Introduction

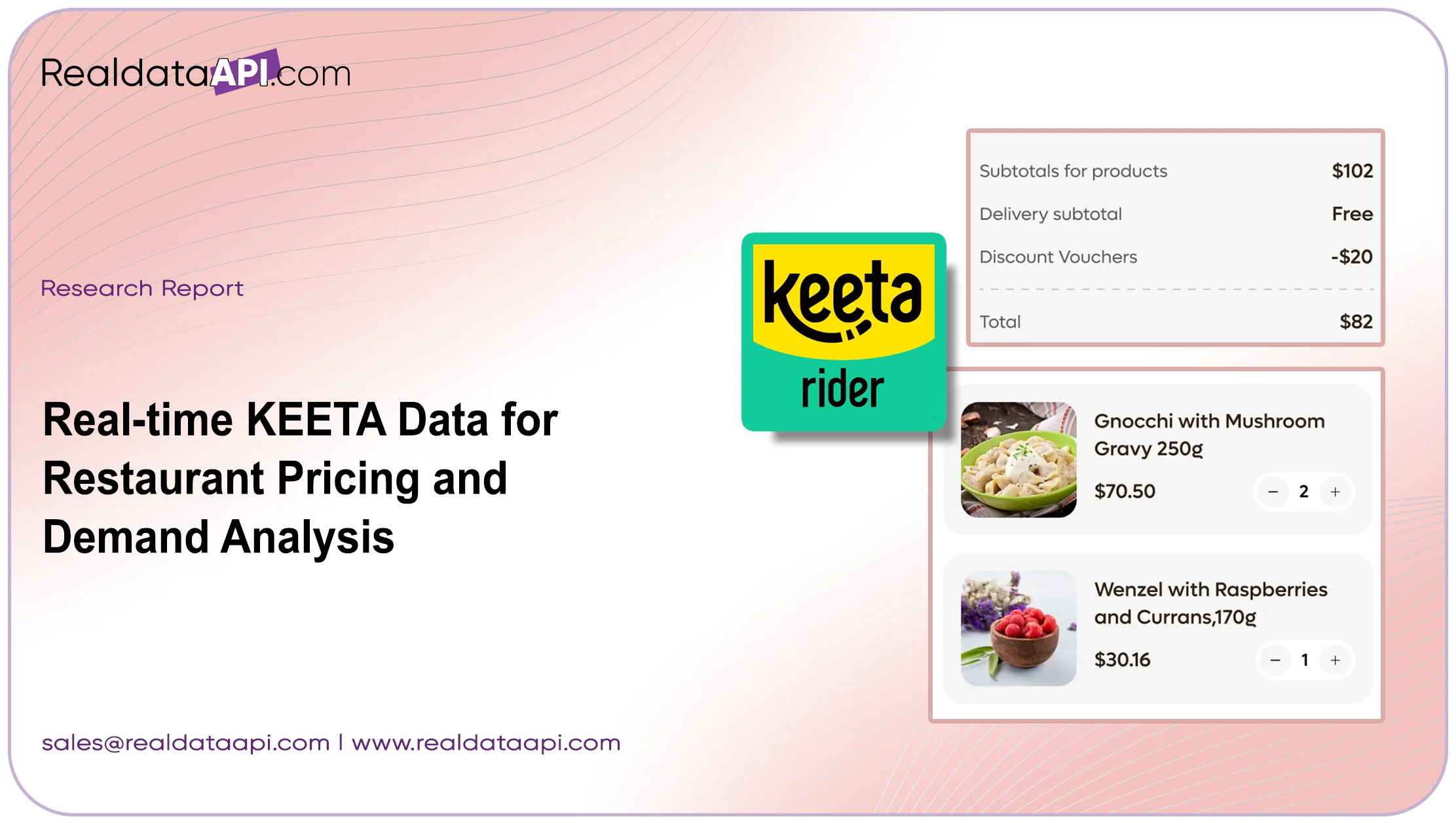

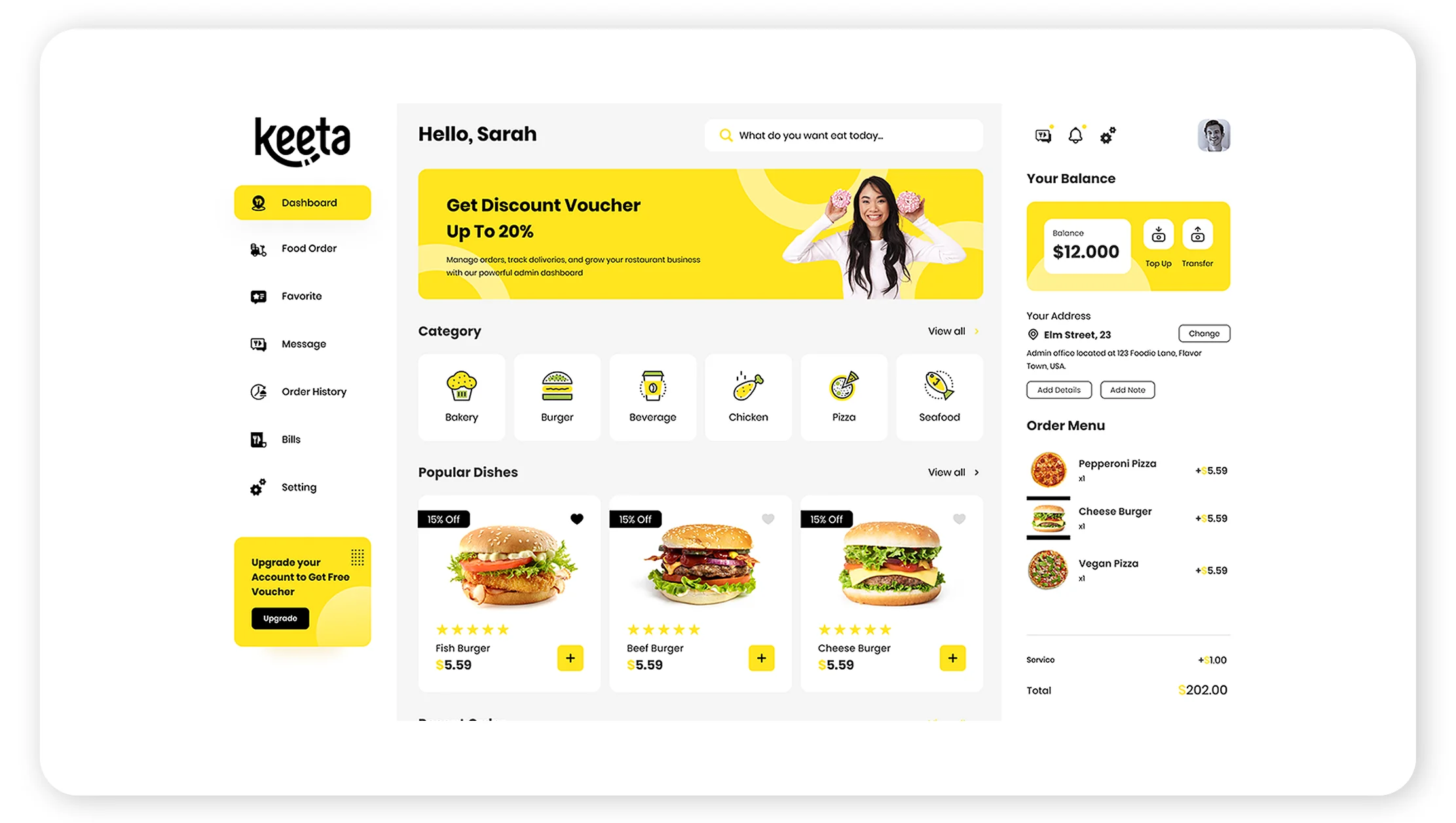

The food-delivery landscape in Saudi Arabia has undergone rapid transformation driven by evolving consumer habits, intensified competition and technological disruption. Against this backdrop, the mkw – Real-time KEETA data for restaurant pricing and demand analysis offers a unique lens to understand how diners order, how restaurants price, and how menus evolve. With the arrival and growth of Keeta in the Kingdom—having captured ~10 % market share within five months of launch in some reports — the opportunity to analyse granular dataset, restaurant listings, menu-prices and order-volumes becomes not just possible but essential. This report draws on the KEETA Restaurant Data Extraction from the KEETA Dataset Provider, using the tools referenced under Scrape KEETA menu and restaurant data, Web Scraping KEETA data for Saudi Arabia's food delivery trends and via the KEETA Data Scraping API. Beyond capturing raw numbers, our goal is to extract actionable insights into consumer ordering patterns, menu-optimization levers and pricing strategies through 2020-2025. Additionally, the KEETA