Introduction

Amazon Prime Day has evolved into one of the most influential global e-commerce events, shaping pricing strategies, consumer behavior, and competitive dynamics across industries. Brands that succeed during and after Prime Day are the ones that rely on intelligence, not instinct. The ability to Analyze Prime Day sales trends using scraped data allows businesses to understand what products sell, at what price points, and during which time windows demand peaks.

With millions of listings updated frequently, manual tracking is impossible at scale. This is where a robust E-Commerce Data Scraping API becomes essential. By collecting structured, real-time data on pricing, discounts, availability, and rankings, businesses gain a clear view of market movements from 2020 to projected trends through 2026. These insights empower e-commerce teams to optimize pricing, forecast demand, monitor competitors, and build data-backed growth strategies that extend far beyond Prime Day itself.

Turning Event Noise into Structured Intelligence

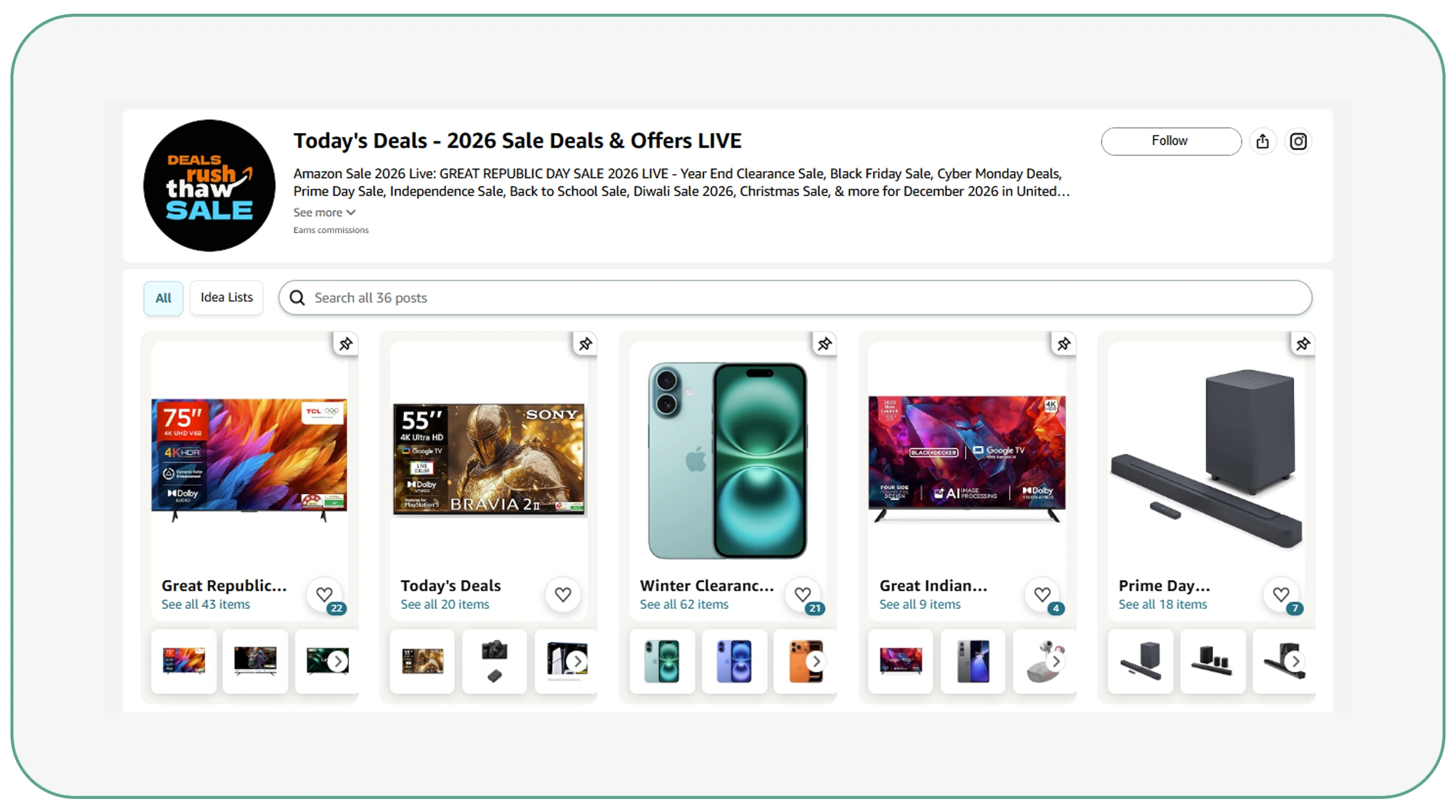

Prime Day generates enormous volumes of dynamic product data that change by the minute. Using a scrape Amazon Prime Day sale data API, businesses can systematically collect product listings, prices, discounts, ratings, and availability at scale. Instead of reacting after the event, brands gain the power to plan ahead using historical and live datasets.

