Introduction

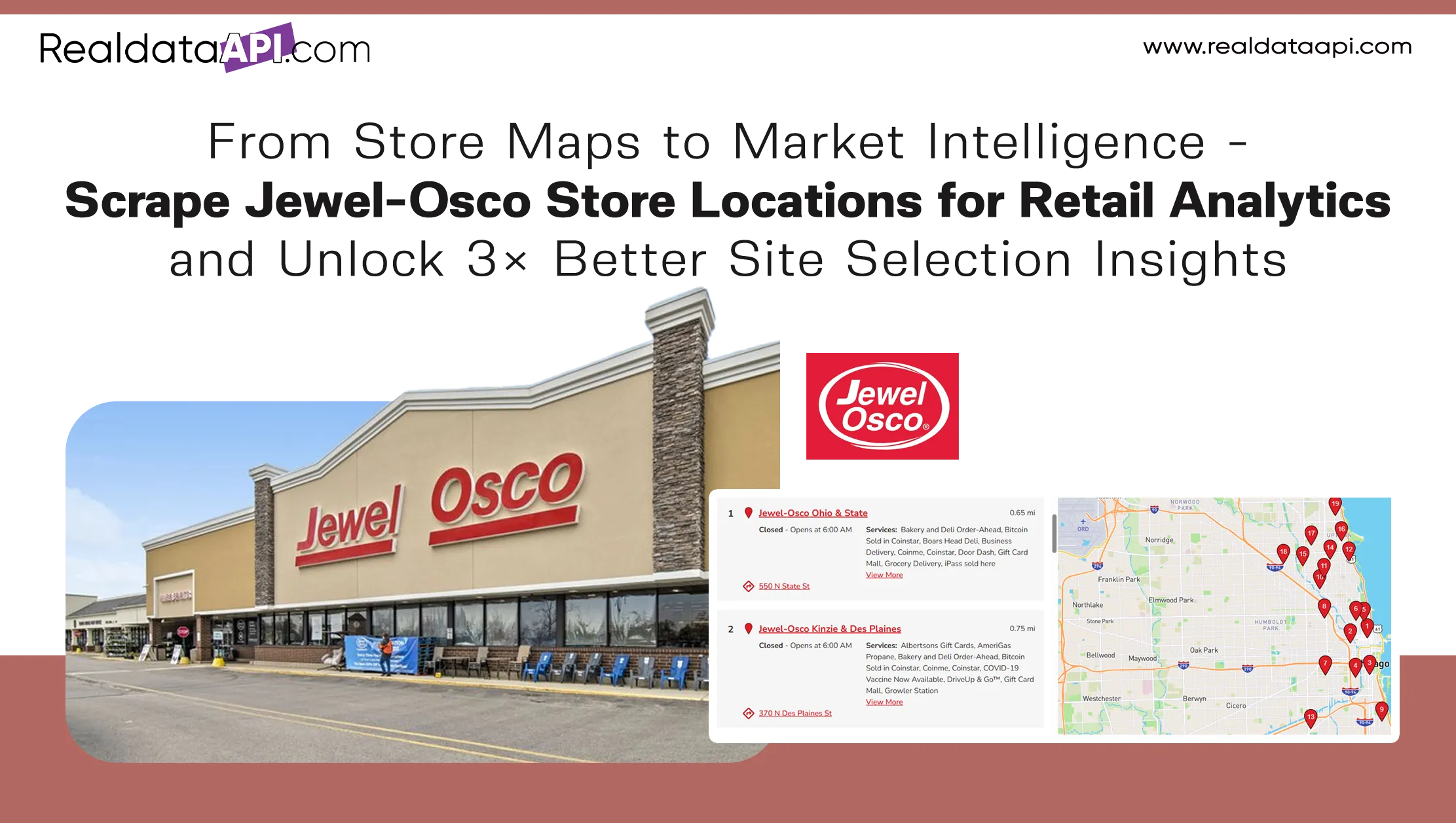

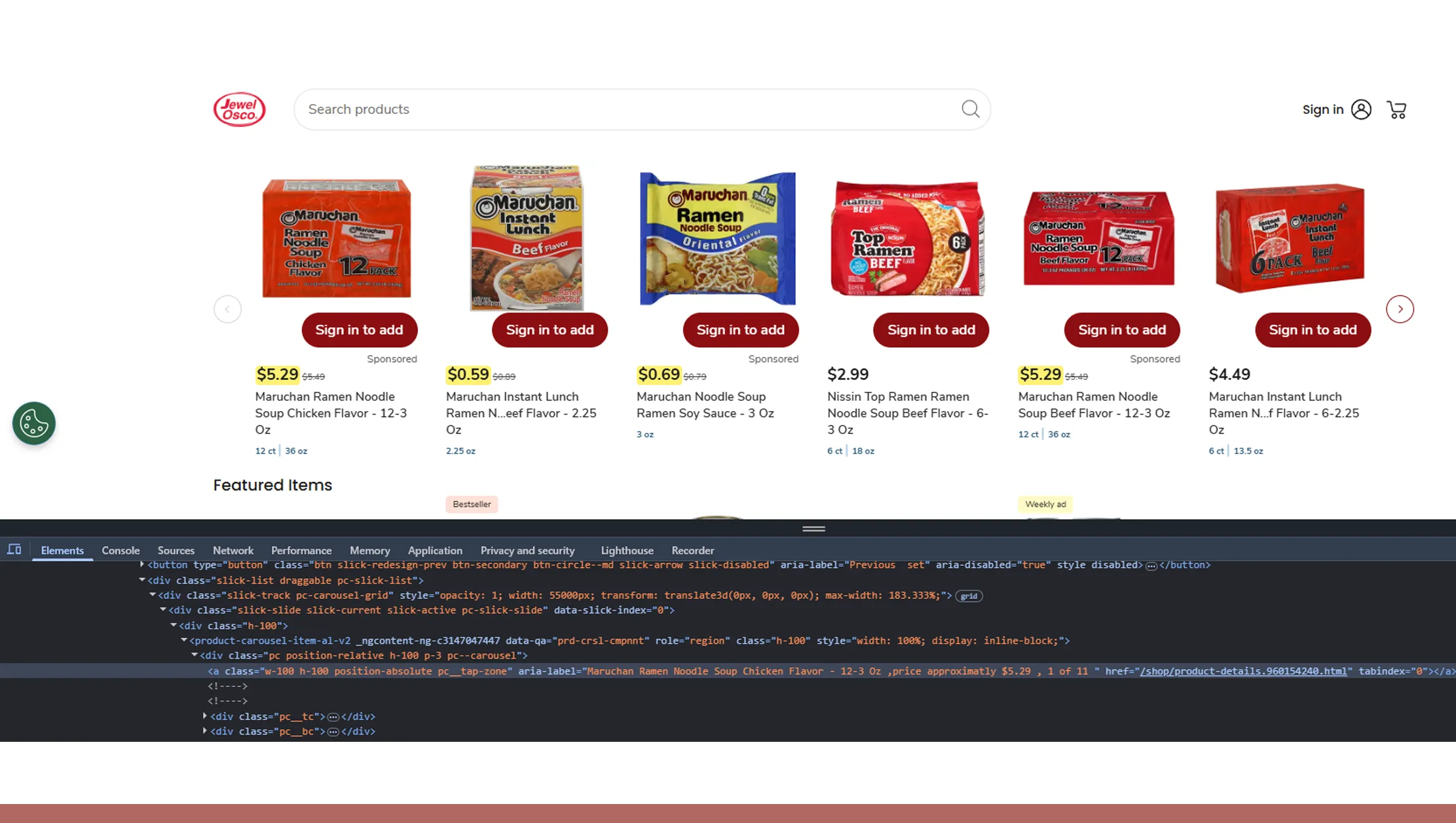

Physical store location data has become a critical asset for retailers, suppliers, real estate planners, and investors looking to understand market demand and optimize expansion strategies. Grocery chains like Jewel-Osco operate in highly competitive, location-sensitive markets where proximity, population density, and regional buying behavior directly influence performance. To transform static store maps into strategic intelligence, businesses increasingly rely on automated data collection methods that enable them to scrape Jewel-Osco store locations for retail analytics at scale.

By capturing structured location attributes such as store count, geographic spread, urban versus suburban placement, and proximity to competitors, organizations gain visibility into demand clusters and underserved regions. This blog explores how Jewel-Osco location data can be converted into actionable insights using Real Data API. We examine trends from 2020 to 2026, highlight enterprise use cases, and demonstrate how scalable web scraping infrastructure empowers smarter site selection, competitive benchmarking, and market expansion decisions.