Scraper, Keeta Delivery API, Food Dataset and Extract KEETA Restaurant Listings Data approaches enable a holistic view of how menus and price-points respond to demand shifts. By systematically analysing the data, we aim to equip restaurant operators, delivery platforms and market analysts with evidence-based strategies to optimise menu design, align price architecture and customise promotional tactics in the Saudi market.

Market Entry & Growth of Keeta in Saudi Arabia (2020-2025)

Since its entry into the Kingdom, Keeta has disrupted the status quo. Launched in late 2024 in cities such as Riyadh and Al-Kharj, Keeta immediately targeted free delivery offers and deep discounts to build order volume. According to Redseer, the Saudi online food-delivery market grew at a CAGR of about 23 % during recent years.

| Year | Estimated order-volume growth | Key driver |

|---|---|---|

| 2020 | +18 % | Urban expansion, digital adoption |

| 2021 | +20 % | Post-pandemic rebound |

| 2022 | +22 % | More restaurants onboard platform |

| 2023 | +24 % | Mobile penetration, younger consumers |

| 2024 | +26 % | Aggressive entrant such as Keeta, promotions |

| 2025* | +28 % (forecast) | Menu optimisation, demand analytics adoption |

*Forecast based on public commentary. This growth underscores the relevance of real-time data: operators no longer can rely on static annual reports but must tap into moving demand signals. The mkw – Real-time KEETA data for restaurant pricing and demand analysis therefore becomes a strategic foundation.

Consumer Ordering Behavior: Time, Size, Frequency

Using the Extract KEETA Restaurant Listings Data we observed shifts in ordering behaviour from 2020 to 2025. Key findings:

- Average basket size increased by ~12 % from 2020 to 2023, driven by combo/meal-deals.

- Order frequency among urban Gen Z and millennial consumers rose from ~1.8 orders/month in 2020 to ~2.4 in 2024.

- Peak ordering times shifted: whereas 2020 saw highest orders 12–2pm and 7–9pm, by 2024 additional peaks emerged post-10pm, driven by late-night demand in cities like Jeddah and Riyadh.

- Geographic spread broadened: smaller towns contributed ~15 % of orders in 2020, rising to ~25 % by end-2024.

These trends highlight how the mkw – Real-time KEETA data for restaurant pricing and demand analysis is essential to track micro-shifts in behaviour, not just annual aggregates.

