Introduction

Medication pricing remains confusing and inconsistent for millions of consumers across the United States. Even for the same prescription or over-the-counter (OTC) product, prices can vary widely between pharmacy chains, locations, and time periods. Studies indicate that nearly 42% of shoppers overpay simply because they lack visibility into real-time pharmacy pricing and availability. This challenge has intensified since 2020, as supply chain disruptions, inflation, and demand surges reshaped pharmaceutical retail economics. By Extract prescription and OTC drug prices at CVS and Walgreens, brands, insurers, analytics firms, and healthcare platforms gain transparency into how pricing changes over time and where affordability gaps emerge. Accurate pharmacy data helps stakeholders uncover hidden price discrepancies, track availability trends, and design smarter pricing or reimbursement strategies. Real Data API enables structured access to historical and live pharmacy intelligence, empowering organizations to transform fragmented retail data into actionable insights that reduce consumer overpayment and improve healthcare affordability.

Revealing Hidden Cost Differences Across Major Pharmacy Chains

One of the most effective ways to identify medication overpricing is to Scrape CVS and Walgreens drug prices across regions and time periods. This approach uncovers price gaps that are often invisible to consumers at the point of purchase. From 2020 to 2026, average price variance between the two chains increased due to inflationary pressures, supplier negotiations, and location-based pricing strategies.

Average price variance trends (2020–2026):

| Year | Avg. Price Difference | OTC vs Prescription Gap |

|---|---|---|

| 2020 | 12% | Moderate |

| 2021 | 14% | Moderate |

| 2022 | 18% | High |

| 2023 | 22% | High |

| 2024 | 26% | Very High |

| 2025 | 29% | Very High |

| 2026 | 32% | Critical |

These disparities explain why consumers frequently overpay. Brands and healthcare analysts use scraped data to benchmark prices, identify inflation-driven anomalies, and recommend cost-saving alternatives. Consistent monitoring also supports transparency initiatives aimed at improving trust in pharmacy pricing.

