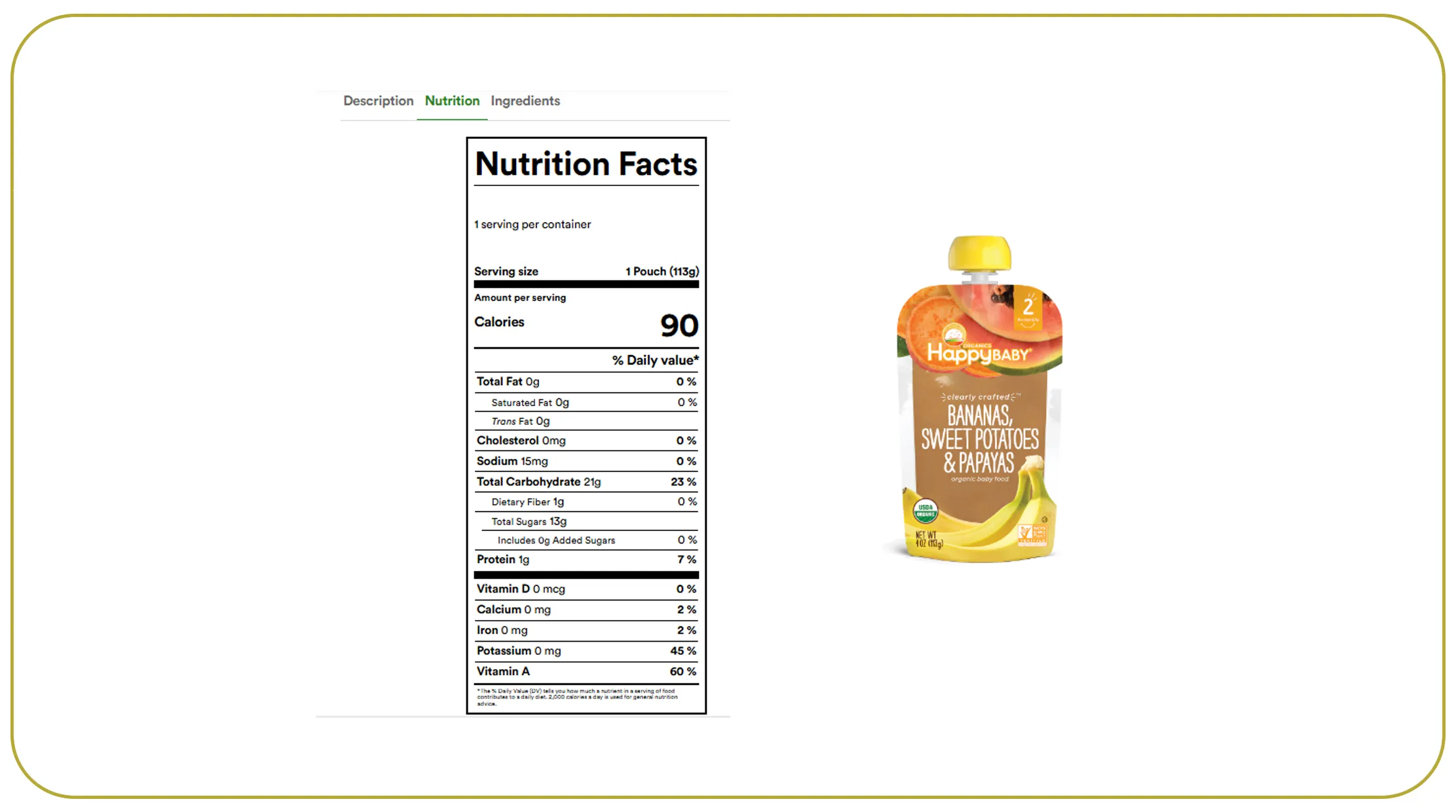

For years, grocery brands relied on periodic market surveys to understand price movements. Today, that approach is no longer sufficient. With Web scraping for real-time grocery price tracking, brands can collect thousands of price points across retailers within minutes. This enables continuous monitoring of SKUs, discounts, and dynamic pricing changes.

Between 2020 and 2026, the adoption of real-time pricing tools has surged, driven by the growth of online grocery platforms and quick-commerce apps. Brands that invested early in automated tracking reported faster response times to competitor discounts and improved margin control.

