Introduction

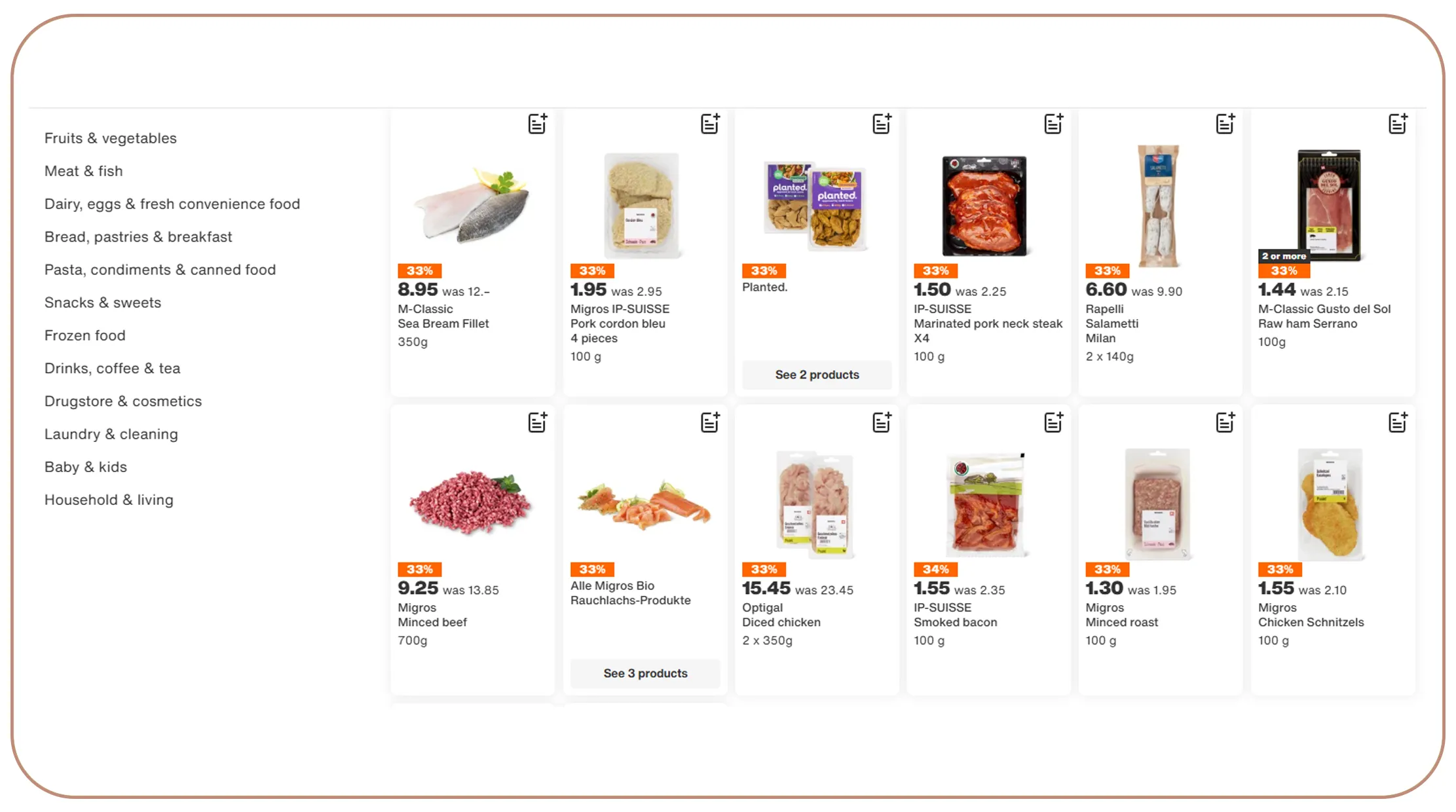

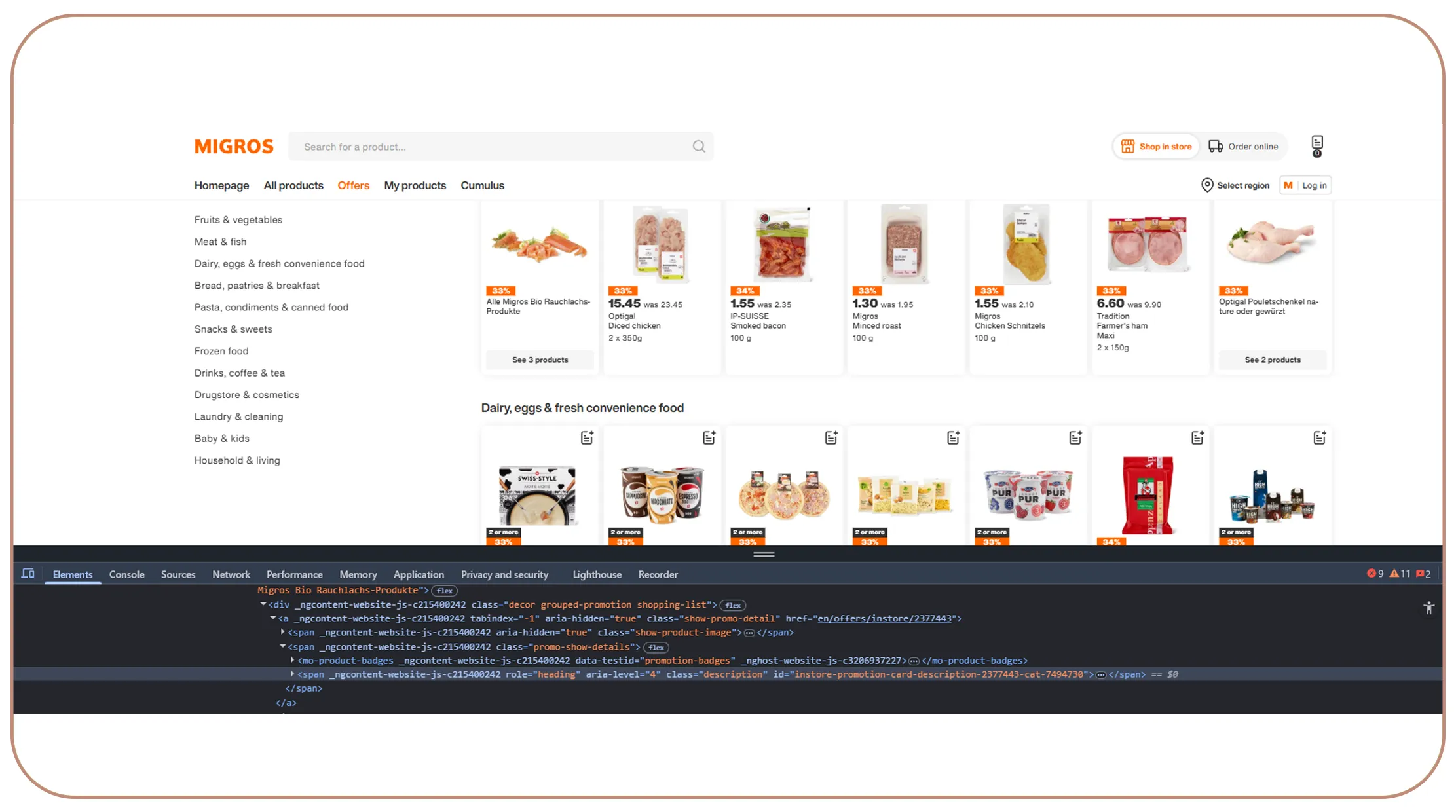

In today's highly competitive grocery retail landscape, brands need accurate, real-time intelligence to stay ahead of pricing fluctuations and shifting consumer demand. Migros, one of Europe's most influential supermarket chains, generates vast volumes of structured and unstructured data across thousands of grocery SKUs. By Scraping Migros grocery data for product movement insights, brands can gain a deeper understanding of how prices evolve, which products move fastest, and how seasonal or regional trends influence sales performance. This data-driven approach allows manufacturers, distributors, and retailers to replace guesswork with actionable insights. Using advanced APIs and scalable data pipelines, businesses can monitor price changes, detect stock availability patterns, and evaluate category-level performance over time. When combined with historical data from 2020 to 2026, Migros grocery datasets help brands forecast demand more accurately, optimize inventory planning, and fine-tune promotional strategies. Real Data API enables this transformation by converting raw Migros data into structured intelligence that supports smarter pricing, better assortment decisions, and sustainable growth in an increasingly dynamic grocery market.

Understanding Price and Stock Visibility Across Retail Channels

Monitoring price consistency and availability across stores is a critical factor for brand success. Using Extract Migros pricing and availability data, businesses can observe how often prices change, how long products remain in stock, and how promotions affect product movement. This intelligence helps brands identify pricing gaps between regions and channels, while also uncovering stock-out risks that may impact sales momentum. Over time, brands can align supply chain decisions with actual shelf performance rather than estimates.

