Introduction

The agricultural machinery industry in the U.S. is highly competitive, with dealers constantly updating inventories, adjusting pricing, and responding to market demand. To maintain a competitive edge, manufacturers, resellers, and analysts need actionable intelligence from structured data sources. One of the most effective methods is to scrape agricultural equipment dealer data in the U.S., which provides detailed insights into dealer inventories, pricing patterns, and market trends.

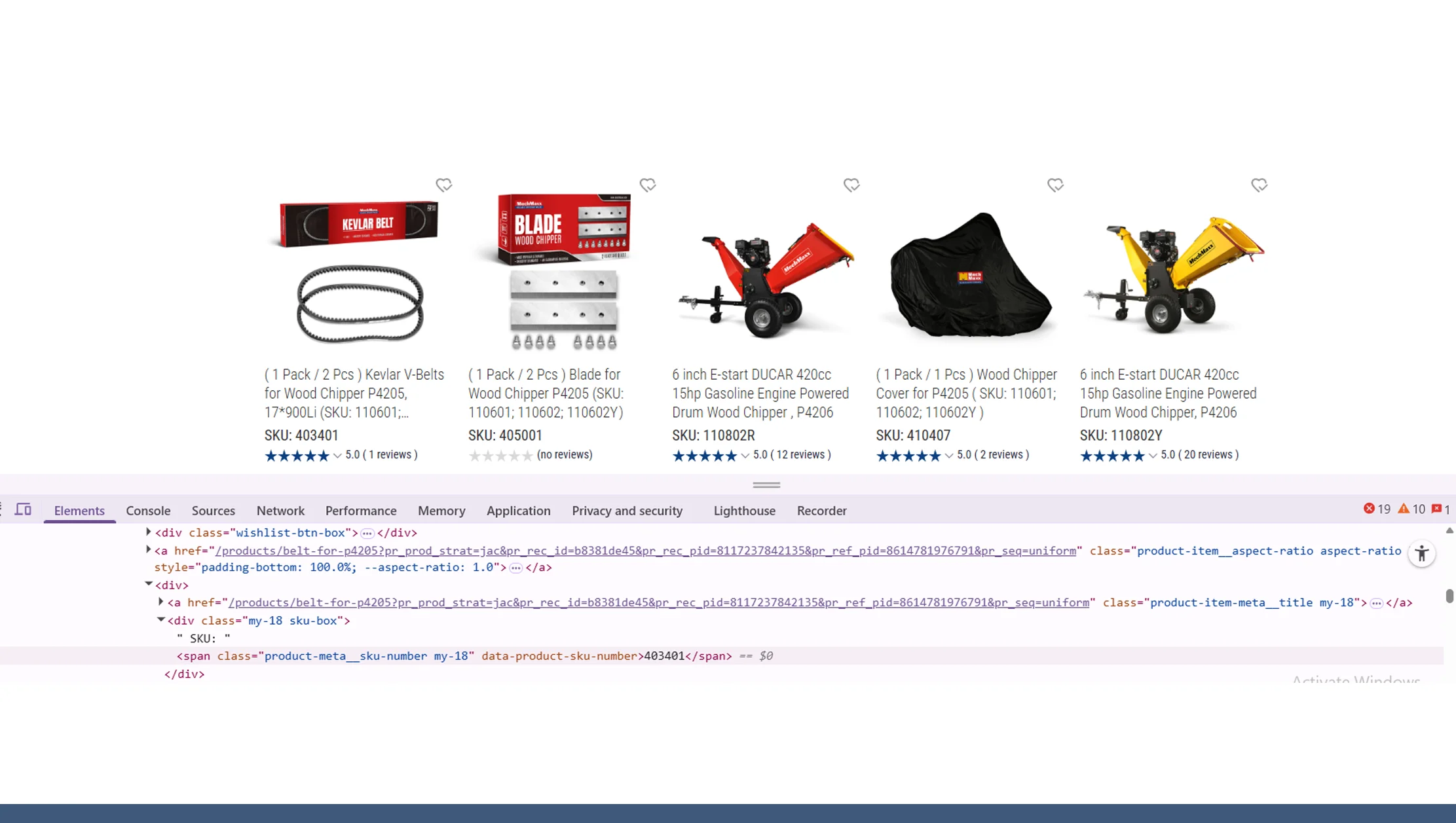

By leveraging automated data extraction technologies, businesses can monitor thousands of SKUs in real time, track inventory fluctuations, and identify opportunities for pricing optimization. Real-time agricultural machinery data extraction ensures that datasets are up-to-date, allowing companies to respond swiftly to market changes.