Market adoption trend (2020–2026):

| Year | % Brands Using Real-Time Price Tracking |

|---|---|

| 2020 | 28% |

| 2021 | 34% |

| 2022 | 46% |

| 2023 | 58% |

| 2024 | 67% |

| 2025 | 74% |

| 2026 | 81% |

With this approach, pricing teams can analyze daily fluctuations instead of monthly averages. The result is sharper decision-making, fewer pricing errors, and stronger brand positioning. Real-time tracking also supports promotional planning by showing which discounts truly move volume versus those that simply erode profit.

Turning Live Price Signals into Strategic Actions

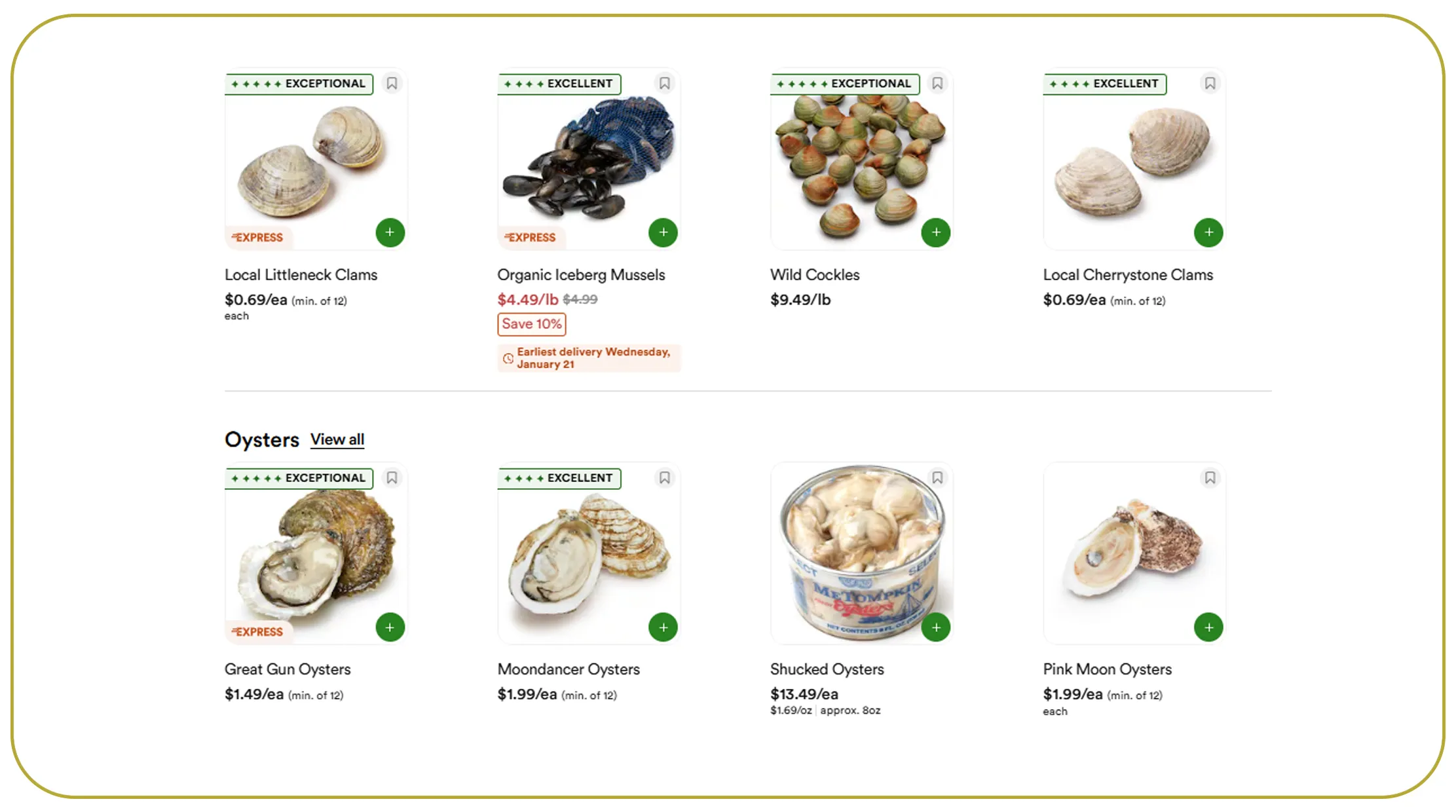

As grocery competition intensifies, brands are increasingly choosing to Scrape grocery supermarket prices in real time to stay aligned with market realities. This practice ensures immediate access to pricing data across supermarkets, hypermarkets, and online platforms—eliminating blind spots in competitive intelligence.