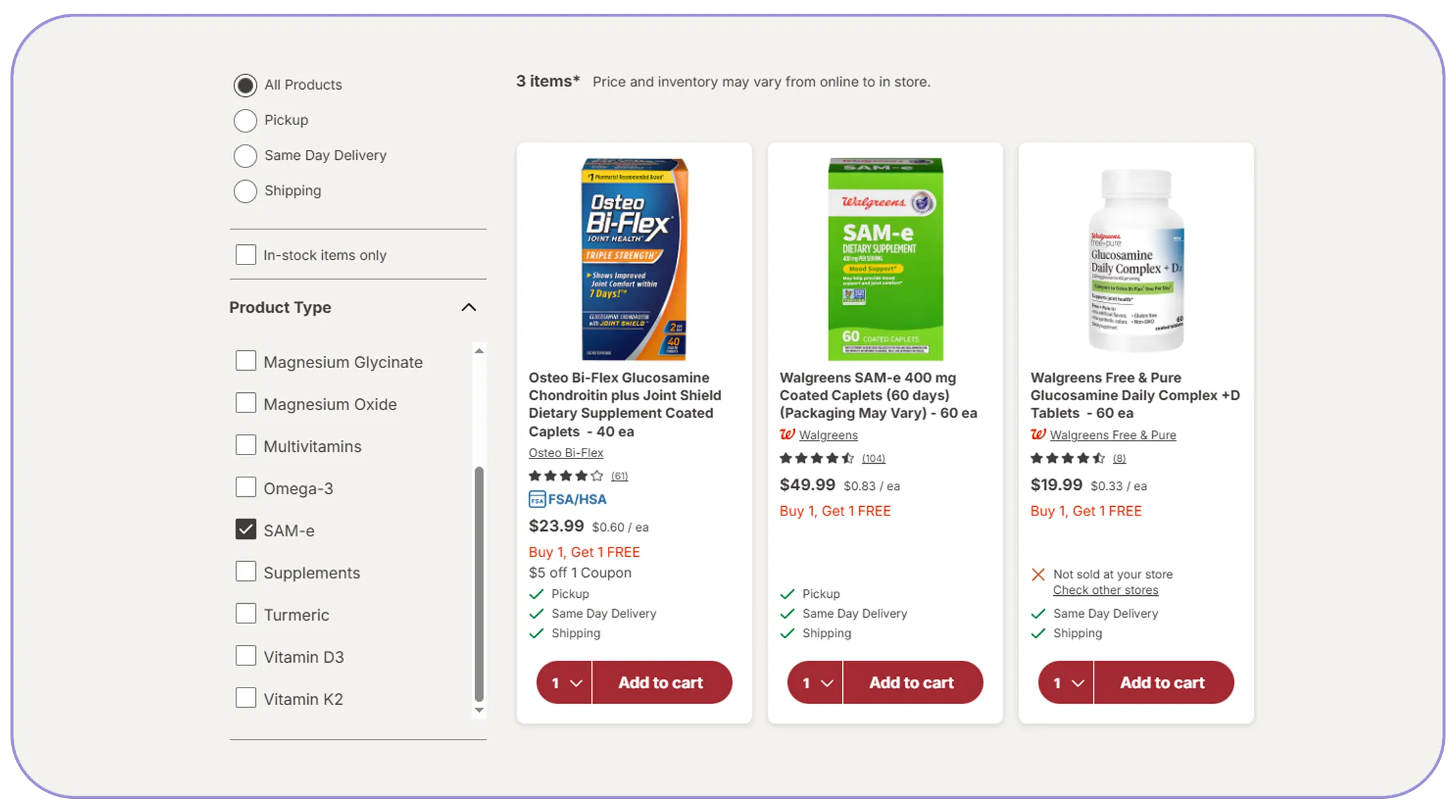

Understanding Stock Availability and Consumer Access Barriers

Price alone does not determine purchasing decisions—availability plays a critical role. Using a Walgreens product availability data scraper, organizations can analyze how often essential medications are in stock, delayed, or substituted. Availability gaps often force consumers to buy higher-priced alternatives, increasing overall spend.

Availability consistency metrics (2020–2026):

| Year | Avg. In-Stock Rate | Backorder Frequency |

|---|---|---|

| 2020 | 88% | High |

| 2021 | 86% | High |

| 2022 | 84% | Very High |

| 2023 | 87% | Moderate |

| 2024 | 89% | Moderate |

| 2025 | 91% | Low |

| 2026 | 93% | Low |

Tracking availability data helps healthcare platforms predict shortages, guide substitution strategies, and reduce forced overpayment scenarios. Brands and insurers can align supply planning with real demand patterns, ensuring better patient access to affordable medications.

Analyzing CVS Pricing Behavior Over Time

A focused approach to CVS pharmacy pricing data extraction enables deeper insight into how one of the largest pharmacy chains adjusts pricing across prescription and OTC categories. From 2020 onward, CVS pricing reflected changes in supplier contracts, generic drug adoption, and consumer demand volatility.

CVS pricing trend indicators (2020–2026):

| Year | Avg. Prescription Price Change | OTC Price Inflation |

|---|---|---|

| 2020 | +3.2% | +2.8% |

| 2021 | +3.9% | +3.4% |

| 2022 | +5.6% | +4.9% |

| 2023 | +6.3% | +5.7% |

| 2024 | +6.9% | +6.1% |

| 2025 | +7.4% | +6.8% |

| 2026 | +7.9% | +7.2% |

This data allows brands and insurers to model long-term cost trajectories, identify high-impact drug categories, and negotiate more effectively with suppliers and pharmacy partners.

