Introduction

CPG brands operate in one of the most volatile retail environments. Grocery prices fluctuate daily, promotions shift weekly, and product availability varies by region and platform. Between 2020 and 2026, the rapid growth of online grocery platforms across global markets has intensified competition and shortened reaction windows for brands. Yet many CPG teams still rely on delayed reports, manual checks, or fragmented retailer data—creating serious market blind spots.

These blind spots affect pricing accuracy, assortment planning, promotional timing, and demand forecasting. Without real-time visibility, brands risk overpricing products, missing stock issues, or launching SKUs into saturated categories.

By choosing to scrape grocery data using API, CPG brands gain direct access to live product listings, prices, inventory signals, and promotions at scale. When combined with a structured Grocery Dataset, this data becomes a strategic asset—helping brands replace assumptions with facts and respond to market changes faster than competitors.

Turning Real-Time Price Signals Into Competitive Power

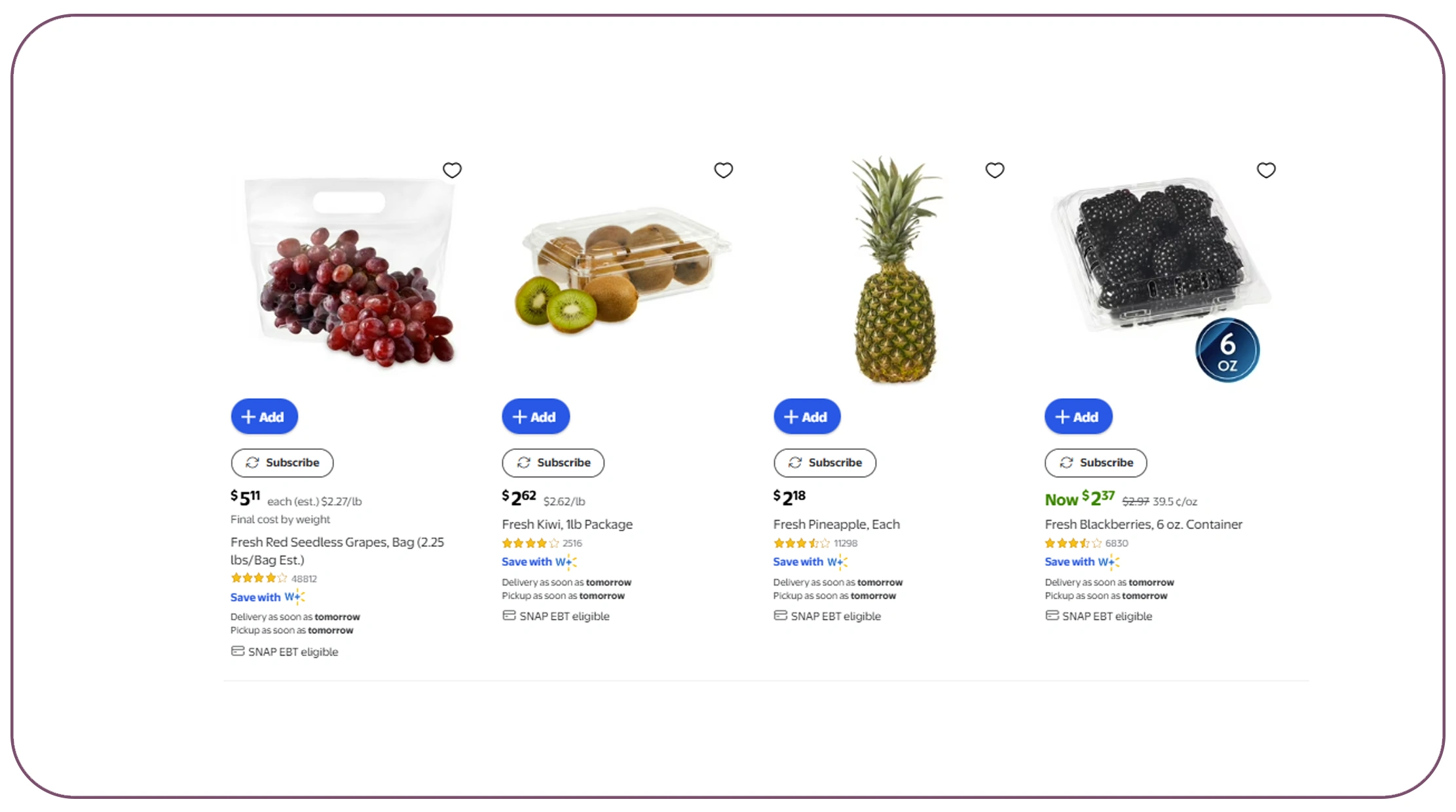

Price visibility is one of the most critical challenges for CPG brands. Using extract grocery prices in real time allows brands to monitor daily price changes across retailers, cities, and product categories without manual intervention.

From 2020 to 2026, average online grocery price volatility increased due to inflation, dynamic pricing, and frequent promotions.

Online Grocery Price Volatility Index

| Year | Price Change Frequency |

|---|---|

| 2020 | Low |

| 2022 | Medium |

| 2024 | High |

| 2026 | Very High |

With real-time pricing data, brands can benchmark against competitors, adjust promotional strategies, and detect unauthorized price changes by resellers. This visibility reduces margin erosion and ensures consistent pricing strategies across channels. Instead of reacting weeks later, CPG teams can respond within hours—turning price intelligence into a competitive advantage.

