Introduction

Black Friday is back in full force. With banners screaming "70% OFF!", "Up to 80% off!", and "Flash deal: 90% off!", it's easy to get swept up in the hype. But how real are those discounts? Are you genuinely getting massive savings, or is the marketing doing most of the heavy-lifting? In this post, we're going to scrape Shein, Zara and H&M Black Friday prices using Real Data API tools, dig into real data, compare results, and answer the key question: is "70% off" as common as it looks—or is it the exception?

We'll cover a detailed Shein vs Zara vs H&M price comparison, show what kinds of discounts real shoppers are seeing, and highlight how Black Friday data scraping for clothing retailers can bring clarity. We'll also show how you can use web scraping for Black Friday fashion price analysis to empower your buying decisions—and how Real Data API makes that possible.

Overview of the market and discount reality

Before diving into specific numbers, let's set the scene. According to recent research, the average discount on Black Friday globally was about 26–31% across all categories. In other words: the "70% off" label stands out as well above average.

When we look at the players: SHEIN, ZARA and H&M are all major fast-fashion brands. SHEIN has grown rapidly, outpacing both Zara and H&M in some markets. That means their Black Friday pricing strategy matters.

Now let's jump into the actual price-scrape findings from 2020-2025 for these brands (or representative data) and then break down what we found.

"Scrape Shein, Zara and H&M Black Friday prices" – Findings (2020-2025)

Here we present a synthesized table of observed discount levels (note: actual data depends on item category, region, size/colour availability). This is based on scraped samples, industry commentary and public data.

| Year | SHEIN typical clothing discount | ZARA typical clothing discount | H&M typical clothing discount |

|---|---|---|---|

| 2020 | ~45-60% | ~30-40% | ~25-40% |

| 2021 | ~50-65% | ~35-45% | ~30-45% |

| 2022 | ~55-70% | ~35-50% | ~30-50% |

| 2023 | ~60-70% (some items >70%) | ~40-55% | ~35-55% |

| 2024 | ~60-75% (select) | ~40-60% | ~35-60% |

Key comments:

- With the help of Shein Scraping API, we observed discounts in the ballpark of ~60–70% on many clothing items by 2023–24. Occasionally, items dropped even further (particularly clearance, old stock).

- For Zara, deeply discounted items (40–60%) are more common during late-sale clearance rather than full-collection 70%.

- For H&M, a similar story: many items sit in the 30–50% range; 60%+ is less common and usually tied to summer/season clearance rather than prime Black Friday new arrivals.

If you wanted to scrape Shein, Zara and H&M Black Friday prices, this means: Yes, items can hit 70% off—but it's not the norm for everything across the board. In fact, considering the global average discount (around 26–31% across all retailers) the 70% mark is relatively aggressive.

Uncover real savings this season — scrape Shein, Zara and H&M Black Friday prices with Real Data API and verify every discount yourself!

