Introduction

The pawn industry plays a critical role in local economies by offering short-term credit, resale opportunities, and asset-backed lending. As consumer behavior shifts and financial pressures fluctuate, understanding where pawn shops operate and how densely they are distributed has become essential for lenders, retailers, investors, and market analysts. Location intelligence is no longer optional—it is a strategic asset.

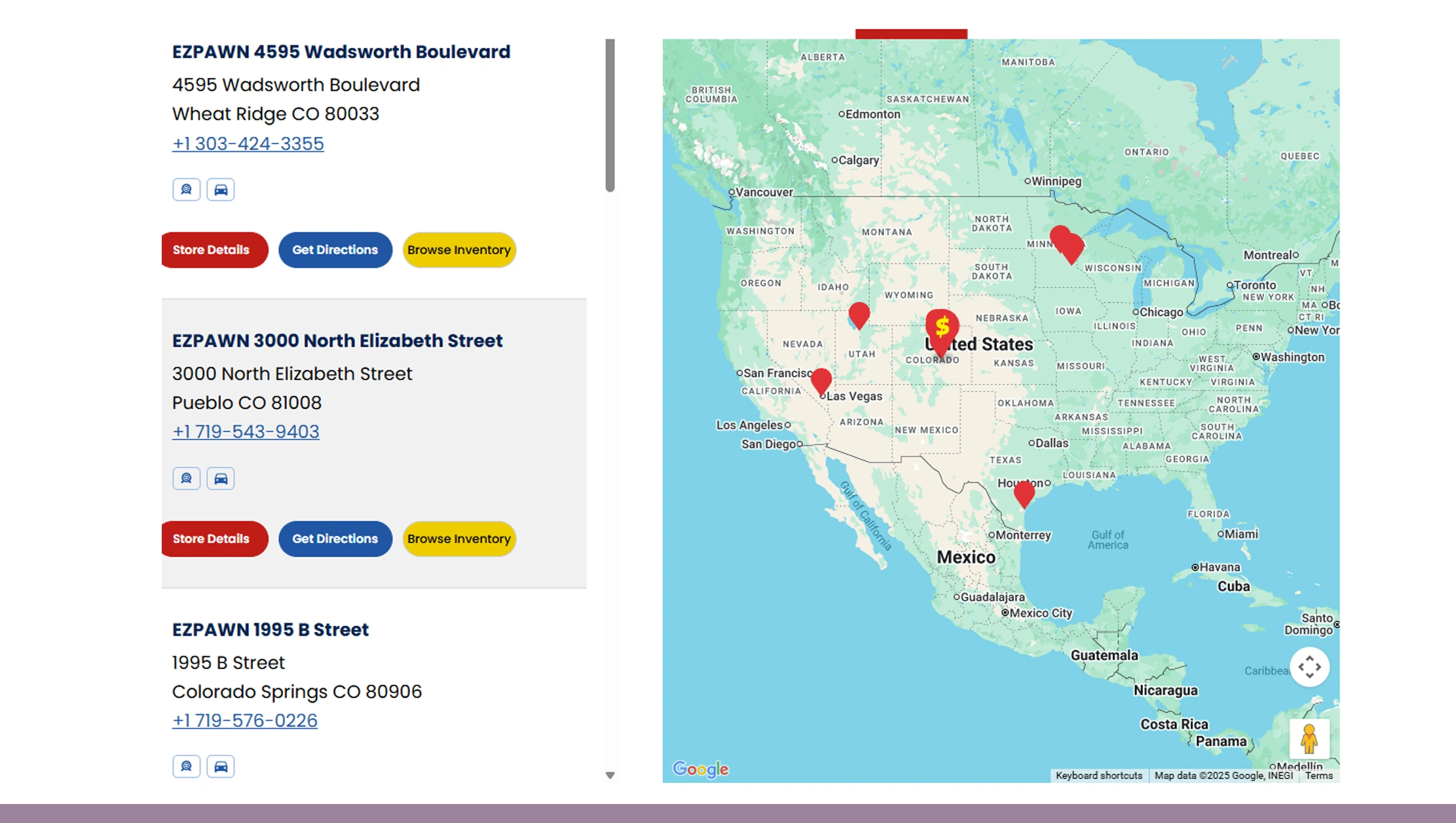

By leveraging scrape EZPawn store locations to map pawn industry trends, businesses gain a geographic lens into demand concentration, underserved regions, and competitive saturation. EZPawn, as one of the largest pawn store chains in the United States, provides a valuable benchmark for analyzing how pawn services align with population density, income patterns, and regional demand shifts.