Understanding Regional Demand Patterns

Accurate store location data allows analysts to model demand at a granular level. Through Jewel-Osco store mapping for demand analysis, businesses can identify correlations between store density, household income, population growth, and purchasing behavior. Grocery demand is highly localized, making spatial data essential for forecasting sales performance.

Jewel-Osco Store Distribution Trends (2020–2026)

| Year | Total Stores | Urban (%) | Suburban (%) |

|---|---|---|---|

| 2020 | 188 | 42 | 58 |

| 2022 | 195 | 44 | 56 |

| 2024 | 203 | 46 | 54 |

| 2026 | 210 | 48 | 52 |

As urban density increases, Jewel-Osco has gradually expanded into high-traffic metropolitan zones while maintaining suburban dominance. Mapping this data helps brands align product assortment, pricing strategies, and marketing campaigns with regional demand characteristics.

For suppliers and logistics providers, demand mapping supports optimized distribution routes and inventory allocation. With automated scraping, this data remains current, enabling real-time analysis rather than outdated snapshots.

Extracting Competitive Grocery Intelligence

Location intelligence extends beyond mapping—it provides insights into market structure and competition. Using grocery market insights via Jewel-Osco data scraping, analysts can compare store placement against competitors such as Kroger, Aldi, and Walmart to identify saturation and white-space opportunities.

Comh4etitive Store Density per Metro Area (2020–2026)

| Year | Avg Competitors Within 5 Miles |

|---|---|

| 2020 | 6.2 |

| 2022 | 6.8 |

| 2024 | 7.4 |

| 2026 | 8.1 |

Rising competitive density indicates intensifying price and promotion pressures. Businesses leveraging scraped data can proactively respond by refining pricing, launching localized promotions, or adjusting store formats.

For investors and consultants, this intelligence enables market risk assessment and valuation modeling. Without scraping, collecting and maintaining this level of competitive insight manually would be impractical and error-prone.

Supporting Strategic Market Expansion

Expansion decisions require accurate, up-to-date intelligence. By Web Scraping Jewel-Osco location data for market expansion, organizations can evaluate where the brand is growing, stagnating, or exiting markets, revealing broader industry trends.

New Store Openings by Region (2020–2026)

| Region | New Stores |

|---|---|

| Midwest | 14 |

| Northeast | 5 |

| West | 2 |

| South | 1 |

This data highlights Jewel-Osco's continued focus on Midwestern markets, signaling strong regional demand and brand loyalty. Retail real estate firms can leverage this insight to anticipate leasing demand, while CPG brands can prioritize sales efforts in high-growth regions.

Scraped datasets also support predictive modeling, helping businesses simulate future expansion scenarios based on historical growth patterns.