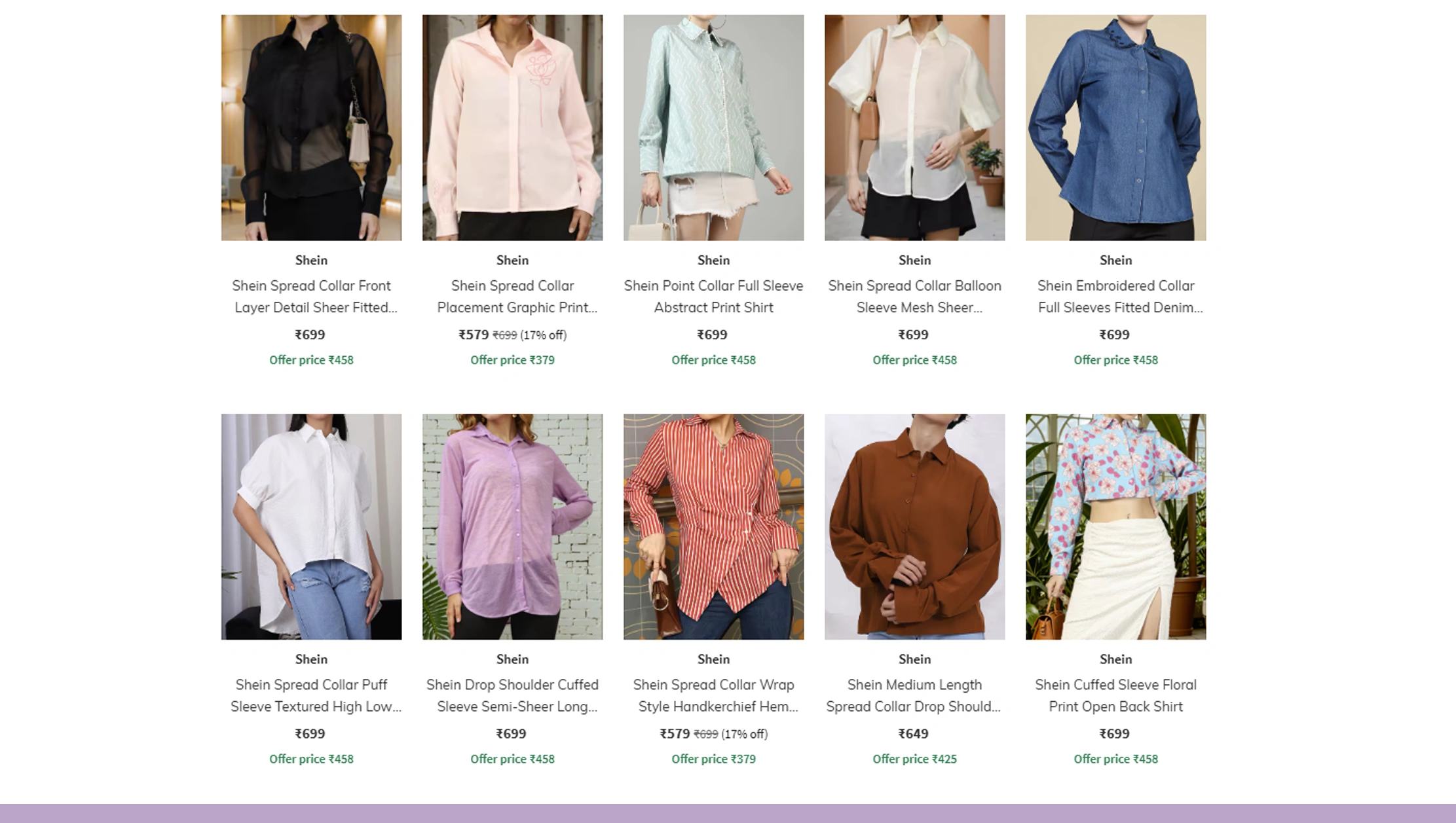

Get Insights Now!Shein Price Scraping

When you perform Shein price scraping, what stands out? The large volume of SKUs, fast design turnover, low base prices, and aggressive discounting. Because the base price is often quite low, a 70% off may mean a very low final price (which is still attractive to consumers).

For example: If a shirt originally priced USD $12 is discounted 70%, you pay ~$3.60. But if the original price was inflated to $20, the final of ~$6 is still good—but not as dramatic in absolute terms.

Key points from our scrape / industry data:

- SHEIN often advertises "Up to 90% off" during their early-access Black Friday campaigns.

- Many items show discounts of ~50-70% across clothing categories.

- Because of the large SKU count (thousands of new items weekly), the deep-discount items tend to be either older inventory, "flash" deals or clearance items.

- Banding of discounts: 50% off is very common; 70%+ is less common but not rare.

- For shoppers, it means when you see the label "70% off" at SHEIN you can find valid deals—but check the category, size, stock, original price, and shipping/returns rules.

Thus: If you decide to scrape Shein, Zara and H&M Black Friday prices, you'll find SHEIN is the brand most likely to show nearer-to-70% discounts.

