Introduction

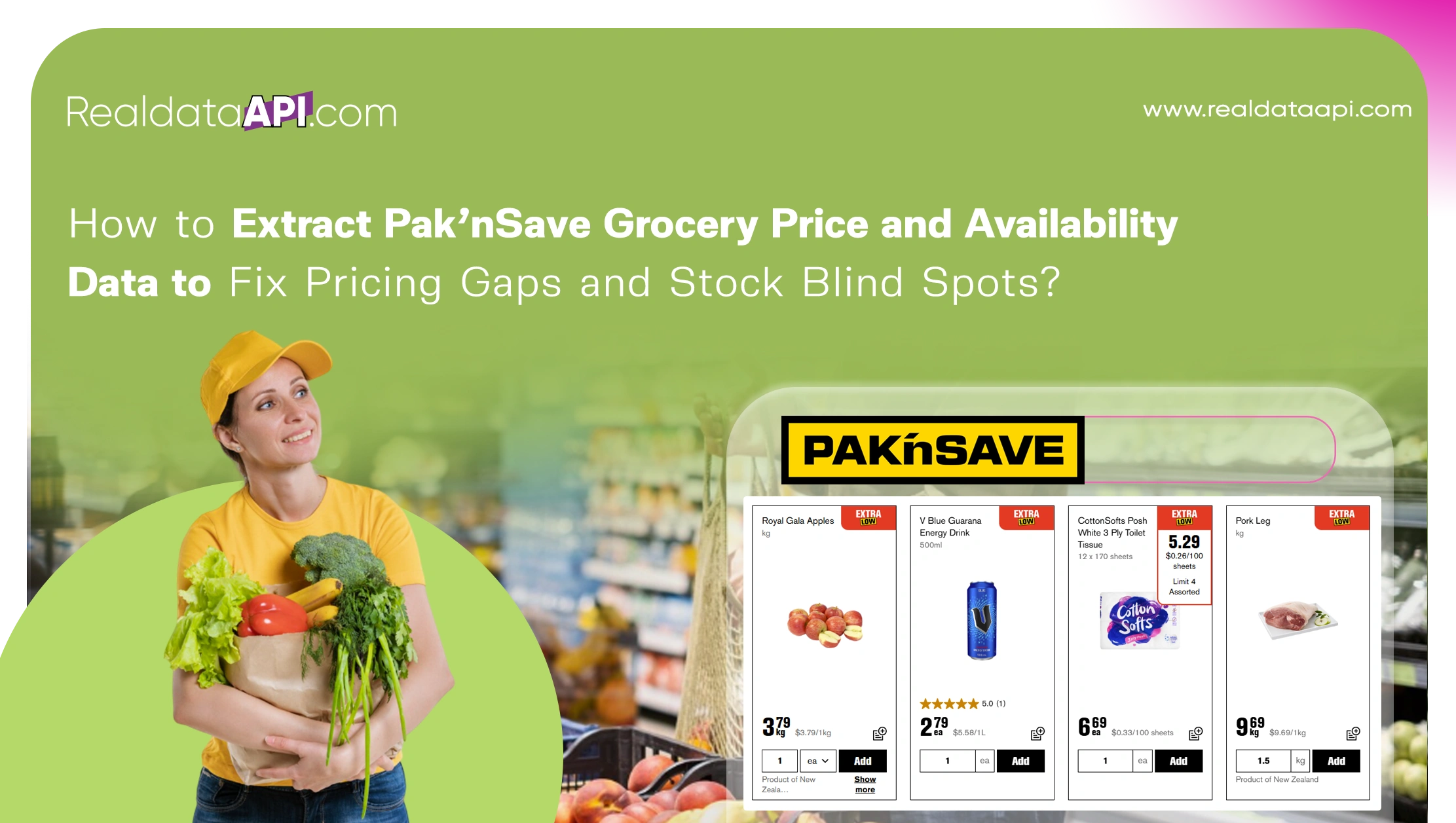

In New Zealand's highly competitive grocery landscape, pricing accuracy and stock visibility directly influence consumer trust, margins, and market share. Pak'nSave, known for its value-driven positioning, plays a critical role in shaping price expectations across regions. For retailers, brands, and analysts, the ability to extract Pak'nSave Grocery price and availability data is no longer optional—it is essential for real-time decision-making.