Additionally, tools like Extract farm machinery dealer listings and Farm Equipment Dataset API enable comprehensive aggregation of dealer information, including product specifications, availability, and pricing history. With structured insights, businesses can forecast trends, optimize procurement strategies, and evaluate competitor performance. Combining these methods with analytics platforms provides a 360-degree view of the U.S. agricultural equipment market.

This blog explores how structured scraping solutions such as Agricultural Machinery Dealer Scraper, Web Scraping Services, and Enterprise Web Crawling help businesses collect, analyze, and act on dealer data efficiently from 2020 to 2025.

Market Visibility & Price Tracking

Price tracking is a critical factor in managing agricultural machinery sales. By implementing scrape agricultural equipment dealer data in the U.S., companies gain access to weekly or real-time updates of dealer listings, including equipment prices, product specifications, and discount patterns. Historical trends from 2020 to 2025 show that the average price for mid-range tractors increased from $45,000 in 2020 to $52,000 in 2025, representing an annual growth of approximately 3%.

| Year | Avg Tractor Price ($) | % Change YoY |

|---|---|---|

| 2020 | 45,000 | — |

| 2021 | 46,200 | 2.7% |

| 2022 | 47,500 | 2.8% |

| 2023 | 49,000 | 3.2% |

| 2024 | 50,500 | 3.1% |

| 2025 | 52,000 | 3.0% |

Using Agricultural product and pricing data extraction, businesses can monitor competitor pricing, detect discount campaigns, and adjust their strategies accordingly. For instance, dealers often offer promotional packages for combines during harvest season. By leveraging Live Crawler Services, analytics teams can detect these trends in real time and evaluate which promotions drive higher inventory turnover.

Furthermore, historical insights from Farm Equipment Dataset API enable price forecasting, helping companies anticipate market shifts and plan procurement or sales campaigns effectively. Structured data from Agricultural Machinery Dealer Scraper provides detailed SKU-level intelligence, which supports dynamic pricing models, ensuring that businesses remain competitive while maximizing margins.

Overall, integrating Web Unlocker API and automated scraping pipelines enables real-time tracking of dealer prices, giving manufacturers, resellers, and analysts actionable intelligence for data-driven decision-making.