Real Data API enables organizations to transform publicly available location data into structured, actionable insights. With accurate store-level intelligence, decision-makers can identify expansion opportunities, forecast demand, and assess market dynamics with confidence.

Turning Store Locations into Strategic Intelligence

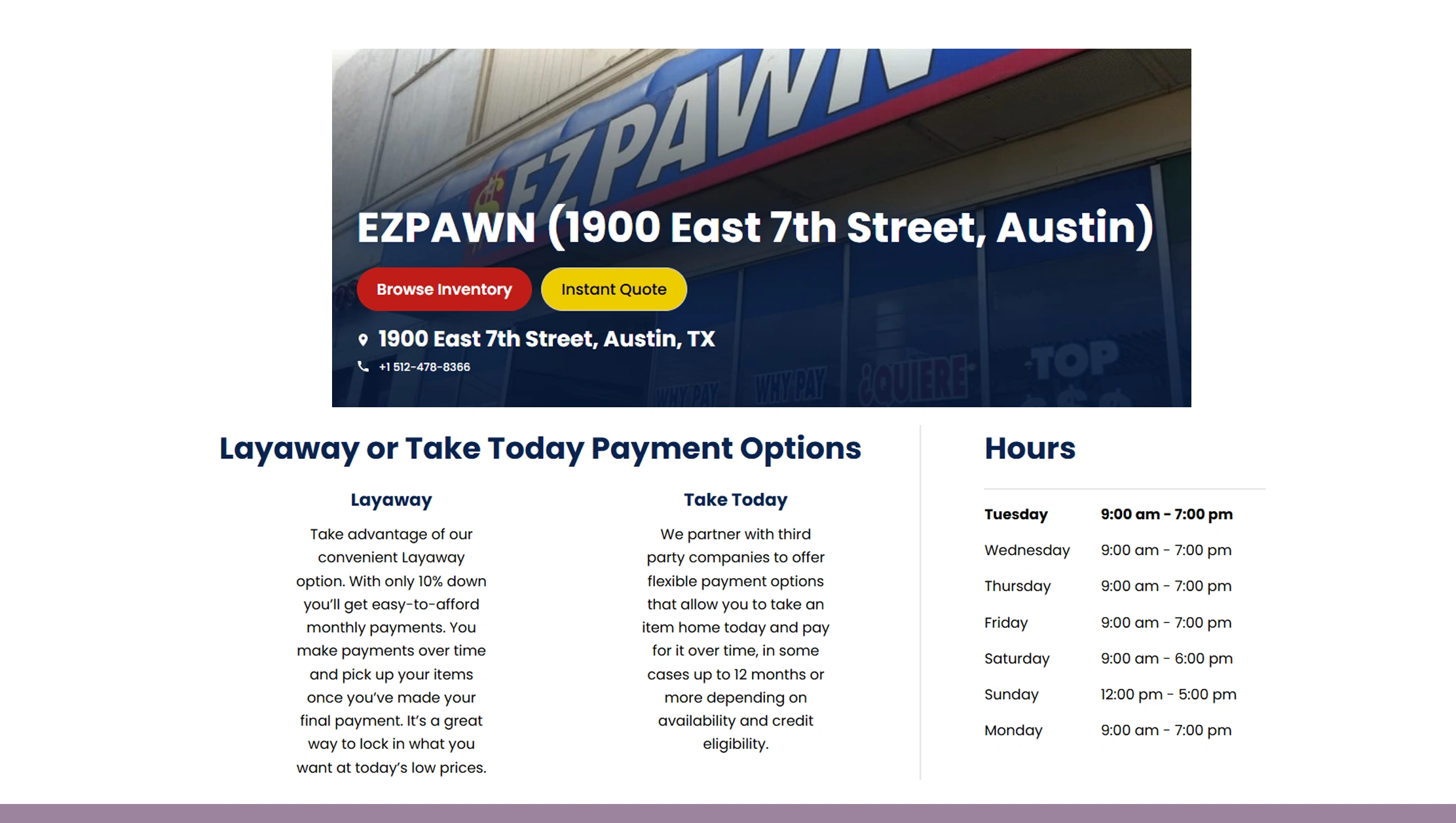

Understanding pawn market structure starts with accurate location data. Using EZPawn store locations data extraction, analysts can systematically collect store addresses, operating regions, and geographic coordinates to build a complete spatial overview of the market.

