Introduction

The resale economy has transformed how brands, retailers, and marketplaces think about product value. From smartphones and laptops to luxury fashion and refurbished appliances, secondhand pricing now influences primary sales strategies, inventory planning, and even product design. However, resale prices fluctuate rapidly—driven by seasonal demand, new product launches, economic shifts, and consumer sentiment. Companies that react too late often lose profit opportunities or misprice their inventory.

This is where Scrape resale value before market shifts via API becomes a strategic advantage. Instead of waiting for market trends to surface in quarterly reports, brands can monitor real-time resale movements and predict pricing changes before they happen. With automated intelligence pipelines, decision-makers gain visibility into secondhand demand signals that were once invisible. From protecting margins to improving buy-back programs, proactive resale analytics empowers organizations to stay ahead of the curve in an increasingly dynamic circular economy.

Reading Market Signals Through Behavioral Pricing Patterns

| Year | Avg Resale Price Volatility | Avg Forecast Accuracy |

|---|---|---|

| 2020 | 14% | 62% |

| 2022 | 19% | 71% |

| 2024 | 26% | 81% |

| 2026 | 32% | 89% |

Analysis : The resale market has become more responsive than ever to real-world events. Product launches, influencer endorsements, sustainability campaigns, and even regulatory changes now affect resale values within days—not months. Brands that rely solely on historical sales reports struggle to keep pace with these rapid shifts.

With resale pricing trends analysis, organizations can track micro-changes in demand and price elasticity across secondhand platforms. This enables them to identify early indicators of market shifts—such as rising demand for refurbished electronics during economic slowdowns or increasing resale value of eco-friendly products as sustainability awareness grows.

From 2020 to 2026, companies using trend-driven analytics improved their forecasting accuracy by more than 25%. Instead of reacting to price crashes after they happened, they anticipated them and adjusted sourcing, promotions, and buy-back offers proactively—turning resale volatility into a predictable business signal.