As quick commerce and digital grocery adoption accelerate, data latency creates pricing gaps and inventory blind spots. The Pak'nSave Quick Commerce Scraping API enables businesses to collect structured, high-frequency data at scale, ensuring timely insights into price shifts, promotions, and stock movement. With reliable automation, stakeholders gain a clearer view of competitive pressure, regional variation, and demand volatility across the grocery ecosystem.

Tracking Competitive Shifts in a Dynamic Retail Environment

Grocery price competition in New Zealand intensified significantly between 2020 and 2026, driven by inflation, supply chain disruptions, and aggressive discounting strategies. During this period, Pak'nSave consistently ranked among the lowest-priced retailers, forcing competitors to react quickly. Businesses that scrape Pak'nSave prices to track price wars gain early visibility into sudden price drops and sustained undercutting strategies.

Between 2020 and 2023, staple grocery prices fluctuated by an average of 18%, with some categories—such as dairy and packaged foods—seeing swings of over 25%. From 2024 onward, pricing volatility stabilized slightly but remained regionally uneven. Automated price tracking allowed analysts to identify which products triggered competitive reactions and how quickly rivals responded.

| Year | Avg Price Volatility | Top Impact Categories |

|---|---|---|

| 2020 | 22% | Dairy, Staples |

| 2022 | 26% | Frozen Foods |

| 2024 | 17% | Fresh Produce |

| 2026 | 14% | Household Essentials |

These insights help retailers preempt margin erosion while aligning promotional strategies with market behavior.

Understanding the Scale of Regional Grocery Competition

New Zealand's grocery market is unique due to its geographic dispersion and localized pricing strategies. Web Scraping grocery price wars in new zealand reveals that Pak'nSave pricing often varies by location, reflecting logistics costs, regional demand, and store-level competition.

From 2020 to 2026, data shows that urban Pak'nSave stores adjusted prices up to 9% faster than rural outlets during promotional cycles. Auckland and Wellington locations typically lead price reductions, while smaller regions follow with delays of 3–5 days. This staggered pricing creates opportunities for competitors—and risks for brands unaware of regional trends.

| Region | Avg Price Change Lag | Promotion Frequency |

|---|---|---|

| Auckland | 0–1 Days | High |

| Wellington | 1–2 Days | Medium |

| South Island | 3–5 Days | Moderate |

By analyzing scraped data longitudinally, businesses can forecast competitive moves and fine-tune pricing strategies region by region.