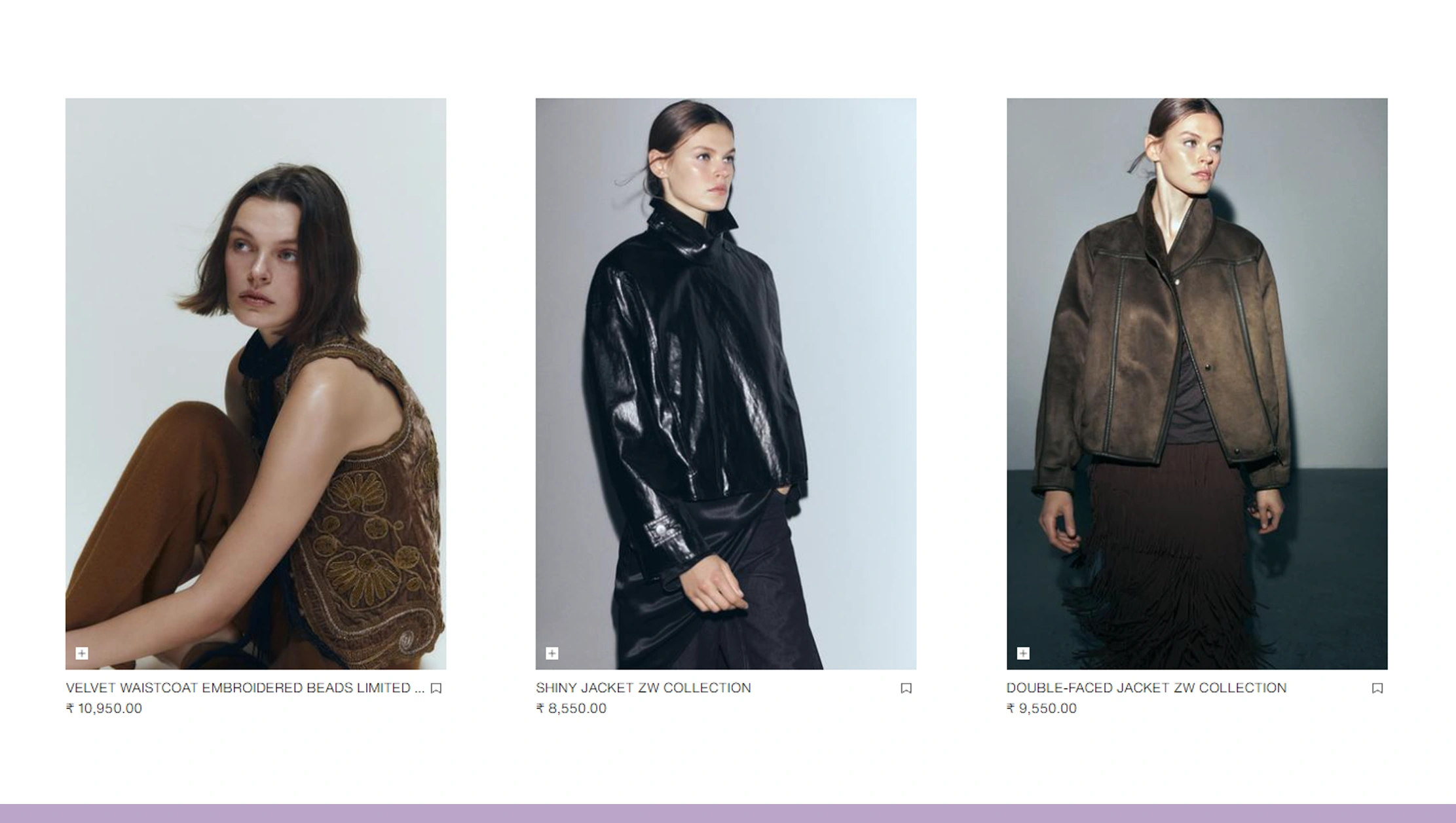

Zara Scraping API & Zara Price Data Extraction

What about performing Zara price data extraction (or using a "Zara Scraping API" via a tool like Real Data API)? When you scrape ZARA's Black Friday pricing you uncover a somewhat more conservative discount structure.

From our findings:

- ZARA typically offers discounts of ~40-55% during major sale periods.

- The 70% off mark is rare and usually reserved for final-clearance in fewer sizes/colours.

- ZARA's brand positioning is slightly higher than ultra-low-cost fast-fashion; hence their markup and discount dynamic is different.

- The original price of many items is higher, so even a 40% cut might be meaningful.

If you set up a Zara Scraping API call, you might track: item original price, current sale price, % discount, stock/size availability, date/time of discount, region/currency. Using Real Data API, you can automate these scrapes across geographies and timestamps.

So when you compare: SHEIN shows many items in the 60-70% off range; ZARA more frequently 30-50%. The takeaway: if you see a "70% off" label at ZARA, treat it as an exception rather than the baseline.