From 2020 to 2026, the number of grocery SKUs tracked daily by major brands has more than tripled. This expansion reflects the shift toward granular insights, where even minor price shifts trigger strategic responses such as flash discounts, bundle offers, or regional pricing adjustments.

Average SKUs tracked daily by enterprise brands:

| Year | SKUs Tracked per Day |

|---|---|

| 2020 | 5,000 |

| 2021 | 7,200 |

| 2022 | 10,500 |

| 2023 | 14,000 |

| 2024 | 18,500 |

| 2025 | 22,000 |

| 2026 | 26,000 |

This depth of monitoring helps brands identify which retailers consistently undercut pricing and which regions show higher willingness to pay. Armed with such insights, teams move from reactive price changes to predictive pricing strategies—anticipating competitor moves before they impact sales.

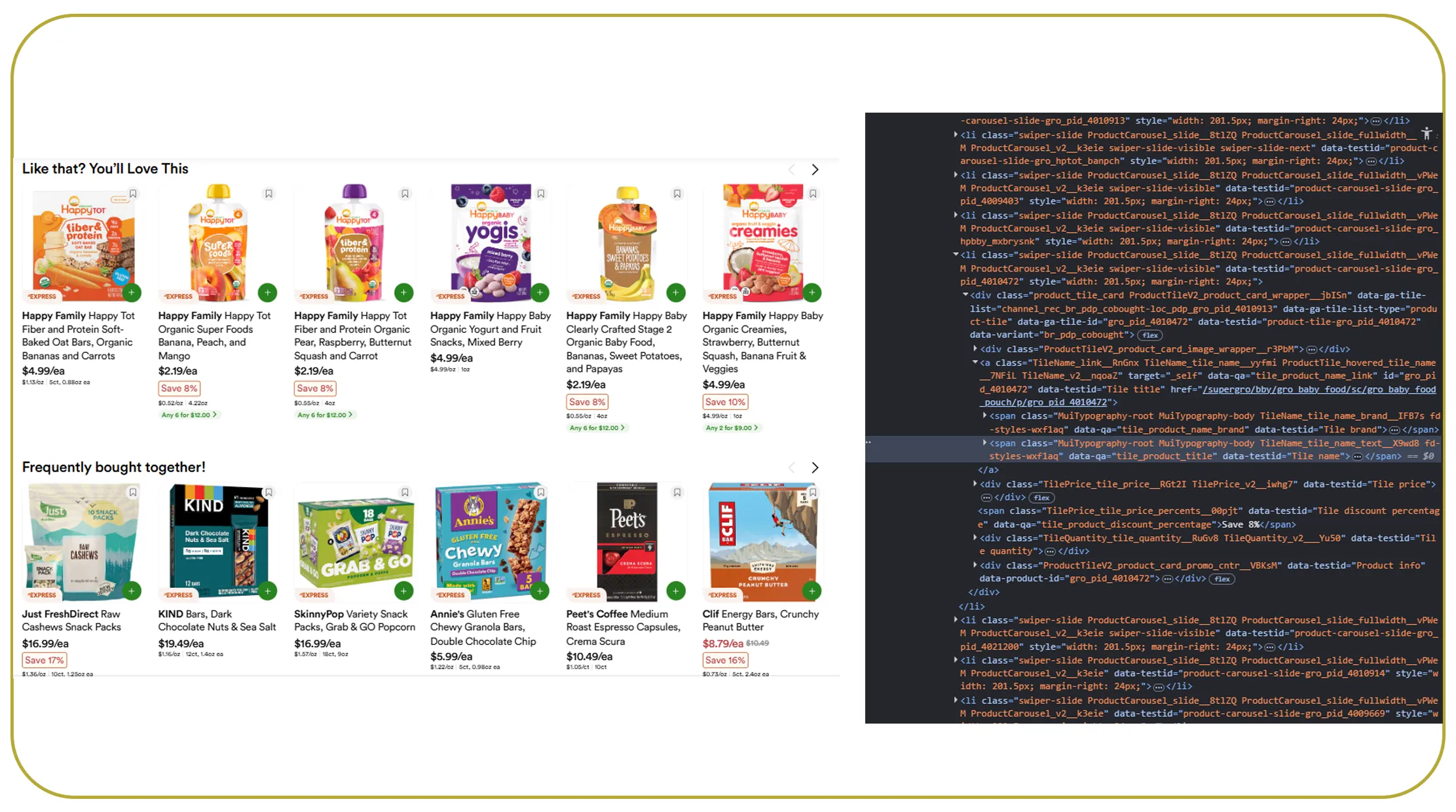

Building Reliable Data Pipelines for Pricing Teams

To handle the massive inflow of pricing data, brands increasingly depend on a grocery price data API provider that delivers structured, clean, and reliable information. APIs simplify the integration of pricing intelligence into dashboards, ERP systems, and BI tools, ensuring that decision-makers always work with up-to-date numbers.

Between 2020 and 2026, API-driven data consumption in retail analytics grew by over 200%, reflecting the need for scalable and automated solutions. Brands that adopted API-based pricing feeds reported fewer data inconsistencies and faster turnaround times for strategic decisions.

Growth in API-based retail data usage:

| Year | Retail Brands Using Pricing APIs |

|---|---|

| 2020 | 22% |

| 2021 | 30% |

| 2022 | 41% |

| 2023 | 53% |

| 2024 | 64% |

| 2025 | 72% |

| 2026 | 80% |

With dependable APIs, pricing teams can focus on insights rather than data collection. This leads to better forecasting, smarter promotion planning, and more effective cross-channel pricing alignment—key advantages in today's omnichannel grocery ecosystem.

