Introduction

The global sneaker market has evolved into a fast-moving, data-driven ecosystem where timing, pricing, and availability determine success. Limited-edition launches sell out within minutes, resale markets fluctuate rapidly, and demand spikes are often unpredictable. Businesses, resellers, and sneaker enthusiasts increasingly rely on structured analytics to stay ahead. By leveraging Scrape Nike API data to track product pricing and drops, stakeholders can monitor release schedules, capture real-time price changes, and analyze stock availability across regions.

Between 2020 and 2026, the global athletic footwear market is projected to grow from $365 billion to over $520 billion, with Nike consistently leading in brand influence and drop-driven demand. However, manual tracking of launches and pricing creates delays and missed opportunities. Automated data extraction enables real-time monitoring of sneaker drops, historical pricing patterns, and product lifecycle trends. This blog explores how data scraping solves release monitoring challenges and strengthens competitive strategy in the sneaker ecosystem.

Capturing Release Momentum in Real Time

The success of limited sneaker drops depends heavily on timing. Using real-time Nike sneaker release data scraping, businesses can monitor product listings, release timestamps, and sudden availability changes as they happen.

From 2020–2026, Nike increased its limited-edition releases by nearly 35%, fueling hype-driven demand cycles. In 2023 alone, over 400 limited sneaker models were launched globally. Missing even a few minutes during a drop can result in lost sales or resale opportunities.

Limited Edition Release Growth (2020–2026)

| Year | Limited Releases | Avg Sell-Out Time (Minutes) | Demand Index |

|---|---|---|---|

| 2020 | 280 | 45 | 100 |

| 2021 | 310 | 38 | 112 |

| 2022 | 350 | 32 | 125 |

| 2023 | 400 | 25 | 140 |

| 2024 | 430 | 22 | 150 |

| 2025 | 460 | 18 | 165 |

| 2026* | 500 | 15 | 180 |

Real-time monitoring reduces reaction lag and ensures instant alerts for restocks and launch-day availability.