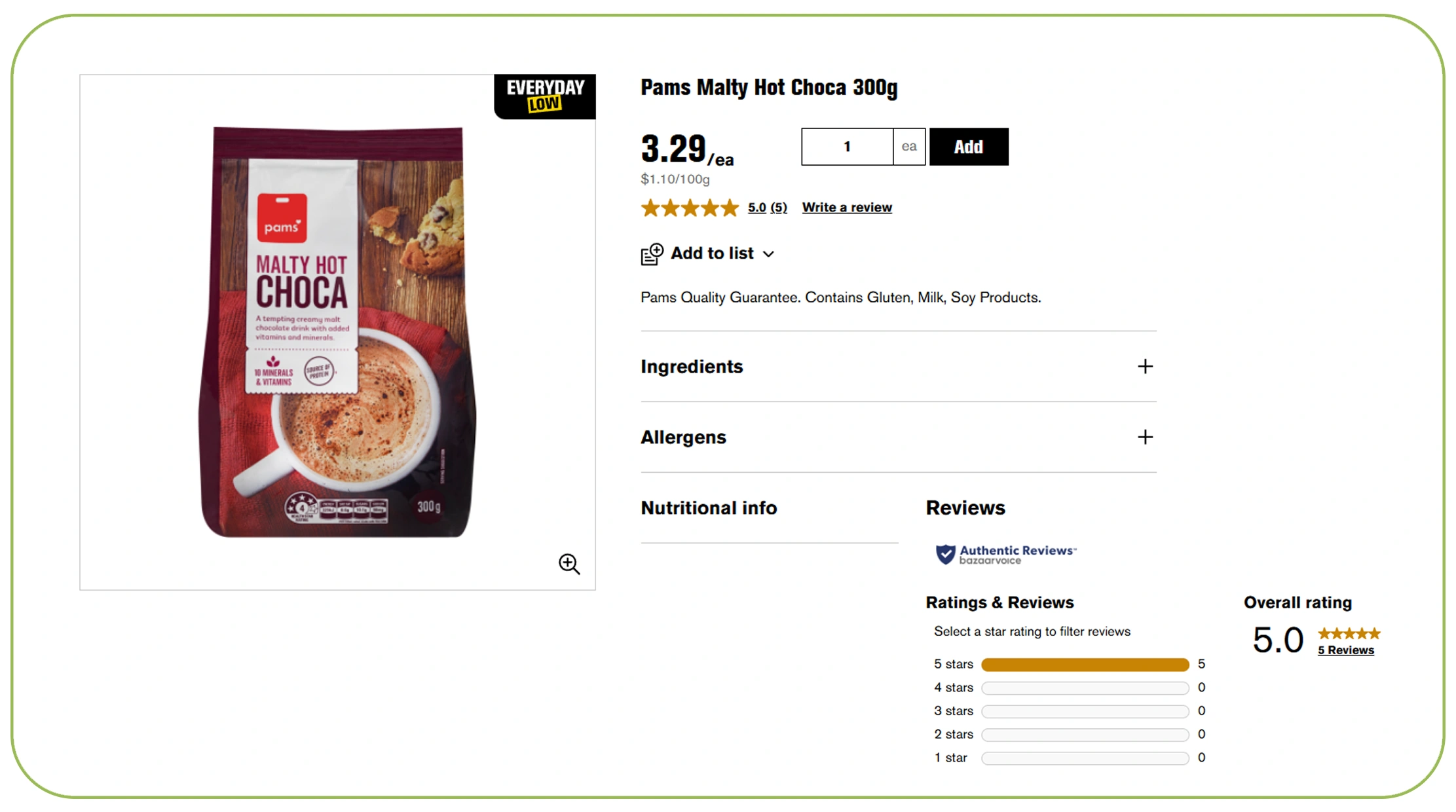

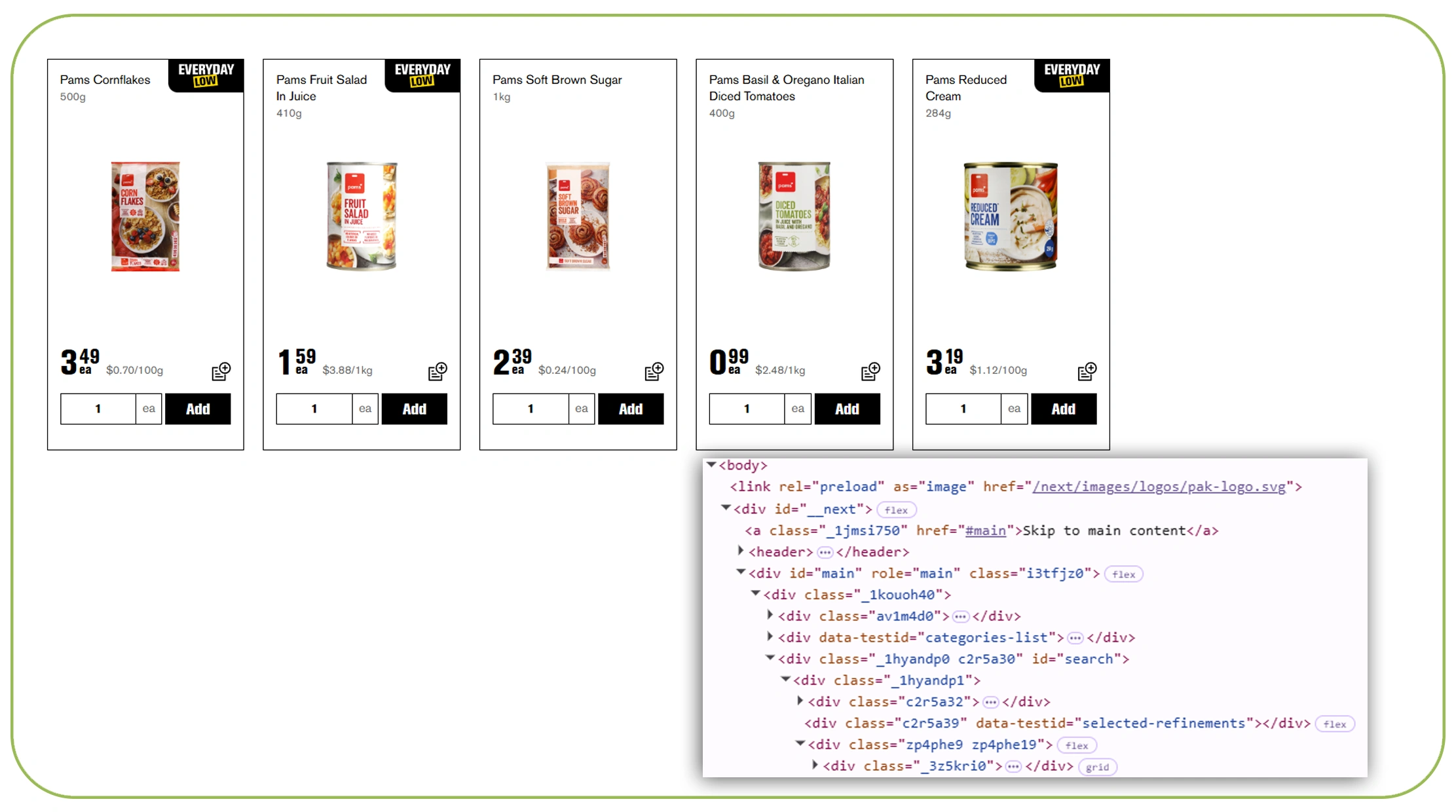

Turning Raw Listings into Structured Intelligence

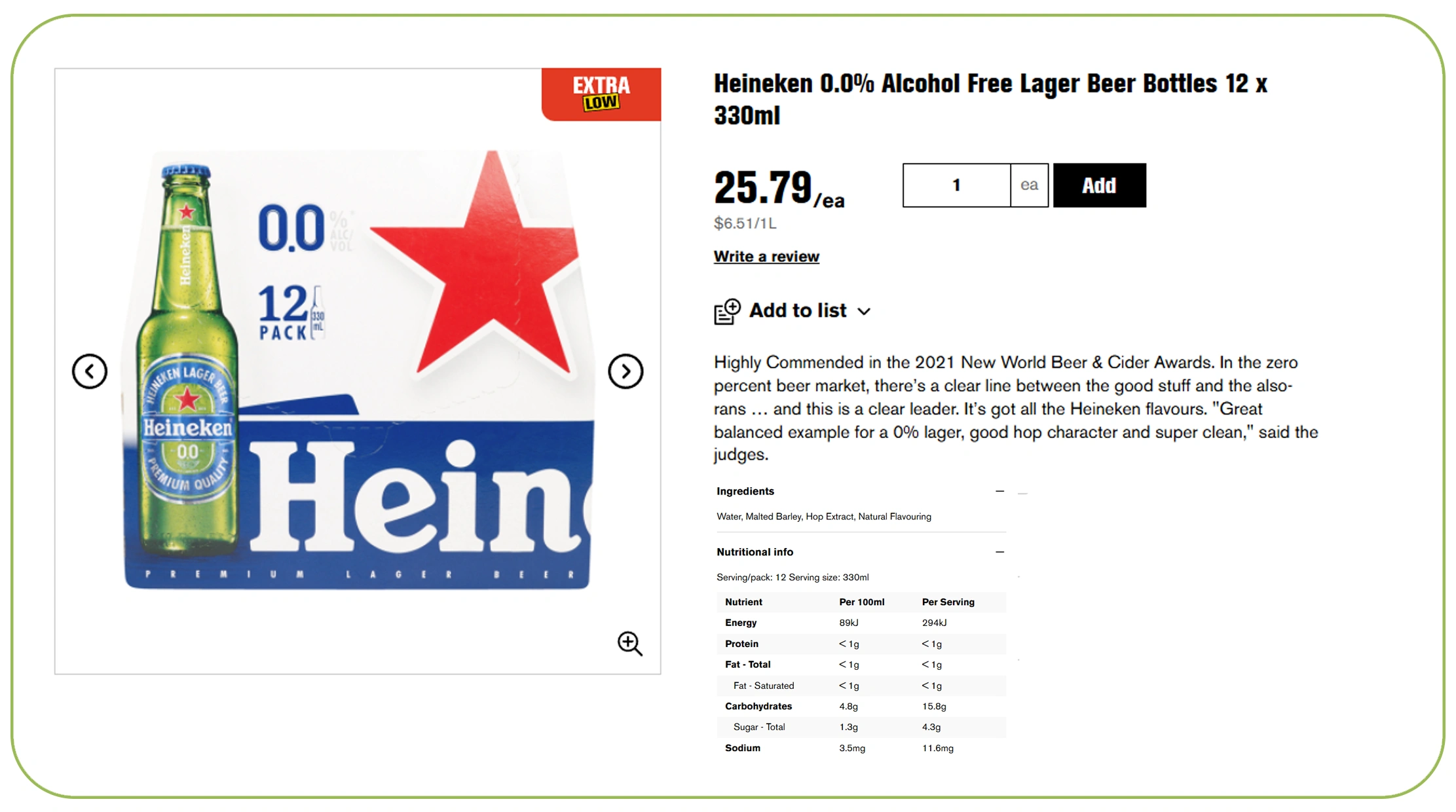

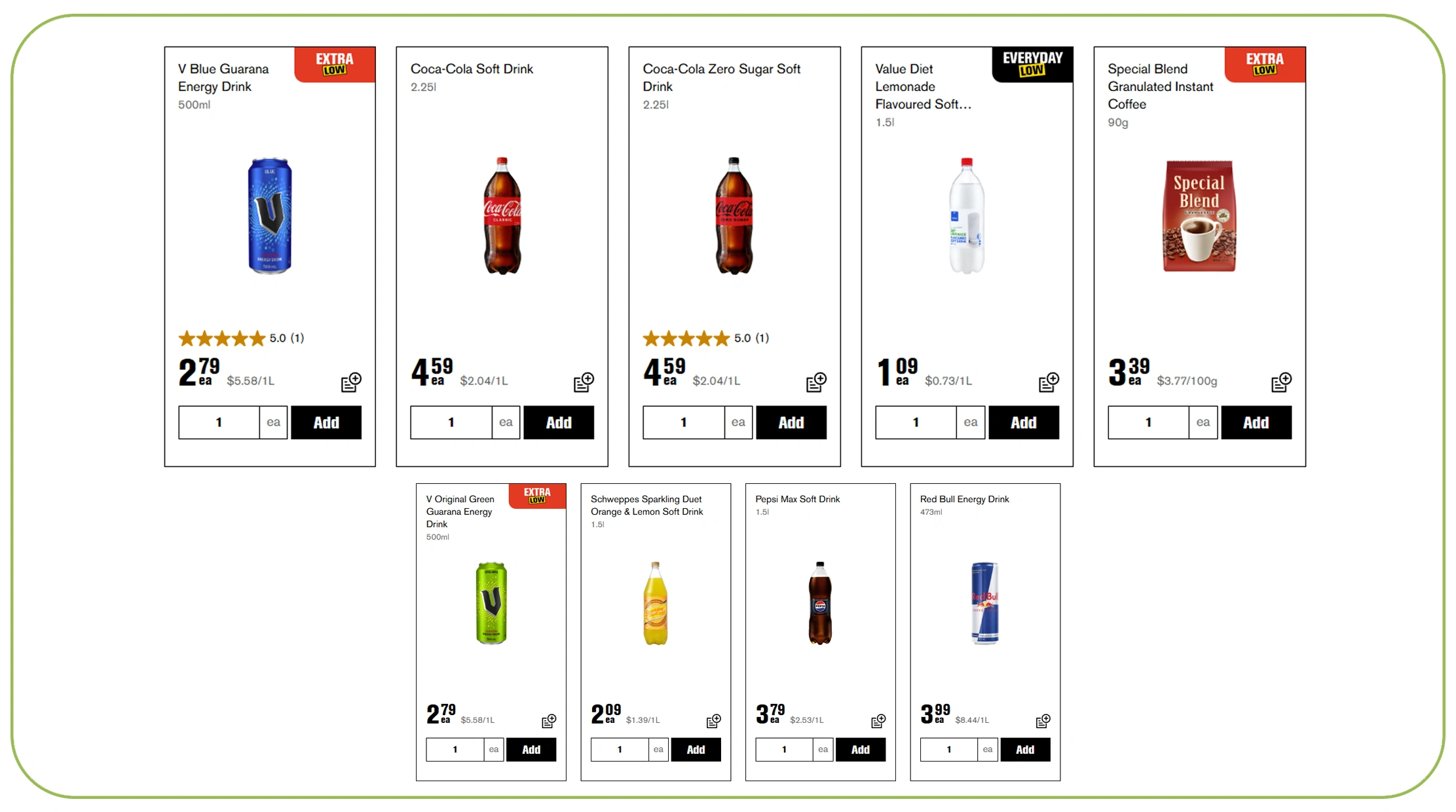

Raw grocery listings alone are not actionable without normalization and validation. Pak'nSave Grocery price data extraction converts unstructured product pages into clean datasets that include price, availability, pack size, and promotional tags.

From 2020 to 2026, structured data analysis revealed that approximately 12–15% of Pak'nSave SKUs experience availability gaps during high-demand periods such as holidays or supply disruptions. Without automated extraction, these blind spots often go unnoticed until sales decline.

| Data Element | Accuracy Gain with Automation |

|---|---|

| Price Changes | +98% |

| Stock Status | +95% |

| Promotion Flags | +93% |

These insights allow brands to optimize replenishment, reduce lost sales, and improve supply planning with confidence.

Scaling Intelligence with Automation and APIs

Manual scraping cannot keep pace with the velocity of modern grocery retail. The Pak'nSave Grocery price scraper API enables high-frequency data collection without infrastructure strain, ensuring consistent coverage across thousands of SKUs.

From 2020 to 2026, API-based extraction increased data refresh rates by over 400%, enabling hourly or daily updates instead of weekly snapshots. This improvement is critical during inflationary periods when prices change rapidly.

| Method | Update Frequency | Error Rate |

|---|---|---|

| Manual Tracking | Weekly | 18% |

| Script-Based Scraping | Daily | 7% |

| API-Based Extraction | Hourly/Daily | <2% |

Automation ensures accuracy, scalability, and compliance while freeing teams to focus on analysis rather than data collection.