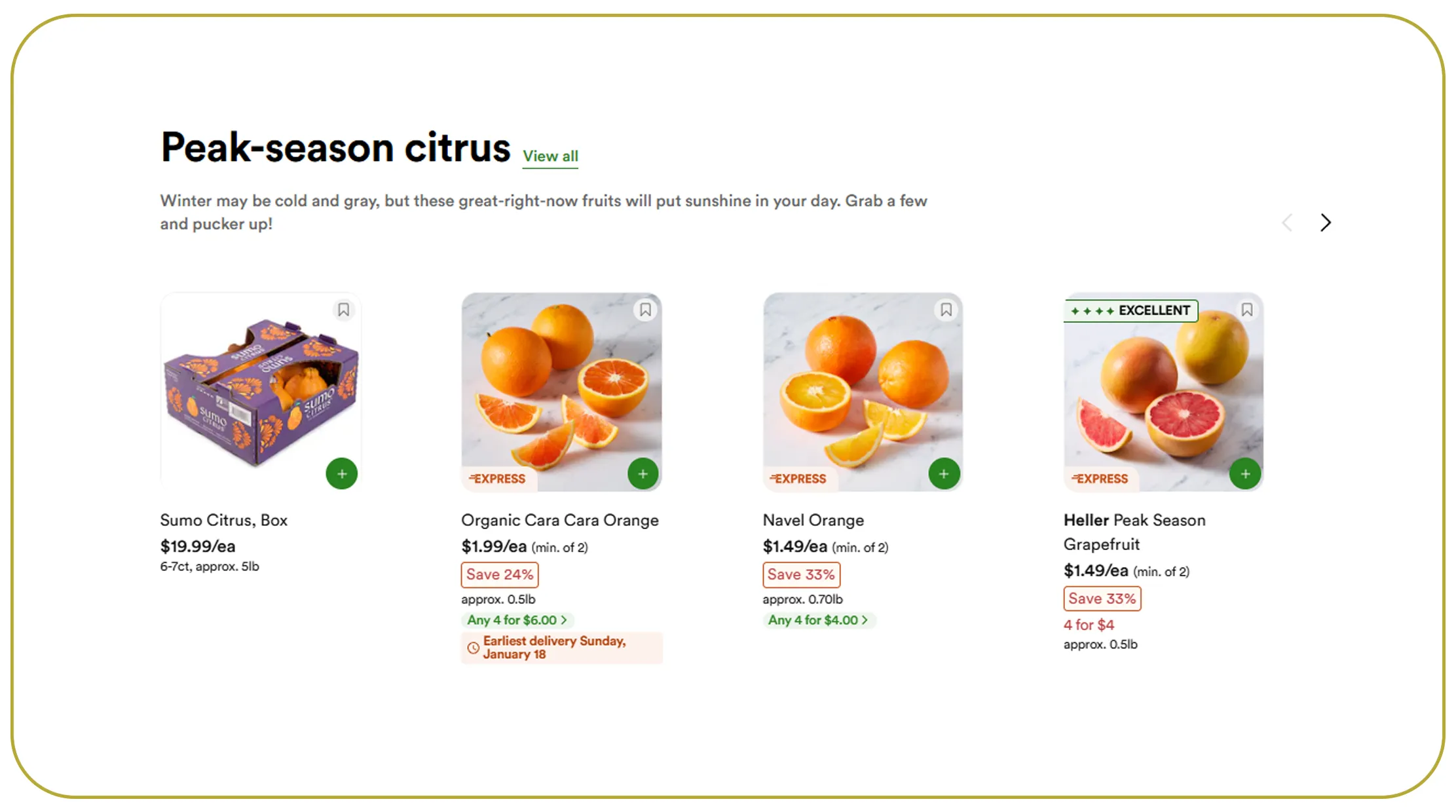

Gaining the Competitive Edge through Market Visibility

In an environment where margins are razor-thin, brands increasingly Extract grocery pricing platforms for competitive analysis to understand not just what competitors charge, but why they price the way they do. This deeper layer of intelligence goes beyond surface-level numbers to reveal patterns in discount timing, seasonal promotions, and private-label strategies.

From 2020 to 2026, brands using advanced competitive analysis tools saw measurable improvements in campaign effectiveness. They could benchmark pricing strategies against top competitors and refine their own tactics based on real performance metrics.

Impact of competitive pricing analysis:

| Year | Brands Reporting Improved Campaign ROI |

|---|---|

| 2020 | 35% |

| 2021 | 42% |

| 2022 | 50% |

| 2023 | 61% |

| 2024 | 69% |

| 2025 | 75% |

| 2026 | 82% |

This approach empowers brands to position themselves more strategically—whether as value leaders, premium providers, or balanced-price innovators. Competitive pricing intelligence ensures that decisions are grounded in data, not assumptions.

