Introduction

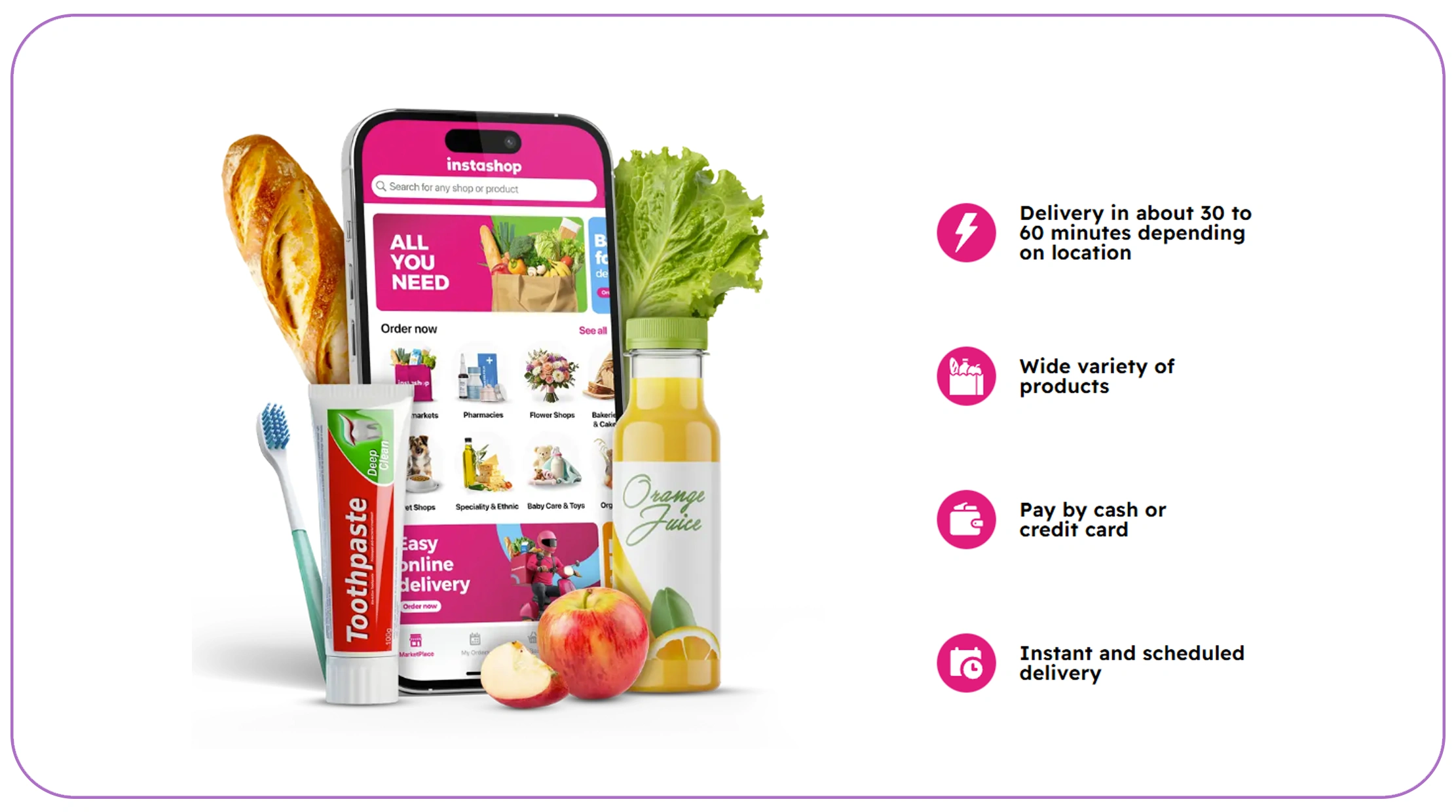

The rapid growth of quick commerce and on-demand grocery platforms has transformed how consumers shop and how retailers compete. Pricing, availability, and delivery promises now change multiple times a day, creating a highly dynamic retail environment. To stay competitive, businesses need immediate access to granular market signals rather than delayed reports or manual tracking. This is where Real-time grocery price Scraping via Instashop data becomes a strategic advantage for modern retail analytics.

