Introduction

The UAE's food and beverage market is one of the most dynamic in the world, shaped by tourism, multicultural tastes, and fast-changing consumer behavior. Between 2020 and 2026, the number of restaurants, cafés, cloud kitchens, and food delivery listings across the UAE has grown exponentially. Yet, many food brands still operate with limited visibility into competitor pricing, menu innovation, and regional demand patterns.

This lack of visibility creates market blind spots—missed opportunities, mispriced items, and delayed responses to emerging food trends. Brands that rely on manual tracking or outdated reports struggle to keep pace with competitors that move faster and smarter.

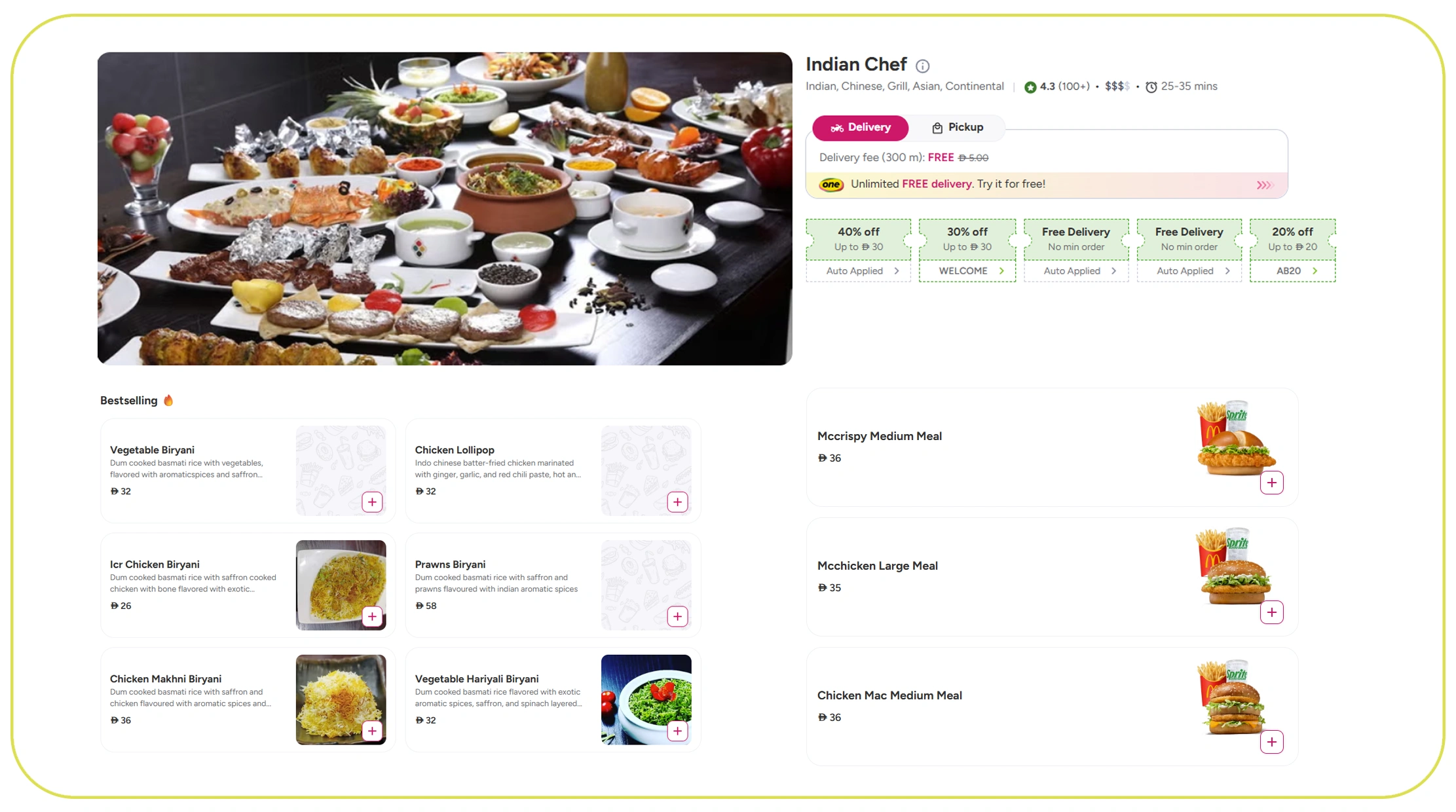

By using scrape dining menus across UAE for competitive analysis alongside a scalable Food Data Scraping API, food brands gain real-time access to structured menu intelligence across cities, platforms, and cuisines. This data-driven approach transforms fragmented menu information into actionable insights, enabling brands to adapt quickly, price strategically, and stay relevant in a highly competitive market.