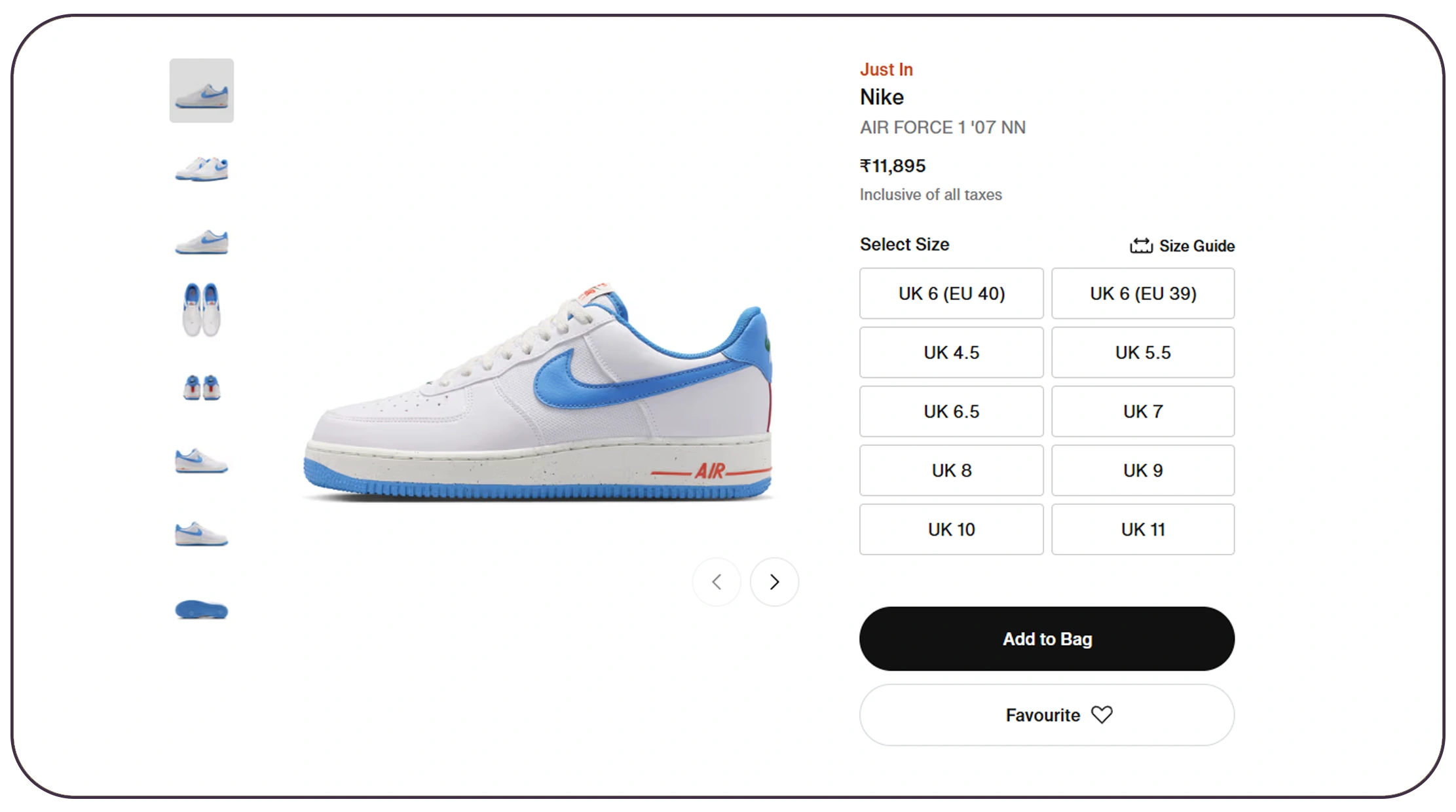

Tracking Pricing and Stock Variability

Pricing volatility is common in sneaker releases due to regional strategies, promotional discounts, and restock events. Businesses that Extract Nike pricing and stock availability data gain granular insight into SKU-level price changes and inventory fluctuations.

Between 2020 and 2026, average retail prices for premium Nike sneakers increased by 18%, while resale market prices fluctuated by up to 60% during peak demand periods. Monitoring these changes helps retailers adjust pricing strategies and manage demand effectively.

Average Retail Price Trends (USD)

| Year | Standard Models | Premium Editions | Collaborations |

|---|---|---|---|

| 2020 | 110 | 180 | 220 |

| 2021 | 115 | 190 | 235 |

| 2022 | 120 | 200 | 250 |

| 2023 | 125 | 210 | 270 |

| 2024 | 130 | 220 | 290 |

| 2025 | 135 | 230 | 310 |

| 2026* | 140 | 240 | 330 |

Structured extraction enables businesses to detect price hikes, promotional campaigns, and inventory restocks instantly.

Forecasting Through Launch Calendar Intelligence

Accurate forecasting depends on launch calendar tracking. With Nike launch calendar data extraction, businesses can monitor upcoming release dates, model variations, and category segmentation.

From 2020–2026, Nike expanded digital-first launches, with over 70% of limited releases announced online. Tracking this data allows retailers and resellers to prepare inventory budgets and marketing campaigns in advance.

Launch Calendar Distribution (2020–2026)

| Year | Online Launch % | In-Store Launch % | Hybrid Model % |

|---|---|---|---|

| 2020 | 55 | 35 | 10 |

| 2021 | 60 | 30 | 10 |

| 2022 | 65 | 25 | 10 |

| 2023 | 70 | 20 | 10 |

| 2024 | 72 | 18 | 10 |

| 2025 | 75 | 15 | 10 |

| 2026* | 78 | 12 | 10 |

Launch calendar intelligence supports proactive demand forecasting and targeted promotional strategies.