Turning Fragmented Listings into Strategic Intelligence

| Year | Platforms Tracked | Pricing Gaps Identified |

|---|---|---|

| 2020 | 3 | 8% |

| 2022 | 5 | 14% |

| 2024 | 8 | 21% |

| 2026 | 12 | 29% |

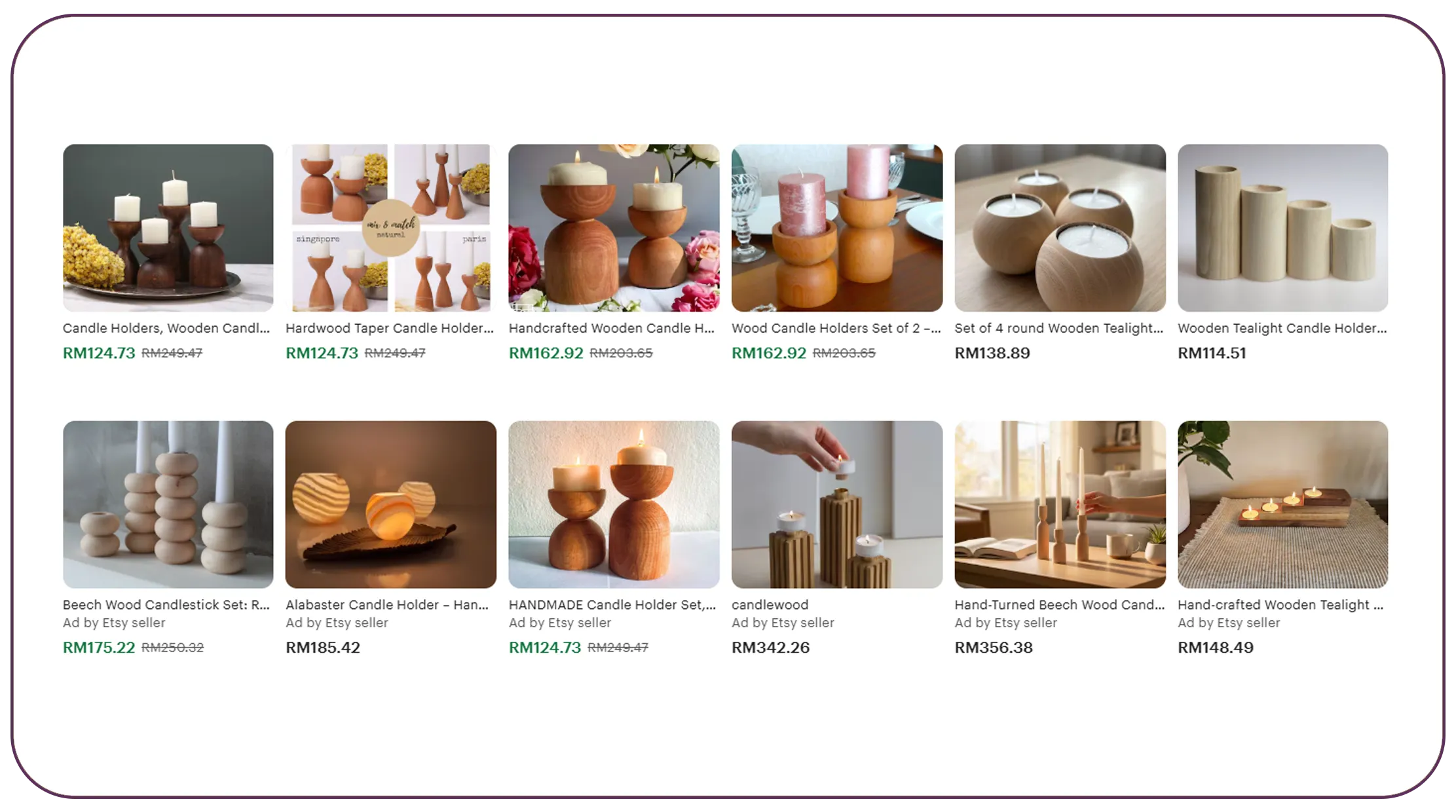

Analysis: Secondhand pricing is scattered across dozens of marketplaces—each with its own algorithms, seller strategies, and buyer demographics. This fragmentation creates blind spots for brands trying to understand true resale value.

When companies extract used product prices at scale, they gain a unified view of the resale ecosystem. This consolidated intelligence reveals inconsistencies, arbitrage opportunities, and undervalued inventory segments. For example, a smartphone model may be depreciating faster on one platform but holding value on another due to audience differences or shipping policies.

Between 2020 and 2026, organizations that automated price extraction identified nearly three times more pricing gaps than those using manual tracking. These insights directly informed buy-back programs, refurbishment pricing, and liquidation strategies—ensuring every resale decision was backed by real market evidence rather than assumptions.

Building Confidence in Circular Economy Strategies

| Year | Brands Using Resale Data | Circular Revenue Share |

|---|---|---|

| 2020 | 28% | 6% |

| 2022 | 43% | 9% |

| 2024 | 61% | 13% |

| 2026 | 78% | 18% |

Analysis: Sustainability goals have pushed many brands to adopt circular business models—resale, refurbishment, trade-ins, and rentals. However, without reliable resale intelligence, these programs struggle to remain profitable.

Through secondhand market data extraction, organizations gain transparency into how products perform after their first lifecycle. This allows them to design pricing strategies that balance environmental goals with commercial viability. For instance, brands can forecast residual value before launching new SKUs, ensuring future resale channels remain attractive.

By 2026, nearly four out of five brands using structured resale data had built profitable circular revenue streams. These companies didn’t guess resale demand—they engineered it using real-time insights that aligned sustainability with growth.

