Introduction

India's grocery retail ecosystem is one of the most complex and fast-evolving markets globally. With millions of SKUs spanning staples, packaged foods, beverages, personal care, and household essentials, maintaining accurate product data is a persistent challenge. Product catalogs frequently change due to new launches, rebranding, pricing updates, and packaging variations. Manual data collection simply cannot keep pace with this scale and speed.

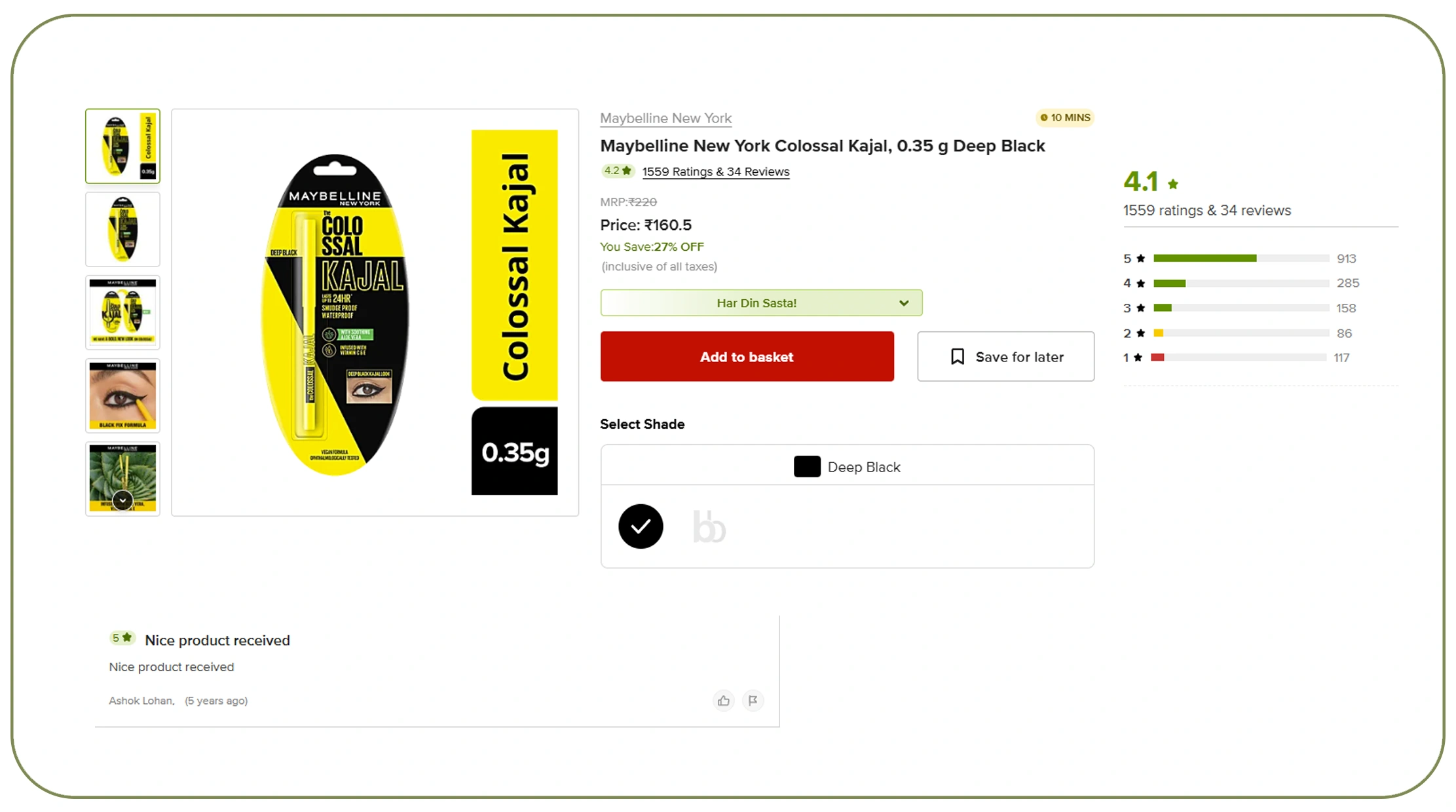

Automation enables businesses to extract an Indian grocery item database with pictures and UPC codes, creating a centralized, structured, and continuously updated dataset. By capturing product images and standardized UPC identifiers, companies can eliminate duplication, improve product matching accuracy, and streamline catalog management.