From 2020 to 2025, EZPawn's footprint reflected broader economic and demographic trends:

| Year | Active EZPawn Stores | Urban vs Rural Split |

|---|---|---|

| 2020 | 490 | 72% Urban / 28% Rural |

| 2021 | 505 | 73% Urban / 27% Rural |

| 2022 | 528 | 74% Urban / 26% Rural |

| 2023 | 560 | 75% Urban / 25% Rural |

| 2024 | 590 | 76% Urban / 24% Rural |

| 2025 | 620 | 77% Urban / 23% Rural |

Extracted data reveals how pawn stores increasingly concentrate in high-demand metropolitan zones while maintaining presence in underserved rural markets. This insight helps businesses evaluate saturation levels, regional competition, and consumer accessibility across financial service deserts.

Automating Location Intelligence at Scale

Manual tracking of hundreds of locations across states is inefficient and error-prone. An EZPawn API scraper allows businesses to automate the collection of store locations, operational updates, and regional coverage changes at scale.

Between 2020 and 2025, the adoption of automated scraping for location intelligence accelerated:

| Year | Locations Tracked Monthly | Data Refresh Frequency |

|---|---|---|

| 2020 | 10,000 | Quarterly |

| 2021 | 18,000 | Monthly |

| 2022 | 30,000 | Bi-weekly |

| 2023 | 45,000 | Weekly |

| 2024 | 65,000 | Weekly |

| 2025 | 85,000 | Near Real-Time |

Automation ensures data consistency and timeliness, allowing analysts to monitor store openings, closures, and relocations as they happen. This level of accuracy supports faster market assessments and more reliable forecasting across the pawn industry.

Linking Location Density to Consumer Demand

Store locations are powerful indicators of financial service demand. By analyzing geographic concentration, businesses can Extract Pawn shop demand insights that reflect regional borrowing behavior, resale activity, and economic stress patterns.

Demand correlation data from 2020–2025 shows clear relationships between store density and transaction volume:

| Year | Avg. Stores per Metro Area | Demand Index |

|---|---|---|

| 2020 | 12 | Medium |

| 2021 | 14 | Medium-High |

| 2022 | 17 | High |

| 2023 | 19 | Very High |

| 2024 | 21 | Very High |

| 2025 | 24 | Extreme |

Higher store density often aligns with increased short-term lending demand and resale turnover. These insights help financial institutions, investors, and policymakers understand where pawn services are most relied upon and where new locations could meet unmet needs.