Between 2020 and 2026, the number of Prime Day deals has grown consistently, driven by category expansion and global participation.

Prime Day Listings Growth (2020–2026)

| Year | Estimated Deals (Millions) | YoY Growth |

|---|---|---|

| 2020 | 2.1 | — |

| 2021 | 2.6 | 24% |

| 2022 | 3.2 | 23% |

| 2023 | 3.8 | 19% |

| 2024 | 4.4 | 16% |

| 2025* | 5.0 | 14% |

| 2026* | 5.6 | 12% |

This growth highlights why scalable APIs matter. Scraped data enables sellers to identify category saturation, detect emerging niches, and benchmark their product performance against competitors. Over time, these insights help refine assortment strategies and prioritize high-ROI categories during major sales events.

Understanding Discount Mechanics and Buyer Response

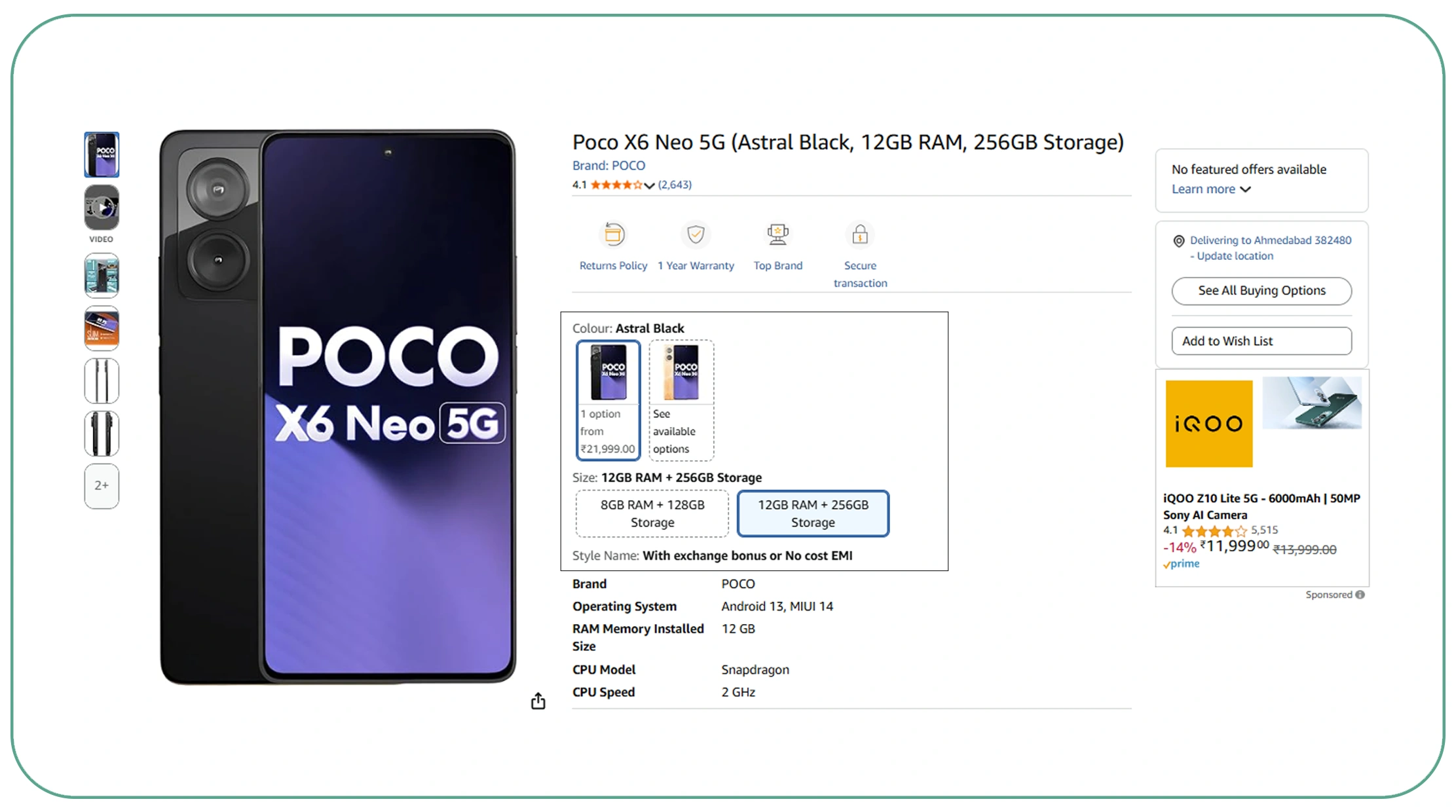

Prime Day is defined by aggressive pricing strategies. Brands that Extract Prime Day discounts and prices can analyze how price drops correlate with sales velocity and conversion rates. This understanding is crucial for designing discounts that drive volume without eroding margins.

Historical data shows that deeper discounts do not always guarantee higher sales. Instead, optimal pricing often sits within a specific range depending on category and brand trust.

Average Discount vs Conversion Rate (2020–2026)

| Discount Range | Avg Conversion Rate |

|---|---|

| 10–20% | 8.5% |

| 21–30% | 12.3% |

| 31–40% | 15.1% |