Seeing the Market Clearly Through Menu Intelligence

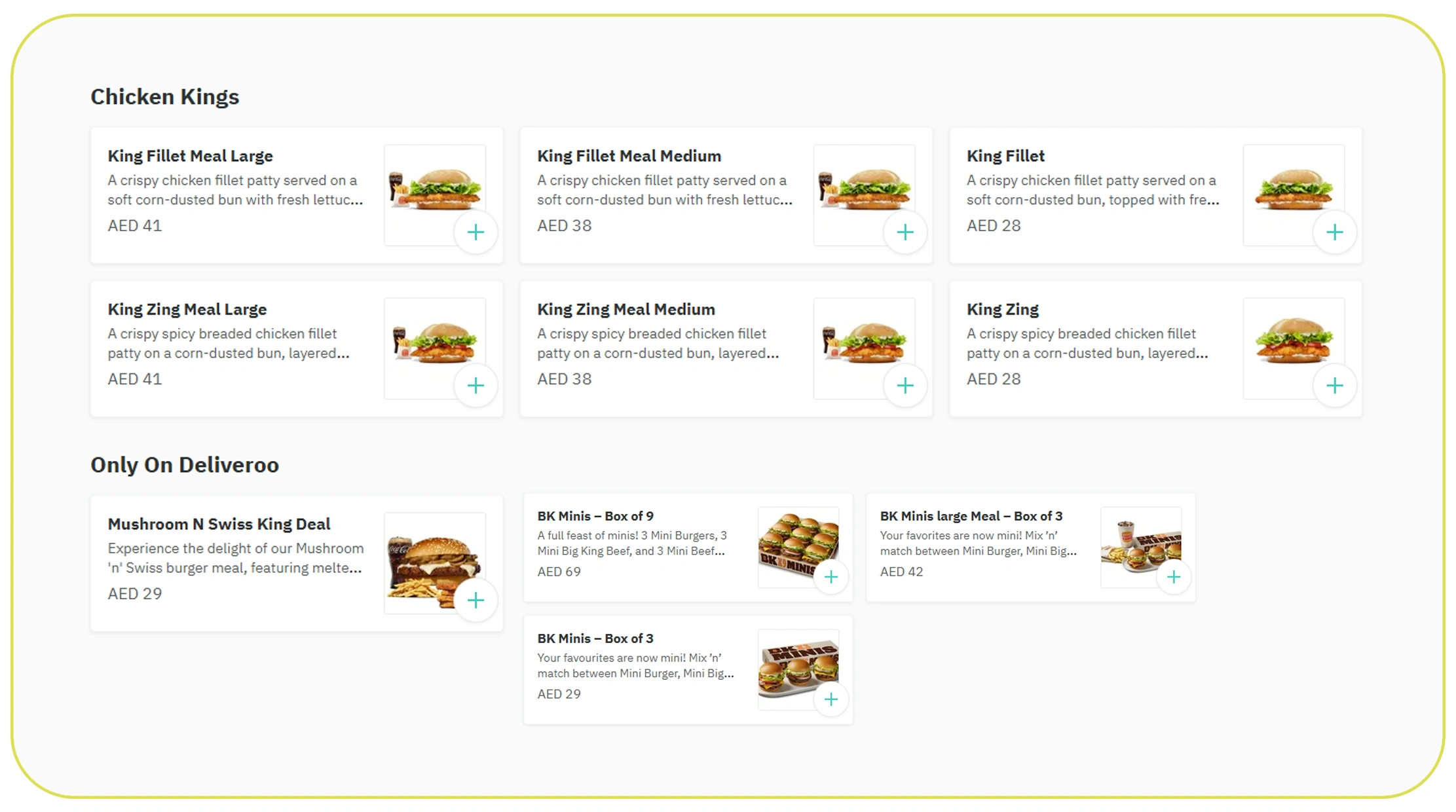

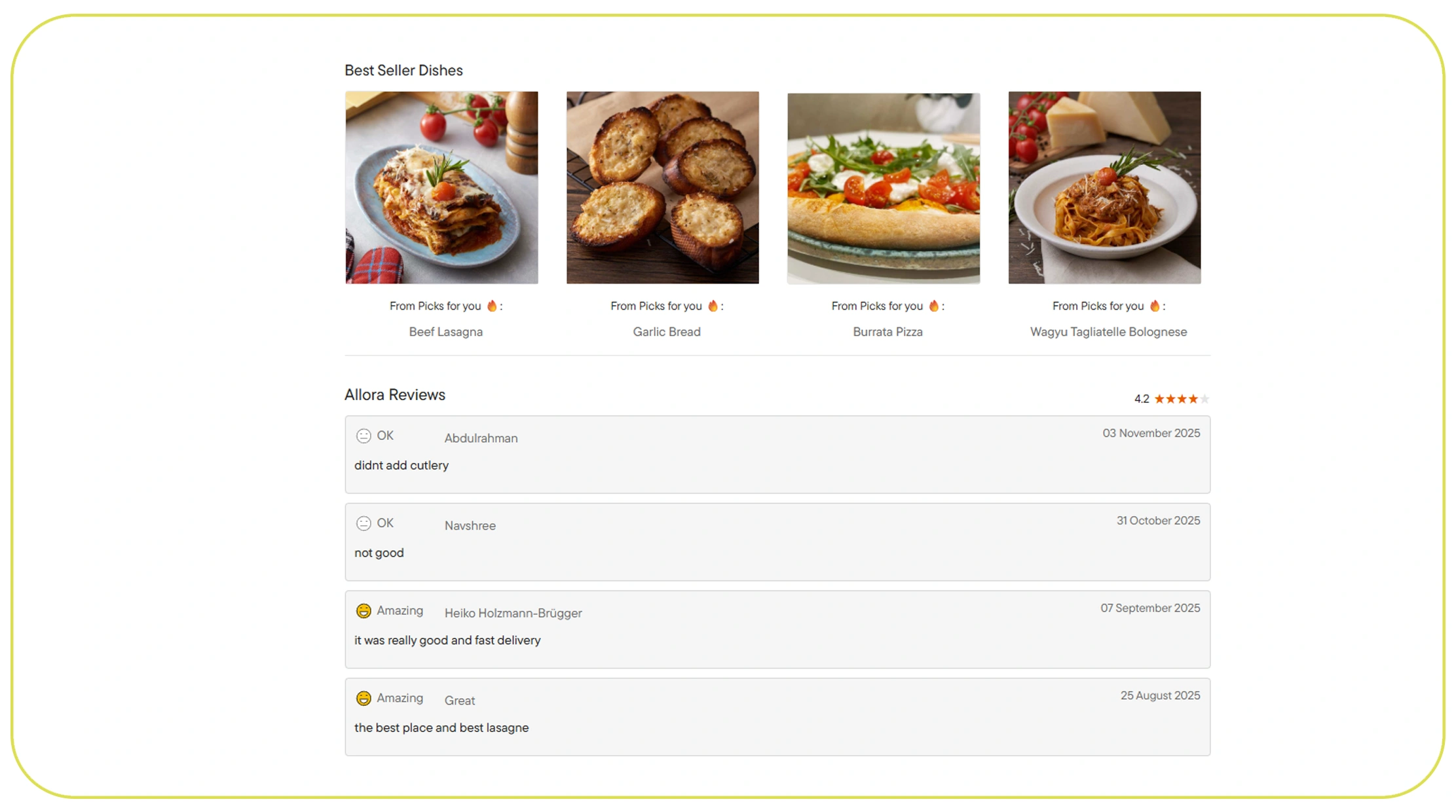

Food brands increasingly depend on scrape restaurant and cafe menus in UAE to monitor how competitors evolve their offerings over time. Menu data reveals far more than dish names—it reflects pricing strategy, portion positioning, cuisine popularity, and customer targeting.

Between 2020 and 2026, the number of listed food outlets across major UAE platforms increased by nearly 60%, driven by cloud kitchens and independent cafés.