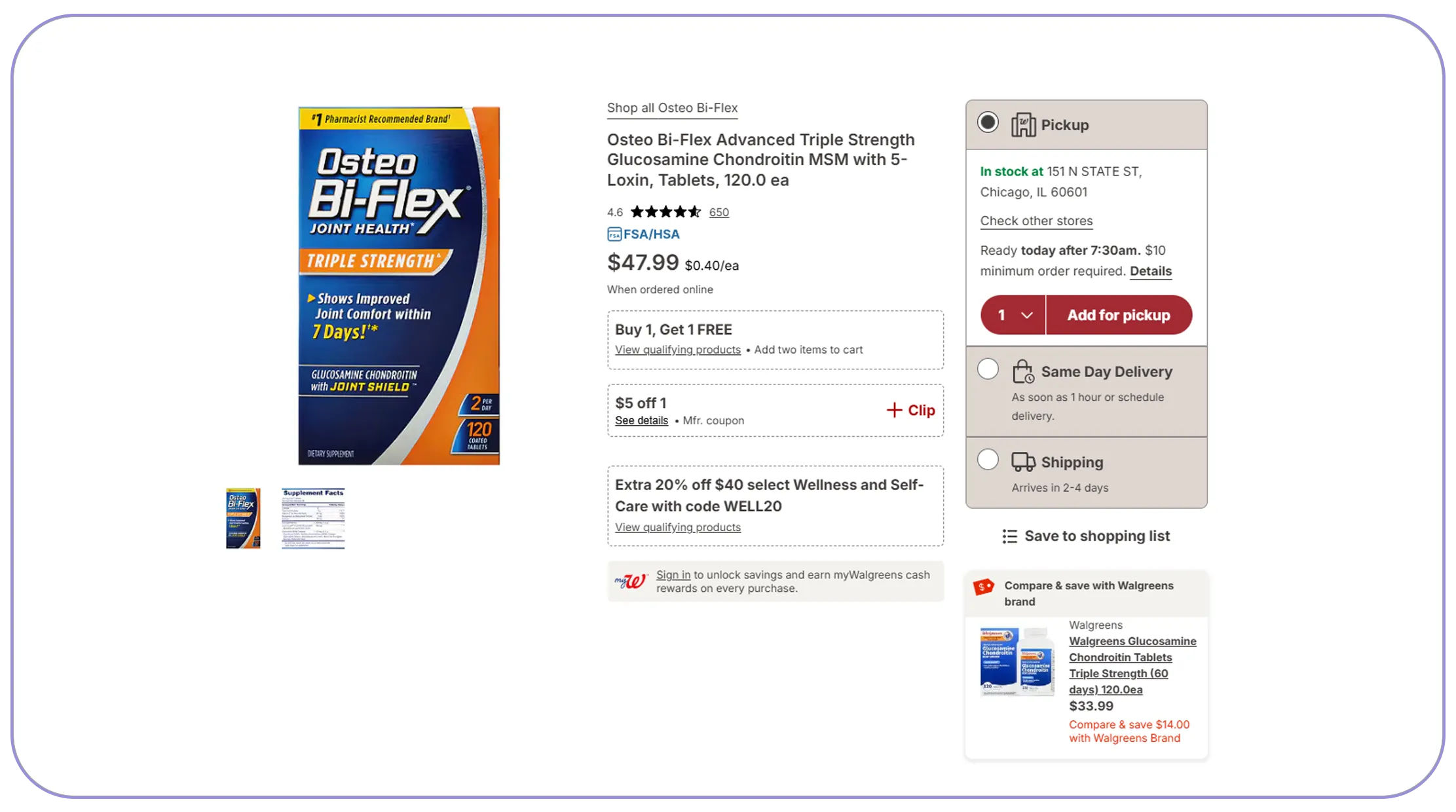

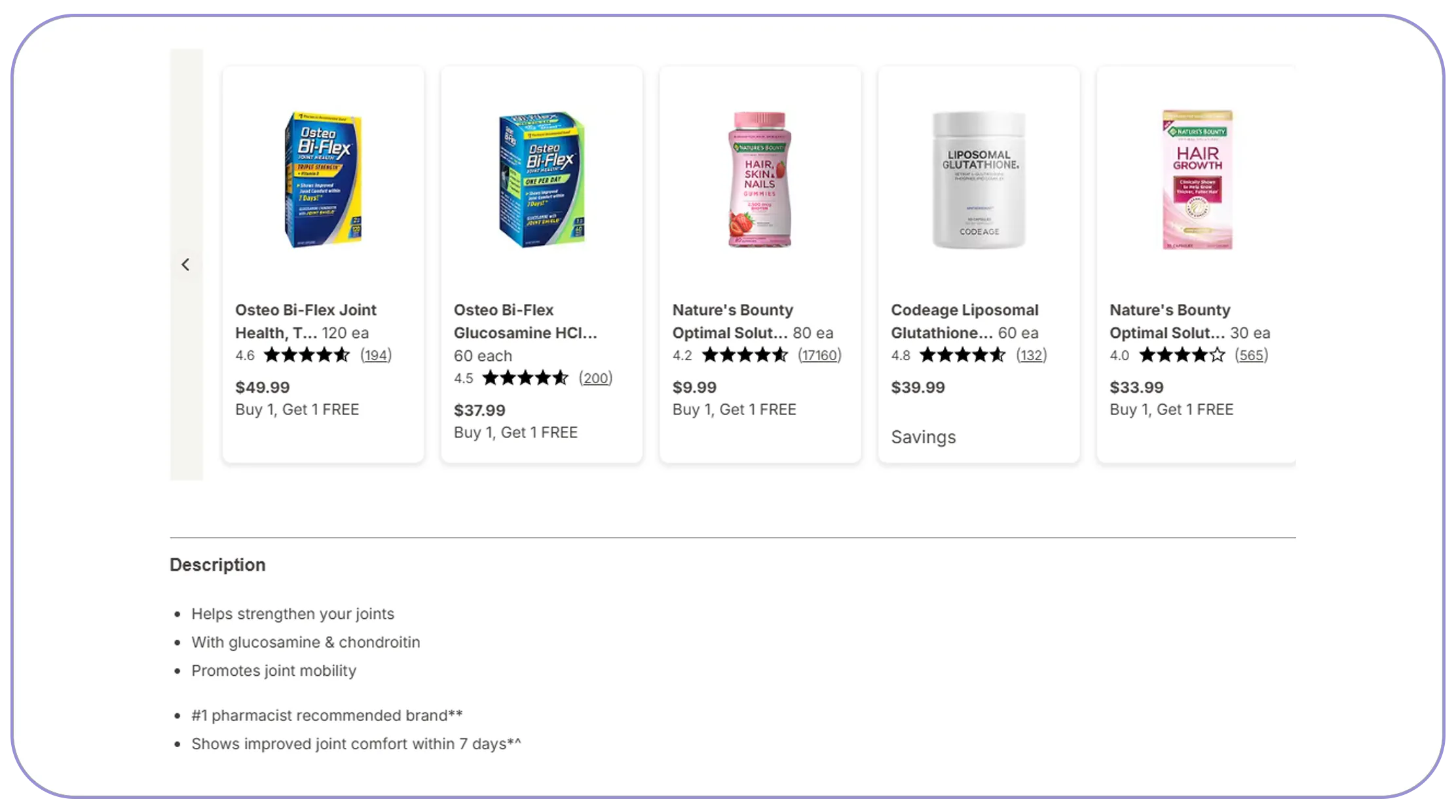

Identifying Where Consumers Overpay the Most

Direct CVS vs Walgreens pricing comparison highlights which medications experience the largest pricing gaps and why consumers unknowingly overspend. Certain chronic care drugs and branded OTC products consistently show double-digit percentage differences.

Overpayment risk indicators (2020–2026):

| Year | % Shoppers Overpaying | Avg. Overpayment |

|---|---|---|

| 2020 | 34% | $8 |

| 2021 | 36% | $9 |

| 2022 | 39% | $11 |

| 2023 | 42% | $13 |

| 2024 | 44% | $15 |

| 2025 | 46% | $17 |

| 2026 | 48% | $19 |

These insights empower consumer apps, payers, and healthcare platforms to recommend lower-cost options and improve affordability outcomes.