Key price and availability trends (2020–2026):

| Year | Avg. Price Change Frequency | Avg. Stock Availability (%) |

|---|---|---|

| 2020 | 2.1 changes/month | 89% |

| 2021 | 2.4 changes/month | 87% |

| 2022 | 2.9 changes/month | 85% |

| 2023 | 3.2 changes/month | 88% |

| 2024 | 3.6 changes/month | 90% |

| 2025 | 3.9 changes/month | 92% |

| 2026 | 4.2 changes/month | 94% |

These insights reveal a steady increase in pricing agility alongside improved availability. Brands leveraging such data can respond faster to competitor moves, manage promotions more effectively, and ensure optimal shelf presence across Migros outlets.

Decoding Consumer Demand Shifts Over Time

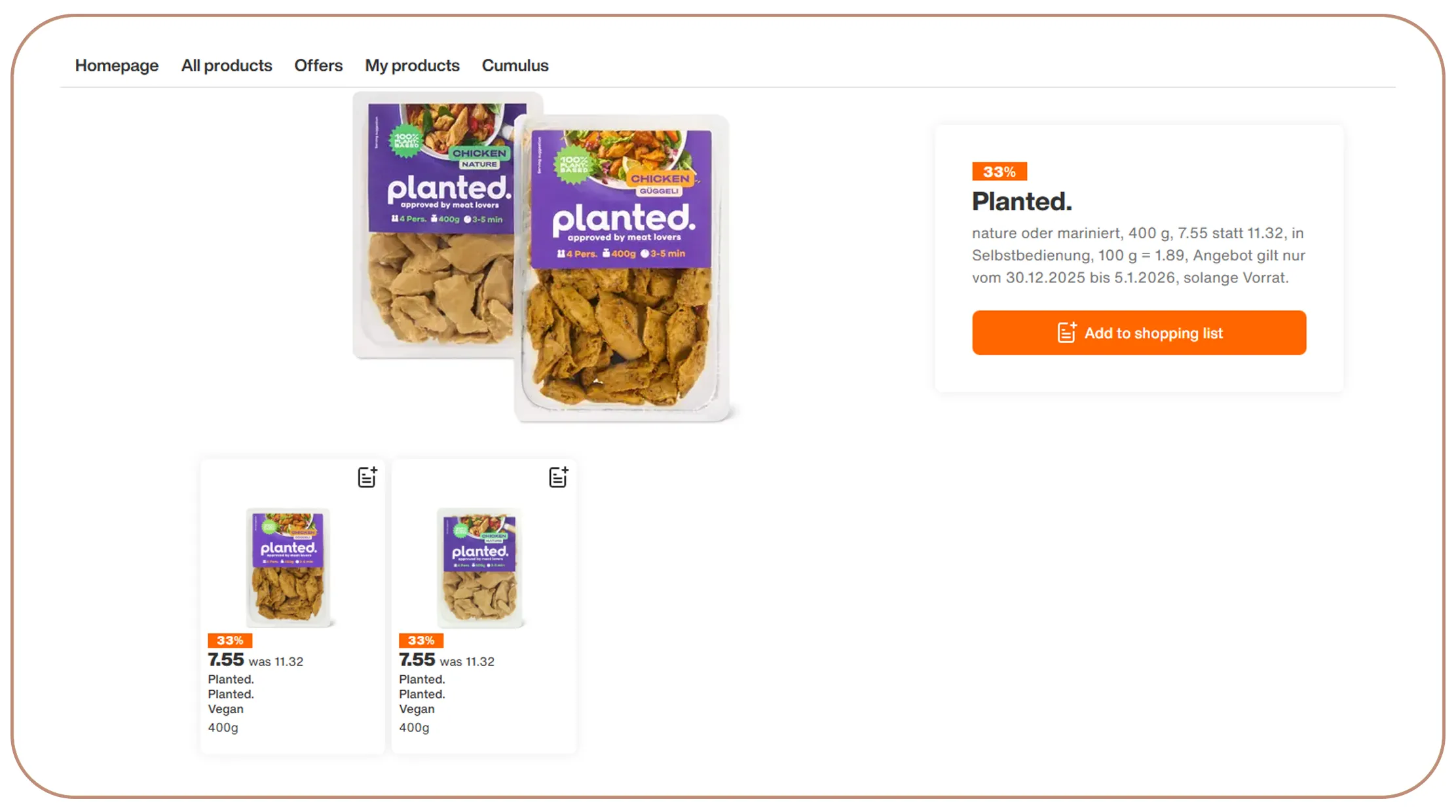

Understanding demand patterns is essential for planning production and distribution. With grocery demand trend analysis via Migros API, brands can analyze how product movement responds to seasonality, inflation, and changing consumer preferences. Demand data highlights which categories experience spikes during holidays, which private-label products gain traction, and how premium versus value segments perform year over year.