Instashop aggregates thousands of grocery items across multiple stores, locations, and brands, making it a valuable source of competitive intelligence. When captured in real time, this data reveals how prices fluctuate, how availability shifts during peak demand, and how promotions influence buyer behavior. For retailers, CPG brands, and analysts, such insights enable smarter pricing decisions, accurate demand forecasting, and better inventory planning.

By leveraging automated data collection through reliable APIs, companies can move from reactive decision-making to proactive strategy. Instead of guessing market movements, they can observe them as they happen and respond instantly. This blog explores how real-time Instashop data fuels smarter retail analytics, backed by trends, statistics, and structured insights from 2020 to 2026.

Mapping Price and Availability Dynamics at Scale

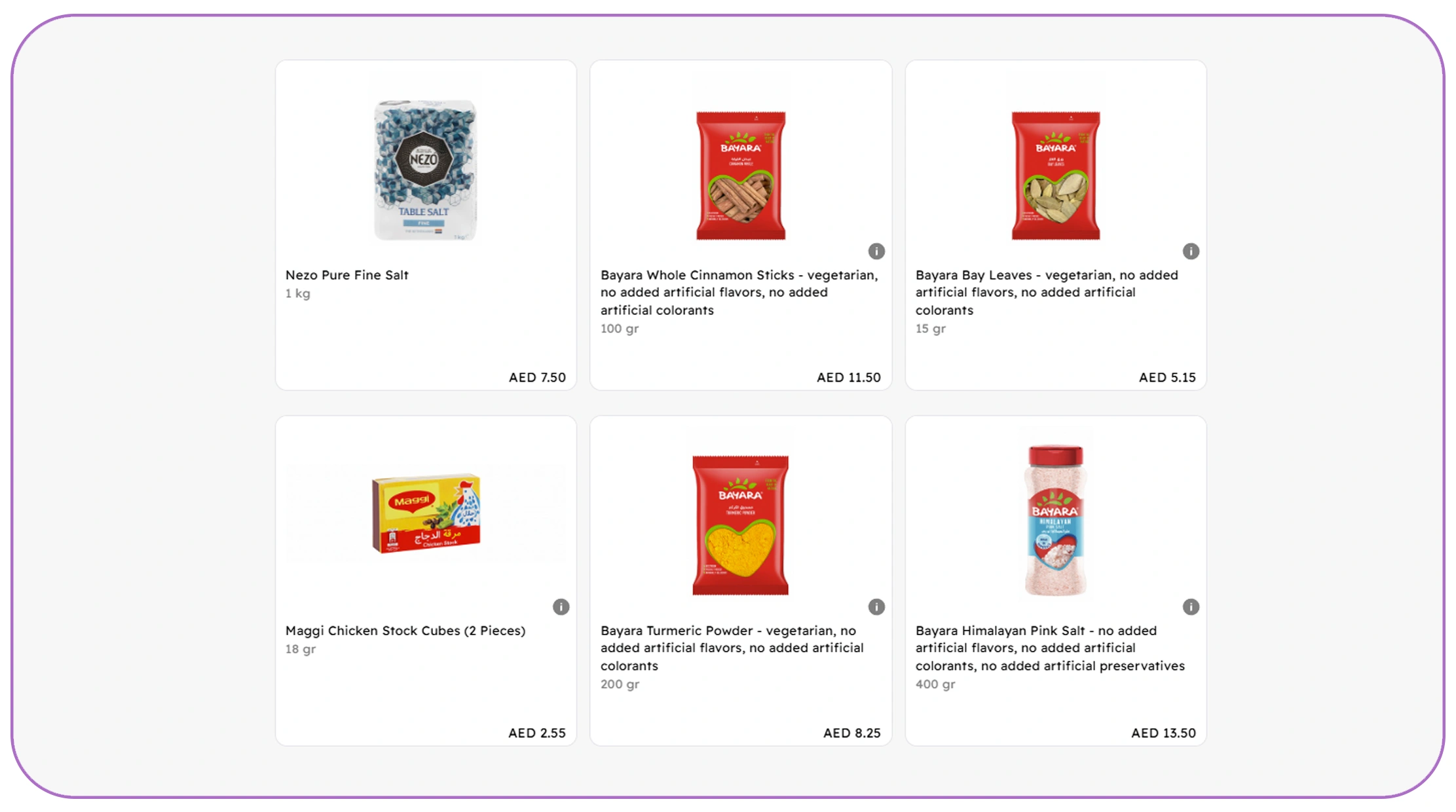

Tracking thousands of SKUs manually across locations is nearly impossible, especially when prices and stock levels change frequently. Instashop product price and availability scraping allows businesses to systematically capture this information at scale, creating a structured dataset that reflects real-world market conditions.

From 2020 to 2026, the number of products listed on quick commerce platforms has grown significantly, driven by urbanization and consumer demand for convenience. Studies show that grocery prices on quick commerce platforms can fluctuate by 5–12% within a single week during high-demand periods. By scraping real-time price and availability data, retailers can identify which products are consistently discounted, which go out of stock fastest, and how regional pricing differs.

| Year | Avg. SKU Count per City | Weekly Price Fluctuation | Avg. Out-of-Stock Rate |