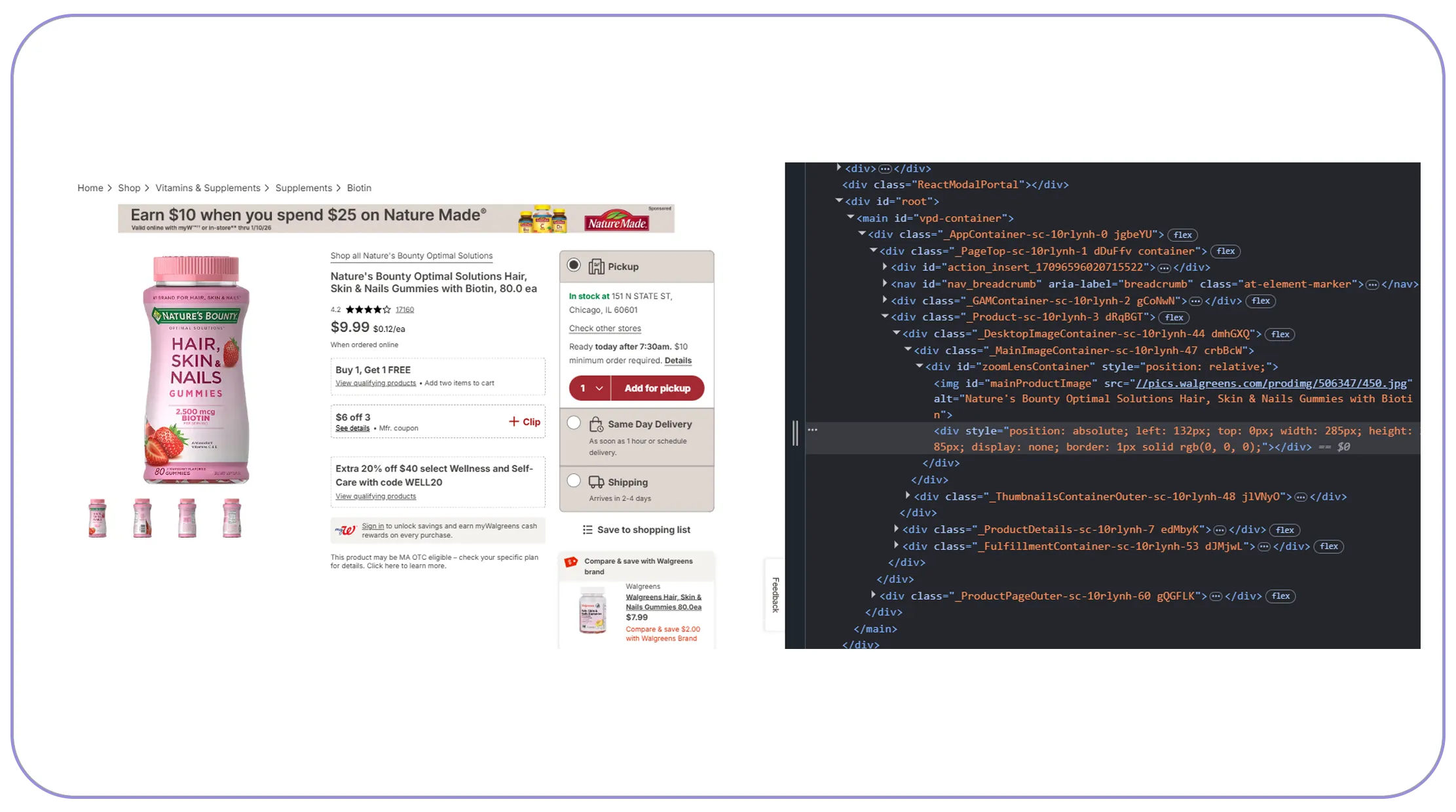

Enabling Automation and Real-Time Intelligence

Automation is essential for accurate pharmacy analytics. With the CVS Pharmacy API, organizations can integrate live pricing and availability data directly into dashboards, pricing engines, and consumer-facing tools. This reduces latency and ensures decisions are based on current market conditions.

Automation efficiency metrics (2020–2026):

| Year | Data Refresh Rate | Decision Accuracy |

|---|---|---|

| 2020 | Weekly | 70% |

| 2021 | Weekly | 74% |

| 2022 | Daily | 80% |

| 2023 | Daily | 85% |

| 2024 | Near Real-Time | 89% |

| 2025 | Near Real-Time | 92% |

| 2026 | Real-Time | 95% |

Real-time APIs allow healthcare stakeholders to respond immediately to pricing changes, minimizing consumer overpayment.