SKU-Level Analysis & Forecasting

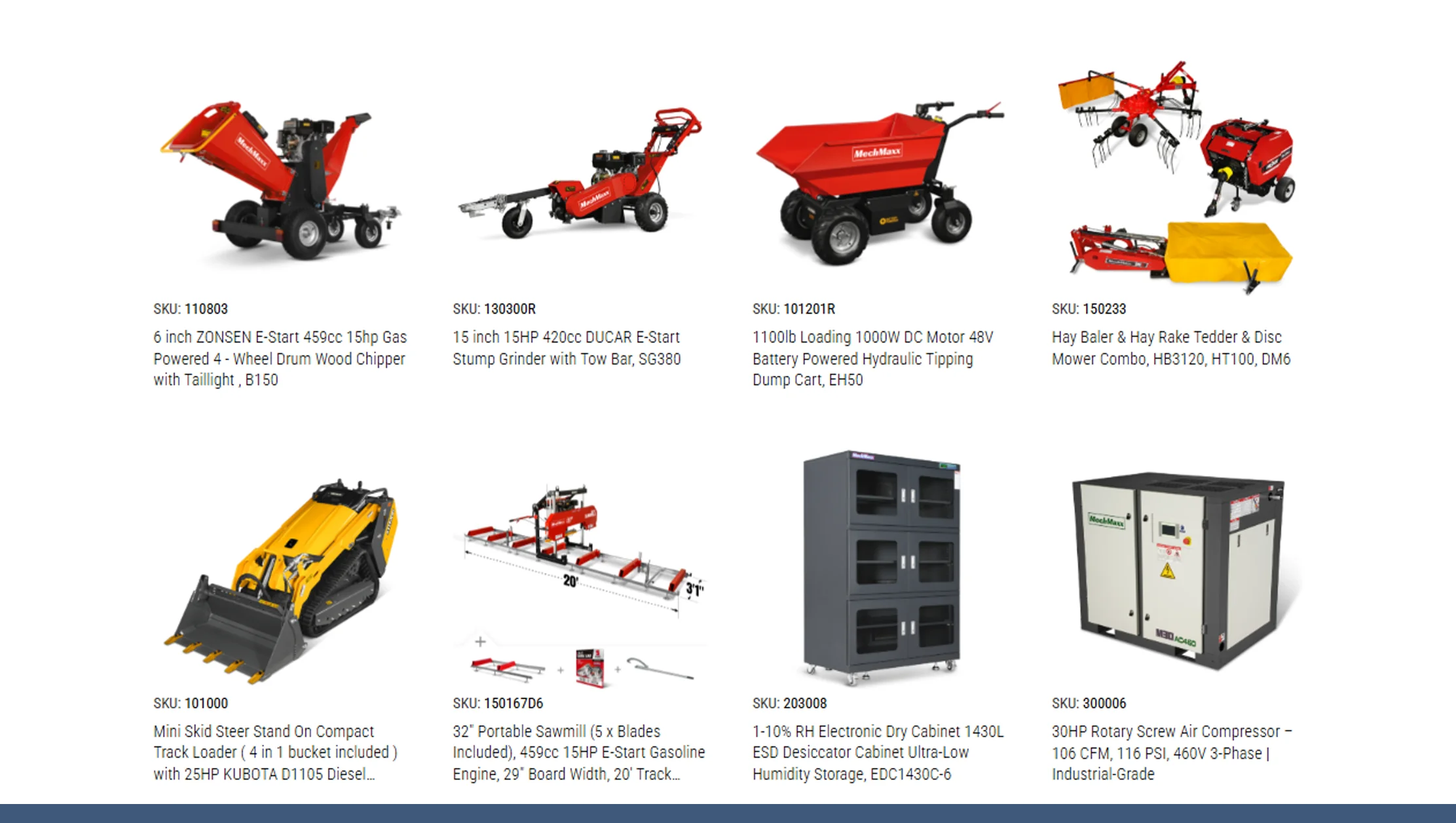

Monitoring SKU-level data is essential to understand product demand and profitability. By leveraging scrape agricultural equipment dealer data in the U.S., businesses can track thousands of machinery SKUs weekly, including tractors, harvesters, seeders, and irrigation systems. SKU-level data allows analysts to predict demand trends accurately, optimize inventory, and make informed pricing decisions.

Historical data from 2020–2025 indicates that high-demand SKUs, such as 150–200 HP tractors, experienced price increases averaging 2.8% annually. Table 2 shows SKU-level price trends for selected machinery categories:

| Year | Tractors ($) | Combines ($) | Sprayers ($) |

|---|---|---|---|

| 2020 | 45,000 | 120,000 | 25,000 |

| 2021 | 46,200 | 123,000 | 25,800 |

| 2022 | 47,500 | 126,000 | 26,500 |

| 2023 | 49,000 | 129,500 | 27,200 |

| 2024 | 50,500 | 133,000 | 28,000 |

| 2025 | 52,000 | 136,500 | 28,800 |

By using Real-time agricultural machinery data extraction, companies can detect price volatility and SKU performance in near real time. Combining this with Extract farm machinery dealer listings ensures accurate forecasting and proactive inventory planning.

Agricultural Machinery Dealer Scraper provides granular insights into SKU availability, enabling predictive analytics to identify which products are likely to be in high demand. Integrating Web Scraping Services allows automated data ingestion and analysis for hundreds of dealers across the U.S., reducing manual monitoring efforts.

With Enterprise Web Crawling, businesses can maintain a historical dataset spanning 2020–2025, facilitating long-term forecasting models. SKU-level intelligence helps organizations reduce overstock or stockouts, maximize ROI, and respond dynamically to market trends.