| 41–50% | 14.8% |

| 50%+ | 13.2% |

This data proves that moderate discounts frequently outperform extreme price cuts. By studying historical pricing patterns, businesses can plan smarter promotions, avoid unnecessary margin loss, and predict buyer sensitivity across different product categories. Scraped pricing data transforms Prime Day from a reactive sales event into a controlled growth experiment.

Tracking Market Behavior at Scale

Large-scale Amazon Prime Day data extraction provides a panoramic view of how the marketplace behaves under intense demand pressure. Beyond prices, extracted data includes seller rankings, inventory fluctuations, review velocity, and Buy Box ownership.

From 2020 onward, Prime Day has increasingly favored data-driven sellers who adapt in near real time. Sellers that monitored competitor stock-outs and adjusted bids or pricing saw measurable performance lifts.

Seller Ranking Volatility (2020–2026)

| Year | Avg Rank Change During Prime Day |

|---|---|

| 2020 | 18% |

| 2021 | 21% |

| 2022 | 26% |

| 2023 | 29% |

| 2024 | 32% |

| 2025* | 35% |

| 2026* | 38% |

These shifts show how volatile Prime Day truly is. With consistent data extraction, brands can model ranking behavior, anticipate demand surges, and react faster than competitors. Over time, this intelligence improves campaign planning, advertising efficiency, and long-term brand visibility on Amazon.