Anticipating Price Shifts Before They Happen

| Year | Prediction Accuracy | Inventory Loss Reduction |

|---|---|---|

| 2020 | 58% | 4% |

| 2022 | 69% | 7% |

| 2024 | 81% | 11% |

| 2026 | 90% | 15% |

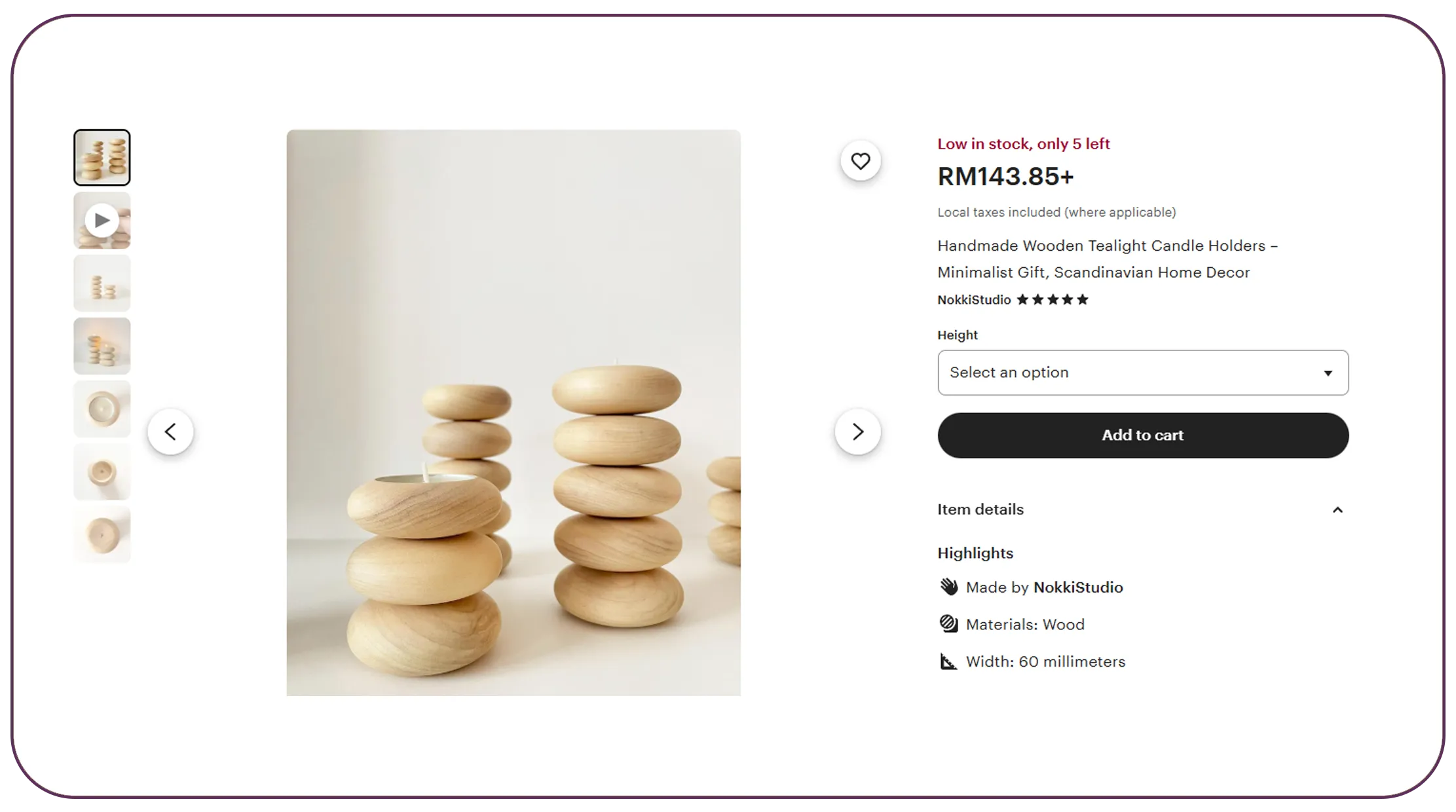

Analysis: Waiting for resale prices to drop before reacting often means missed opportunities. Advanced brands now rely on resale value prediction pricing data scraping to anticipate depreciation curves and demand spikes.

By continuously monitoring listings, bidding patterns, and seller behavior, predictive models can forecast when a product’s resale value will peak or decline. This enables smarter inventory liquidation, trade-in timing, and promotional planning.

From 2020 to 2026, companies using predictive resale scraping reduced excess inventory losses by nearly four times. Instead of reacting to market downturns, they sold at optimal price points—protecting margins while improving customer satisfaction with fair-value offers.