From 2020 to 2026, India's digital grocery penetration grew from 4% to over 18%, dramatically increasing the need for reliable product intelligence. High-quality grocery datasets now power pricing analytics, inventory optimization, recommendation engines, and omnichannel retail strategies. With the right data extraction framework, organizations can unlock scalable, image-rich grocery intelligence built for long-term growth.

Building Visual and Barcode-Based Product Intelligence

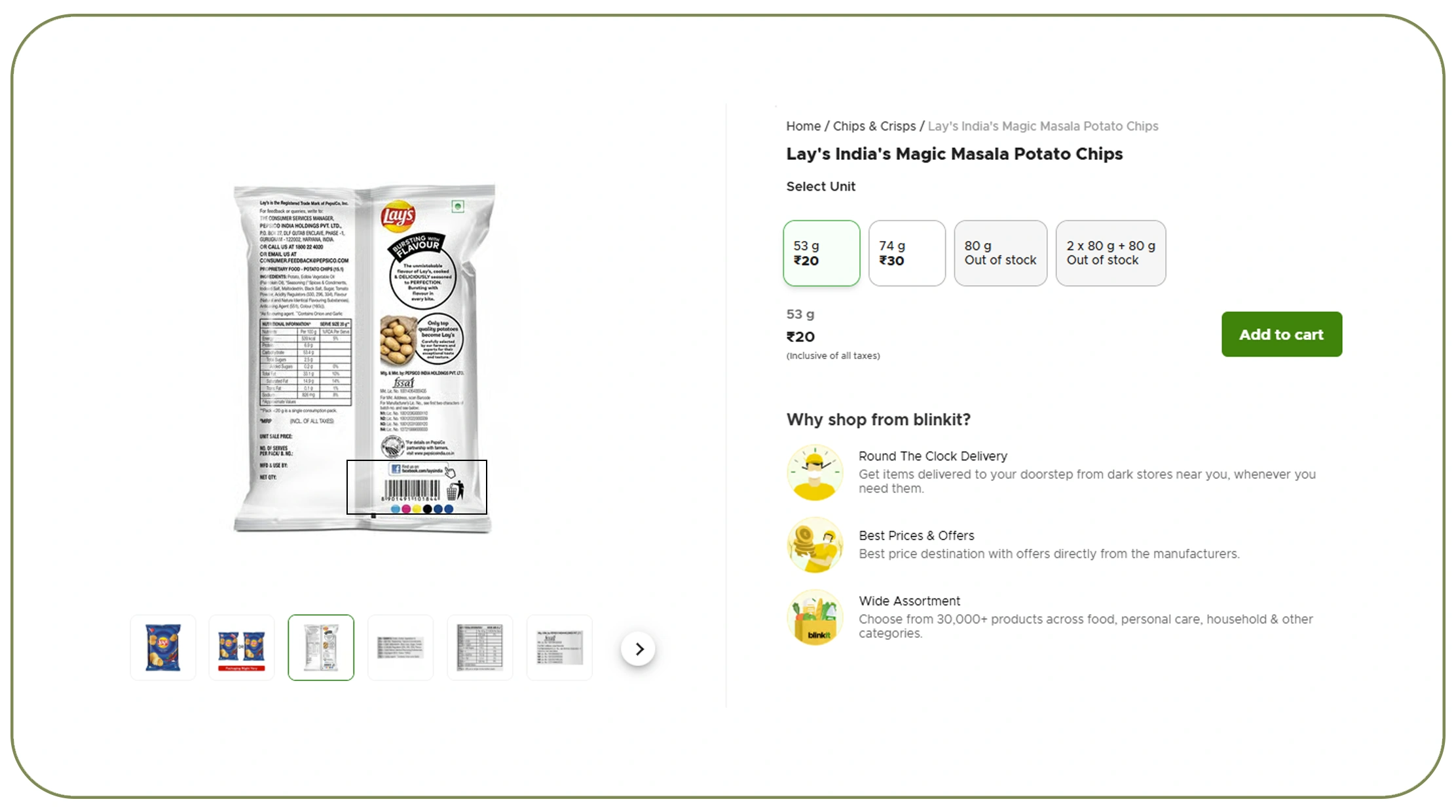

The foundation of grocery intelligence lies in accurate SKU-level visibility. Scrape Indian grocery products with images and UPC codes enables businesses to build visually verifiable and standardized product databases across thousands of brands. Images help distinguish similar SKUs with different pack sizes, flavors, or packaging updates, while UPC codes ensure precise identification across platforms.