Gaining Visibility Across Expanding Product Assortments

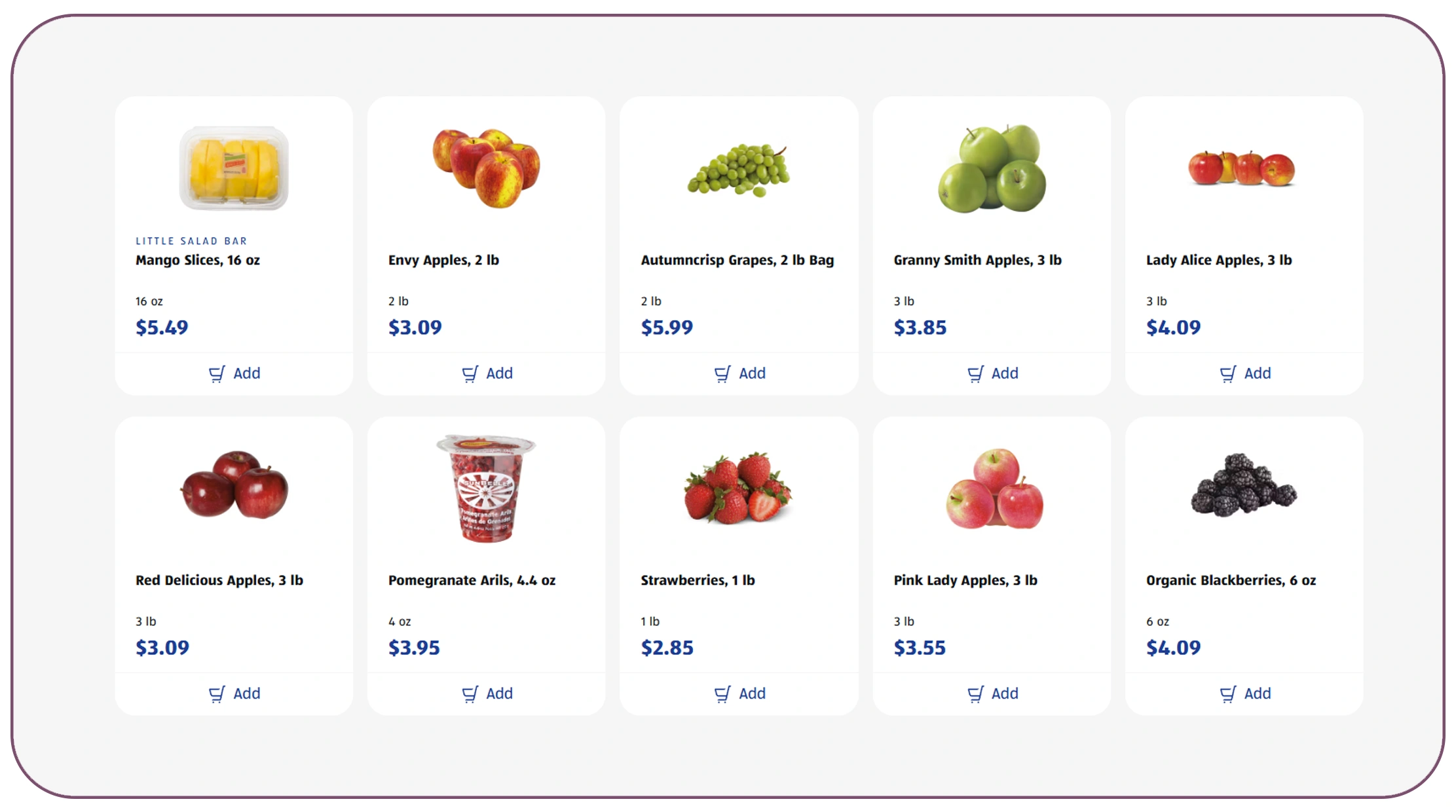

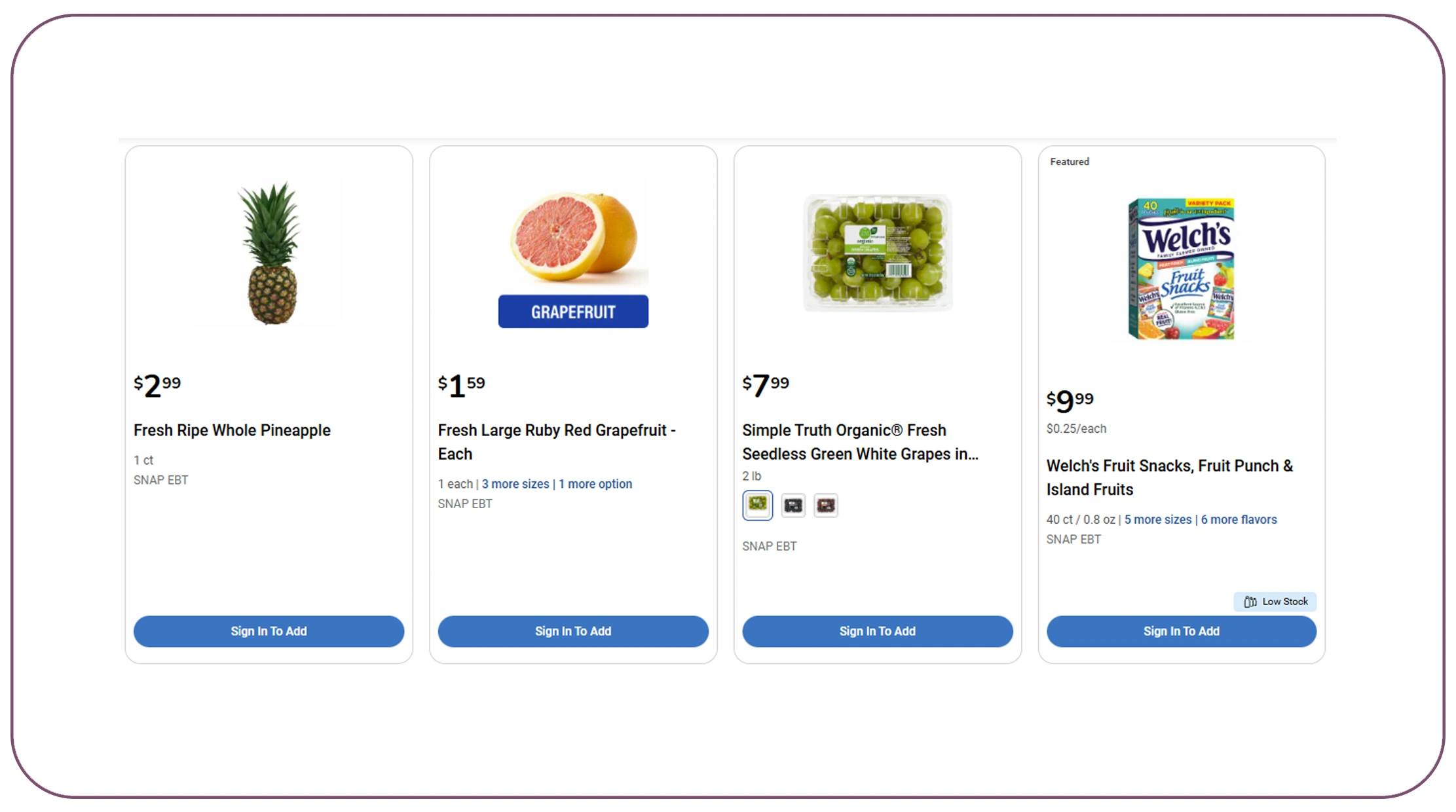

As grocery platforms expand, so do their product catalogs. Grocery catalog data extraction enables brands to track category growth, new product launches, and assortment shifts across retailers.

Between 2020 and 2026, the average number of SKUs per online grocery platform grew by over 70%.

Average SKU Growth Per Platform

| Year | Avg. Listed SKUs |

|---|---|

| 2020 | 18,000 |

| 2022 | 24,500 |

| 2024 | 29,800 |

| 2026 | 31,200 |

Catalog-level data helps brands understand where competition is intensifying and where whitespace opportunities still exist. By analyzing category saturation, packaging formats, and brand frequency, CPG teams can optimize portfolio strategies and prioritize high-growth segments instead of spreading resources thin.

Eliminating Stock-Level Blind Spots

Out-of-stock issues directly impact revenue and brand perception. A Grocery inventory data Scraper allows brands to monitor availability signals across platforms and regions.

From 2020 to 2026, online grocery stockouts increased due to demand spikes, supply chain disruptions, and flash promotions.

Average Online Stockout Rates

| Year | Stockout Rate |

|---|---|

| 2020 | 6% |

| 2022 | 9% |

| 2024 | 12% |

| 2026 | 14% |

Inventory data helps brands identify recurring availability issues, assess retailer performance, and plan replenishment more effectively. Instead of discovering stock problems through sales drops, brands gain early signals—allowing proactive action and stronger retailer collaboration.