|---|---|---|---|

| 2020 | 4,500 | 6% | 14% |

| 2022 | 6,800 | 8% | 12% |

| 2024 | 9,200 | 10% | 9% |

| 2026* | 12,000 | 12% | 7% |

These insights help retailers optimize assortments and adjust pricing strategies based on real demand signals. Brands can also measure how promotions affect availability, ensuring campaigns do not unintentionally create stock shortages. Ultimately, structured price and availability intelligence turns raw listings into actionable retail insights.

Understanding Inventory Volatility and Demand Signals

Inventory visibility is one of the most critical challenges in grocery retail. Products can go out of stock within hours, especially during peak demand windows or promotional events. Using Extract Instashop stock and inventory availability data, businesses can gain a near real-time view of how inventory levels behave across locations and time periods.

Between 2020 and 2026, data indicates that urban grocery demand spikes have become shorter but more intense. For example, evening demand peaks can increase order volume by up to 35% within a two-hour window. By continuously extracting inventory availability data, retailers can correlate stock-outs with pricing changes, delivery times, and customer demand patterns.

| Metric | 2020 | 2023 | 2026* |

|---|---|---|---|

| Avg. Daily Inventory Updates | 3 | 8 | 15 |

| Peak Demand Stock-outs | 22% | 16% | 10% |

| Inventory Forecast Accuracy | 68% | 78% | 88% |

Such data supports more accurate demand forecasting models and helps retailers allocate stock more efficiently. For brands, it reveals how quickly products sell once listed and which SKUs require faster replenishment. Over time, inventory analytics driven by real-time data reduce lost sales, improve fulfillment rates, and enhance overall customer satisfaction.