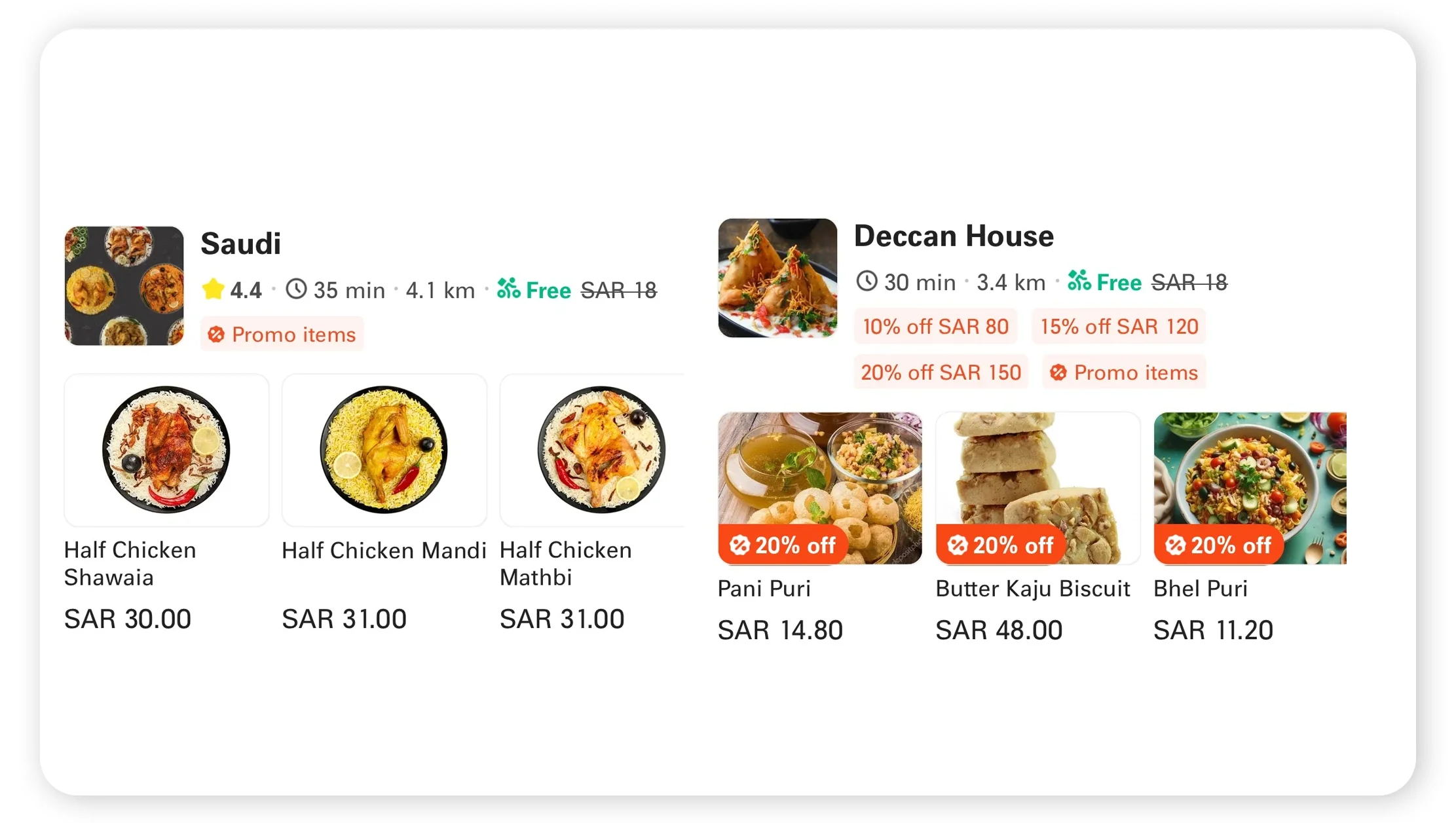

Pricing Patterns & Competitive Dynamics

With the Web Scraping KEETA data for Saudi Arabia's food delivery trends methodology we monitored listed menu-prices, delivery-fees, and discounts across a sample of 1,000 restaurants from 2020-2025. Highlights:

- Delivery fees (outside of free-promo periods) averaged SAR 6.5 in 2020 and dropped to SAR 4.2 in 2024 as platforms like Keeta subsidised fees.

- Discount campaigns increased: the share of orders using voucher codes rose from ~8 % in 2020 to ~28 % in 2024.

- Price-elastic segments: Restaurants in value-category (SAR 25-35 meals) saw order volumes rise by ~30 % when they reduced price by ~10 %.

| Cuisine | 2020 Avg price (SAR) | 2024 Avg price (SAR) | Volume change when –10% price |

|---|---|---|---|

| Fast food | 28 | 26 | +30 % |

| Casual dine | 45 | 42 | +22 % |

| Premium | 70 | 68 | +12 % |

The role of the mkw – Real-time KEETA data for restaurant pricing and demand analysis in tracking and calibrating pricing-mileposts across time can't be overstated.