Estimated Growth of Listed Food Outlets (2020–2026)

| Year | Estimated Active Listings |

|---|---|

| 2020 | 18,000 |

| 2022 | 22,500 |

| 2024 | 26,800 |

| 2026 | 29,500 |

With structured menu data, brands can identify gaps such as underserved price ranges, missing dietary options, or overcrowded cuisine categories. Instead of reacting late, brands adjust offerings based on real market signals, reducing guesswork and improving product-market fit.

Turning Price Chaos Into Strategic Advantage

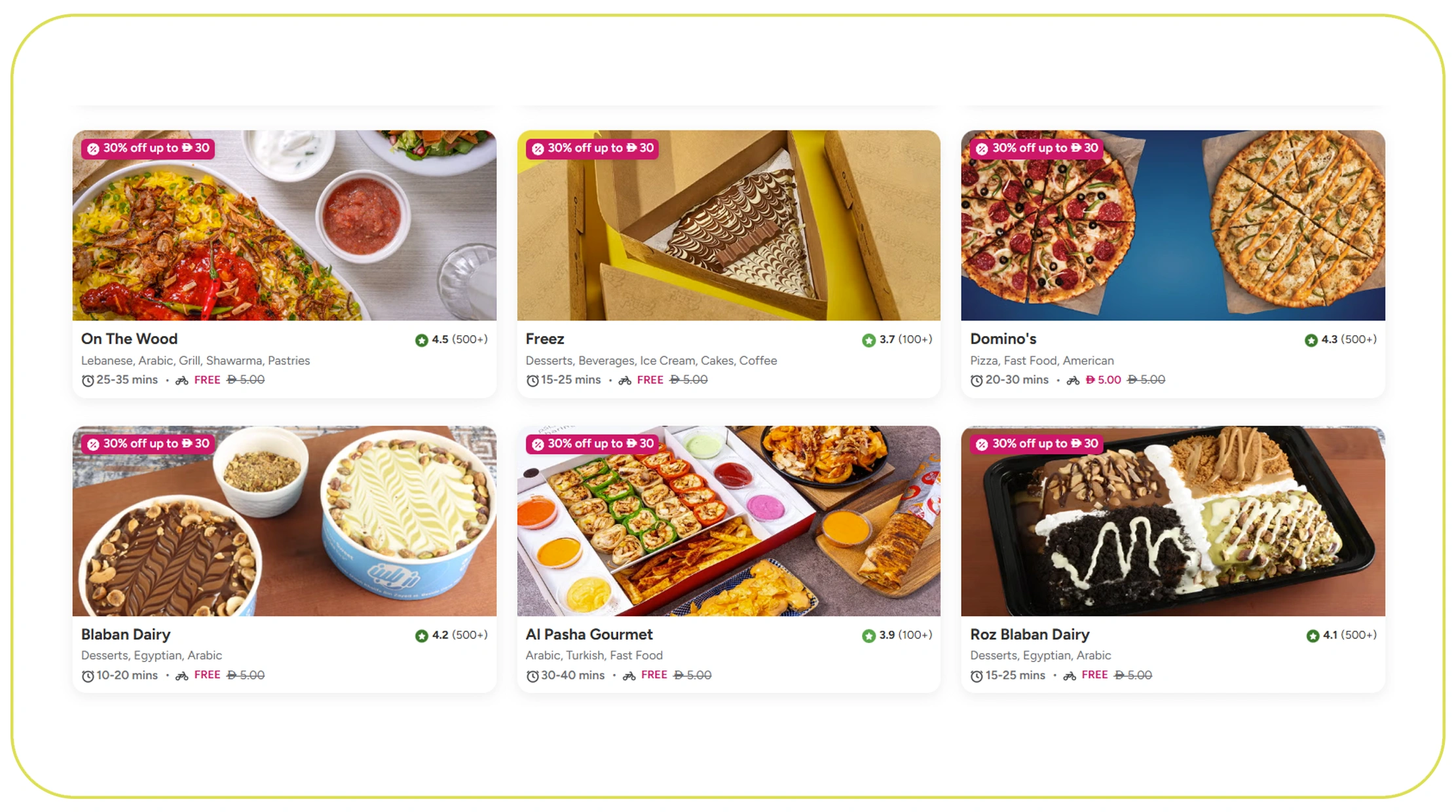

One of the biggest blind spots for food brands is inconsistent pricing across locations and platforms. Using extract food menu prices across UAE enables brands to normalize pricing insights and detect trends that would otherwise go unnoticed.