Scaling Price Intelligence with Automation

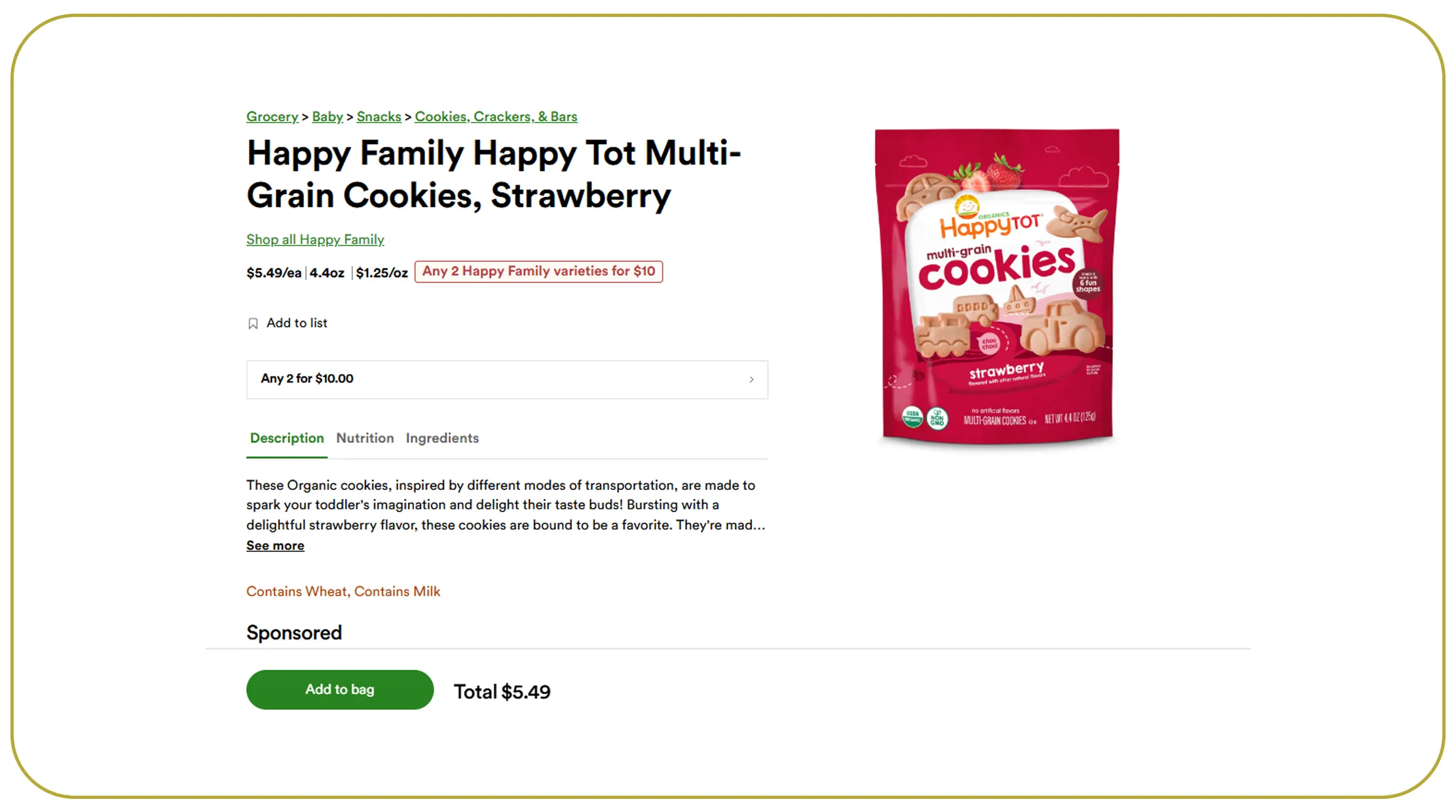

As the volume of grocery data grows, manual tracking becomes unsustainable. This is where a Grocery Data Scraping API plays a transformative role by automating the entire process—from data extraction to normalization and delivery.

Between 2020 and 2026, brands using automated scraping tools reduced pricing analysis time by more than 60%, freeing teams to focus on strategy rather than operations. Automation also minimizes errors caused by manual entry, ensuring higher data accuracy.

Efficiency gains from automated data scraping:

| Year | Avg. Time Spent on Pricing Analysis (hrs/week) |

|---|---|

| 2020 | 18 |

| 2021 | 16 |

| 2022 | 13 |

| 2023 | 10 |

| 2024 | 8 |

| 2025 | 7 |

| 2026 | 6 |

With automation in place, brands gain the agility to test new pricing models, respond to sudden market shifts, and optimize promotions in near real time—an essential capability in today's fast-paced grocery sector.

Turning Raw Numbers into Strategic Assets

Beyond real-time tracking, long-term success depends on building a reliable Grocery Dataset that supports forecasting, trend analysis, and scenario planning. Historical pricing data enables brands to study seasonal patterns, consumer sensitivity to discounts, and long-term margin trends.

From 2020 to 2026, brands that invested in comprehensive datasets improved demand forecasting accuracy by nearly 40%. This allowed them to align pricing with inventory planning, reducing stockouts and overstock situations.

Impact of historical pricing datasets:

| Year | Forecast Accuracy Improvement |