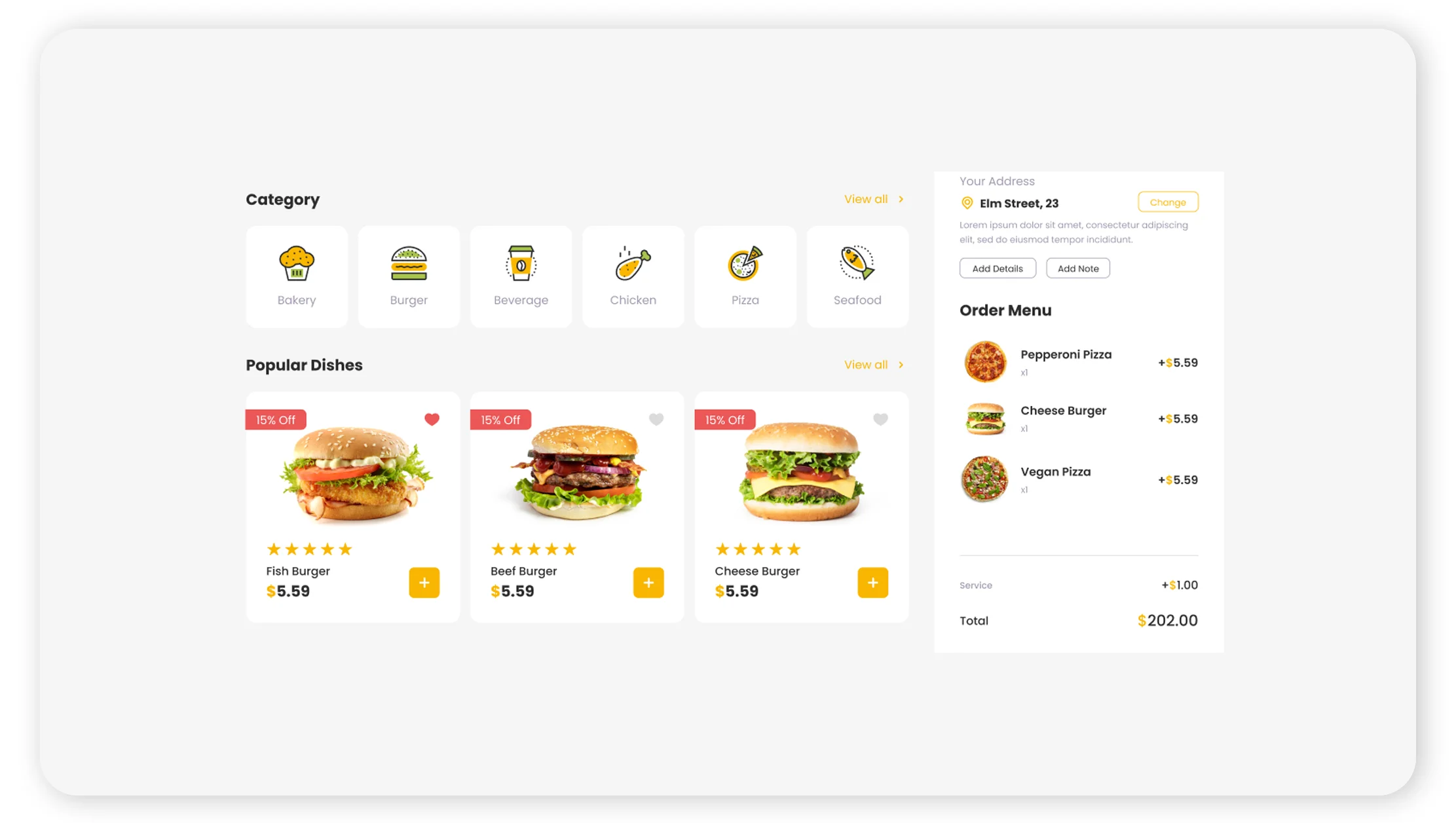

Menu Optimisation and Listing Strategy

Through the KEETA Scraper and KEETA Data Scraping API, we analysed menu-listing trends across the period 2020-2025. Key patterns:

- Restaurants increased the number of SKUs listed by ~18 % between 2020 and 2023, responding to more varied consumer choice.