From 2020 to 2026, average menu prices in the UAE rose due to inflation, delivery demand, and premium positioning—yet price sensitivity also increased.

Average Menu Price Movement (AED)

| Year | Avg. Main Course Price (AED) |

|---|---|

| 2020 | 38 |

| 2022 | 44 |

| 2024 | 49 |

| 2026 | 55 |

With price extraction data, brands can benchmark themselves accurately, avoid overpricing, and identify zones where premium pricing is viable. This level of intelligence helps brands optimize margins while staying competitive in price-sensitive segments.

Understanding Café Culture at a Granular Level

The UAE café market has exploded over the last six years, driven by specialty coffee, remote work culture, and lifestyle branding. UAE cafe menu data extraction gives brands visibility into how cafés differentiate through menu design, add-ons, and pricing tiers.

From 2020 to 2026, café-focused menus grew faster than full-service restaurants, particularly in Dubai and Abu Dhabi.

Café Segment Growth Trends

| Metric | 2020 | 2026 |

|---|---|---|

| Avg. Café Menu Items | 18 | 32 |

| Specialty Drinks (%) | 22% | 41% |

| Plant-based Options (%) | 9% | 26% |

These insights help food brands align offerings with evolving consumer preferences—such as dairy alternatives, premium beverages, and snack-based menus—without relying on assumptions.

Scaling Competitive Monitoring With Automation

Manual tracking fails when menu changes happen weekly or even daily. A UAE Restaurant menu price scraper allows brands to monitor thousands of listings automatically, ensuring insights remain current and reliable.

Between 2020 and 2026, menu update frequency increased due to seasonal launches, promotional pricing, and delivery-platform experiments.

Menu Update Frequency Trends

| Year | Avg. Updates per Month |

|---|---|

| 2020 | 1.4 |

| 2023 | 2.7 |

| 2026 | 4.1 |

Automated scraping ensures brands don't miss sudden shifts—like price hikes, limited-time offers, or bundle strategies—allowing faster reaction times and better decision-making at scale.

Building Intelligence From Structured Data Assets

Raw menu data becomes far more powerful when organized into a centralized Food Dataset. Structured datasets allow brands to analyze trends historically and forecast future opportunities.

From 2020 to 2026, brands using structured datasets were able to reduce time-to-market for new menu launches by an estimated 30–40%.

Key Dataset Attributes Used by Brands

| Attribute | Usage Rate |

|---|---|

| Item Name & Category | 100% |

| Price & Variants | 92% |

| Cuisine Type | 81% |

| Dietary Tags | 64% |

With clean datasets, brands can run predictive models, identify emerging cuisines early, and test new concepts with confidence rather than intuition.

Supporting Strategic Decisions With Market Insights

Ultimately, menu scraping supports broader Market Research goals. Menu-level intelligence complements sales data, customer feedback, and location analytics to create a 360-degree market view.

Between 2020 and 2026, food brands using real-time menu data improved forecasting accuracy and reduced failed launches.

Impact of Data-Driven Research

| Outcome | Improvement |

|---|---|

| Pricing Accuracy | +28% |

| Trend Detection Speed | +35% |

| Menu Launch Success | +22% |

Market research powered by menu intelligence allows brands to identify saturation points, emerging demand pockets, and whitespace opportunities before competitors do.

Why Choose Real Data API?

Real Data API enables brands to collect accurate, structured menu data at scale using a robust Web Scraping API designed for reliability and compliance. With automated workflows, brands can continuously scrape dining menus across UAE for competitive analysis without manual effort or data inconsistencies.

The platform supports high-volume extraction, structured outputs, and seamless integration into analytics systems—making it ideal for food brands, aggregators, and market research teams seeking actionable insights rather than raw data dumps.

Conclusion

In a rapidly evolving UAE food landscape, blind spots can cost brands market share and momentum. Leveraging real-time menu intelligence empowers brands to make faster, smarter decisions rooted in actual market behavior. By choosing to scrape dining menus across UAE for competitive analysis, food brands move from reactive strategies to proactive leadership. Start uncovering hidden opportunities today—partner with Real Data API and turn menu data into your competitive advantage!