Capturing the Pulse of the Quick Commerce Economy

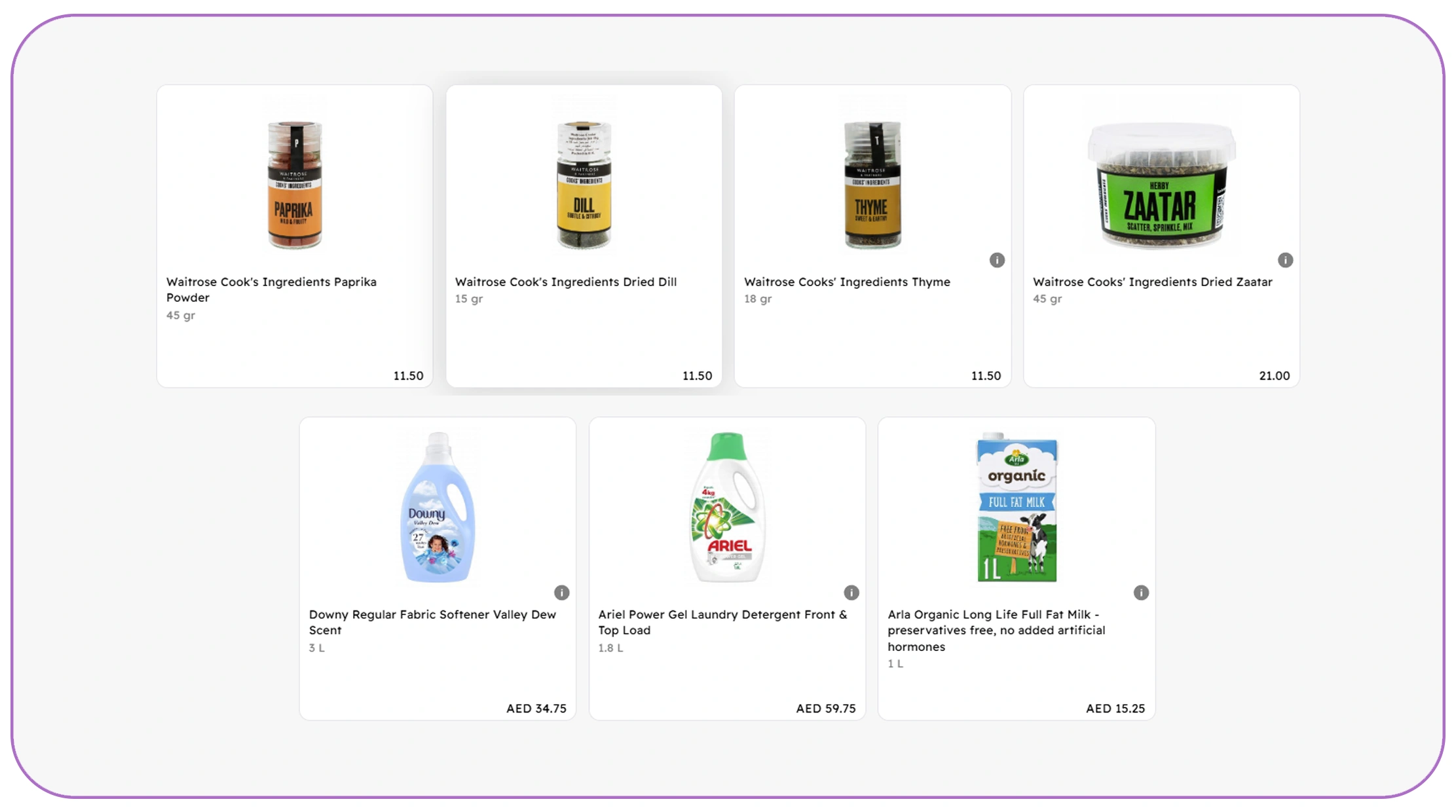

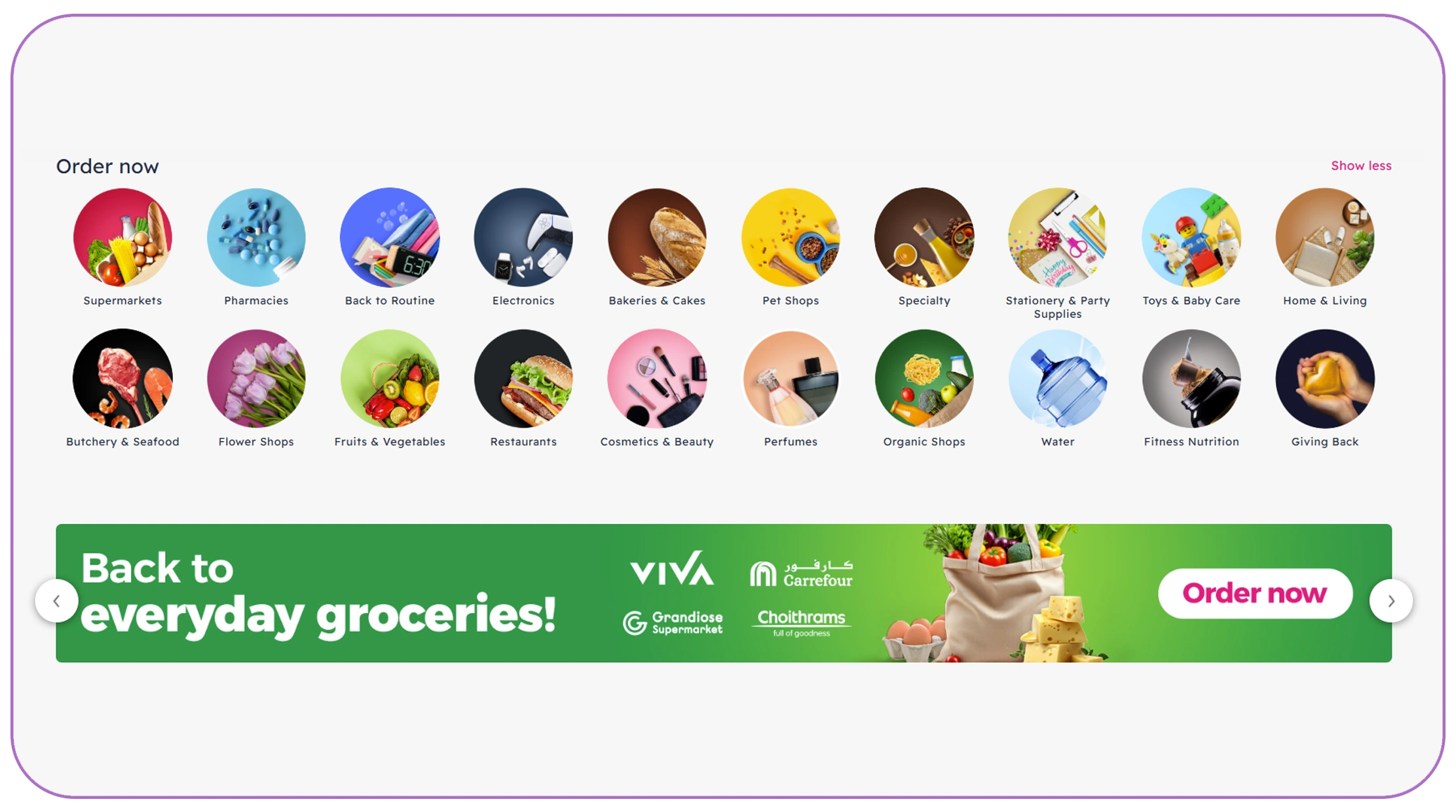

Quick commerce has reshaped consumer expectations around speed, pricing, and convenience. To fully understand this evolving ecosystem, businesses rely on Scrape Instashop data for quick commerce market insights that go beyond basic pricing.

From 2020 to 2026, quick commerce adoption has grown at a compound annual growth rate exceeding 20% in many urban markets. Scraped Instashop data reveals not only prices and availability but also category growth, private label penetration, and promotional intensity. For example, ready-to-eat and fresh produce categories have seen higher price volatility compared to packaged goods.

| Category | Avg. Price Change Frequency | Promotion Intensity |

|---|---|---|

| Fresh Produce | High | Medium |

| Dairy & Eggs | Medium | High |

| Packaged Foods | Low | Medium |

| Household Essentials | Medium | Low |

By analyzing these patterns, retailers can identify which categories drive margins and which require aggressive pricing to remain competitive. Investors and market researchers also use this data to assess platform growth and consumer behavior shifts. In essence, quick commerce analytics powered by Instashop data provide a real-time pulse of the grocery economy.