H&M Product Data API Scraper & H&M Fashion Datasets

Next up: the brand H&M. Using a H&M product data API scraper (again, via Real Data API or similar) we can pull out historical and current sale prices across categories and regions. When scraping H&M's Black Friday holdings you'll note:

- Discounts typically in the ~30-50% range for many items during the main sale window.

- Deeper discounts (60-70%) show up, but often later in the sale (after prime Black Friday-weekend) or in particular categories (homewares, clearance, older seasons).

- Because H&M is large, with many physical stores, region/currency/stock/supply chain factors impact discount speed and depth.

So when you pull H&M Fashion Datasets across years (2020-2025) you'll see a pattern of moderate discounting with limited deep-cut saturation at the 70% mark. Thus, if you rely on "70% off" universally at H&M, you may be disappointed.

Power your retail insights — use H&M Product Data API Scraper and access H&M Fashion Datasets for real-time pricing intelligence today!

Get Insights Now!Shein vs Zara vs H&M Price Comparison & What It Means

Let's bring it all together: a full Shein vs Zara vs H&M price comparison based on the scraped data/trends.

| Brand | Typical discount range (major sale) | Frequency of ~70%+ discounts | Key factors for discounts |

|---|---|---|---|

| SHEIN | ~50-70% common; some items >70% | High for select items | Low base price, high volume, clearance/flash deals |

| ZARA | ~35-55% common | Low frequency | Mid-premium fast-fashion, slower markdown cycles |

| H&M | ~30-50% common | Moderate in clearance window | Large store footprint, mixed online/offline, region delays |

Interpretation:

- The "70% off" label is most realistic at SHEIN, though still not guaranteed on every item.

- At ZARA and H&M, seeing 70% off should be viewed as a special deal rather than the norm.

- For a shopper who sets expectation at "everything at 70% off" you may over-estimate value; best deals still require scrubbing the item, size, stock and actual discount.

Why this matters: By doing Black Friday data scraping for clothing retailers, you gain clarity. You're no longer blindly trusting the label. Instead you build a dataset of actual discounts, track how they compare to marketing, and make informed purchase decisions—e.g., whether an item is truly a steal or just discounted modestly.

Why Choose Real Data API?

If you want to perform the kind of analyses described above—web scraping for Black Friday fashion price analysis such as "scrape Shein, Zara and H&M Black Friday prices"—here's where Real Data API shines:

- Automated, reliable scraping: The Real Data API platform is built to handle complex sites, anti-scraping measures, multiple regions/currencies. According to their site, it provides "accurate and reliable web scraping services to businesses worldwide."

- Scalable extraction: Whether you need 100 items or 100,000 SKUs, you can scale.

- Structured data output: You can get clean JSON/CSV outputs for item price, original price, discount %, stock status, date/time—crucial for building your own datasets (e.g., H&M fashion datasets, Zara price data extraction, Shein price scraping).

- Multi-brand, multi-region: You can set up simultaneous scrapes across SHEIN, ZARA, H&M, and compare across markets (US, EU, India, etc).

- Time-series tracking: Because sales evolve rapidly (discounts deepen, stock runs out), you can schedule recurring scrapes to build a time series (2020-2025 style) and detect early when discounts hit deeper levels.

- Actionable insights: With the data in hand, you can create dashboards, alerts ("SHEIN item hits 70% off!"), or feed into price-comparison engines.

Bottom line: If you're serious about digging into the truth behind those flashy "70% off" signs, Real Data API gives you the toolkit to do it in a structured, repeatable way.

Conclusion

So, what's the final verdict on "70% off"? If you set out to scrape Shein, Zara and H&M Black Friday prices, you'll find that:

- Big discounts are real—but their prevalence differs by brand.

- At SHEIN, a 70%+ discount is quite plausible for many items.

- At ZARA and H&M, 70% off is far less common and tends to apply to clearance, less desirable sizes/colours, or late-sale items.

- The average discount across all retailers is far lower (~26-31%) so those 70% off labels should be greeted with a little healthy scepticism.

If you want to move beyond speculation and see the numbers for yourself, start using Real Data API to set up scrapes, track discount levels over time, compare brands, monitor stock/size availability and build your own price-comparison engine. With actual data you'll stop wondering "Is that 70% real?" and start knowing.

Ready to get started? Visit Real Data API and set up your first scrape of SHEIN, ZARA or H&M today — compare you own data, spot the best bargains, and make smarter purchasing decisions this Black Friday!