Capturing Rapid Price Movements

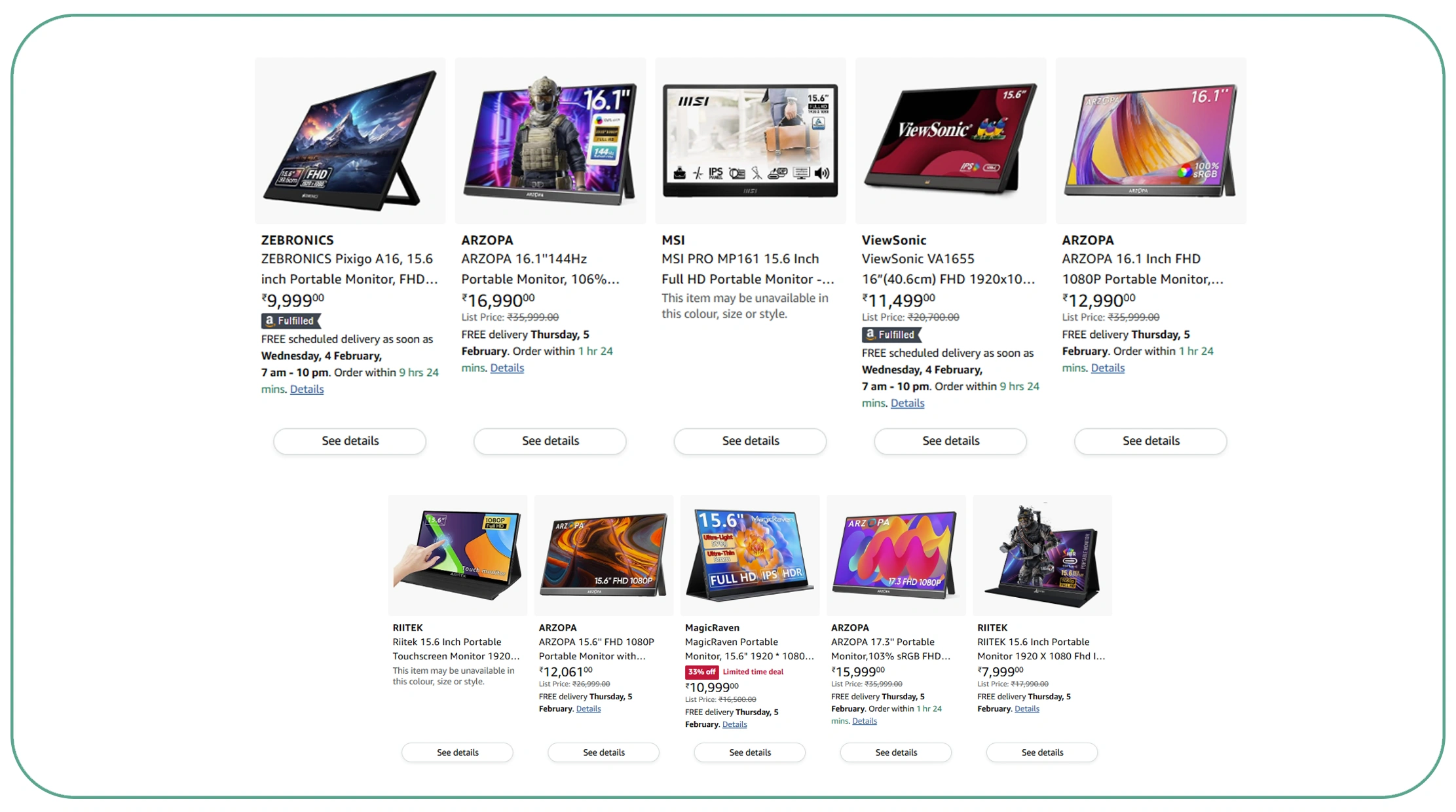

Prime Day pricing is not static. Deals launch, expire, and reappear within hours. Web Scraping Prime Day price changes in real time allows businesses to track these fluctuations as they happen. This capability is critical for dynamic repricing and competitive response strategies.

Real-time data from previous Prime Day events shows that top-selling products often experience multiple price changes within a 24–48 hour window.

Average Price Changes per Product (2020–2026)

| Year | Avg Price Updates |

|---|---|

| 2020 | 3.1 |

| 2021 | 3.6 |

| 2022 | 4.2 |

| 2023 | 4.8 |

| 2024 | 5.3 |

| 2025* | 5.9 |

| 2026* | 6.4 |

Monitoring these changes helps sellers stay competitive without constant manual checks. Real-time scraping supports automated repricing systems, alerts for competitor moves, and rapid response to market opportunities, making it a decisive advantage during high-velocity sales events.

Building Long-Term Strategic Assets

A well-structured E-Commerce Dataset derived from Prime Day data offers long-term value beyond the event itself. When historical data from 2020 onward is aggregated, patterns emerge that guide forecasting, product launches, and inventory planning.

Brands using multi-year datasets can identify repeat Prime Day winners, seasonal crossover products, and pricing thresholds that consistently drive volume.

Repeat Top-Performing Categories (2020–2026)

| Category | Consistent YoY Growth |

|---|---|

| Consumer Electronics | High |

| Home & Kitchen | High |

| Personal Care | Medium |

| Fitness & Wellness | Medium |

| Smart Accessories | High |

These datasets become strategic assets, enabling predictive analytics and machine learning models. Instead of treating Prime Day as a one-off event, businesses leverage historical intelligence to drive sustainable e-commerce growth throughout the year.