Between 2020 and 2026, the average number of SKUs listed by major Indian online grocers increased by 210%, driven by private labels and regional brand expansion. Automated scraping captures product names, brand details, images, UPCs, pack sizes, and categories, ensuring consistency across catalogs.

| Year | Avg SKUs per Platform | Image Coverage | UPC Availability |

|---|---|---|---|

| 2020 | 35,000 | 62% | 48% |

| 2022 | 58,000 | 74% | 61% |

| 2024 | 82,000 | 86% | 72% |

| 2026* | 110,000 | 94% | 85% |

With visual and barcode-backed data, businesses reduce SKU duplication by up to 40% and significantly improve catalog accuracy, especially in high-volume grocery categories.

Structuring Pricing and Image Data at Scale

Accurate grocery intelligence requires more than just product names—it demands rich, structured attributes. Web Scraping Indian grocery product images, UPC, and pricing data allows companies to monitor real-time price movements while preserving visual and barcode integrity. Price volatility in India's grocery sector averaged 18–25% annually between 2020 and 2026, influenced by inflation, supply chain disruptions, and regional demand.

Scraped datasets include MRPs, discounted prices, offers, stock status, and image URLs mapped to UPC codes. This structured approach enables seamless price comparison and historical trend analysis across cities and platforms.

| Year | Avg Price Change (%) | Discount Frequency |

|---|---|---|

| 2020 | 9% | 22% |

| 2022 | 14% | 31% |

| 2024 | 19% | 38% |

| 2026* | 24% | 45% |

Businesses leveraging structured pricing datasets report up to 28% improvement in pricing decisions and faster reaction times to competitor changes, strengthening market positioning.

Standardizing Product Identification Across Platforms

Product identification inconsistencies remain one of the biggest challenges in Indian grocery retail. Barcode and UPC data extraction for grocery platforms solves this issue by introducing a universal reference point for each SKU. UPCs eliminate ambiguity caused by spelling variations, language differences, and inconsistent product naming.

From 2020 to 2026, retailers relying on barcode-standardized datasets reduced catalog mismatches by 35–50%. UPC-linked datasets also support seamless integration across ERP systems, inventory tools, and analytics platforms.

| Metric | 2020 | 2023 | 2026* |

|---|---|---|---|

| Catalog Duplication Rate | 21% | 13% | 7% |

| Product Match Accuracy | 72% | 84% | 93% |

Barcode-centric grocery intelligence ensures reliable SKU tracking across omnichannel environments, supporting accurate forecasting, replenishment planning, and reporting.

Scaling Data Collection Across Supermarkets

Large supermarket chains and online grocers host massive and frequently updated product catalogs. A Grocery Supermarket product database scraper enables continuous extraction of SKU-level data across categories, brands, and regions. Between 2020 and 2026, supermarket-led online grocery sales in India grew by over 3x, intensifying the need for scalable data pipelines.

Automated scrapers capture category hierarchies, product attributes, images, UPCs, and availability status. This enables businesses to track assortment depth, private label growth, and category-level competition.

| Year | Avg Categories | Private Label Share |

|---|---|---|

| 2020 | 120 | 18% |

| 2022 | 165 | 24% |

| 2024 | 210 | 31% |

| 2026* | 260 | 38% |

Scalable supermarket data extraction supports assortment optimization, shelf-space planning, and competitive benchmarking at scale.