Understanding How Products Are Positioned Online

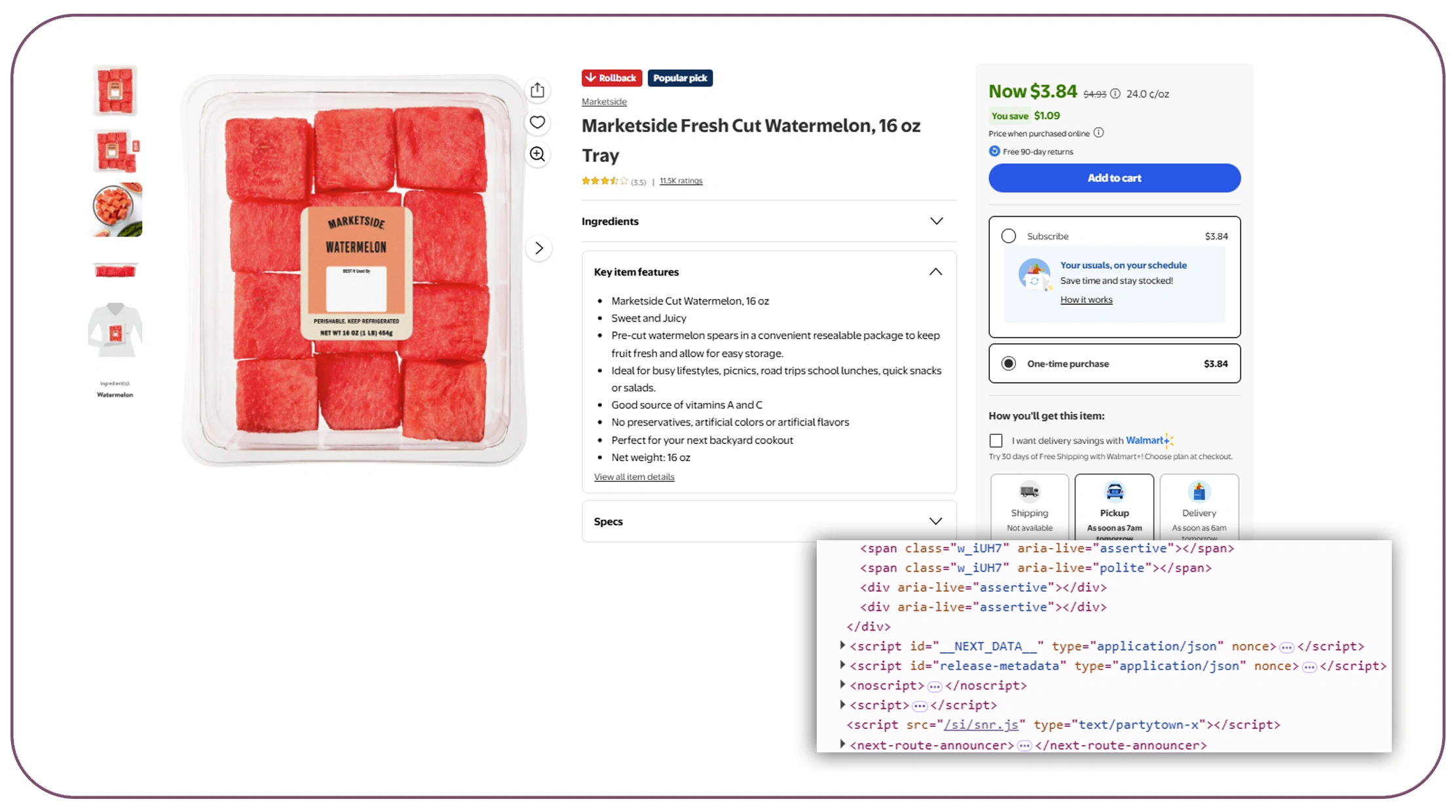

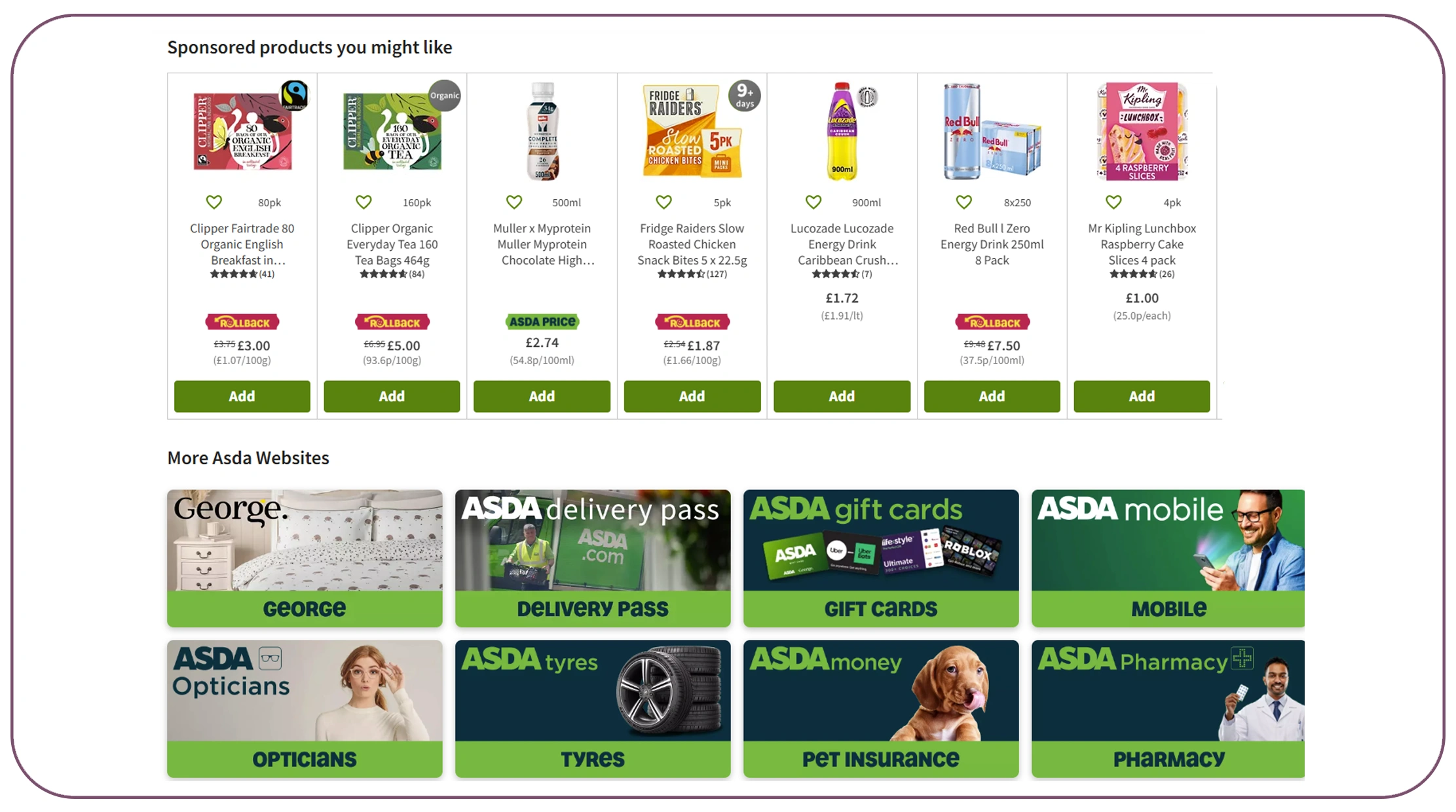

Product listing presentation plays a major role in conversion. Using a grocery product listing data extractor, brands can analyze titles, images, descriptions, pack sizes, and ranking positions.

Between 2020 and 2026, optimized product listings showed significantly higher click-through and conversion rates.

Impact of Optimized Listings

| Metric | Improvement |

|---|---|

| Click-through Rate | +24% |

| Conversion Rate | +19% |

| Search Visibility | +31% |

Listing data allows brands to align packaging claims, nutritional highlights, and keyword usage with top-performing competitors. This insight helps marketing and ecommerce teams refine listings to maximize digital shelf performance without relying on trial-and-error updates.

Scaling Data Collection Without Manual Effort

Manual data collection simply cannot keep up with modern grocery ecosystems. A Grocery Data Scraping API enables scalable, automated extraction of prices, listings, inventory, and promotions across platforms.