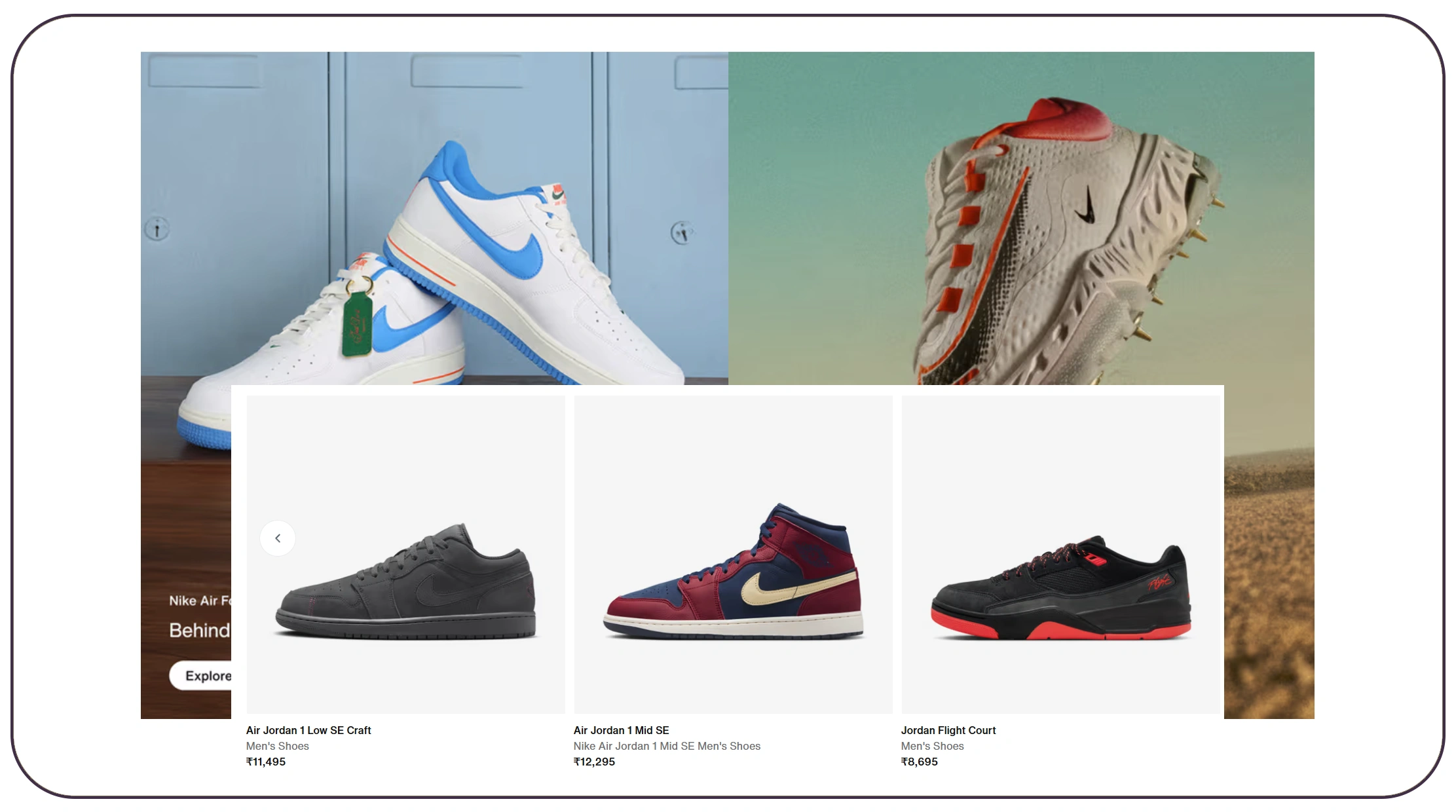

Monitoring Limited-Edition Drops at Scale

High-demand collaborations and exclusive releases require specialized tracking. Web Scraping Nike limited edition releases enables continuous monitoring of product pages, drop alerts, and early-access programs.

Between 2020–2026, collaboration releases (e.g., artist or designer partnerships) increased resale premiums by 40–70% compared to standard models. Automated scraping ensures immediate updates when limited SKUs become available.

Collaboration Release Growth

| Year | Collab Releases | Avg Resale Premium % |

|---|---|---|

| 2020 | 60 | 40 |

| 2021 | 75 | 45 |

| 2022 | 90 | 50 |

| 2023 | 110 | 55 |

| 2024 | 125 | 60 |

| 2025 | 140 | 65 |

| 2026* | 160 | 70 |

Monitoring limited editions ensures competitive advantage in high-value sneaker markets.

Structured Integration for Seamless Insights

Leveraging the Nike API enables structured access to product listings, pricing updates, and release schedules. API-driven integration ensures low-latency updates and scalable data pipelines.

By combining API feeds with Nike Fashion Datasets, businesses gain comprehensive visibility into product lifecycles, demand spikes, and regional availability patterns.

Dataset Expansion (2020–2026)

| Year | SKUs Tracked | Data Fields per SKU | Regions Covered |

|---|---|---|---|

| 2020 | 5,000 | 12 | 15 |

| 2021 | 6,200 | 15 | 18 |

| 2022 | 7,800 | 18 | 20 |

| 2023 | 9,000 | 20 | 25 |

| 2024 | 10,500 | 22 | 30 |

| 2025 | 12,000 | 25 | 35 |

| 2026* | 14,000 | 28 | 40 |

Structured datasets enable predictive analytics, pricing optimization, and comprehensive drop monitoring.

Why Choose Real Data API?

Real Data API offers a scalable Fashion Scraping API designed for high-frequency sneaker data extraction. With automated pipelines and robust infrastructure, businesses can efficiently Scrape Nike API data to track product pricing and drops without latency or data gaps.

Our solutions combine real-time scraping, API integration, historical dataset storage, and AI-driven analytics dashboards. From limited-edition launches to everyday pricing updates, Real Data API ensures accurate, timely, and structured insights.

With enterprise-grade security, customizable data feeds, and global coverage, we empower retailers, resellers, and analytics firms to monitor sneaker releases and pricing volatility confidently.

Conclusion

In the competitive sneaker market, timing and pricing intelligence determine profitability. By leveraging a scalable Web Scraping API, businesses can Scrape Nike API data to track product pricing and drops efficiently and proactively.

Real-time release monitoring, historical trend analysis, and automated alerts eliminate manual tracking challenges and ensure rapid response to high-demand launches.

Partner with Real Data API today to unlock structured sneaker data intelligence and gain a decisive edge in monitoring Nike product pricing and limited-edition drops.