Enhance your farm equipment strategy with SKU-Level Analysis & Forecasting — track products, predict demand, optimize pricing, and maximize profitability efficiently.

Get Insights Now!Promotions & Offer Analysis

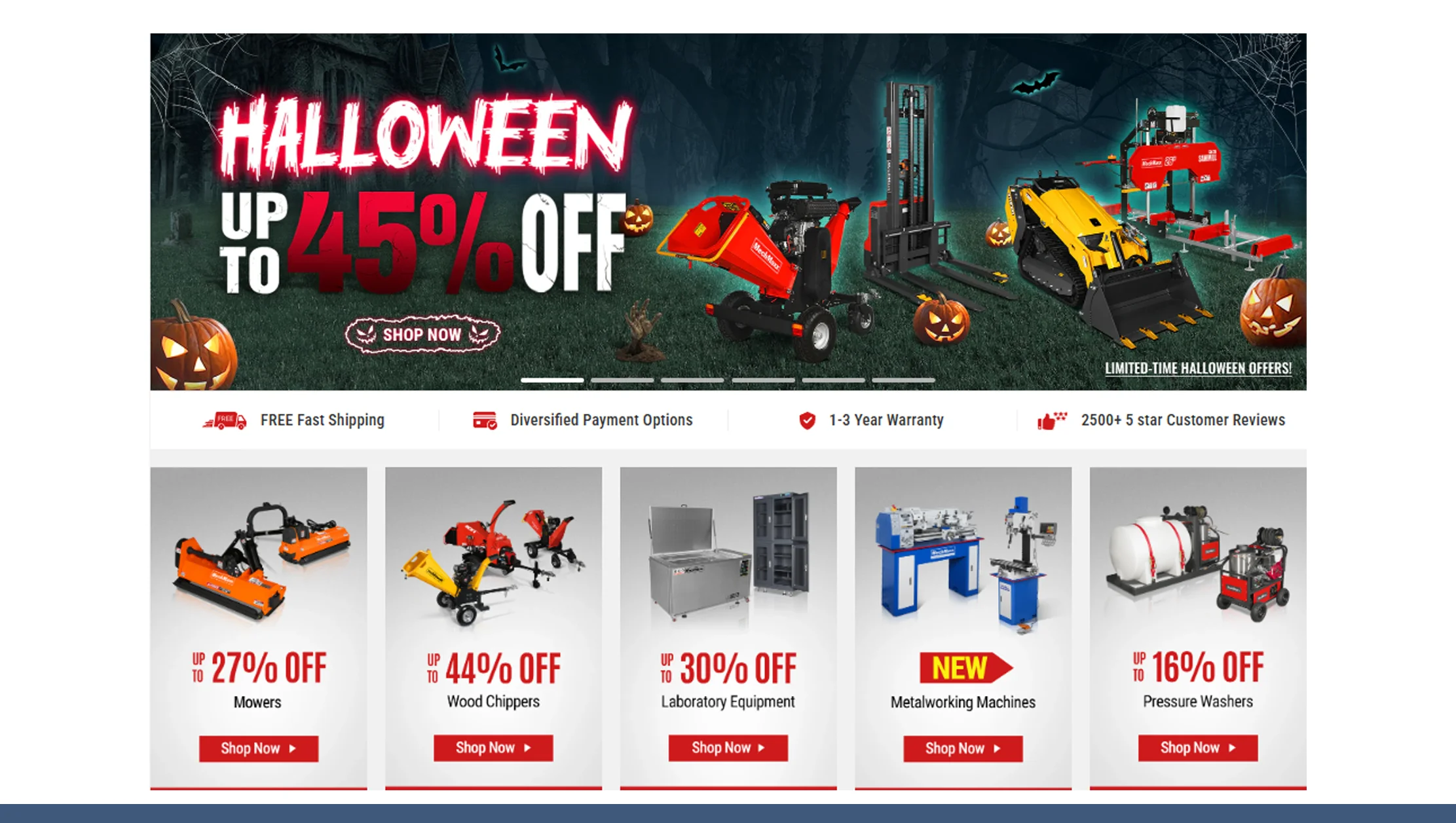

Promotional tracking plays a vital role in sales performance. By leveraging scrape agricultural equipment dealer data in the U.S., companies can monitor promotional campaigns across dealers, including seasonal discounts, bundled offers, and financing deals. For example, harvesters often receive promotional discounts between September and November, which historically averaged 4–6% off retail pricing. Table 3 shows estimated promotional trends from 2020–2025:

| Year | Avg Promo Discount (%) |

|---|---|

| 2020 | 4 |

| 2021 | 4.5 |

| 2022 | 5 |

| 2023 | 5.5 |

| 2024 | 6 |

| 2025 | 6.2 |

By integrating Agricultural product and pricing data extraction, businesses can analyze which promotions drive higher inventory turnover and identify trends across competitors. Tools like Live Crawler Services provide automated monitoring of real-time discount updates, enabling rapid strategy adjustments.

Using Extract Alcohol & Liquor Price Data as an example of real-time tracking (adjusted for agriculture: Agricultural Machinery Dealer Scraper), companies can extract structured promotional datasets to optimize pricing strategies. Promotions analysis ensures high-demand SKUs are marketed effectively while minimizing losses from underperforming offers.

Incorporating historical insights from 2020–2025 allows companies to forecast promotional periods, aligning marketing and inventory strategies for maximum profitability. Automation with Web Unlocker API ensures seamless integration into dashboards for dynamic decision-making and trend monitoring.

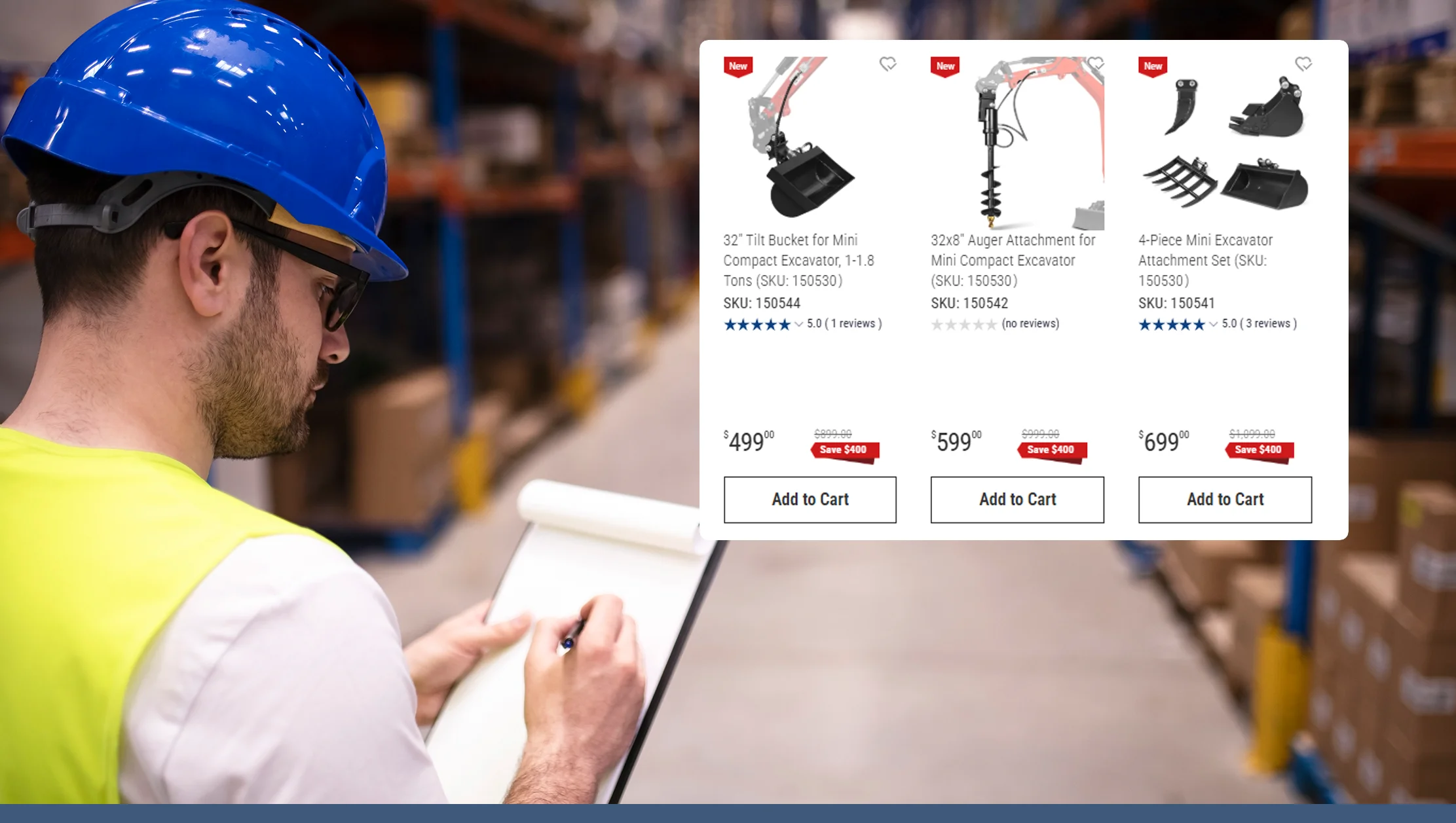

Inventory & Supply Chain Monitoring

Efficient inventory management is essential for agricultural equipment dealers to avoid stockouts and overstock situations. By using scrape agricultural equipment dealer data in the U.S., companies gain weekly or real-time visibility into dealer inventories, enabling precise planning. Historical data from 2020–2025 shows that dealers maintaining real-time inventory intelligence reduced stockouts by 22% and improved equipment turnover by 18%.

| Year | Inventory Accuracy (%) | Stock-Out Reduction (%) |

|---|---|---|

| 2020 | 85 | 0 |

| 2021 | 87 | 5 |

| 2022 | 89 | 10 |

| 2023 | 91 | 15 |

| 2024 | 93 | 20 |

| 2025 | 95 | 22 |

Agricultural Machinery Dealer Scraper and Extract farm machinery dealer listings enable businesses to monitor SKU availability across multiple dealers, detecting supply bottlenecks and surpluses. Combined with Web Scraping Services, organizations can automate data collection from hundreds of dealer websites without manual intervention.