From 2020 to 2026, brands adopting API-based data collection reduced manual data effort by up to 60%.

Operational Efficiency Gains

| Metric | Improvement |

|---|---|

| Data Collection Speed | +3x |

| Coverage Accuracy | +35% |

| Reporting Frequency | +4x |

API-driven workflows ensure consistency, reliability, and near real-time updates. This allows CPG brands to integrate grocery intelligence directly into dashboards, forecasting tools, and pricing systems—making data actionable, not just accessible.

Strengthening Strategic Decision-Making With Data

At the strategic level, grocery intelligence supports broader Market Research initiatives. Menu-level insights combine with pricing, availability, and listing data to reveal macro and micro trends.

From 2020 to 2026, data-driven CPG brands improved demand forecasting accuracy and reduced failed product launches.

Research-Driven Outcomes

| Outcome | Improvement |

|---|---|

| Forecast Accuracy | +27% |

| Promotion Effectiveness | +22% |

| Product Launch Success | +18% |

Market research powered by real grocery data enables brands to spot early signals—such as emerging categories, shifting price thresholds, and regional demand patterns—before they appear in traditional reports.

Why Choose Real Data API?

Real Data API provides enterprise-grade Web Scraping Services designed for scale, accuracy, and flexibility. Brands can continuously scrape grocery data using API across multiple platforms, categories, and regions without infrastructure complexity.

With structured outputs, high-frequency updates, and seamless integrations, Real Data API transforms raw grocery data into decision-ready intelligence—helping CPG teams stay ahead in fast-moving retail markets.

Conclusion

Market blind spots cost CPG brands speed, margin, and relevance. In an era of dynamic pricing and digital shelves, intuition is no longer enough. Brands that act on real-time grocery intelligence gain clarity where others operate in the dark.

By choosing to scrape grocery data using API, CPG brands turn fragmented online signals into a unified source of truth.

Start uncovering hidden retail insights today—partner with Real Data API and power smarter grocery decisions with real-time data!