Demand growth indicators (2020–2026):

| Year | YoY Demand Growth (%) | Top Performing Category |

|---|---|---|

| 2020 | +3.5% | Staples |

| 2021 | +4.1% | Frozen Foods |

| 2022 | +2.8% | Health & Wellness |

| 2023 | +5.0% | Ready-to-Eat Meals |

| 2024 | +5.6% | Organic Products |

| 2025 | +6.2% | Plant-Based Foods |

| 2026 | +6.9% | Functional Nutrition |

By tracking these trends, brands can adapt assortments proactively, prioritize high-growth segments, and align marketing strategies with actual shopper behavior rather than assumptions.

Transforming Raw Retail Information into Actionable Intelligence

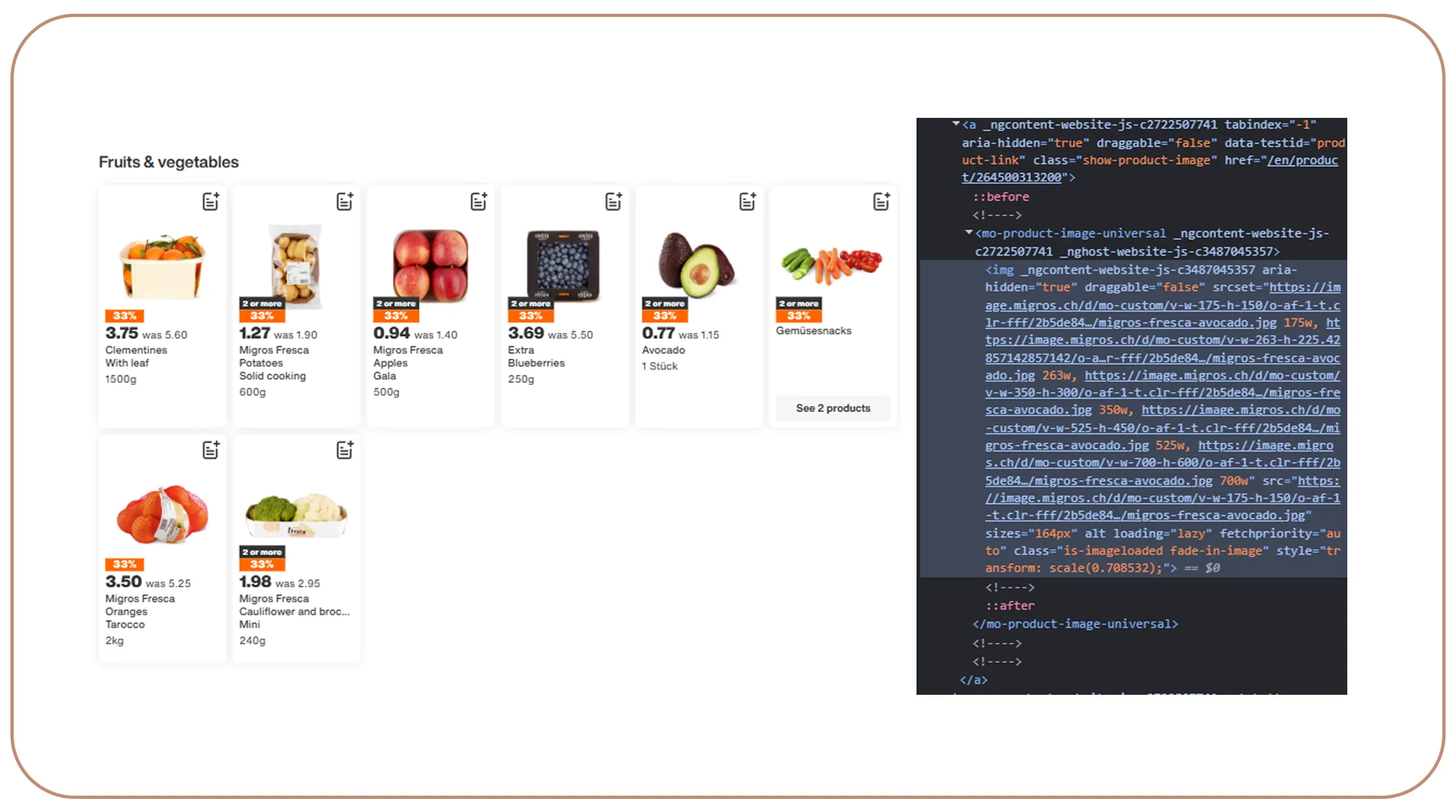

Access to raw data alone is not enough; structure and accuracy are critical. Through Migros grocery data extraction, brands can collect detailed SKU-level information such as prices, package sizes, promotions, and availability across locations. This structured data enables advanced analytics, from basket analysis to elasticity modeling.