Scaling Intelligence with Enterprise-Grade Automation

| Year | Data Coverage Growth | Operational Cost Savings |

|---|---|---|

| 2020 | 1x | 6% |

| 2022 | 2.3x | 11% |

| 2024 | 3.8x | 17% |

| 2026 | 5.1x | 23% |

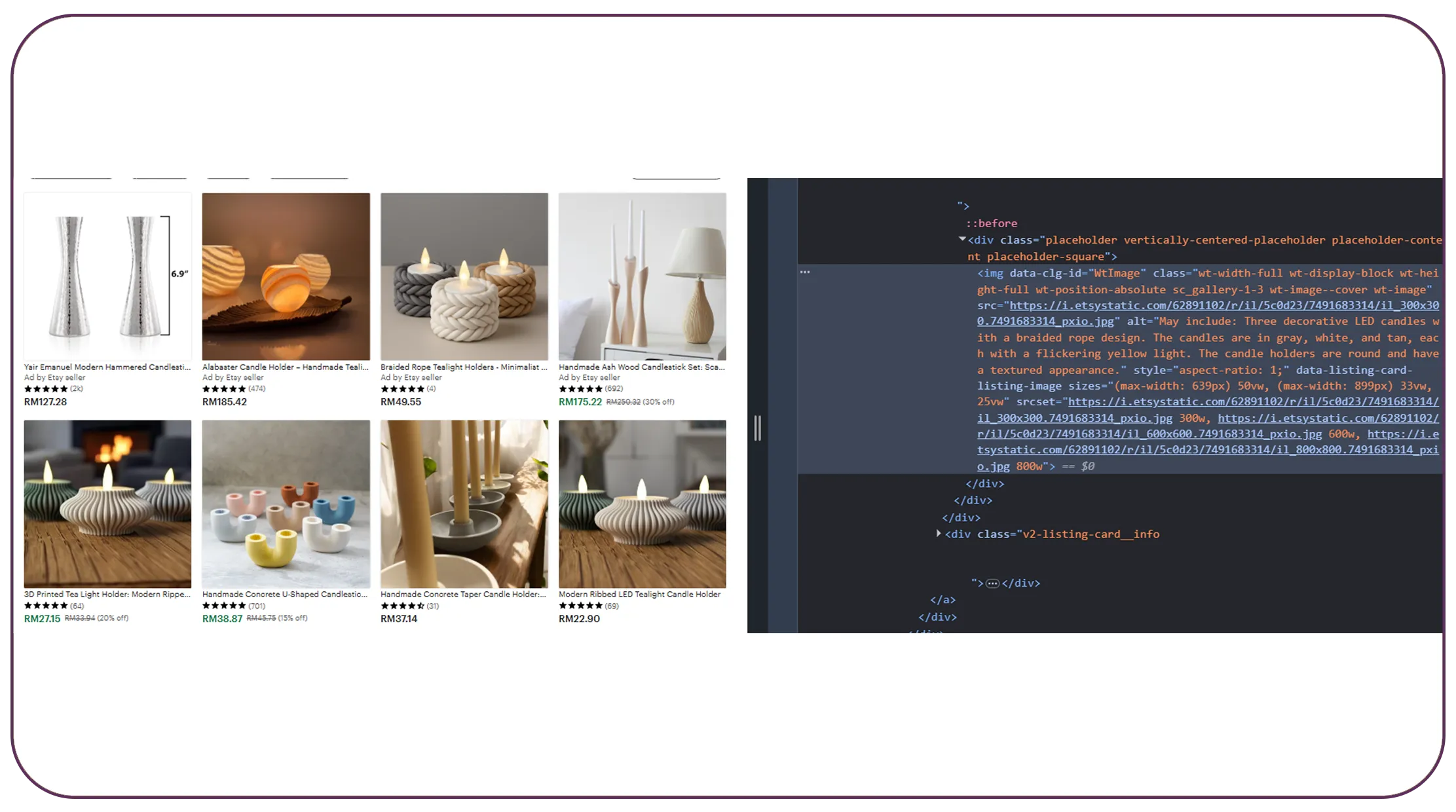

Analysis: Manual resale monitoring is not scalable. As marketplaces multiply and data volumes explode, organizations require Web Scraping Services to stay competitive.

Automated systems collect millions of data points daily—from prices and product conditions to seller reputation and shipping costs. This scale allows brands to shift from reactive decision-making to continuous optimization.

Between 2020 and 2026, enterprises that adopted automated scraping expanded market coverage fivefold while reducing operational costs by nearly a quarter. The result was a more agile resale strategy—powered by data, not guesswork.