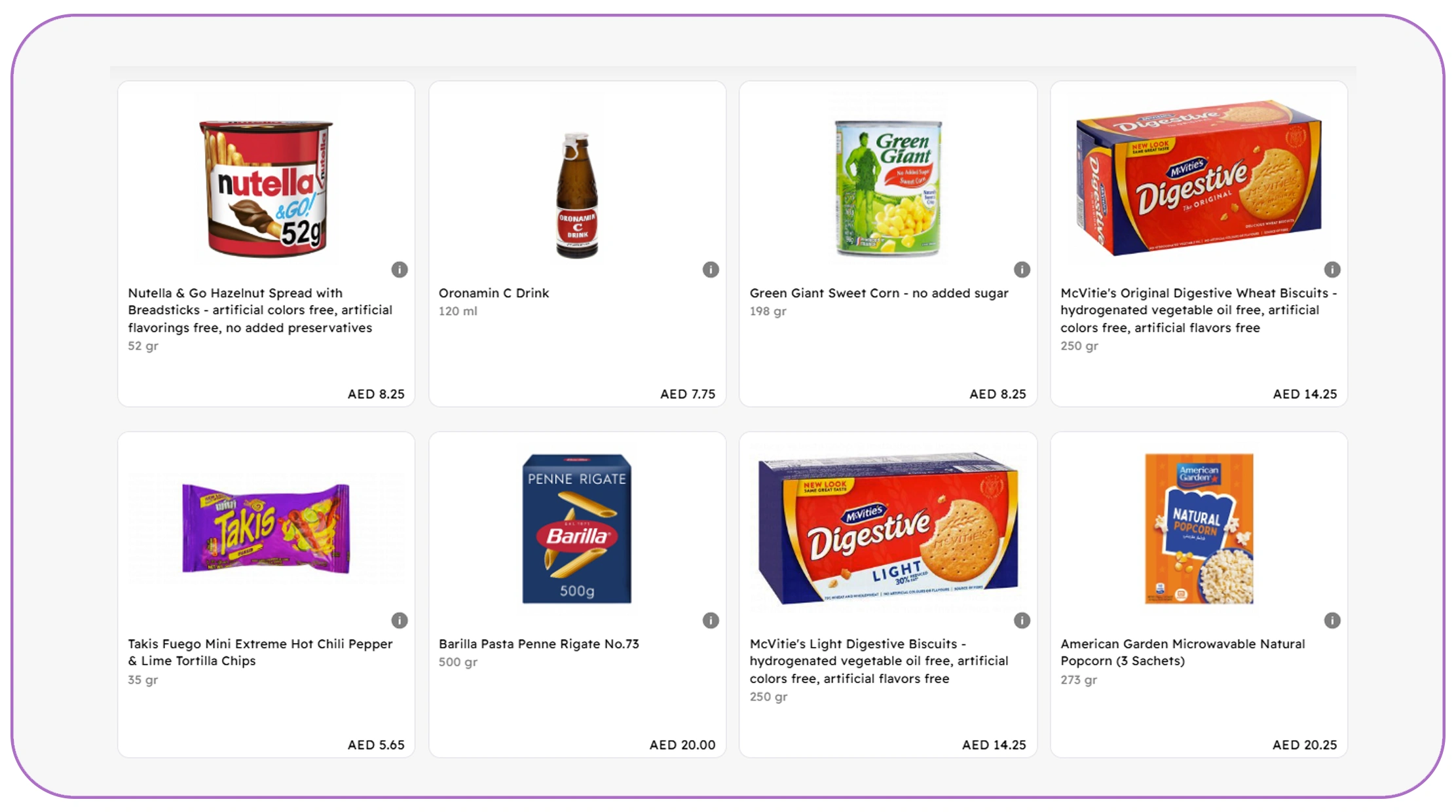

Turning Raw Listings into Pricing Intelligence

Raw pricing data alone has limited value unless it is contextualized and structured. Web Scraping retail pricing data for Instashop enables businesses to transform unstructured listings into standardized datasets suitable for analytics and machine learning.

From 2020 onward, retailers increasingly adopted dynamic pricing models. By 2026, it is estimated that over 60% of large grocery retailers will use algorithmic pricing influenced by real-time competitor data. Scraped pricing data allows companies to track minimum, maximum, and average prices per SKU, detect sudden price drops, and identify regional pricing gaps.

| Insight Type | Business Impact |

|---|---|

| Competitive Price Gaps | Improved price positioning |

| Discount Frequency | Better promotion planning |

| Regional Variance | Localized pricing strategies |

With consistent data feeds, analytics teams can build dashboards that reflect current market realities instead of historical snapshots. This supports faster decision-making and ensures pricing strategies remain aligned with consumer expectations and competitor movements.

Automating Data Collection for Scalable Analytics

As data volumes grow, manual scraping methods become unreliable and inefficient. The Instashop Quick Commerce Scraping API provides a scalable solution for continuous, automated data collection without interruptions.

Between 2020 and 2026, the average number of daily data points required for grocery analytics has increased more than fivefold. APIs allow businesses to schedule data extraction, maintain consistency, and integrate directly with analytics platforms. This automation reduces errors and ensures data freshness.

| Feature | Manual Collection | API-Based Collection |

|---|---|---|

| Data Freshness | Low | High |

| Scalability | Limited | Extensive |

| Error Rate | High | Low |

| Integration | Manual | Seamless |

By leveraging APIs, companies can focus on analysis rather than data gathering. This is particularly valuable for enterprises operating across multiple cities or countries, where data consistency is critical for accurate insights.