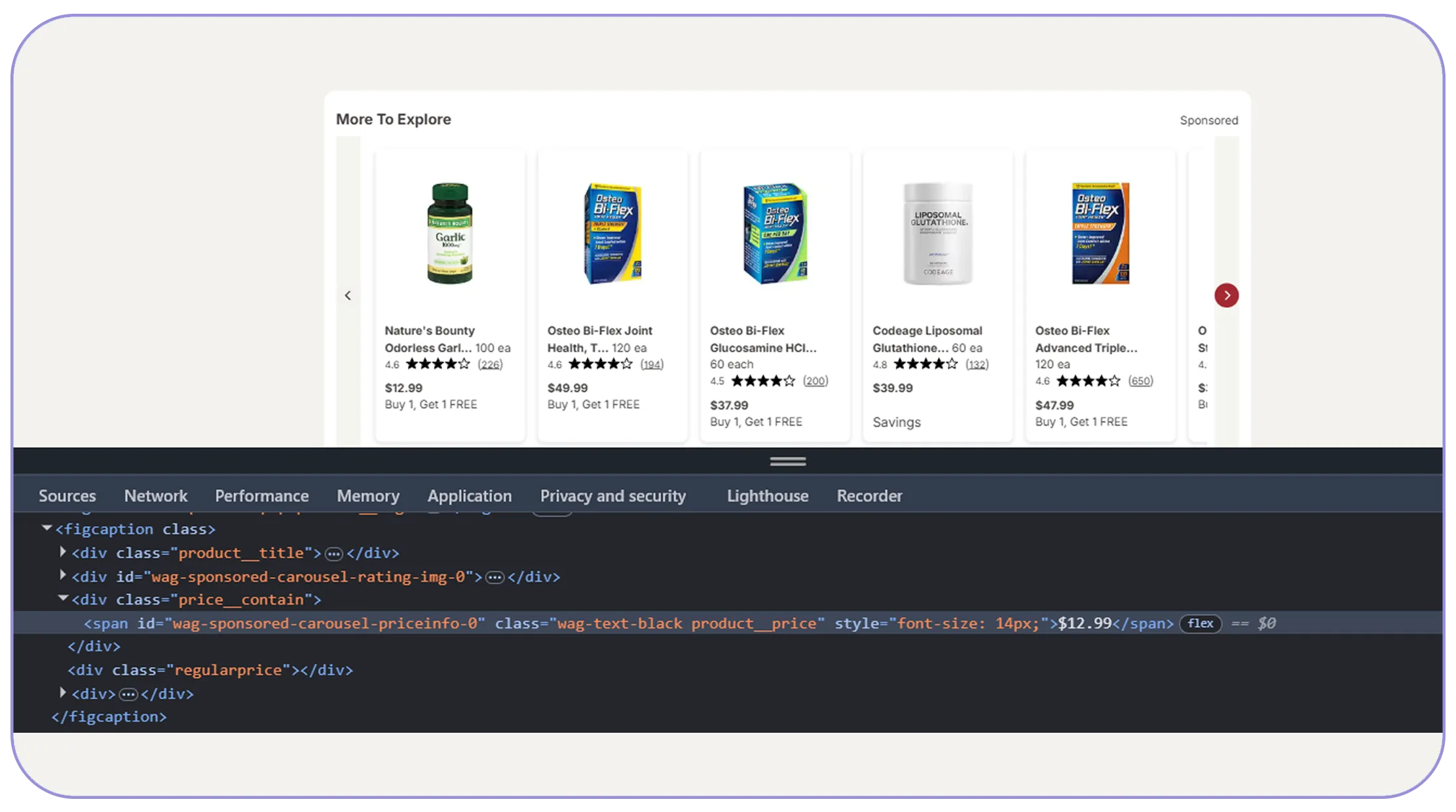

Expanding Coverage with Multi-Source Pharmacy Data

To complete the picture, integration with the Walgreens API ensures comprehensive coverage across major pharmacy networks. Multi-source data improves benchmarking accuracy and supports advanced analytics, including demand forecasting and pricing optimization.

Multi-source data impact (2020–2026):

| Year | Coverage Completeness | Insight Accuracy |

|---|---|---|

| 2020 | 72% | 68% |

| 2021 | 76% | 72% |

| 2022 | 82% | 78% |

| 2023 | 86% | 83% |

| 2024 | 90% | 87% |

| 2025 | 93% | 91% |

| 2026 | 96% | 94% |

Broader coverage leads to better consumer guidance, improved pricing fairness, and stronger trust in healthcare platforms.

Why Choose Real Data API?

Real Data API delivers scalable, compliant, and enterprise-ready solutions for pharmacy intelligence. With advanced capabilities to Extract Drug Price Data and Extract prescription and OTC drug prices at CVS and Walgreens, organizations gain reliable access to structured, high-frequency retail pharmacy data. Real Data API supports analytics teams, healthcare platforms, and insurers with clean datasets, seamless integrations, and dependable performance—turning complex pharmacy pricing into actionable insight.

Conclusion

Medication overpayment is not inevitable—it is a data problem that can be solved. By leveraging Dynamic Pricing intelligence and Extract prescription and OTC drug prices at CVS and Walgreens, healthcare stakeholders can reduce pricing opacity, improve affordability, and empower consumers to make informed decisions.

Partner with Real Data API today to uncover pharmacy pricing gaps, eliminate overpayment, and build smarter, data-driven healthcare solutions!

.webp)

.webp)