Data volume growth (2020–2026):

| Year | SKUs Tracked | Daily Records Captured |

|---|---|---|

| 2020 | 18,000 | 120,000 |

| 2021 | 21,500 | 145,000 |

| 2022 | 25,000 | 170,000 |

| 2023 | 28,800 | 195,000 |

| 2024 | 32,400 | 225,000 |

| 2025 | 36,900 | 260,000 |

| 2026 | 41,000 | 300,000 |

This steady increase reflects the growing importance of granular retail intelligence. Brands using extracted Migros data can benchmark performance, evaluate competitor positioning, and uncover micro-trends that drive smarter decision-making.

Enabling Competitive Price Benchmarking at Scale

Competitive pricing remains one of the most powerful levers in grocery retail. A Grocery supermarket pricing data scraper allows brands to benchmark their products against competitors on Migros shelves with precision. By tracking price changes, discounts, and promotional cycles, businesses can understand how pricing strategies influence product movement and revenue outcomes.

Pricing strategy insights (2020–2026):

| Year | Avg. Discount Depth | Promo Frequency |

|---|---|---|

| 2020 | 12% | Monthly |

| 2021 | 14% | Monthly |

| 2022 | 16% | Bi-weekly |

| 2023 | 18% | Bi-weekly |

| 2024 | 19% | Weekly |

| 2025 | 21% | Weekly |

| 2026 | 22% | Weekly |

These insights empower brands to optimize promotional calendars, avoid unnecessary margin erosion, and ensure competitive yet profitable pricing strategies.

Leveraging Automation for Continuous Retail Monitoring

Automation is essential for maintaining up-to-date retail intelligence. With the Migros Grocery Scraping API, brands can automate data collection and integrate it directly into dashboards, BI tools, or forecasting systems. This ensures continuous monitoring of price movements, product launches, and assortment changes without manual effort.

Automation impact metrics (2020–2026):

| Year | Data Refresh Frequency | Manual Effort Reduction |

|---|---|---|

| 2020 | Weekly | 40% |

| 2021 | Weekly | 45% |

| 2022 | Daily | 55% |

| 2023 | Daily | 65% |

| 2024 | Near Real-Time | 75% |

| 2025 | Near Real-Time | 82% |

| 2026 | Real-Time | 88% |

API-driven automation allows brands to react faster to market changes, reduce operational costs, and focus resources on strategic analysis rather than data collection.

Building Long-Term Intelligence with Historical Retail Data

Historical context is vital for accurate forecasting. A comprehensive Grocery Dataset spanning multiple years enables brands to analyze long-term price elasticity, demand cycles, and category evolution. When combined with predictive analytics, historical Migros data supports scenario planning and risk mitigation.

Dataset coverage growth (2020–2026):

| Year | Historical Years Covered | Forecast Accuracy |

|---|---|---|

| 2020 | 1 Year | 72% |

| 2021 | 2 Years | 75% |

| 2022 | 3 Years | 78% |

| 2023 | 4 Years | 82% |

| 2024 | 5 Years | 85% |

| 2025 | 6 Years | 88% |

| 2026 | 7 Years | 91% |

Brands using extended datasets can make confident long-term decisions backed by real market behavior rather than short-term signals.

Why Choose Real Data API?

Real Data API delivers enterprise-grade solutions designed for scale, reliability, and accuracy. With Enterprise Web Crawling, brands gain access to robust infrastructure capable of handling high-frequency data collection across thousands of Migros SKUs. Combined with Scraping Migros grocery data for product movement insights, Real Data API transforms complex retail data into clean, structured, and actionable intelligence. Businesses benefit from customizable data feeds, compliance-ready scraping practices, and seamless integration with analytics platforms. This empowers teams to monitor prices, track demand shifts, and optimize go-to-market strategies with confidence.

Conclusion

As grocery retail becomes increasingly data-driven, brands that harness real-time and historical intelligence gain a decisive competitive edge. By leveraging Live Crawler Services alongside Scraping Migros grocery data for product movement insights, businesses can monitor prices, analyze sales trends, and anticipate market changes with precision.

Ready to turn Migros grocery data into actionable insights? Partner with Real Data API today and power your pricing and demand strategies with trusted retail intelligence!