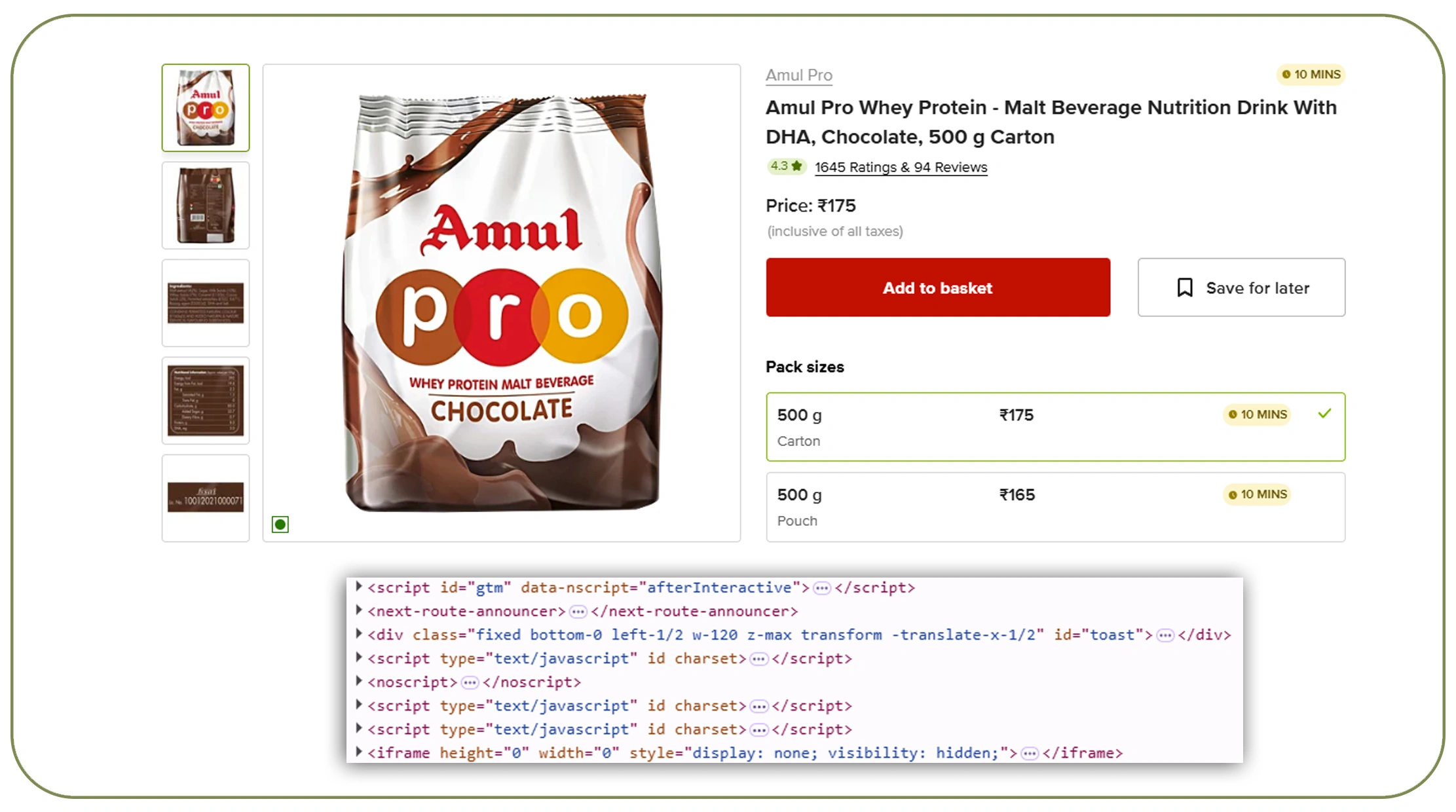

API-Driven Grocery Intelligence Pipelines

Modern enterprises increasingly rely on APIs to streamline data ingestion and analytics. A Grocery Data Scraping API delivers structured grocery datasets directly into internal systems without the overhead of building and maintaining custom scraping infrastructure. API adoption in retail analytics grew by 45% between 2020 and 2026, reflecting the demand for real-time data access.

APIs provide standardized endpoints for products, pricing, images, and UPCs, ensuring consistent updates and high reliability. Businesses using API-driven grocery data pipelines reported 30–40% faster deployment cycles and lower operational costs.

| Benefit | Impact |

|---|---|

| Data Freshness | Near real-time |

| Manual Effort Reduction | 60% |

| Integration Speed | +35% |

API-driven extraction ensures scalability, accuracy, and long-term maintainability for data-driven grocery strategies.