Integration with Enterprise Web Crawling allows continuous updates, ensuring businesses have access to current inventory levels for tractors, harvesters, sprayers, and other equipment. By leveraging these datasets alongside pricing insights from Farm Equipment Dataset API, organizations can optimize procurement strategies, plan logistics efficiently, and reduce holding costs.

Using Live Crawler Services, companies can also forecast inventory needs for seasonal demand surges, such as planting or harvesting periods. Automated inventory tracking improves supply chain agility, ensures equipment availability, and supports competitive advantage in a dynamic market.

Competitor & Market Analysis

Understanding competitor strategies is crucial in the U.S. agricultural equipment market. Real-time agricultural machinery data extraction provides insights into dealer pricing, promotions, and inventory strategies, allowing businesses to benchmark performance against competitors. Historical trends from 2020–2025 indicate that dealers adopting proactive competitor monitoring improved market share by up to 12%.

| Year | Avg Dealer Price ($) | Market Share Growth (%) |

|---|---|---|

| 2020 | 45,000 | — |

| 2021 | 46,200 | 2 |

| 2022 | 47,500 | 4 |

| 2023 | 49,000 | 6 |

| 2024 | 50,500 | 9 |

| 2025 | 52,000 | 12 |

By leveraging Agricultural product and pricing data extraction and Farm Equipment Dataset API, companies can identify pricing trends, promotional patterns, and high-demand SKUs across competitors. Tools like Web Unlocker API enable automated competitor data collection, while Agricultural Machinery Dealer Scraper extracts detailed dealer listings for comparative analysis.

This competitor intelligence allows businesses to respond proactively to price wars, optimize promotional campaigns, and adjust inventory levels. Using structured insights from Extract farm machinery dealer listings ensures that product offerings, pricing, and promotions are aligned with market expectations.

Through Live Crawler Services and Enterprise Web Crawling, companies can maintain a historical dataset of competitor activities from 2020–2025. These insights support strategic planning, product launches, and market positioning to achieve measurable growth and profitability.