|---|---|

| 2020 | 12% |

| 2021 | 16% |

| 2022 | 21% |

| 2023 | 27% |

| 2024 | 32% |

| 2025 | 36% |

| 2026 | 40% |

By transforming raw price data into strategic intelligence, brands shift from short-term reactions to long-term planning—creating sustainable competitive advantages in an increasingly complex grocery market.

Why Choose Real Data API?

At Real Data API, we empower grocery brands with Real-Time Price Data Monitoring for Grocery Prices and Discounts that delivers unmatched accuracy, speed, and scalability. Our solutions are built to handle high-volume data streams while maintaining reliability and compliance. From competitor price tracking to promotion intelligence, we provide end-to-end support that turns complex data into clear, actionable insights. Whether you're a growing brand or an enterprise retailer, our tools help you stay agile, informed, and ahead of market shifts—so every pricing decision is backed by real-time intelligence, not assumptions.

Conclusion

In today's digital-first grocery ecosystem, pricing success is no longer about intuition—it's about intelligence. Brands that master data-driven strategies gain the power to anticipate trends, outmaneuver competitors, and protect profitability. By focusing on Price Comparison, Leverage Top Retail Pricing Platforms for Grocery Price monitoring, companies can move beyond reactive tactics and build proactive pricing models that scale with the market.

Ready to transform your grocery pricing strategy? Partner with Real Data API today and unlock the power of real-time retail intelligence for smarter, faster, and more profitable decisions.