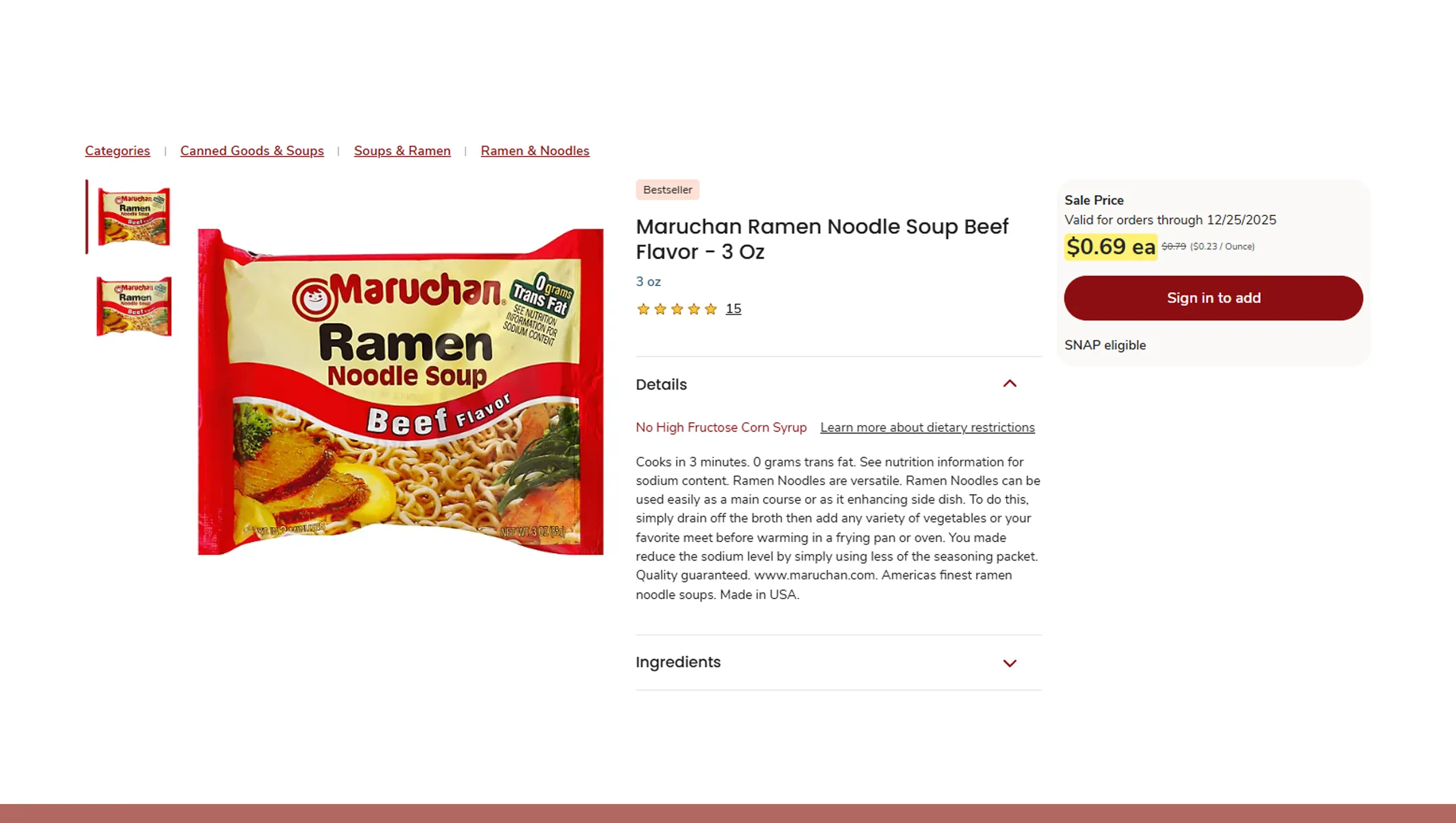

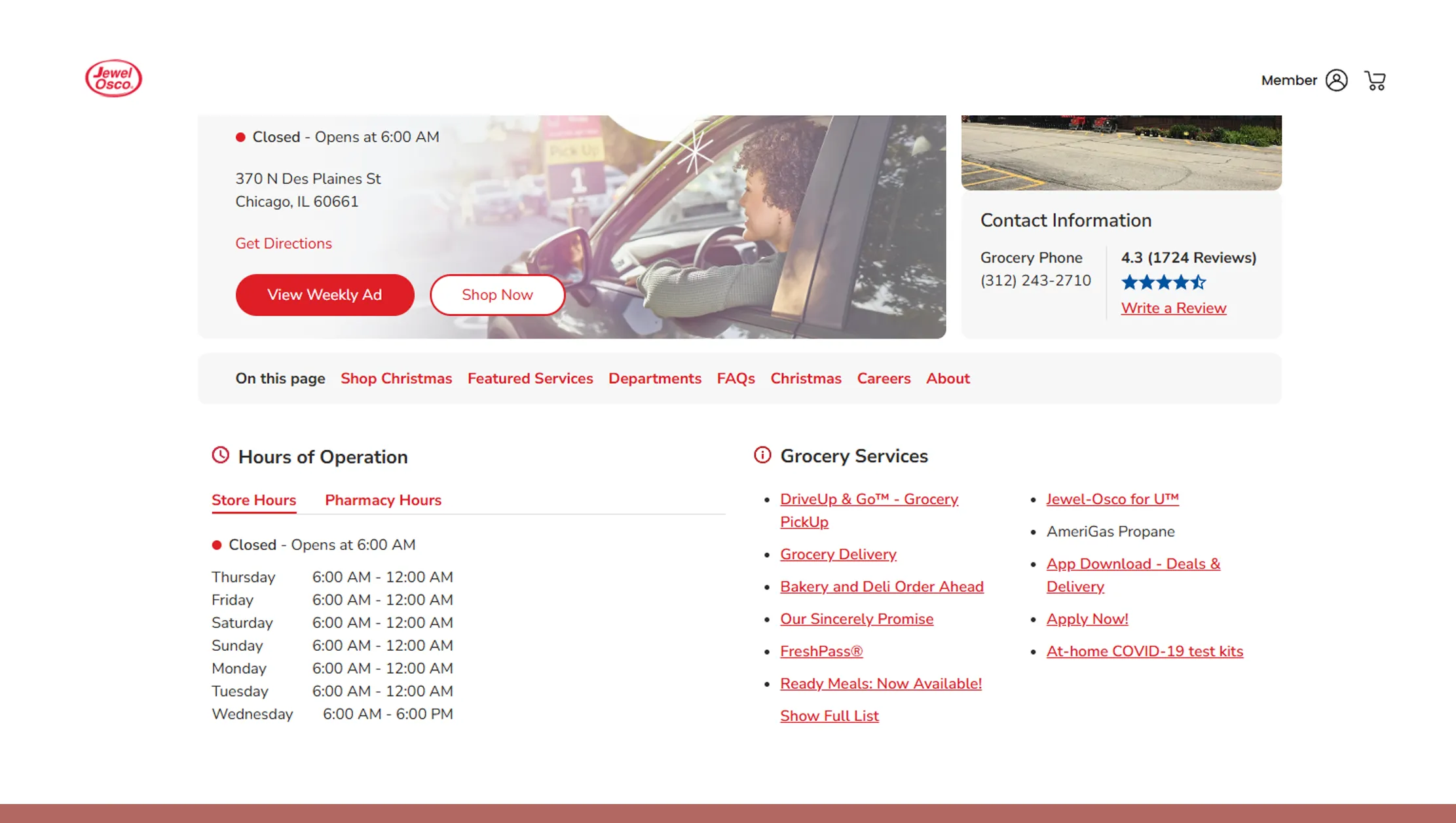

Enhancing Consumer Accessibility Insights

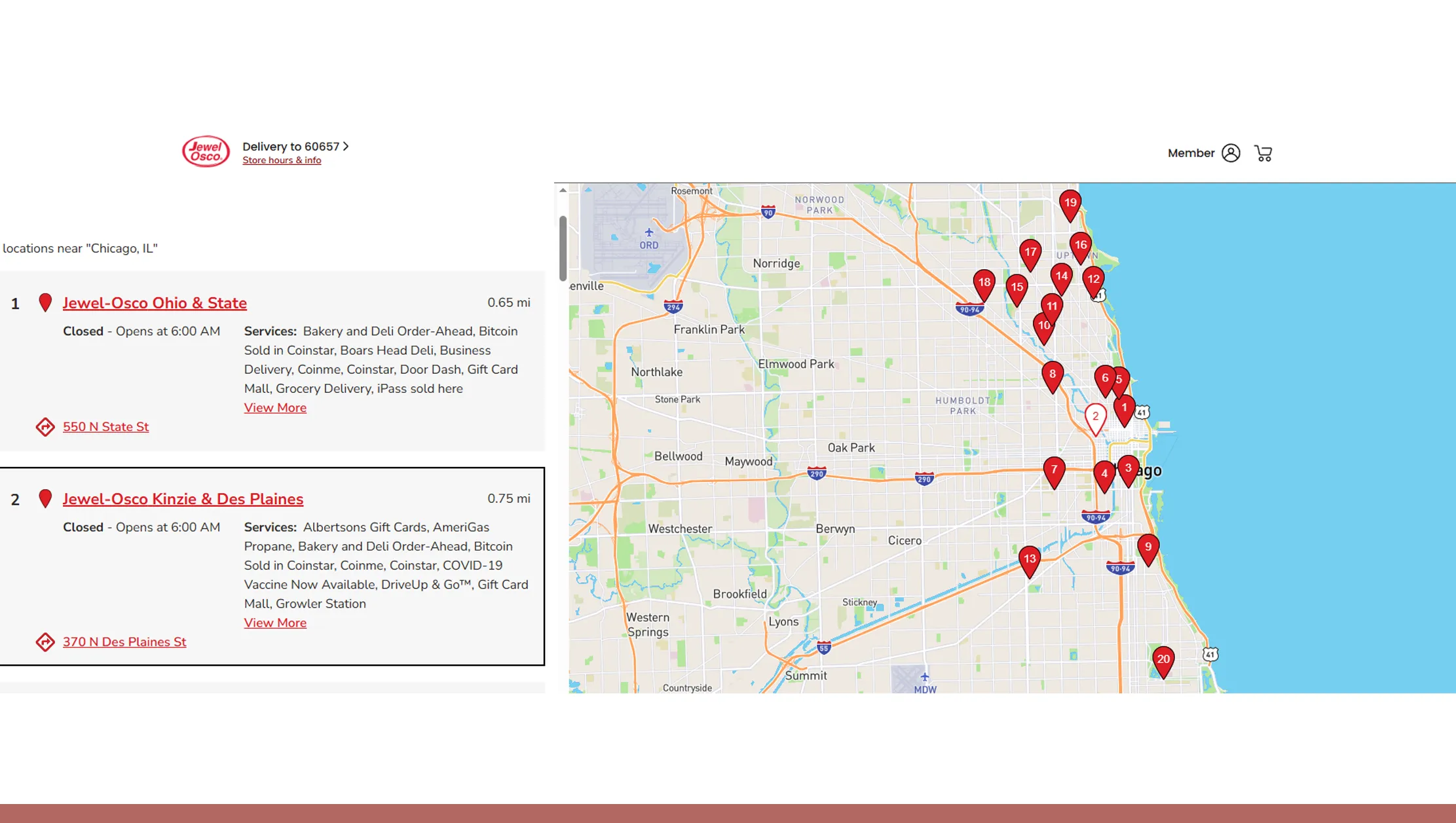

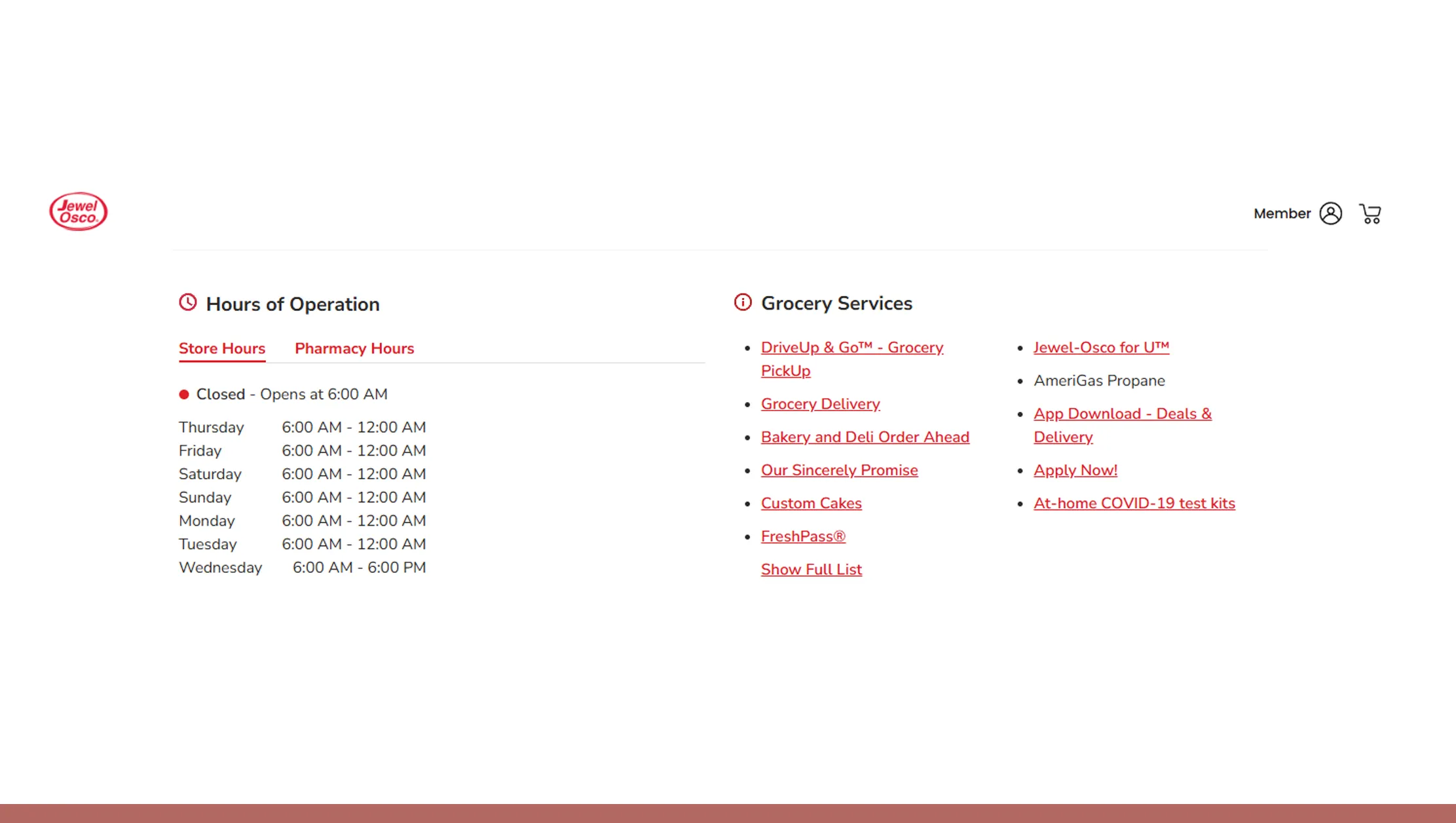

Store locator data is more than a convenience feature—it's a valuable analytics resource. Analyzing Jewel-Osco store locator information allows businesses to understand accessibility, drive-time coverage, and customer reach.

Average Customer Drive Time (2020–2026)

| Year | Avg Drive Time (Minutes) |

|---|---|

| 2020 | 11.6 |

| 2022 | 10.9 |

| 2024 | 10.2 |

| 2026 | 9.7 |

Decreasing drive times indicate improved store placement and accessibility. This data helps retailers refine last-mile delivery strategies and evaluate the feasibility of smaller footprint stores or dark stores.