Building Custom Pipelines for Continuous Intelligence

A flexible scraping solution is essential for adapting to platform changes and evolving business needs. The Instashop Scraper enables organizations to build custom data pipelines that align with specific analytical goals.

From tracking private label performance to monitoring competitor expansion, customized scrapers allow businesses to capture exactly the data they need. Between 2020 and 2026, companies using tailored scraping solutions reported faster insight generation and higher ROI on data investments.

Custom pipelines also support advanced use cases such as predictive analytics and AI-driven recommendations. With continuous data feeds, models can be trained on up-to-date information, improving accuracy and relevance. This approach transforms Instashop data from a static resource into a living intelligence system.

Why Choose Real Data API?

Choosing the right data partner is as important as choosing the right data source. Real Data API delivers high-quality, structured grocery intelligence through reliable pipelines. With access to a comprehensive Grocery Dataset, businesses can analyze pricing, availability, and trends across markets. Combined with Real-time grocery price Scraping via Instashop data, this ensures decision-makers always work with fresh, actionable insights.

Real Data API prioritizes scalability, accuracy, and compliance, making it suitable for startups and enterprises alike. Its flexible integration options allow seamless connection with BI tools, data warehouses, and analytics platforms, accelerating time to insight.

Conclusion

The grocery retail landscape is more dynamic than ever, driven by quick commerce and real-time consumer demand. Leveraging Market Research powered by Real-time grocery price Scraping via Instashop data enables retailers, brands, and analysts to stay ahead of pricing shifts, inventory challenges, and competitive moves.

With the right data infrastructure, businesses can transform raw listings into strategic intelligence, optimize pricing, and enhance customer satisfaction.

Get started with Real Data API today and turn real-time Instashop data into smarter retail decisions!