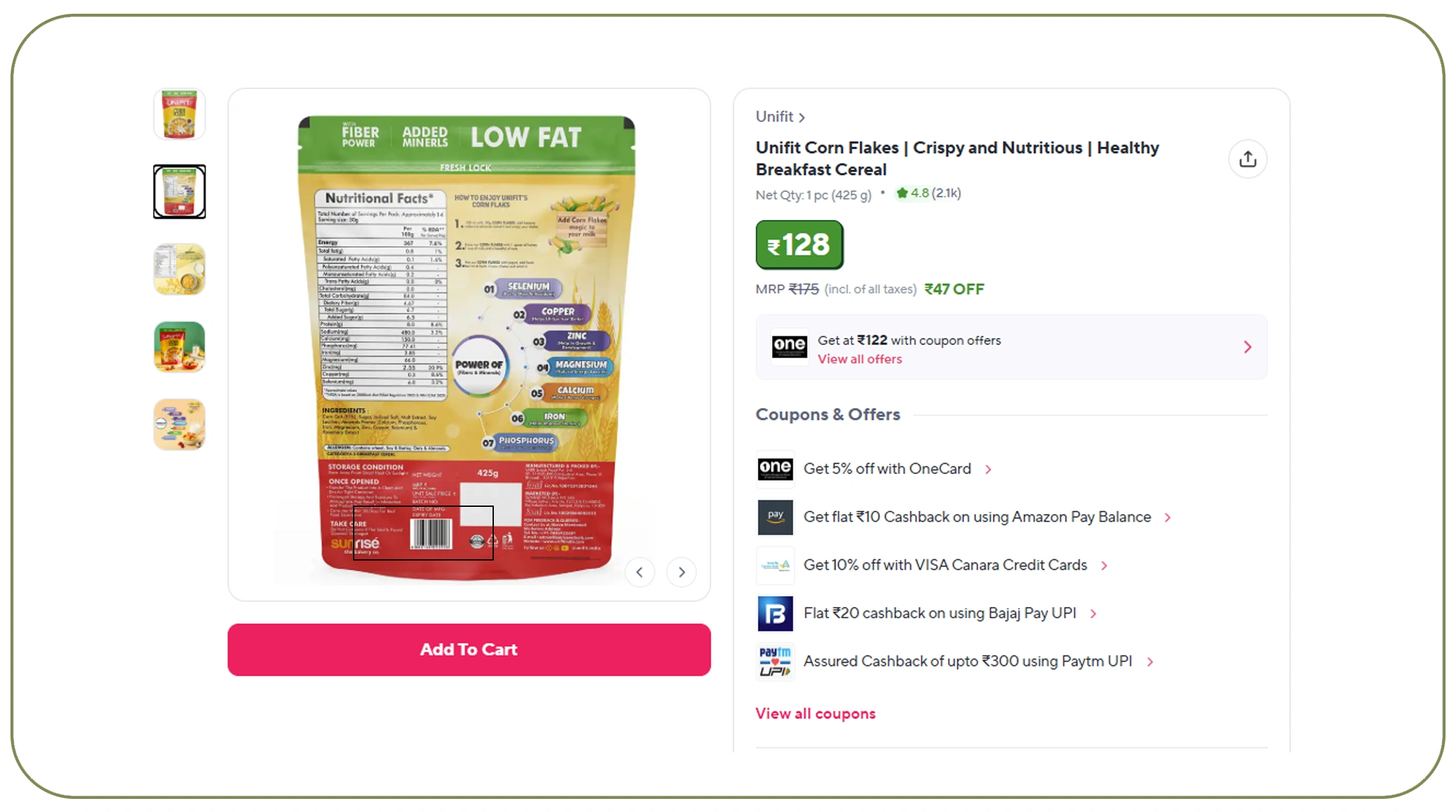

Transforming Raw Data into Actionable Datasets

Once extracted, raw grocery data must be cleaned, standardized, and enriched. A well-structured Grocery Dataset includes normalized product names, verified UPCs, image validation, pricing history, and category mapping. From 2020 to 2026, businesses investing in data enrichment improved analytics accuracy by over 32%.

Clean datasets power advanced use cases such as demand forecasting, recommendation engines, and dynamic pricing models. Image-backed datasets also enhance visual search and AI-based product recognition capabilities.

| Dataset Attribute | Business Impact |

|---|---|

| Image Validation | Better SKU accuracy |

| UPC Mapping | Seamless integrations |

| Price History | Trend forecasting |

High-quality grocery datasets serve as the backbone for scalable, intelligent retail operations.

Why Choose Real Data API?

Real Data API delivers enterprise-grade grocery intelligence solutions built for scale, accuracy, and performance. Our expertise in Grocery Price Comparison enables businesses to track price movements across platforms and regions, while our ability to extract an Indian grocery item database with pictures and UPC codes ensures complete, image-rich product visibility.

Why businesses trust Real Data API:

- High-frequency data refresh cycles

- Scalable API infrastructure

- Clean, analytics-ready datasets

- Robust coverage across Indian grocery platforms

We help retailers, brands, and analytics teams transform fragmented grocery data into a single source of truth.

Conclusion

As India's grocery market continues its rapid digital expansion, accurate and standardized product data is no longer optional—it's essential. The ability to Extract Product Barcodes and systematically extract an Indian grocery item database with pictures and UPC codes empowers businesses to eliminate catalog errors, improve pricing intelligence, and scale operations with confidence.

Automation-driven grocery data extraction reduces manual effort, improves accuracy, and unlocks deeper market insights across the retail value chain.

Ready to build a comprehensive, image-rich grocery database for smarter decisions? Contact Real Data API today and turn raw grocery data into actionable intelligence!