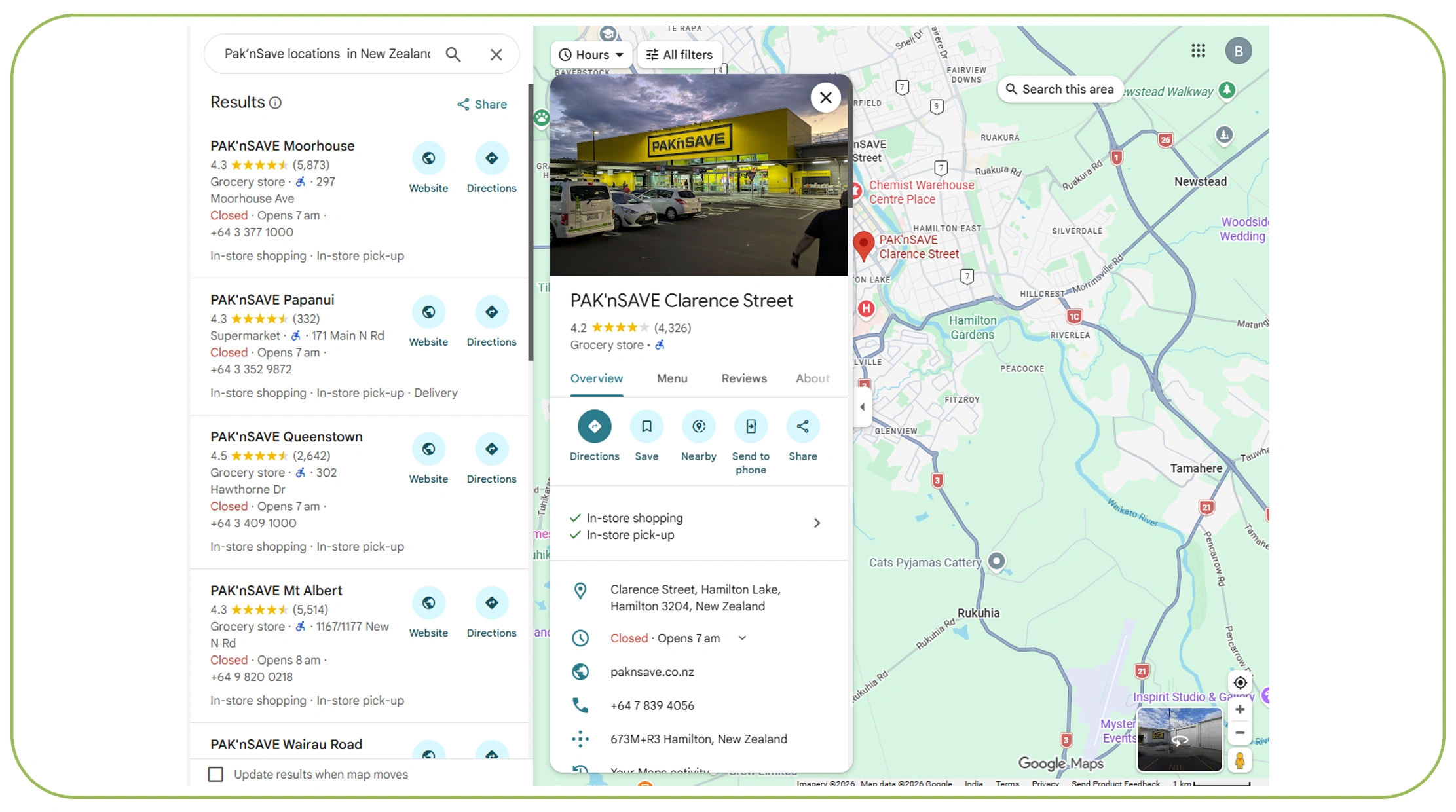

Leveraging Location-Level Intelligence

Pricing and availability are only meaningful when viewed in geographic context. Scrape Pak'nSave locations data in New Zealand to understand how store density, regional demand, and logistics influence pricing decisions.

Between 2020 and 2026, location-level analysis showed that stores in high-competition zones adjusted prices 30% more frequently than isolated outlets. Availability gaps were also more common in remote areas, especially during seasonal demand spikes.

| Location Type | Avg Stockout Rate |

|---|---|

| Urban | 8% |

| Suburban | 11% |

| Rural | 16% |

Location-aware data enables smarter distribution planning and targeted promotions.

Building Long-Term Intelligence Assets

A well-structured Grocery Dataset becomes more valuable over time. Historical data from 2020–2026 supports trend modeling, demand forecasting, and inflation impact analysis.

Longitudinal datasets reveal patterns such as recurring seasonal shortages, price elasticity by category, and promotional effectiveness. Businesses using multi-year datasets improved forecast accuracy by up to 28% compared to short-term data users.

| Dataset Duration | Forecast Accuracy |

|---|---|

| <1 Year | 62% |

| 2–3 Years | 74% |

| 5+ Years | 90% |

This long-term intelligence transforms reactive pricing into proactive strategy.

Why Choose Real Data API?

Real Data API delivers enterprise-grade grocery intelligence built for speed, accuracy, and scale. With built-in Price Comparison capabilities, businesses can benchmark Pak'nSave pricing against competitors instantly. The platform's ability to extract Pak'nSave Grocery price and availability data ensures uninterrupted visibility across products, regions, and timeframes.

From automated extraction to structured analytics-ready outputs, Real Data API removes friction from grocery intelligence workflows while maintaining compliance and reliability.

Conclusion

In an era of volatile pricing and unpredictable demand, businesses cannot afford blind spots. The ability to extract Pak'nSave Grocery price and availability data empowers retailers, brands, and analysts to close pricing gaps, anticipate stock risks, and act with confidence.

If you're ready to eliminate guesswork and build smarter grocery strategies, connect with Real Data API today and transform Pak'nSave data into real-time competitive advantage.