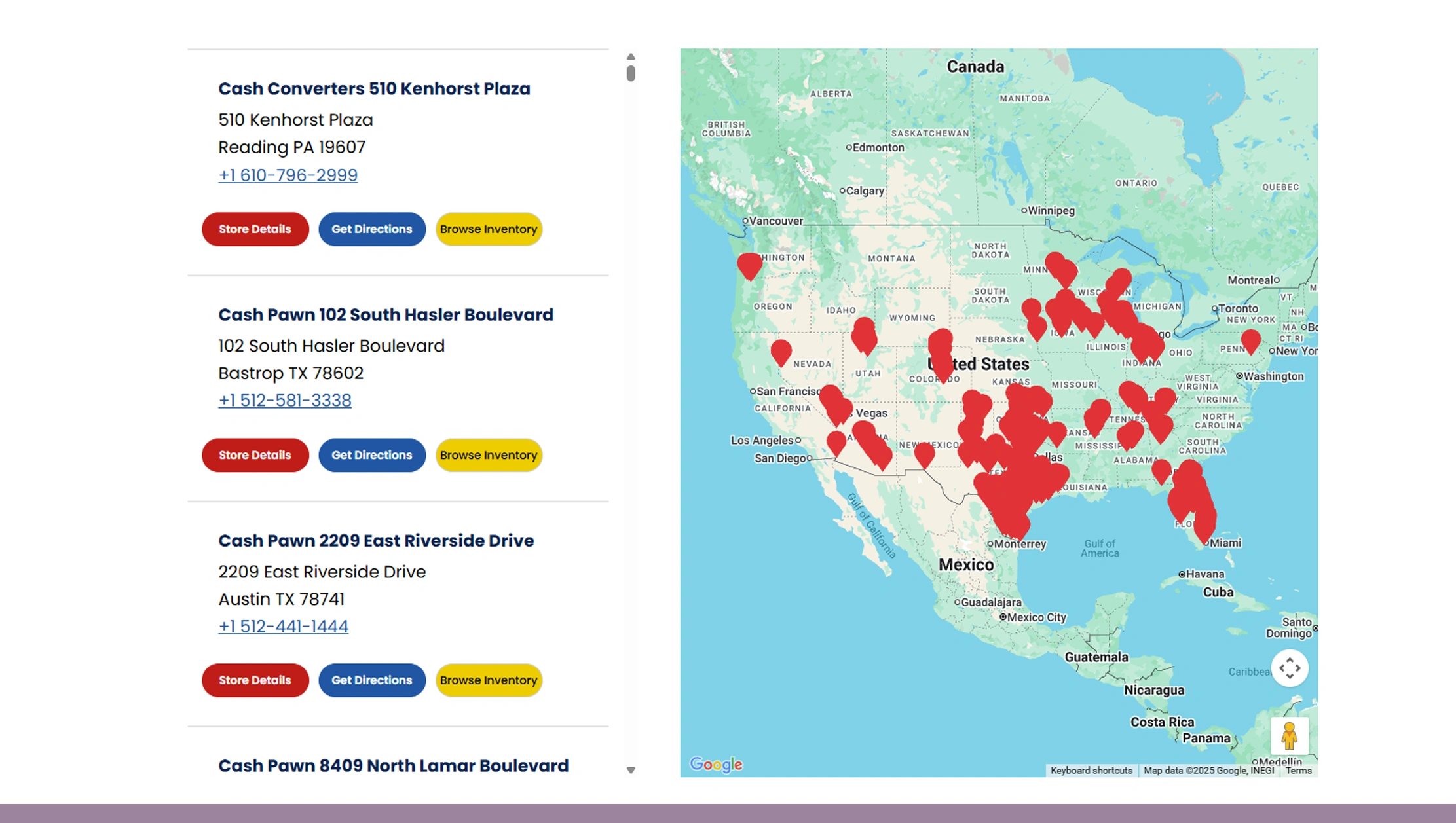

Creating Accurate Geographic Market Maps

Accurate mapping requires consistent, validated data sources. Through Web Scraping EZPawn store location data, Real Data API enables precise geographic visualization of pawn market coverage across states and cities.

Mapping accuracy improved significantly from 2020 to 2025:

| Year | Mapping Accuracy | Data Completeness |

|---|---|---|

| 2020 | 88% | Moderate |

| 2021 | 91% | High |

| 2022 | 94% | High |

| 2023 | 96% | Very High |

| 2024 | 98% | Very High |

| 2025 | 99% | Near-Perfect |

Geospatial maps derived from scraped data allow stakeholders to overlay demographic, income, and economic indicators. This creates a multidimensional view of market demand, enabling smarter expansion planning and competitive positioning.

Understanding Regional Coverage Across the United States

Regional analysis is essential for national market strategies. By choosing to Scrape EZPAWN store locations in the USA, businesses gain a state-by-state breakdown of pawn market presence.

Regional expansion data from 2020–2025:

| Region | Stores (2020) | Stores (2025) |

|---|---|---|

| Southwest | 120 | 165 |

| Southeast | 95 | 130 |

| Midwest | 80 | 105 |

| West Coast | 70 | 95 |

| Northeast | 45 | 60 |

This regional visibility helps identify high-growth states, emerging demand corridors, and underpenetrated markets. It also supports compliance planning, logistics optimization, and targeted marketing strategies for pawn-related services.

Transforming Location Data into Strategic Decisions

Location intelligence becomes truly valuable when applied to broader Market Research initiatives. By integrating pawn store distribution data with economic indicators, population trends, and consumer behavior, businesses gain a holistic understanding of the industry.

From 2020 to 2025, companies using data-driven location research reported:

| Year | Forecast Accuracy | Expansion Success Rate |

|---|---|---|

| 2020 | 70% | Moderate |

| 2021 | 75% | High |

| 2022 | 80% | High |

| 2023 | 85% | Very High |

| 2024 | 88% | Very High |

| 2025 | 92% | Exceptional |

These outcomes demonstrate how structured location data supports smarter investments, reduced risk, and improved long-term planning across the pawn ecosystem.

Why Choose Real Data API?

Real Data API delivers reliable, scalable data solutions designed for location-driven intelligence. Businesses rely on the platform to scrape EZPawn store locations to map pawn industry trends with precision and consistency.

Beyond location data, Real Data API supports competitive benchmarking and strategic planning through advanced Price Comparison capabilities. This combination allows organizations to evaluate both geographic presence and pricing dynamics within the pawn industry, creating a comprehensive market intelligence framework.

Conclusion

The pawn industry is deeply influenced by geography, local demand, and economic conditions. By leveraging accurate location intelligence and advanced data pipelines, businesses can identify opportunity zones, anticipate demand shifts, and make informed expansion decisions.

With Price Monitoring capabilities layered on top of location insights, organizations gain a powerful advantage—understanding not just where pawn shops operate, but how market dynamics evolve over time.

Ready to unlock actionable pawn industry insights with real-time location intelligence? Partner with Real Data API today and turn raw store data into strategic advantage.