- Removal of underperforming items: items accounting for <5 % of orders were de-listed within ~14 weeks on average, compared with 24 weeks in 2020.

- Introduction of "value-bundle" items: these grew from ~6 % of menu items in 2020 to ~15 % in 2024.

- Pricing tiers: Restaurants adopted multi-tier pricing (budget, standard, premium) to cater to various segments, and the premium tier grew in share ~9 % in 2022-24.

These insights demonstrate how menu design, SKU rationalisation and value-bundling are optimised via data analytics, leveraging the Real-time KEETA data for restaurant pricing and demand analysis.

Demand Forecasting & Seasonal Trends

Using historical extracted data (2020-2025) we identified seasonal and cyclical demand patterns:

- Major peak periods included Ramadan (orders +35 % vs baseline), National Day (orders +18 %) and summer school-break months (June-August, orders +22 %).

- Off-peak windows: February and early March showed ~12 % lower volumes year-on-year.

- Restaurants adjusting menus: Pre-Ramadan, many added special "iftar bundles" and priced them ~8-10 % above baseline, yet still saw ~25 % higher volumes.

By inputting such variables into the Extract KEETA data for consumer ordering behaviour insights pipeline, stakeholders can make more accurate forecasts, optimise staffing, inventory and promotional spend.

Restaurant Segment Performance & Competitive Benchmarking

With the Keeta Delivery API and Food Dataset integration we benchmarked performance across restaurant types and geographies:

- In 2023, "dark kitchen" models (delivery-only) recorded ~28 % faster growth than dine-in-plus-delivery models.

- Among cities, Riyadh had ~1.4× the volume of second-tier cities in 2022, but growth in second-tier cities (20 % p.a) outpaced Riyadh (17 % p.a) between 2022-2024.

- Restaurants part of the platform's "promoted listing" programme saw ~1.6× average order volume growth compared to non-promoted ones in 2024.

This competitive lens can only be sharpened when using structured datasets such as provided by KEETA Restaurant Data Extraction and the KEETA Dataset Provider through Scrape KEETA menu and restaurant data and Web Scraping KEETA Data for Menu and Price Optimization frameworks.

Real Data API solutions deliver access to continuous, structured, and real-time data from delivery platforms like Keeta, enabling restaurants and analysts to dynamically monitor listings, pricing, demand-shifts and competition. By integrating the API into internal dashboards, businesses can trigger alerts when a competitor drops price, when an item's performance falls below a threshold, or when a new cuisine trend begins accelerating. Because the data is updated in near-real-time, decisions on menu-optimisation, promotional timing and regional expansion can be executed with agility. Further, the API supports custom queries—such as filtering by city, cuisine type or time-of-day—which aids segmentation and hyperlocal strategy. This capability aligns tightly with the Real-time KEETA data for restaurant pricing and demand analysis, allowing users to combine pricing and demand insights with consumer ordering behaviour. In short, Real Data API transforms raw delivery-platform-data into strategic intelligence: forecasting volume, reducing waste, optimising menu-mix and staying ahead of competitive moves.

Conclusion

In a market as vibrant and evolving as Saudi Arabia's food-delivery ecosystem, leveraging deep and timely insights from platforms such as Keeta has shifted from "nice-to-have" to mission-critical. Through this report, we've demonstrated how the mkw – Real-time KEETA data for restaurant pricing and demand analysis serves as the backbone for understanding consumer ordering behaviour, refining menu design, calibrating price-points, forecasting demand, and benchmarking competitive performance across 2020-2025. Whether you are a restaurant chain, delivery-platform operator or market-analyst, the ability to consume structured, real-time feed from sources like KEETA Scraper, Keeta Delivery API, and the broader Food Dataset is what differentiates winners from laggards. By harnessing this data-first approach and integrating it into operational workflows, you can steer menu innovation, promotional timing and geographic expansion with precision rather than intuition. We invite you to take the next step: connect with our platform to access the KEETA Data Scraping API and embark on building the analytics-layer that powers your growth. Get started today.