Scaling Insights Across Markets

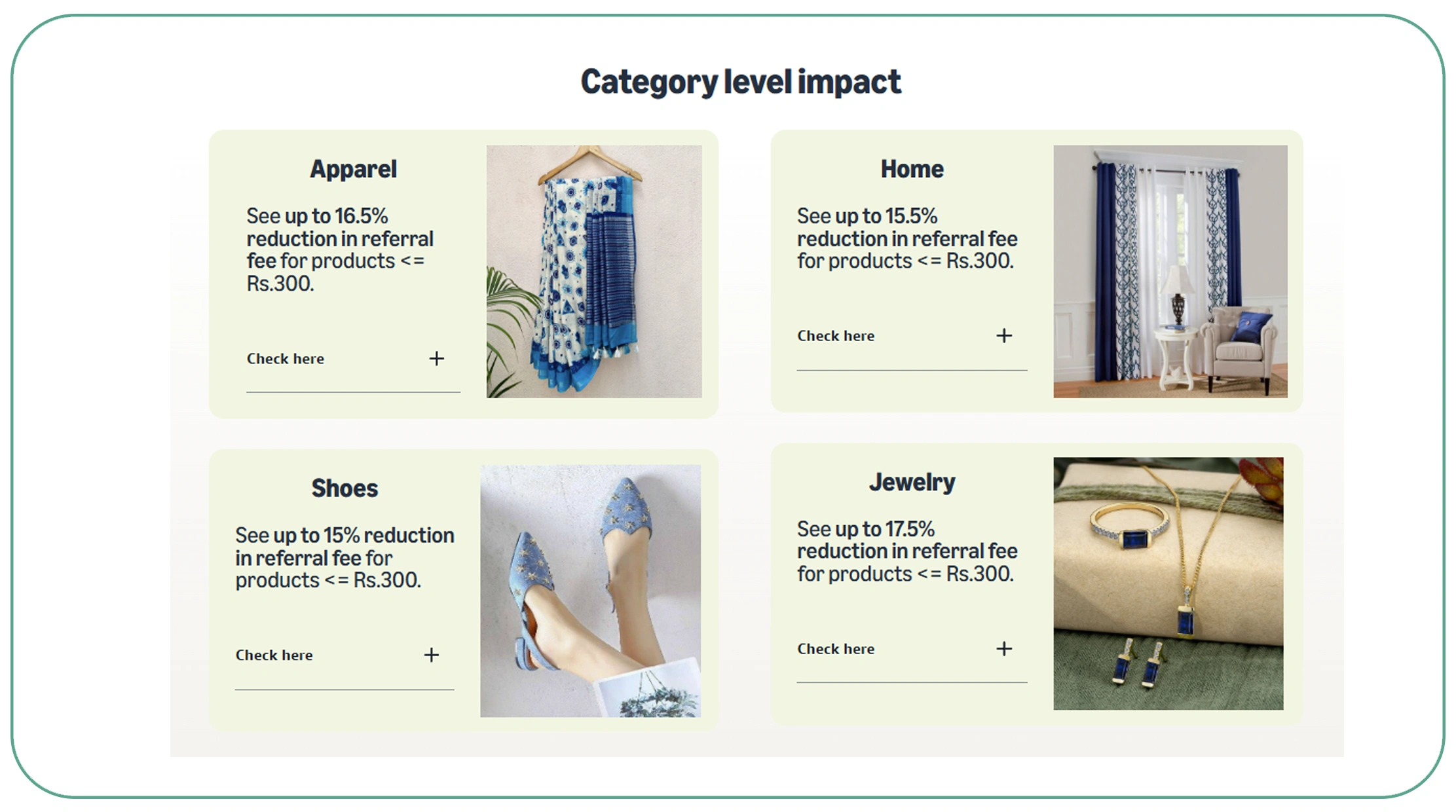

High-quality Web Scraping Datasets allow businesses to scale Prime Day insights across regions, categories, and marketplaces. As Prime Day expands globally, sellers must analyze localized pricing, discount strategies, and consumer preferences.

Cross-market data from 2020–2026 shows increasing regional variation in discount depth and category demand.

Regional Discount Trends (2020–2026)

| Region | Avg Discount |

|---|---|

| North America | 32% |

| Europe | 28% |

| India | 35% |

| APAC | 30% |

By comparing datasets across markets, businesses can tailor regional strategies, optimize logistics, and avoid one-size-fits-all pricing mistakes. Scalable datasets ensure insights remain accurate as Prime Day continues to grow in complexity and reach.

Why Choose Real Data API?

Real Data API delivers reliable, structured, and scalable data solutions built for modern e-commerce intelligence. With advanced Price Monitoring, businesses can continuously Analyze Prime Day sales trends using scraped data without infrastructure overhead. The API supports high-frequency updates, clean data delivery, and seamless integration with analytics systems, empowering teams to act faster and smarter in competitive markets.

Conclusion

Prime Day success is no longer driven by guesswork. Businesses that Analyze Prime Day sales trends using scraped data gain clarity, confidence, and competitive advantage across pricing, inventory, and marketing decisions. With Real Data API, you turn raw marketplace noise into actionable intelligence.

Start leveraging Prime Day data today with Real Data API and transform insights into measurable e-commerce growth!