For urban planners and delivery platforms, such insights support infrastructure planning and service optimization.

National-Scale Location Intelligence

Operating at scale requires comprehensive national datasets. With Scrape Jewel Osco store locations data in the USA, enterprises gain visibility into regional coverage, state-level penetration, and cross-market trends.

State-Level Store Concentration (Top 5 States, 2026)

| State | Store Count |

|---|---|

| Illinois | 132 |

| Indiana | 34 |

| Wisconsin | 21 |

| Iowa | 13 |

| Michigan | 10 |

This concentration underscores Jewel-Osco's strong Midwest footprint. National brands can use this data to tailor regional marketing strategies, while logistics firms optimize warehouse placement.

Scraping ensures consistent updates as stores open, close, or relocate—critical for maintaining data accuracy over time.

Scaling Location Intelligence for Enterprises

Large organizations require robust infrastructure to manage vast datasets. Enterprise Web Crawling enables automated, high-frequency collection of store location data across multiple sources without manual intervention.

Enterprise Data Collection Growth (2020–2026)

| Year | Locations Tracked |

|---|---|

| 2020 | 200 |

| 2022 | 450 |

| 2024 | 780 |

| 2026 | 1,200+ |

Scalable crawling supports integration with GIS systems, BI dashboards, and AI-driven forecasting models. Enterprises benefit from reduced operational overhead, improved data reliability, and faster decision cycles.

Why Choose Real Data API?

Real Data API delivers enterprise-grade infrastructure designed for large-scale retail intelligence. By enabling Competitive Benchmarking and supporting the ability to scrape Jewel-Osco store locations for retail analytics, the platform empowers businesses to transform raw location data into strategic insights. With flexible endpoints, compliance-first architecture, and high data accuracy, Real Data API is built for modern analytics teams.

Conclusion

Store location data is no longer static—it's a dynamic intelligence asset. Organizations that invest in automation gain a decisive advantage in site selection, competitive analysis, and market expansion planning. With a powerful Web Scraping API and proven expertise in scrape Jewel-Osco store locations for retail analytics, Real Data API helps businesses unlock 3× better insights from store maps.

Start leveraging Real Data API today to turn retail location data into actionable market intelligence and stay ahead of the competition.