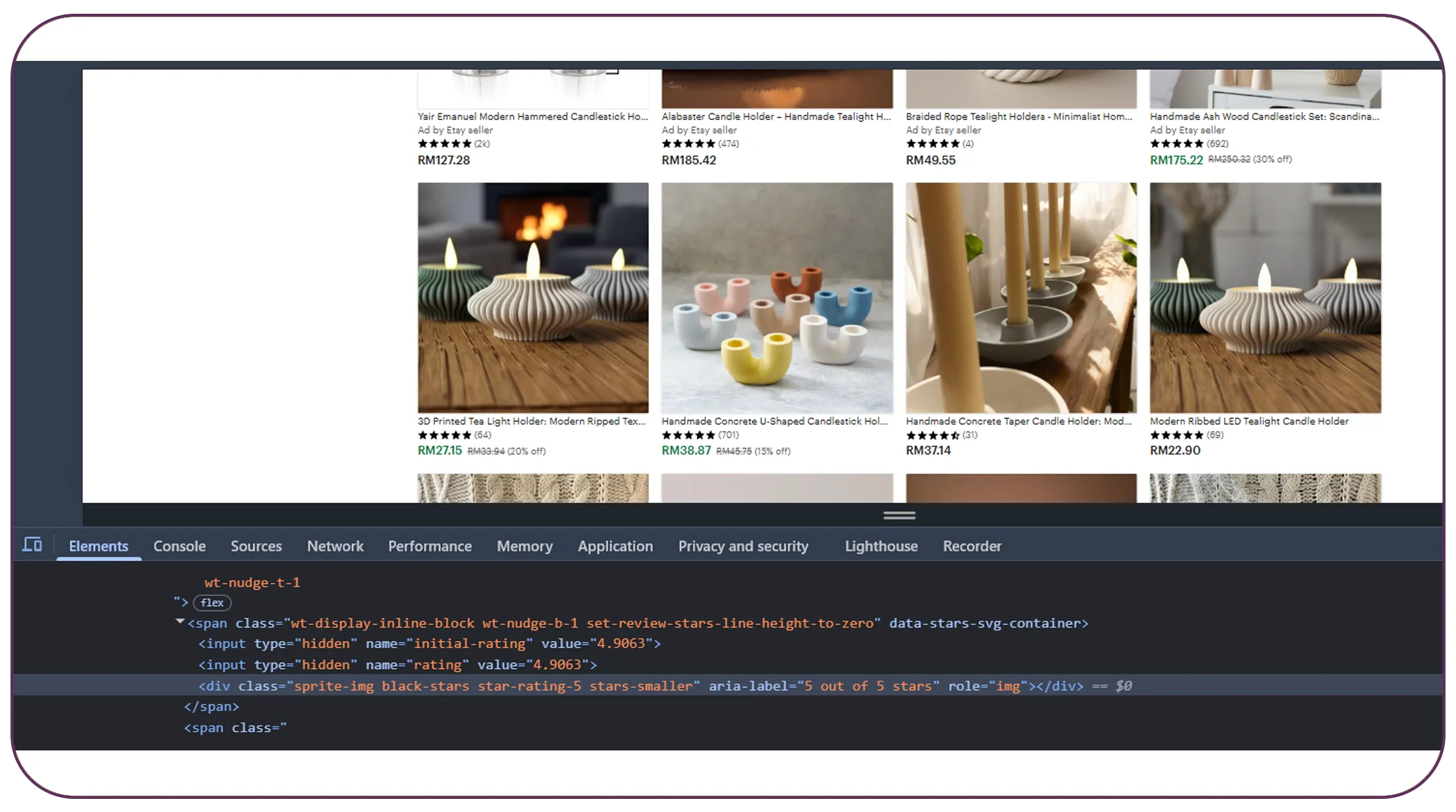

Enabling Real-Time Decisions Through API Integration

| Year | API Adoption Rate | Time-to-Insight Reduction |

|---|---|---|

| 2020 | 31% | 22% |

| 2022 | 49% | 38% |

| 2024 | 67% | 55% |

| 2026 | 83% | 72% |

Analysis: Speed is everything in resale markets. By integrating a Web Scraping API, brands embed real-time resale intelligence directly into their pricing engines, inventory tools, and CRM systems.

This eliminates delays between data collection and action. For example, when resale value drops for a product category, automated systems can instantly adjust trade-in values or promotional pricing—ensuring alignment with current market conditions.

By 2026, organizations using API-driven intelligence reduced time-to-decision by more than 70%. This agility transformed resale data from a reporting function into a core operational capability.

Why Choose Real Data API?

Real Data API empowers brands with cutting-edge resale intelligence through its advanced Web Unlocker API, designed to overcome geo-restrictions, anti-bot systems, and dynamic pricing barriers. Our platform enables you to Scrape resale value before market shifts via API, ensuring your business always stays ahead of demand fluctuations.

From consumer electronics and fashion to refurbished goods and B2B equipment, Real Data API delivers accurate, compliant, and scalable resale insights—helping you optimize pricing strategies, reduce inventory risks, and unlock new revenue streams in the circular economy.

Conclusion

The resale economy no longer rewards late movers. Brands that succeed are those that anticipate value shifts—not react to them. With Live Crawler Services and the power to Scrape resale value before market shifts via API, organizations gain a strategic edge in pricing, inventory planning, and sustainability initiatives.

From predicting depreciation to maximizing buy-back margins, proactive resale intelligence transforms uncertainty into opportunity.

Ready to future-proof your resale strategy? Partner with Real Data API today and turn second-hand data into first-class business advantage.