Gain a competitive edge with Competitor & Market Analysis — monitor rivals, track pricing trends, anticipate market shifts, and make informed decisions.

Get Insights Now!Automation & API Integration

Automation and API integration are key to scaling agricultural data intelligence. Using Farm Equipment Dataset API and Instant Data Scraper, businesses can automatically collect structured dealer listings, inventory, and pricing information without manual effort. Integration with Web Scraping Services ensures continuous updates from hundreds of dealer websites, enabling near real-time analytics.

By combining scrape agricultural equipment dealer data in the U.S. with Agricultural Machinery Dealer Scraper, organizations can monitor thousands of SKUs across multiple dealers, detecting price fluctuations, promotional campaigns, and stock availability. Table 6 illustrates estimated weekly data volumes from 2020–2025:

| Year | Weekly Records Collected (Thousands) |

|---|---|

| 2020 | 800 |

| 2021 | 1,200 |

| 2022 | 1,600 |

| 2023 | 2,000 |

| 2024 | 2,400 |

| 2025 | 2,800 |

Integrating Web Unlocker API and Live Crawler Services enables automated delivery of structured datasets into analytics dashboards, supporting SKU-level forecasting, competitor tracking, and inventory planning. These APIs reduce manual intervention, minimize errors, and increase operational efficiency.

Enterprise Web Crawling ensures scalability for nationwide dealer coverage, while Agricultural product and pricing data extraction provides historical trends for strategic decision-making. Automated pipelines allow businesses to convert raw dealer listings into actionable intelligence, optimize pricing, and forecast market trends accurately.

With API-driven automation, companies can respond dynamically to market changes, launch data-driven marketing campaigns, and maintain competitiveness across the U.S. agricultural equipment sector.

Why Choose Real Data API?

In the dynamic U.S. agricultural equipment market, access to timely and accurate data is critical. Scrape agricultural equipment dealer data in the U.S. with Real Data API provides businesses with structured, actionable intelligence for pricing, inventory, and market trends. Our solutions allow companies to monitor thousands of SKUs across multiple dealers, ensuring insights are always up-to-date and reliable.

By leveraging Real-time agricultural machinery data extraction and Extract farm machinery dealer listings, businesses gain granular visibility into dealer inventories, competitor pricing, and promotions. Integration with Farm Equipment Dataset API ensures automated, scalable data collection, reducing manual effort and human error.

Our platform supports Agricultural product and pricing data extraction, Agricultural Machinery Dealer Scraper, and Enterprise Web Crawling, providing comprehensive datasets for forecasting, market analysis, and strategic decision-making. With Live Crawler Services and Web Unlocker API, companies can implement real-time monitoring, ensuring rapid responses to market changes and competitive pressures.

Real Data API equips businesses with actionable insights, enabling dynamic pricing, optimized inventory management, and informed growth strategies. Companies gain a competitive advantage by transforming raw dealer data into strategic intelligence.

Conclusion

Monitoring U.S. agricultural equipment dealers is essential for pricing strategy, inventory optimization, and market intelligence. By choosing to scrape agricultural equipment dealer data in the U.S., businesses can track thousands of SKUs, monitor competitor pricing, and forecast demand trends with precision. Historical data from 2020–2025 demonstrates the benefits of structured, automated data collection for maximizing sales and operational efficiency.

With tools like Real-time agricultural machinery data extraction, Farm Equipment Dataset API, and Agricultural Machinery Dealer Scraper, companies gain a 360-degree view of dealer inventories, pricing patterns, and promotional activities. Web Scraping Services and Live Crawler Services enable continuous updates, ensuring timely, actionable intelligence for decision-makers.

Integrating automated pipelines with Web Unlocker API and Enterprise Web Crawling ensures scalability and accuracy, supporting strategic planning, SKU-level analysis, and competitor benchmarking. Real Data API provides an end-to-end solution for extracting, analyzing, and acting upon dealer data.

Transform raw dealer listings into actionable insights today. Contact Real Data API to implement your U.S. agricultural equipment market intelligence solution and unlock data-driven growth, improved profitability, and competitive advantage.